If you’ve worked in the LTL industry for any bit of time, then you know that it’s always changing. Yes, sometimes that means it gets a bit more complicated. Rates adjust. Rules and processes are modified. Despite all this, there is usually one constant – the core LTL carriers we work with. Yet, in 2023, that changed; we saw the departure of the legacy LTL carrier known as Yellow Corporation.

The closing of such a large and well-established LTL carrier is very rare. The industry hadn’t felt the void of such a large company since Consolidated Freightways closed 20 years prior. So, what happened? Considering Yellow Corporation was the third largest LTL carrier, what happened to all the freight they handled?

As someone with a career in LTL, I saw this happen in real-time and have directly seen its ripple effects. I can answer some of those questions and share with you my thoughts, experiences, and observations of this impactful event in LTL history.

The Fall of Yellow Corporation

Yellow Corporation (commonly referred to as YRC) was no stranger to financial turmoil. The company was laden with debt that was worsened with the Great Recession. It almost put them into filing for bankruptcy in 2009.

A stint of other factors after that didn’t put them in a better position when COVID-19 rolled around in 2020. YRC was granted a $700 million COVID-relief loan by the U.S. government, which it used nearly half of to cover past due payments to healthcare and pensions, payments on equipment and properties, and interest accrued by its other debts. Fast forward to 2023, and that’s where their final chapter began.

A few months into 2023, YRC and the Teamsters Union engaged in back-and-forth negotiations. YRC wanted to change operational procedures and sought extra funding to help it pay off its debts. Teamsters disagreed with the proposed changes. We saw news articles and hit pieces about the conflict, week after week. It was nearly impossible for the industry to ignore it.

In July, whispers began of a possible union strike that would effectively halt YRC’s freight network. This was the writing on the wall for many shippers and third-party logistics (3PL) companies. At this point, the hull had been punctured, and water pouring in. Do you stay or do you go?

YRC and its subsidiaries were promptly disabled from countless TMS platforms. No customer wanted their freight stuck in limbo if Teamsters were to go on strike against YRC. Because of this, YRC saw a sharp decline in freight volume and tonnage. A company that was in financial disarray was now losing its primary source of revenue.

On July 30th, Yellow Corporation ceased all operations. The Teamsters had not agreed to the negotiations, and the 11th hour came and went. So, what now?

The Aftermath of YRC’s Closing

YRC’s exit affected two parties: shippers using LTL and other LTL carriers.

For shippers using LTL, they were two buckets: those who had already begun shifting their freight to other carriers in their pricing roster and those unfortunate enough to still have most or all freight with YRC. The latter had a more difficult situation to overcome as they now had to find an LTL carrier to move their freight without paying an arm and a leg.

For LTL carriers, YRC’s existing freight had to go somewhere, so they had to figure out how to absorb it. Carriers such as Estes, FedEx, and XPO and their capabilities were pushed to their limit, now drinking from a firehose of incoming freight. Volumes increased drastically, and with such a rapid rise came decreased capacity.

LTL carriers were making the difficult decision to exclude certain shippers in favor of others just to service accounts and keep their networks moving without bottlenecking. This left many smaller shippers stranded with a shorter list of available LTL carriers.

As carriers became inundated with freight, their operating ratios took a hit, and something had to be done to regain control. A season of atypical general rate increases (GRI) began. LTL carriers needed to remain profitable lest they succumb to a fate like Yellow.

3PLs and shippers alike started getting notifications from their carrier representatives about rates going up. Shipping LTL got more expensive now that the carriers had to pick and choose who they serviced with their finite capacity. The increased rate structures also priced out shippers that were used to YRC’s competitively priced tariffs or couldn’t stomach the increases.

For many shippers and 3PLs, the immediate aftermath of the Yellow Corporation bankruptcy was unlike any they had previously experienced.

Now, that’s the long and short of it, but how are things today? Surely, the disappearance of a significant LTL carrier like that would have lasting, irreversible affects.

Well, yes, but also no.

The Current Impact of YRC’s Closing

Today the LTL industry has mostly stabilized. YRC’s freight volume has dispersed, and the dust has settled. The LTL carriers have course-corrected their capacity concerns.

After the YRC bankruptcy, there were also new questions to answer, one of which was “What happens to their assets?” Those went through the bankruptcy courts, but the LTL carriers were eager to get a piece of it.

The purchased terminals and trailers meant increased footprint and capacity, which can be the difference between being the best and the biggest for LTL carriers. Several carriers bid to acquire the terminals left behind by Yellow Corporation.

Estes Express, a prominent national LTL carrier, was one of the larger victors in the bidding war. As one of Trinity’s carrier relationships, I asked Estes if they could share the impact YRC’s exit had on their company. Here’s what President and COO Webb Estes had to say:

“Estes acquired 29 terminals and a large amount of equipment as a result of Yellow’s exit from the marketplace. I can’t say enough for the dedication and resiliency of our team to work together tirelessly to quickly bring them online and add to our steady capacity growth. In addition we purchased several tractors and trailers, and we were also able to buy many smaller items – such as load bars, airbags, and freight tables – all of which help us do an even better job protecting our customer’s freight,” said Estes. “One other surprising benefit is that the additional freight we’ve taken on has allowed us to add more direct linehaul lanes, and we’re seeing better overall service in 2024 compared to last year.” Estes added, “This is a great example of how Estes continues to invest wisely in assets and capabilities that create capacity, opportunity, and resiliency for our company and those we serve. And that remains a primary reason why customers from coast-to-coast continue to rely on us for their shipping needs.”

While LTL carriers, larger shippers, and 3PLs came out in the black or relatively unscathed, others did not. Smaller shippers with all their freight lanes with YRC had no backup plans except to pay increased, non-discounted LTL rates with other carriers or risk their business operations.

How Did Trinity Logistics Fare?

At Trinity, those first few months after the bankruptcy were interesting! We saw many new shippers start a relationship with us and saw some complications in LTL carrier transit lanes that bottlenecked. Don’t worry, they were quickly resolved. Since Trinity has a broad roster of national and regional LTL carrier contracts in place, our shipper relationships were able to use our rates to course correct from the YRC closure and effectively avoid any critical disruption.

Is the last time we’ll see an industry-shaking event in the LTL space? Likely not. For now, the industry is stable, and many LTL carriers are growing and reporting profitable earnings.

In my 10+ years working in the LTL industry at a 3PL, the Yellow Corporation was always a top LTL carrier for us. Seeing them fade into the wind after decades of LTL service was surreal, and I felt sad for the many YRC employees I’ve grown to know.

Despite such an impactful event, now written in the history books, it’s a year later, and the LTL landscape is still thriving (and volatile), even with one less player at the table.

Final Thoughts

Considering the size of Yellow and the steady decline until evaporation from the industry, I actually expected more disarray from it. Sure, the first weeks after the bankruptcy had the GRIs, shipment delays, and new shipper partnerships for Trinity to handle, but after a month or two, it was relatively smooth sailing back to normal.

I think that speaks volumes to the age we live in. The amount of technology and time-saving efficiencies that LTL carriers invest in year after year. It allowed the industry to absorb the freight volume of one of the largest LTL carriers in the world and it did so in less than 60 days! It’s kind of crazy and a testament to the LTL industry and its controlled chaos.

Working with Yellow for so many years, I grew familiar with some of the names worked there. People we would see at conferences, have calls with or see on emails. People who had been in the industry much longer than I have, had extensive backgrounds, and grew their roots at Yellow.

The bankruptcy landed them in the middle of it all, but many of them went on to other LTL carriers and took their experience, adding value there. I think that’s a silver lining here. Despite the financial decision of Yellow as a company, it had people on its roster that brought purpose to LTL and now these people are creating an impact for other carriers and customers alike. For how vast it is, the LTL industry can be closeknit, so to see those former Yellow employees succeed at other LTL carriers is a bright spot in this saga.

Learn More About Trinity's LTL Services Get More Content Like This In Your InboxABOUT THE AUTHOR

Curt Kouts holds the Director of LTL position at Trinity Logistics. Kouts has been with Trinity and in the logistics industry for 14 years, having held several titles among carrier vetting, account management, and within the LTL Team itself. His main responsibilities as Director focus on elevating Trinity’s LTL customers’ experience, helping the LTL Team support in operations and billing, and aiding the company in overall LTL sales and success. Kouts finds the LTL industry incredibly challenging, presenting him and his Team a ton of problems that they have a passion for solving. He enjoys learning more about LTL whenever possible and overall, making LTL an experience that keeps all his customers, both internal and external, coming back.

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

LIKE TRACKING A HURRICANE

I’m sure we’ve all felt like we were in a bad storm over the past few years when it comes to the freight market, and particularly, shipping rates. As we’re now into a new year, shippers and brokers are looking at their 12-month rate forecasts and wondering how things will look come December ‘24. It’s relatively easy to project for the first few months, even the first quarter, but as you get further and further away from when you send those projections to your finance team, the level of angst goes up.

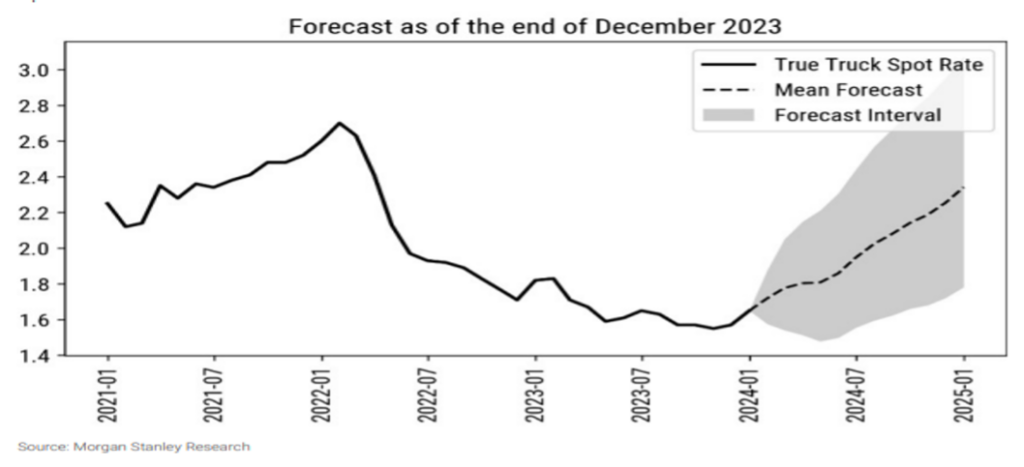

Figure 1.1 will hopefully help in assessing if your year will have a good outcome, or if there may be reason to look at your contingency plan. As we typically see in the first months of a calendar year (setting aside what we saw in 2021), rates are usually at their lowest point due to volume being restrained. Using the current rates for dry van freight, you can see the projections are for upward movement in rates as we go through the year, with rates pushing past $2.30 per mile as we close out 2024. However, as with any forecast or projection, there is always that “margin of error”.

If the projected supply and demand balance is more volatile, it’s possible to see freight rates pushing $0.50-$0.60 per mile higher. On the opposite end, if demand for freight is muted, and the carrier churn rate levels out or, dare I say, we see an increase in capacity, freight rates could be well below $2.00 per mile.

As with any major storm, it’s better to prepare and not need, than the other way around. As a shipper, boosting your carrier and broker base to give you options is always a prudent move.

CONSUMER SPENDING TO STEADY

There are some positive signs for 2024.

The dreaded word “recession” that has been thrown around for seemingly all of 2023 doesn’t seem likely. The U.S. is poised for modest GDP growth and inflation shows signs of easing throughout 2024. There is also a strong likelihood we will see rate CUTS from the Fed this year.

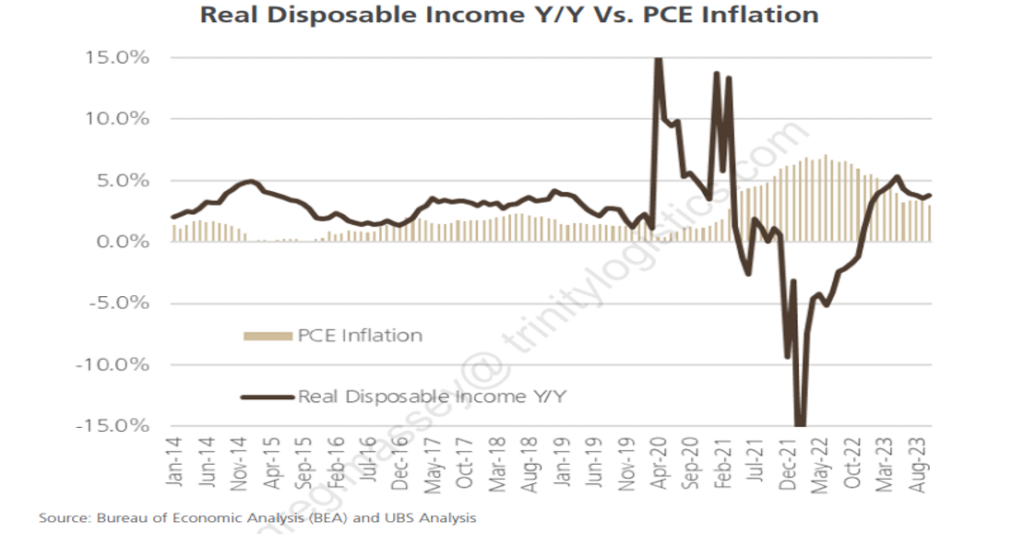

As we know, consumers are a big driver of freight activity. Look no further than the second half of 2020 and all of 2021 to see the impact consumers with disposable income can have on movement of goods. Figure 2.1 gives an indication that consumer buying will continue this year. As the ship steadies with inflation, that line will most likely head towards three percent at the end of the year, as consumers are finding dollars available to spend.

There was a lot of pent-up demand for services that gobbled up U.S. consumer dollars over the past year plus, which lends credence to consumers looking to spend their dollars on things versus services. This will certainly be a shot in the arm for the freight-challenged industry we have experienced over the last 12 months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Shippers – Don’t wait ‘Til It’s Too Late

Probably every shipper has, at certain times or maybe all the time, been inundated with requests to handle their freight over the past year. This is in stark contrast to 2021 and most of 2022 when carriers and brokers were keenly focused on existing customers and not as aggressive in pursuing new business relationships.

Currently, shippers are enjoying relatively abundant capacity and spot rates, which have fallen below $2.00 per mile. As we all know, the freight market is cyclical. Several signs point to a period of supply and demand balance, and likely a crunch with capacity. Will it happen tomorrow? No. Six months from now? Possibly. Most likely, we’ll see this scenario play out as we head toward the latter part of 2024.

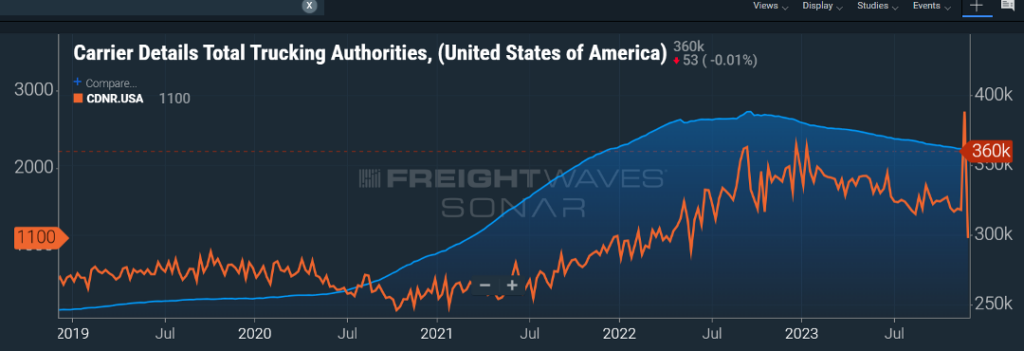

Figure 1.1 shows the total for-hire trucking authorities (blue line) and the carrier net revocations of authority (orange line) over the past five years. Clearly, carriers started flooding the market in late 2020, in response to the surge in goods moving within the supply chain. Much of that was consumer driven thanks to direct and indirect government stimulus action.

As we’ve seen freight volumes decline, carriers, mostly single person operations or small and micro fleets, have decided the juice is not worth the squeeze. This downward trend in available for-hire carriers will continue, and possibly accelerate, as we head toward more lean freight months ahead.

Shippers over the past year have right-sized their provider network. Now is the time for shippers to look at their volume forecasts and imagine having to manage that freight movement with 25-40 percent fewer providers than they currently have in their network.

If you haven’t started efforts to expand your carrier and broker partners, don’t wait until you have freight sitting on your dock and no one to move it from point A to point B. Nobody wants to be stymied like they were just a few years ago.

LTL Costs Rise

Does it feel like LTL shipments are getting more expensive, while truckload shipments are going the other direction? Why are the rates not cheaper if freight volumes are less than what we saw a few years ago?

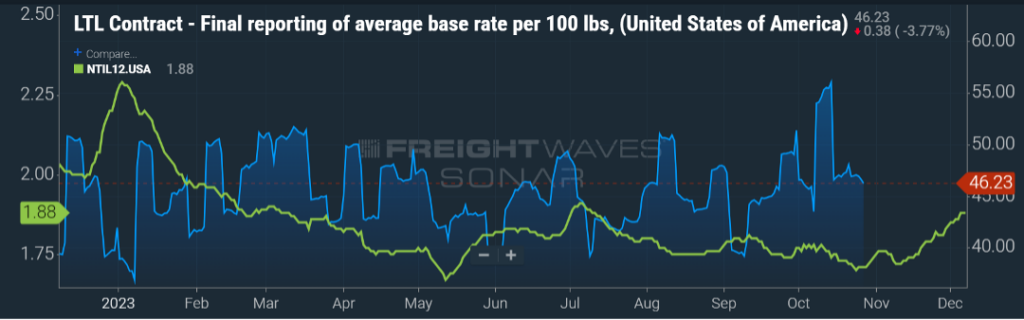

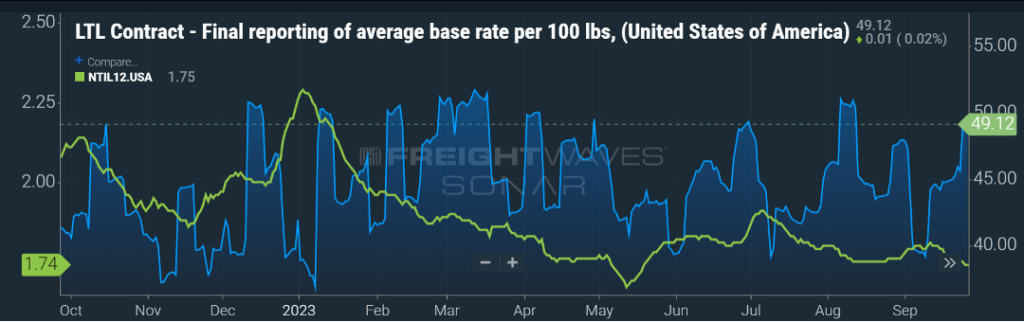

Figure 1.2 shows the spot truckload rate (green line) being almost $0.40 per mile less than the beginning of the year. LTL for the most part has seen rates (blue line) gradually head upwards as we have gone throughout the year.For a new shipper to the industry, this can be a head scratcher.

Short answer, truckload has a much more expansive network of providers, and as we highlighted above, that door being opened for new entrants into the market can happen quickly. The LTL model is more complex and a much bigger barrier of entry to the market. It would be a tremendous capital investment for a new LTL entrant to enter the market – trucks, trailers, terminals, labor, maintenance, etc. With the recent departure of one of the top 10 LTL providers (Yellow Corporation), that freight volume has been gobbled up by the remaining LTL carriers in the market but for the most part at a higher rate.

We are also approaching the time of year when LTL carriers, after assessing their financial statements and forecasting costs for the upcoming year, will start knocking on doors to discuss general rate increases (GRIs). Notice I said “increases”, not the other way. Don’t be surprised when your LTL contact lays out a proposal that elevates your LTL freight spend by four-to-six percent in the coming year.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

FLAT RATES, EXCEPT FOR LTL

Much of what we have seen this year has been around carrier rates remaining relatively flat. Apart from a few seasonal or holiday peaks, and a slight up or down influence due to fuel costs, spot rates and contract have been stagnant. As you can see in Figure 1.1, the green line has hovered between $1.70 and $1.80 for the past six months.

Less-than-truckload (LTL) rates, one would reason, would follow a similar pattern as they typically follow truckload rate movement with a few months lag. In the past few months, as indicated by the blue line in Figure 1.1, there has been an acceleration in LTL contract rates. As you probably recall, one of the larger LTL carriers, Yellow Corporation, filed for bankruptcy in August and ceased operations.

One may ask, “Well, why would rates elevate when the LTL industry was operating at less than capacity and nothing has caused an influx of new LTL freight?”

Yes, the remaining national and regional carriers were, based on available capacity on the books, able to absorb the freight Yellow was moving with no additional investment in equipment or labor. But just because the available resources are there, does not mean they are positioned in the places where service was needed.

This has necessitated LTL carriers realigning their network to move the freight that Yellow was doing prior. The more prevailing reason for rates to increase is the aggressive nature in which Yellow competed for the freight they were servicing. Typically, Yellow’s rates were far more discounted than most.

So, while the remaining LTL carriers in the network were able to position their fleets to handle the volume, they did not offer the same discounted rates that Yellow did. When you bundle all these factors together, you get rates increasing by about 10 percent in the last several months and I would not anticipate that 10 percent increase being reversed anytime soon. If anything, look for those annual general rate increases to happen as we embark on a new calendar year.

SUPPLY & DEMAND BALANCE IN 2025?

In prior monthly updates, we have highlighted the current freight environment being one of more supply than demand. Suffice to say that truckload freight volumes have been relatively unchanged over the last 12 months and carriers are saying “yes” to almost every shipment offered to them on the contract side.

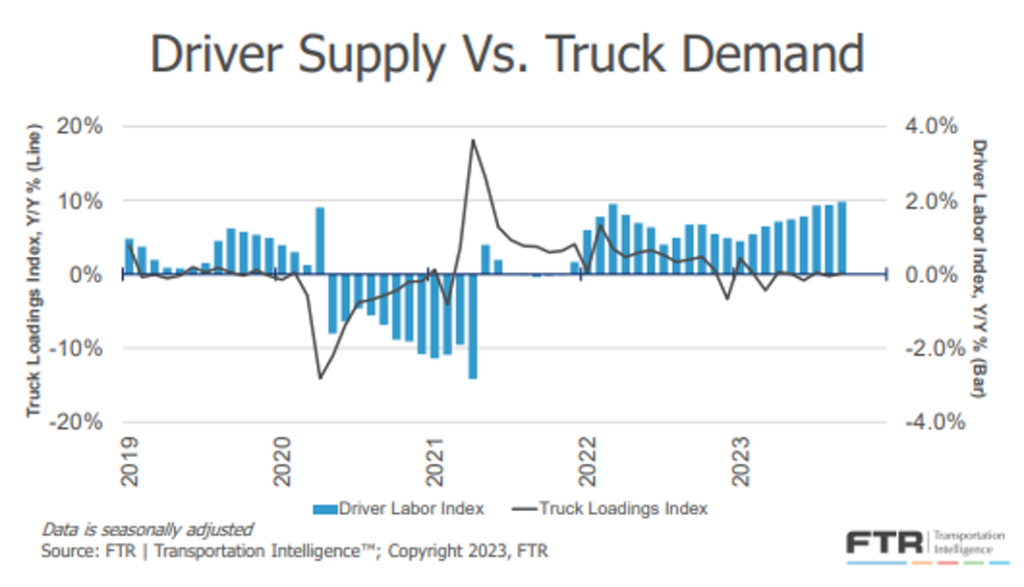

This has resulted in less freight hitting the spot market and has helped to keep rates at levels that are $0.70-$0.80 less than contract rates. When will there be better balance? A great illustration of this from FTR in Figure 1.2 tells the story.

As you can see, the driver labor index sits well above the truck loadings index and has been for the past two years. When you factor in prospects for freight volumes to accelerate, economic conditions, and the pace at which carriers are exiting the market, it will most likely be 2025 before balance returns.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxIf you move your freight through LTL (less-than-truckload) carriers, sooner or later you’ll hear the term General Rate Increases or GRI’s pop up. What is it and how can you reduce your impact from them?

What is a GRI?

GRI’s are the average amount that an LTL motor carrier will increase their base shipping rates. GRI’s have zero impact on contracted rates, but they give us insight on what to expect during contracted negotiations.

Typically, GRI’s only happen once a year. As of March 2020, industry leaders like FedEx, UPS, and Old Dominion have already announced and published their increases, which ranged from 4-6 percent. The rate increases assure that carriers continue to operate efficiently and maintain profitability. They happen for many reasons such as:

Offsetting Carrier Costs

GRI’s are meant to offset any predicted increases that carriers may incur. Increases in carrier costs this year were caused by technology upgrades, increases in regulatory compliance, and rising fuel costs.

Increased Competition for Drivers

Attracting new drivers and keeping current ones is still a hot topic for carrier companies. Keeping up with demand means offering carriers better pay and benefits. These includes things like higher driver wages, better sign-on packages, better health insurance, and 401Ks to stay competitive in the industry. Those costs work their way to shippers through General Rate Increases.

Equipment Costs

The need for companies to invest in new technology, manage and update their fleet, and brick-and-mortar costs can cause an increase in their rates.

Reducing Your GRI Impact

Shippers can often predict and plan in a General Rate Increase but working with a third-party logistics company like Trinity Logistics can help reduce your impact from GRI’s altogether.

3PLs are less impacted by GRI’s. You can count on our experience negotiating with carriers, buying power, and our LTL relationships keeping the impact of GRI’s to your company to a minimum.

Choose to ease the headaches of GRI’s and begin working with Trinity Logistics today.