Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Imports on the Rebound?

For the past 14 months, much of the conversation around U.S. container import volume has been gloomy.

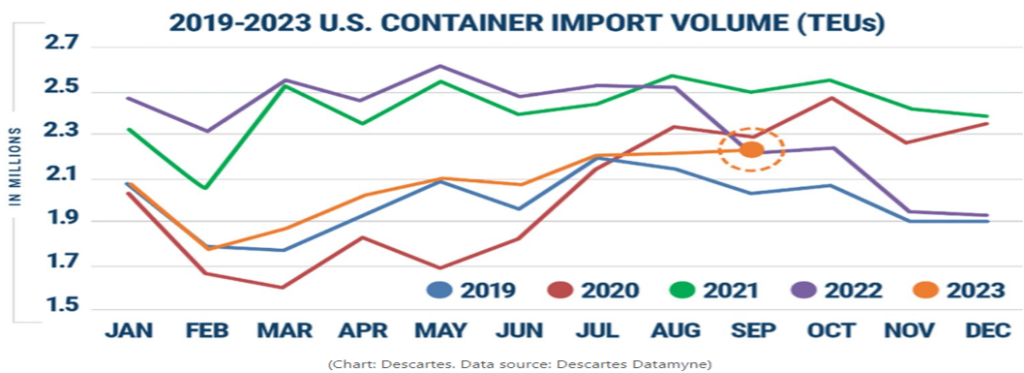

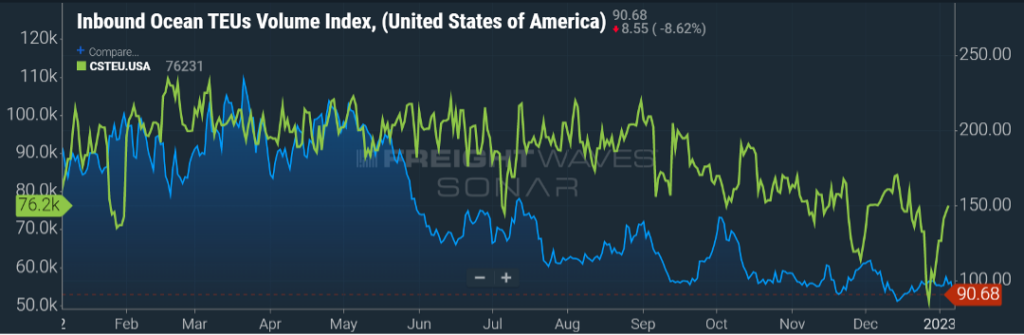

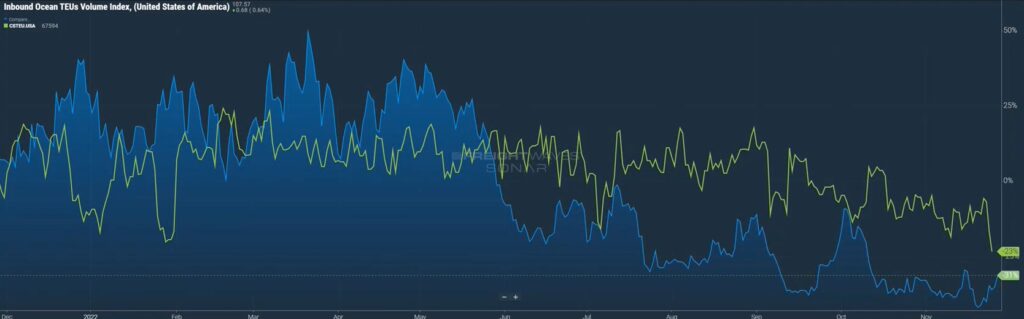

Figure 1.1 shows the steady decline in import volume that began in August of 2022, and those volumes have remained lower when you compare them year-over-year (YoY) for most of 2023.

September and October have begun to see that narrative change, with September of this year outpacing September of 2022. Comparing this year’s volume to 2021 and even 2022 is somewhat an “apples to oranges” comparison because of the frenzied consumer activity. A better comparison is how 2023 is stacking up versus pre-Covid years.

September 2019 saw approximately 2.05 million twenty-foot equivalent units (TEU’s) come through U.S. ports. September 2023 is seeing an increase of roughly seven percent in comparison. There are numerous efforts underway with U.S. retailers – like Walmart, Target and Amazon – to boost consumer sales with deals ahead of the traditional holiday buying season. This should continue to boost imports through the remainder of the year.

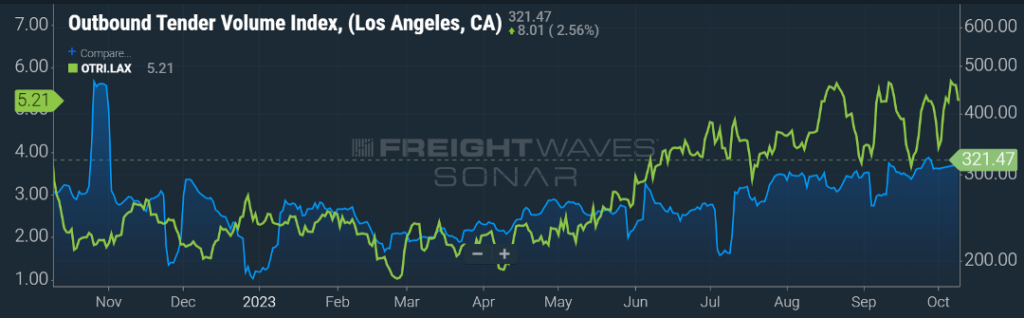

It will be important for shippers, carriers, and brokers to keep an eye on activity around U.S. ports as rates will reflect the supply and demand. An example can be seen the Los Angeles market. As seen in Figure 1.2, in the past 90 days, outbound volume from this market has increased almost 23 percent and the rate of carrier rejections has also shown an upward trend by over 50 percent.

Capacity Declining

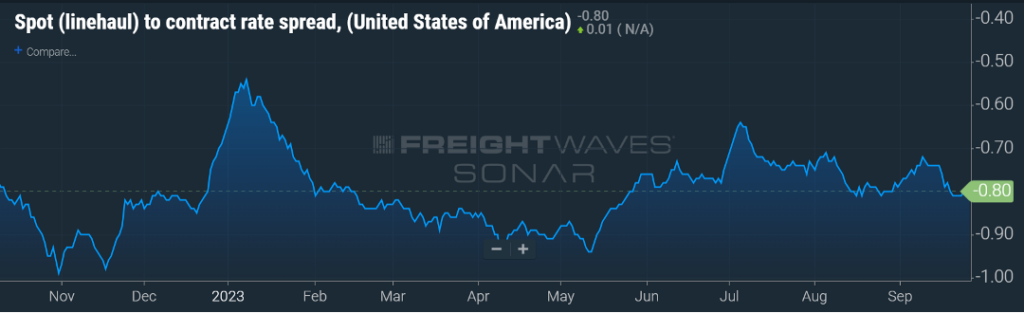

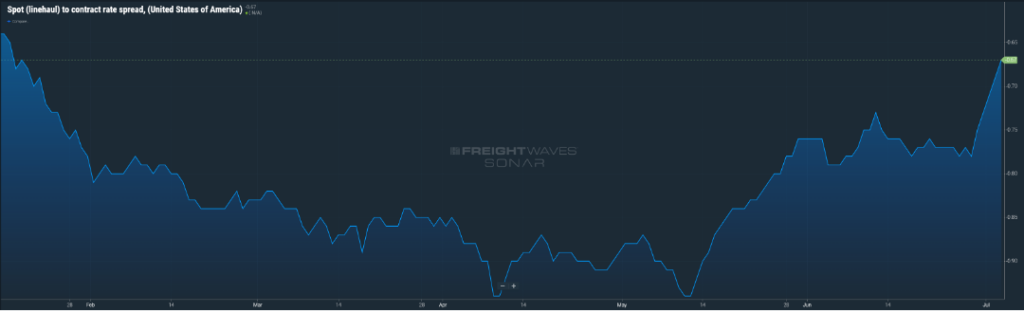

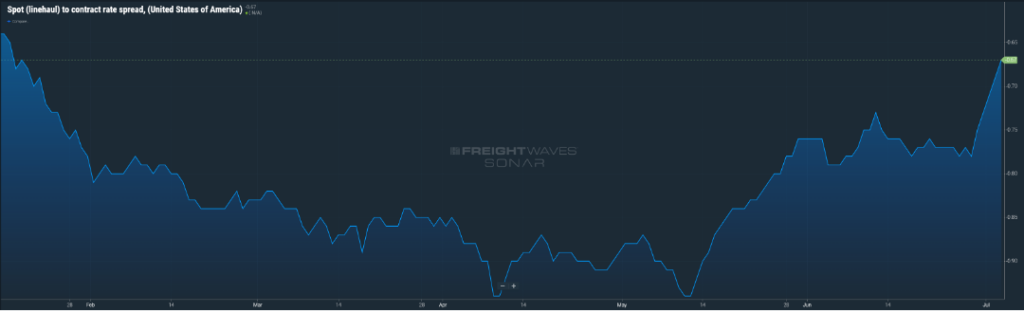

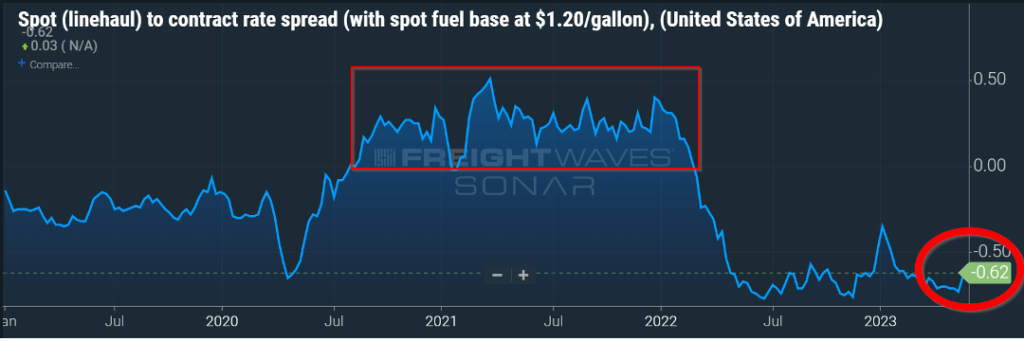

Six months ago, I would have taken a bet with anyone that the spread between contract and spot rates would not be greater than $0.50 per mile.

With capacity exiting the market and shippers making more frequent use of rate tools like mini-bids, the prevailing thought was that spot rates would remain relatively stagnant, or possibly a slight uptick, but contract rates would show a sharp decline. Good thing I was nowhere near a betting window.

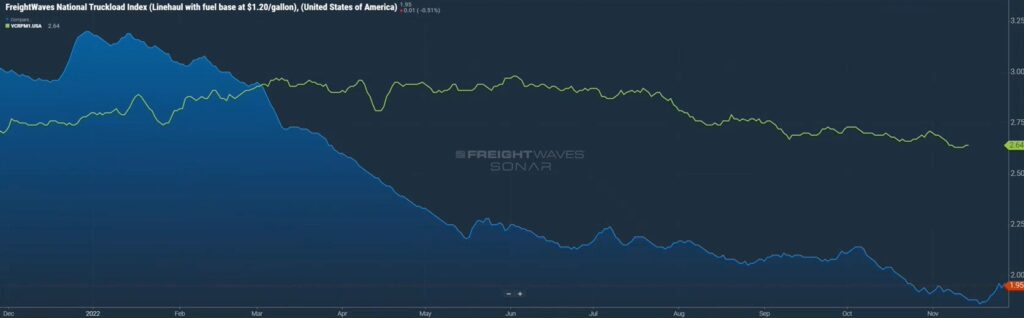

The spread continues to hover around $0.80 per mile as seen in Figure 1.3, with contract rates being higher. Annual bid season is fast approaching, and it will be interesting to see if recent upward volume trends combined with an increase in carrier revocations will continue to keep contract rates where they currently reside or if the “sharpen the pencil” adage will be more prevalent.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Freight Volumes Stagnant

As the U.S. continues to pull the levers to throttle the over-heated economy we experienced over the past few years, freight volumes, which are largely driven by consumer activity, have seen the impact of less buying from John and Jane Doe. It’s expected that muted consumer activity will continue through the first half of the calendar year 2024. We still expect to see a seasonal increase in spending at the end of the year for holiday shopping, but with consumers being more dependent on credit for purchases, and the rate of savings on the decline, expenditures are expected to be less than in prior years.

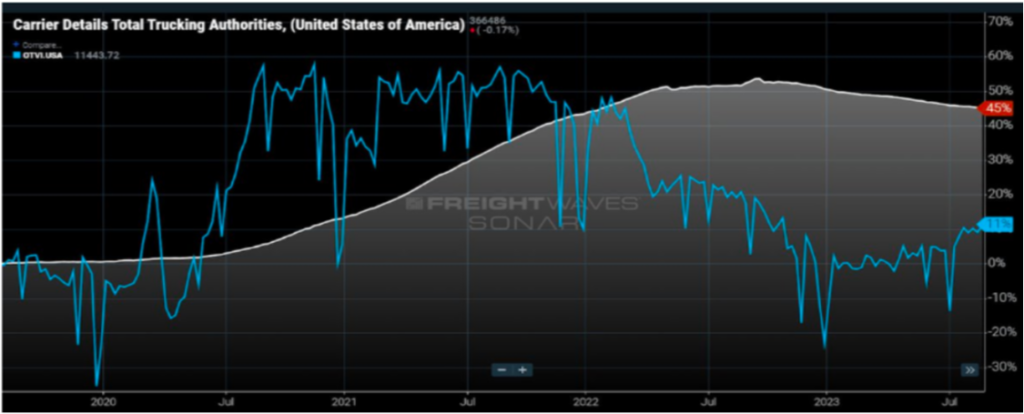

Combined with declines seen on the industrial production and manufacturing side, the hope for a rebound in freight volumes will not take place in 2023. The prevailing thought at this point is a return to a more balanced supply and demand regarding freight transportation will be driven by carrier attrition.

Nobody likes to see businesses fail, but we continue to see a market where oversupply has created trucking rates, particularly on the spot side, that are borderline if not less than what it costs a carrier to operate. Since the middle of 2022 and continuing this year, that decline in carriers for hire has continued as seen in Figure 1.1. Most of the attrition is carriers with five trucks or less, but as we’ve seen recently with Yellow Corporation closing its doors, no carrier is immune.

Capacity Declining

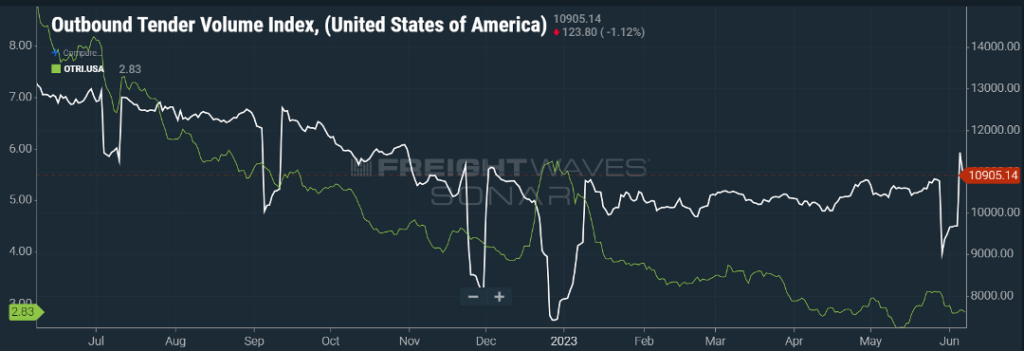

To further illustrate the impact of freight volumes on capacity, Figure 1.2 shows how capacity responds, almost in lockstep, with increases and decreases in freight volumes.

As freight volumes were accelerating in the latter part of 2020 and through early 2022, trucking companies popped up at a rapid pace to meet the demands of shippers. Carrier compliance, to a small extent, took a backseat as shippers were eager to make new friends with those who could get their product off the docks and to the end user in a race to satisfy consumer demand.

As freight volumes started to decline, as seen by the blue line in Figure 1.2, the need for capacity waned and began the downward trend (as shown by the white line) regarding carriers in the market.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Length of Haul Does Impact Acceptance Rate

If you’ve been following the overall U.S. volume and shipment rejection rates this year, aside from the typical blips seen around the holidays, these have been relatively stagnant. The overall rejection rate has hovered very near the three percent range.

However, if you break that down by the length of haul, it’s clear that carriers clamor for those short-haul shipments, anything less than 250 miles, as this typically will allow the drivers to be home at night. On the other end of the spectrum, those mid-range shipments (250-450 miles) are seeing the highest rejection rate, just below four percent as seen in Figure 1.1.

There could be several reasons for this. Most likely it’s the fact that a driver can make a trip of that length in one day, but it’s not a full day’s worth of driving. So, if the driver is getting a per-mile rate and not driving for the full 11 hours that are eligible, this length of haul “loses” money when compared to longer shipments that allow the driver to hammer down for the full allotment of driving hours.

Now, I realize four versus two-point-five percent doesn’t seem like a big gap, but that is a 60 percent variance. If the freight volumes and capacity begin to balance, and rejection rates by length of haul follow the same trends, you could see mid-range rejection rates in the 15 percent range while shorter hauls only see rejection rates in the six percent range. Certainly that will have an influence on future rates.

SPOT AND CONTRACT GETTING CLOSER

As expected in Figure 1.2, the variance between contract and spot rates continues to shrink. Since the widest gap this year, when contract rates were about $0.78 per mile higher than spot rates, the gap has shrunk by almost 30 percent in a three-month period.

For the most part, spot rates have found a floor, and if anything, have seen a modest uptick. Contract rates have seen frequent requests for re-pricing. Carriers continue to refine their contracted rates balanced with the expectation of almost 100 percent compliance with freight tenders and excellent service.

In 2021 and 2022, shippers were open to expanding their carrier and broker pool as capacity constraints and increased volume necessitated more choices. Now that the balance has shifted, shippers are looking to right-size their partners, with a mix of compliance, price, and service steering their decision-making process.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Stagnant Freight volumes Continue to Push Carrier Compliance

2023 continues to see freight volumes showing little fluctuation. With freight volumes dipping more than 30 percent lower than the industry experienced over the past year, and little attrition at this point with carrier capacity, shippers are seeing freight tenders gobbled up almost exclusively as soon as they are offered.

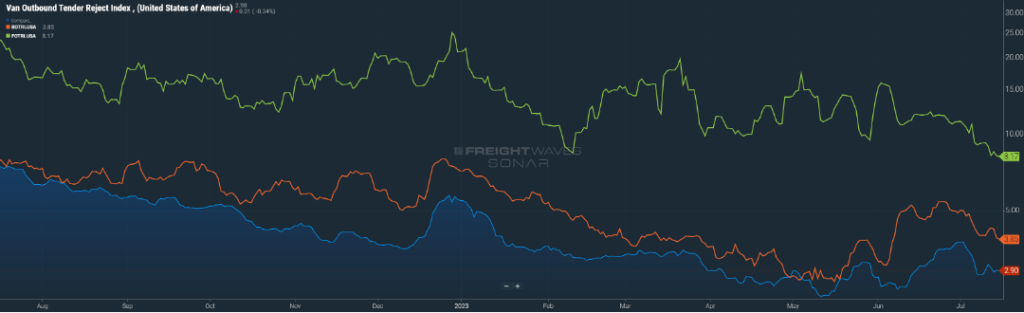

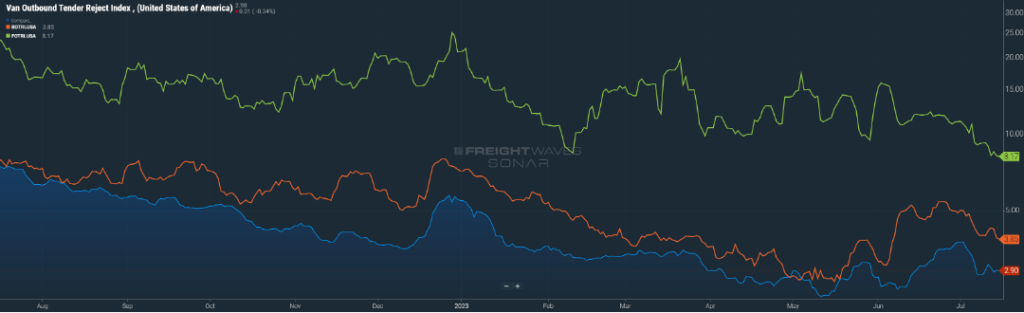

While there was a slight increase during the July 4th holiday week, primarily due to drivers taking extended time off the road, rejection rates have returned to their normal place of three percent on the van and reefer side (Figure 1.1). Flatbeds continue to see rejection rates almost three times what vans and reefers are experiencing, but the trend has been slightly downward over the past two months.

With no major signs of a rebound in volume, carriers will continue to strive for 100 percent compliance with freight tendered to them, and push for impeccable service to show why they need to continue to be a mainstay for shippers.

Start Preparing for a Balanced Market

There seems to be a tightening of the gap between contract and spot rates (Figure 2.1). This was helped a bit by spot rates seeing an increase at the start of July, but contracted rates being rebid over the last three months have been the primary driver.

In a normal market, the spread between contract and spot rates is around $0.15 – $.20 per mile. Currently, contract rates are $0.65 per higher per mile.

As shippers expanded their carrier network in 2021 and 2022, look for a trimming over the next six months as shippers look to honor their volume commitments to contracted partners but provide themselves an opportunity to realize savings with capacity in the spot market.

We do expect the supply and demand cycle to balance as we head into 2024, so shippers need to ensure they are not creating hurt feelings with carriers that find themselves on the outside looking in. Remember, this industry is a three-legged stool, and everyone benefits when things are in balance.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Why are Contract Rates Elevated in Comparison to Spot Rates?

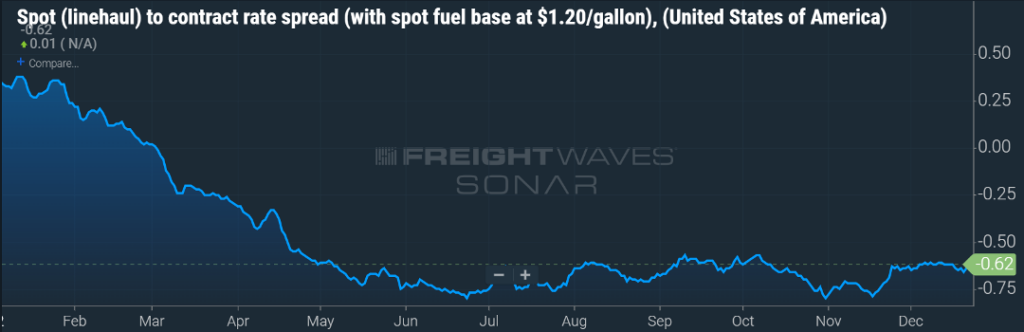

If freight volumes are, by some accounts, 30 percent less than what we experienced in the over-heated freight market of ’21 and most of ’22; and rejection rates are almost nil, why is the gap between contract and spot rates so wide, currently at $0.62 per mile as seen in Figure 1.1?

Typically, the gap between spot and contract in a “normal” freight market hovers around $0.15 per mile. During 2021 and most of 2022, spot rates were higher than contract rates for an extended period. For the majority of 2023, spot rates have fallen short of their contract rate counterparts.

As rates were high, especially on the spot side the last few years, capacity, particularly single-truck or small fleet operations, flooded the market. When challenging consumer conditions presented themselves towards the end of 2022, that meant less freight was traveling on America’s roads. So, you had a situation where less freight was in the contract space, which meant contract carriers were less likely to say “no” to freight tenders. This meant less freight flowed downstream to the spot market. When it did hit the spot market, there was a glut of carriers just waiting to bid for it, oftentimes doing so at break-even or very skinny profit margins just to keep the wheels turning.

We have seen in recent days the gap narrow. Part of that is due to continued pressure on contracted rates and another part of that is due to recent holiday and safety events that have stymied spot capacity. The gap will continue to narrow, mainly due to contract rates continuing to recede as spot rates, while maybe not at their floor, have very little room to move downward before they put carriers in a negative profit situation.

HO, HUM

On the topic of volumes and rejection rates, not much has changed since we last visited our trusty SONAR charts (Figure 2.1).

There was a brief blip in volume around the Memorial Day holiday, but that was short-lived, and volumes are returning to the levels we have become accustomed to over the past several months. Additionally, rejection of freight briefly pushed past the three percent mark but has since fallen back into the mid-two percent range.

Produce season will certainly give a boost to volumes, and drive rejections a tad higher. As well, depending on the situation with labor disputes at the west coast ports, that could potentially cause a brief halt to movement out of the west coast ports. When the labor disputes are resolved, it will give a burst to freight coming out of the ports of Los Angeles and Long Beach especially. But for now, things are a bit ho-hum.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

READY FOR A REBOUND?

Given the sluggish flow of freight in 2023, seeing any signs of life is encouraging. The industry muddled through the first four months of the year with the volume index registering very little movement as seen in Figure 1.1.

Heading into late April, and the early part of May, seeing upward movement was a welcome sight to carriers and intermediaries. Mid-spring typically brings a bounce from produce and seasonal freight, and this year we are seeing that lift, albeit not at an aggressive pace. Still, even with the slight upturn, freight opportunities continue to be gobbled up by carriers, particularly on the contract side. Historic low rejection rates of under three percent not only mean less freight heading to the spot market, but shippers continue to have the pendulum in their favor with regard to rates.

FLATBED SEES BALANCE

Speaking of tender rejection rates, the low rejection rate is not being felt across all types of equipment as we see in Figure 2.1.

Vans and reefers are pretty much accepting anything that comes their way. These are two equipment types that saw increases in their number from mid-2020 through 2022, primarily in response to the overwhelming consumer goods demand which typically travels in these types of trailers. Now that demand for these items has cooled, vans and reefers find themselves in a situation where demand is still there, just nowhere near what it was the past few years.

Flatbeds, on the other hand, did not experience the same demand. In the over-heated freight market, we experienced in the last few years, flatbeds felt the most normal with regard to freight patterns and demand. While they did not get the direct benefit of shippers clamoring for their services, flatbed carriers have also not experienced the same falling out. As a result, they enjoy a balanced market with rejection rates hovering in the mid-teens. This could be short-lived as downward trends in manufacturing and industrial production, combined with a cooling housing market, will lessen the demand for flatbed services.

the gap remains

Carrier rates continue to normalize.

As seen in Figure 3.1, the spot rate on the van side seems to have found a bottom. Contract rates have contracted slightly, but the spread between carrier-published rates and those available with spot rate pricing continues to push past $0.70 per mile. An uptick in spot rates may relieve some of the pressure from shippers on the contracted side for carriers. Ideally, a spread of $0.15-$0.20 would be more balanced.

Could this modest uptick in volume shrink the rate gap even more? Stay tuned to June’s update to find out.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Not Interested in Reading? Check Out Our Video Instead!

2023 Crystal Ball

It’s usually this time of year when predictions for the upcoming year start to make headlines. It’s safe to say that most folks could make some predictions based on what has transpired recently, so I wanted to highlight a few of those as we kick off the new year.

The gap between spot and contract rates will stabilize.

Now, this does not mean that they will be equal – that rarely happens. Just about a month ago, the spread was quickly approaching $1.00 per mile between contract and spot rates (with contract being higher). That gap is slowly starting to shrink (Figure 1.1). Some of that is due to spot rates seeing a holiday bump, and part of that is related to new contract rates taking hold. With many carriers taking an extended break from the road since mid-December, less capacity has pushed spot rates higher. This upward trend will be short-lived and expect rates below $2.00 per mile to become the norm as we chug through winter and into early spring. Contract rates will also trend downward, finding a floor most likely in the middle part of the year.

Few sectors will see bright spots in 2023.

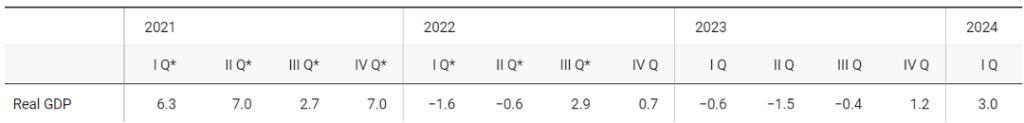

I don’t think anyone thought the economy could continue to chug along at its rapid pace seen in the latter half of 2020 and through most of 2021. Even though 2022’s growth was not as robust as the prior year, the U.S. Gross Domestic Product (GDP) should seek out a modest two percent growth rate. However, where that growth occurred sets the stage for this year.

2022 saw a return of spending on services versus goods. So, while things like healthcare are important to the overall economy, from a freight standpoint, service spending has much less impact on transportation. Expect auto sales, both new and used, to continue their strong run. As parts and inventory issues continue to be resolved, vehicles with temporary tags will be more commonplace as Americans continue to purchase cars and trucks.

On the opposite end, most notably, the housing market will have a rough 2023. With Americans seeing inflation compete for more of their take-home dollars, and the cost of borrowing increasing, many will choose to remain in their current situation. And it’s not just the building materials that will see less of a demand. With fewer new homes comes less demand for things that go in those homes – like appliances, carpets, and furniture.

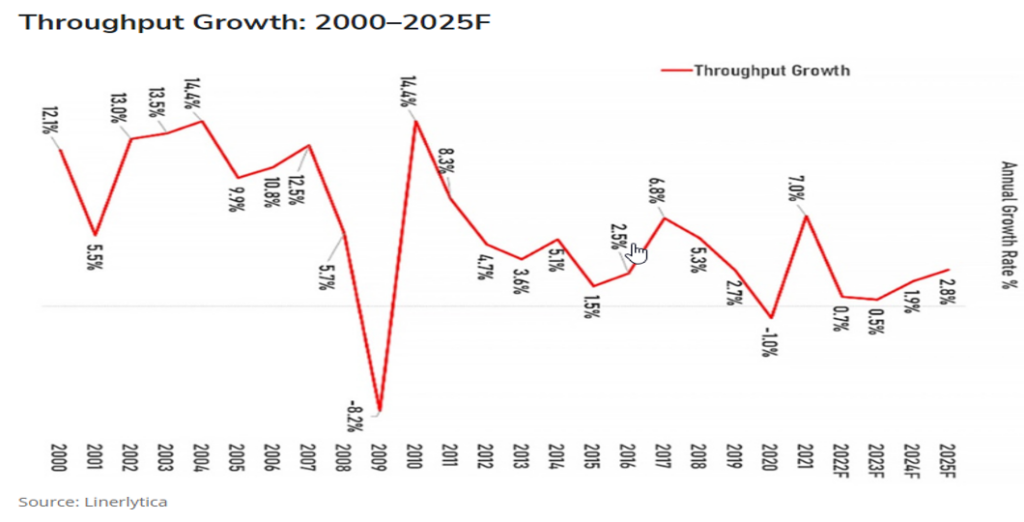

Following the building industry, manufacturing will be the next downstream effect, and banking will also see less demand for consumer and business loans. Overall, expect 2023 to see, at best, no year-over-year (YoY) growth in GDP, with 2024 being a rebound year (Figure 2.1)

Import activity will continue to slow.

As we saw in last month’s update, Figure 3.1 shows the impact of the ship backlog being resolved and container movement starting to slow. That will be a common theme this year. While 2022 saw year-over-year import activity down almost 20 percent, that downward YoY story will continue in 2023. This will have an immediate impact on intermodal activity, but also over-the-road and less-than-truckload volumes will feel the impact.

One thing to keep in mind as we see recent actual and forecasted numbers showing negative, that is against a backdrop of a very successful 2021 and modest growth year in 2022. So while 2023 will not continue that positive trend, by comparison to a recent down year like 2019, 2023 will be up from an overall volume standpoint versus just a few years ago.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

As we near the end of 2022 and the start of 2023, let’s look at three things in relation to the freight market: freight volumes, the rates, and what’s happening in the maritime segment.

SLOWING FREIGHT VOLUMES

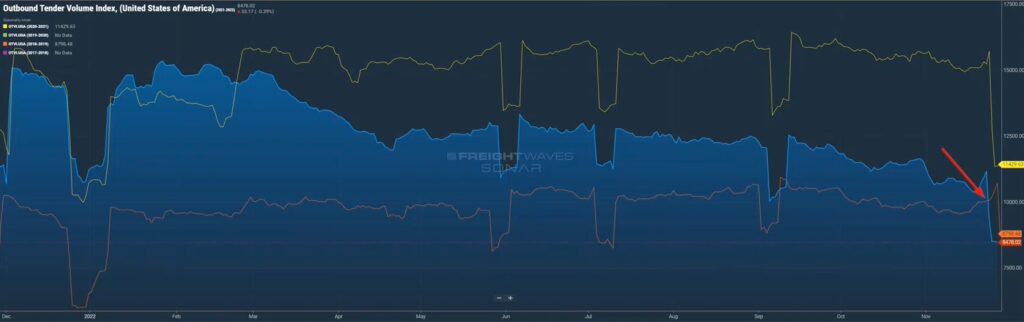

In Figure 1.1, you can see the contracted outbound tender volume index over the past four years. The yellow line on the top represents 2021, the blue line represents 2022.

Since about the end of the first quarter of this year, we started seeing those volumes pacing around the same way as last year, but then all of the sudden they started to take a nosedive. Contract volumes are down around 15 percent below 2021 levels. What that means is we’re seeing less volume trickling to the spot market and this trend will certainly continue as we go into 2023.

FALLING RATES

Speaking of rates, in figure 2.1, you’ll see the top green line represents the average van rate for contracted freight. The blue line is vans for the spot market.

As you can see, just like with freight volumes, they were running neck and neck until about March, and then there was a discrepancy. We’re seeing this on the rates side as well. Typically, the difference between contracted and spot rates is maybe 10 or 15 cents per mile. The fact that right now it’s about 70 to 80 cents a mile, we’ve never seen it at that high of a discrepancy. We do feel that as we get into the bidding season, new contracted rates will start to kick in, so we do anticipate that the green line will trend down. I’m not sure how much the blue line, the spot line, can continue to go, as it’s currently sitting at just below $2.00/mile. We may soon reach a point where carriers are not profitable on spot rates.

FINDING MARITIME BALANCE

On the maritime side of things, in figure 3.1, the green line shows the number of actual containers that are clearing customs. They are coming off the ships, being unloaded, and clearing customs to be distributed via warehouses, intermodal, truckload, and what have you. The blue line shows the number of actual import bookings that have happened.

You may say to yourself, that doesn’t make sense. If somebody is booking freight and that number is going down, how come we are still clearing these containers? Remember, throughout much of 2021 and even 2020, there was a backlog of ships, particularly on the West Coast, waiting to get unloaded. So, while the flow of ships is not coming into the ports as greatly as it was, it just kind of shows you how big of a backlog there was, that it’s taken six months and we’re still not through this backlog of ships, both on the West and East Coast.

Overall import volume is down 20 percent year over year. Yet, East Coast and Gulf ports are up as shippers moved their freight to the East Coast when the West Coast was originally facing backlog delays.

KEY TAKEAWAYS

Low, single-digit rejection rates on contracted freight mean less is hitting the spot market, by some accounts 30 percent less than last year.

Carriers need, and we need carriers, to remain solvent. Be diligent in negotiations with carriers but understand that we are very close to the floor for when a carrier becomes unprofitable.

Less freight is coming through the ports. Short-term will trigger an over-supply situation, particularly on ports with declining YoY volumes like Los Angeles and Long Beach. Other ports like Savannah, Houston, New York, and New Jersey will see more capacity balance.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesManaging transportation costs is a top challenge for shippers, while another challenge that goes in hand is sourcing consistent and reliable capacity. Here enters the contract and spot markets. Which one is best? Which has better shipping freight rates?

Some believe the spot market is the way for shippers to save money and stay on top of capacity, while others think it’s contract. Choosing to use spot rates versus contract rates can be one of the biggest decisions for a logistics manager. Understanding their differences and when is best to use them will help give your business success. So, let’s dive into each of these markets so you can better determine your business’s strategy.

WHAT ARE SPOT RATES? WHAT IS THE SPOT MARKET?

Spot freight rates are short-term transactional quotes for moving freight. These shipping freight rates are the price a transportation provider offers a shipper for a one-time quote to move their product from origin to destination. They reflect the real-time balance of supply and demand in logistics and the truckload market.

The quote is based on the value of the equipment needed at the moment of settlement. What determines the value of that equipment? Well, whether there is an excess or shortage of that exact equipment in the market and the lane at that time. Because market conditions directly affect spot rates, they are dynamic and can change day to day, even hour to hour. This is because the freight market can be more complex than simple supply and demand.

Thus, an increase in supply will lower spot rate prices if not accompanied by increased demand. And an increase in demand will raise spot rate prices unless accompanied by increased supply.

How to Track Rates in the Spot Market

You can keep track of the spot market through several industry websites and freight load boards to give you an inclination of what’s happening in the spot market. Some resources we like to follow are DAT and FREIGHTWAVES.

We even push out a monthly update to keep you in the loop of rates and other happenings in logistics. You can find our latest Freight Market Update on our YouTube channel.

It’s crucial to stay on top of the spot market should you find the need to use it. Even if you decide to use contract freight, it’s good to keep a pulse on it as contract rates are affected by the spot market. The higher spot rates are, the higher contract rates are too.

Who is the Spot Market Best for?

Many carriers, shippers, and third-party logistics (3PL) companies turn to the spot market for competitive rates. No matter how big or small, every shipper will move some of their freight on the spot market at some point. The spot market is great for when you might have a one-off shipment outside your usual shipping lanes. It’s good for shippers who don’t have enough regular volume for contracts or those who need more capacity than they contracted out. Or even those specialty shipments or non-standard load requirements.

Spot Market Pros/Cons

HOW TO GET YOUR BEST SHIPPING FREIGHT RATE ON THE SPOT MARKET

Provide Accurate, Detailed Shipment Information

Though you can get a spot quote with as little as the origin and destination zip codes, pick-up date, and equipment type, it’s best to have ALL shipment information ready. Excluding any critical information may have you unexpectedly paying for it later. The more precise information you have, the more accurate your spot rate quote will be, so you won’t have any surprise added charges.

Information you should have for your best quote:

- Origin city or zip code

- Destination city or zip code

- If your shipment requires EXACT pick-up and delivery appointments, make sure to communicate your appointments times

- Pickup date

- Equipment type (i.e., dry van, refrigerated, flatbed, RGN, etc.)

- Commodity type

- Product weight

- Any special requirements or non-standard requirements

- Examples of special/non-standard requirements are live load or unload, “no-touch” by the driver, drop trailer, hazardous materials, multi-stop, driver assist, floor-loaded, more than two hours of loading/unloading, and equipment age restrictions.

Provide Ample Lead Time

Shippers will request spot quotes anywhere from a week in advance to the day of. Most will request them one to two business days before their shipping date. The more time you can give before your shipping date, the better, as spot rates tend to increase as the pickup date approaches.

Giving yourself a few extra days to secure pricing and capacity will usually work in your favor and lead to less expensive freight rates. This is because there will be more carriers available versus trying to find one on your shipment day.

Don’t Wait Too Long to Confirm a Good Spot Rate Quote

Spot market rates are volatile and quickly change over short periods of time. Therefore, the quote you received yesterday may be different today. So, when you find a rate that works for your shipment, don’t wait to confirm it. Instead, lock it in ASAP for confirmed pricing and capacity. Once agreed on a rate, a reliable provider will rarely change it UNLESS an important piece of information about your shipment changes.

Set Appointments During Regular Business Hours

There is usually more capacity available during regular business hours. As incredibly hard-working as they are, drivers still like to be home on holidays, weekends, or nights when possible.

If your appointments need to be precise, make sure to include that information in your quote request so your quote can be accurate. But, if you can be flexible with your times, setting appointment windows instead of strict appointment times can open you up to more capacity. For example, drivers have to manage their strict Hours of Service so a flexible appointment window can help them better plan their day.

Spot Market Technology

Many providers offer digital freight platforms and give you access to free instant freight quotes. This can be a great way to stay on top of current pricing without sending a lot of emails to different providers. Good freight providers will have logistics experts on call should you have questions or need more help. But having the ability to get quotes on demand can add time back into your day.

Be Mindful of Carrier Selection

While cost is important when choosing your transportation provider, make sure you consider several other factors into consideration. You should consider their experience, efficiency, and service. While a cheap quote is great, it can sometimes result in a missed pick-up, hidden accessorial, or even a damaged product. All this could end up costing your business more.

When shopping the spot market, shop around and get quotes from a few different providers. Once you have a few quotes, evaluate the rates while considering your shipment requirements and ask yourself a few questions about your potential provider:

- Will this provider meet my service requirements?

- Are they easy to do business with?

- Can I use their tech tools to operate more efficiently?

- If something goes wrong, can I trust them to fix it?

WHAT ARE CONTRACT RATES? WHAT IS THE CONTRACT MARKET?

A contract rate is a rate quoted by a transportation provider to a shipper for a set lane and its freight characteristics over a set period of time. Contract rates can also be known as primary rates, bid rates, committed or dedicated rates. In short, they are a long-term, stable pricing agreement between shippers and transportation providers.

The contract market is highly dependent on the spot market. Typically, the three to six months of spot market activity leading up to an RFP will influence contract rates.

Contract agreements are great for both shippers and transportation providers as the shipper gains committed capacity while the transportation provider gains fixed rates and dedicated freight volume. Everybody wins.

How Contract Agreements are Set

Contracted agreements or Requests For Proposals (RFP) can be set as mini bids (monthly), quarterly, bi-annually, or annually. However, since the contract market and its rates are based on the fluctuating spot market, it’s rare to see a contracted agreement set for more than a year to stay in tune with the market.

Contract agreements are set during the bidding process, aka the RFP. The shipper will take the RFP and send it to a network of transportation providers and those providers will reply with their quotes. At the end of the bid process, the shipper will award lanes to specific providers based on their rate, service, capacity, and any other considerations.

CONTRACT RATE PROS/cons

HOW TO GET YOUR BEST SHIPPING FREIGHT RATE ON THE CONTRACT MARKET

Any shipper has the opportunity to host a bid. There’s no set minimum shipment requirement. So, no matter how large or small you are, you can take advantage of an RFP.

Just like getting quotes for the spot market, the contract market requires detailed information to get your best rates. The more information you can tell your potential providers, the more reliable rates and capacity you’ll be able to get offered. Information that should be included in your bid:

- Commodity type(s)

- Weight per load

- Cargo value

- Estimated shipping volume for each lane

- Time frame of RFP contract

- Origin and destination zip for each lane

- Shipment frequency for each lane

- Any performance requirements

- Any special load requirements/accessorials

- Fuel surcharges

- Keep in mind that fuel surcharges account for around 30 percent of a carrier’s operating expenses, and as we all know, fuel costs can fluctuate dramatically.

- It’s important to establish your own fuel surcharge matrix for each potential diesel price and communicate that with your providers before conducting a bid. This will help you get consistent and accurate rates.

What Happens When a Contract is Broken?

Sometimes, contracts will get broken. For both shippers and carriers, breaking a contract may result in fines. Most likely when a carrier breaks a contract, they will end up with a dissatisfied customer and disqualification from future bid opportunities. While shippers will face a damaged carrier relationship, less reliable capacity, and most likely, higher rates on the next bid.

Technology Needed for RFPs

While the practice of RFPs sounds great, what’s the catch? For an RFP to work effectively, shippers need to be organized in their execution and collection of information. No matter your size, every shipper needs a way to track and store their supply chain data and procurement information. It helps to have one central location to keep all your freight volumes, provider names, and awarded lanes.

Some smaller shippers will use tools like Microsoft Excel, Google Docs, or even their providers’ technology platforms to manage their RFP data.

But if you’re a larger shipper, those tools can be overkill. Instead, 90 percent of shippers use digital platforms, often transportation management systems (TMS) to manage their procurement information. A TMS can help take the complexity out of RFPs and take your process from a few hours to a few minutes. It allows you to enter your contract information quickly, select the transportation providers you want quotes from, and click send. It will also help you have one location to easily view bids and communication around your loads, keeping you from overwhelming clutter.

Regardless of which workflow you decide for your business, it’s crucial to have a well-documented record on hand to easily reference.

WHAT’S BEST FOR ME?

Usually, no shipper runs all their freight through the contract market alone. As there are positives to each market and it can be hard to predict all volume, most shippers work to have a strategic blend of both spot and contract rates. What works best for your business will depend on the current state of the freight market, your freight, and your provider relationships.

Some questions to ask yourself when determining what market will work best for you are:

- Are my freight lanes affected by peak capacity demands during the year?

- If you answered yes, the contract market, especially during those times of tight capacity, may be best for you.

- Am I willing to take on the risk of price fluctuations?

- If you answered yes, you might want to look at the spot market first.

- Does the contract price include a capacity guarantee throughout the year, without a general rate increase (GRI)?

- If you answered yes, the contract market may be best for you.

If you have determined that your volume is sporadic and not consistent, the spot market may be best for you, but it doesn’t mean that you can’t work with a carrier contractually. You can still build an approved carrier list with strong relationships even if you have to use the spot market on every shipment.

If you decide contracted freight is best for your company, keep an eye on spot market indexes and position your RFP bidding based on the freight cycle when possible. By moving your RFPs to when the market is at its lowest levels, you’ll gain your best rates.

Some shippers budget for 70 percent contracted and 30 percent spot or 50-50. No matter your balance, the freight market is always changing and so should your strategy. Keep a pulse on the market and your business needs so you can always find what’s best for your company.

NEED HELP WITH YOUR STRATEGY FOR COMPETITIVE SHIPPING FREIGHT RATES?

A shipper’s decision in balancing the use of contract versus spot rates can be difficult. Finding a good strategy for competitive shipping freight rates can be a lot of trial and error.

If you’re having challenges deciding when to use each market, Trinity Logistics can help. We have the technology and expertise you need to simplify your logistics management and offer support. Our Team Member experts are here to help you with your logistics strategy, including offering Quarterly Business Reviews and Freight Market Updates, so you can keep a pulse on industry trends and your company’s growth.

START A CONVERSATION WITH TRINITY TODAY