Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Feels like 2022

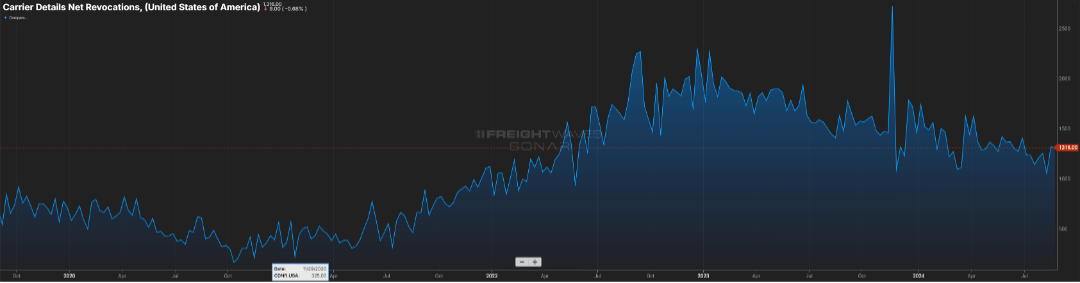

For the majority of this year, volumes have seen their traditional seasonal patterns and have been trending above 2023 levels. Many have commented that market balance will be driven more by carrier attrition versus an event that spurs freight volumes.

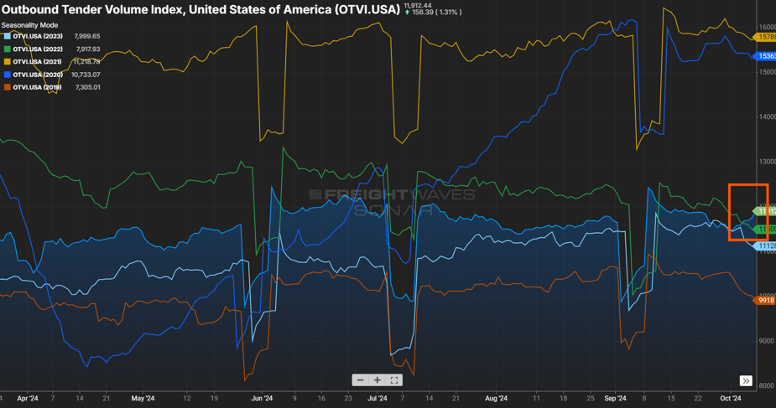

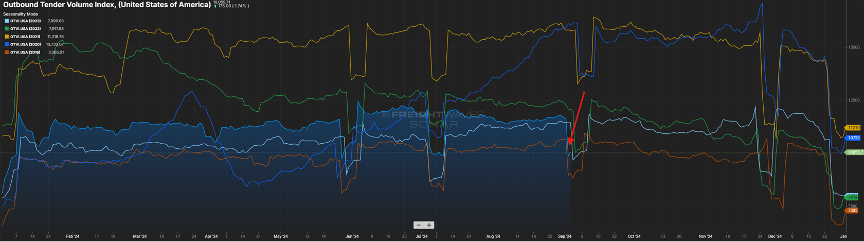

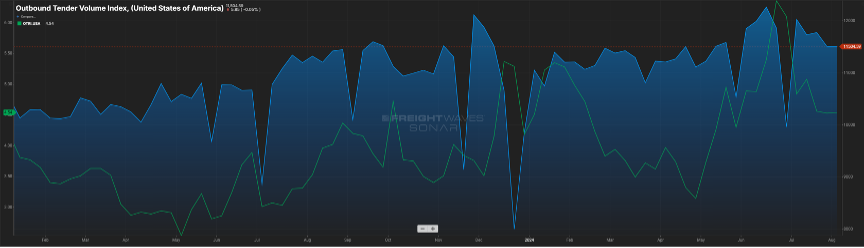

2022 was a pretty good year from an industry standpoint. Volumes were still elevated (certainly not like we saw in 2021) and capacity was inline. While it may be a blip on the radar, we have now seen the Outbound Tender Volume Index eclipse 2022 levels for the first time in two years as seen in Figure 1.1.

I think it is still too early to pin the volume uptick on the interest rate reduction or the recent hurricanes that severely impacted states in the southeast, but these events, and any potential storms that might still pop up (hurricane season isn’t quite over yet), could impact freight volumes in the coming months. Combined with consumers continuing to spend, volumes could remain consistent through the end of the year versus following their traditional end of year downward movement.

FINE….FOR NOW

While there was a sigh of relief from many with the ILA and USMX reaching a deal on wage increases for dock workers, this does not mean that everything is resolved, and potential port disruptions could occur at the 20-something docks along the East and Gulf coast.

Union-member wages were the major bargaining chip that was agreed upon last week, with dock workers receiving an immediate pay increase, with yearly pay increases to follow. When all increases have taken effect, dock workers will see a 62 percent increase in pay. One issue that was not finalized was the use of automation at select ports, which the labor union has opposition to full and semi-automation. The two sides will continue their negotiation discussions, with a timetable of three months from now to finalize a deal.

If these points can’t be resolved, it may be rinse and repeat with the threat of another strike as we get into the start of 2025.

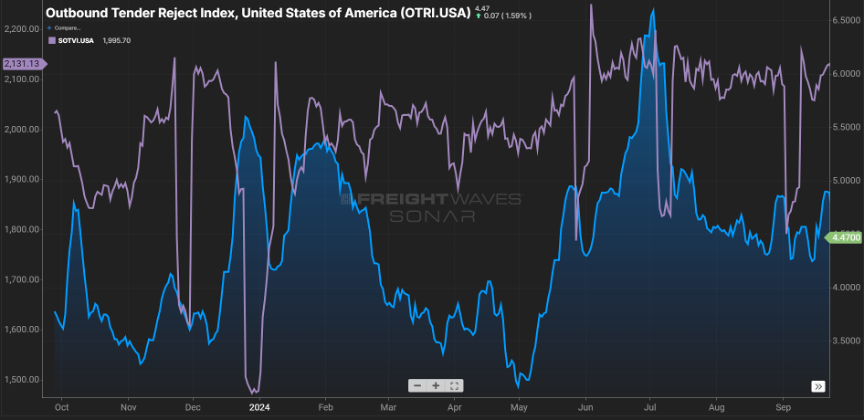

Speaking of the recent shut down of port activity, it will take a week or so to work through the container backlog. This, along with the disruption in shipping patterns caused by the recent hurricanes, has been impacting tender rejection rates as seen in Figure 2.1.

Rejection rates crested the five percent mark recently. As port activity comes back online, expect the volume for short haul shipments (<250 miles) to remain elevated as also seen in Figure 2.1.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

YES, IT IS IMPORT-ANT

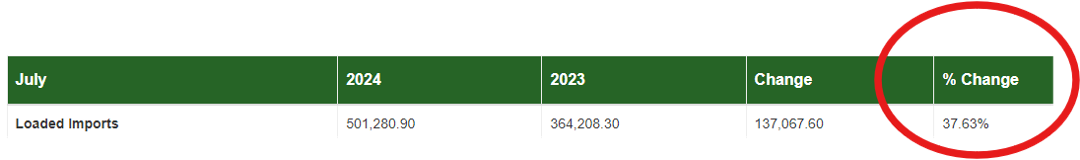

There has been much buzz in the last month around inbound container volumes to U.S. ports. There are 300+ ports of entry for goods into the country, with much of that volume handled by the top 20. Most of that buzz is around the uptick in volume.

In figure 1.1, you will see for the port of Los Angeles, the largest in the country, that container volume is up almost 38 percent. That’s certainly impressive, but the neighboring port (Long Beach) was up a staggering 60 percent.

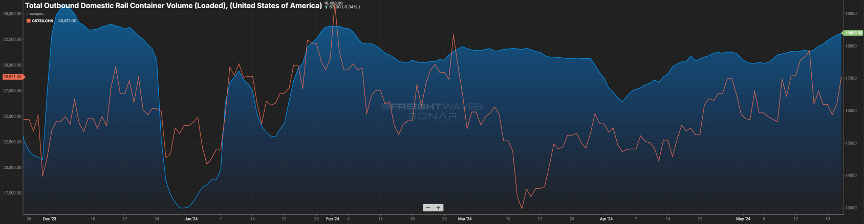

Many would anticipate this similarly impacting the outbound over-the-road volume for that market. And yes, while we see in Figure 1.2 via the blue line, there is a noticeable increase from what it was heading into the Memorial Day holiday, but it is not a direct correlation. The beige line represents the domestic rail volume from that same market, and unlike what we experienced in the “Covid years”, the rails have been a bigger mover of goods versus the bottlenecks we saw back then.

We should expect to see import volumes continue through the next few months. As goods produced overseas have become cheaper to buy, major retailers have taken advantage of these discounts with the anticipation of robust consumer spending. Remember, almost three-fourths of inbound volume is directly related to consumer purchasing. Good news for consumers as these retailers will want to liquidate this inventory quickly at lower prices.

NOT FAR FROM HEALTHY

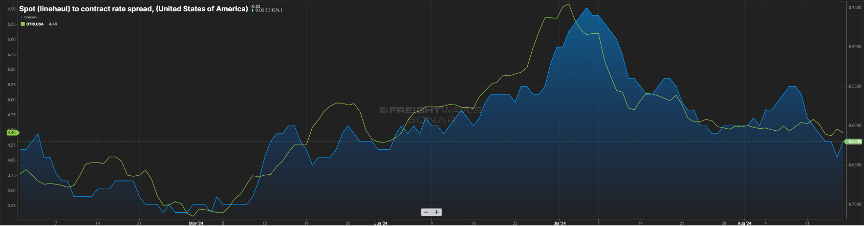

While not in balance, the spread between contract and spot rates continues to shrink, now sitting about $0.60 per mile higher on the contract side. Keep in mind this gap was in the $0.75 to $0.90 for much of the past year. Almost in lockstep has been the tender rejection index. It has continued its slow upward movement as seen by the green line in Figure 2.1.

This can be attributed to capacity continuing to shrink slightly (Figure 2.2) and contract rates moving downward. It’s rare that spot rates will eclipse contract rates, but a spread of $0.40 to $0.50 is indicative of a healthier market, and we are not far from that right now.

I spent a few days traversing the state of Tennessee recently. At one stretch of a major interstate, there was a back-up at least five miles long. Luckily for me, it was on the eastbound side, and I was heading the opposite direction.

What struck me was the sheer number of trucks that sat idled. By my estimates, almost 80 percent of the volume was truck traffic. And while you can’t tell if a van is loaded or not, every single flatbed had freight on it. So, ladies and gentlemen, freight is still moving in this country. While it may not feel like it, volumes are trending close to 2022 levels as seen in Figure 3.1 (blue vs. green line). They say the fourth quarter is the time when carriers make hay; so here’s to an optimistic outlook for the next four months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

GOOD NEWS, BUT…

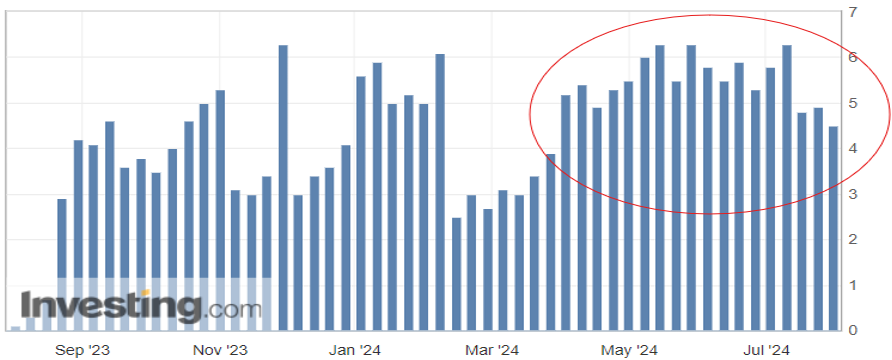

Consumer spending is the biggest driver of the U.S. economy, accounting for roughly two-thirds of the nation’s Gross Domestic Product (GDP). One measurement of that consumer spending is the Redbook index, which compares year-over-year growth for large domestic general retailers (think Walmart, Amazon, Target). The index has averaged just over 3.5 percent for the past 20 years, so the recent year-over-year (YoY) growth in the four-plus percent range speaks to the strength of consumer spending (Figure 1.1). This index alone certainly gives reason for optimism, however there is a cautionary tale with regards to consumer debt.

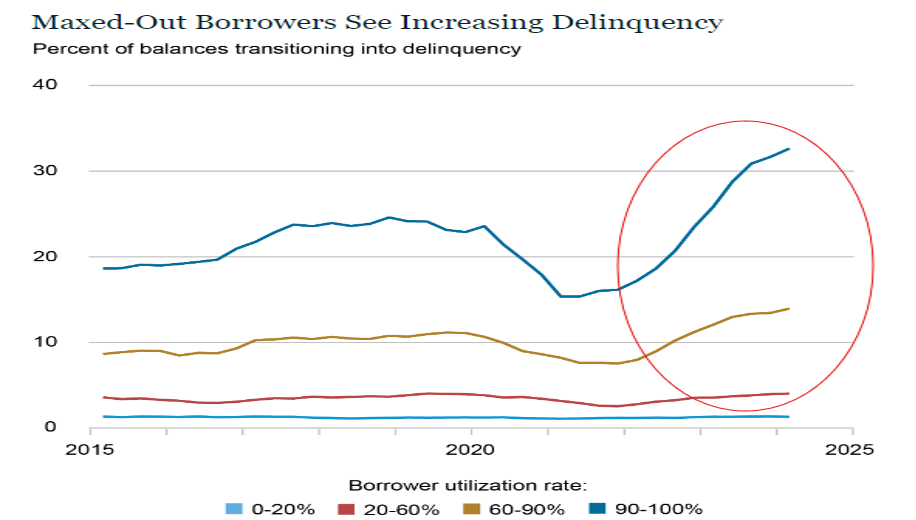

After years of next to zero interest rates to keep the economy on its legs, consumers have seen interest rates on the rise, with the federal funds rate at its highest level since the early 2000’s. With the increase in interest to borrow funds, combined with the increased costs of essentials (food, housing, energy), many households have turned to credit cards to fill the gap for funding of these necessities. Figure 1.2 from the New York Fed Consumer Credit Panel shows the rise in consumer delinquency particularly in those groups that utilize more than half of their available credit line.

While there appears to be relief on the horizon with the impending reduction in interest rates, it appears a portion of active consumers may be pulling back on purchases for those items that are not mission critical. This, in turn, will have an impact on restocking of inventories and trucking activity.

While it is not approaching the levels seen in 2021, the volume index is quickly approaching levels seen in 2022. This has buoyed optimism in the industry.

JUST SOME GOOD LUCK? TIME WILL TELL

The uptick in consumer spending, restocking of inventories and the threat of labor strife in the fourth quarter of this year has been to the benefit of those involved with the rail and import business.

In Figure 2.1 below, the blue line represents loaded container rail volume in the U.S. and the past three months have seen the volume grow. Similarly, container volumes to the U.S. have been on the rise.

The orange line represents container volume from China over the past six months. While some of that traditional volume is now flowing through other countries, like Mexico, there is still a great deal of activity with U.S.-China trade. Will this continue or is it fool’s gold? That is something we will continue to keep an eye on as a pullback in consumer spending will dictate how the needle moves.

STAYING RIGHT WHERE WE ARE

Finally, looking at domestic over-the-road volume (blue line) compared with carrier rejection rates (green line). The slight upward trend continues with volumes and rejection rates (Figure 3.1). Rejection rates continue to inch towards 2022 levels, but a five-to-six rejection rate is about half of what one would see in a balanced freight market.

This has yet to manifest itself in the way of increased freight rates, as capacity still exists in the market.Shippers and carriers should anticipate little change in conditions (although hurricane season is looming) until early 2025.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

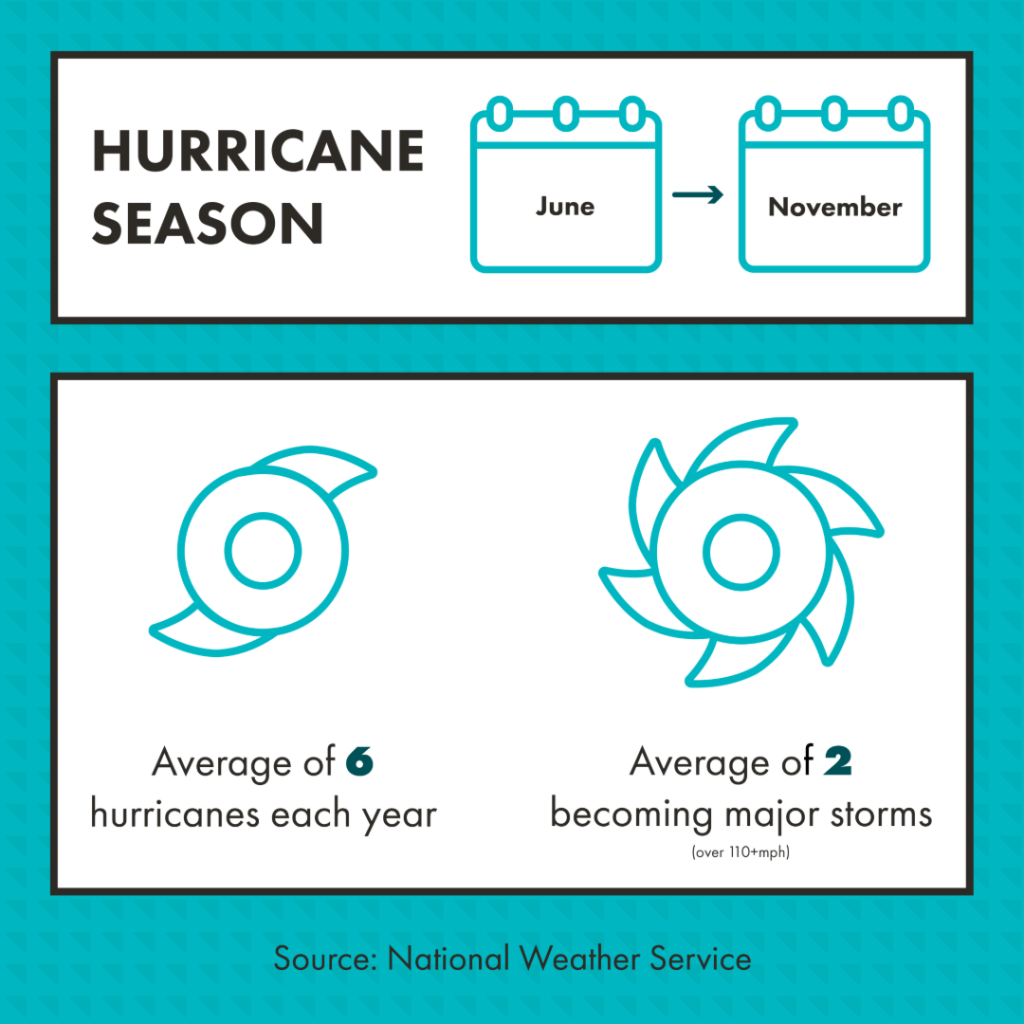

Get Weekly News Updates in Your InboxJune 1st through the end of November is considered Hurricane Season for the Atlantic and Gulf Coast, with heightened chances of storms occurring from early August to October. According to the National Weather Service, there’s an average of six hurricanes each year, with two typically becoming major storms hosting winds of 110-plus mph.

Even on its best days, the logistics industry is considered complicated. Throw a hurricane in the mix, and you can have straight-up chaos. Hurricane Season means supply chains should prepare for the worst in weather, like heavy rain, dangerous gusts of wind, limited visibility, and flooding. Shipping setbacks such as impassable roadways, stranded trucks and drivers, loss of cargo, and extended deliveries are just some of what can be experienced. Here’s what your organization needs to know to prepare during peak Hurricane Season so your company can avoid delays and a loss in revenue.

Supply Chain Tips for Peak Hurricane Season

Stay Informed

A hurricane’s path and level of impact can change very quickly. It’s crucial you stay informed of potential storms that could impact your supply chain during Hurricane Season.

Set up alerts to be notified of newly formed storms and hurricanes. When a potential storm is in your path find a trusted weather news source and check it often for updates. Don’t just follow the updates before the storm, but also during and after. You may also adopt and use advanced weather tracking systems to get up-to-date information to make informed, real-time decisions.

Maintain Communication

Natural disasters, like hurricanes, can have a huge impact on your company’s supply chain. An easy way to stay ahead is to be transparent and communicate openly throughout. Transparency builds trust and helps manage expectations during a crisis.

If a potential hurricane threatens your business, acknowledge it immediately. Then, start communicating with your customers and partners about the potential effects. Regular updates on potential disruptions and recovery efforts can go a long way in maintaining strong business relationships.

Have an Emergency Plan Ready

You should have a company-wide plan that outlines its actions during a hurricane. Your emergency plan should include important details like;

- an evacuation route for buildings affected

- a crisis communication plan

- assigned employee emergency roles and responsibilities

- instructions on how to protect inventory and equipment

- where emergency supplies are located and how best to use them

- how capable facilities will support when others are affected

When planning, make safety your company’s top priority during a hurricane. Once established, your plan should be reviewed often and updated as needed to ensure it remains effective. Additionally, running practice drills can help everyone know their roles and responsibilities.

Consider Alternatives

Consider what alternative workspaces and methods of transport you could use in the event of a hurricane. Are there temporary warehouse solutions where inventory could be stored? Could intermodal replace a truckload shipment that’s in the path of the storm? Are there alternative routes? How can facilities outside of the storm’s path support those affected? These alternative options should be included in your emergency plan.

While you may not have all the answers when planning, the more you include, the quicker you can make strategic decisions when needed. Having room for flexibility and adaptability is key to minimizing disruptions.

Have Visibility in Your Supply Chain

Visibility is needed now more than ever for supply chains. Having visibility not only helps you on good days but especially during hurricane season.

A transportation management system (TMS) can provide the necessary visibility during a hurricane. It provides critical data about your shipments and orders in real-time, giving you an advantage should a problem arise. This can help you make quick decisions to reroute shipments, avoid affected areas, and keep your customers informed.

See how a TMS could help youThink About Recovery

According to the Federal Emergency Management Agency (FEMA), almost 40 percent of businesses that have to shut down for 24 hours due to a natural disaster never open again.

Ensure your business won’t be in that 40 percent if it happens. Have a plan ready to roll for the aftermath of a hurricane. Prepare for the worst and then plan how to recover from it quickly. This will help prevent any potentially steep revenue loss.

Recovery Team, assemble! It’s time to identify the key employees and providers to get your business back to normal operations. An initial assessment will need to take place and your team’s sole responsibility should be to restore and resume processes. Having those alternative solutions and backup suppliers or providers will be handy here.

Weather the Storm with a Reliable Logistics Partner

Sometimes, you just need extra help. A relationship with a reliable logistics provider, like Trinity Logistics, can help your supply chain overcome the threats of Hurricane Season.

Hurricanes can roll in a cloudy overcast of unknowns, but Trinity shines a light toward safety and security. We have over 45 years of experience helping thousands of supply chains through ups and downs. We thrive on problem-solving and handling issues like the ones hurricanes can bring. We also have a dedicated After-Hours Team to support and quickly resolve any potential challenges – no matter the time of night, holidays, or weekend.

Our nationwide network of trusted carrier relationships ensures your shipments arrive safely at their delivery locations. Additionally, multiple transportation options offer the flexibility to keep your goods moving. Lastly, we’ll help you find real-time visibility with our customizable Managed Transportation solutions. Our dedicated Team (comprised of six Regional offices across the nation) is ready to help you maintain continuity and resilience in your supply chain.

Partner with Trinity logistics so your supply chain can stay afloat, no matter the weather. (Our exceptional service might just blow you away, though!)

GET A FREE QUOTE ON YOUR NEXT SHIPMENT SUBSCRIBE & STAY IN THE KNOW LEARN MORE ABOUT TRINITY LOGISTICS