The food and beverage industry is enormous, including subindustries like grocery, restaurants, bars, catering, and more. The industry continues to evolve and adapt despite frequently changing consumer preferences and new, complex challenges. So, what’s currently affecting those in food and beverage? In this blog, we’re going to dive into some of the latest trends in the food and beverage industry.

TRENDS IN THE FOOD AND BEVERAGE INDUSTRY

LABOR SHORTAGES IN FOODSERVICE

ARTIFICIAL INTELLIGENCE & AUTOMATION

CONTINUED COLD CHAIN GROWTH

One of the well-known trends in the food and beverage industry is the continued growth of cold chains. Recently, a Grand View Research study shows that the cold chain market was estimated at USD $330,680 billion in 2023. Furthermore, it’s estimated to grow at a Compound Annual Growth Rate (CAGR) of 14.8 percent from 2024 to 2030.

Recently, there’s been an increased demand for temperature-controlled pharmaceutical logistics (think vaccines and biologics), rising demand for better food quality, including more fresh and frozen foods, and a surging need to reduce food waste. All this is anticipated to drive the market’s growth.

In light of the pandemic, the risks of COVID-19 have made consumers more interested in healthier, less processed foods that will boost their immune systems. However, less processed foods mean more food products that will need temperature control.

Additionally, the frozen food sector looks to be growing. Besides filling home freezers, frozen foods are growing in restaurants. Restaurants are also providing new menu items for the frozen grocery aisle. In an American Frozen Food Institute report, 72 percent of frozen food consumers said they combine frozen and fresh ingredients in their meals.

Comparatively, shippers are also using more cold chain services to preserve the shelf life of their products, even when temperature-controlled transportation isn’t needed.

SUSTAINABILITY

Growing climate issues are making sustainability a common trend in almost all industries. Consumers are taking notice of the sustainable practices of companies. From ethical sourcing, carbon neutrality, to eco-friendly packaging, consumers want the brands they buy from to be sustainable. Additionally, food waste is a major contributor to greenhouse gas emissions globally, contributing to cold chain issues. This makes sustainability one of the top trends in the food and beverage industry.

Consumers Care About Sustainability

One way consumers can show their support for the environment is by choosing to purchase from sustainable brands. Consumers have shown they’re willing to pay more and be loyal to brands that invest in their sustainability efforts. In a survey by YouGov, more than half of consumers said they would be willing to pay up to 10 percent more on sustainable versions of regular packaged food and drinks. In another consumer survey, 78 percent of respondents agree that sustainability is import, with 63 percent stating they have adopted greener buying habits.

Food Waste Prevention

In fact, an S&P Global Ratings report says food waste contributes to 10 percent of emissions and that $1 trillion of food is wasted each year. Similarly, according to the U.S. Environmental Protection Agency (EPA), between 73 to 152 million metric tons of food get wasted each year in the U.S. The most wasted foods are fruits and vegetables, followed by dairy and eggs, with over half of all waste occurring in households and restaurants. In addition, the food processing sector generates 34 million metric tons of food waste per year. And over the past decade, the total U.S. food waste has increased by 12 percent to 14 percent.

To put it differently, the EPA said halving food waste in the U.S. would save 3.2 trillion gallons of water, 640 million pounds of fertilizer, 262 billion kilowatt-hours of energy, and 92 million metric ton equivalents of carbon dioxide. According to the Agency, reducing the waste of meats, cereals, and fresh fruits and vegetables would have the most significant impact.

Due to this growing issue, governments and businesses have been working hard to improve sustainability efforts. In July 2021, the Zero Food Waste Act was introduced to provide grants to businesses that significantly reduce their food waste. Additionally, in November 2021, the Food Donation Improvement Act was introduced to lower food waste by making it easier for companies to donate food instead of throwing it out.

Cold chain improvements have seen growing importance even outside the food and beverage industry. One example is UPS Healthcare developing a system and opening facilities to move medicines safely. Part of their plan includes using reusable cold chain packaging. In addition, Amazon is working on insulation packaging to reduce material waste and replace 735,000 pounds of plastic film, 3.15 million pounds of cotton fiber, and 15 million pounds of non-recyclable plastic.

LABOR SHORTAGES In Foodservice

Labor shortages are common among other industries, making this another relatable trend in the food and beverage industry. As a result, hiring workers in the U.S. is becoming near impossible. According to a recent market report, labor shortages are a top concern for 23 percent of food and beverage businesses. The most difficult positions to fill look to be those in the restaurant and foodservice sectors. It’s not just the hiring of new workers, but retaining them as well.

Workers are leaving the industry due to a combination of burnout, low wages, and a desire for better work-life balance. Because of this, restaurants and foodservice companies have had to reduce their hours or limit their menu, while consumers have felt it in longer wait times and less personalized service. With good customer experiences being paramount to a company’s success, resolving this issue is critical.

For this reason, advanced technology can help remove some redundant tasks and help supplement amidst labor shortages. For example, those in the bar sector are being introduced to self-pour technology, which uses RFID tracking and allows customers to pour their own beverages. .

CONSUMERS ARE MORE COMPLEX

Over the years, consumers and their choices in food and beverage and their preferred shopping habits, have become more complex. Because of this, there is a greater assortment of products than ever, with more items requiring temperature control as consumers move away from processed foods and look for fresher, healthier items. Consequently, the supply chain for grocery continues to evolve as the message from consumers is clear. They want what they want, when they want it, where they want it, and expect businesses to respond to their demands.

Continued Decline of In-Person Shopping

In speaking to consumer shopping preferences, it looks like online grocery shopping, food delivery, and food subscription boxes are here to stay. Many consumers prefer the option to receive food and beverage products at their door. For instance, in recent a study by Drive Research, the use of grocery delivery services in 2024 have risen 56 percent compared to 2022. Additionally, the use of grocery curbside or pickup in 2024 have risen 100 percent compared to 2022, further showing the decline of in-person shopping for food and beverage items.

Cost of Food and Beverage Products a Large Concern

Additionally, inflation and rising costs for everyday items, including food and beverages, have consumers rethinking how much and what brands they buy. For example, a recent study showed 54 percent of respondents stating they’ve reduced how much, and unfortunately, 20 percent said they were skipping meals to save money on food. Data from another survey found that 43 percent of consumers are cooking dishes with less meat to save on grocery costs. Others are choosing to purchase cheaper cuts of meat.

Private label brands continue to see growth as shoppers look to save money whenever possible. In fact, according to Numerator, private label brands hold almost a quarter of sales in the grocery sector. The Private Label Manufacturers Association shows that private label sales saw 2.5 percent growth compared to a decline of 0.8 percent by national brands in 2024.

Taste and Experience is a Must

Consumers want to feel good about what they eat. They want nutritious options that alight with their dietary preferences or health goals. In a survey but the International Food Information Council, 54 percent of consumers consider the healthfulness of food in their purchasing decision. Yet, even with the health benefits, they still want their products to taste good, as Datassential shared 35 percent of them purchase items that sound both delicious and healthy.

Consumers are interested in trends like unprocessed foods, natural ingredients, anti-inflammatory, and hydration. Alcohol-free and non-alcoholic beverages are also a rapidly growing trend, with 2 in 5 consumers abstaining from drinking alcohol.

Consumers generally want a positive experience with food and beverage products. While it’s fuel for the body, it can also serve as a source of community, entertainment, and more. In one study, 53 percent of consumers see experiences as essential to their personal lives, especially among the younger generations since the pandemic. They’re interested in trying to tastes and spices, products that bring a sense of nostalgia, or food and beverages that tie in with a story, as shown by the recent increase in pop-up restaurants and bars.

supply chain Challenges

Since the pandemic, supply chains have been seen more of the limelight. As shown by rising costs faced by consumers, food and beverage supply chains have been challenged by shortages of raw materials, disruptions like strikes or a bridge collapse, and a growing demand by consumers for transparency and speed.

Consumers are also becoming more interested in knowing where the products they buy come from. According to a study by IBM, nearly 70 percent of consumers want to see a brand’s sourcing practices. They want to know how the products they buy were manufactured. They’re looking for companies who show concern to how their manufacturing affects the planet’s life span and how their product is raised or grown. Consumers want to feel like the products they choose to buy will make a difference.

According to a Mckinsey report, food and beverage supply chains see supply chain disruption roughly once every three years. A 2023 risk report shows that supply chain executives are concerned about disruptions from climate change, environmental factors, and geopolitical conflicts. Another risk report shows that 73 percent of companies experienced higher supply chain losses within that past two years. Because of this, building supply chain resiliency is a huge trend for food and beverage companies.

ARTIFICIAL INTELLIGENCE & AUTOMATION

Artificial intelligence (AI) is a buzzword across all industries, but how could it affect food and beverage? One way is through providing clearer insights into shopper preferences, helping companies better market to them to grow brand loyalty. It can help with supply chain optimization, helping businesses better understand consumer demand and optimize production planning and management, reduce overstocking, and minimize waste. Some companies, like Campbell Soup Co., are using AI to help with product development, tracking data and discovering what its customers want next.

According to WifiTalents, 62 percent of food and beverage executives believe AI will have a significant impact on their industry within the next five years. With the uses for AI in the food and beverage industry being so extensive, it will be interesting to see how companies make use of it.

There’s also a lot to be talked about in AI and automation for the customer experience. Companies are looking into AI-driven customer service opportunities and ways to streamline customer interactions. You see a lot of this in the restaurant industry with the use of table side tablets, interactive menus, and mobile ordering and payment. AI is used in mobile apps to personalize menus and promotions based on customer preferences.

Growing Cold Storage Demand

The demand for refrigerated warehouses is continuing to soar to new heights. A report from Skyquest forecasts the U.S. cold storage market to increase with a compound annual growth rate of 13.5 percent through 2031, expecting to reach a value of $118.8 billion.

Temperature-controlled storage is critical to many sectors, from grocery to pharmaceutical companies. The growing demand for cold storage facilities comes the adoption of automation and technology, the popularity of ecommerce and demand for faster delivery, as well as online grocery platforms. There’s also a thriving demand for convenience foods – those that are usually chilled but ready to eat with little to no preparation.

STAY AHEAD OF TRENDS IN THE FOOD & BEVERAGE INDUSTRY

No matter the trends in the food and beverage industry, having a logistics resource, consultant, or expert is one way to stay ahead. Whatever phrase you want to use but ultimately, have support on your side for any complex situation. This is where a third-party logistics company (3PL), such as Trinity Logistics, can come in. We can help you find creative solutions to your logistics challenges.

Now, you’re likely wondering, “why work with Trinity Logistics?” For one, we’ve been serving cold chains for over 45 years! Whether you have a complex challenge or just need help with one shipment, we have the experience and quality carrier relationships to meet your needs.

You can also count on us to stay knowledgeable on what’s going on in your industry so you can stay updated too. We know that even in times of supply chain disruption, your industry doesn’t stop, so neither do we.

And lastly, what makes Trinity unique from other 3PLs and what our customers praise the most is our exceptional People-Centric service. We’re a company built on a culture of family and servant leadership, and that culture shines through in our service to you. It’s our care, compassion, and communication that you’ll notice and appreciate.

If you’re ready to have Trinity Logistics on your side for logistics support and expertise, no matter the industry trends, then let’s get connected.

DISCOVER HOW WORKING WITH TRINITY CAN BENEFIT YOUR COMPANY STAY UP-TO-DATE VIA OUR EMAILStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

COULD WE LOSE CARRIER CAPACITY….WITHOUT LOSING ACTUAL CAPACITY?

Certainly, this question could cause one to scratch his head. If we don’t have a decline in the number of operating authorities, or available trucks, then how could we lose capacity?

Well, technically, the answer is you would not be physically losing trucks. However, an impact could be felt from recent events with regards to container shipping that would make it feel like less trucks are available. With recent geo-political events, and events at home, shipping to the West Coast has become more feasible than it was a year, certainly two years, ago. As ocean carriers are mindful of events in the Red Sea, combined with an easing of labor tensions at the West Coast ports, freight that in prior years was diverted to the East Coast is now heading back to the left coast of our country.

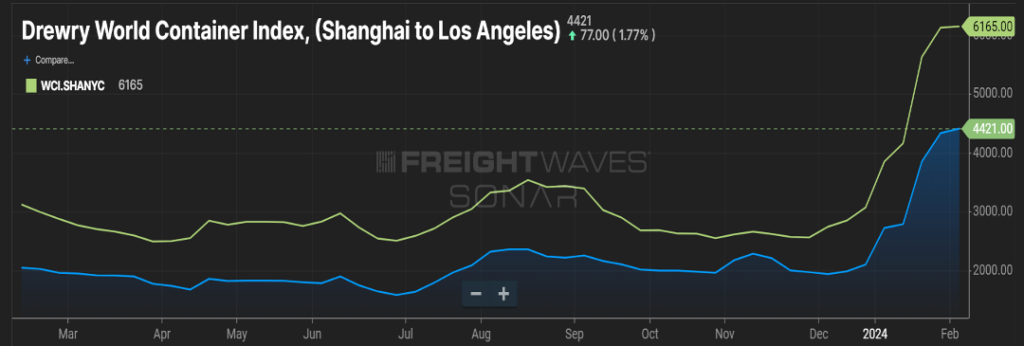

As you can see in Figure 1.1, container costs from Asia to Los Angeles are over $1700 cheaper than freight bound for an East Coast port, such as New York. Figure 2.1 shows outbound freight volume for the last year in the Los Angeles market, currently seven percent higher than this time last year.

So how could this impact capacity? When freight hits the East Coast ports, it’s typically consumed close to the port or at the very least, the coast itself. This means more regional runs. When freight hits the West Coast, typically that freight is destined for locations such as Dallas, TX or Chicago, IL, so taking freight up and down the East Coast may be a one-day run. Freight out of the Los Angeles market, heading to further destinations would take a day and a half, two days.

Same freight, same one-truck move, but now it occupies that truck for twice as long. Additionally, this could necessitate a shifting of fleet resources from one coast to the other, potentially creating an over-capacity on one side of the U.S. while the other coast is more desperate for trucks.

SPRING IN 6 WEEKS?

Will that rodent in Pennsylvania be right this year, and will freight volumes accelerate quicker as a result? First of all, ‘ol Punxsutawney Phil is batting less than 50 percent for his career and the last 10 years he’s only been accurate three times.

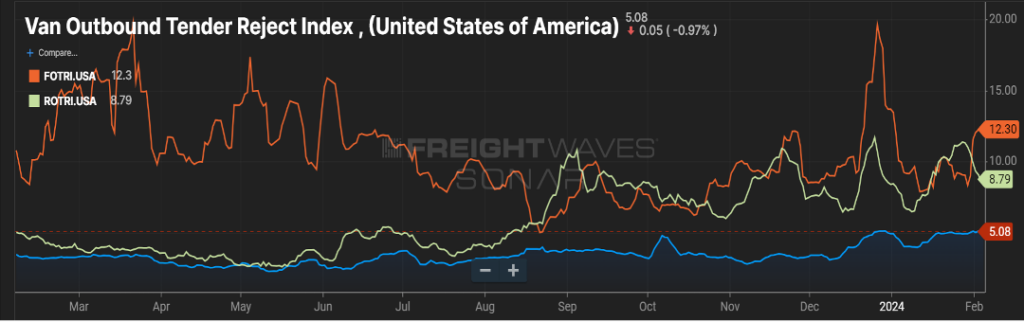

A better canary in the cave would be how the rejection rate index ebbs and flows. As you can see in Figure 3.1, van rejection rates have been pretty stagnant for the past year. Flatbed has remained relatively high and reefer rejection rates have trended up the last five months. If Phil is a soothsayer this year, we expect flatbed rejection rates to continue rising. If produce season also starts earlier than most, reefer rejection rates will then follow.

As reminder, with increases in rejection rates, shippers typically see transportation costs increase on the spot market.

Stay tuned for next month’s update to see if an early spring is a turning of the tide for the freight market.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxFinding and selecting a cold chain logistics provider can be a tough and lengthy process. You want to make sure you find the right one. The one who you can trust in understanding your freight’s regulations and has the quality of the transportation you need for your temperature-controlled freight. Here at Trinity, we consider ourselves uniquely qualified within the cold chain. We’ve worked with thousands of shippers with temperature-controlled products, making us well-versed in the requirements and regulations.

Don’t just take our (written) word for it. Join us and our parent company, Burris Logistics, for an educational webinar to discuss our Fully Connected Cold Chain. In this webinar, you’ll hear from three experts in the industry: Mark Peterson and Mo Shearer of Trinity Logistics and Nick Falk of Burris Logistics. They’ll all speak to the intricacies you can experience in cold chain distribution and their personal stories of expertise with commodities like seafood, produce, and more.

Find out why Burris Logistics has become a well-known cold storage provider and how they have further grown within the cold chain industry by finding support in other areas of logistics, such as freight management with Trinity Logistics. Learn from our panelists why cold chain logistics is often best left to the experts.

If you’re in the cold chain space and have any questions or concerns about your logistics, this is the webinar to attend. Don’t miss out on the chance to learn more about our people-centric and servant approach, together with Burris, straight from some of our top members of the company.

Join us for “A Fully Connected Cold Chain”

February 2, 2021 at 1:00pm EST.

REGISTERShipping produce can be a bit tricky. Produce is time-sensitive to make sure consumers at its freshest. Certain produce can be sensitive to pressure, like peaches, that bruise easily. Other produce requires certain temperatures to keep it at its freshest. It’s a juggling act to make sure your produce is at its highest quality when delivered to your customer.

When shipping produce, you need to consider temperature, shelf life, and transit times. Here are three tips to making the process as easy as possible.

Tip #1:

Give as much lead time as you can for orders.

Normally more time means better shipping capacity. Not every truck can haul fresh produce. Refrigerated trucks or reefers are ideal to transport produce because they can adjust and keep temperatures where they need to be for your product. Especially during produce season, the more lead time, the better chance of finding an available reefer at a decent shipping rate.

Tip #2:

Make sure the carrier or transportation partner you select is FSMA (Food Safety Modernization Act) compliant.

Passed in 2011 and implemented in 2017, this regulation focuses on maintaining food safety during transportation. Its goal is to prevent illnesses from contaminated food. If found in violation of FSMA, you can be subjected to large fines and even imprisonment.

Tip #3:

Have detention rules clearly laid out.

Communication is key in your part of shipping produce. In the case of a delay at the farm or pick-up location, drivers can be notified ahead of time, keeping everyone on the same page. This also helps build up your reputation as a shipper of choice, so more quality carriers and transportation partners want to work with you.

Shipping produce is one of Trinity’s specialties. With Burris Logistics as our parent company, we have the warehousing, handling, tracking, and shipping solutions to accommodate you. Shipping produce can be complicated, but it doesn’t have to be. We can help you simplify it.

Looking for a transportation solution for your produce?

Check out our Temperature Shipping Guide.

This time of year in the United States, the weather gets a little warmer, people start daydreaming about trips to the beach or vacations to the mountains, and farmers are gearing up for their busiest work season. Not only does produce need to be harvested at peak freshness, it also needs to be shipped; thus the world of fresh produce logistics. When it comes to fresh produce, the most impactful time for any area in the United States is March through June.

With new food safety in transportation regulations, like the Food Safety Modernization Act, and decreased capacity due to supply and demand, finding a reliable carrier who can pick-up and deliver your fresh produce at peak freshness can be time-consuming, and quite frustrating.

The fresh produce logistics team at Trinity Logistics has the resources and industry expertise to arrange your shipment, regardless of how specialized your requirements may be. So if you’re shipping cucumbers, berries, broccoli, apples, or bananas, know that we love coordinating it all.

Produce by Region

The U.S. has different produce harvest times based on region and climate, so we’ll go over some of the top crops and time frames to get an idea of what’s being transported and when.

Texas, Arizona, and New Mexico

The most impactful time for produce harvest in Texas is March to June, but produce can be found here year-round as it is brought over from Mexico. In surrounding states, New Mexico and Arizona, there’s another push for produce that occurs October through November. Some of the top crops you’ll see out of this area include broccoli, cabbage, cauliflower, grapefruit, cucumbers, onions, lettuce, pumpkins, and peppers (especially the spicy variety).

California

In California, produce season kicks in around the southern part of the state in March to June, and slowly creeps its way up north of the state, ending in September. Some of the top fresh produde from California during these times include carrots, clementines, nectarines, artichokes, lemons, green leafy vegetables, avocados, and kiwi.

The East Coast

Produce season along the East Coast, like California, starts in the south and slowly creeps its way North. Florida begins its big harvest around May, while the harvest in Maine ends in the fall. From south to north, some of the most popular crops from the East Coast include oranges, peaches, tomatoes, watermelon, corn, cucumbers, apples, cherries, and blueberries.

Shipping Produce

There are a lot of factors that go into making sure fresh produce arrives in the same fresh condition for grocery stores, markets, and restaurants relying on it for their business. Total transit time, proper refrigeration, and shipper’s documents in line with the Food Safety Modernization Act all have to be taken into consideration.

We have 35 plus years of experience arranging refrigerated truckload shipments, so we know that no detail can be left out when it comes to these time-sensitive products. We help arrange produce shipments with dedicated full truckload services, port services, and even supply chain consulting and Transportation Management System solutions. Basically – no matter what scale operation you need, we have a solution that can help.

Our dedicated teams handle the careful transportation of your produce and are available to answer your questions 24/7.

Need a Produce Shipping Quote?

If you’re a produce shipper and you’re looking for a freight quote, it’s simple!

Give us a little bit of information about your shipment via our “Request a Quote” form by clicking below, or give us a call at 1-866-603-5679.

Request a Quote!