Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

WILL 2024 BE A FREIGHT REBOUND YEAR?

I certainly do not expect that we will return to freight volumes like we saw in 2021, and part of 2022. Now, I will never say never, but those were most likely once in a lifetime events. However, there are many signs that point to a potential for 2024 to see a rebound in freight volumes and carrier rates.

First, let’s talk about rates for over-the-road (OTR) carriers. Many new entrants came to the carrier market in ’21 and ’22, but currently, we’re seeing the contraction of for-hire carriers.

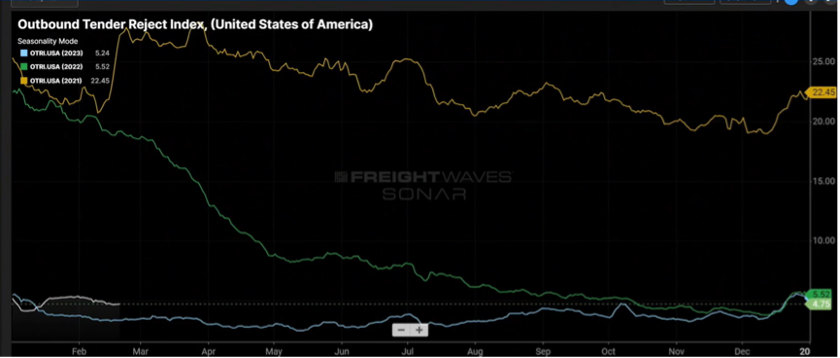

As shown in Figure 1.1, the past 14 months have seen less carriers in the market. As supply continues to dwindle, this will put upward pressure on rates. Granted, it may take another 12 months for the carrier market to find an economic balance.

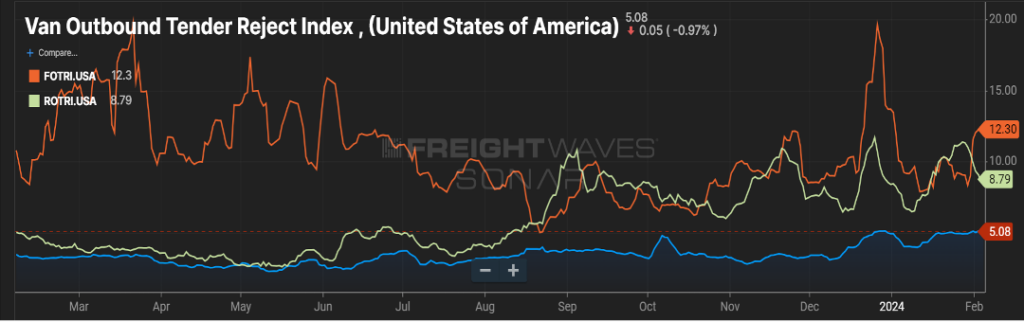

Figure 1.2 measures the rate at which carriers reject tenders (shipments) and continues to slowly climb upward. Granted, a rejection rate of five-plus percent is not earth-shattering, but in comparison to where it was in 2023, sub three percent in several months, five percent and the continuing upward movement is noticeable.

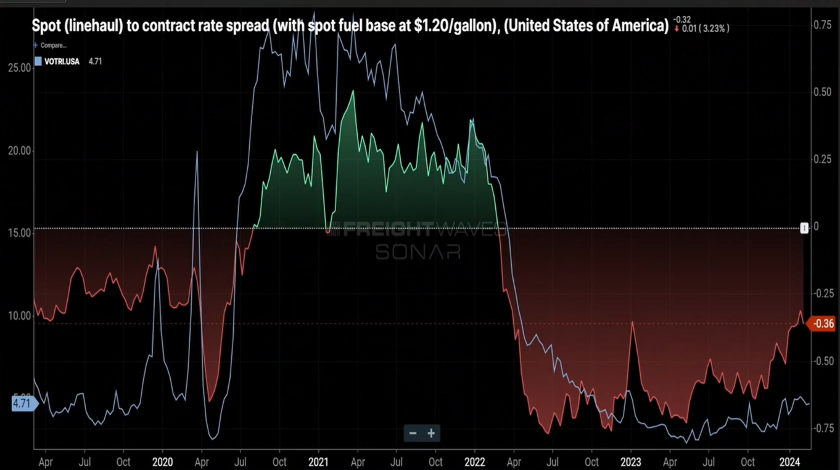

Lastly, Figure 1.3 shows that spot rates continue their slow rebound from the middle part of 2023. Contract rates throughout much of 2022 and half of 2023, were $0.60 to $0.70 cents per mile higher. Today, that gap stands at $0.36 per mile. This is a combination of spot rates inching higher, but also contract rates being less than prior years.

An Opportunistic Outlook

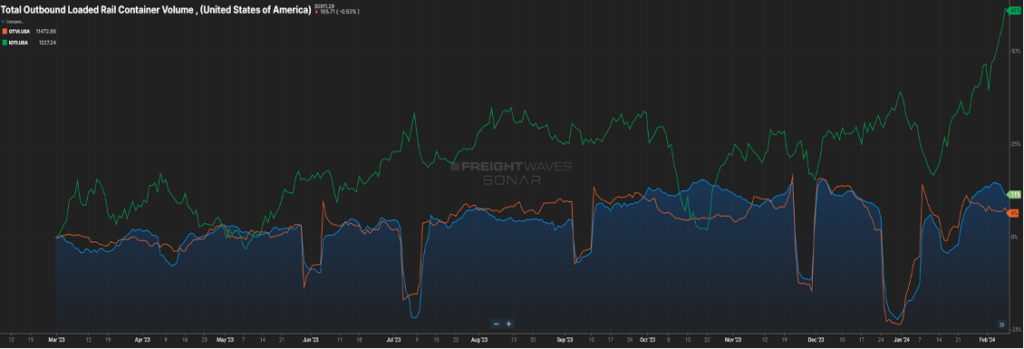

While contraction in the carrier market will influence the supply side of the economic equation, there also needs to be a demand component. The below chart (Figure 2.1) shows loaded rail car volume and over-the-road volume trending up and to the right, but the green line, representing inbound ocean containers, is really peaking.

Eventually, these containers will morph into rail and OTR volume. This is most likely a result in the drawing down of inventories, and the need for replenishment. Combine this with continuing increases in the manufacturing sector and housing market that will show better signs than 2023, it sets the stage for strong demand especially in the second half of 2024.

Will it be a bull or bear year in ’24? Well, if you would have asked that question six months ago, even maybe three months ago, my answer would have been slightly bearish or at best flat. However, seeing the recent signs on freight activity and the carriers needed to move this freight gives more reason to be optimistic as we go through the next ten months of the year.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

COULD WE LOSE CARRIER CAPACITY….WITHOUT LOSING ACTUAL CAPACITY?

Certainly, this question could cause one to scratch his head. If we don’t have a decline in the number of operating authorities, or available trucks, then how could we lose capacity?

Well, technically, the answer is you would not be physically losing trucks. However, an impact could be felt from recent events with regards to container shipping that would make it feel like less trucks are available. With recent geo-political events, and events at home, shipping to the West Coast has become more feasible than it was a year, certainly two years, ago. As ocean carriers are mindful of events in the Red Sea, combined with an easing of labor tensions at the West Coast ports, freight that in prior years was diverted to the East Coast is now heading back to the left coast of our country.

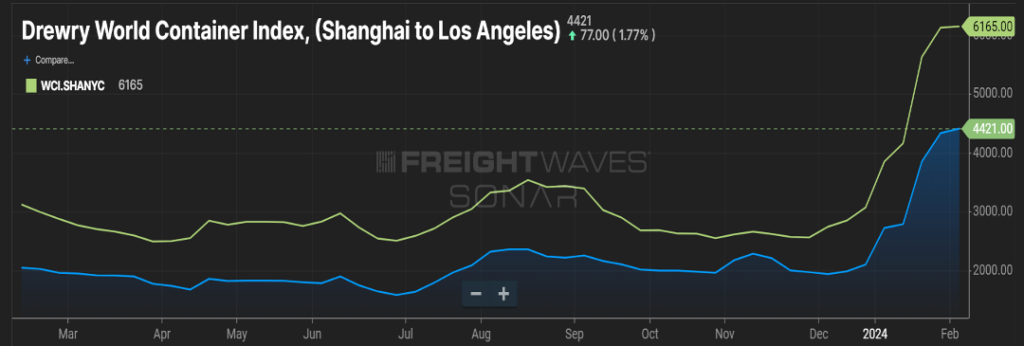

As you can see in Figure 1.1, container costs from Asia to Los Angeles are over $1700 cheaper than freight bound for an East Coast port, such as New York. Figure 2.1 shows outbound freight volume for the last year in the Los Angeles market, currently seven percent higher than this time last year.

So how could this impact capacity? When freight hits the East Coast ports, it’s typically consumed close to the port or at the very least, the coast itself. This means more regional runs. When freight hits the West Coast, typically that freight is destined for locations such as Dallas, TX or Chicago, IL, so taking freight up and down the East Coast may be a one-day run. Freight out of the Los Angeles market, heading to further destinations would take a day and a half, two days.

Same freight, same one-truck move, but now it occupies that truck for twice as long. Additionally, this could necessitate a shifting of fleet resources from one coast to the other, potentially creating an over-capacity on one side of the U.S. while the other coast is more desperate for trucks.

SPRING IN 6 WEEKS?

Will that rodent in Pennsylvania be right this year, and will freight volumes accelerate quicker as a result? First of all, ‘ol Punxsutawney Phil is batting less than 50 percent for his career and the last 10 years he’s only been accurate three times.

A better canary in the cave would be how the rejection rate index ebbs and flows. As you can see in Figure 3.1, van rejection rates have been pretty stagnant for the past year. Flatbed has remained relatively high and reefer rejection rates have trended up the last five months. If Phil is a soothsayer this year, we expect flatbed rejection rates to continue rising. If produce season also starts earlier than most, reefer rejection rates will then follow.

As reminder, with increases in rejection rates, shippers typically see transportation costs increase on the spot market.

Stay tuned for next month’s update to see if an early spring is a turning of the tide for the freight market.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox