Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

FRANCIS SCOTT KEY BRIDGE IMPACT

Watching the video of the bridge collapse was surreal. To have that structure there one minute, then five seconds later be completely gone, was jaw-dropping. Certainly, our thoughts and prayers are with those whose lives were impacted by the collapse.

Since the incident, clean-up has begun and a temporary waterway has been established, but it will take a while for the port to fully recover, let alone the bridge itself to be rebuilt. While the 30,000 plus vehicles that regularly cross that bridge is a sizable number, it’s about one-sixth of the volume that uses nearby major thoroughfares like I-695 or I-95 in the Baltimore area. Still, that traffic will need to go somewhere.

From the trucking side, there will likely be two main areas of impact. First, local freight that is destined for ocean travel will now need to find another port of departure, likely destinations the ports of NJ/NY; Philadelphia; and Norfolk, VA. This means more freight will be heading out of the Baltimore area.

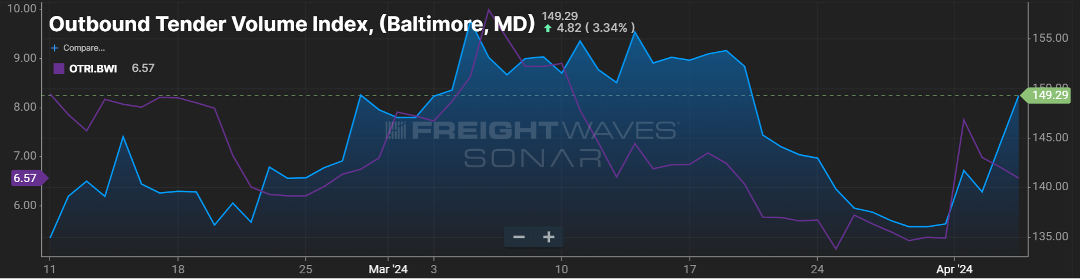

Figure 1.1 below shows that since the end of March, right around the time of the bridge collapse, outbound volume, and freight tender rejection rates, have trended upward. Second, freight that travels around the Baltimore area will likely incur more out of “normal” route miles if the bridge was part of its route.

More carrier miles = more time to deliver = less time for other freight = increased freight costs.

SOME BALANCE SEEN

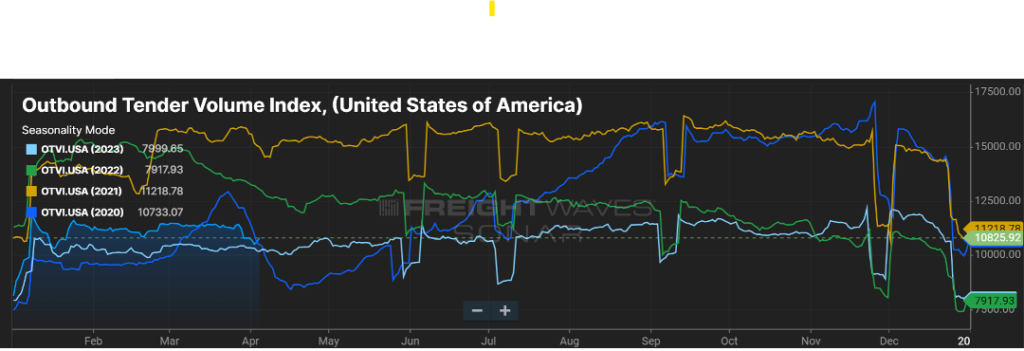

Overall, freight volumes have trended slightly above 2023 (Figure 2.1).

This has not dramatically impacted freight rates nationally or freight tender rejection rates. Excess capacity continues its slow runoff, and March saw an uptick in for hire carriers.

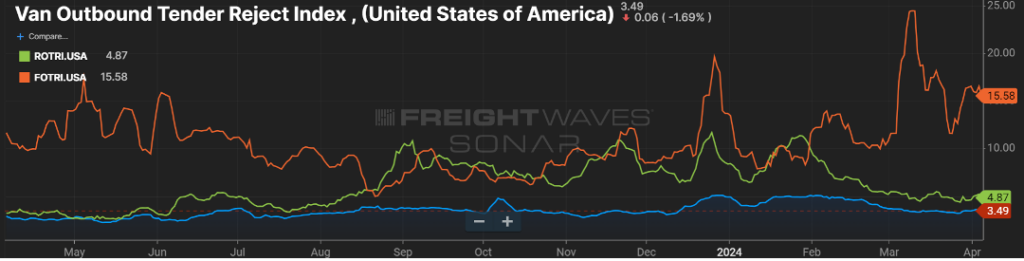

On a more granular scale, flatbed freight seems to be more optimistic. As seasonal flatbed type freight, combined with an uptick in industrial production and manufacturing activity is occurring, it has pushed flatbed rejection rates to more normal levels over the past few months as seen in Figure 3.1.

Flatbed rejection rates reached their highest point in over a year recently, and a 15 percent rejection rate is indicative of a more balanced freight market, if only for a certain equipment type segment.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

WILL 2024 BE A FREIGHT REBOUND YEAR?

I certainly do not expect that we will return to freight volumes like we saw in 2021, and part of 2022. Now, I will never say never, but those were most likely once in a lifetime events. However, there are many signs that point to a potential for 2024 to see a rebound in freight volumes and carrier rates.

First, let’s talk about rates for over-the-road (OTR) carriers. Many new entrants came to the carrier market in ’21 and ’22, but currently, we’re seeing the contraction of for-hire carriers.

As shown in Figure 1.1, the past 14 months have seen less carriers in the market. As supply continues to dwindle, this will put upward pressure on rates. Granted, it may take another 12 months for the carrier market to find an economic balance.

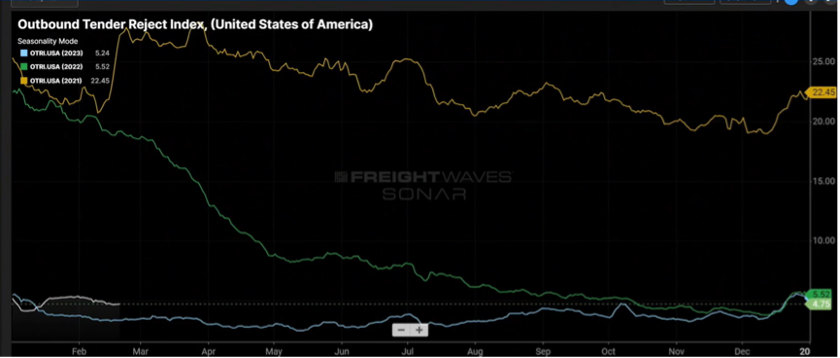

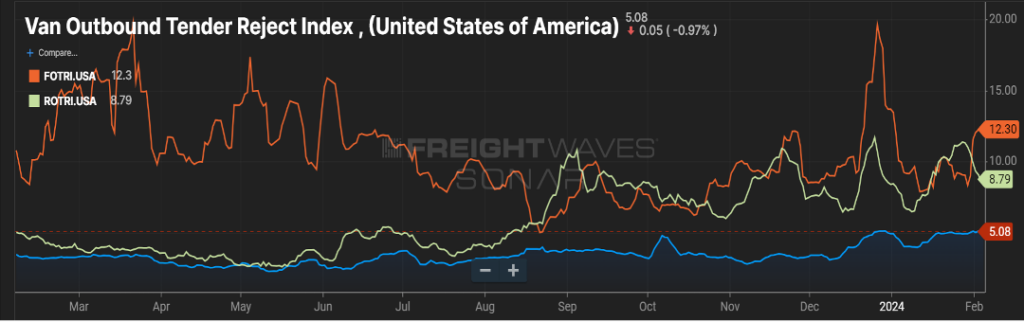

Figure 1.2 measures the rate at which carriers reject tenders (shipments) and continues to slowly climb upward. Granted, a rejection rate of five-plus percent is not earth-shattering, but in comparison to where it was in 2023, sub three percent in several months, five percent and the continuing upward movement is noticeable.

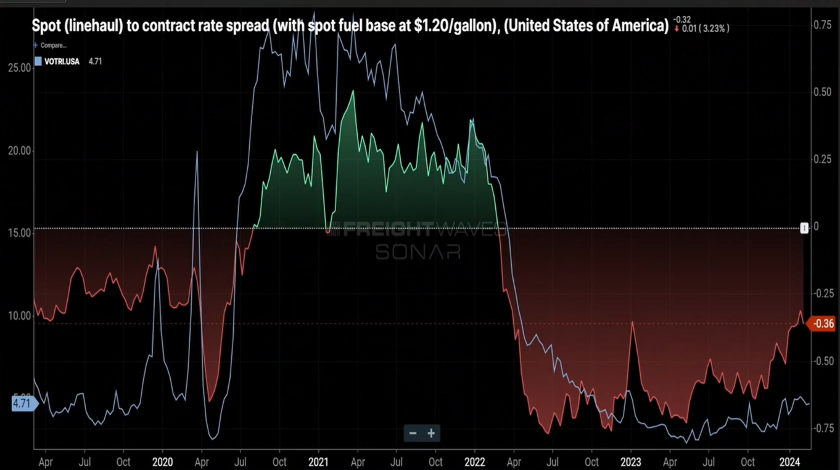

Lastly, Figure 1.3 shows that spot rates continue their slow rebound from the middle part of 2023. Contract rates throughout much of 2022 and half of 2023, were $0.60 to $0.70 cents per mile higher. Today, that gap stands at $0.36 per mile. This is a combination of spot rates inching higher, but also contract rates being less than prior years.

An Opportunistic Outlook

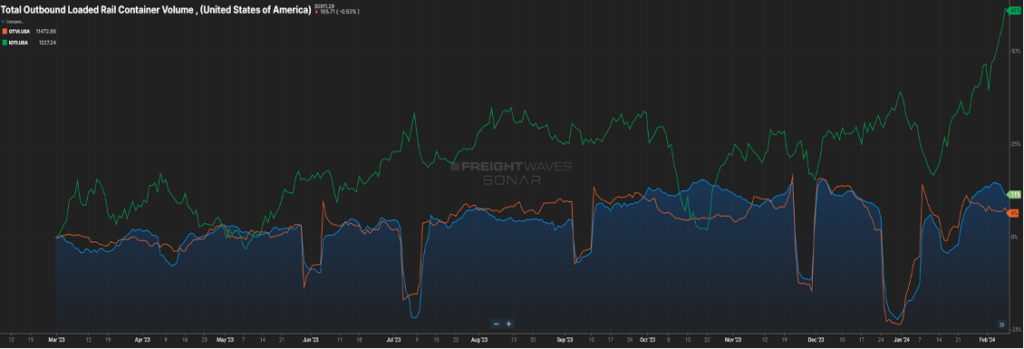

While contraction in the carrier market will influence the supply side of the economic equation, there also needs to be a demand component. The below chart (Figure 2.1) shows loaded rail car volume and over-the-road volume trending up and to the right, but the green line, representing inbound ocean containers, is really peaking.

Eventually, these containers will morph into rail and OTR volume. This is most likely a result in the drawing down of inventories, and the need for replenishment. Combine this with continuing increases in the manufacturing sector and housing market that will show better signs than 2023, it sets the stage for strong demand especially in the second half of 2024.

Will it be a bull or bear year in ’24? Well, if you would have asked that question six months ago, even maybe three months ago, my answer would have been slightly bearish or at best flat. However, seeing the recent signs on freight activity and the carriers needed to move this freight gives more reason to be optimistic as we go through the next ten months of the year.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

COULD WE LOSE CARRIER CAPACITY….WITHOUT LOSING ACTUAL CAPACITY?

Certainly, this question could cause one to scratch his head. If we don’t have a decline in the number of operating authorities, or available trucks, then how could we lose capacity?

Well, technically, the answer is you would not be physically losing trucks. However, an impact could be felt from recent events with regards to container shipping that would make it feel like less trucks are available. With recent geo-political events, and events at home, shipping to the West Coast has become more feasible than it was a year, certainly two years, ago. As ocean carriers are mindful of events in the Red Sea, combined with an easing of labor tensions at the West Coast ports, freight that in prior years was diverted to the East Coast is now heading back to the left coast of our country.

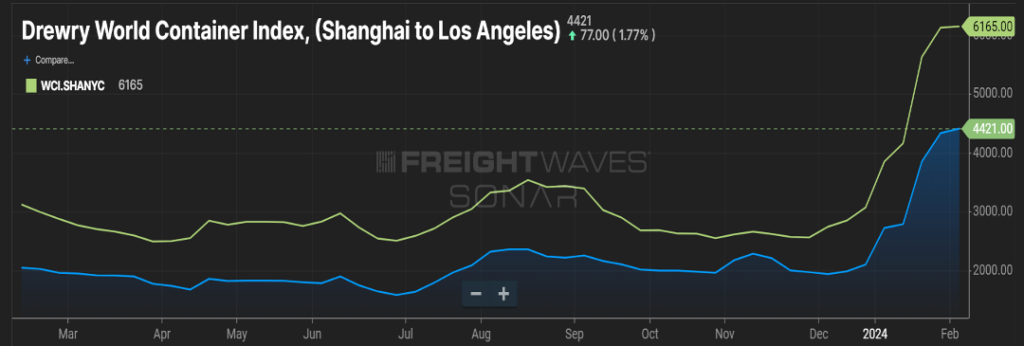

As you can see in Figure 1.1, container costs from Asia to Los Angeles are over $1700 cheaper than freight bound for an East Coast port, such as New York. Figure 2.1 shows outbound freight volume for the last year in the Los Angeles market, currently seven percent higher than this time last year.

So how could this impact capacity? When freight hits the East Coast ports, it’s typically consumed close to the port or at the very least, the coast itself. This means more regional runs. When freight hits the West Coast, typically that freight is destined for locations such as Dallas, TX or Chicago, IL, so taking freight up and down the East Coast may be a one-day run. Freight out of the Los Angeles market, heading to further destinations would take a day and a half, two days.

Same freight, same one-truck move, but now it occupies that truck for twice as long. Additionally, this could necessitate a shifting of fleet resources from one coast to the other, potentially creating an over-capacity on one side of the U.S. while the other coast is more desperate for trucks.

SPRING IN 6 WEEKS?

Will that rodent in Pennsylvania be right this year, and will freight volumes accelerate quicker as a result? First of all, ‘ol Punxsutawney Phil is batting less than 50 percent for his career and the last 10 years he’s only been accurate three times.

A better canary in the cave would be how the rejection rate index ebbs and flows. As you can see in Figure 3.1, van rejection rates have been pretty stagnant for the past year. Flatbed has remained relatively high and reefer rejection rates have trended up the last five months. If Phil is a soothsayer this year, we expect flatbed rejection rates to continue rising. If produce season also starts earlier than most, reefer rejection rates will then follow.

As reminder, with increases in rejection rates, shippers typically see transportation costs increase on the spot market.

Stay tuned for next month’s update to see if an early spring is a turning of the tide for the freight market.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxIt’s no secret that capacity gets tighter and freight rates higher for all shippers during produce season. While the increased freight demand during produce season affects all markets, produce shippers and those with other temperature-controlled products are hit the hardest. Yet, produce shippers that make use of these suggested tips have a better chance of finding capacity and keeping their costs manageable.

TABLE OF CONTENTS

- When is produce season?

- Tips for produce shippers during produce season

- Make your produce easy to work with

- Have your produce truck ready

- Make sure your carriers are vetted

- Find providers that run temp-controlled year-round

- Make use of technology

- Be the produce shipper all the carriers want to work with

- Look into multimodal solutions

- Measure carrier performance

- Consider a 3PL

- It’s not too late!

When is Produce Season?

Produce season is impactful because it puts pressure on freight shipping rates, which affects shippers both inside and outside the produce sector. To simplify, it’s the rise in crop volumes and heightened demand for trucks to transport these crops that impact capacity during this season. These factors lead to an increase in rates, not only for the shippers who need trucks with temperature control but for a majority of shippers across other modes and regions as well.

It’s vital for produce shippers and all others impacted by produce season to know exactly when the spike in shipping begins. Generally, produce season begins sometime around February and runs through early fall. The main regional areas shipping increased produce are Florida and the East Coast, Texas and surrounding states, and California.

Texas Produce Season

The most impactful time is from March through June however, produce can be found year-round coming from over the border out of Mexico. In Arizona and New Mexico, there is a push for produce that usually occurs in October or November.

Florida Produce Season

Starting as early as March, southeastern states like Florida begin to see an uptick in produce shipping. As temperatures warm up, produce season creeps its way up the East Coast with northeastern states’ produce shippers slowing down sometime in early fall.

California Produce Season

Like the East Coast, produce season starts in the southern part of the state around March and creeps its way up to the northern region, ending in early fall.

Tips for Produce Shippers During Produce Season

Produce shippers facing challenges with capacity during produce season isn’t new. But there are things produce shippers can do to make shipping during produce season easier. Here are some tips you should consider to make it through this tough season.

Make Your Produce Easy to Work With

When capacity is tight and rates are high, carriers get to pick and choose what load they want. Make your produce shipments more desirable by making the job easy to complete.

One way to do this is through freight consolidation. Regional consolidation makes freight easier for carriers to work with. Simply put, instead of using a long-haul truck to make many pick-ups or deliveries in a regional area, hire a regional short-haul expert to do that part. They make all the pick-ups and deliver to one spot so that your long-haul carrier can make one easy pick-up and drive onward. Vice versa is that the long-haul carrier would drop off at one regional facility, and then you use the regional carrier to make the many deliveries.

We’ve found that consolidating the freight this way increases the percentage of on-time delivery, increasing your product’s shelf life and customer satisfaction.

Make Sure Your Produce is Truck Ready

This goes hand in hand with making your produce easy to work with. Often, produce vendors will work with many packing house facilities. Make sure you confirm with the produce shipper where the truck needs to pick up. It’s never a great start to a shipment when a driver has to search location after location for their pick-up. Not only does the driver get frustrated, but with it being a time-sensitive shipment, you want to make sure there are no hang-ups, so it’s picked up on time, delivered on time, and your product’s shelf life is as long as possible.

Make Sure Your Carriers are Vetted

This may be your most important piece of advice. Make sure your selected carriers are properly vetted.

What exactly do we mean by that? This means making sure they have reefer breakdown coverage. Or making sure they have the right amount of insurance coverage in case something goes wrong.

For example, cherries are hard to come by and based on market conditions, their value can change. Does your carrier have that coverage should there be a problem?

There’s also FSMA compliance to consider now. Does your carrier know how to work with produce shipments? Do they have that experience? Do they carry pulp thermometers in their trucks and understand that process to ensure they are not loading produce that is too hot or too cold, making sure it will be in good shape when it’s delivered? All these factors are something to keep in mind regardless of market conditions.

When selecting and vetting your carriers, remember there is a big difference between the cheapest truck and the RIGHT truck.

Find Providers that Run Temp-Controlled Year-Round

Finding and building a relationship with providers that execute year-round temperature-controlled freight across the country can give produce shippers a competitive advantage. By having that relationship, you’ll know and better trust your provider because they have the proven experience and understanding of working with your perishable freight. Additionally, having that reliable relationship can help you keep your costs down during peak produce season.

Make Use of Technology

Making use of transportation management (TMS) technology can help during this season. A TMS can help you with routing decisions by matching freight with the best carriers, lanes, rates, and transit service. In addition, it will allow you to optimize the in-house processes of your transportation network – which can help in both times of disruption and easier times. By selecting the best carriers and optimizing your routes, you’ll not only increase your service levels but reduce your risk.

Having a best-in-class TMS also provides you with data-driven insight to better manage disruptions, reduce downtime, and effectively plan and budget your logistics spend. By using data analytics, you’ll be able to recognize which carriers are most likely to have the capacity, allowing you to reduce your harvesting to minimal levels.

Having a TMS on hand gives you a full view of your network and transportation management. You’ll be able to see what’s happening across all markets, ensure proper rates for shipments, find freight consolidation options, and track everything from start to finish. You’ll be better prepared for now and any future disruptions. Not to mention, you’ll also gain an extra layer of security to your supply chain, which is something top of mind for everyone in this industry.

Be the Produce Shipper All the Carriers Want to Work With

There is never a time when you shouldn’t strive to be a shipper of choice. Carriers are in the position of choosing which shippers they want to work with. Produce shippers who provide better experiences for carriers can reap long-term benefits in the form of higher service levels, fewer claims, and better rates.

To become a shipper that carriers want to work with, it’s important to run efficient and friendly dock operations, reduce driver wait times, provide comfortable breakroom and restroom accommodations, and pay carriers quickly. Let’s break these down further.

Have a Fair Accessorial Schedule

Make sure it is in line with industry standards. You can also leverage your relationships with other carriers, shippers, and 3pls to see how you compare.

Pay Quickly

In business, cash is king, especially for carriers. Favorable payment terms can make a world of a difference to a smaller carrier company or an owner-operator. Anything under 30 days is often ideal.

Tender with Ample Lead Time

This may not always be possible, but the sooner you get a load tender to your selected carrier, the better they can plan their own workload. Providing as much lead time as possible can help you get the best capacity available at the most cost-effective rates. It can also get you more committed freight and keep you out of the spot market. 48 hours or more is ideal.

Simplify Your Appointment Scheduling Process

Put yourself in your provider’s shoes. What is it like to get an appointment set? Is it a huge effort or is it quick and easy? The easier and more user-friendly the process is, the more carriers will want to work with you.

Have Realistic Transit Times

Whenever possible, schedule pick-ups and deliveries that set carriers up for success. If transit is too tight and a late driver will have to wait hours for the facility to work them in, then the load is less attractive. Whereas if the pick-up and delivery are too far apart and a driver will have to sit around to get unloaded, then the load is also less attractive. Make sure your transit times are reasonable and make sense to keep carriers moving along. They will appreciate it.

Turn Drivers as Quickly as Possible

The industry standard is two hours or less. Anything over that and your facility is at risk of having a negative reputation among drivers. Depending on your freight and operations, this may not be possible, but it is something important to keep in mind.

Provide Basic Amenities for Drivers

Access to bathrooms, vending machines, waiting rooms, Wi-Fi, and most importantly, a friendly smile at the dock will go a LONG way.

Look Into Multimodal Solutions

When truckload capacity is tight, using a variety of modes can help mitigate capacity challenges while reducing your cost. Exploring multimodal options can be a great way to diversify risk, add capacity, and protect your freight budget. It can also give you the opportunity to reduce your company’s carbon footprint.

Measure Carrier Performance

Whether you awarded hundreds of lanes in an RFP event or are a small shipper relying on the spot market, it’s important to have your supply chain driven by data, and tracking carrier performance is a part of that. If you can’t track it, how else can you make improvements?

Be sure to communicate your KPIs to every carrier you work with so they can be crystal clear on your expectations. Regularly evaluate your carrier base. Give them report cards and make sure their performance is not a mystery to you or them. You should also have a process in place for taking action for poor performance when needed. Again, clearly communicate that process to your providers, and be sure to stick with it. Inflationary markets will often show you which providers are serious about being your business partner.

Consider Working With a 3PL

To gain quick access to capacity, produce shippers should work with a quality third-party logistics company (3PL). 3PLs work by having quality carrier relationships often in a network way larger than you can manage alone. Additionally, working with them gets you access to TMS technology and an expert to help you throughout times of disruption. It allows you easy access to multimodal solutions so you can easily compare rates across modes. Quality 3pls will include proper carrier vetting, so you know you’re working with a qualified carrier. Additionally, 3pls keep tabs on the industry and are well known for their skills in navigating disruptions with ease.

IT’S NOT TOO LATE!

If you found some tips that could better help you, it’s not too late to act. Any improvements that you make now will help you ship better. The faster you act, the more likely you will beat your competition to the punch. Now all this might seem like an overwhelming amount to do, which is why we’d like to offer you our help.

Trinity has over 40 years of experience working through produce season and years of supply chain disruptions. We can help you with capacity through our network of strong carrier relationships available. We can also help you in your journey of being a shipper of choice as we offer carriers Quick Pay options through TriumphPay, available within two days.

Interested in freight consolidation or multimodal options? Our Team of Experts are here to help. We also have best-in-class TMS technology available with customized solutions to fit your needs, not the other way around, and experts to support you in those applications. Most importantly, we offer you a People-Centric approach throughout every step of the process.

No matter what you need to get through produce season, Trinity Logistics is capable and ready to support your business.

Discover how we help produce shippers succeed Get a Free Freight QuoteHello there. I’m Holly, Trinity’s friendly neighborhood freight Agent Recruiter.

Every day I have the privilege of working with our Authorized Agents as well as finding new freight agent businesses to welcome into the Trinity family. This has given me a bird’s eye view of what it takes to run a successful freight agent business. And I can tell you, IT’S HARD!!! It’s a grind. It’s a hustle. It requires a BIG dose of grit and determination. But it’s in our blood! We thrive on the fast pace, the opportunity for unlimited income, and the flexibility of running our own show.

With all that being said, I’m extremely proud of the tools, resources, and personalized support Trinity provides to our Authorized Agents daily. While I could go into all the things we can do to help support your freight agent business, today, I’ll settle for the opportunity to introduce you to four unique resources we provide our Authorized Agent network to make their days easier and their businesses more profitable.

SAVE TIME WITH RFPs

Do you find Requests For Proposals (RFPs) an annoying time suck? Not anymore! At Trinity, we take care of the heavy lifting for you.

Trinity’s Authorized Agents have full access to our in-house Pricing Team for RFPs both large and small. Our Team works hard to combine data from many market sources plus our extensive internal lane history to compare a total of nine data points. That’s some impressive wizardry, I tell you! This will not only save you time from figuring out the right pricing but also give you confidence that the pricing details you share with your customer are spot on.

And that’s not all! We also provide you with real-time market-specific rates focused on your customer’s needs. This way, you can be as hands-on or hands-off in the process as you choose.

AND DON’T WORRY ABOUT CAPACITY

You’ve just saved time on the pricing aspect of your RFP. It’s complete, and you’ve won your lanes, but what happens next?

You get on the phone with your relationship carriers for their rates and volume commitments. In an ideal world, the rates are great and there’s plenty of capacity. Awesome! Time to get back to helping your customers and growing your freight agent business.

But how often does that really happen? Often, your relationship carriers don’t run those new lanes, don’t have the capacity to commit, or ask for rates above the market. So, what do you do then? Most likely, head on to those dreaded load boards.

Here comes Trinity to save the day. Our Authorized Agents have full access to our Carrier Procurement and Development Team. This Team of Trinity experts will take the data from your RFP, find you capacity using our proprietary lane matching technology and then get rate agreements in place for COMMITTED capacity to service your customer’s needs.

So, if you often work with RFPs for your customers, go ahead and press the easy button with Trinity!

WORK SMARTER, NOT HARDER

Are you looking for a deeper dive to uncover your most profitable freight? We’re here to help you with that! By using your load history, our Pricing Team will provide you with a Network Analysis to give valuable insight into your most profitable lanes. With this data in mind, you’ll be able to focus your sales efforts on the markets that produce the highest margin to help you reach your freight agent business goals. We’ll help you work smarter, not harder!

EASILY DIVERSIFY YOUR FREIGHT AGENT BUSINESS

One more thought for the day; let’s say you specialize in full truckload freight. In fact, you’re such an expert that you can almost move it with your eyes closed.

But in this constantly evolving freight market, your customers ask you for help with all kinds of other weird stuff like less-than-truckload (LTL), intermodal, drayage, ocean or air, expedited freight, technology solutions, warehousing, e-commerce…maybe even a total outsource!

With you being a full truckload shipping expert, this may sound intimidating! And the last thing you want to do is send them somewhere else and risk that “other guy” poaching your freight.

There’s no longer a need to worry! Trinity Logistics has you covered. We offer full operations teams for our Authorized Agents to handle ALL other modes besides full truckload. Pair that with our parent company, Burris Logistics, and their opportunities, and it’s simple. You bring the opportunity, and we do the rest. All you need to do is sit back and collect the extra margin for your growing freight agent business.

Additionally, we provide you with monthly mode training classes so you can learn and be confident in what you are selling. There’s no need to be the subject matter expert on all modes when you have Trinity Team Members to support you and your freight agent business.

JOIN THE TRINITY FAMILY AND BEGIN GROWING YOUR FREIGHT AGENT BUSINESS

Trinity Logistics has over 30 years of experience aiding in the success of our freight agent businesses, with many of our newer businesses seeing a 50 percent increase over a two-year period from joining. Consider joining our Authorized Agent Network today so you can gain more time to focus on your customers, generate more revenue, and we’ll focus on everything else.

To learn more about our Authorized Agent program and all the ways we can save you time and help you build a successful freight agent business, feel free to contact our Agent Team phone at 800-846-3400 x 1908 or click the button below!

I'd like to connect with TrinityAs more shippers look to reduce freight costs and their carbon footprint, intermodal logistics continues to see rapid growth. The Intermodal Freight Transportation Market has predicted a Compound Annual Growth Rate (CAGR) of 8.27 percent from 2021 to 2026 for intermodal logistics. And with intermodal peak season on the way, shippers using this mode must have the right shipping strategies in place.

Intermodal can be a very effective mode when it matches up with the right customers, but with the rapid growth of customers choosing intermodal logistics, we often hear a similar question from our shipping customers: “What should I expect during intermodal peak season?” So, let’s learn more about what peak season for intermodal is, how it may affect you, and what you can do to stay ahead.

WHEN IS INTERMODAL PEAK SHIPPING SEASON?

Peak shipping season refers to the time of year when freight volumes see an influx. For most modes, this falls in line with the time of year when retailers begin pushing inventory for back-to-school and the holiday season. During this time, shippers try to keep up with demand and manage inventories while fulfilling a high volume of orders, and motor carriers are busier than usual trying to deliver freight on time.

Historically, the peak shipping season for intermodal logistics is around June to December. While June may seem a bit early, many shippers are rushing to get their goods through West Coast ports before June 30th, and rail is a popular way for shippers to transport their West Coast imports. According to the Alameda Corridor Transportation Authority, since 2006, the number of goods imported and then loaded into intermodal equipment through Los Angeles and Long Beach ports has grown 25 percent.

With roughly two-thirds of intermodal containers coming off the West Coast from import traffic during peak season, this limits the supply of 53’ containers heading East.

Even though June is the typical start of peak season for intermodal, it can fluctuate. Some years it can be later or earlier. But since the start of the pandemic, intermodal logistics have been greatly affected by capacity, making peak season more year-round than in former years. This is because of the rapid increase in online shopping year-round for consumers, which the pandemic only heightened.

“The past two years since the beginning of covid-19 has greatly impacted intermodal capacity,” says Jennifer Fritz, Trinity intermodal expert. “Historically peak season for intermodal logistics usually starts June through December, but with capacity affected by the change in supply chains from covid-19, it’s been tight year-round, making peak season pressure felt year-round instead of a few months of the year.”

CHALLENGES OF INTERMODAL PEAK SEASON

Expected or unexpected, any time there is a major shift in supply chains, it can throw off your operation. So, how does peak season affect intermodal logistics? Well, it’s not much different than peak season shipping for any other mode.

You’ll see tightened capacity because of the increased freight volumes and demand. And anytime we see tightened capacity, we see increased prices as well. So, the more in demand something is with less supply, it equals higher rates.

You’re also bound to see some shipping delays and need to give longer lead times. Your usual service levels may also drop because of the overwhelming volumes of freight needing to be moved during peak season shipping. Especially lately with the continued covid-19 pandemic still affecting the market, West Coast ports, and ultimately, intermodal logistics.

Take Control of Your Intermodal Logistics During Peak Season

Make sure you’re not unprepared for intermodal peak season. Each peak season is variable, rarely unlike another, and planning is more critical than ever with it being more frequent and extreme. Here are some tips to help you take control of intermodal peak season.

Give Even More Lead Time

Book your intermodal shipments as far in advance as possible. Prices are volatile during intermodal peak season, and the rate to move a shipment through intermodal logistics can increase by hundreds of dollars over a single day. In addition, available equipment can often be an issue. This is not the season to wait until the last minute.

Stay Updated on the Industry

Ever since the start of the pandemic, it’s more important than ever to know what’s going on in intermodal logistics. As we’ve seen over the past few years, supply chain disruption can happen at any time, so make sure you check the news daily or have a good resource to give you all the information you need.

Try Shipping Later

Perhaps all your items don’t need to arrive during peak season. Great. If possible, schedule those shipments to ship after intermodal peak season, when there is more capacity and you’ll likely get a better shipping rate, or at least stagger them. So, if part of your shipment needs to arrive right away, have that delivered faster. And for any freight that doesn’t need to deliver quickly, schedule that shipment for a later date.

Plan for Extra Time

As noted, with the influx of freight needing to be moved, there are bound to be delays. Many intermodal carriers have fully planned days and if they get delayed, it affects the rest of their movements. So, make sure you allow plenty of time for your products to get to their destination. This will help keep a delay from happening and possibly get you a better freight rate.

Shop Around

Prices can fluctuate between providers and from day to day. If you have the time, try getting prices from a few different providers or being more flexible with your dates to see if you can find a better value. For example, the difference between a 15-day delivery time and a 20-day delivery time could be significant. Check out all avenues and find what works best for your budget and freight.

Have Modal Flexibility

Sometimes a mode will max out on capacity. If capacity is reached for intermodal logistics, ensure you have relationships with over-the-road carriers or a third-party logistics company as a backup. This ensures no matter what, you’ll be able to get your freight from point A to point B.

Leverage Partnerships

Partnering with an experienced 3PL can make navigating peak season for intermodal logistics, or any logistics mode, more accessible. Companies, like Trinity Logistics, often have longstanding relationships with carriers for all modes, plus logistics technology and well-trained teams ready to help you. A reputable 3PL will have seen it all during peak shipping seasons and be able to help you manage your logistics without batting an eyelash.

GET HELP WITH YOUR INTERMODAL LOGISTICS, NO MATTER THE SEASON

While we can’t look into a crystal ball and predict how long this never-ending peak season for intermodal logistics will last, we can tell you that many logistics providers and shippers are adapting. Intermodal peak season shipping can be stressful, but these tips can help you better navigate your intermodal logistics during the peak shipping season.

If you’re looking for help, Trinity Logistics is here to support you. We have a full Team of Intermodal Experts, experienced and ready to assist you with your intermodal logistics. Simply click the button below and let’s get connected.

Learn about our Intermodal serviceIf you follow any of the transportation or trucking-related publications or are situated on the West Coast, you probably have seen or heard the term “AB5”. The AB5 law, popularly known as the “gig worker bill”, is formerly known as California Assembly Bill 5. Here’s a quick rundown of how it came to be, what it means, and who is affected.

WHAT IS THE AB5 LAW TIMELINE?

- Passed by the California Senate and House, and signed into law by the Governor of California in September 2019

- A preliminary injunction delayed the enactment of the bill in 2020

- In June 2022, the Supreme Court of the U.S. declined to hear the appeal, thus rendering the injunction defunct and AB5 cleared to be enacted

WHAT DOES THE AB5 LAW MEAN?

At its core, the bill was passed to decide if a worker meets the classification of an employee or maintains independent contractor status. The bill uses a three-prong test to determine a worker’s classification. To be identified as an independent contractor, a worker must:

- Be free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

- Perform work that is outside the usual course of the hiring entity’s business.

- Be customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

WHO GETS AFFECTED?

Like any piece of legislation, there are exceptions. Unfortunately, independent contractor truck drivers, otherwise known as owner-operators are not part of the exception list, and that number is approximately 70,000 in the state of California. Trucking companies that utilize the service of owner-operators to run their business are at risk of being in violation of the law.

IF I WANT TO WORK WITH A motor CARRIER BASED IN CALIFORNIA, DO I NEED TO VERIFY THAT THEY ARE AB5 COMPLIANT?

As with any carrier, whether they are based in California or any other state, they are required to comply with all federal and state regulations. Some states have more regulations than others, with the California CARB regulation being a good example. As with those regulations, the responsibility to comply 100 percent lies with the carrier.

WHAT COULD BE THE IMPACT OF THIS LEGISLATION TAKING EFFECT?

The estimate is that 70,000 truck drivers in the state of California could be impacted. Certainly, there is the option for companies that utilize these independent truck drivers to hire them as employees. That may be unlikely as these drivers enjoy the benefits of running their own business versus being a company driver. There is also the possibility that owner-operators will look to relocate outside the state of California. Nonetheless, this law will put further pressure on California’s capacity among current activity in ad around California’s ports, creating another disruption to the U.S.’s already stressed supply chains.

STAY UP TO DATE

Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Updates” when you select your preferences.

Join Our Mailing ListHow do we get supply chains back on track after years of constant disruption and setbacks? The supply chain backlogs came largely from the shock at the start of the pandemic, but even before then, there have been many supply chain vulnerabilities.

Supply Chain Resiliency: Alleviating Backlogs and Strengthening Long-Term Security

Recently, Congress met to discuss our national and global supply chains, current supply chain issues that we need to focus on now, and how to build supply chain resiliency for the long term. Congress invited individuals and organizations to come to testify, to present their views for inclusion on the topic. U.S. Senator for Delaware, Tom Carper, asked Doug Potvin, Chief Financial Officer (CFO) of Trinity Logistics to testify.

With 16 years of service at Trinity and over 30 years of industry experience, Doug sees first-hand the problems plaguing supply chains. Doug’s testimony gave the Members of this panel valuable insight into the continued problems in supply chains and how members of the Transportation Intermediary Association (TIA), like Trinity Logistics, continue to serve the nation amidst these difficult times.

Doug’s Testimony Before Congress

“ I want to introduce myself as the CFO, Chief Fun Officer at Trinity Logistics because we like to have fun when we’re working hard. Thank you for the opportunity to speak with you today regarding how policymakers and business leaders are addressing the existing backlogs in the supply chain in the short term and building more resilient supply chains in the long term. My name is Doug Potvin. I’m the CFO of Trinity, a third-party logistics company (3PL) headquartered in Seaford. I’m privileged, honored, and humbled here today representing Trinity, our association, Transportation Intermediary Association, and the entire third-party logistics industry that we serve.

We serve as an intermediary in solving the logistical needs of our shipper customers by sourcing capacity from motor carriers and vendor partners. We are proud to report today that this past year we’ve generated over 1 billion dollars in revenue, arranged over half a million shipments, and offered 350 individuals full and part-time jobs. We truly are a proud Delaware company.

From Charles Dickens, the novel, The Tale of Two Cities; It was the best of times, it was the worst of times. Season of light is the season of darkness, a spring of hope is a winter of despair. Over the last two years, the same could be said of the international supply chain and from our perspective, closer to home, the domestic transportation industry.

In March of 2020 as both domestic and international countries shut our businesses including the shutting of the port cities and operations in China and the fact most consumers were at home facing an uncertain future, freight volumes plummeted. Motor carrier capacity increased dramatically due to the steep drop in goods moving and the transportation market saw prices for motor carriers fall. In fact, Trinity Logistics was mentioned on a Facebook post that we were earning an average gross margin of 60 percent, which was simply wrong.

In addition, a small number of motor carriers came to Washington D.C. and demanded rate transparency. Interesting after the businesses, ports, and countries opened up freight volumes began to skyrocket, available motor carrier capacity tightened up, and rates paid to motor carriers increased due to reflecting the change in market conditions. Demand for rate transparency went silent.

The pricing in our industry is driven by market conditions, supply and demand. Large scale, no entity on either side of the equation has enough market share to drive rates. In addition, each shipment has its own variable considerations to take into account including everything from available to capacity in various regional markets, lead time for products, dwell time at shippers and consignees, commodities needing move, and type of equipment needed. All this happens in real-time to ensure goods get to market, keeping our economy moving forward.

Now more than ever, the role of third-party logistics professionals has become more valuable. Companies like Trinity and the other 28,000 licensed property brokers are working overtime to ensure that essential goods continue to be delivered in an efficient manner to meet our customer and consumer needs. Our industry along with motor carriers are the main component as the why during the crisis and disruption, the supply chain bent but never broke.

Trinity Logistics applauds the U.S. Senate and House of Representatives’ Bipartisan passage of the Infrastructure Investment and Job Act, a historic investment into transportation and infrastructure. We’re very pleased to see how quickly the Federal Motor Carrier Safety Administration (FMSCA) established the Safe Driver Apprenticeship Pilot Program. Trinity hopes this three-year pilot program will be successful and made permanent so individuals ages 18 to 20 will explore interstate transport careers. Trinity also believes that as the spending on the Investment Act ramps up in the near future it will provide enough support to the economy to keep the motor carriers employed as we are starting to see freight volumes pull back over the last 30 to 60 days.

Trinity would also like to thank Chairman Carper, John Cornyn, Senator Menendez, and Senator Tim Scott for the support in offering legislation and getting the Senate to act unanimously in passing the Custom Trade Partnership Against Terrorism Act (CTPAT).

Currently, the vaccine mandate for truck drivers coming to the country to deliver freight from Canada and Mexico continues, these professional drivers spend most of their professional time alone in the truck cab, presenting a zero percent risk of spreading Covid-19. This should be lifted immediately to open up capacity and shorten the amount of time it takes to move goods across borders.

Another issue that greatly impacts not only the efficient movement of goods, but highway safety, is the lack of a federal motor carrier safety selection standard. Currently, because of broken safety rating systems from the FMCSA, almost 90 percent of trucking companies are considered unrated. There are no requirements in place before selecting a trucking company, that drastically impacts the overall safety of our nation’s highways. The latest report from the national highway traffic safety administration noted that the number of accidents involving commercial motor vehicles increased 13 percent in 2021. The status quo is not working, and highway safety needs to be improved. Trinity Logistics and our trade association, TIA, fully support legislation to create a motor carrier safety selection and mend the safety rating process.

The U.S. trucking spot market conditions have reflected towards weaker and more normal conditions, though we still will see what the future holds and how that trend continues. Hopefully as a result of this meeting and coordinated actions taken by the United States, our trading partners, manufacturers, supply chain vendors, our nations become resilient when facing similar conditions and uncertainty.”

Trinity Logistics would like to thank Chairman Tom Carper and the TIA for inviting Doug to testify before the Committee. He is a very valuable leader in the industry and Trinity Logistics appreciates all he does for our company, our industry, and our nation.

If you would like to watch the full hearing:

Stay in the know. Join our mailing list.Managing transportation costs is a top challenge for shippers, while another challenge that goes in hand is sourcing consistent and reliable capacity. Here enters the contract and spot markets. Which one is best? Which has better shipping freight rates?

Some believe the spot market is the way for shippers to save money and stay on top of capacity, while others think it’s contract. Choosing to use spot rates versus contract rates can be one of the biggest decisions for a logistics manager. Understanding their differences and when is best to use them will help give your business success. So, let’s dive into each of these markets so you can better determine your business’s strategy.

WHAT ARE SPOT RATES? WHAT IS THE SPOT MARKET?

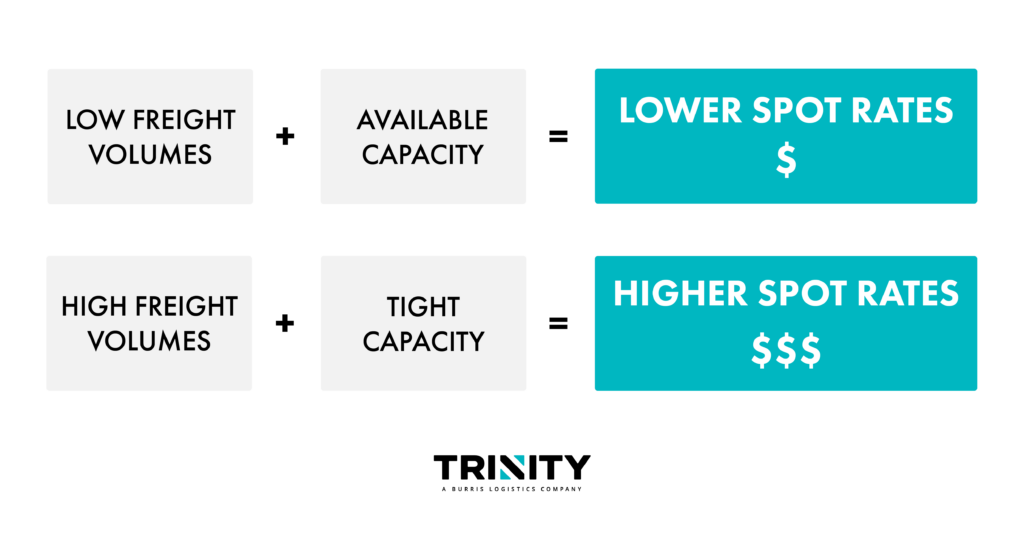

Spot freight rates are short-term transactional quotes for moving freight. These shipping freight rates are the price a transportation provider offers a shipper for a one-time quote to move their product from origin to destination. They reflect the real-time balance of supply and demand in logistics and the truckload market.

The quote is based on the value of the equipment needed at the moment of settlement. What determines the value of that equipment? Well, whether there is an excess or shortage of that exact equipment in the market and the lane at that time. Because market conditions directly affect spot rates, they are dynamic and can change day to day, even hour to hour. This is because the freight market can be more complex than simple supply and demand.

Thus, an increase in supply will lower spot rate prices if not accompanied by increased demand. And an increase in demand will raise spot rate prices unless accompanied by increased supply.

How to Track Rates in the Spot Market

You can keep track of the spot market through several industry websites and freight load boards to give you an inclination of what’s happening in the spot market. Some resources we like to follow are DAT and FREIGHTWAVES.

We even push out a monthly update to keep you in the loop of rates and other happenings in logistics. You can find our latest Freight Market Update on our YouTube channel.

It’s crucial to stay on top of the spot market should you find the need to use it. Even if you decide to use contract freight, it’s good to keep a pulse on it as contract rates are affected by the spot market. The higher spot rates are, the higher contract rates are too.

Who is the Spot Market Best for?

Many carriers, shippers, and third-party logistics (3PL) companies turn to the spot market for competitive rates. No matter how big or small, every shipper will move some of their freight on the spot market at some point. The spot market is great for when you might have a one-off shipment outside your usual shipping lanes. It’s good for shippers who don’t have enough regular volume for contracts or those who need more capacity than they contracted out. Or even those specialty shipments or non-standard load requirements.

Spot Market Pros/Cons

HOW TO GET YOUR BEST SHIPPING FREIGHT RATE ON THE SPOT MARKET

Provide Accurate, Detailed Shipment Information

Though you can get a spot quote with as little as the origin and destination zip codes, pick-up date, and equipment type, it’s best to have ALL shipment information ready. Excluding any critical information may have you unexpectedly paying for it later. The more precise information you have, the more accurate your spot rate quote will be, so you won’t have any surprise added charges.

Information you should have for your best quote:

- Origin city or zip code

- Destination city or zip code

- If your shipment requires EXACT pick-up and delivery appointments, make sure to communicate your appointments times

- Pickup date

- Equipment type (i.e., dry van, refrigerated, flatbed, RGN, etc.)

- Commodity type

- Product weight

- Any special requirements or non-standard requirements

- Examples of special/non-standard requirements are live load or unload, “no-touch” by the driver, drop trailer, hazardous materials, multi-stop, driver assist, floor-loaded, more than two hours of loading/unloading, and equipment age restrictions.

Provide Ample Lead Time

Shippers will request spot quotes anywhere from a week in advance to the day of. Most will request them one to two business days before their shipping date. The more time you can give before your shipping date, the better, as spot rates tend to increase as the pickup date approaches.

Giving yourself a few extra days to secure pricing and capacity will usually work in your favor and lead to less expensive freight rates. This is because there will be more carriers available versus trying to find one on your shipment day.

Don’t Wait Too Long to Confirm a Good Spot Rate Quote

Spot market rates are volatile and quickly change over short periods of time. Therefore, the quote you received yesterday may be different today. So, when you find a rate that works for your shipment, don’t wait to confirm it. Instead, lock it in ASAP for confirmed pricing and capacity. Once agreed on a rate, a reliable provider will rarely change it UNLESS an important piece of information about your shipment changes.

Set Appointments During Regular Business Hours

There is usually more capacity available during regular business hours. As incredibly hard-working as they are, drivers still like to be home on holidays, weekends, or nights when possible.

If your appointments need to be precise, make sure to include that information in your quote request so your quote can be accurate. But, if you can be flexible with your times, setting appointment windows instead of strict appointment times can open you up to more capacity. For example, drivers have to manage their strict Hours of Service so a flexible appointment window can help them better plan their day.

Spot Market Technology

Many providers offer digital freight platforms and give you access to free instant freight quotes. This can be a great way to stay on top of current pricing without sending a lot of emails to different providers. Good freight providers will have logistics experts on call should you have questions or need more help. But having the ability to get quotes on demand can add time back into your day.

Be Mindful of Carrier Selection

While cost is important when choosing your transportation provider, make sure you consider several other factors into consideration. You should consider their experience, efficiency, and service. While a cheap quote is great, it can sometimes result in a missed pick-up, hidden accessorial, or even a damaged product. All this could end up costing your business more.

When shopping the spot market, shop around and get quotes from a few different providers. Once you have a few quotes, evaluate the rates while considering your shipment requirements and ask yourself a few questions about your potential provider:

- Will this provider meet my service requirements?

- Are they easy to do business with?

- Can I use their tech tools to operate more efficiently?

- If something goes wrong, can I trust them to fix it?

WHAT ARE CONTRACT RATES? WHAT IS THE CONTRACT MARKET?

A contract rate is a rate quoted by a transportation provider to a shipper for a set lane and its freight characteristics over a set period of time. Contract rates can also be known as primary rates, bid rates, committed or dedicated rates. In short, they are a long-term, stable pricing agreement between shippers and transportation providers.

The contract market is highly dependent on the spot market. Typically, the three to six months of spot market activity leading up to an RFP will influence contract rates.

Contract agreements are great for both shippers and transportation providers as the shipper gains committed capacity while the transportation provider gains fixed rates and dedicated freight volume. Everybody wins.

How Contract Agreements are Set

Contracted agreements or Requests For Proposals (RFP) can be set as mini bids (monthly), quarterly, bi-annually, or annually. However, since the contract market and its rates are based on the fluctuating spot market, it’s rare to see a contracted agreement set for more than a year to stay in tune with the market.

Contract agreements are set during the bidding process, aka the RFP. The shipper will take the RFP and send it to a network of transportation providers and those providers will reply with their quotes. At the end of the bid process, the shipper will award lanes to specific providers based on their rate, service, capacity, and any other considerations.

CONTRACT RATE PROS/cons

HOW TO GET YOUR BEST SHIPPING FREIGHT RATE ON THE CONTRACT MARKET

Any shipper has the opportunity to host a bid. There’s no set minimum shipment requirement. So, no matter how large or small you are, you can take advantage of an RFP.

Just like getting quotes for the spot market, the contract market requires detailed information to get your best rates. The more information you can tell your potential providers, the more reliable rates and capacity you’ll be able to get offered. Information that should be included in your bid:

- Commodity type(s)

- Weight per load

- Cargo value

- Estimated shipping volume for each lane

- Time frame of RFP contract

- Origin and destination zip for each lane

- Shipment frequency for each lane

- Any performance requirements

- Any special load requirements/accessorials

- Fuel surcharges

- Keep in mind that fuel surcharges account for around 30 percent of a carrier’s operating expenses, and as we all know, fuel costs can fluctuate dramatically.

- It’s important to establish your own fuel surcharge matrix for each potential diesel price and communicate that with your providers before conducting a bid. This will help you get consistent and accurate rates.

What Happens When a Contract is Broken?

Sometimes, contracts will get broken. For both shippers and carriers, breaking a contract may result in fines. Most likely when a carrier breaks a contract, they will end up with a dissatisfied customer and disqualification from future bid opportunities. While shippers will face a damaged carrier relationship, less reliable capacity, and most likely, higher rates on the next bid.

Technology Needed for RFPs

While the practice of RFPs sounds great, what’s the catch? For an RFP to work effectively, shippers need to be organized in their execution and collection of information. No matter your size, every shipper needs a way to track and store their supply chain data and procurement information. It helps to have one central location to keep all your freight volumes, provider names, and awarded lanes.

Some smaller shippers will use tools like Microsoft Excel, Google Docs, or even their providers’ technology platforms to manage their RFP data.

But if you’re a larger shipper, those tools can be overkill. Instead, 90 percent of shippers use digital platforms, often transportation management systems (TMS) to manage their procurement information. A TMS can help take the complexity out of RFPs and take your process from a few hours to a few minutes. It allows you to enter your contract information quickly, select the transportation providers you want quotes from, and click send. It will also help you have one location to easily view bids and communication around your loads, keeping you from overwhelming clutter.

Regardless of which workflow you decide for your business, it’s crucial to have a well-documented record on hand to easily reference.

WHAT’S BEST FOR ME?

Usually, no shipper runs all their freight through the contract market alone. As there are positives to each market and it can be hard to predict all volume, most shippers work to have a strategic blend of both spot and contract rates. What works best for your business will depend on the current state of the freight market, your freight, and your provider relationships.

Some questions to ask yourself when determining what market will work best for you are:

- Are my freight lanes affected by peak capacity demands during the year?

- If you answered yes, the contract market, especially during those times of tight capacity, may be best for you.

- Am I willing to take on the risk of price fluctuations?

- If you answered yes, you might want to look at the spot market first.

- Does the contract price include a capacity guarantee throughout the year, without a general rate increase (GRI)?

- If you answered yes, the contract market may be best for you.

If you have determined that your volume is sporadic and not consistent, the spot market may be best for you, but it doesn’t mean that you can’t work with a carrier contractually. You can still build an approved carrier list with strong relationships even if you have to use the spot market on every shipment.

If you decide contracted freight is best for your company, keep an eye on spot market indexes and position your RFP bidding based on the freight cycle when possible. By moving your RFPs to when the market is at its lowest levels, you’ll gain your best rates.

Some shippers budget for 70 percent contracted and 30 percent spot or 50-50. No matter your balance, the freight market is always changing and so should your strategy. Keep a pulse on the market and your business needs so you can always find what’s best for your company.

NEED HELP WITH YOUR STRATEGY FOR COMPETITIVE SHIPPING FREIGHT RATES?

A shipper’s decision in balancing the use of contract versus spot rates can be difficult. Finding a good strategy for competitive shipping freight rates can be a lot of trial and error.

If you’re having challenges deciding when to use each market, Trinity Logistics can help. We have the technology and expertise you need to simplify your logistics management and offer support. Our Team Member experts are here to help you with your logistics strategy, including offering Quarterly Business Reviews and Freight Market Updates, so you can keep a pulse on industry trends and your company’s growth.

START A CONVERSATION WITH TRINITY TODAYThe chemical industry serves as support for many other industries, like agriculture, automotive, construction, and pharmaceuticals. According to an American Chemistry Council report, 96 percent of all manufactured goods trace back to chemical manufacturers. Chemical manufacturers often process raw materials into refined products used in other industries or within the chemical industry. However, raw materials costs have been rising recently, along with additional operating costs in the chemical industry.

As chemical manufacturers face increased expenses, many find it more challenging to remain profitable. How can chemical manufacturers better manage their operating costs? In this blog, we’ll take a walk through what chemical manufacturers are currently facing and how they can better manage their operating expenses.

Rising Raw Material Costs

Raw materials costs have been rising in recent years. Part of the cause for increased prices is because they’ve gotten scarcer as the demand has risen for them. For example, raw agricultural materials have increased 117 percent since 2000, rubber has seen an increase of 359 percent, and steel is up 167 percent.

Crude oil, which many chemical companies use for energy and other materials, is up 250 percent since 2000. Crude oil prices are the most important ones to watch because it affects so many different markets. For example, many basic ingredients originate in the oil and gas fields and then travel through a global supply chain to make materials like plastics, packaging, fertilizers, lubricants, paints, and much more. Additionally, higher energy costs mean higher operating costs for the chemical industry.

Logistics Operating Costs in the Chemical Industry

The strength of long, global supply chains continue to be tested. From the start of the Covid-19 pandemic to battling intense weather and labor shortages, prices for logistics operating costs in the chemical industry have skyrocketed. Chemical supply chains have had their weaknesses exposed, from their dependence upon the volatile oil and gas sector to their global shipping networks. It’s caused additional cost as many of the materials needed to operate are out of stock due to shipping congestion and backlogs. According to a survey done by the National Association of Chemical Distributors, 85 percent of chemical industry distributors reported at least one imported item out of stock.

How to Better Manage Operating Costs in the Chemical Industry

Interestingly enough, skyrocketing logistics costs are beginning to outweigh other operating expenses for chemical manufacturers. Finding better management and control in your logistics may be the thing to keep your chemical company cost competitive. As a result, a growing trend among chemical manufacturers is turning to outside help for their logistics. Many chemical companies find that using a third-party logistics company (3PL) makes a lot of sense. It helps them free up resources to focus on other aspects of their business. Here are some ways working with a 3PL can help you manage your operating costs.

Find the Right Carrier – In Less Time

We all know the stress and workload of finding a carrier to move your freight, especially for chemical manufacturers who need carriers that know how to handle their products safely. Capacity can be limited when looking for a hazmat certified, or tanker endorsed carrier for a decent shipping rate. Outsourcing your transportation is one solution to that problem.

3PLs will take over the responsibilities of finding and vetting qualified carriers. A 3PL should make sure carriers have the proper credentials, insurance, and experience for your freight. Take control of your time and let someone else take on the workload so you can gain time for the rest of your business.

Create Efficiency With A 3PL’s Technology

Working with a 3PL also offers you access to their technology services, like shipment tracking, automated workflows, and detailed reporting. By replacing your manual processes with logistics technology, you’ll find more visibility into your supply chain. And that visibility can help you find efficiencies to help you manage your operating costs. While the technology itself can be an extra cost alone, most 3PLs offer you technology applications along with freight arrangements. Additionally, you’ll have experts you can rely on to help you navigate those applications.

Transportation Management Systems

All chemical companies are focusing on streamlining their operations, whether they choose to outsource their logistics or not. Many companies are turning to transportation management systems (TMS) to optimize their transportation networks.

A TMS can help your business gain visibility into your supply chain, create new efficiencies, and automate your manual workload, so you can better manage operating costs.

When using a 3PL, you often have options to choose how you want to integrate your TMS. Trinity Logistics offers you customer integration and a specialist to work with you every step of the way. No matter what option you choose, you gain the visibility and automation you’re looking.

Control Your Logistics Costs

In business and life, there are certain aspects that you can manage and control. As a chemical manufacturer, you must manage those costs that you can control and plan for those variances in costs for those you cannot. Logistics is one operating cost you can manage when you choose to partner with a 3PL.

And you don’t have to look too far to find one. Trinity Logistics is well-versed in the chemical industry and understands your complicated market. Our Team of experts is here to help you find the quality carrier you need while offering technology to help you create efficiencies. We can help you gain control over your logistics costs, so you can make room for those other unknowns.

If you’re ready to get a handle on your operating costs in the chemical industry, let’s get connected.

Author: Christine Morris