11/22/2024 by Tracy Mitchell

Credit Management Success in a Post-Pandemic B2B Sector

B2B credit management has evolved since 2019. Here’s how to ensure your credit department succeeds.

The COVID-19 pandemic drastically changed the world, businesses, and their credit departments. It reshaped our economy. In order to meet the changing business landscape, credit managers have adapted quickly to maintain their companies’ financial stability.

Let’s briefly review the economy before the pandemic started. This will give us a clearer picture of the changes that have happened and the difficulties B2B credit managers now face. We’ll look at how your sales team can become a credit ally and close with tips on how to decision today’s B2B credit with success.

Pre-Pandemic Stability

Before COVID-19, the economy experienced comparatively stable growth. Companies were generally optimistic about their clients’ creditworthiness. The approval process for B2B credit managers was a relatively simple routine. They usually assessed customer creditworthiness based on financial statements, credit reporting, and industry benchmarks. Once a credit limit was approved, customers were generally given net payment terms.

Pandemic-Induced Shifts

The pandemic triggered a series of economic shifts that profoundly affected B2B credit practices. Government stimulus programs, supply chain disruptions, and inflation surges all contributed to a climate of uncertainty and volatility.

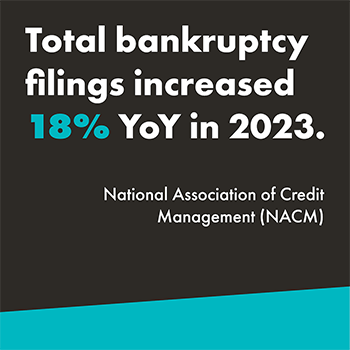

According to the National Association of Credit Management (NACM), total bankruptcy filings increased 18 percent year-over-year (YoY) in 2023.

As a result of these changes, businesses became more cautious about extending credit and credit managers had to adopt a more rigorous approach to risk assessment.

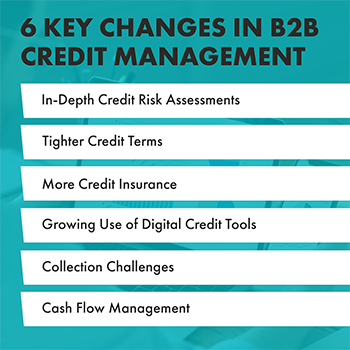

6 Key Changes in B2B Credit Management

In-Depth Credit Risk Assessments

Economic changes caused credit managers to become more reliant on data analysis to assess creditworthiness. This includes using financial modeling tools to assess a company’s ability to meet its debt obligations. Credit bureaus and alternative data sources are also leveraged to achieve a comprehensive view a customer’s financial health.

Tighter Credit Terms

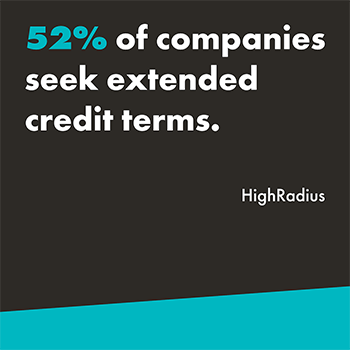

As businesses become more risk-averse, they are tightening their credit terms. This can involve shortening payment terms (e.g., from net 60 to net 30), reducing credit limits for existing customers, and issuing lower initial credit lines for new customers. According to a March 2024 report by HighRadius, 52 percent of companies seek extended terms – quite the opposite view. The same report shows that 17 percent of customers blatantly ignore credit terms while another 48 percent intentionally delay payment. This can make building strong customer relationships difficult.

Increased Use of Credit insurance

The rise in economic uncertainty has led to a surge in demand for credit insurance. Credit insurance protects businesses from monetary loss if a customer defaults on their payments. A 2023 survey by AU Group shows that since the third quarter of 2022, the number of business failures in almost every region of the world has risen. In line with that statistic, credit insurers expect growth in their sales over the next six years.

Growing Use of Digital Credit Tools

The pandemic has accelerated the adoption of digital credit tools and automation. Tasks like processing credit applications, credit checks, and collections are now being completed faster and allowing credit teams to focus on exception management.

Collection Challenges

The pandemic caused many businesses to experience cash flow disruptions. It’s made it more difficult for some companies to meet and/or maintain on time payments.

Cash Flow Management

Businesses are focusing on more effective ways to manage their working capital. This can include reworking their collection processes and closely tracking inventory levels.

Opportunity Emerges

All these changes have significantly affected credit managers and their teams. Now, they carry heavier workloads and face increased pressure to mitigate credit related risks. They also need to be able to adapt to rapid changes that may happen in today’s economy.

While these changes may have increased the burden on credit managers, they’ve also created opportunities for collaboration with sales teams. By working together, credit managers and sales teams can better service their businesses and customers.

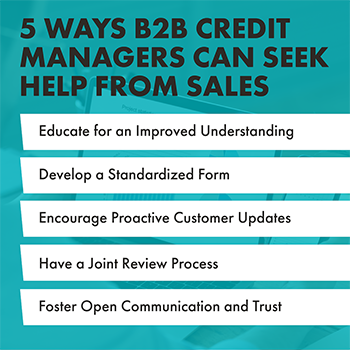

5 Ways B2B Credit Managers Can Seek Help from Sales

In today’s risky and fraud-ridden environment, the sales team support in customer onboarding and credit is vital. Credit and sales teams must collaborate to ensure a positive and seamless customer experience. Here are some tips to foster better collaboration:

Educate for an Improved Understanding

Sales teams are crucial in helping gather customer information to assess creditworthiness. Credit managers can help sales teams understand the importance of collecting this information. Sharing its use and how having it can make the approval process faster helps, too.

Develop a Standardized Form

A standardized customer information form ensures sales teams collect all the required information. This can help streamline the credit approval process.

Encourage Proactive Customer Updates

Credit teams must stay updated on customer developments. Encourage the sales team to proactively share any relevant customer updates with the credit department. Discuss what information is “relevant”, so everyone is on the same page.

Have a Joint Review Process

Joint sales and credit reviews can ensure both teams understand customer creditworthiness. They can help prevent incidents where a customer is given an okay by sales and later is deemed to be a credit risk. At the same time, joint reviews will strengthen the relationship between sales and credit while improving the customer experience.

Foster Open Communication and Trust

Open communication and trust are essential for effective collaboration between teams. Credit managers should be available to answer sales teams’ questions and provide guidance on any credit-related matters.

Is This the New Normal for B2B Credit Management?

It appears this “new normal” of post-pandemic business is here to stay, and it’s changed credit management for the foreseeable future. Because of this, we must have a more strategic and data-driven approach to B2B credit management. Those credit teams that adapt to these changes and improve collaboration with sales will be well-positioned to thrive in today’s economy. Furthermore, those who stay flexible and committed to delivering exceptional service will aid their company’s success. Will your credit team be the ones to hold revenue back or help drive it forward?

Get More Content Like This In Your InboxAbout the Author

Tracy Mitchell currently holds the position of Director of Accounts Receivable at Trinity Logistics. She has worked at Trinity for nine years, with over five years of those in credit management. She holds a Credit Business Association (CBA) designation. With a deep understanding of the industry’s dynamics, she has firsthand knowledge and provides the company with invaluable insights into the complexities of credit risk assessment, collections, and sales alignment.