Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

WHEN WILL FREIGHT VOLUMES START TO IMPROVE?

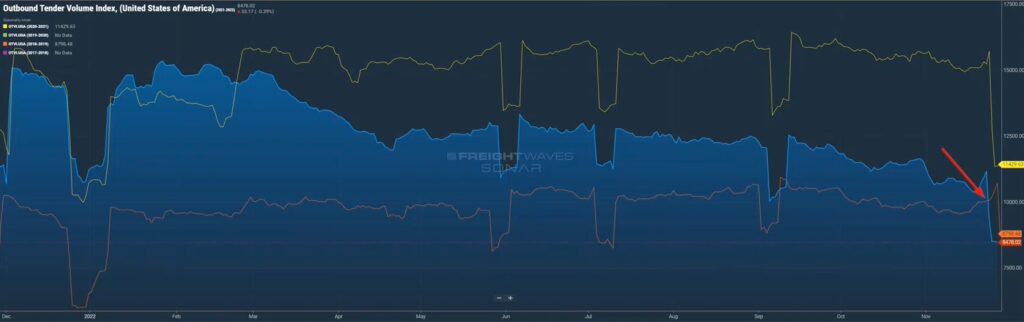

That is the $64,000 question. Since the start of the year, freight volumes have been stable but certainly suppressed as compared to the last few years (Figure 1.1). In addition, the rate at which carriers reject shipment tenders is almost nil, with almost 97 percent of the freight tenders being nabbed by carriers with contract pricing.

We will certainly see the seasonal freight patterns in 2023, with produce and outdoor products providing a boost in the coming weeks. And the end-of-year push for back-to-school and Christmas should also lend a boost, although that end-of-year buying seems to be more spread throughout the year. Many in the industry got accustomed to an over-heated, reactionary market over the past few years. With that as the backdrop, the one word I can think of to describe how the market will feel is “blah” in 2023.

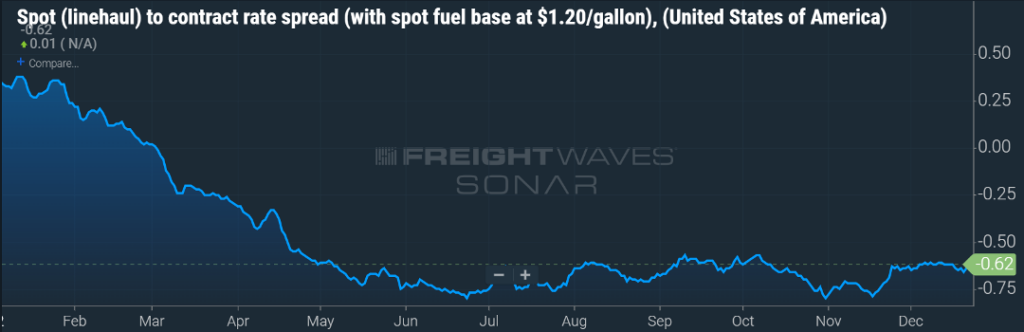

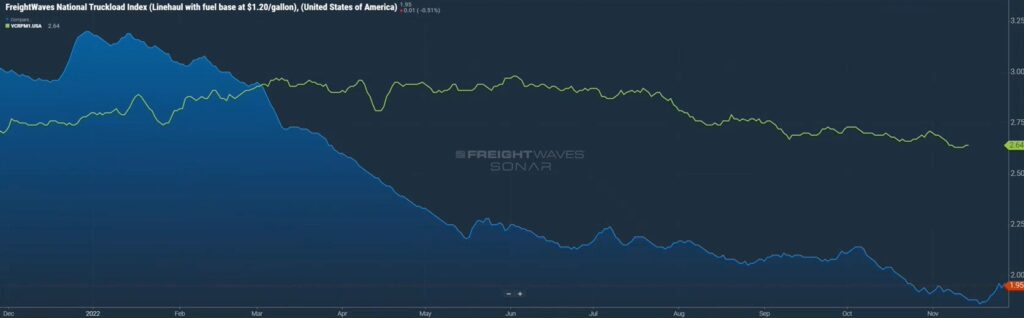

Contract rates continue to outpace the spot market. While carriers with submitted contract rates are right-sizing rates in response to the market, expenses that have been exaggerated over the past few years, such as driver pay and benefits, maintenance costs, and insurance premiums, are keeping contract rates well above spot.

As one can see in Figure 1.2, as rejection rates have declined, meaning less freight being pushed to the spot market, it has a mirror effect on the spread between contract and spot rates, currently sitting at $0.84 less per mile on the spot side. Shippers will continue to fulfill their contractual obligations with regards to tendered volume, but being able to utilize the spot market does bring cost savings to shippers.

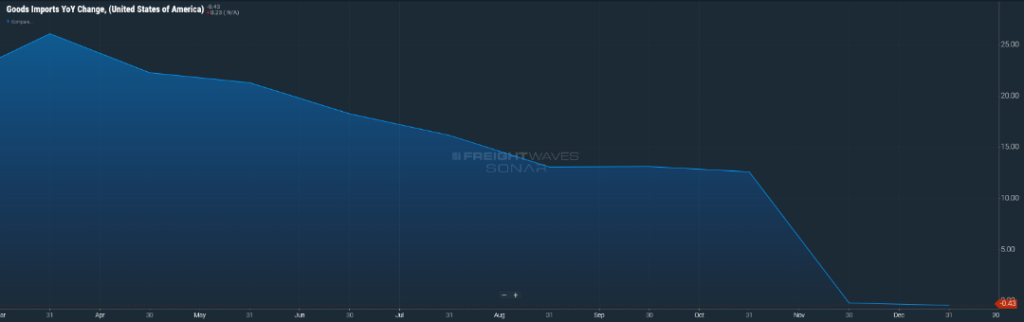

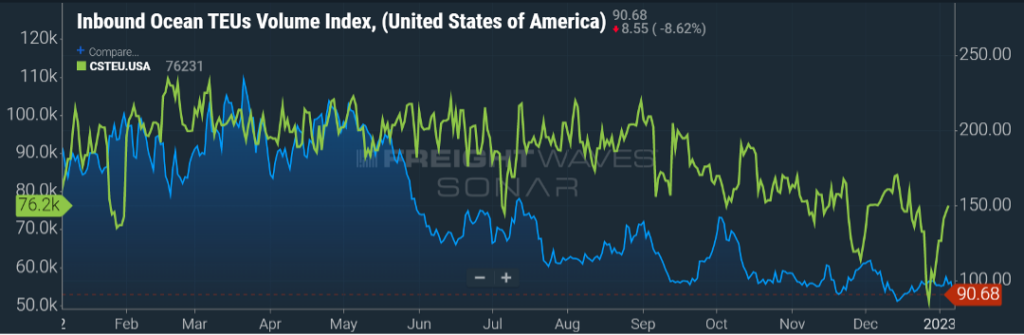

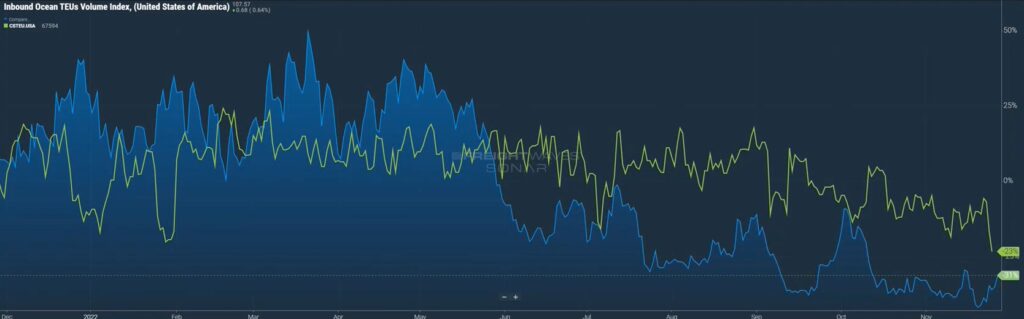

Finally, activity at the ports continues to decline, especially on the import side. As seen in Figure 1.3, just a year ago, ports were handling 10-20 percent more inbound volume, that change today is a decrease from a year ago. Inventories have been replenished over the past year and a half, and consumer demand for goods is less. This trend is most likely to continue through the year, driving the spot container cost down and subduing activity around U.S. ports.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

SOMEWHAT HO-HUM

The current landscape for over-the-road freight looks like what it was a month ago. Freight volumes are lower year-over-year (YoY) but seem to have found a floor.

If anything, the flat lining of volume (Figure 1.1) we are seeing is eerily like what we saw in the early part of 2020. And that is not just relative to freight volumes.

Back in ’20, carriers were snatching up tenders as soon as they were offered, with rejection levels hovering in the five percent range. Right now, we are just below that five percent mark. It’s anticipated that freight flows will follow their seasonal patterns, albeit at reduced volumes compared to what we saw in 2021 and most of 2022. Spot rates continue to trend lower than contract rates, although that gap continues to shrink. It’s also anticipated that contract rates will continue to slide while spot rates should be pretty near their floor.

DECLINING PORT ACTIVITY

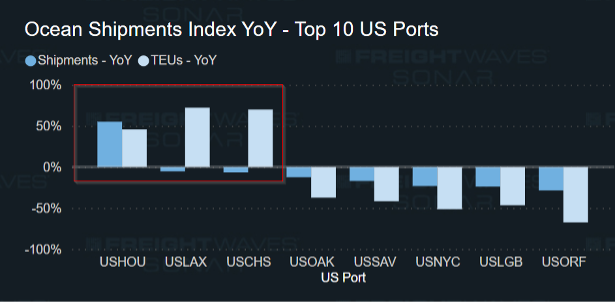

Imports will continue to weaken over the next several months. While some ports have seen slight increases in YoY volume, that increase is not indicative of an overall volume surge. It’s due to the shifting of where the freight is entering the U.S.

So, while ports like Houston (up 5.2 percent) and Baltimore (up four percent) are robust with above-average activity, major entry points like Los Angeles (down 30 percent), Oakland (down 58 percent) and Seattle (down 41 percent) are feeling the lack of volume. An opportunity should be seen with export activity (Figure 1.2). While the U.S. dollar losing value is not good for imports, it has the opposite effect on export activity.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Not Interested in Reading? Check Out Our Video Instead!

2023 Crystal Ball

It’s usually this time of year when predictions for the upcoming year start to make headlines. It’s safe to say that most folks could make some predictions based on what has transpired recently, so I wanted to highlight a few of those as we kick off the new year.

The gap between spot and contract rates will stabilize.

Now, this does not mean that they will be equal – that rarely happens. Just about a month ago, the spread was quickly approaching $1.00 per mile between contract and spot rates (with contract being higher). That gap is slowly starting to shrink (Figure 1.1). Some of that is due to spot rates seeing a holiday bump, and part of that is related to new contract rates taking hold. With many carriers taking an extended break from the road since mid-December, less capacity has pushed spot rates higher. This upward trend will be short-lived and expect rates below $2.00 per mile to become the norm as we chug through winter and into early spring. Contract rates will also trend downward, finding a floor most likely in the middle part of the year.

Few sectors will see bright spots in 2023.

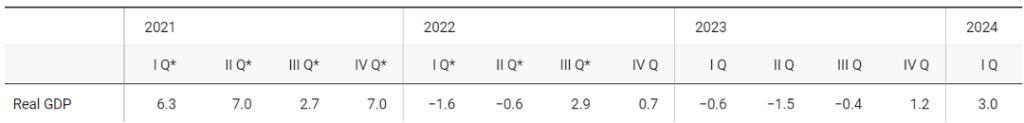

I don’t think anyone thought the economy could continue to chug along at its rapid pace seen in the latter half of 2020 and through most of 2021. Even though 2022’s growth was not as robust as the prior year, the U.S. Gross Domestic Product (GDP) should seek out a modest two percent growth rate. However, where that growth occurred sets the stage for this year.

2022 saw a return of spending on services versus goods. So, while things like healthcare are important to the overall economy, from a freight standpoint, service spending has much less impact on transportation. Expect auto sales, both new and used, to continue their strong run. As parts and inventory issues continue to be resolved, vehicles with temporary tags will be more commonplace as Americans continue to purchase cars and trucks.

On the opposite end, most notably, the housing market will have a rough 2023. With Americans seeing inflation compete for more of their take-home dollars, and the cost of borrowing increasing, many will choose to remain in their current situation. And it’s not just the building materials that will see less of a demand. With fewer new homes comes less demand for things that go in those homes – like appliances, carpets, and furniture.

Following the building industry, manufacturing will be the next downstream effect, and banking will also see less demand for consumer and business loans. Overall, expect 2023 to see, at best, no year-over-year (YoY) growth in GDP, with 2024 being a rebound year (Figure 2.1)

Import activity will continue to slow.

As we saw in last month’s update, Figure 3.1 shows the impact of the ship backlog being resolved and container movement starting to slow. That will be a common theme this year. While 2022 saw year-over-year import activity down almost 20 percent, that downward YoY story will continue in 2023. This will have an immediate impact on intermodal activity, but also over-the-road and less-than-truckload volumes will feel the impact.

One thing to keep in mind as we see recent actual and forecasted numbers showing negative, that is against a backdrop of a very successful 2021 and modest growth year in 2022. So while 2023 will not continue that positive trend, by comparison to a recent down year like 2019, 2023 will be up from an overall volume standpoint versus just a few years ago.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

As we near the end of 2022 and the start of 2023, let’s look at three things in relation to the freight market: freight volumes, the rates, and what’s happening in the maritime segment.

SLOWING FREIGHT VOLUMES

In Figure 1.1, you can see the contracted outbound tender volume index over the past four years. The yellow line on the top represents 2021, the blue line represents 2022.

Since about the end of the first quarter of this year, we started seeing those volumes pacing around the same way as last year, but then all of the sudden they started to take a nosedive. Contract volumes are down around 15 percent below 2021 levels. What that means is we’re seeing less volume trickling to the spot market and this trend will certainly continue as we go into 2023.

FALLING RATES

Speaking of rates, in figure 2.1, you’ll see the top green line represents the average van rate for contracted freight. The blue line is vans for the spot market.

As you can see, just like with freight volumes, they were running neck and neck until about March, and then there was a discrepancy. We’re seeing this on the rates side as well. Typically, the difference between contracted and spot rates is maybe 10 or 15 cents per mile. The fact that right now it’s about 70 to 80 cents a mile, we’ve never seen it at that high of a discrepancy. We do feel that as we get into the bidding season, new contracted rates will start to kick in, so we do anticipate that the green line will trend down. I’m not sure how much the blue line, the spot line, can continue to go, as it’s currently sitting at just below $2.00/mile. We may soon reach a point where carriers are not profitable on spot rates.

FINDING MARITIME BALANCE

On the maritime side of things, in figure 3.1, the green line shows the number of actual containers that are clearing customs. They are coming off the ships, being unloaded, and clearing customs to be distributed via warehouses, intermodal, truckload, and what have you. The blue line shows the number of actual import bookings that have happened.

You may say to yourself, that doesn’t make sense. If somebody is booking freight and that number is going down, how come we are still clearing these containers? Remember, throughout much of 2021 and even 2020, there was a backlog of ships, particularly on the West Coast, waiting to get unloaded. So, while the flow of ships is not coming into the ports as greatly as it was, it just kind of shows you how big of a backlog there was, that it’s taken six months and we’re still not through this backlog of ships, both on the West and East Coast.

Overall import volume is down 20 percent year over year. Yet, East Coast and Gulf ports are up as shippers moved their freight to the East Coast when the West Coast was originally facing backlog delays.

KEY TAKEAWAYS

Low, single-digit rejection rates on contracted freight mean less is hitting the spot market, by some accounts 30 percent less than last year.

Carriers need, and we need carriers, to remain solvent. Be diligent in negotiations with carriers but understand that we are very close to the floor for when a carrier becomes unprofitable.

Less freight is coming through the ports. Short-term will trigger an over-supply situation, particularly on ports with declining YoY volumes like Los Angeles and Long Beach. Other ports like Savannah, Houston, New York, and New Jersey will see more capacity balance.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News Updates