After several record setting years, 2023 saw shifts to the freight market. How did the 2023 freight market affect shipper and carrier businesses? Did other businesses have the same struggles as yours? Are they expecting to face similar difficulties in 2024? How are their partner relationships?

Trinity Logistics wanted to get answers to these questions for you, so we asked a random sample of our shipper and carrier relationships to gauge the effect 2023 had on their business and what their expectations for 2024 in our first Freight Market Survey. Here’s what we found out:

2023 SHipper & Carrier Data: Freight Market Survey Results

Past Challenges – Same, But Different

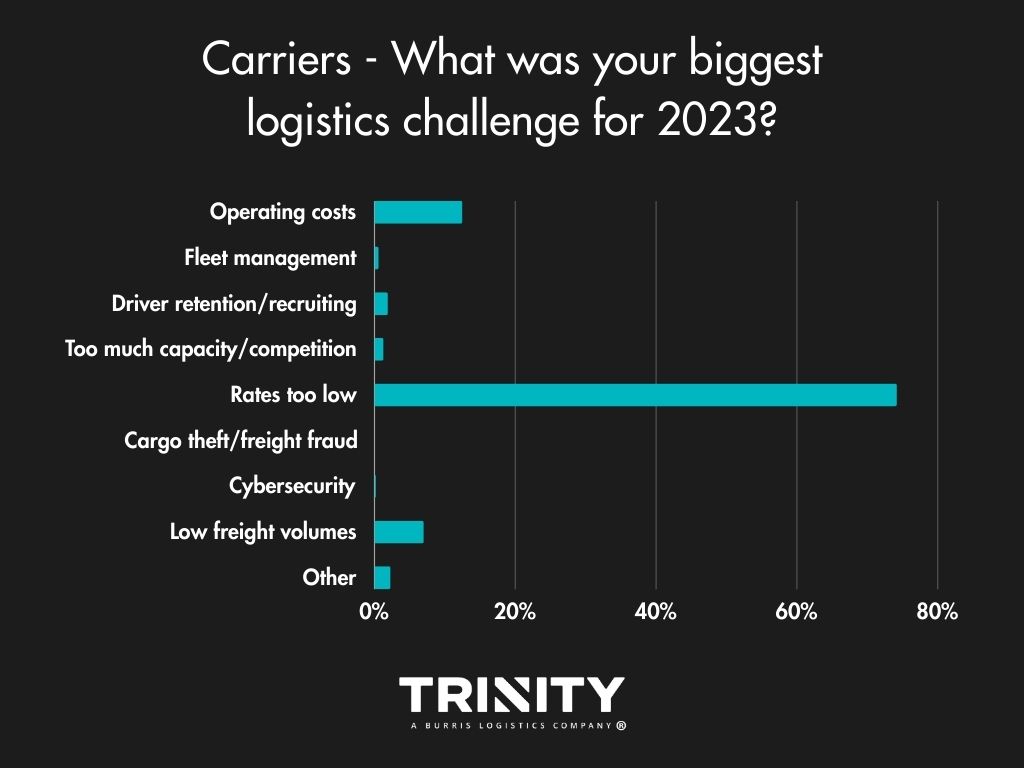

Considering the recent turndown of demand and the freight market, it’s not a big surprise that money was the biggest issue for shippers and carriers alike. Shippers answered that transportation costs were their biggest challenge in 2023, with supply chain delays/disruption and capacity not far behind. Low rates and increasing operating costs were the main challenges facing carriers.

Business Impact – Could Have Been Better

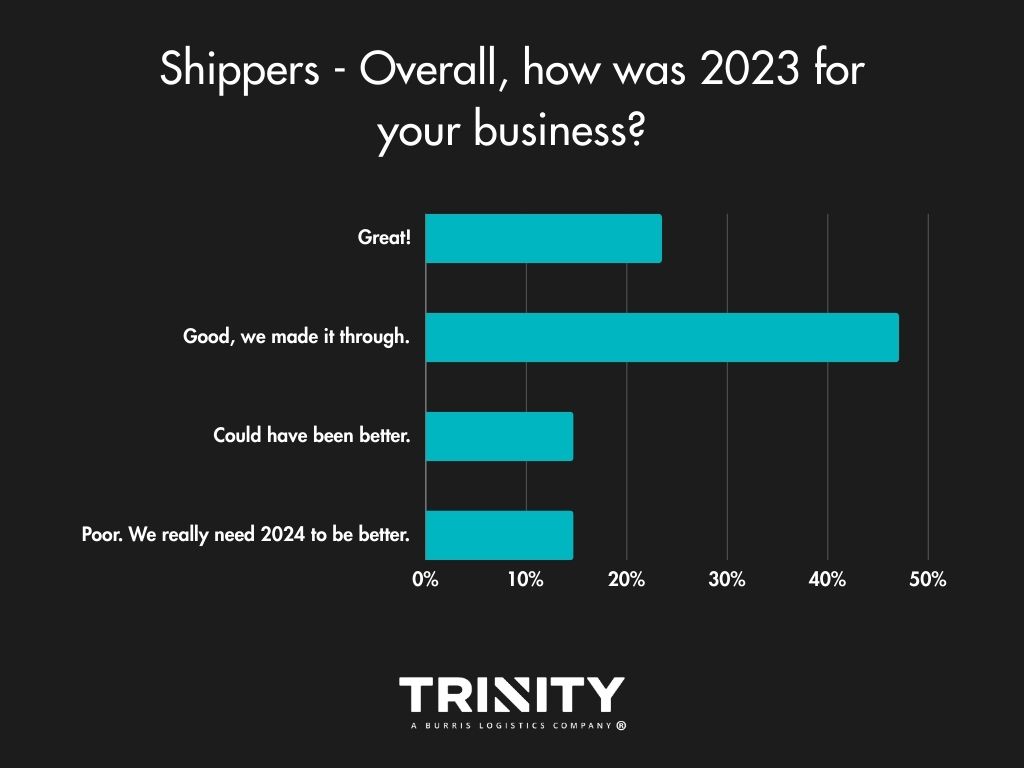

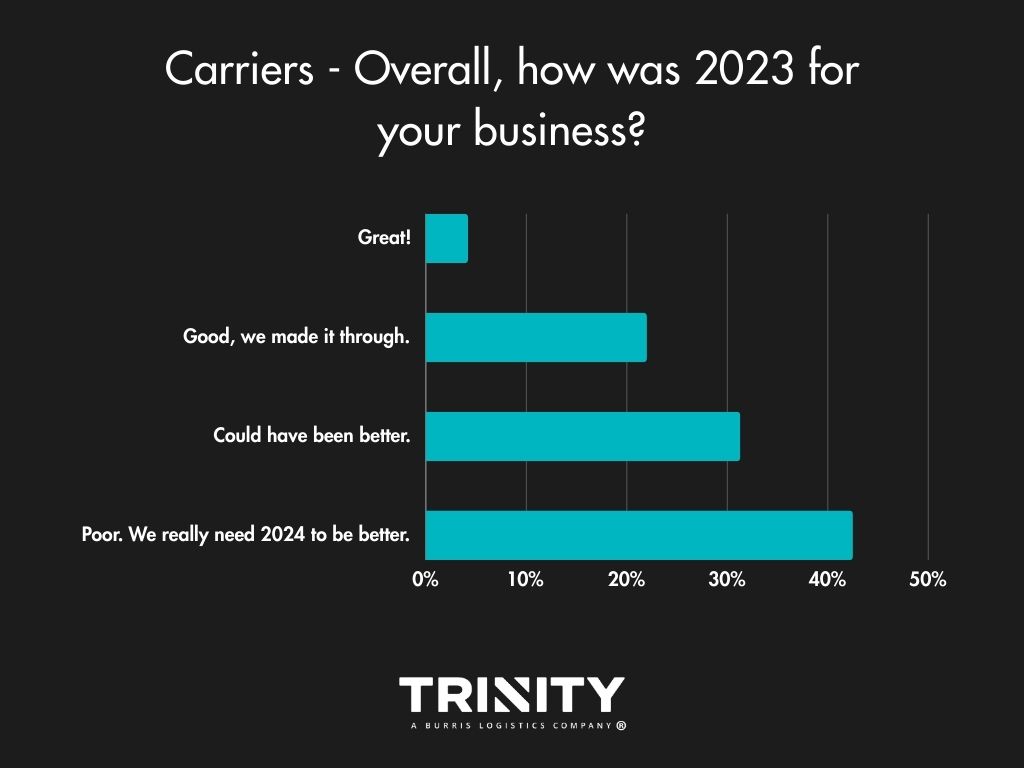

Even with the change in consumer demand trending downwards throughout 2023, most shippers answered that their year was good overall. Carriers on the other hand seemed to face a rougher year in business with over half of them stating their year could have been better or was poor.

A LOOK INTO 2024

Future Challenges – Money Problems

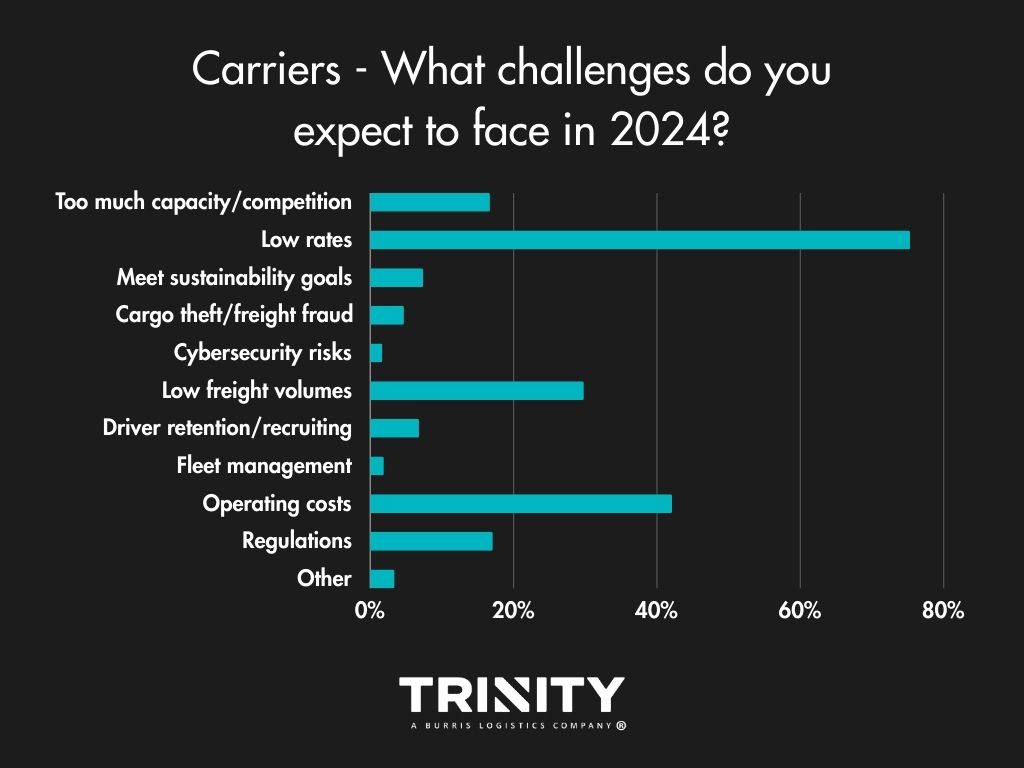

2024 isn’t looking much different in terms of challenges compared to 2023. Shippers look to have the same financial challenges as they did in 2023 with transportation costs, supply chain delays/disruption, and decreased demand being the top concerns selected. Carriers are still concerned about low rates, operating costs, and low freight volumes hurting their businesses.

Hot Trends

Even though transportation costs are shippers’ strongest concerns in their previous answers, it seems the increased amount of supply chain disruptions and delays we’ve all experienced in these recent years have hit a nerve, with the majority answering that supply chain resilience is the trend their business is most interested in. Cybersecurity also looks to be a growing interest.

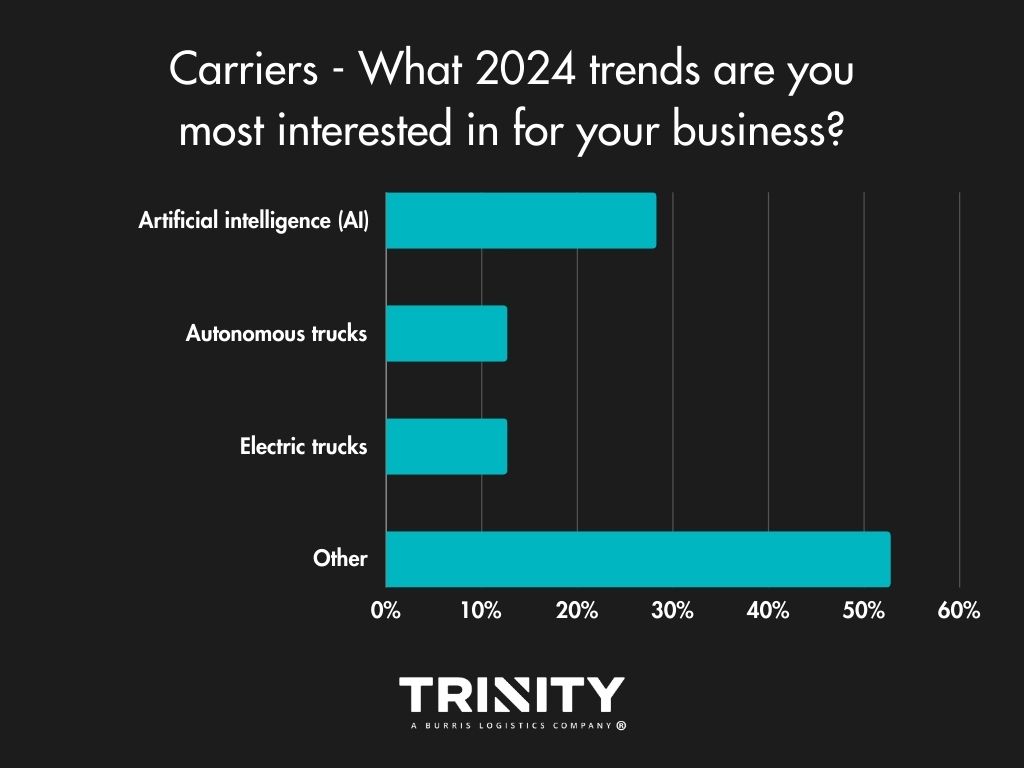

Carriers on the other hand, interestingly enough, look to the recent trend of Artificial Intelligence (AI). Also, as noted in the comment boxes of our “Other” option, increased rates and better fuel prices were trends they’d like to see in 2024.

Load Volumes & Capacity – Slightly Positive Outlook

Overall, shippers are slightly more optimistic for 2024, thinking it won’t bring any change or the change it brings will be positive. Most think load volumes will stay the same or there will be a little more in freight volumes this year. As for truck capacity, they think it will be the same as 2023 or slightly tighter.

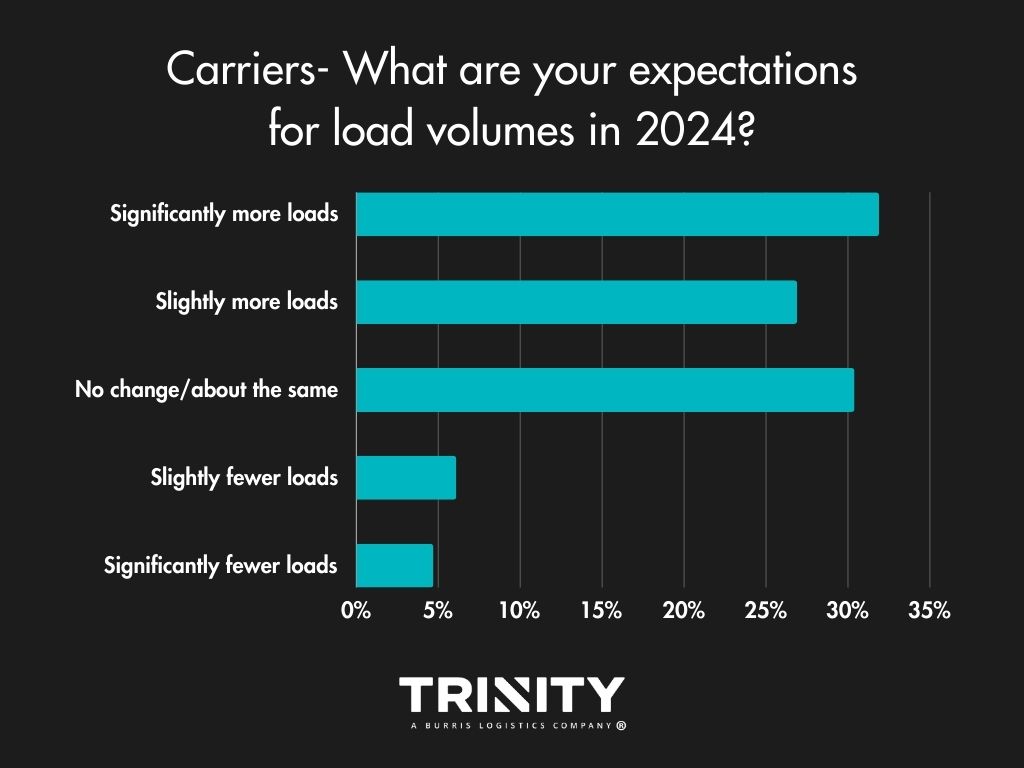

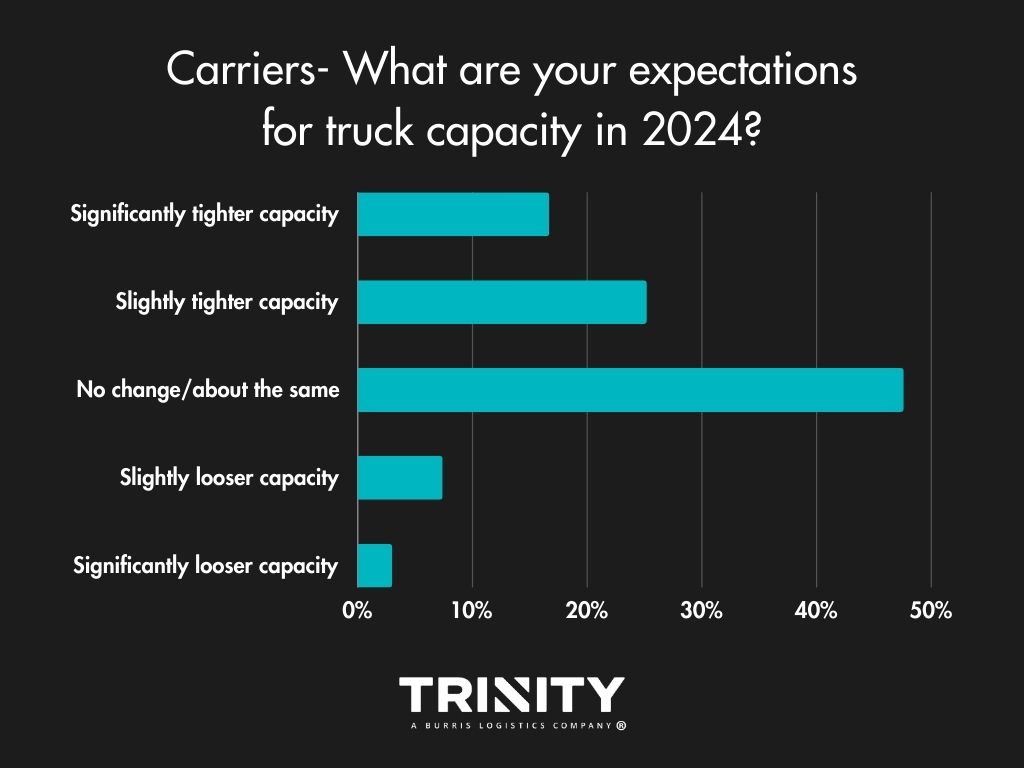

Carriers also think 2024 will bring more freight volumes and that capacity will likely stay the same or get tighten slightly versus 2023.

Spot or Contract?

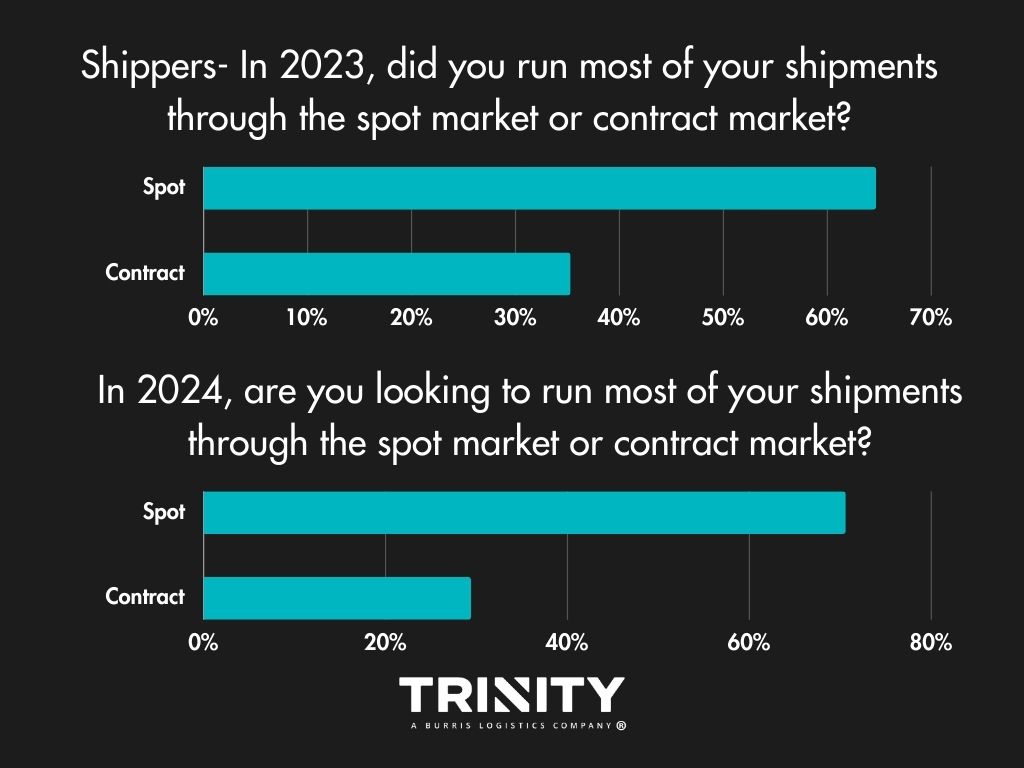

Year-over-year, shippers aren’t looking to change much in terms of which market they turn to. Most look to continue to put most of their freight on the spot market.

For carriers, there looks to be some change anticipated. In 2023, most carriers ran spot market freight but in 2024, over half of them look to haul contracted freight.

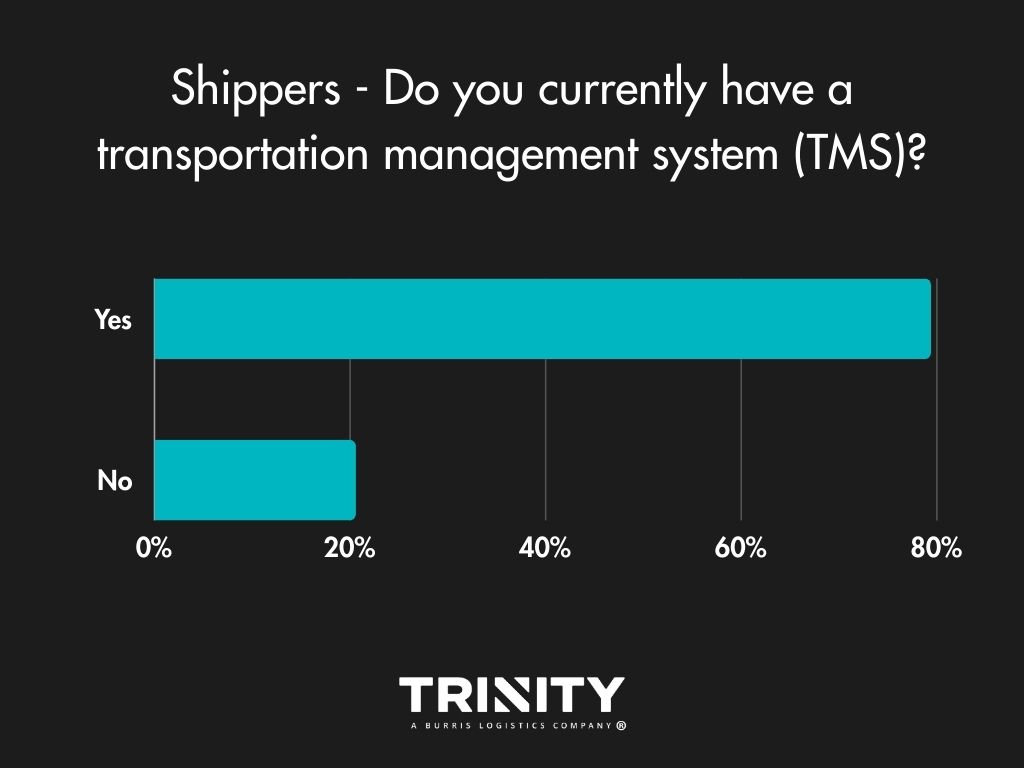

Do Shippers Have a TMS?

It’s 2024, so you’d think most shippers would have a transportation management system (TMS), and no surprise, they do. For those that don’t and answered, it seems they did not have a good experience with one in the past or don’t know enough about them.

Brokers Are the Way to Go

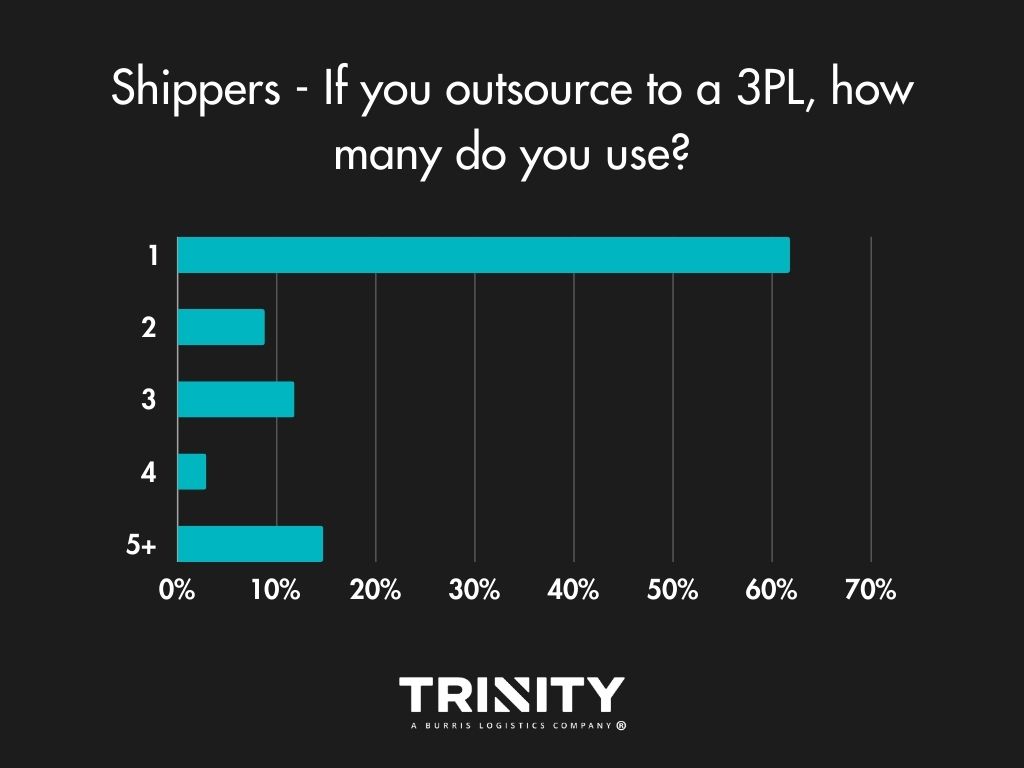

When asked how they like to move their shipments, most shippers use a mix of carriers and third-party logistics providers (3PLs) or just 3PLs. A few do use their own trucks. For those that do outsource to 3PLs, they usually just stick to one provider.

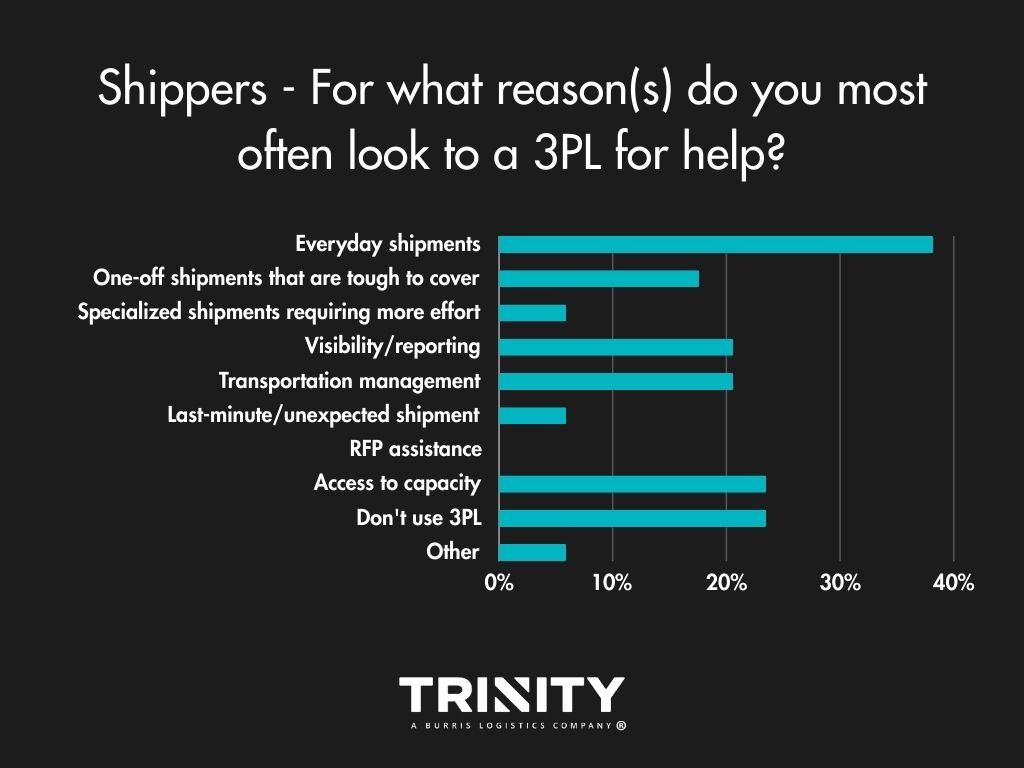

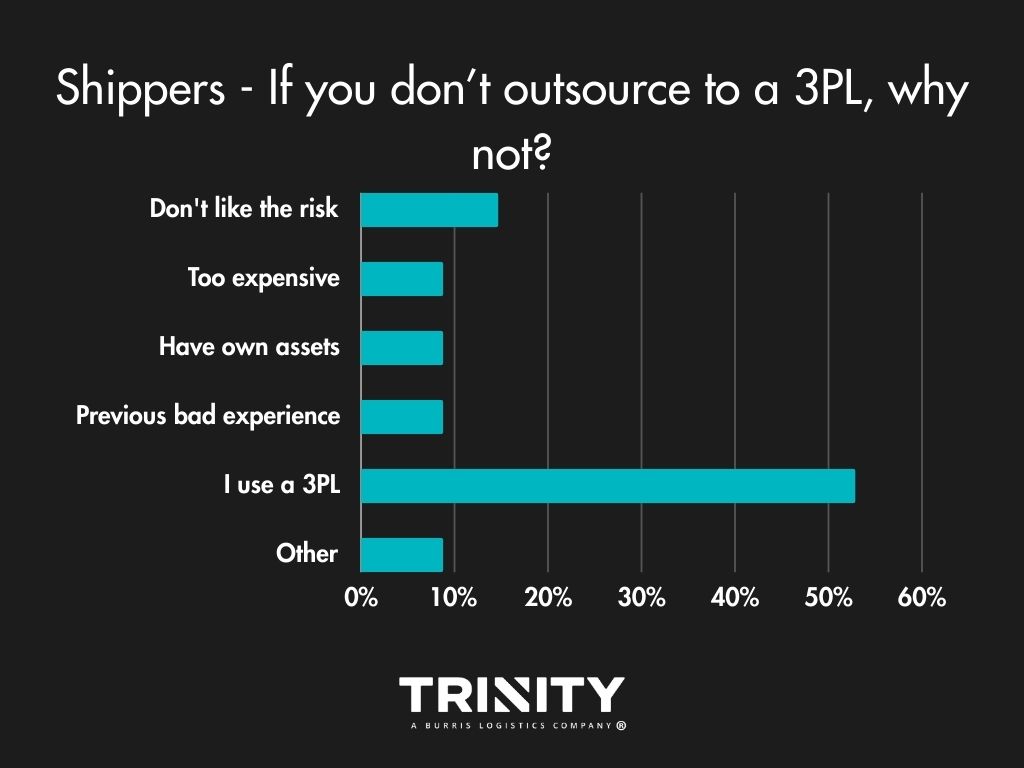

Shippers most often look to a 3PL for help with their everyday shipments, for transportation management, visibility, and access to their capacity. The main reason shippers choose not to work a 3PL for their logistics? They don’t like the risk.

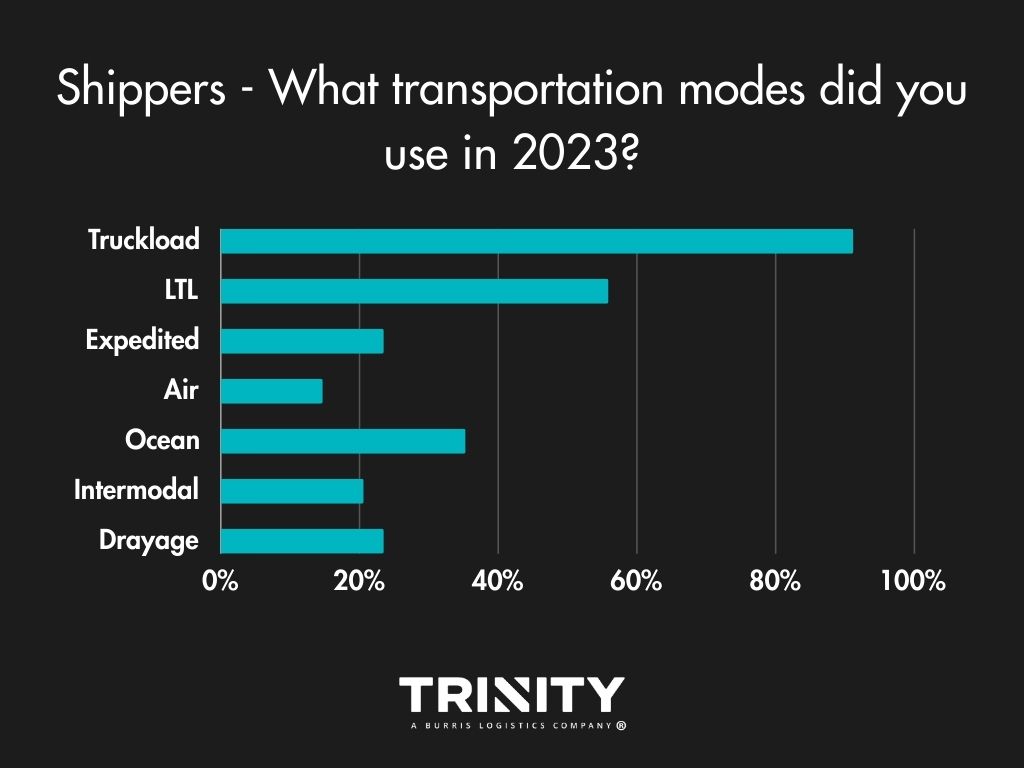

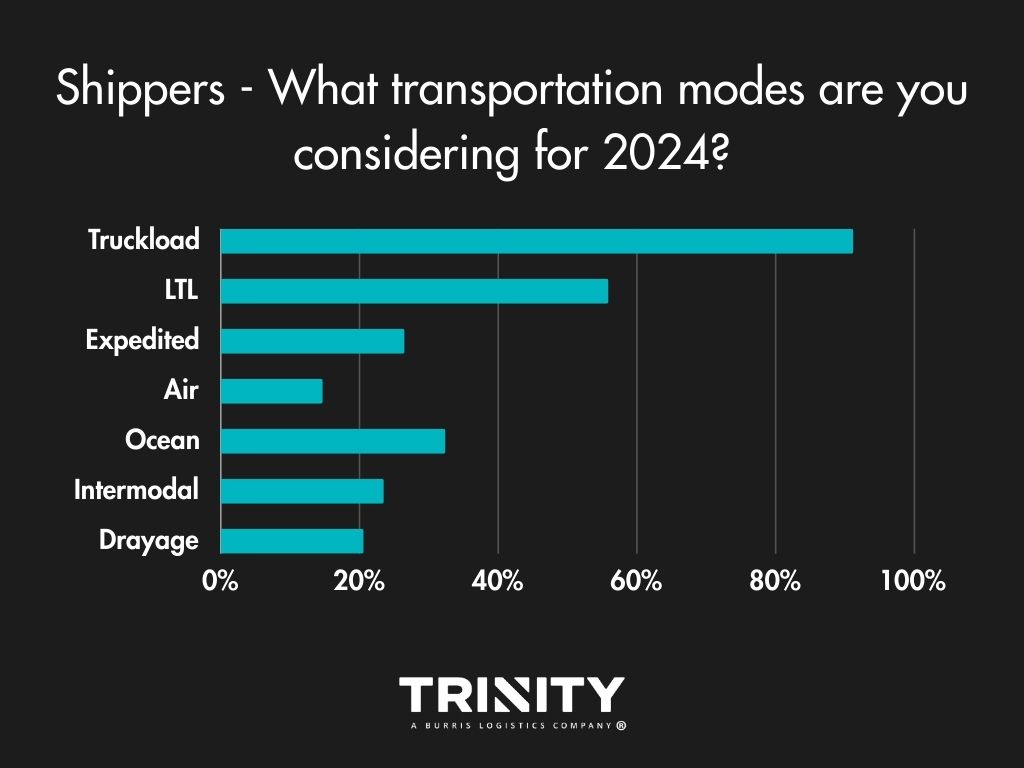

Transportation Modes – Staying Consistent

Overall, shippers aren’t looking to change what transportation modes they use for their shipments. Truckload and less-than-truckload (LTL) are the primary modes they like to use, with a little diversification sprinkled in.

Exceptional Service Stands the Test of Time

When it comes to their logistics partners, shippers find the most value in receiving exceptional service, with costs coming in as a close second.

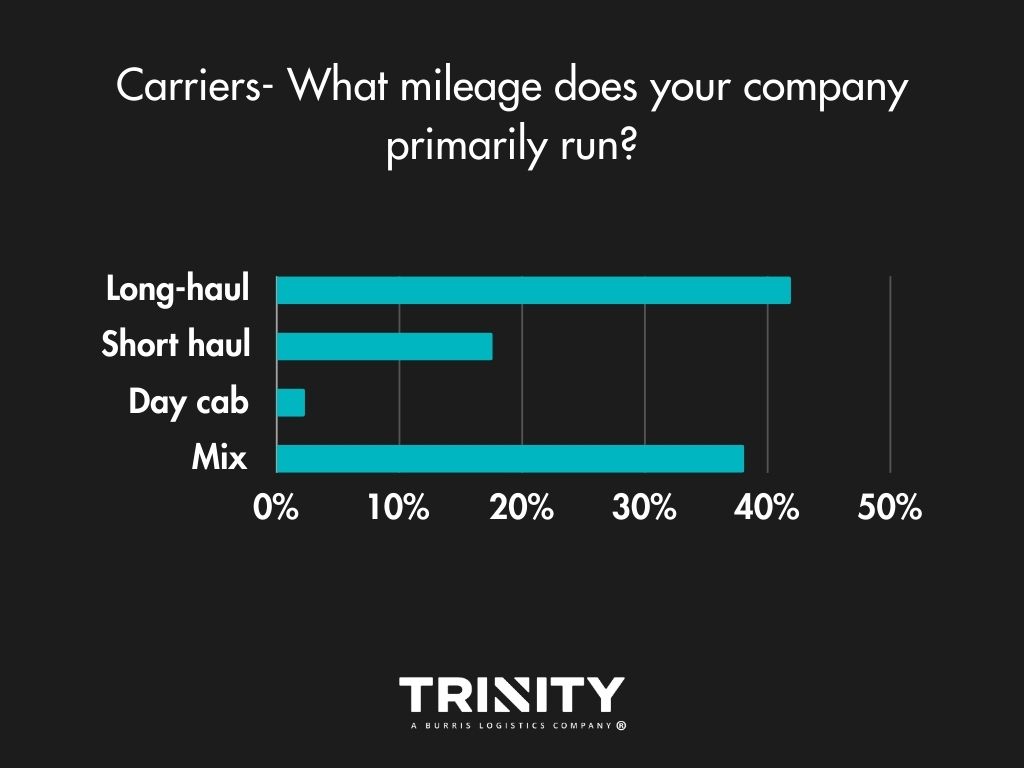

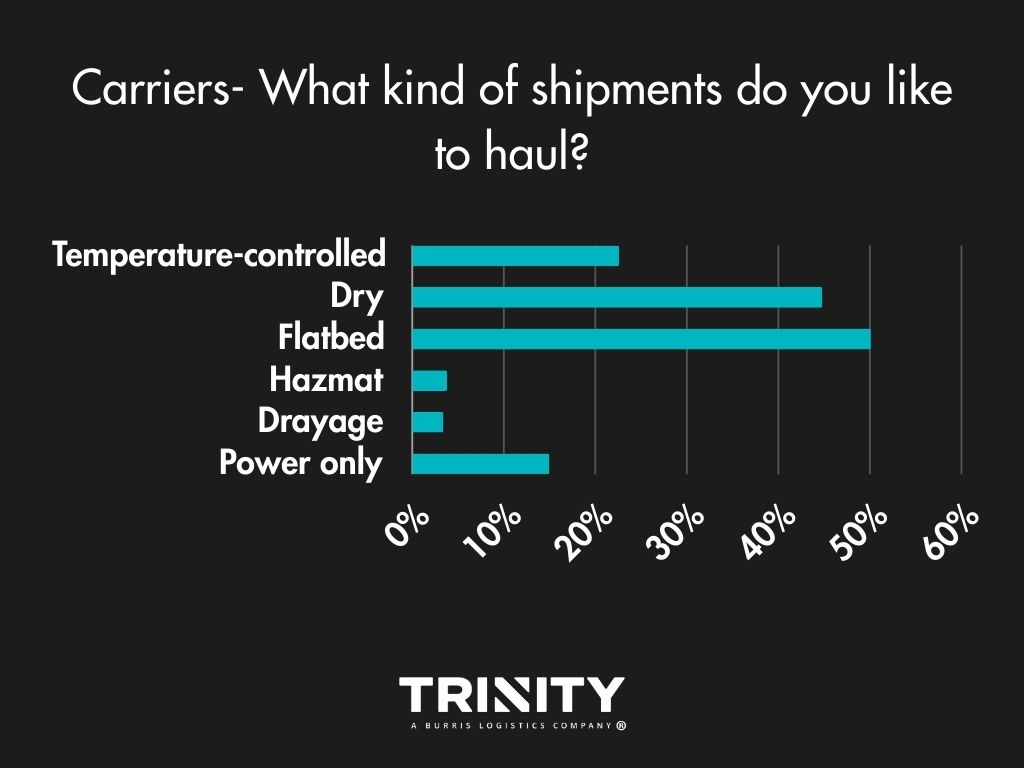

Most Wanted: Long Mileage, Flatbed Shipments

When it comes to mileage, most carrier companies tend to run long-hauls or a mix of short and long shipments. Flatbed hauls are the type of shipments most carriers like to haul with dry van coming in as a close second.

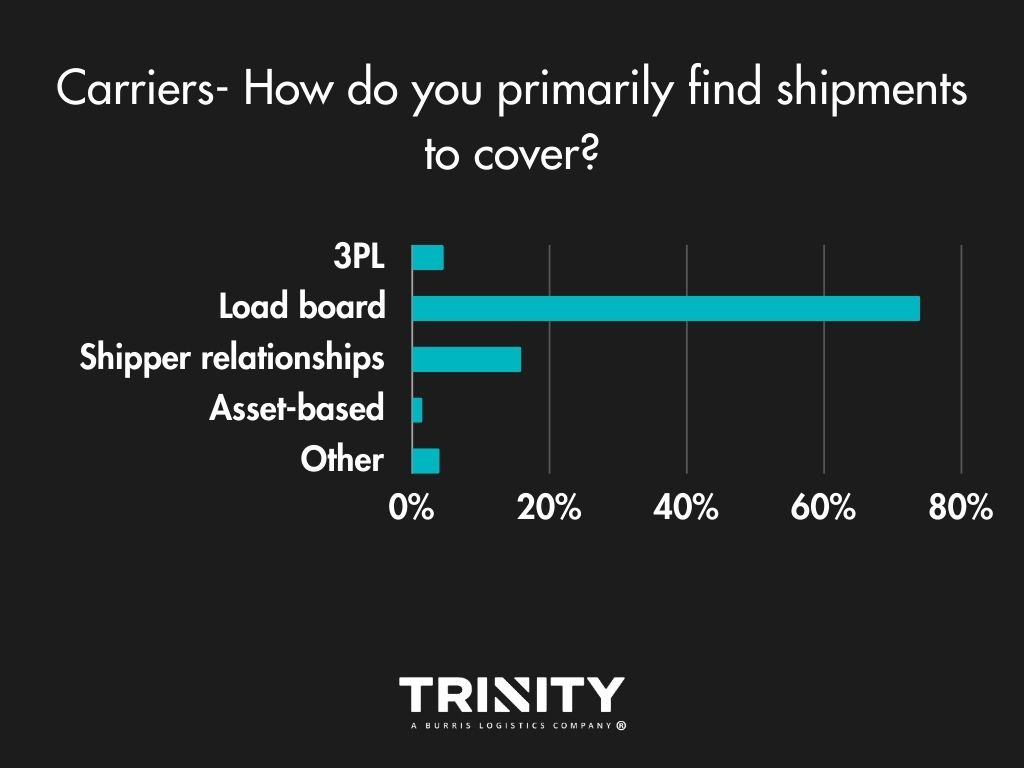

Load Boards are the Way

With 74 percent selecting this option, load boards are the norm for carriers to find available shipments. Sometimes they use their shipper relationships, and occasionally they make use of a 3PL.

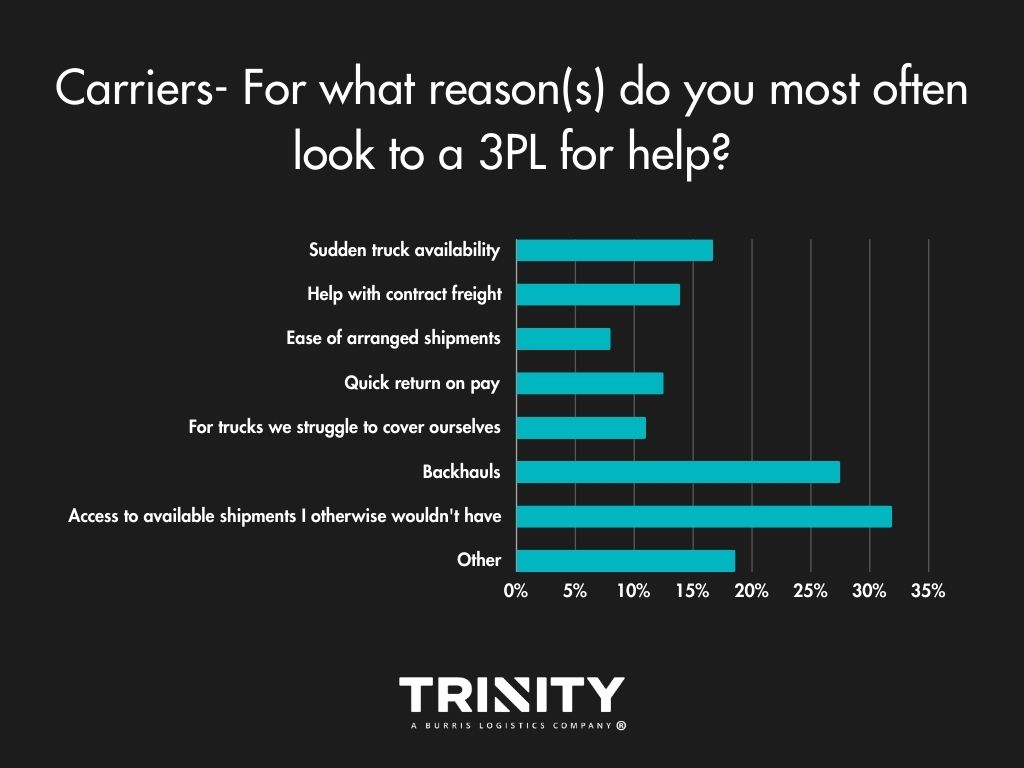

3PLs – Expanding a Carrier’s Reach

Carriers most often look to a 3PL for help with gaining access to available shipments that they wouldn’t have otherwise. Covering backhauls are another big reason carriers reach out to a 3PL.

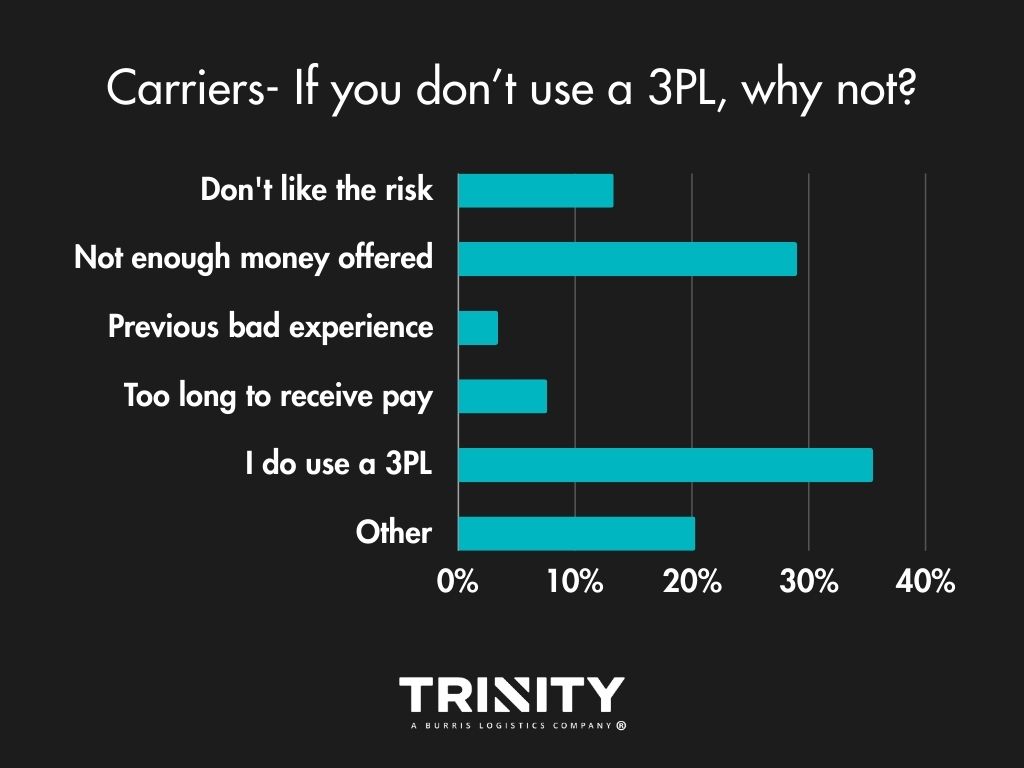

For those that choose to not work with a 3PL, it’s often because of money; rates not being high enough. Surprisingly in the comments, many are not familiar with what a 3PL or freight broker is as well.

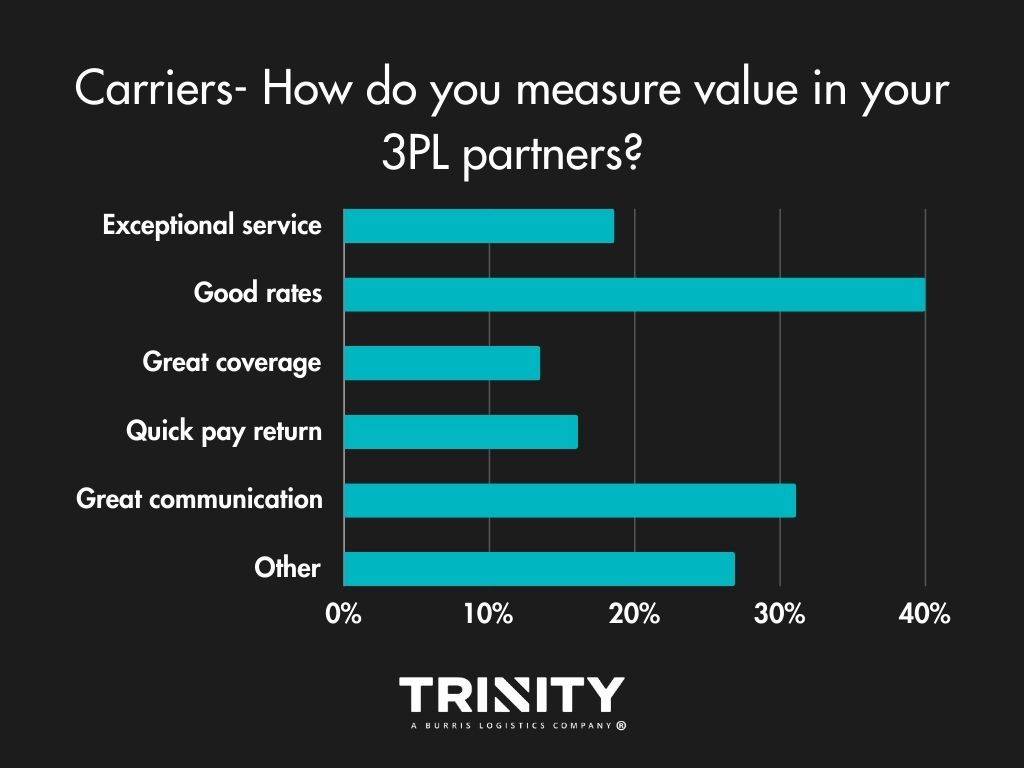

When it comes to measuring value in their 3PL partners, most carriers want good rates and great communication.

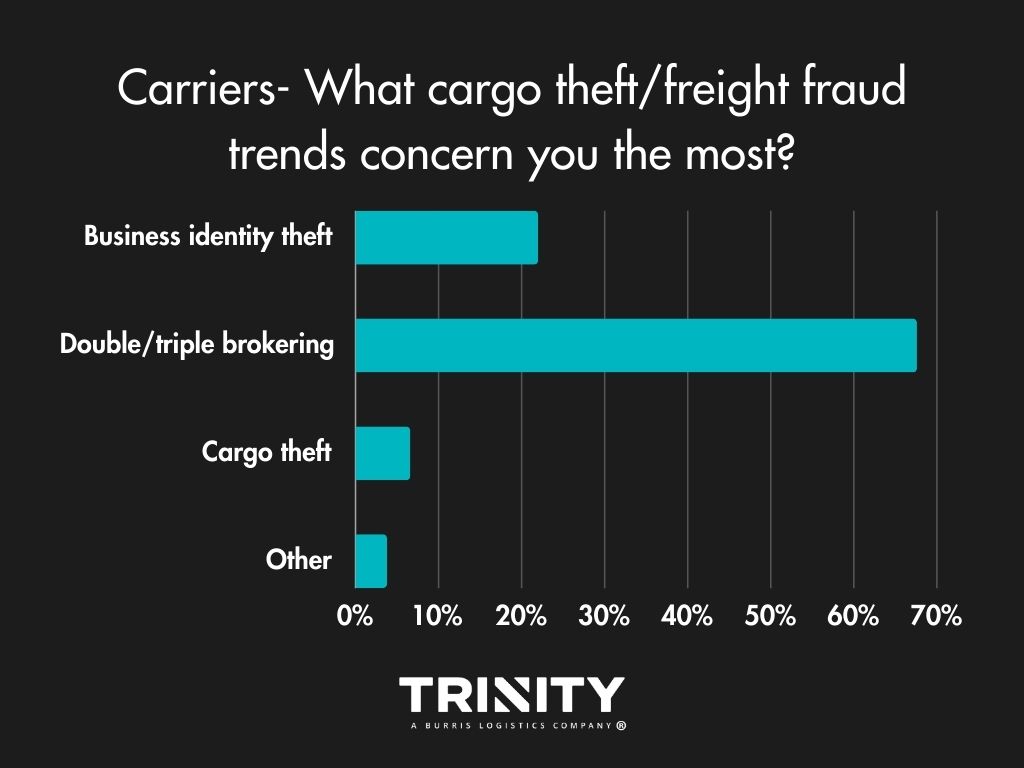

Fraud Concerns Growing

Fraud and scams have been growing in the industry, so we wanted to know what carriers think about it. Carriers are most worried about double and triple brokering affecting their businesses compared to concerns of identity theft or cargo theft.

At the time this article is being published, it’s been 22 months, just shy of 2 years, with Covid-19. As time has passed and treatments and vaccines have become available, most (though not all) of life has returned to normal. A “new normal” as many now call it. In-person gatherings and events have returned, remote and flexible workstyles have become the new norm, kids are back in school, and online shopping and inflation have rapidly risen. So, what are we wishing wasn’t part of this “new normal”? Supply chain disruption.

The Start of Supply Chain Disruption

As COVID-19 began to spread, governments responded with lockdowns. Nonessential businesses closed, and panicked consumers bought out paper products, soap, and disinfectants. With many businesses closed or down to a skeleton crew, this meant longer transportation times. To make do, alternative routes and modes were sought out, but even those became backlogged too. Shipping networks started to become strained. With people staying home and governments offering financial help, online shopping quickly increased.

Amidst the waves of Covid-19 came more supply chain disruption. There was the Texas freeze that caused many manufacturing plants to shut down. Then there was the Suez Canal blockage which caused severe delays in imports from several days of being blocked. There were the wildfires that raged across the west coast, adding further supply chain disruption. As a result, companies have faced material shortages, increased freight costs, labor shortages, tight capacity, and more.

Current Conditions

In the standard supply chain, raw materials get sent to factories to manufacture goods. Then shipped to warehouses for storage, then to retailers or consumers. Currently, companies face warehouse shortages, labor shortages, tight capacity, exponentially high freight rates, and import delays. It’s gotten so bad for so long that supply chain disruption continues to be a headline in the news. Even people not in or knowledgeable about logistics are talking about it.

The hot topic in the news as of late is the overwhelming demand surging at U.S. ports. Demand for goods has grown so rapidly since the start of the pandemic that it’s equal to adding about 50 million new Americans to the economy, as reported by Insider. Lately, we’ve seen record highs in ships waiting to dock, containers waiting to unload, a lack of storage space to put goods, and empty containers sitting in truck lots and streets, with no place to go.

What to Expect in 2022

Experts continue to say that we will keep seeing supply chain disruption and delays through 2022, if not to 2023. This is because we’ll still have our current supply chain bottlenecks to work through, labor, material, and warehousing shortages to figure out, and Covid-19 remains an issue.

But perhaps we will begin to see some easing of supply chain disruption this coming year. For one, the recently passed infrastructure bill will hopefully begin to affect and strengthen supply chains through its funding into roads, bridges, and ports. More and better infrastructure will help keep certain supply chain disruptions at bay, such as offering more warehousing space and keeping bridges and roads safe and free from closing. Nonetheless, this is longer-term and farther out.

Ideally, what would give the supply chain some short-term relief would be if consumers slowed down a bit with their online shopping. It’s still expected that consumer spending will at one point switch back to travel and entertainment at some port, but no one is quite sure when that may happen.

Tips for Shippers

The past (almost) two years have shown us that supply chains aren’t as resilient as we thought they were. Considering we’re still in the thick of supply chain disruption, it makes sense to improve your supply chain and logistics. Here are some tips you may find useful in keeping your business moving forward until we get back to normal.

Consider Shortening Your Chain

Global supply chains are seeing the worst disruption in their logistics. If anything’s come to light since Covid-19 began, it’s that businesses might want to look into shortening their supply chains. One way to do this is by moving your manufacturing back to the U.S., also known as onshoring.

Identify Any Vulnerabilities

By understanding where any risks lie, you’ll be able to better protect yourself from supply chain disruption. You’ll need to take some time to map out your entire supply chain, down to your distribution facilities and transportation hubs. Though this may be time-consuming and expensive, it can help prevent you from facing a surprise disruption that brings your business to a stop and can be much more costly.

Diversify Your Supply Chain

Once you’ve identified where risk is in your supply chain, you can take that information to address it. This can be done by diversifying your resources. Instead of heavy dependence on one high-risk source, you can add more sources in locations that are not vulnerable to the same risk, so if one gets disrupted, you don’t have to be shut down completely.

Begin Holding Safety Stock (if possible)

This may not be possible for all shippers, and now may not be the best time to start this considering all the current bottlenecks supply chains are facing. But, when possible, this is something that could save you from supply chain disruption down the road.

Keep Up With Timely Communication

Communication is always needed to run your best business, but even more so during this pandemic. Make sure you are communicating properly and timely with your carriers and transportation providers on any new sanitation procedures, requirements, changes in operating hours, or upcoming closures.

Also, Keep Transparency

Be transparent with your audiences. They appreciate it more than you think.

Stay Informed

COVID-19 and many other supply chain disruptions came quickly, and the future remains uncertain. Be sure to stay updated on current developments that may end up slowing down your business.

Find Support in a Transportation Partner

Third-party logistics companies, such as Trinity Logistics, can help you find creative ways to your logistics challenges. We’re experienced in complicated situations and stay knowledgeable on what is going on in the industry. We were quickly able to pivot when the pandemic first hit, so we could keep your business moving forward. We know that even in times of disruption, the shipping industry does not stop, so neither do we.

If you’re ready to gain support in your logistics with Trinity Logistics, no matter the condition of the industry, let’s get connected.

Author: Christine Morris