01/17/2025 by Greg Massey

January 2025 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Rising Tide of Rejection

Continuing our theme of tender rejection rates being a leading indicator of freight rates, the momentum gained over the last few months continues.

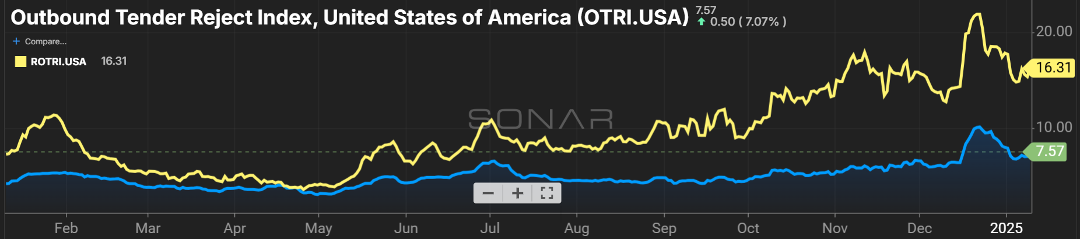

While the tender rejection rate (Figure 1.1) for the overall U.S. (blue line) briefly touched the 10 percent marker, it has retreated. However, it still appears to be slowly climbing, currently sitting just below eight percent. Being 300 basis points above the mark a year ago is a big deal and shows the relationship that exists between carriers saying “no thank you” to a shipment offered to them and the continuing retreat in carrier capacity.

Further, the rejection rate on refrigerated shipments (yellow line) has continued its run of outpacing the overall U.S. rejection rate for the past eight months. Colder than normal temperatures across much of the country has contributed to the need for reefer unit trailers to keep product from freezing. Shippers, especially those that play in refrigerated commodities, need to ensure they are flush with carrier and broker capacity, and should anticipate rate increase requests from their providers.

Speaking of capacity, we continue to see the slow trickle of carriers leaving the market. Looking at the past year, the trend for 2025 is we will see capacity decline at a three-to-five percent pace. Figure 2.1 shows the net change in carrier authorities, for the most part staying in the negative territory.

Looking further into the loss of capacity, the teal line shows the change in authority for micro fleets (one-to-five trucks). This is typically the owner operator community. Increases in costs to operate, as well as equipment where these carriers may be upside down on payments, has caused several to retreat from operating in the industry.

Calm Waters Ahead

Finally, a potential strike at East Coast and Gulf ports was averted for a second time. This is certainly good news as shippers continue to pull forward orders in anticipation of tariffs being imposed on import volume.

Just a few years ago, East Coast ports were seeing almost half of the U.S. import volume flow through their ports. Much of this shift was due to labor and operations issues on the West Coast. We are now seeing that reverse course.

East Coast ports are handling 41 percent of inbound ocean freight, while West Coast ports are up over the same two-year period, from 37 percent to 47 percent. With ILWU voting in favor of a contract that extends through mid-2028, and East and Gulf port workers agreeing on a six-year deal, a sense of calm should come to shippers and manufacturers that depend on our ports to receive their freight.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox