Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Not Interested in Reading? Check Out Our Video Instead!

2023 Crystal Ball

It’s usually this time of year when predictions for the upcoming year start to make headlines. It’s safe to say that most folks could make some predictions based on what has transpired recently, so I wanted to highlight a few of those as we kick off the new year.

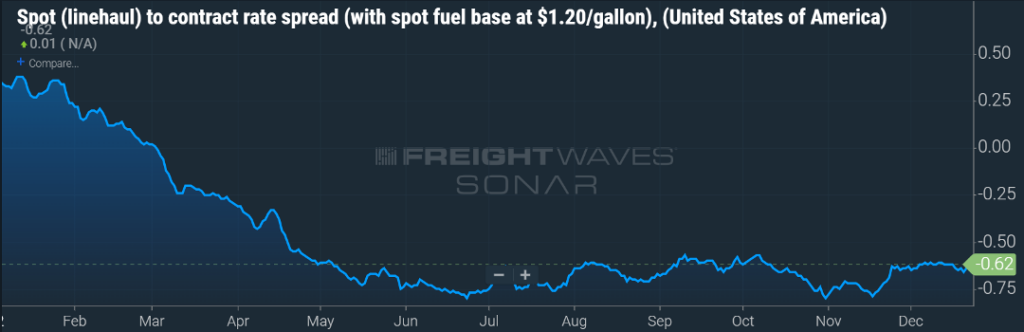

The gap between spot and contract rates will stabilize.

Now, this does not mean that they will be equal – that rarely happens. Just about a month ago, the spread was quickly approaching $1.00 per mile between contract and spot rates (with contract being higher). That gap is slowly starting to shrink (Figure 1.1). Some of that is due to spot rates seeing a holiday bump, and part of that is related to new contract rates taking hold. With many carriers taking an extended break from the road since mid-December, less capacity has pushed spot rates higher. This upward trend will be short-lived and expect rates below $2.00 per mile to become the norm as we chug through winter and into early spring. Contract rates will also trend downward, finding a floor most likely in the middle part of the year.

Few sectors will see bright spots in 2023.

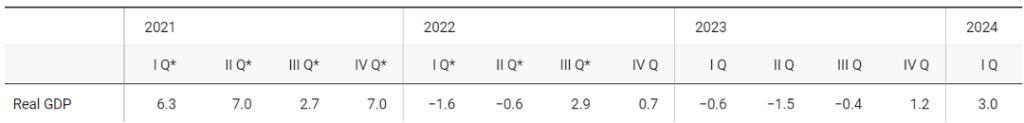

I don’t think anyone thought the economy could continue to chug along at its rapid pace seen in the latter half of 2020 and through most of 2021. Even though 2022’s growth was not as robust as the prior year, the U.S. Gross Domestic Product (GDP) should seek out a modest two percent growth rate. However, where that growth occurred sets the stage for this year.

2022 saw a return of spending on services versus goods. So, while things like healthcare are important to the overall economy, from a freight standpoint, service spending has much less impact on transportation. Expect auto sales, both new and used, to continue their strong run. As parts and inventory issues continue to be resolved, vehicles with temporary tags will be more commonplace as Americans continue to purchase cars and trucks.

On the opposite end, most notably, the housing market will have a rough 2023. With Americans seeing inflation compete for more of their take-home dollars, and the cost of borrowing increasing, many will choose to remain in their current situation. And it’s not just the building materials that will see less of a demand. With fewer new homes comes less demand for things that go in those homes – like appliances, carpets, and furniture.

Following the building industry, manufacturing will be the next downstream effect, and banking will also see less demand for consumer and business loans. Overall, expect 2023 to see, at best, no year-over-year (YoY) growth in GDP, with 2024 being a rebound year (Figure 2.1)

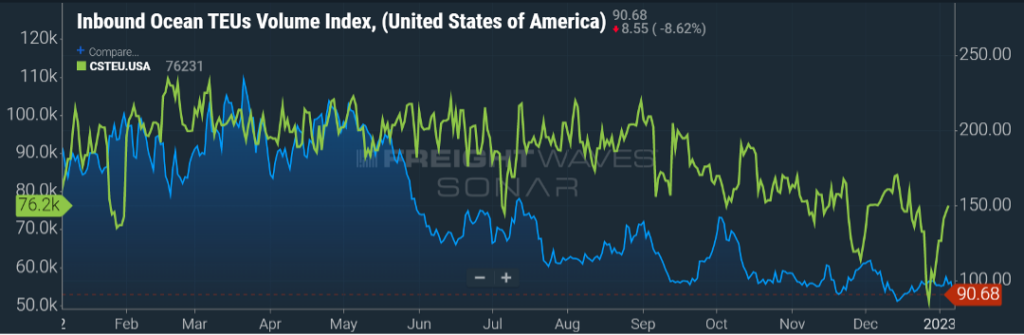

Import activity will continue to slow.

As we saw in last month’s update, Figure 3.1 shows the impact of the ship backlog being resolved and container movement starting to slow. That will be a common theme this year. While 2022 saw year-over-year import activity down almost 20 percent, that downward YoY story will continue in 2023. This will have an immediate impact on intermodal activity, but also over-the-road and less-than-truckload volumes will feel the impact.

One thing to keep in mind as we see recent actual and forecasted numbers showing negative, that is against a backdrop of a very successful 2021 and modest growth year in 2022. So while 2023 will not continue that positive trend, by comparison to a recent down year like 2019, 2023 will be up from an overall volume standpoint versus just a few years ago.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesIt’s no surprise that one of the hottest topics in the world lately is the pain felt at the pump. Rising fuel prices have been at an all-time high, surpassing the costs since 2008, and these prices will only continue to climb. As a result, businesses are being forced to pay more to operate, causing a ripple effect for everyone.

Wait, How Did This Even Start?

You may be wondering how fuel prices even got to this all-time high. Well, they can’t be blamed on any specific event or occurrence as many different factors caused fuel prices to surge.

World Conflict

World conflict is one issue affecting fuel prices, specifically those in Western Europe. The Russia-Ukraine war has been brewing for some time now, and due to attacks, the United States among others has stopped imports, like oil, coming from Russia.

Russia is one of the world’s largest oil exporters, exporting nearly eight million barrels in one month. The drastic change in accepting oil imports from Russia has caused the price of fuel to rise because it’s not as available as it once was.

The Dreaded “C” Word

Another catalyst for the spike in fuel prices is the continual effect of Covid-19. I’m sure you’re tired of hearing it, but the world is still feeling the pains of the virus while we aim to return to life. Recently, Covid forced Chinese ports to close for a brief period and now that the ports are opening back up, supply cannot keep up with demand.

As people try to live alongside Covid-19, office workers are going back to in-person work and people are returning to travel after two years of staying put. With more people leaving their homes, it’s causing a greater demand for fuel while our supply is limited.

The Effects of These Issues

Fuel prices are affecting everyone, including consumers, and businesses, but those in the logistics industry are seeing greater challenges. That’s because the logistics sector has seen disruption after disruption. First, with the issues started by the pandemic, then the port congestion once businesses began to reopen, and so on to now with increased fuel prices. This industry has barely had a moment to catch its breath.

Logistics is at a crossroads; with the United States economy looking at a recession, and world conflicts yet to improve, it’s going to be hard for fuel prices to drop back to normal levels until everything balances out.

How Bad is it Actually?

Even though everyone has been hearing and seeing the high fuel prices, how bad are these prices? Well, in June, the U.S. national average price per gallon topped $5, which is 50 percent higher than it was this time last year. Even pre-pandemic prices were at $2.55 average for that month, showing the direct impact that covid and other issues have caused.

These prices only continue to rise when we talk about the cost of diesel fuel. This type is often more expensive than regular gas, and this is what truck drivers use to fill up their tanks. In June, diesel fuel averaged $5.50 per gallon in the U.S., which is a .50-cent increase from regular fuel. While this increase seems small, when truckers are driving over 500 miles per day, the extra cost can add up quickly.

President Joe Biden has tried to take steps to lower fuel prices in the United States. He has called on Congress to do a Federal Gas Tax Holiday, releasing the charges that the federal government has on fuel. Typically, the government charges an 18-cent tax per gallon on gasoline and a 24-cent tax per gallon on diesel, but President Biden has called for the Tax Holiday to give Americans breathing room as they battle other economic issues like inflation.

High fuel prices are not an issue solely faced by the United States. In fact, gas prices in the United States are on the lower end of the spectrum compared to other countries. For example, while the average in June for the United States was $5 per gallon, in Germany, it averaged $8.26 per liter, while one of the highest fuel prices was in Hong Kong, where gas was $10.71 per liter in June.

How Do High Fuel Prices Impact You?

So, how do the rising fuel prices affect those in the logistics industry? Well, let’s take a look.

Shippers

Increased fuel prices mean higher logistics costs because it’s now more expensive to move their products from point A to point B.

Consumers

Consumers see a direct cost increase on products due to fuel prices. Because it now costs more for shippers to move their products to their destinations, they must also raise the price of their products to continue to make a profit.

Carriers

The biggest issue carriers are seeing with the high fuel prices is the impact on their income. Their operating costs have increased due to the rising fuel and product prices. And with rates lower than they’ve been throughout the pandemic, many carriers have decided to put a pause on driving until the market return to normal. This could cause added chaos to the market. Should more carriers halt their work, there could be an imbalance in the industry, causing more backlogs and shipping delays as a result.

Trinity is Here to Help

As an experienced third-party logistics company with over 40 years in business, we’ve worked with many shippers and motor carriers through the ups and downs faced in this industry, including this one. We’ve seen it all and are here to help you through these troubling times.

Whether you’re a shipper looking for better logistics management or a motor carrier looking for dedicated freight to keep you consistently moving, you can find all the solutions you need with our People-Centric approach.

Get connected with us today so you can start having Trinity Logistics, a Burris Logistics Company, by your side, no matter the state of the market.

Learn more about Trinity Logistics Join our mailing list