Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

UP AND TO THE RIGHT

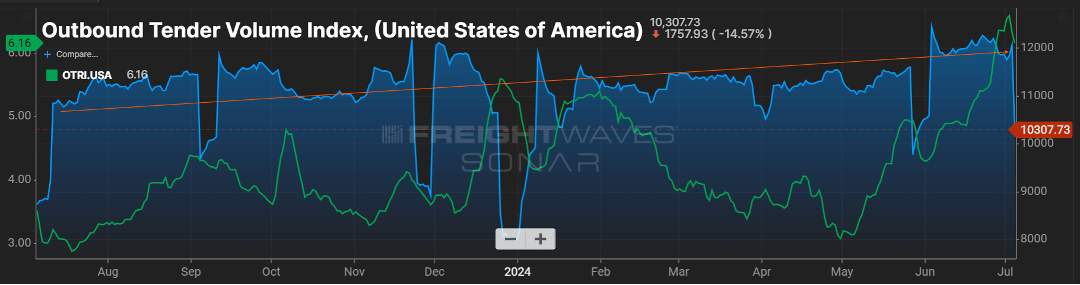

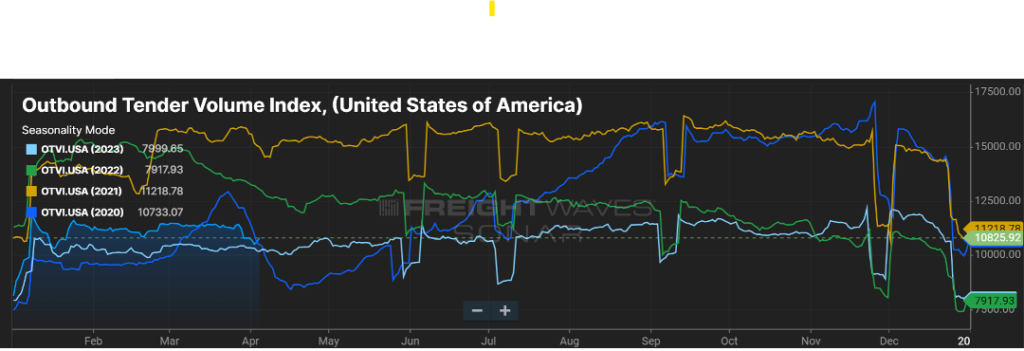

For the past year, the general direction of the Outbound Tender Volume Index (OTVI) has been on an upward trajectory as seen in Figure 1.1.

While it is not approaching the levels seen in 2021, the volume index is quickly approaching levels seen in 2022. This has buoyed optimism in the industry.

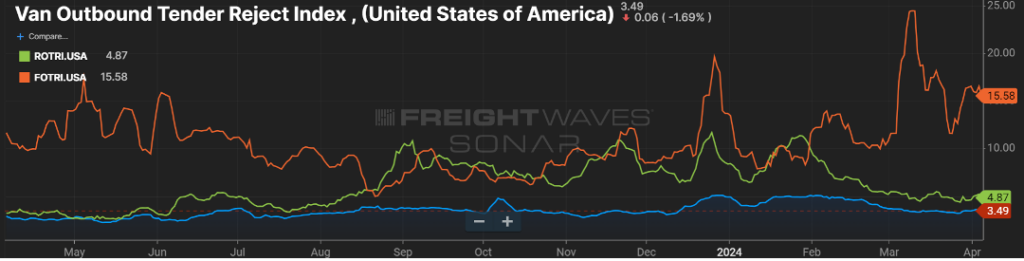

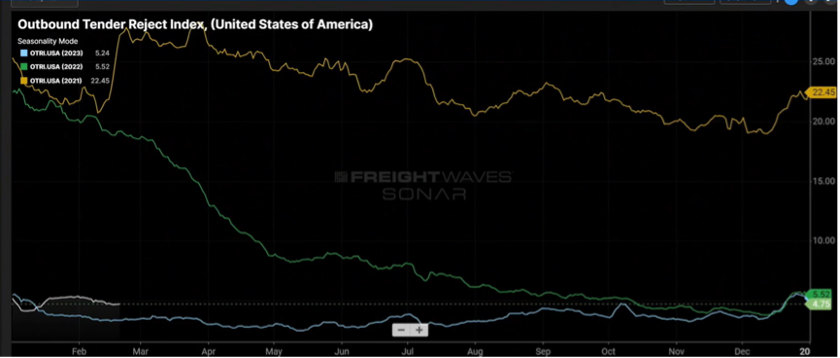

Another rise we’re keeping an eye on is the Outbound Tender Rejection Index, the rate at which carriers are saying “no” to freight where they have paper rates with a shipper. A six percent rejection rate may not sound important, but considering the rejection rate has stagnated in the three-to-four percent range for the past year plus, it’s another sign that the freight pendulum may be nearing more of a balanced market.

In 2021, rejection rates hovered in the 20-30 percent range. This was more a product of increased freight volumes and carriers realizing they could get higher rates in the spot market versus the contracted rates they had in place. The uptick in rejection now appears to be more of a limit of capacity in certain markets versus carriers hedging their bets on the open load board.

Drip, Drip, Drip

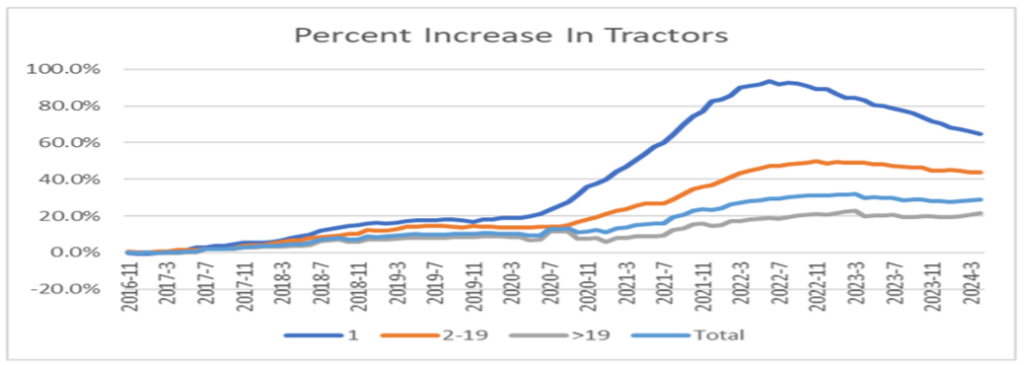

Speaking of that capacity, there is a reduction happening, albeit a slow drip. As shown in Figure 1.2, for the past year and a half, almost two years, the biggest reduction in capacity has been from the owner-operator segment. Most likely, the carriers in this group that have exited the market are those that rushed in when freight and rates were plentiful, and now are finding more normalized rates combined with high overhead to be unsustainable.

As shippers continue to look ahead, not having reliability among this segment of carriers could prove problematic as volumes escalate and more freight flows to the spot market, which is supported heavily by owner-operator drivers. This is a good reason for shippers to ensure they have a good mix of carrier and broker partners.

Baltimore Still Recovering

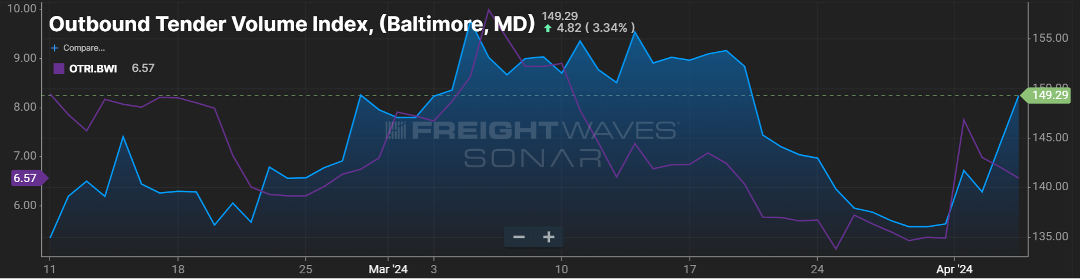

Finally, it has been just over three months since the bridge collapsed near Baltimore, MD. The waterways in the surrounding area appear to be returning to normal, and the need for traffic that populated the bridge to divert to alternate routes seems to be no worse for the wear on drivers.

Looking at volume in that market in Figure 1.3 since the end of March when the event occurred, after a slight dip when freight had to be re-routed, volumes as measured by the OTVI have increased just over 10 percent. Certainly, there is still work to be done, short- and long-term, but the Baltimore area appears to have powered through an unfortunate event.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

A LOOK AT THE PAST AND FUTURE OF THE FREIGHT MARKET

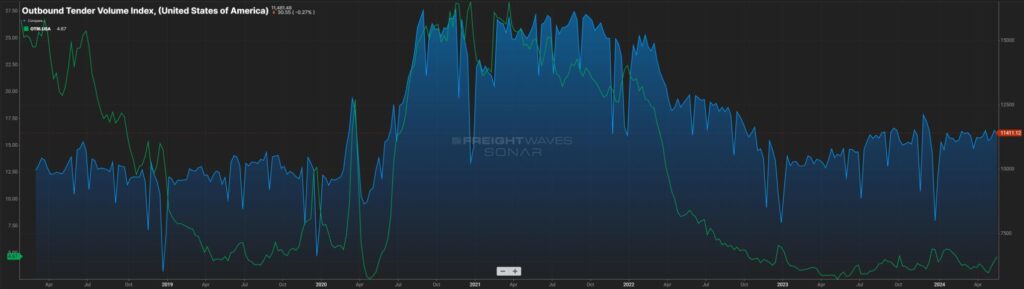

The Outbound Tender Volume Index (OTVI) measures the volume of contracted freight in the U.S. While this does not account for the spot market, ebbs and flows in contract freight have a direct impact on spot market volume and pricing. The outlier on the graph below (Figure 1.1) is the yellow line, representing calendar year 2021. This was an unprecedented year for freight volume, primarily influenced by consumer spending. While many feel the freight market is suppressed, that is not necessarily the case. 2024 will follow a more traditional freight flow pattern, with volumes up five to eight percent, year-over-year (YoY).

Measuring the freight volume is not enough to predict swings in pricing. Being able to overlay the frequency in which carriers say “no” to freight tenders via the Outbound Tender Rejection Index (OTRI) gives a good picture whether the capacity side of the market can handle those swings.

The below chart (Figure 2.1) looks at the amount of contracted freight volume (blue line) with the frequency of tender rejections (green line) overlayed. As can see, most of 2019 and the first part of 2020 saw a market where freight volumes were easily handled. This was a result of lower than anticipated freight volumes versus a glut of carriers in the market.

Then March 2020 happened. Everything went on lockdown. Volumes and rejection rates plummeted. That was quickly followed by a freight injection and for the latter part of 2020, and all of 2021, the market struggled with a lack of capacity to handle the record freight volumes.

For example, most LTL carriers were operating at 105-107 percent of capacity when they normally are in the low to mid-90s range. The freight market pendulum was in favor of the carriers. When the market gets hot, everyone wants in, which is what was happening in 2021, and 2022 – new carriers raced to get in on the action while existing carriers looked to soak up as much rolling stock as they could to capitalize on the market.

2023 saw a return to more traditional levels, but the capacity remained. As a result, rejection rates for freight tenders took a dive to below five percent, indicating carriers were eager for any freight that kept their fleets moving. This caused freight rates to take a dive (Figure 3.1) and then stabilize as of late.

But how long will shippers be able to rely on rate stability? Most likely the best determination will be the pace at which carriers exit the market.

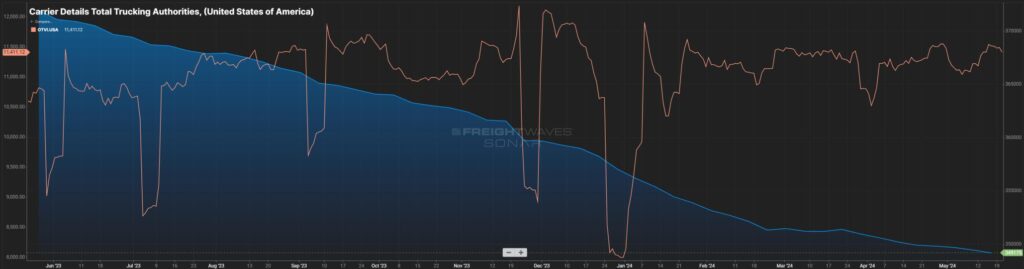

Figure 4.1 clearly shows capacity has been coming out of the market (blue line) for the past year. Most of that capacity is small – micro-fleets and owner operators. Certainly, this is dwindling capacity, but not to the extent of a large carrier pulling out of the market. A slow drip for sure.

The orange line represents the OTVI (volume) in the market, and that has slowly climbed over the last 12 months with the normal seasonal up and downs. At some point, as the volume inches up and capacity comes down, it’s simple supply and demand. Many are pointing to the end of this year, more likely spring of 2025 when that balance starts to shift. Now is the time for shippers to learn the contingency plans that are in place with their carrier and broker providers to account for this.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

FREIGHT VOLUMES ARE ACTUALLY UP

It seems much of the news clippings have been around freight rates and how they remain suppressed. One could jump to the conclusion that this is a result of freight volumes being down. On the contrary, freight volumes are elevated from what we saw in 2023.

As you can see in Figure 1.1, volumes for the majority of 2024 are between six to eight percent higher compared to 2023. What is driving (or not driving) rates remains the capacity in the market.

Capacity is showing a net decline, albeit slower than expected. Much of that reduction is being felt in the less-than-10 tractor-fleets, so while the number of for-hire carriers is declining, the impact to actual trucks to haul freight is a slow drip.

That capacity continues to hold tender rejection rates at extremely low levels, meaning few loads are hitting the spot market. As a result, spot rates remain almost $0.70 per mile less than contracted rates. There has been some closing of the gap over the past year, as shown in Figure 1.2, but look for the gap to remain relatively consistent for the remainder of the year.

The Aftermath of The Francis Scott Key Bridge Collapse

It has been about six weeks since the bridge collapse in Baltimore. Removal efforts continue and certainly, a return to normal traffic flow is years away.

In positive news, looking at the *headhaul index for that market (Figure 1.3), aside from the drop around the time of the collapse, things appear to be back to normal from a balance standpoint. Certainly, there are more out-of-route miles and freight that may be entering at nearby ports, but for the most part, outbound and inbound freight volumes appear to be back to normal for the Baltimore market.

*headhaul measures the variance in outbound versus inbound freight

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

FRANCIS SCOTT KEY BRIDGE IMPACT

Watching the video of the bridge collapse was surreal. To have that structure there one minute, then five seconds later be completely gone, was jaw-dropping. Certainly, our thoughts and prayers are with those whose lives were impacted by the collapse.

Since the incident, clean-up has begun and a temporary waterway has been established, but it will take a while for the port to fully recover, let alone the bridge itself to be rebuilt. While the 30,000 plus vehicles that regularly cross that bridge is a sizable number, it’s about one-sixth of the volume that uses nearby major thoroughfares like I-695 or I-95 in the Baltimore area. Still, that traffic will need to go somewhere.

From the trucking side, there will likely be two main areas of impact. First, local freight that is destined for ocean travel will now need to find another port of departure, likely destinations the ports of NJ/NY; Philadelphia; and Norfolk, VA. This means more freight will be heading out of the Baltimore area.

Figure 1.1 below shows that since the end of March, right around the time of the bridge collapse, outbound volume, and freight tender rejection rates, have trended upward. Second, freight that travels around the Baltimore area will likely incur more out of “normal” route miles if the bridge was part of its route.

More carrier miles = more time to deliver = less time for other freight = increased freight costs.

SOME BALANCE SEEN

Overall, freight volumes have trended slightly above 2023 (Figure 2.1).

This has not dramatically impacted freight rates nationally or freight tender rejection rates. Excess capacity continues its slow runoff, and March saw an uptick in for hire carriers.

On a more granular scale, flatbed freight seems to be more optimistic. As seasonal flatbed type freight, combined with an uptick in industrial production and manufacturing activity is occurring, it has pushed flatbed rejection rates to more normal levels over the past few months as seen in Figure 3.1.

Flatbed rejection rates reached their highest point in over a year recently, and a 15 percent rejection rate is indicative of a more balanced freight market, if only for a certain equipment type segment.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

WILL 2024 BE A FREIGHT REBOUND YEAR?

I certainly do not expect that we will return to freight volumes like we saw in 2021, and part of 2022. Now, I will never say never, but those were most likely once in a lifetime events. However, there are many signs that point to a potential for 2024 to see a rebound in freight volumes and carrier rates.

First, let’s talk about rates for over-the-road (OTR) carriers. Many new entrants came to the carrier market in ’21 and ’22, but currently, we’re seeing the contraction of for-hire carriers.

As shown in Figure 1.1, the past 14 months have seen less carriers in the market. As supply continues to dwindle, this will put upward pressure on rates. Granted, it may take another 12 months for the carrier market to find an economic balance.

Figure 1.2 measures the rate at which carriers reject tenders (shipments) and continues to slowly climb upward. Granted, a rejection rate of five-plus percent is not earth-shattering, but in comparison to where it was in 2023, sub three percent in several months, five percent and the continuing upward movement is noticeable.

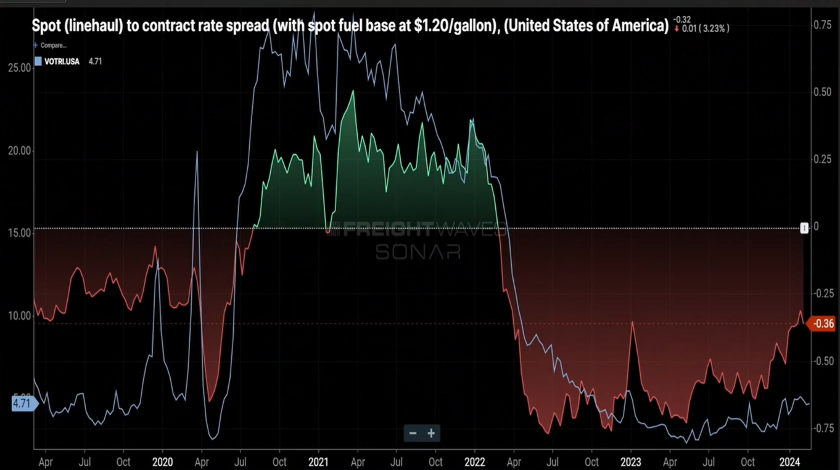

Lastly, Figure 1.3 shows that spot rates continue their slow rebound from the middle part of 2023. Contract rates throughout much of 2022 and half of 2023, were $0.60 to $0.70 cents per mile higher. Today, that gap stands at $0.36 per mile. This is a combination of spot rates inching higher, but also contract rates being less than prior years.

An Opportunistic Outlook

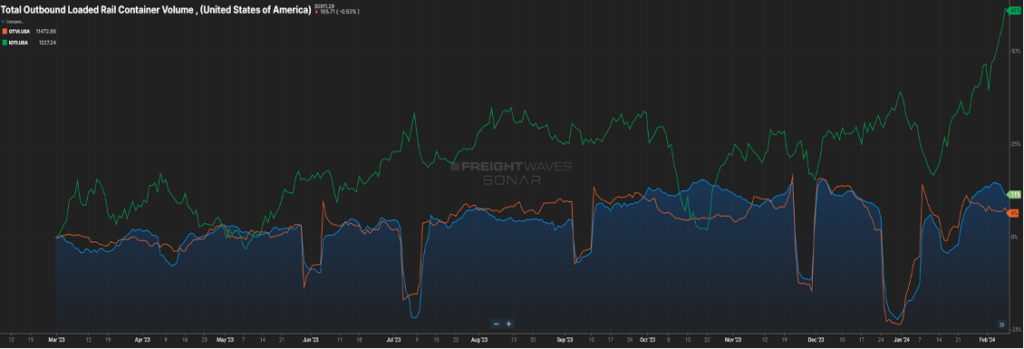

While contraction in the carrier market will influence the supply side of the economic equation, there also needs to be a demand component. The below chart (Figure 2.1) shows loaded rail car volume and over-the-road volume trending up and to the right, but the green line, representing inbound ocean containers, is really peaking.

Eventually, these containers will morph into rail and OTR volume. This is most likely a result in the drawing down of inventories, and the need for replenishment. Combine this with continuing increases in the manufacturing sector and housing market that will show better signs than 2023, it sets the stage for strong demand especially in the second half of 2024.

Will it be a bull or bear year in ’24? Well, if you would have asked that question six months ago, even maybe three months ago, my answer would have been slightly bearish or at best flat. However, seeing the recent signs on freight activity and the carriers needed to move this freight gives more reason to be optimistic as we go through the next ten months of the year.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

COULD WE LOSE CARRIER CAPACITY….WITHOUT LOSING ACTUAL CAPACITY?

Certainly, this question could cause one to scratch his head. If we don’t have a decline in the number of operating authorities, or available trucks, then how could we lose capacity?

Well, technically, the answer is you would not be physically losing trucks. However, an impact could be felt from recent events with regards to container shipping that would make it feel like less trucks are available. With recent geo-political events, and events at home, shipping to the West Coast has become more feasible than it was a year, certainly two years, ago. As ocean carriers are mindful of events in the Red Sea, combined with an easing of labor tensions at the West Coast ports, freight that in prior years was diverted to the East Coast is now heading back to the left coast of our country.

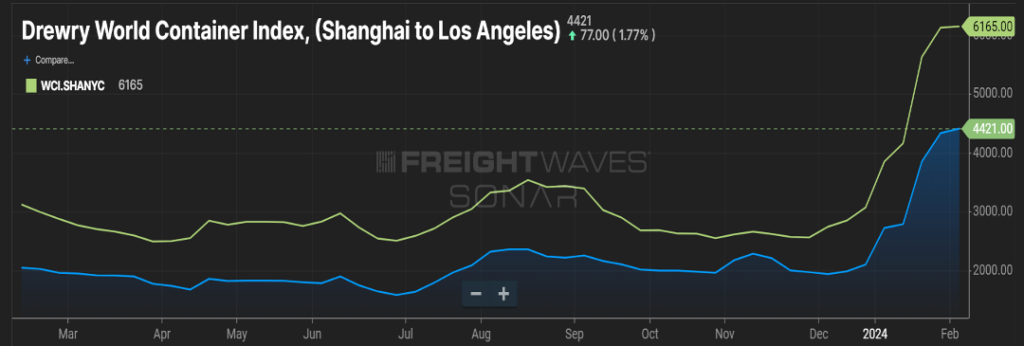

As you can see in Figure 1.1, container costs from Asia to Los Angeles are over $1700 cheaper than freight bound for an East Coast port, such as New York. Figure 2.1 shows outbound freight volume for the last year in the Los Angeles market, currently seven percent higher than this time last year.

So how could this impact capacity? When freight hits the East Coast ports, it’s typically consumed close to the port or at the very least, the coast itself. This means more regional runs. When freight hits the West Coast, typically that freight is destined for locations such as Dallas, TX or Chicago, IL, so taking freight up and down the East Coast may be a one-day run. Freight out of the Los Angeles market, heading to further destinations would take a day and a half, two days.

Same freight, same one-truck move, but now it occupies that truck for twice as long. Additionally, this could necessitate a shifting of fleet resources from one coast to the other, potentially creating an over-capacity on one side of the U.S. while the other coast is more desperate for trucks.

SPRING IN 6 WEEKS?

Will that rodent in Pennsylvania be right this year, and will freight volumes accelerate quicker as a result? First of all, ‘ol Punxsutawney Phil is batting less than 50 percent for his career and the last 10 years he’s only been accurate three times.

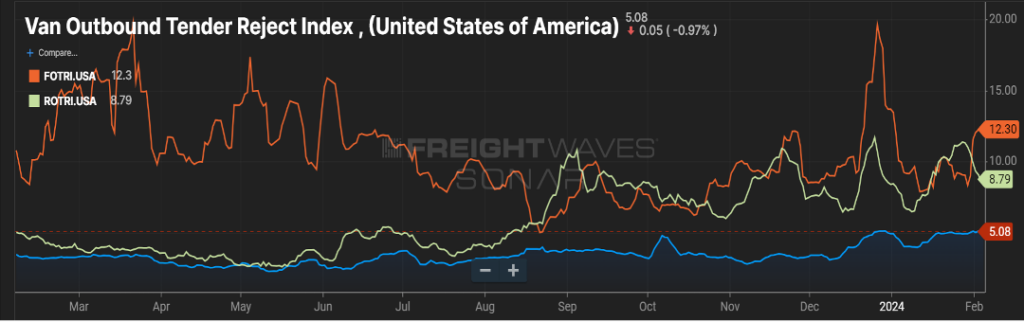

A better canary in the cave would be how the rejection rate index ebbs and flows. As you can see in Figure 3.1, van rejection rates have been pretty stagnant for the past year. Flatbed has remained relatively high and reefer rejection rates have trended up the last five months. If Phil is a soothsayer this year, we expect flatbed rejection rates to continue rising. If produce season also starts earlier than most, reefer rejection rates will then follow.

As reminder, with increases in rejection rates, shippers typically see transportation costs increase on the spot market.

Stay tuned for next month’s update to see if an early spring is a turning of the tide for the freight market.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

LIKE TRACKING A HURRICANE

I’m sure we’ve all felt like we were in a bad storm over the past few years when it comes to the freight market, and particularly, shipping rates. As we’re now into a new year, shippers and brokers are looking at their 12-month rate forecasts and wondering how things will look come December ‘24. It’s relatively easy to project for the first few months, even the first quarter, but as you get further and further away from when you send those projections to your finance team, the level of angst goes up.

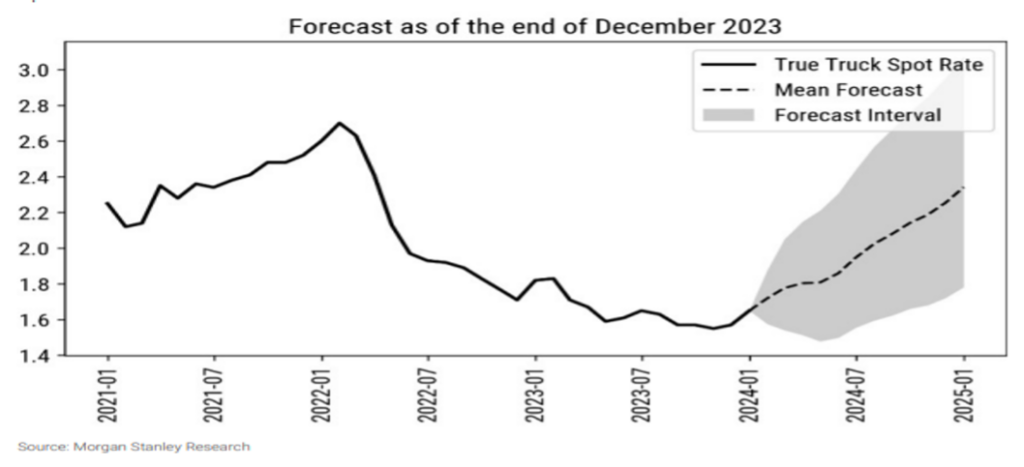

Figure 1.1 will hopefully help in assessing if your year will have a good outcome, or if there may be reason to look at your contingency plan. As we typically see in the first months of a calendar year (setting aside what we saw in 2021), rates are usually at their lowest point due to volume being restrained. Using the current rates for dry van freight, you can see the projections are for upward movement in rates as we go through the year, with rates pushing past $2.30 per mile as we close out 2024. However, as with any forecast or projection, there is always that “margin of error”.

If the projected supply and demand balance is more volatile, it’s possible to see freight rates pushing $0.50-$0.60 per mile higher. On the opposite end, if demand for freight is muted, and the carrier churn rate levels out or, dare I say, we see an increase in capacity, freight rates could be well below $2.00 per mile.

As with any major storm, it’s better to prepare and not need, than the other way around. As a shipper, boosting your carrier and broker base to give you options is always a prudent move.

CONSUMER SPENDING TO STEADY

There are some positive signs for 2024.

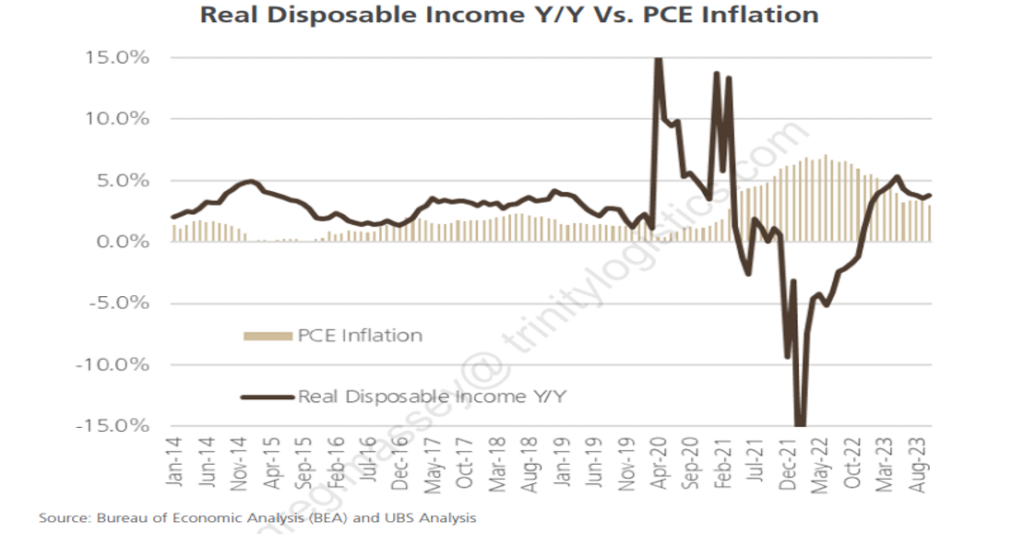

The dreaded word “recession” that has been thrown around for seemingly all of 2023 doesn’t seem likely. The U.S. is poised for modest GDP growth and inflation shows signs of easing throughout 2024. There is also a strong likelihood we will see rate CUTS from the Fed this year.

As we know, consumers are a big driver of freight activity. Look no further than the second half of 2020 and all of 2021 to see the impact consumers with disposable income can have on movement of goods. Figure 2.1 gives an indication that consumer buying will continue this year. As the ship steadies with inflation, that line will most likely head towards three percent at the end of the year, as consumers are finding dollars available to spend.

There was a lot of pent-up demand for services that gobbled up U.S. consumer dollars over the past year plus, which lends credence to consumers looking to spend their dollars on things versus services. This will certainly be a shot in the arm for the freight-challenged industry we have experienced over the last 12 months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Shippers – Don’t wait ‘Til It’s Too Late

Probably every shipper has, at certain times or maybe all the time, been inundated with requests to handle their freight over the past year. This is in stark contrast to 2021 and most of 2022 when carriers and brokers were keenly focused on existing customers and not as aggressive in pursuing new business relationships.

Currently, shippers are enjoying relatively abundant capacity and spot rates, which have fallen below $2.00 per mile. As we all know, the freight market is cyclical. Several signs point to a period of supply and demand balance, and likely a crunch with capacity. Will it happen tomorrow? No. Six months from now? Possibly. Most likely, we’ll see this scenario play out as we head toward the latter part of 2024.

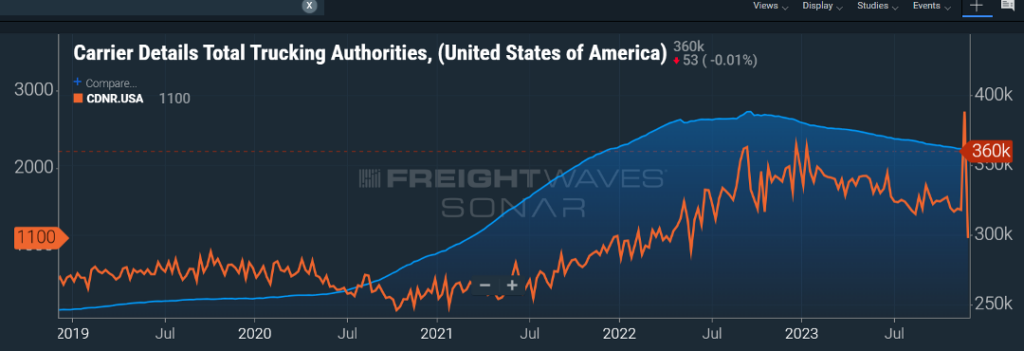

Figure 1.1 shows the total for-hire trucking authorities (blue line) and the carrier net revocations of authority (orange line) over the past five years. Clearly, carriers started flooding the market in late 2020, in response to the surge in goods moving within the supply chain. Much of that was consumer driven thanks to direct and indirect government stimulus action.

As we’ve seen freight volumes decline, carriers, mostly single person operations or small and micro fleets, have decided the juice is not worth the squeeze. This downward trend in available for-hire carriers will continue, and possibly accelerate, as we head toward more lean freight months ahead.

Shippers over the past year have right-sized their provider network. Now is the time for shippers to look at their volume forecasts and imagine having to manage that freight movement with 25-40 percent fewer providers than they currently have in their network.

If you haven’t started efforts to expand your carrier and broker partners, don’t wait until you have freight sitting on your dock and no one to move it from point A to point B. Nobody wants to be stymied like they were just a few years ago.

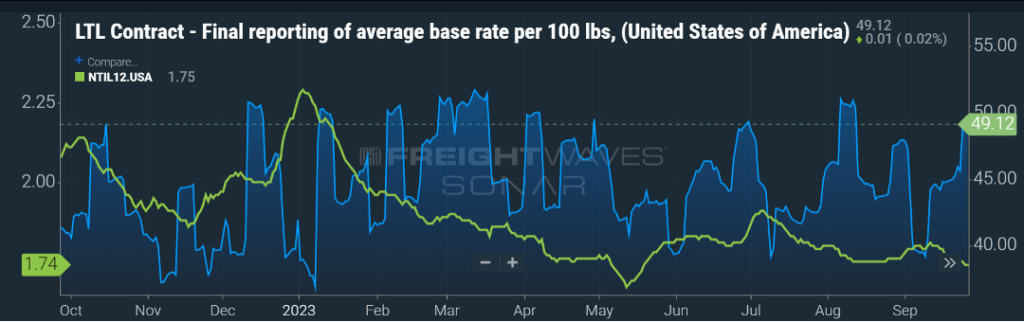

LTL Costs Rise

Does it feel like LTL shipments are getting more expensive, while truckload shipments are going the other direction? Why are the rates not cheaper if freight volumes are less than what we saw a few years ago?

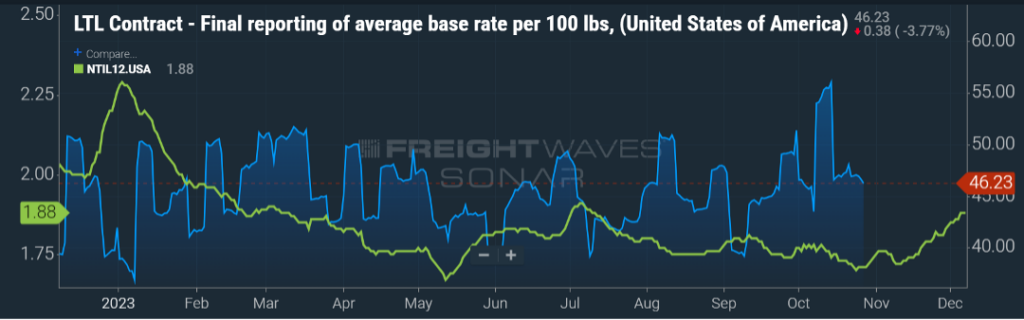

Figure 1.2 shows the spot truckload rate (green line) being almost $0.40 per mile less than the beginning of the year. LTL for the most part has seen rates (blue line) gradually head upwards as we have gone throughout the year.For a new shipper to the industry, this can be a head scratcher.

Short answer, truckload has a much more expansive network of providers, and as we highlighted above, that door being opened for new entrants into the market can happen quickly. The LTL model is more complex and a much bigger barrier of entry to the market. It would be a tremendous capital investment for a new LTL entrant to enter the market – trucks, trailers, terminals, labor, maintenance, etc. With the recent departure of one of the top 10 LTL providers (Yellow Corporation), that freight volume has been gobbled up by the remaining LTL carriers in the market but for the most part at a higher rate.

We are also approaching the time of year when LTL carriers, after assessing their financial statements and forecasting costs for the upcoming year, will start knocking on doors to discuss general rate increases (GRIs). Notice I said “increases”, not the other way. Don’t be surprised when your LTL contact lays out a proposal that elevates your LTL freight spend by four-to-six percent in the coming year.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

FLAT RATES, EXCEPT FOR LTL

Much of what we have seen this year has been around carrier rates remaining relatively flat. Apart from a few seasonal or holiday peaks, and a slight up or down influence due to fuel costs, spot rates and contract have been stagnant. As you can see in Figure 1.1, the green line has hovered between $1.70 and $1.80 for the past six months.

Less-than-truckload (LTL) rates, one would reason, would follow a similar pattern as they typically follow truckload rate movement with a few months lag. In the past few months, as indicated by the blue line in Figure 1.1, there has been an acceleration in LTL contract rates. As you probably recall, one of the larger LTL carriers, Yellow Corporation, filed for bankruptcy in August and ceased operations.

One may ask, “Well, why would rates elevate when the LTL industry was operating at less than capacity and nothing has caused an influx of new LTL freight?”

Yes, the remaining national and regional carriers were, based on available capacity on the books, able to absorb the freight Yellow was moving with no additional investment in equipment or labor. But just because the available resources are there, does not mean they are positioned in the places where service was needed.

This has necessitated LTL carriers realigning their network to move the freight that Yellow was doing prior. The more prevailing reason for rates to increase is the aggressive nature in which Yellow competed for the freight they were servicing. Typically, Yellow’s rates were far more discounted than most.

So, while the remaining LTL carriers in the network were able to position their fleets to handle the volume, they did not offer the same discounted rates that Yellow did. When you bundle all these factors together, you get rates increasing by about 10 percent in the last several months and I would not anticipate that 10 percent increase being reversed anytime soon. If anything, look for those annual general rate increases to happen as we embark on a new calendar year.

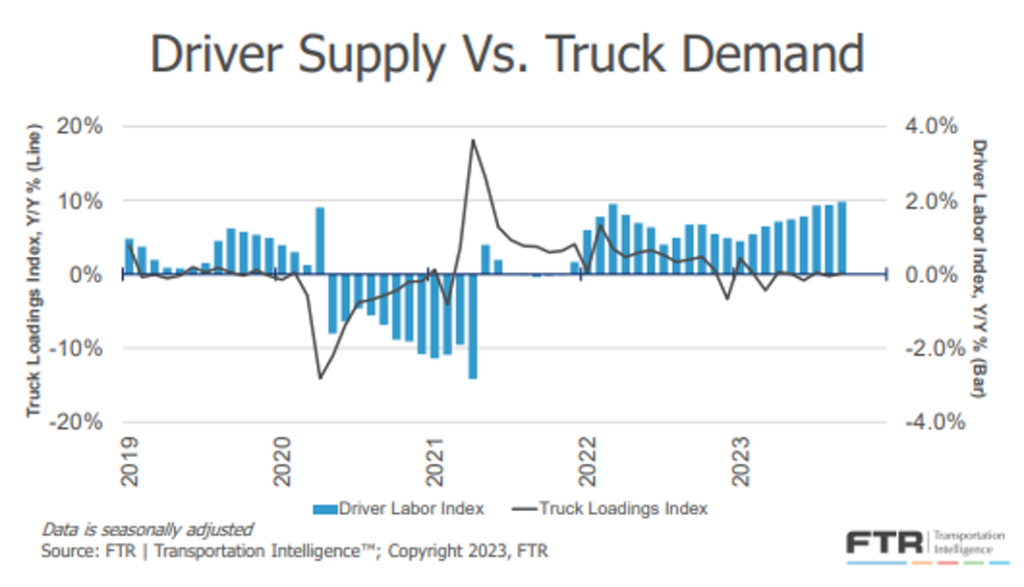

SUPPLY & DEMAND BALANCE IN 2025?

In prior monthly updates, we have highlighted the current freight environment being one of more supply than demand. Suffice to say that truckload freight volumes have been relatively unchanged over the last 12 months and carriers are saying “yes” to almost every shipment offered to them on the contract side.

This has resulted in less freight hitting the spot market and has helped to keep rates at levels that are $0.70-$0.80 less than contract rates. When will there be better balance? A great illustration of this from FTR in Figure 1.2 tells the story.

As you can see, the driver labor index sits well above the truck loadings index and has been for the past two years. When you factor in prospects for freight volumes to accelerate, economic conditions, and the pace at which carriers are exiting the market, it will most likely be 2025 before balance returns.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxSitting trucks cost your business money, so why not look into dedicated freight?

Do you have times when your company’s trucks aren’t moving? Are you tired of working for different people, transporting different kinds of freight, and your drivers running different routes every day?

For carriers looking for consistency in their schedules and stable revenue, dedicated freight is the key to keeping your trucks moving, developing strong business relationships, and steady earnings.

What is Dedicated Freight?

Dedicated freight is a contracted arrangement between a carrier and a shipper or freight broker. This differs from spot freight because the carrier agrees to haul consistent truckload shipments in the same lane and at a fixed rate for a specified amount of time – often three to six months or a year. Contract or primary freight are other names for it.

In a dedicated contract, the carrier commits a certain amount of their driver capacity to the shipper and often must meet minimum service requirements, like on-time pickup or tender acceptance, to keep the lane. In turn, the shipper commits a certain amount of consistent freight to the carrier, with usually at least one load per week. Unlike fluctuating spot rates, contract rates stay the same, excluding any fuel changes.

Is Dedicated Freight Pay Better?

That depends on the market.

If it’s a “carrier’s market”, one in which there is more freight available than carriers, the spot market often pays a higher rate than dedicated.

If it’s a “shipper’s market”, one in which there are more carriers than freight available, then the spot market often pays a lower rate than dedicated since its pricing is locked in over the length of the contract.

The biggest takeaway with dedicated freight is its consistency. Dedicated freight is steady freight with a locked-in rate, so you’ll have stable revenue, no matter the market conditions. Because of this, most carrier businesses aim to have a mix of spot and dedicated freight to get the best of both worlds.

How Many Trucks Do I Need for Dedicated Freight?

Many carriers think that you need to have a large fleet, but that’s simply not true. There are many companies with 50 or fewer trucks hauling contracted freight.

While there’s no set limit to how many trucks you need to handle dedicated opportunities, most find that around 15 trailers or more is what’s needed to be able to manage a shipper’s needs.

Benefits of Moving Dedicated Freight

Consistent freight to haul and a stable payday aren’t the only benefits of running dedicated freight.

Improved Driver Safety and Satisfaction

Consistent freight in the same lanes means your drivers are going to get familiar with their routes, the facilities, and the staff. They will quickly learn how to better navigate their journey, reducing their risk of getting lost, and being less prone to accidents. On top of this, they’ll gain a more predictable schedule, meaning they know exactly when they should be getting home to their families. This also means it may be easier to keep current and recruit new drivers for your business.

Happier Dispatchers

Your dispatchers will be happier too! Having dedicated lanes frees up time for your dispatchers to focus on finding tougher backhauls, keeping your drivers happy, and getting reimbursed for any accessorials.

No More Fighting Over Available Loads

Have you ever seen a load that you were ready to book on a load board only to find another carrier snagged it first? With dedicated freight, there will be no more fighting over posted shipments since the tender goes right to you.

Build Strong Customer Relationships

Working with a consistent customer means you can build a strong relationship with them and possibly gain repeat business.

More Efficient Business

Since your drivers will become more familiar with their route and freight, your business will become more efficient in the process.

Budget and Forecast Easier

By having long-term agreements for steady shipments, you can budget and forecast your company finances more easily.

Opportunities for Growth

With dedicated freight, you don’t have to worry about the fluctuating freight market. You’ll have more time to manage the rest of your business and look into growing your fleet.

How to Move Dedicated Freight with Trinity Logistics

It can be difficult to find and win dedicated freight opportunities alone. That’s why it’s beneficial to work with a third-party logistics (3PL) company, like Trinity Logistics, to easily open the doors to them.

Currently, carriers in the Trinity Logistics network move over 1,400 shipments each day. While most of what gets moved is on an as-needed basis, we constantly encourage our shipper relationships with consistent freight to try dedicated contracts.

Now, you know your business best. That’s why we have a Carrier Development Team that works to better understand your company, your needs, and your business goals. This helps you out so that when we gain a dedicated freight opportunity or bidding opportunities on behalf of our shipper relationships, we know what carrier relationships to send them based on criteria such as location, equipment type, or visibility through tracking.

So, if you’re already a carrier with Trinity Logistics, make sure your carrier profile is up to date. If you’re not sure whether yours is, send our Carrier Development Team a message at [email protected].

Not yet registered as a carrier with Trinity Logistics?

Check Our Our Carrier Requirements