Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Feels like 2022

For the majority of this year, volumes have seen their traditional seasonal patterns and have been trending above 2023 levels. Many have commented that market balance will be driven more by carrier attrition versus an event that spurs freight volumes.

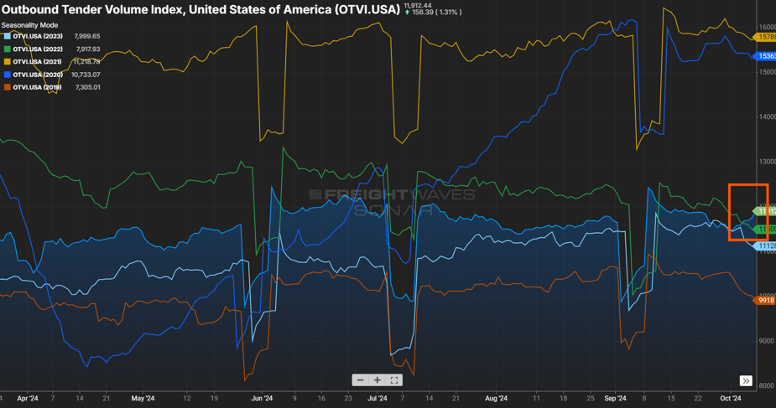

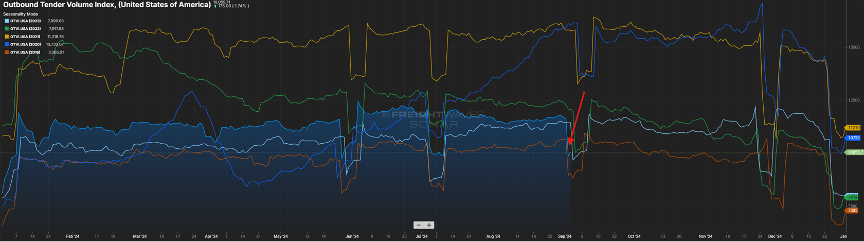

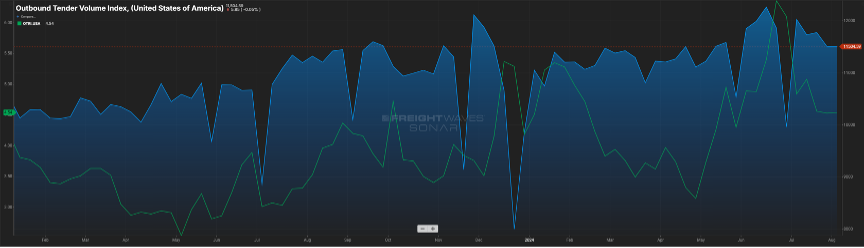

2022 was a pretty good year from an industry standpoint. Volumes were still elevated (certainly not like we saw in 2021) and capacity was inline. While it may be a blip on the radar, we have now seen the Outbound Tender Volume Index eclipse 2022 levels for the first time in two years as seen in Figure 1.1.

I think it is still too early to pin the volume uptick on the interest rate reduction or the recent hurricanes that severely impacted states in the southeast, but these events, and any potential storms that might still pop up (hurricane season isn’t quite over yet), could impact freight volumes in the coming months. Combined with consumers continuing to spend, volumes could remain consistent through the end of the year versus following their traditional end of year downward movement.

FINE….FOR NOW

While there was a sigh of relief from many with the ILA and USMX reaching a deal on wage increases for dock workers, this does not mean that everything is resolved, and potential port disruptions could occur at the 20-something docks along the East and Gulf coast.

Union-member wages were the major bargaining chip that was agreed upon last week, with dock workers receiving an immediate pay increase, with yearly pay increases to follow. When all increases have taken effect, dock workers will see a 62 percent increase in pay. One issue that was not finalized was the use of automation at select ports, which the labor union has opposition to full and semi-automation. The two sides will continue their negotiation discussions, with a timetable of three months from now to finalize a deal.

If these points can’t be resolved, it may be rinse and repeat with the threat of another strike as we get into the start of 2025.

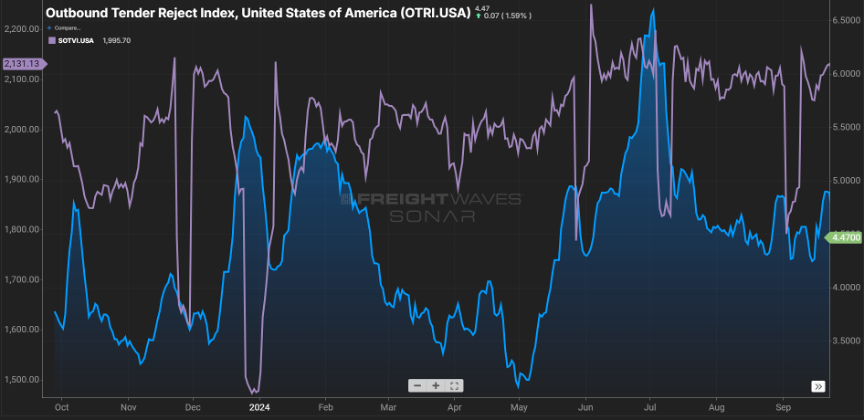

Speaking of the recent shut down of port activity, it will take a week or so to work through the container backlog. This, along with the disruption in shipping patterns caused by the recent hurricanes, has been impacting tender rejection rates as seen in Figure 2.1.

Rejection rates crested the five percent mark recently. As port activity comes back online, expect the volume for short haul shipments (<250 miles) to remain elevated as also seen in Figure 2.1.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

YES, IT IS IMPORT-ANT

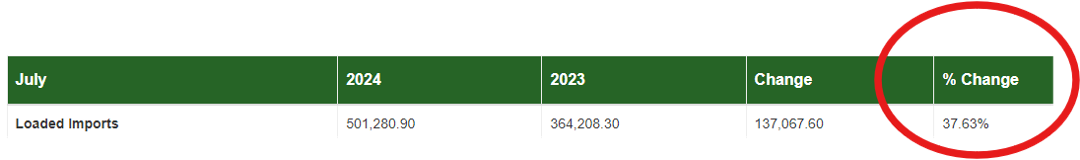

There has been much buzz in the last month around inbound container volumes to U.S. ports. There are 300+ ports of entry for goods into the country, with much of that volume handled by the top 20. Most of that buzz is around the uptick in volume.

In figure 1.1, you will see for the port of Los Angeles, the largest in the country, that container volume is up almost 38 percent. That’s certainly impressive, but the neighboring port (Long Beach) was up a staggering 60 percent.

Many would anticipate this similarly impacting the outbound over-the-road volume for that market. And yes, while we see in Figure 1.2 via the blue line, there is a noticeable increase from what it was heading into the Memorial Day holiday, but it is not a direct correlation. The beige line represents the domestic rail volume from that same market, and unlike what we experienced in the “Covid years”, the rails have been a bigger mover of goods versus the bottlenecks we saw back then.

We should expect to see import volumes continue through the next few months. As goods produced overseas have become cheaper to buy, major retailers have taken advantage of these discounts with the anticipation of robust consumer spending. Remember, almost three-fourths of inbound volume is directly related to consumer purchasing. Good news for consumers as these retailers will want to liquidate this inventory quickly at lower prices.

NOT FAR FROM HEALTHY

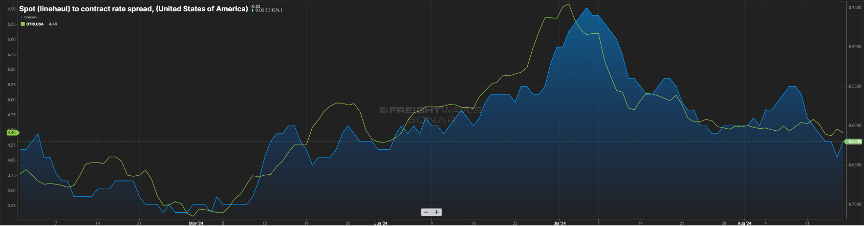

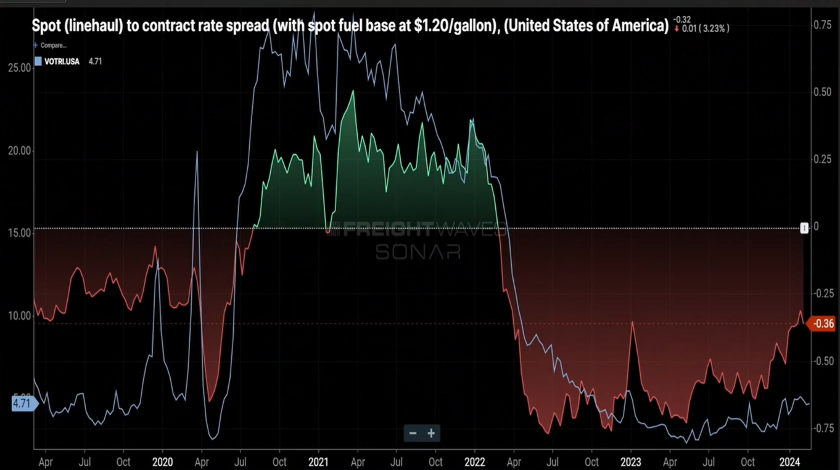

While not in balance, the spread between contract and spot rates continues to shrink, now sitting about $0.60 per mile higher on the contract side. Keep in mind this gap was in the $0.75 to $0.90 for much of the past year. Almost in lockstep has been the tender rejection index. It has continued its slow upward movement as seen by the green line in Figure 2.1.

This can be attributed to capacity continuing to shrink slightly (Figure 2.2) and contract rates moving downward. It’s rare that spot rates will eclipse contract rates, but a spread of $0.40 to $0.50 is indicative of a healthier market, and we are not far from that right now.

I spent a few days traversing the state of Tennessee recently. At one stretch of a major interstate, there was a back-up at least five miles long. Luckily for me, it was on the eastbound side, and I was heading the opposite direction.

What struck me was the sheer number of trucks that sat idled. By my estimates, almost 80 percent of the volume was truck traffic. And while you can’t tell if a van is loaded or not, every single flatbed had freight on it. So, ladies and gentlemen, freight is still moving in this country. While it may not feel like it, volumes are trending close to 2022 levels as seen in Figure 3.1 (blue vs. green line). They say the fourth quarter is the time when carriers make hay; so here’s to an optimistic outlook for the next four months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

GOOD NEWS, BUT…

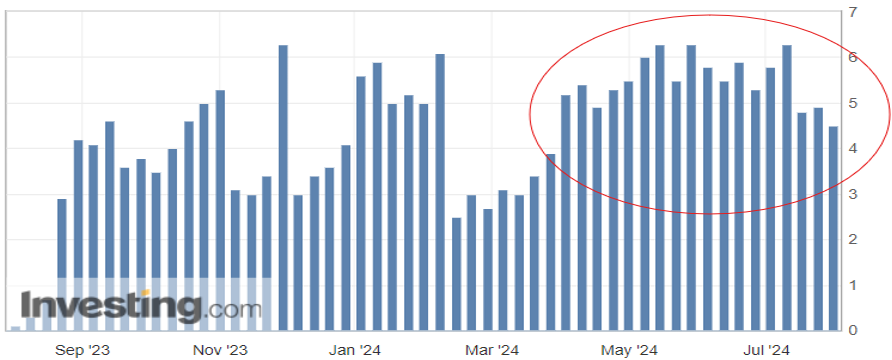

Consumer spending is the biggest driver of the U.S. economy, accounting for roughly two-thirds of the nation’s Gross Domestic Product (GDP). One measurement of that consumer spending is the Redbook index, which compares year-over-year growth for large domestic general retailers (think Walmart, Amazon, Target). The index has averaged just over 3.5 percent for the past 20 years, so the recent year-over-year (YoY) growth in the four-plus percent range speaks to the strength of consumer spending (Figure 1.1). This index alone certainly gives reason for optimism, however there is a cautionary tale with regards to consumer debt.

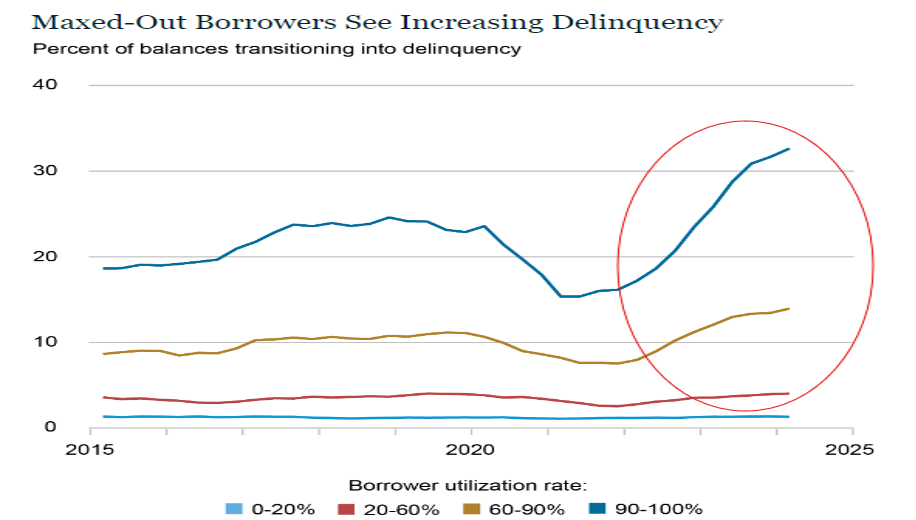

After years of next to zero interest rates to keep the economy on its legs, consumers have seen interest rates on the rise, with the federal funds rate at its highest level since the early 2000’s. With the increase in interest to borrow funds, combined with the increased costs of essentials (food, housing, energy), many households have turned to credit cards to fill the gap for funding of these necessities. Figure 1.2 from the New York Fed Consumer Credit Panel shows the rise in consumer delinquency particularly in those groups that utilize more than half of their available credit line.

While there appears to be relief on the horizon with the impending reduction in interest rates, it appears a portion of active consumers may be pulling back on purchases for those items that are not mission critical. This, in turn, will have an impact on restocking of inventories and trucking activity.

While it is not approaching the levels seen in 2021, the volume index is quickly approaching levels seen in 2022. This has buoyed optimism in the industry.

JUST SOME GOOD LUCK? TIME WILL TELL

The uptick in consumer spending, restocking of inventories and the threat of labor strife in the fourth quarter of this year has been to the benefit of those involved with the rail and import business.

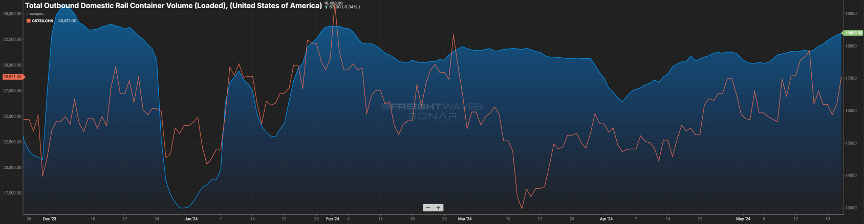

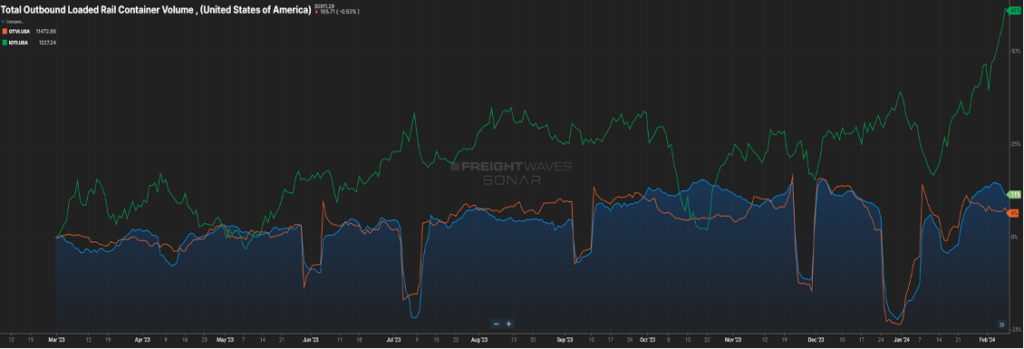

In Figure 2.1 below, the blue line represents loaded container rail volume in the U.S. and the past three months have seen the volume grow. Similarly, container volumes to the U.S. have been on the rise.

The orange line represents container volume from China over the past six months. While some of that traditional volume is now flowing through other countries, like Mexico, there is still a great deal of activity with U.S.-China trade. Will this continue or is it fool’s gold? That is something we will continue to keep an eye on as a pullback in consumer spending will dictate how the needle moves.

STAYING RIGHT WHERE WE ARE

Finally, looking at domestic over-the-road volume (blue line) compared with carrier rejection rates (green line). The slight upward trend continues with volumes and rejection rates (Figure 3.1). Rejection rates continue to inch towards 2022 levels, but a five-to-six rejection rate is about half of what one would see in a balanced freight market.

This has yet to manifest itself in the way of increased freight rates, as capacity still exists in the market.Shippers and carriers should anticipate little change in conditions (although hurricane season is looming) until early 2025.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

WILL 2024 BE A FREIGHT REBOUND YEAR?

I certainly do not expect that we will return to freight volumes like we saw in 2021, and part of 2022. Now, I will never say never, but those were most likely once in a lifetime events. However, there are many signs that point to a potential for 2024 to see a rebound in freight volumes and carrier rates.

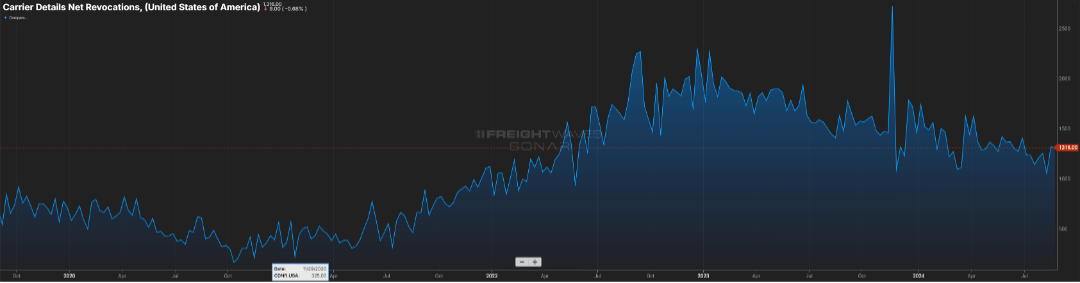

First, let’s talk about rates for over-the-road (OTR) carriers. Many new entrants came to the carrier market in ’21 and ’22, but currently, we’re seeing the contraction of for-hire carriers.

As shown in Figure 1.1, the past 14 months have seen less carriers in the market. As supply continues to dwindle, this will put upward pressure on rates. Granted, it may take another 12 months for the carrier market to find an economic balance.

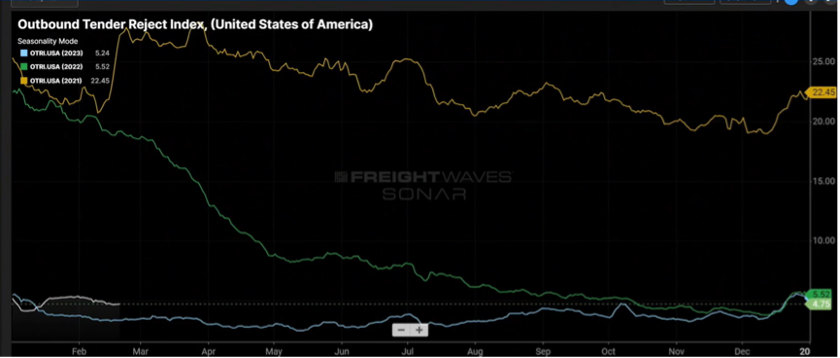

Figure 1.2 measures the rate at which carriers reject tenders (shipments) and continues to slowly climb upward. Granted, a rejection rate of five-plus percent is not earth-shattering, but in comparison to where it was in 2023, sub three percent in several months, five percent and the continuing upward movement is noticeable.

Lastly, Figure 1.3 shows that spot rates continue their slow rebound from the middle part of 2023. Contract rates throughout much of 2022 and half of 2023, were $0.60 to $0.70 cents per mile higher. Today, that gap stands at $0.36 per mile. This is a combination of spot rates inching higher, but also contract rates being less than prior years.

An Opportunistic Outlook

While contraction in the carrier market will influence the supply side of the economic equation, there also needs to be a demand component. The below chart (Figure 2.1) shows loaded rail car volume and over-the-road volume trending up and to the right, but the green line, representing inbound ocean containers, is really peaking.

Eventually, these containers will morph into rail and OTR volume. This is most likely a result in the drawing down of inventories, and the need for replenishment. Combine this with continuing increases in the manufacturing sector and housing market that will show better signs than 2023, it sets the stage for strong demand especially in the second half of 2024.

Will it be a bull or bear year in ’24? Well, if you would have asked that question six months ago, even maybe three months ago, my answer would have been slightly bearish or at best flat. However, seeing the recent signs on freight activity and the carriers needed to move this freight gives more reason to be optimistic as we go through the next ten months of the year.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxHave you ever wondered what drayage is? Perhaps you hear the term mentioned by other shippers, motor carriers, or your logistics providers. You’ve likely heard some other terms associated with drayage, like demurrage or drop fees, and are curious what those are. Well, if drayage is piquing your curiosity, we’re here to help you learn what it is and if it’s for your business. Here are the most asked questions we receive about drayage from our shipper relationships.

What is Drayage?

This is a great question. You’re probably wondering, what does drayage even mean? Essentially, drayage is the local movement of a container from point A to point B, usually less than 100 to 200 miles. Point A and point B can be moving it from a terminal or port to a receiver or from a shipper back to the terminal or port location.

How Does Drayage Work?

There are two different forms of drayage – imports and exports.

For example, let’s say you have an imported container coming into the U.S. from another country into a terminal, like Los Angeles. As your third-party logistics (3PL) provider, we help you arrange the move of that container to be picked up by a drayage carrier at the terminal and transported to its destination or receiver.

Now, for the second example, let’s say you have freight that you need to get transported on a ship from the U.S. to another country. As your trusted 3PL, we’ll help arrange a drayage carrier to assist you in getting your freight to the port. That drayage carrier will pick up an empty container from the terminal and bring it to your pickup location to get loaded. Then the drayage carrier will take the container with your freight to the port to be loaded onto the ship.

Why is it Called Drayage?

The term dray refers to the movement of freight in a local setting, so a very local move. The word dray stems from moving freight or something heavy in a cart or wagon with no sides. This used to be done using horses, so you’d have dray horses moving dray carts. However, now the containers have replaced the carts, and trucks have replaced the horses, but the movement of freight still refers to a short, local move.

What’s the Difference Between Drayage and Freight?

Drayage itself is the movement of the freight. But what is the freight? The freight is the actual product being moved via drayage.

What is Demurrage?

First off, it’s pronounced like “duh-mur-uhj”. As a customer, you may see or hear the term demurrage from time to time. Essentially, it’s a storage fee.

Once your container arrives at its terminal or port, they are going to give you a certain number of days in which your container can sit there for free.

For example, let’s say you have three free days. Your container arrives on June 5th, so you have June 5th, 6th, and 7th, in which your container can sit there, free of charge. Once June 7th approaches, that is called your Last Free Day (LFD). LFD is a term you will hear very often. Once it’s June 8th, that is going to be the first day of demurrage, or the terminal or port charging you for storing your container and taking space in their yard.

Why is Drayage Important?

You may be wondering, what’s the big deal with drayage? Why do I hear this term so often? What do I need to know about drayage?

Drayage is important because it’s another mode, another way to move your freight. Instead of a standard truckload or less-than-truckload (LTL), it’s another way to get your freight overseas to its destination in the U.S. or from the U.S. to overseas. Really, it’s another way to reach your market or suppliers that may not be located here in the U.S.

What is a Drop Fee in Drayage?

This is important, as you want to know all the fees you may incur. You may be told that there’s a drop fee on your shipment. In a traditional shipment when picking up or delivering, they are being loaded or unloaded right then and there. This is what we call a live load.

In drayage, if a receiver says, “I need you to drop this container today, but we likely won’t be able to unload it until tomorrow. I’ll let you know once we can unload it and then you can come back.” This is where a drop fee comes in. Since the drayage carrier will have to drop the container and then come back to pick it up, the drop fee is a charge by the carrier for having to come back and pick up the empty container to return it to the terminal or port.

You want to make sure you’re having conversations with your logistics provider to get a full understanding of what’s needed for that container. Are they loading and unloading live or is it loading and unloading as a drop? That way you know whether to expect any drop fees.

What is a Chassis? Who Owns Them?

A chassis is the underbody of the truck and container. It’s what the container sits on. Pickup trucks have chassis, as do your 53-foot dry vans.

Drayage carriers do not own chassis. Instead, the drayage carriers must rent the chassis from the terminal or port. Once the drayage carrier has the chassis hooked on, a crane will load a full or empty container onto the chassis for them to transport.

What is Overweight for Drayage?

Every drayage carrier has slightly different weight limits, but universally there are some general limits.

First off, you have different types of containers and sizes. The standard sizes are 20-foot and 40-foot containers, and you have refrigerated (also referred to as a reefer) or dry containers.

Refrigerated containers will be able to hold a little less than your dry containers because reefer containers hold heavier freight, like frozen goods. They also sometimes have generators connected to them as well, taking away from the amount they can carry.

A 20-foot refrigerated container can hold up to around 36,000 to 38,000 pounds.

A 40-foot refrigerated container can hold up to around 38,000 to 40,000 pounds.

A 20-foot dry container can hold up to 38,000 to 40,000 pounds.

A 40-foot dry container can hold up to 42,000 to 44,000 pounds.

Make sure you’re having a conversation with your logistics provider to get a full scope of the weights that can be handled so your freight can be loaded correctly on those containers.

Who Needs Drayage?

Well, if you’re reading this article, you might be considering drayage because there may be some point at which your business will need it. It’s a great mode and tool to have when you may be talking to other suppliers overseas. Drayage is one way to service them. For example, with drayage, you can say, “Not only can we get your freight from Germany to California, but we can do that final mile delivery for you as well.” It gives you more to offer your partners and another way to move your freight.

How is Drayage Cost Calculated?

As a customer of Trinity Logistics, we want to make sure we’re transparent with you and that you understand all the different charges that you may see or come across.

Typically, you’re going to have three charges that you’ll see on most of your drayage quotes.

First, there’s your line haul. That’s moving the freight from point A to point B.

Then, there’s your fuel surcharge, which is a percentage of your line haul for fuel expenses.

Lastly, there’s the chassis charge.

As far as any additional charges, your Trinity relationship will provide you with a list of any potential charges that may arise, such as that overweight fee, drop fee, hazmat, or refrigerated fee. We want to make sure you know exactly what you’re being charged so there are never any surprises.

LEARN MORE ABOUT TRINITY'S DRAYAGE SERVICE.As more shippers look to reduce freight costs and their carbon footprint, intermodal logistics continues to see rapid growth. The Intermodal Freight Transportation Market has predicted a Compound Annual Growth Rate (CAGR) of 8.27 percent from 2021 to 2026 for intermodal logistics. And with intermodal peak season on the way, shippers using this mode must have the right shipping strategies in place.

Intermodal can be a very effective mode when it matches up with the right customers, but with the rapid growth of customers choosing intermodal logistics, we often hear a similar question from our shipping customers: “What should I expect during intermodal peak season?” So, let’s learn more about what peak season for intermodal is, how it may affect you, and what you can do to stay ahead.

WHEN IS INTERMODAL PEAK SHIPPING SEASON?

Peak shipping season refers to the time of year when freight volumes see an influx. For most modes, this falls in line with the time of year when retailers begin pushing inventory for back-to-school and the holiday season. During this time, shippers try to keep up with demand and manage inventories while fulfilling a high volume of orders, and motor carriers are busier than usual trying to deliver freight on time.

Historically, the peak shipping season for intermodal logistics is around June to December. While June may seem a bit early, many shippers are rushing to get their goods through West Coast ports before June 30th, and rail is a popular way for shippers to transport their West Coast imports. According to the Alameda Corridor Transportation Authority, since 2006, the number of goods imported and then loaded into intermodal equipment through Los Angeles and Long Beach ports has grown 25 percent.

With roughly two-thirds of intermodal containers coming off the West Coast from import traffic during peak season, this limits the supply of 53’ containers heading East.

Even though June is the typical start of peak season for intermodal, it can fluctuate. Some years it can be later or earlier. But since the start of the pandemic, intermodal logistics have been greatly affected by capacity, making peak season more year-round than in former years. This is because of the rapid increase in online shopping year-round for consumers, which the pandemic only heightened.

“The past two years since the beginning of covid-19 has greatly impacted intermodal capacity,” says Jennifer Fritz, Trinity intermodal expert. “Historically peak season for intermodal logistics usually starts June through December, but with capacity affected by the change in supply chains from covid-19, it’s been tight year-round, making peak season pressure felt year-round instead of a few months of the year.”

CHALLENGES OF INTERMODAL PEAK SEASON

Expected or unexpected, any time there is a major shift in supply chains, it can throw off your operation. So, how does peak season affect intermodal logistics? Well, it’s not much different than peak season shipping for any other mode.

You’ll see tightened capacity because of the increased freight volumes and demand. And anytime we see tightened capacity, we see increased prices as well. So, the more in demand something is with less supply, it equals higher rates.

You’re also bound to see some shipping delays and need to give longer lead times. Your usual service levels may also drop because of the overwhelming volumes of freight needing to be moved during peak season shipping. Especially lately with the continued covid-19 pandemic still affecting the market, West Coast ports, and ultimately, intermodal logistics.

Take Control of Your Intermodal Logistics During Peak Season

Make sure you’re not unprepared for intermodal peak season. Each peak season is variable, rarely unlike another, and planning is more critical than ever with it being more frequent and extreme. Here are some tips to help you take control of intermodal peak season.

Give Even More Lead Time

Book your intermodal shipments as far in advance as possible. Prices are volatile during intermodal peak season, and the rate to move a shipment through intermodal logistics can increase by hundreds of dollars over a single day. In addition, available equipment can often be an issue. This is not the season to wait until the last minute.

Stay Updated on the Industry

Ever since the start of the pandemic, it’s more important than ever to know what’s going on in intermodal logistics. As we’ve seen over the past few years, supply chain disruption can happen at any time, so make sure you check the news daily or have a good resource to give you all the information you need.

Try Shipping Later

Perhaps all your items don’t need to arrive during peak season. Great. If possible, schedule those shipments to ship after intermodal peak season, when there is more capacity and you’ll likely get a better shipping rate, or at least stagger them. So, if part of your shipment needs to arrive right away, have that delivered faster. And for any freight that doesn’t need to deliver quickly, schedule that shipment for a later date.

Plan for Extra Time

As noted, with the influx of freight needing to be moved, there are bound to be delays. Many intermodal carriers have fully planned days and if they get delayed, it affects the rest of their movements. So, make sure you allow plenty of time for your products to get to their destination. This will help keep a delay from happening and possibly get you a better freight rate.

Shop Around

Prices can fluctuate between providers and from day to day. If you have the time, try getting prices from a few different providers or being more flexible with your dates to see if you can find a better value. For example, the difference between a 15-day delivery time and a 20-day delivery time could be significant. Check out all avenues and find what works best for your budget and freight.

Have Modal Flexibility

Sometimes a mode will max out on capacity. If capacity is reached for intermodal logistics, ensure you have relationships with over-the-road carriers or a third-party logistics company as a backup. This ensures no matter what, you’ll be able to get your freight from point A to point B.

Leverage Partnerships

Partnering with an experienced 3PL can make navigating peak season for intermodal logistics, or any logistics mode, more accessible. Companies, like Trinity Logistics, often have longstanding relationships with carriers for all modes, plus logistics technology and well-trained teams ready to help you. A reputable 3PL will have seen it all during peak shipping seasons and be able to help you manage your logistics without batting an eyelash.

GET HELP WITH YOUR INTERMODAL LOGISTICS, NO MATTER THE SEASON

While we can’t look into a crystal ball and predict how long this never-ending peak season for intermodal logistics will last, we can tell you that many logistics providers and shippers are adapting. Intermodal peak season shipping can be stressful, but these tips can help you better navigate your intermodal logistics during the peak shipping season.

If you’re looking for help, Trinity Logistics is here to support you. We have a full Team of Intermodal Experts, experienced and ready to assist you with your intermodal logistics. Simply click the button below and let’s get connected.

Learn about our Intermodal service