After several record setting years, 2023 saw shifts to the freight market. How did the 2023 freight market affect shipper and carrier businesses? Did other businesses have the same struggles as yours? Are they expecting to face similar difficulties in 2024? How are their partner relationships?

Trinity Logistics wanted to get answers to these questions for you, so we asked a random sample of our shipper and carrier relationships to gauge the effect 2023 had on their business and what their expectations for 2024 in our first Freight Market Survey. Here’s what we found out:

2023 SHipper & Carrier Data: Freight Market Survey Results

Past Challenges – Same, But Different

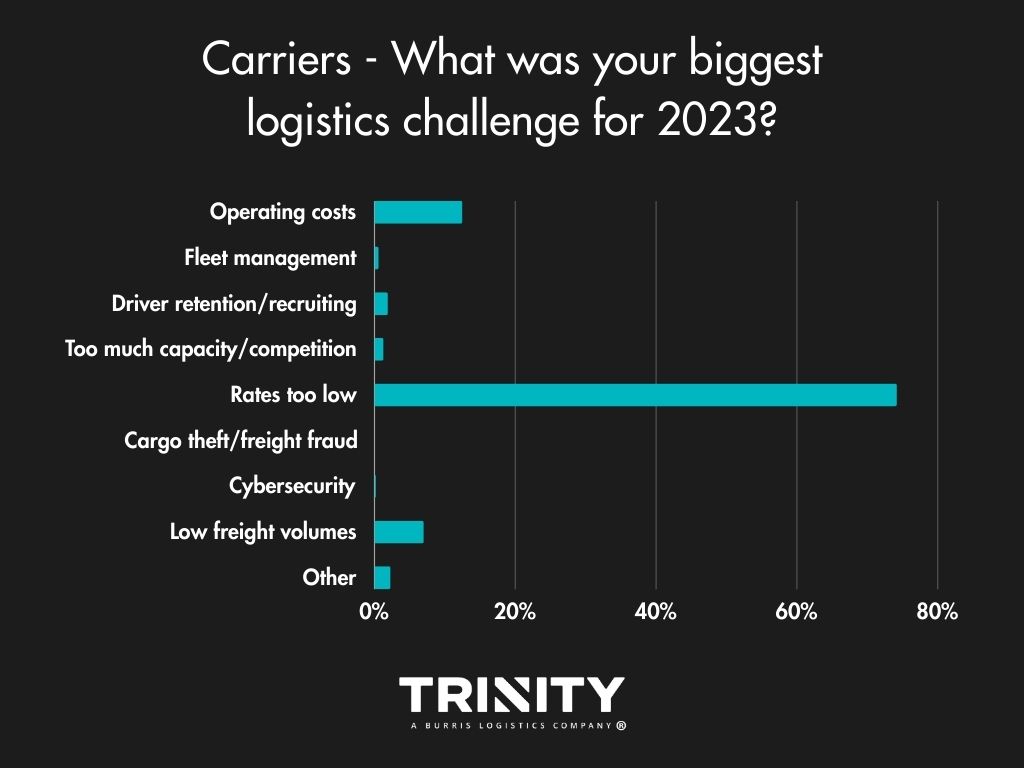

Considering the recent turndown of demand and the freight market, it’s not a big surprise that money was the biggest issue for shippers and carriers alike. Shippers answered that transportation costs were their biggest challenge in 2023, with supply chain delays/disruption and capacity not far behind. Low rates and increasing operating costs were the main challenges facing carriers.

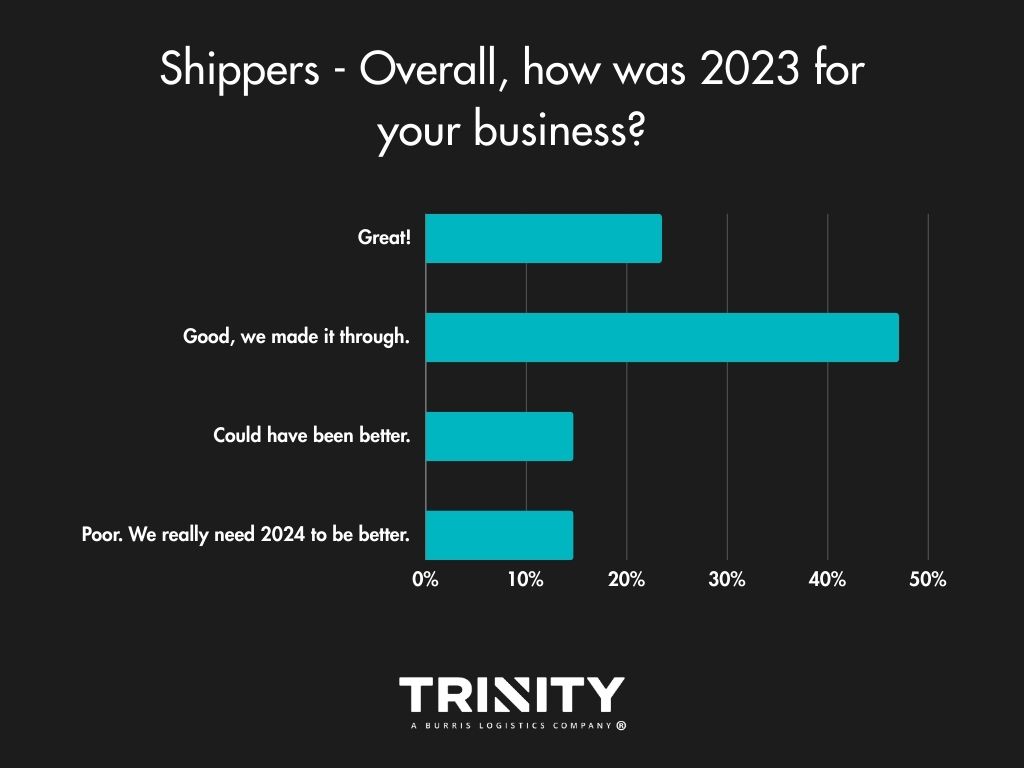

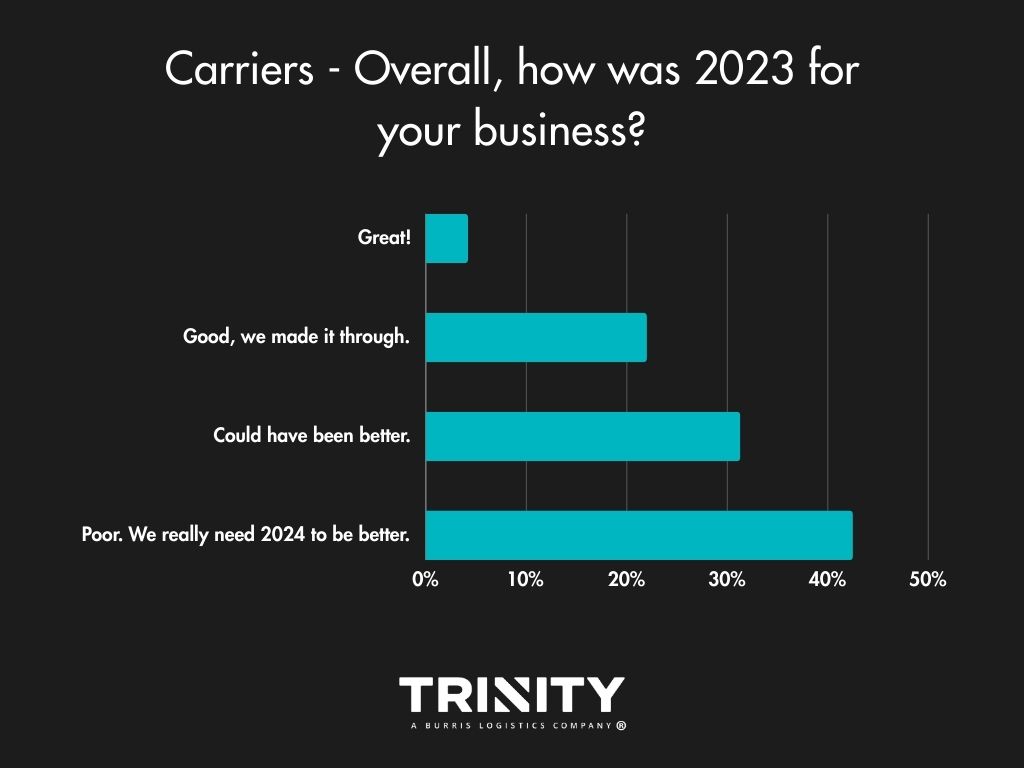

Business Impact – Could Have Been Better

Even with the change in consumer demand trending downwards throughout 2023, most shippers answered that their year was good overall. Carriers on the other hand seemed to face a rougher year in business with over half of them stating their year could have been better or was poor.

A LOOK INTO 2024

Future Challenges – Money Problems

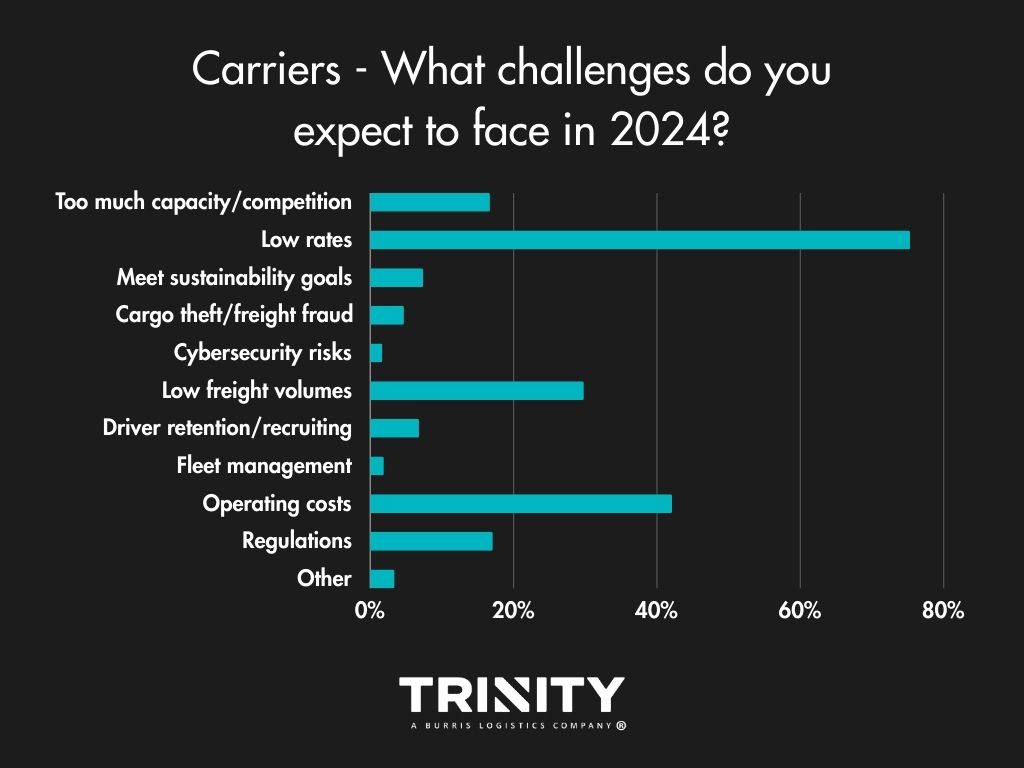

2024 isn’t looking much different in terms of challenges compared to 2023. Shippers look to have the same financial challenges as they did in 2023 with transportation costs, supply chain delays/disruption, and decreased demand being the top concerns selected. Carriers are still concerned about low rates, operating costs, and low freight volumes hurting their businesses.

Hot Trends

Even though transportation costs are shippers’ strongest concerns in their previous answers, it seems the increased amount of supply chain disruptions and delays we’ve all experienced in these recent years have hit a nerve, with the majority answering that supply chain resilience is the trend their business is most interested in. Cybersecurity also looks to be a growing interest.

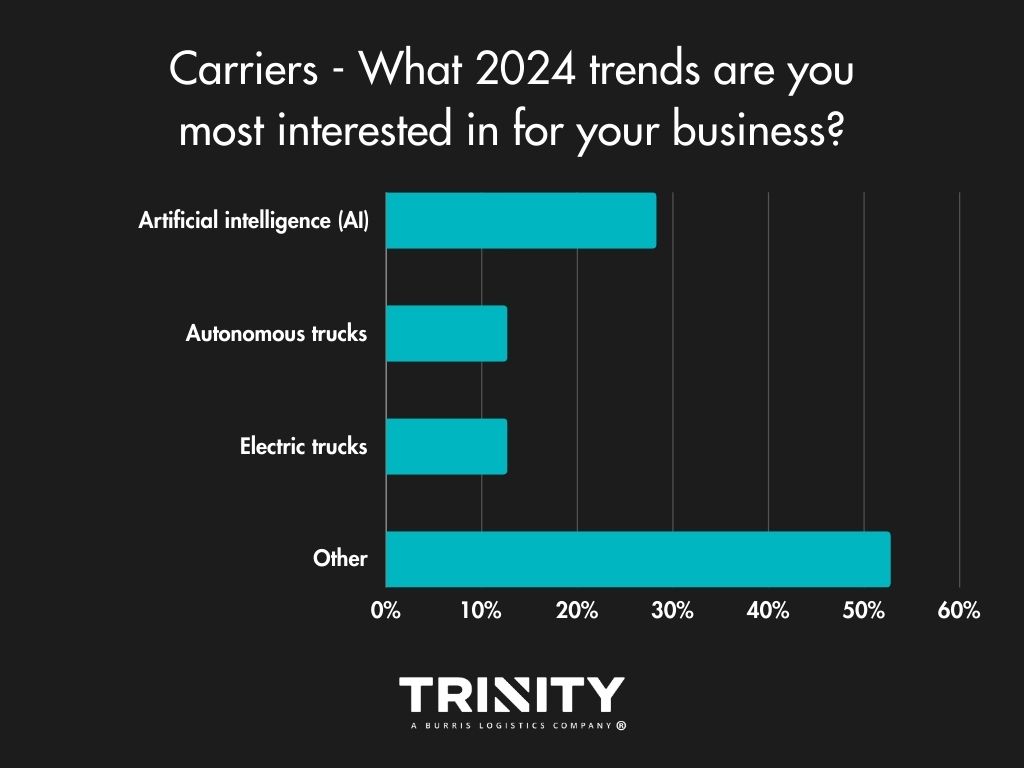

Carriers on the other hand, interestingly enough, look to the recent trend of Artificial Intelligence (AI). Also, as noted in the comment boxes of our “Other” option, increased rates and better fuel prices were trends they’d like to see in 2024.

Load Volumes & Capacity – Slightly Positive Outlook

Overall, shippers are slightly more optimistic for 2024, thinking it won’t bring any change or the change it brings will be positive. Most think load volumes will stay the same or there will be a little more in freight volumes this year. As for truck capacity, they think it will be the same as 2023 or slightly tighter.

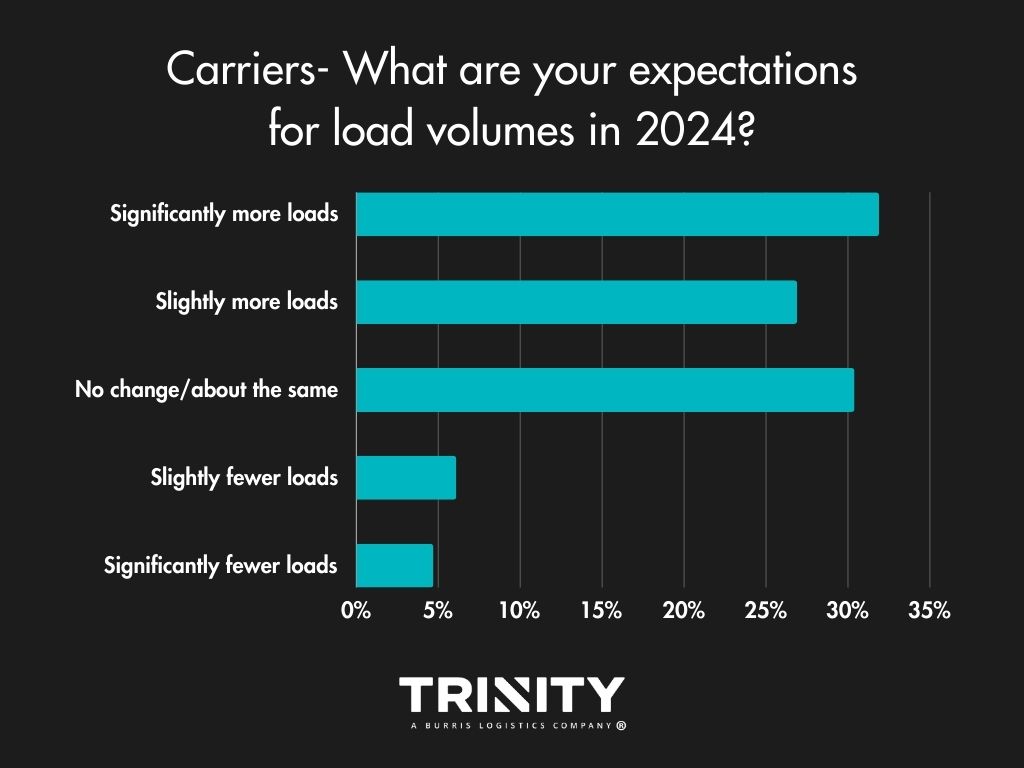

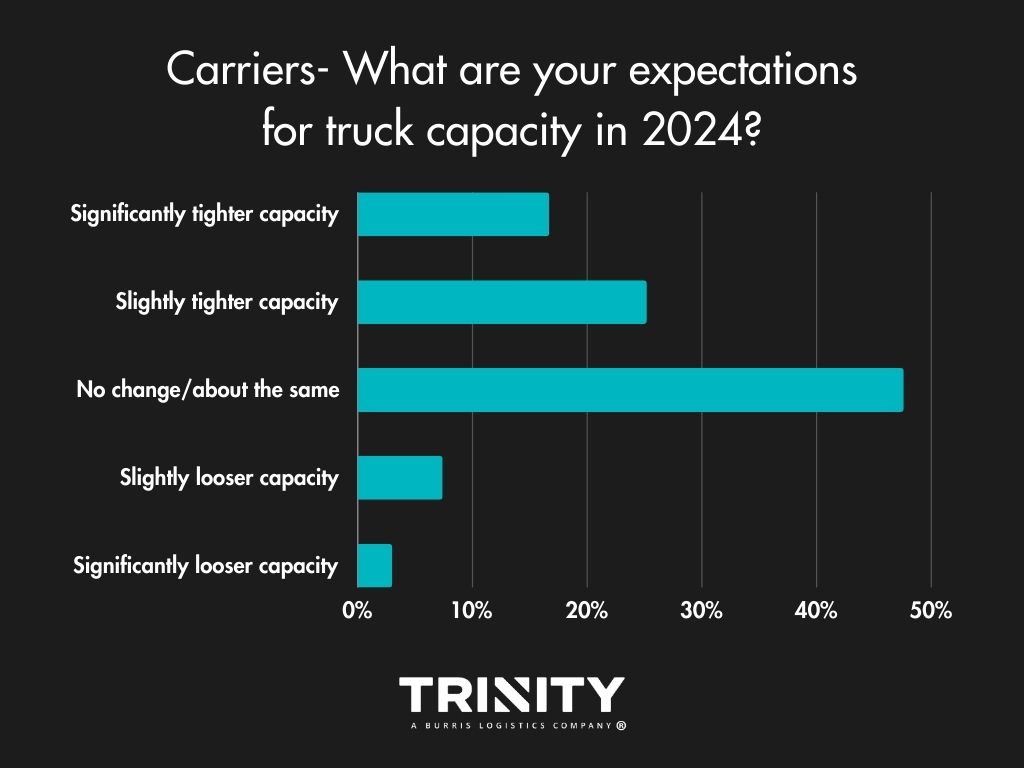

Carriers also think 2024 will bring more freight volumes and that capacity will likely stay the same or get tighten slightly versus 2023.

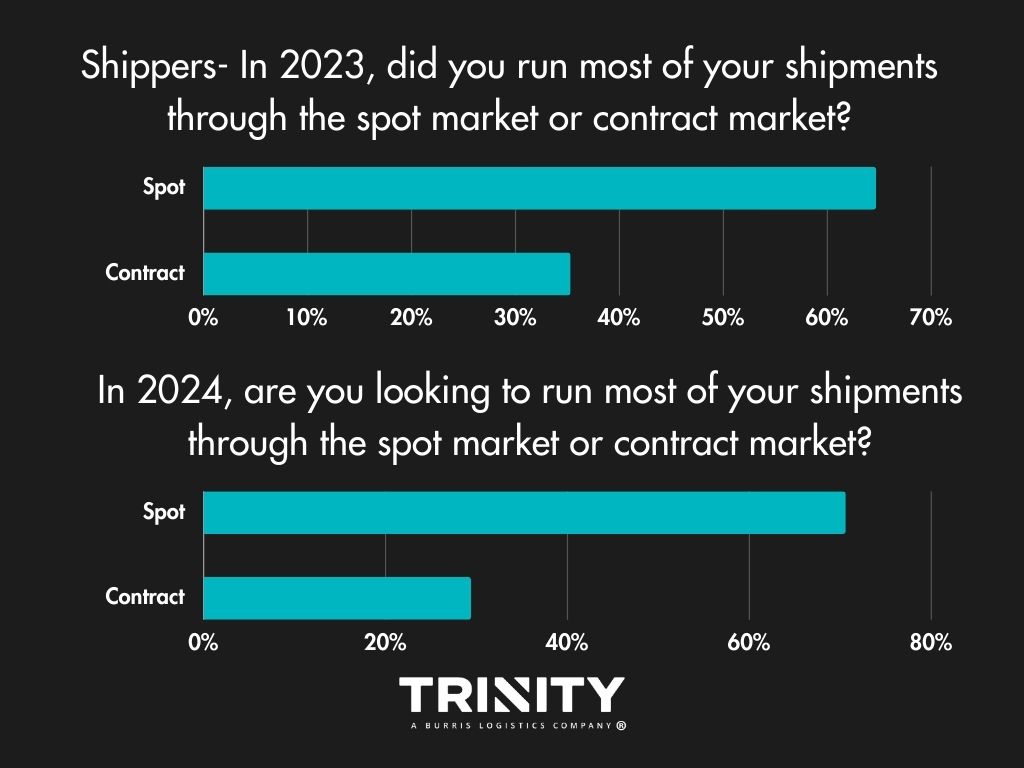

Spot or Contract?

Year-over-year, shippers aren’t looking to change much in terms of which market they turn to. Most look to continue to put most of their freight on the spot market.

For carriers, there looks to be some change anticipated. In 2023, most carriers ran spot market freight but in 2024, over half of them look to haul contracted freight.

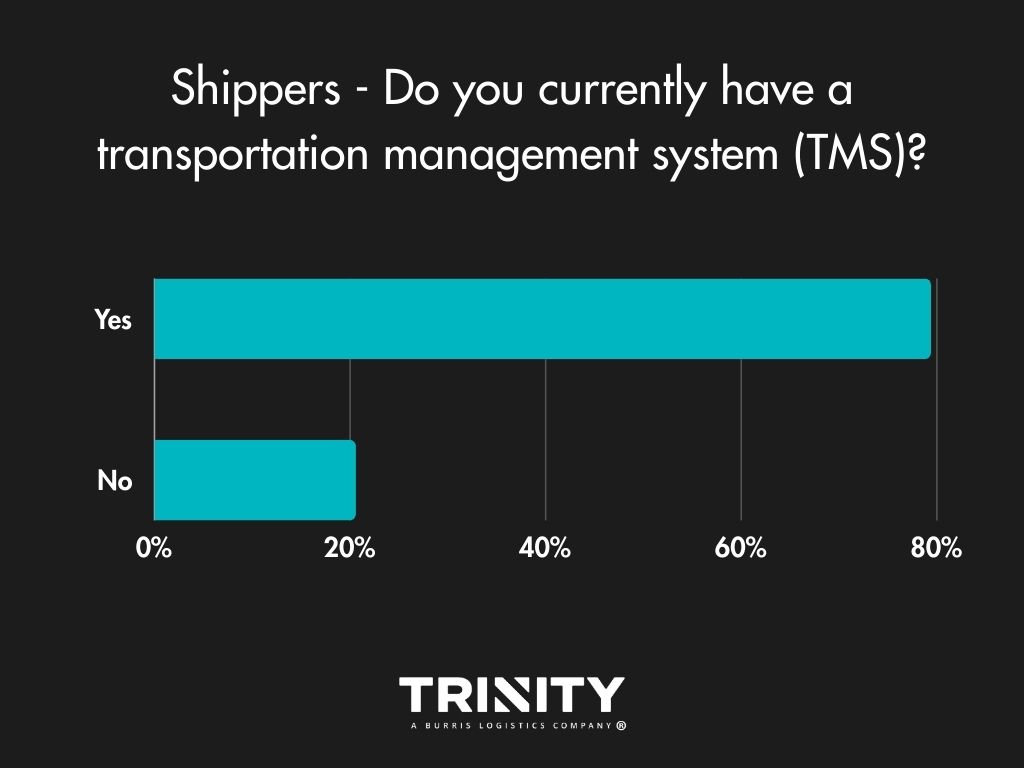

Do Shippers Have a TMS?

It’s 2024, so you’d think most shippers would have a transportation management system (TMS), and no surprise, they do. For those that don’t and answered, it seems they did not have a good experience with one in the past or don’t know enough about them.

Brokers Are the Way to Go

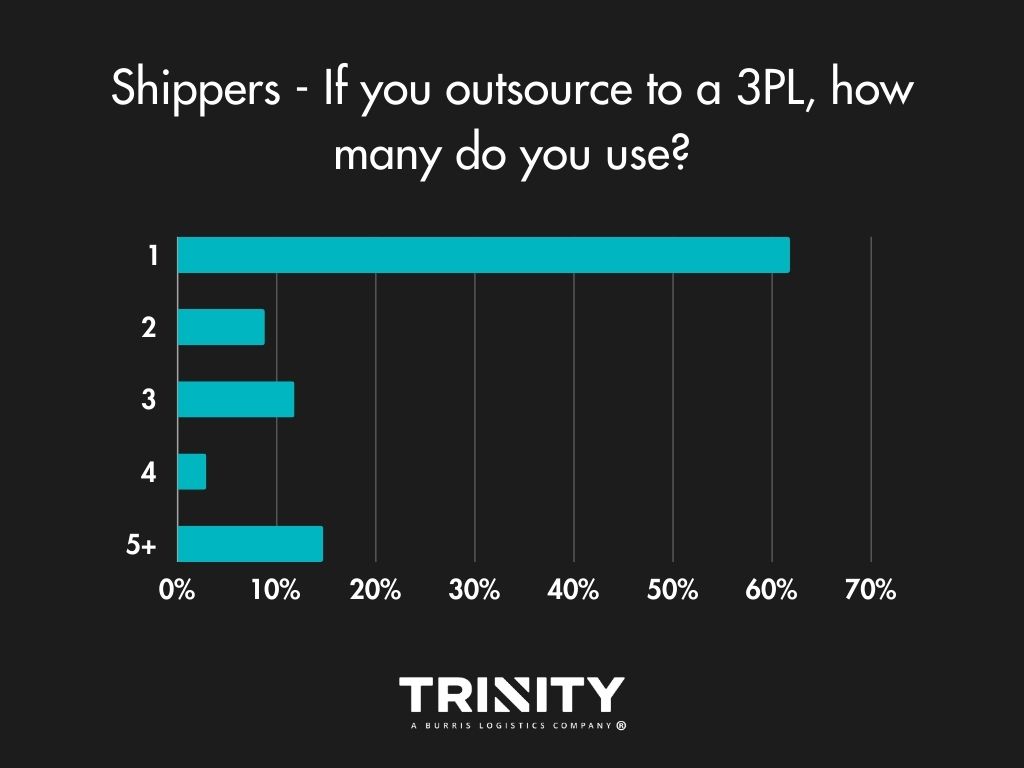

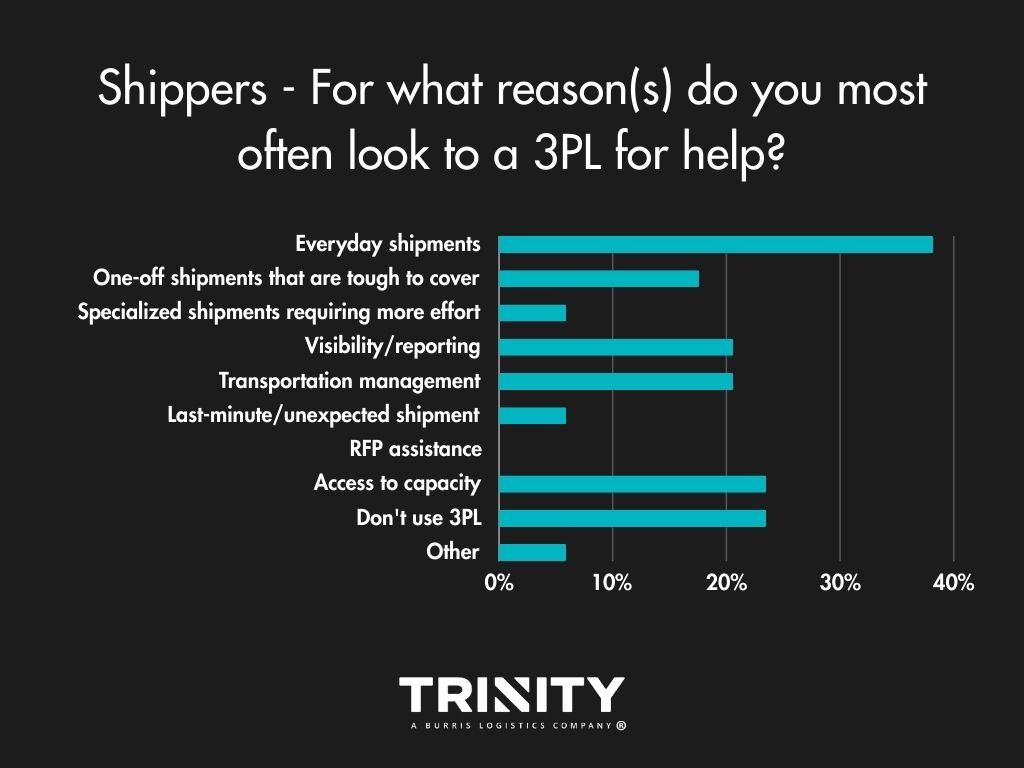

When asked how they like to move their shipments, most shippers use a mix of carriers and third-party logistics providers (3PLs) or just 3PLs. A few do use their own trucks. For those that do outsource to 3PLs, they usually just stick to one provider.

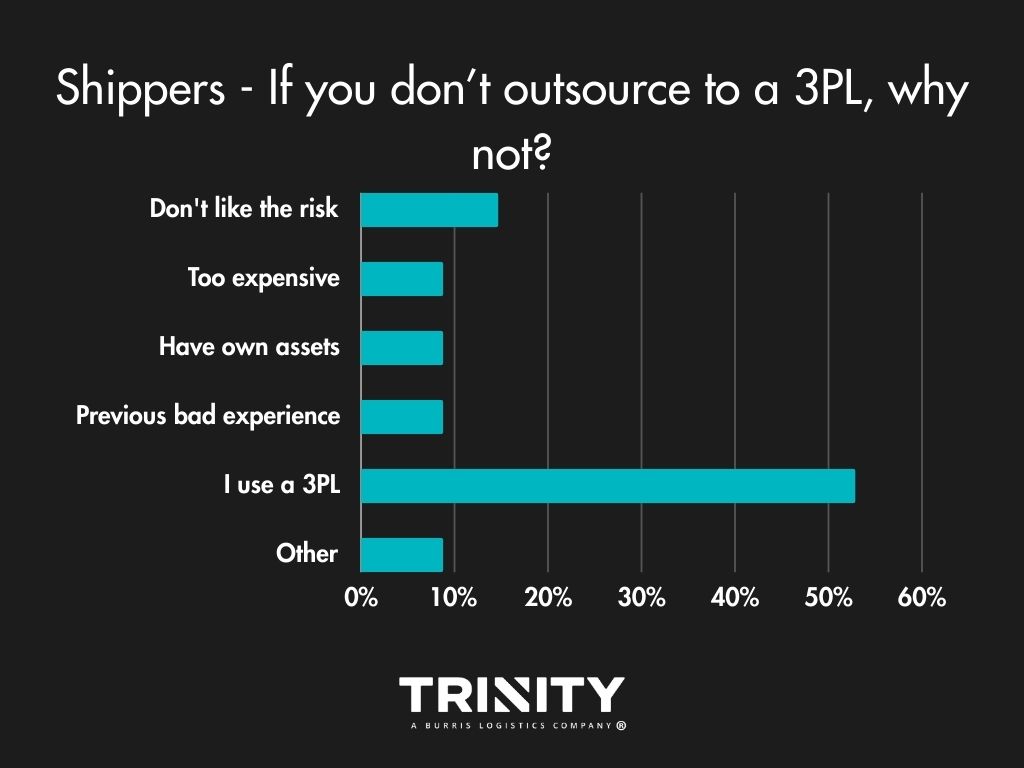

Shippers most often look to a 3PL for help with their everyday shipments, for transportation management, visibility, and access to their capacity. The main reason shippers choose not to work a 3PL for their logistics? They don’t like the risk.

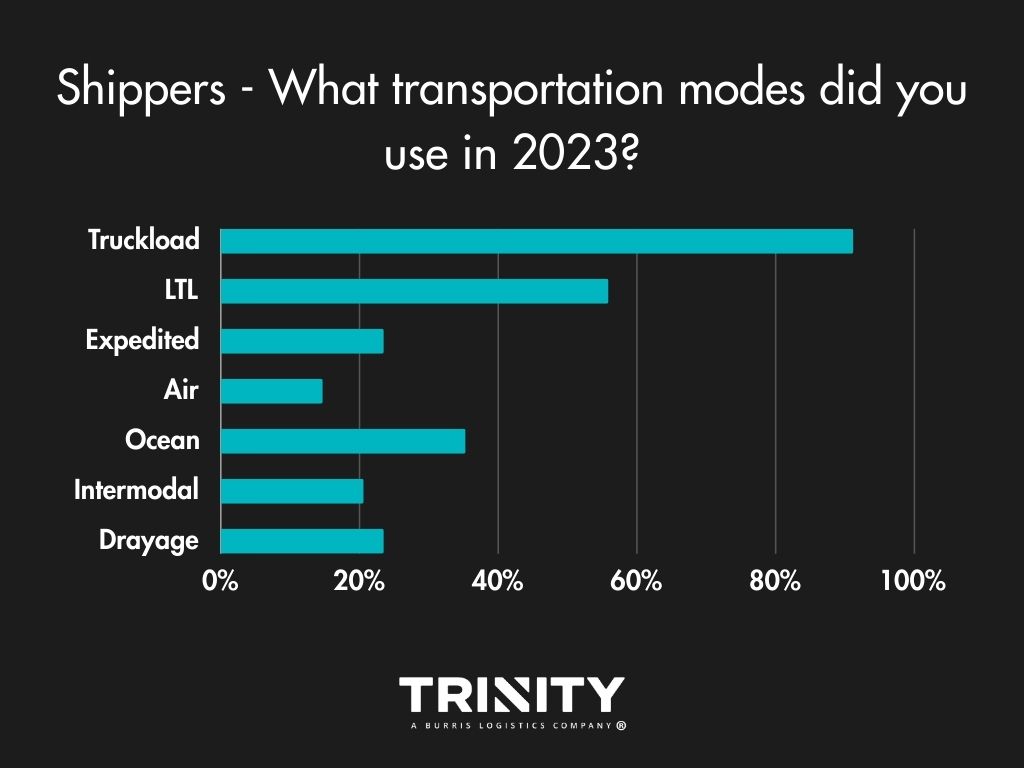

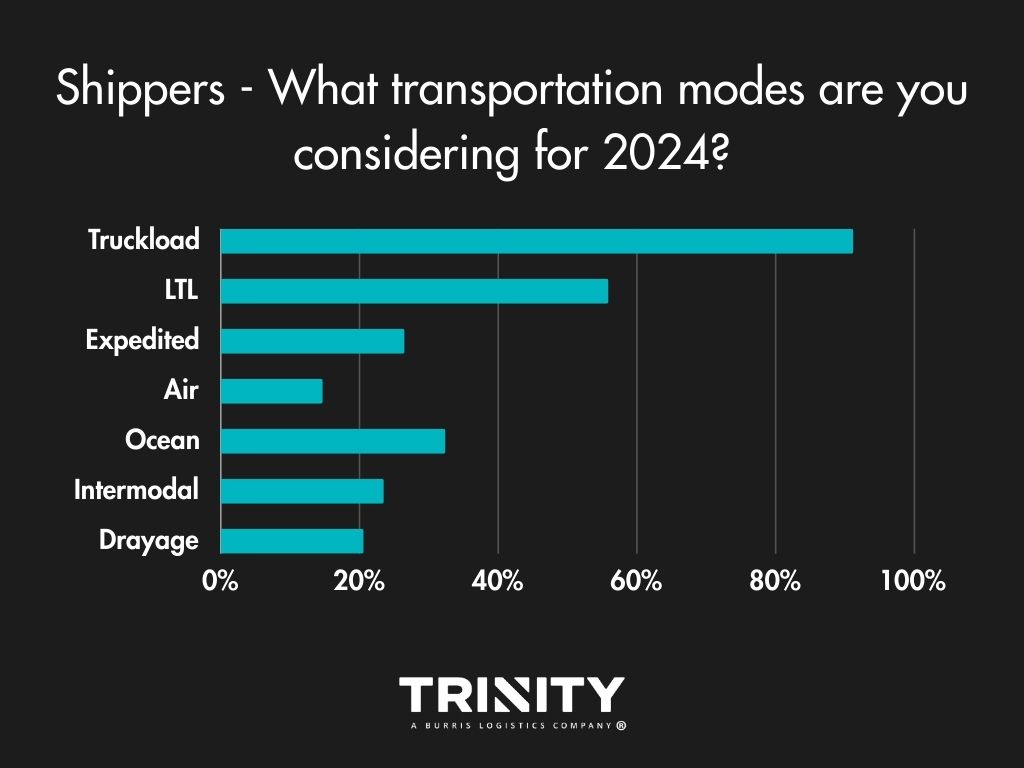

Transportation Modes – Staying Consistent

Overall, shippers aren’t looking to change what transportation modes they use for their shipments. Truckload and less-than-truckload (LTL) are the primary modes they like to use, with a little diversification sprinkled in.

Exceptional Service Stands the Test of Time

When it comes to their logistics partners, shippers find the most value in receiving exceptional service, with costs coming in as a close second.

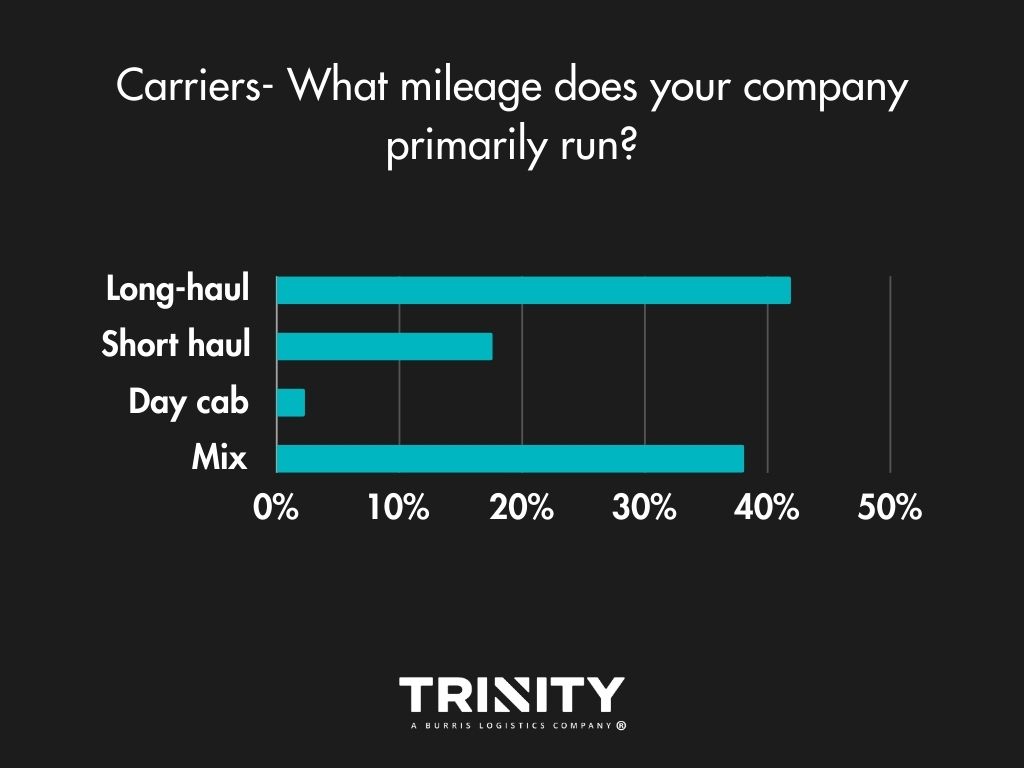

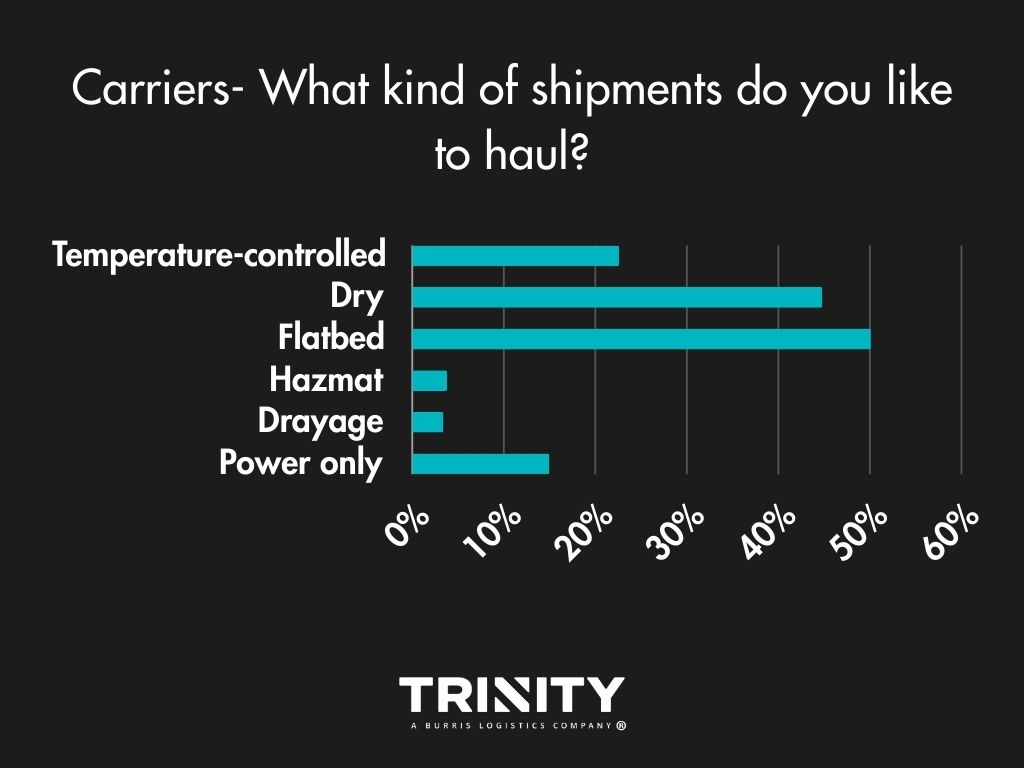

Most Wanted: Long Mileage, Flatbed Shipments

When it comes to mileage, most carrier companies tend to run long-hauls or a mix of short and long shipments. Flatbed hauls are the type of shipments most carriers like to haul with dry van coming in as a close second.

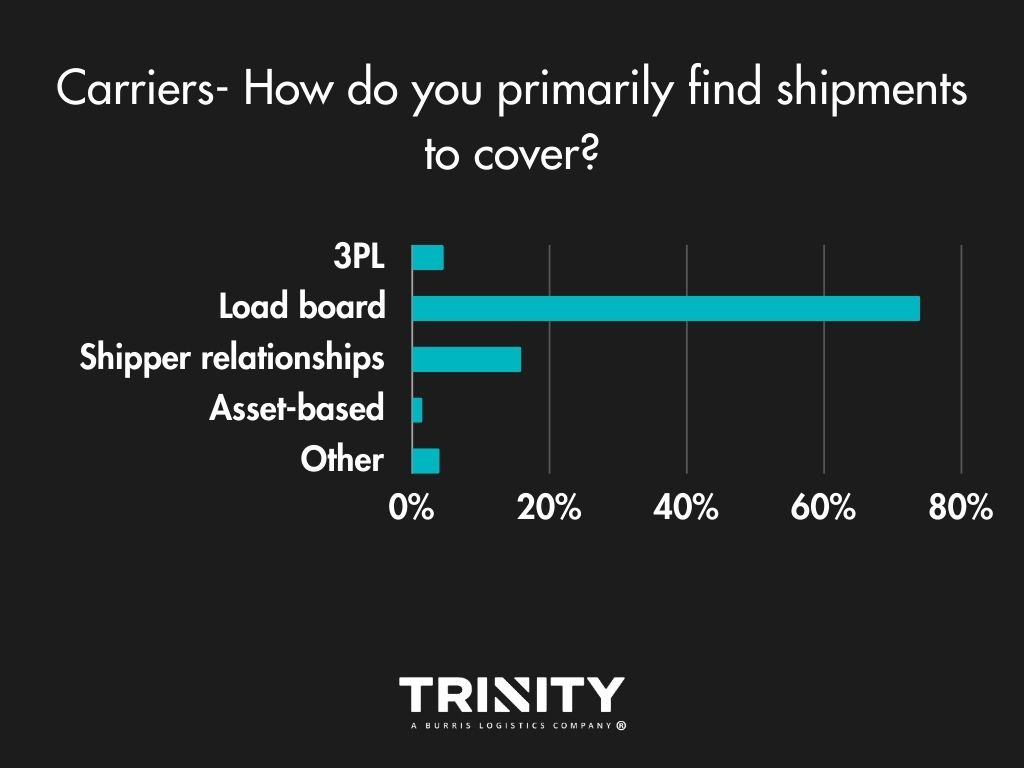

Load Boards are the Way

With 74 percent selecting this option, load boards are the norm for carriers to find available shipments. Sometimes they use their shipper relationships, and occasionally they make use of a 3PL.

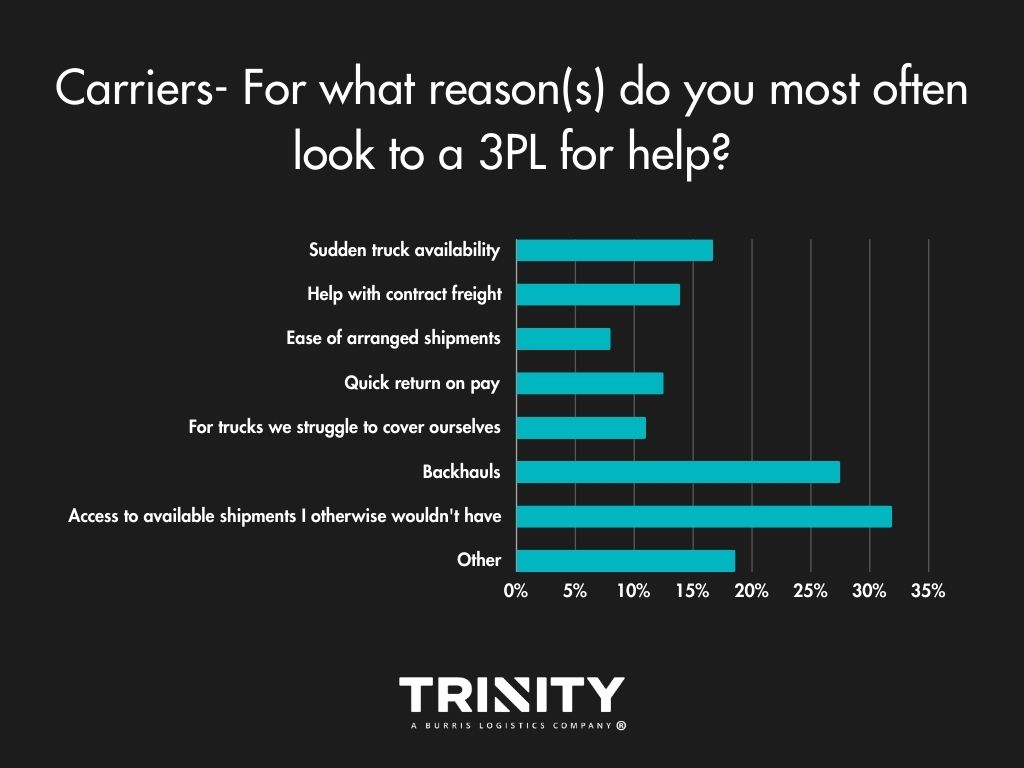

3PLs – Expanding a Carrier’s Reach

Carriers most often look to a 3PL for help with gaining access to available shipments that they wouldn’t have otherwise. Covering backhauls are another big reason carriers reach out to a 3PL.

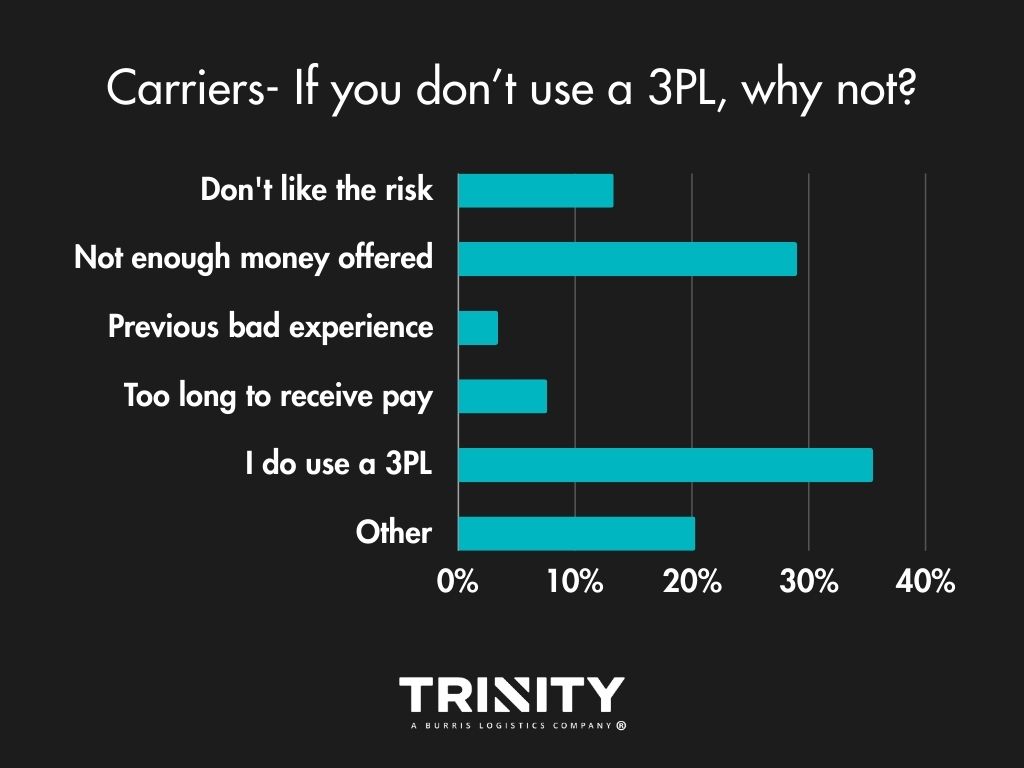

For those that choose to not work with a 3PL, it’s often because of money; rates not being high enough. Surprisingly in the comments, many are not familiar with what a 3PL or freight broker is as well.

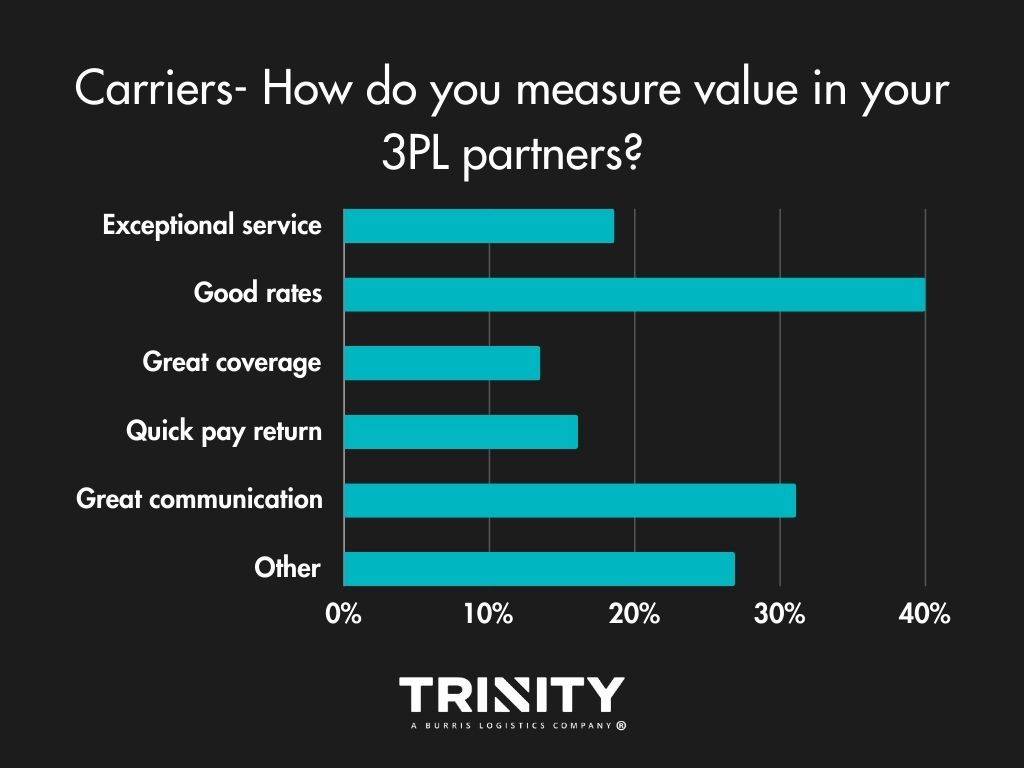

When it comes to measuring value in their 3PL partners, most carriers want good rates and great communication.

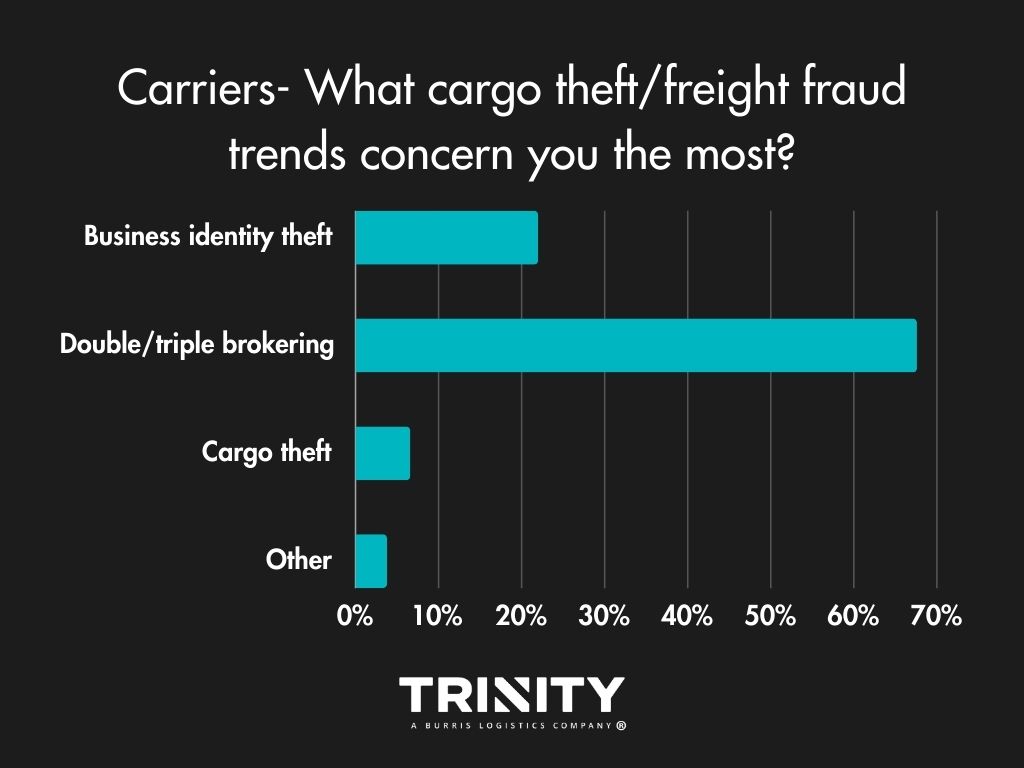

Fraud Concerns Growing

Fraud and scams have been growing in the industry, so we wanted to know what carriers think about it. Carriers are most worried about double and triple brokering affecting their businesses compared to concerns of identity theft or cargo theft.