B2B credit management has evolved since 2019. Here’s how to ensure your credit department succeeds.

The COVID-19 pandemic drastically changed the world, businesses, and their credit departments. It reshaped our economy. In order to meet the changing business landscape, credit managers have adapted quickly to maintain their companies’ financial stability.

Let’s briefly review the economy before the pandemic started. This will give us a clearer picture of the changes that have happened and the difficulties B2B credit managers now face. We’ll look at how your sales team can become a credit ally and close with tips on how to decision today’s B2B credit with success.

Pre-Pandemic Stability

Before COVID-19, the economy experienced comparatively stable growth. Companies were generally optimistic about their clients’ creditworthiness. The approval process for B2B credit managers was a relatively simple routine. They usually assessed customer creditworthiness based on financial statements, credit reporting, and industry benchmarks. Once a credit limit was approved, customers were generally given net payment terms.

Pandemic-Induced Shifts

The pandemic triggered a series of economic shifts that profoundly affected B2B credit practices. Government stimulus programs, supply chain disruptions, and inflation surges all contributed to a climate of uncertainty and volatility.

According to the National Association of Credit Management (NACM), total bankruptcy filings increased 18 percent year-over-year (YoY) in 2023.

As a result of these changes, businesses became more cautious about extending credit and credit managers had to adopt a more rigorous approach to risk assessment.

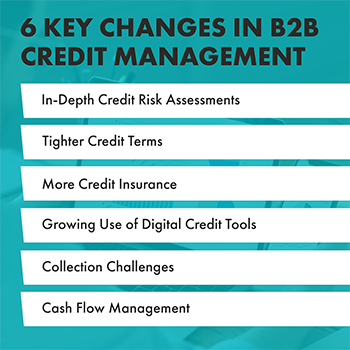

6 Key Changes in B2B Credit Management

In-Depth Credit Risk Assessments

Economic changes caused credit managers to become more reliant on data analysis to assess creditworthiness. This includes using financial modeling tools to assess a company’s ability to meet its debt obligations. Credit bureaus and alternative data sources are also leveraged to achieve a comprehensive view a customer’s financial health.

Tighter Credit Terms

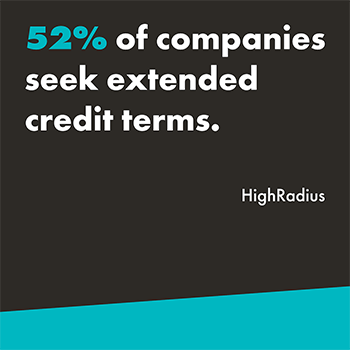

As businesses become more risk-averse, they are tightening their credit terms. This can involve shortening payment terms (e.g., from net 60 to net 30), reducing credit limits for existing customers, and issuing lower initial credit lines for new customers. According to a March 2024 report by HighRadius, 52 percent of companies seek extended terms – quite the opposite view. The same report shows that 17 percent of customers blatantly ignore credit terms while another 48 percent intentionally delay payment. This can make building strong customer relationships difficult.

Increased Use of Credit insurance

The rise in economic uncertainty has led to a surge in demand for credit insurance. Credit insurance protects businesses from monetary loss if a customer defaults on their payments. A 2023 survey by AU Group shows that since the third quarter of 2022, the number of business failures in almost every region of the world has risen. In line with that statistic, credit insurers expect growth in their sales over the next six years.

Growing Use of Digital Credit Tools

The pandemic has accelerated the adoption of digital credit tools and automation. Tasks like processing credit applications, credit checks, and collections are now being completed faster and allowing credit teams to focus on exception management.

Collection Challenges

The pandemic caused many businesses to experience cash flow disruptions. It’s made it more difficult for some companies to meet and/or maintain on time payments.

Cash Flow Management

Businesses are focusing on more effective ways to manage their working capital. This can include reworking their collection processes and closely tracking inventory levels.

Opportunity Emerges

All these changes have significantly affected credit managers and their teams. Now, they carry heavier workloads and face increased pressure to mitigate credit related risks. They also need to be able to adapt to rapid changes that may happen in today’s economy.

While these changes may have increased the burden on credit managers, they’ve also created opportunities for collaboration with sales teams. By working together, credit managers and sales teams can better service their businesses and customers.

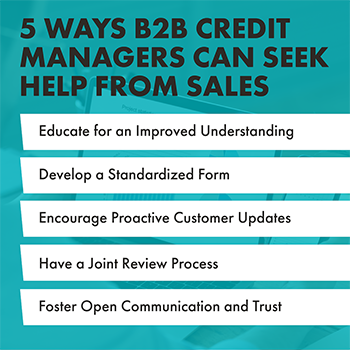

5 Ways B2B Credit Managers Can Seek Help from Sales

In today’s risky and fraud-ridden environment, the sales team support in customer onboarding and credit is vital. Credit and sales teams must collaborate to ensure a positive and seamless customer experience. Here are some tips to foster better collaboration:

Educate for an Improved Understanding

Sales teams are crucial in helping gather customer information to assess creditworthiness. Credit managers can help sales teams understand the importance of collecting this information. Sharing its use and how having it can make the approval process faster helps, too.

Develop a Standardized Form

A standardized customer information form ensures sales teams collect all the required information. This can help streamline the credit approval process.

Encourage Proactive Customer Updates

Credit teams must stay updated on customer developments. Encourage the sales team to proactively share any relevant customer updates with the credit department. Discuss what information is “relevant”, so everyone is on the same page.

Have a Joint Review Process

Joint sales and credit reviews can ensure both teams understand customer creditworthiness. They can help prevent incidents where a customer is given an okay by sales and later is deemed to be a credit risk. At the same time, joint reviews will strengthen the relationship between sales and credit while improving the customer experience.

Foster Open Communication and Trust

Open communication and trust are essential for effective collaboration between teams. Credit managers should be available to answer sales teams’ questions and provide guidance on any credit-related matters.

Is This the New Normal for B2B Credit Management?

It appears this “new normal” of post-pandemic business is here to stay, and it’s changed credit management for the foreseeable future. Because of this, we must have a more strategic and data-driven approach to B2B credit management. Those credit teams that adapt to these changes and improve collaboration with sales will be well-positioned to thrive in today’s economy. Furthermore, those who stay flexible and committed to delivering exceptional service will aid their company’s success. Will your credit team be the ones to hold revenue back or help drive it forward?

Get More Content Like This In Your InboxAbout the Author

Tracy Mitchell currently holds the position of Director of Accounts Receivable at Trinity Logistics. She has worked at Trinity for nine years, with over five years of those in credit management. She holds a Credit Business Association (CBA) designation. With a deep understanding of the industry’s dynamics, she has firsthand knowledge and provides the company with invaluable insights into the complexities of credit risk assessment, collections, and sales alignment.

Successful goal-setting is a necessity for Freight Agents to run prosperous businesses. If you’re feeling stuck with your goal setting, the Fresh Start Effect could help you achieve what you want.

If you perform a web search on the “Fresh Start Effect”, you’ll find a lot of articles and studies on the impact that a Fresh Start Date has on goal setting.

What is a Fresh Start Date?

It’s a date that signifies a clear end and a new beginning. New Year’s Day is the epitome of a fresh start date because you’re ending one year and starting a new one. However, a Fresh Start Date doesn’t have to be as well known as New Year’s Day. It can be any day that signifies a new beginning such as your birthday, Mondays, the first day of a new month, etc.

Why Is a Fresh Start Date Important in Goal-Setting?

Studies show that people are more likely to commit to their goals when centered around a Fresh Start Date. It gives a boost to let go of the past, whether it’s a behavior that you would like to let go of or a new behavior that you would like to start.

Tips for Freight Agents to Achieve Their Goals

If you’re looking to really set yourself up for success when setting your goals, here are some tips you can put into place.

1. Set Your Fresh Start Date

Choose your Fresh Start date to give yourself an extra chance at committing to your goal!

2. Make It S.M.A.R.T.

Using this tried-and-true goal setting method can help you become specific in what you are trying to accomplish. Make sure your goals are specific, measurable, attainable, realistic, and timely, giving you a greater chance at seeing success.

3. Know Your Why

Make it personal. Why is this goal important to you? How will your life look different when it is accomplished? Goals that don’t have a personal why behind them can seem arbitrary and make it very easy to quit.

4. Write It Down and Share It!

Writing down your goal in a place that you can see often, such as a daily planner, helps keep you focused on the goal. Having someone else aware of your goal also helps you stay accountable to yourself!

5. Plan Ahead

This is the beauty of a Fresh Start Date. By knowing when you are going to start, you can put in the work ahead of time to close out your current chapter and begin the new one. Whether it’s transitioning and delegating responsibilities or researching and learning so that you can hit the ground running on your fresh start date, having some pre-planning time will allow you to focus on the goal ahead.

6. Celebrate!

Having a significant reward or way to signify the achievement of a goal can help maintain motivation. For example, one goal that many of Trinity’s Independent Freight Agents have each year is to achieve Platinum status. This is a designation set aside for Agents that hit production goals in a calendar year. The reward for our Platinum Agents is an all-expense paid vacation for two! It’s a great way to recognize success, celebrate, and network with other Platinum agents so that you can start getting motivated for the next year!

One thing many people forget is that goals don’t just have to be professional; they can be personal, too. Whether you want to strengthen your relationships or learn a new skill, use these tips to get yourself there.

How Trinity Helps Freight Agents Get a Fresh Start for Their Business

At Trinity, we plan our goals around our monthly periods. This gives us the opportunity to evaluate regularly to ensure that we are staying on track and adjust quickly if needed. With our Independent Freight Agents, we work with them based on their personal business needs. Depending on the particular goal of a Freight Agent office, we may review these monthly, quarterly, or annually.

For instance, many of our Agents set the goal to achieve Platinum Agent status. Because of this, we have a Platinum Agent tracking tool that we can send out at any time to help them track their progress toward this important goal.

A Fresh Start Date is just one tactic to setting your Freight Agent business up for success and always a great time to re-evaluate your current brokerage partner. In fact, Freight Agents who partner with Trinity Logistics often see an average of 20 percent growth within their first two years of joining.

Check out the details of Trinity’s Freight Agent program to see if making a change at your next Fresh Start Date may be right for your business.

LEARN MORE ABOUT TRINITY’S FREIGHT AGENT PROGRAM