Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Feels like 2022

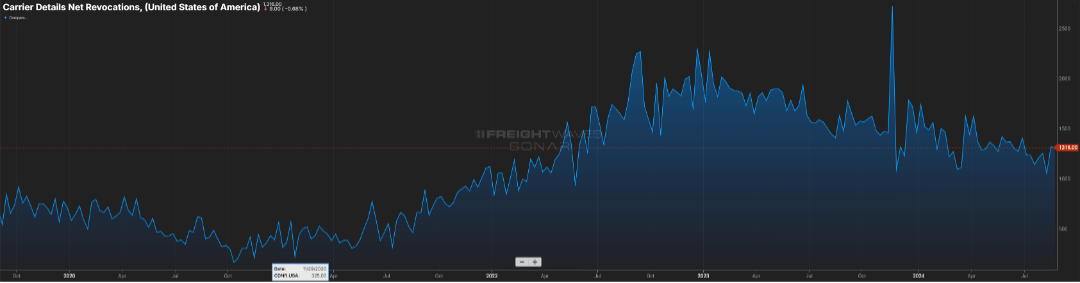

For the majority of this year, volumes have seen their traditional seasonal patterns and have been trending above 2023 levels. Many have commented that market balance will be driven more by carrier attrition versus an event that spurs freight volumes.

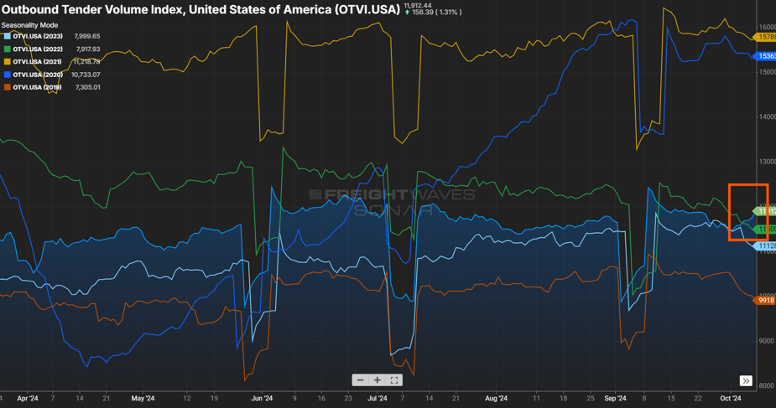

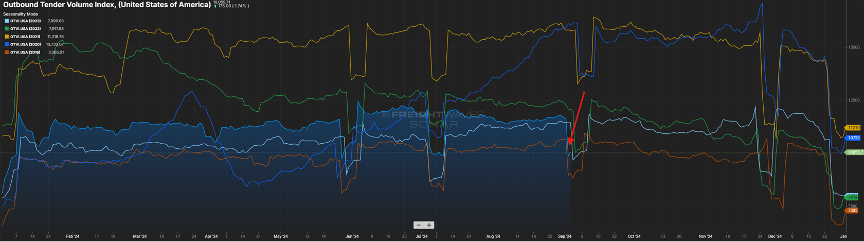

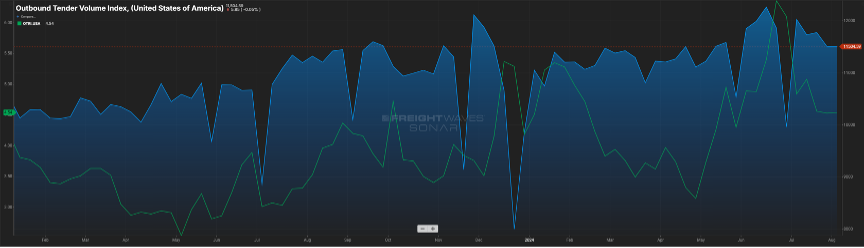

2022 was a pretty good year from an industry standpoint. Volumes were still elevated (certainly not like we saw in 2021) and capacity was inline. While it may be a blip on the radar, we have now seen the Outbound Tender Volume Index eclipse 2022 levels for the first time in two years as seen in Figure 1.1.

I think it is still too early to pin the volume uptick on the interest rate reduction or the recent hurricanes that severely impacted states in the southeast, but these events, and any potential storms that might still pop up (hurricane season isn’t quite over yet), could impact freight volumes in the coming months. Combined with consumers continuing to spend, volumes could remain consistent through the end of the year versus following their traditional end of year downward movement.

FINE….FOR NOW

While there was a sigh of relief from many with the ILA and USMX reaching a deal on wage increases for dock workers, this does not mean that everything is resolved, and potential port disruptions could occur at the 20-something docks along the East and Gulf coast.

Union-member wages were the major bargaining chip that was agreed upon last week, with dock workers receiving an immediate pay increase, with yearly pay increases to follow. When all increases have taken effect, dock workers will see a 62 percent increase in pay. One issue that was not finalized was the use of automation at select ports, which the labor union has opposition to full and semi-automation. The two sides will continue their negotiation discussions, with a timetable of three months from now to finalize a deal.

If these points can’t be resolved, it may be rinse and repeat with the threat of another strike as we get into the start of 2025.

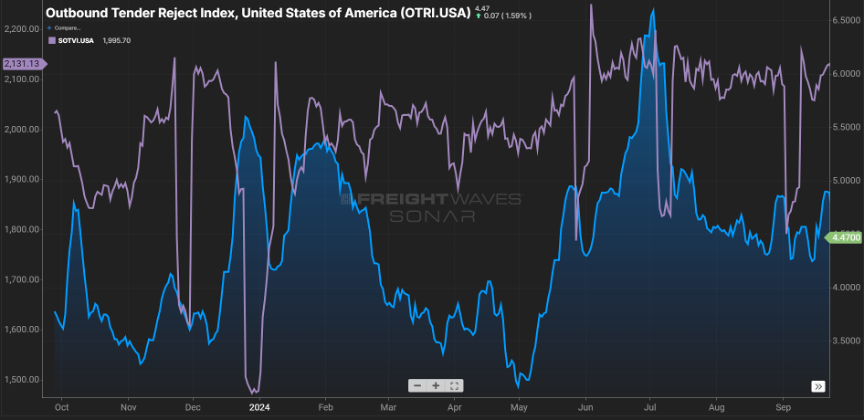

Speaking of the recent shut down of port activity, it will take a week or so to work through the container backlog. This, along with the disruption in shipping patterns caused by the recent hurricanes, has been impacting tender rejection rates as seen in Figure 2.1.

Rejection rates crested the five percent mark recently. As port activity comes back online, expect the volume for short haul shipments (<250 miles) to remain elevated as also seen in Figure 2.1.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

YES, IT IS IMPORT-ANT

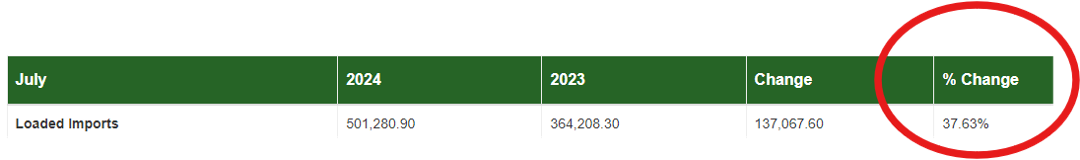

There has been much buzz in the last month around inbound container volumes to U.S. ports. There are 300+ ports of entry for goods into the country, with much of that volume handled by the top 20. Most of that buzz is around the uptick in volume.

In figure 1.1, you will see for the port of Los Angeles, the largest in the country, that container volume is up almost 38 percent. That’s certainly impressive, but the neighboring port (Long Beach) was up a staggering 60 percent.

Many would anticipate this similarly impacting the outbound over-the-road volume for that market. And yes, while we see in Figure 1.2 via the blue line, there is a noticeable increase from what it was heading into the Memorial Day holiday, but it is not a direct correlation. The beige line represents the domestic rail volume from that same market, and unlike what we experienced in the “Covid years”, the rails have been a bigger mover of goods versus the bottlenecks we saw back then.

We should expect to see import volumes continue through the next few months. As goods produced overseas have become cheaper to buy, major retailers have taken advantage of these discounts with the anticipation of robust consumer spending. Remember, almost three-fourths of inbound volume is directly related to consumer purchasing. Good news for consumers as these retailers will want to liquidate this inventory quickly at lower prices.

NOT FAR FROM HEALTHY

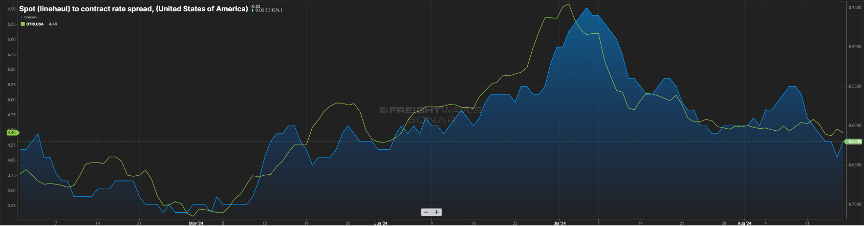

While not in balance, the spread between contract and spot rates continues to shrink, now sitting about $0.60 per mile higher on the contract side. Keep in mind this gap was in the $0.75 to $0.90 for much of the past year. Almost in lockstep has been the tender rejection index. It has continued its slow upward movement as seen by the green line in Figure 2.1.

This can be attributed to capacity continuing to shrink slightly (Figure 2.2) and contract rates moving downward. It’s rare that spot rates will eclipse contract rates, but a spread of $0.40 to $0.50 is indicative of a healthier market, and we are not far from that right now.

I spent a few days traversing the state of Tennessee recently. At one stretch of a major interstate, there was a back-up at least five miles long. Luckily for me, it was on the eastbound side, and I was heading the opposite direction.

What struck me was the sheer number of trucks that sat idled. By my estimates, almost 80 percent of the volume was truck traffic. And while you can’t tell if a van is loaded or not, every single flatbed had freight on it. So, ladies and gentlemen, freight is still moving in this country. While it may not feel like it, volumes are trending close to 2022 levels as seen in Figure 3.1 (blue vs. green line). They say the fourth quarter is the time when carriers make hay; so here’s to an optimistic outlook for the next four months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

GOOD NEWS, BUT…

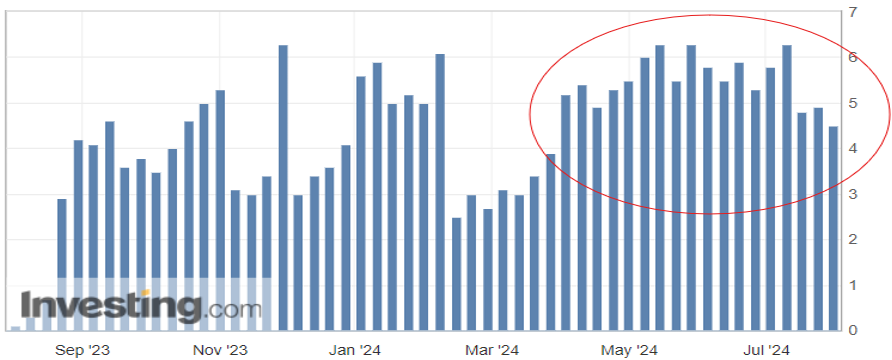

Consumer spending is the biggest driver of the U.S. economy, accounting for roughly two-thirds of the nation’s Gross Domestic Product (GDP). One measurement of that consumer spending is the Redbook index, which compares year-over-year growth for large domestic general retailers (think Walmart, Amazon, Target). The index has averaged just over 3.5 percent for the past 20 years, so the recent year-over-year (YoY) growth in the four-plus percent range speaks to the strength of consumer spending (Figure 1.1). This index alone certainly gives reason for optimism, however there is a cautionary tale with regards to consumer debt.

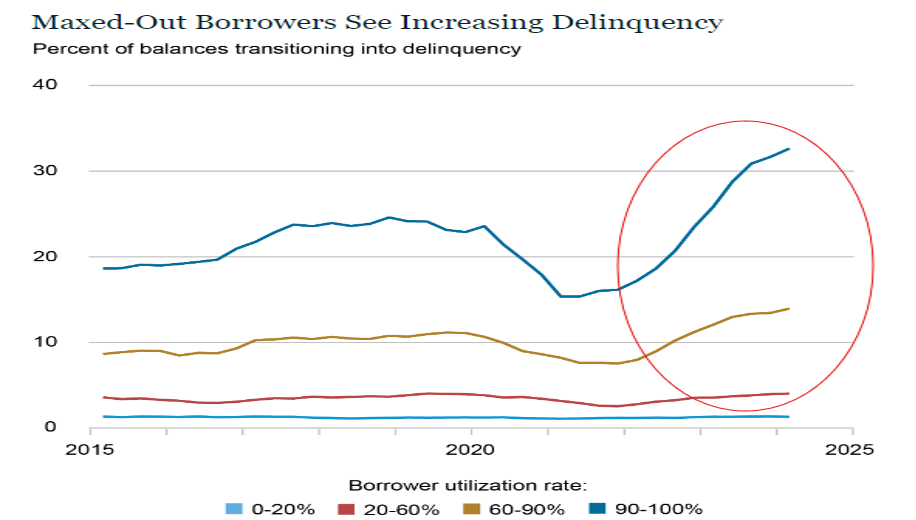

After years of next to zero interest rates to keep the economy on its legs, consumers have seen interest rates on the rise, with the federal funds rate at its highest level since the early 2000’s. With the increase in interest to borrow funds, combined with the increased costs of essentials (food, housing, energy), many households have turned to credit cards to fill the gap for funding of these necessities. Figure 1.2 from the New York Fed Consumer Credit Panel shows the rise in consumer delinquency particularly in those groups that utilize more than half of their available credit line.

While there appears to be relief on the horizon with the impending reduction in interest rates, it appears a portion of active consumers may be pulling back on purchases for those items that are not mission critical. This, in turn, will have an impact on restocking of inventories and trucking activity.

While it is not approaching the levels seen in 2021, the volume index is quickly approaching levels seen in 2022. This has buoyed optimism in the industry.

JUST SOME GOOD LUCK? TIME WILL TELL

The uptick in consumer spending, restocking of inventories and the threat of labor strife in the fourth quarter of this year has been to the benefit of those involved with the rail and import business.

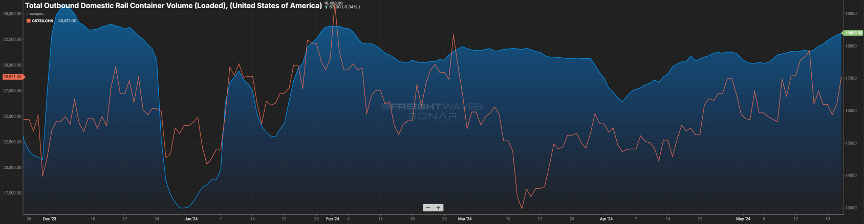

In Figure 2.1 below, the blue line represents loaded container rail volume in the U.S. and the past three months have seen the volume grow. Similarly, container volumes to the U.S. have been on the rise.

The orange line represents container volume from China over the past six months. While some of that traditional volume is now flowing through other countries, like Mexico, there is still a great deal of activity with U.S.-China trade. Will this continue or is it fool’s gold? That is something we will continue to keep an eye on as a pullback in consumer spending will dictate how the needle moves.

STAYING RIGHT WHERE WE ARE

Finally, looking at domestic over-the-road volume (blue line) compared with carrier rejection rates (green line). The slight upward trend continues with volumes and rejection rates (Figure 3.1). Rejection rates continue to inch towards 2022 levels, but a five-to-six rejection rate is about half of what one would see in a balanced freight market.

This has yet to manifest itself in the way of increased freight rates, as capacity still exists in the market.Shippers and carriers should anticipate little change in conditions (although hurricane season is looming) until early 2025.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxIf you’re a large-scale manufacturer, getting liquid freight transported in bulk is a non-negotiable complexity. Bulk transportation, especially liquid freight, has its challenges and may seem daunting. But, with the right information and provider, it doesn’t have to be. So, whether you’re new to bulk transportation for your liquid freight or a seasoned vet, this article breaks it all down so you can safely and efficiently have your liquid bulk product transported.

What Kinds Of Bulk Liquid Products Are There?

What Is Bulk Transportation For Liquid Freight?

Complexities Of Bulk Transportation For Liquid Freight

What Can Go Wrong With Shipping Bulk Liquid Freight?

What Kind Of Equipment Is Needed For Bulk Liquid Transportation?

How Do You Transport Bulk Liquids?

Bulk Transportation: Liquid Freight Regulations

WHAT IS A BULK PRODUCT?

Before we dive into bulk liquid freight, let’s go over what bulk products are. The term “bulk” is used in transportation to describe goods that are not in containers and loose, transported in mass quantities or volumes. Bulk products are usually packed in one large container to be moved, such as a tanker trailer. Bulk products are often not intended for general consumers but are useful to manufacturers. Examples of bulk products are raw materials, ingredients for food manufacturing, materials for landscaping, gravel, dried beans, oil, or grains.

Another term to be aware of when working with bulk products is “break bulk”. Breakbulk is when a bulk shipment is broken down into smaller containers. This is important to know because bulk shipments are handled as loose goods whereas breakbulk shipments are loaded individually in some sort of container. Therefore, when you have a product to ship, it’s very important to properly communicate whether your shipment is bulk or breakbulk.

WHAT KINDS OF BULK LIQUID PRODUCTS ARE THERE?

There are many sorts of liquid products that ship via bulk transportation. These types of liquids are often used in manufacturing, food processing, agriculture, and more. Some examples of bulk liquid freight are:

- Vegetable oil

- Alcohol

- Milk

- Juice

- Syrup

- Sugar alcohols

- Vinegar

- Essential oils

- Mineral oils

- Artificial colors or dyes

- Chemicals

- Hydrogen peroxide

- Sulphuric acid

- Nitric acid

- Mining chemicals

- Solvents

- resins

- All types of water

WHAT IS BULK TRANSPORTATION FOR LIQUID FREIGHT?

Bulk transportation for liquid freight involves using a tanker trailer instead of smaller drums or tanks. Bulk liquid transportation usually refers to the act of moving liquid freight by truck over long distances.

COMPLEXITIES OF BULK TRANSPORTATION FOR LIQUID FREIGHT

Bulk liquid freight, especially when it’s hazardous, can carry more risk than other types of freight. For example, an accident involving a tanker truck can cause the shutdown of roadways, manufacturing production lines, and ultimately, the loss of raw material needed for many products.

The first complexity of bulk liquid freight is the way it’s packaged and stored. Unlike other freight, it’s not packaged in totes or smaller containers. Instead, bulk liquid freight is stored and transported in large containers and tankers, and because of their liquid state, they can slosh around and spill.

Since bulk liquid freight shipments transport differently than dry van shipments, you’ll find complexity in its logistics like:

Longer Lead Times

Tanker transportation is considered more of a specialty compared to dry vans, so you’ll notice fewer tankers available. This can make finding an available tanker longer to find.

Higher Rates

Being a specialty type of transportation, it’s easy to see why rates will be higher for this type of shipping. First, carriers pay more for this kind of special equipment. On average a tanker trailer can cost $100,000 to $125,000 compared to the cost of a dry van around $35,000 to $40,000.

Also, your shipping costs will include deadhead miles every time as each delivery requires a trip to wash the tanker. And unlike other types of transportation, you’ll have the same rate regardless of how full the tanker trailer is since different liquid freight cannot be combined for motor carriers to create a “full tank load” shipment.

Different Driver Requirments

No matter the product, tanker drivers are required to have a tanker endorsement, and if the liquid freight is hazardous, they’ll also be required to have a hazmat certification as well.

More Insurance

Carriers hauling hazardous liquid freight in bulk must carry a minimum of $5 million in liability insurance.

WHAT CAN GO WRONG WITH SHIPPING BULK LIQUID FREIGHT?

A lot can go wrong when shipping bulk liquids, so working with an experienced provider is very important. Drivers must be extra careful when pulling a bulk tanker trailer of liquid freight. Just as you must be careful when carrying a glass of water, liquid freight in a bulk tanker sloshes around with movement. If a driver brakes too hard or turns too fast, the weight of the liquid freight can surge to one side and topple the trailer. And if the freight is hazardous, then massive environmental damage can also happen.

Outside of concerns about a toppled trailer, drivers must be mindful of other issues. For example, what happens when you shake or stir liquid? It agitates and causes foam. This also happens with liquid freight during bulk transport. While foam can be annoying when later unloading the trailer, at worst, too much aeration can ruin a shipment depending on the kind of liquid.

Another thing that can go wrong when transporting liquid freight is contamination. Therefore, tank washing is a requirement for every shipment. If a tank isn’t properly cleaned before the next shipment is loaded, residue from the previous shipment can contaminate it.

Lastly, leaky tanks are another serious issue with bulk liquid shipping. If a leak goes unnoticed, even a small one, a significant amount of product can be lost during transport.

WHAT KIND OF EQUIPMENT IS NEEDED FOR BULK LIQUID TRANSPORTATION?

Bulk liquid freight cannot be transported without the proper equipment. Most often, a bulk tanker trailer is needed to haul liquid freight. A bulk tanker is a large, cylindrical metal tank pulled by a standard freight truck.

But there are several different kinds of tankers that can be used for the bulk transportation of liquid freight. For example, there are tankers designed to keep a product’s temperature regulated or tankers with hoppers on the bottom to make unloading easier. In addition, some tankers include pressurized tanks or acid-resistant tanks. Which type of tanker you’ll need is determined by the liquid freight you need to transport.

Some questions to ask yourself, or that your provider may ask of you, to determine what kind of equipment is needed are:

- What bulk liquid do you intend to transport?

- Is the freight hazmat?

- Is the freight temperature sensitive?

- What volume are you transporting?

- From what kind of container(s) will you be loading it?

- Can the loading facility accept a center or rear unload trailer?

- Does the tanker truck need special connectors?

- Is a pump or compressor required for unloading?

- Can the customer accept air compressor offload?

- At what pressure can the tanker unload?

- Does the product need a rubber-lined trailer?

- Are there any prior content restrictions we need to be aware of?

- Will you need a dropped trailer?

- Do you need any extra hoses for loading or unloading?

- What are the pre and post-wash requirements?

Types of Tanker Trailers for Liquid Freight

Tanker trailers can be categorized into two categories, depending on the content they transport or their structures.

Tankers by Structure

General Purpose Tanker

These tankers are used to transport bulk liquid freight that doesn’t require special care or procedures. They are usually made of steel.

General Purpose w/ Heat Coils

These tankers are the same except for the addition of heat coils to help raise or maintain the temperature of the product.

Pneumatic Tanker

These tankers have a series of hoppers on their underbellies to help with unloading. Although pneumatic tank trailers are mostly used to transport dry bulk freight. They are also effective for liquid bulk.

Vacuum Tanker

This is simply a tanker with a pump to help load bulk liquid from underground or any other location into the tank. These tankers are most used to transport septage, industrial liquids, sewage, or animal waste.

Rubber Lined Tanker

These tankers are commonly used to transport corrosive chemicals.

Aluminum Tanker

These lightweight tankers can carry more volumes before reaching their weight limit and have lower operating costs. They are typically used to transport petroleum and petrochemicals.

Compartmentalized Tanker

These tankers have compartments built into them that allow tanker carriers to ship different chemicals.

Fiberglass Reinforced Plastic Tanker

These tankers are most used for food-grade bulk liquids, corrosive chemicals, and other hazardous liquid freight.

ISO Tankers

These tankers are built according to the standards of the International Standard Organization (ISO) for the shipping of most bulk liquid freight.

Tankers by Liquid Content

Fuel/Petroleum

These carry gasoline, fuel, oil, or propane. Most often these tankers are required to carry a hazmat certification, also making this a more dangerous job.

Food Grade

These tankers carry liquid freight like water, milk, or juice. These tankers can be equipped with heating or cooling systems for temperature control.

Chemical/Acid

These are used to transport many types of industrial chemicals. Some are designed to carry corrosive chemicals.

But Wait, There’s More…

Before we move on to the next section, two things you might want to know about are baffles and tanker weight limits.

Baffles

What are baffles? Remember when we spoke on liquid agitation earlier? That’s where baffles come in. Most tankers have baffles on the inside to help reduce the movement of the liquid. They act as different chambers to help divide the liquid up into smaller compartments, so the entire weight of the liquid is prevented from surging up against the side of the tank.

Tanker Weight Limits

Tankers are not limited by the amount of liquid they can contain, but by their weight. The U.S. Department of Transportation mandates that the maximum weight limit for trucks on public roads cannot exceed 80,000 pounds. So, if the liquid you need to transport is dense, like syrup or paint, you might not be able to fill an entire tanker truck. This is essential to keep in mind when arranging your bulk liquid shipments.

HOW DO YOU TRANSPORT BULK LIQUIDS?

Now that we know what kinds of equipment are used in transporting bulk liquid freight, let’s talk loading and unloading. These proper handling procedures ensure your liquid freight is transported safely.

Loading and Unloading

Before loading, the carrier must have the tanker cleaned so that it is without any residue or odor. The only time a tank washing may not be required is if the tanker is transporting the exact type of chemical it most recently unloaded.

They must also thoroughly inspect that nothing is out of place and there are no leaks. If there is any concern, the entire tank can be filled with water to test for leaks. Not only is a leaking tank inconvenient and expensive, but it’s also illegal.

There are two major methods for loading and unloading liquid freight from a bulk tanker: compressors and pumps. Pumps suck the liquid out of the tank while air compressors rely on pressure to force liquid out. It’s important to know that you cannot use air compressors for any flammable liquids as static electricity could build up and cause a spark.

Fun fact: When you unload a tanker of liquid freight using a pump, you must vent it by opening the hatch on top. The trailer can implode if this step is missed, just like your pressurized cooker at home. However, if you’re unloading with a compressor, make sure the hatch is closed.

When a bulk liquid shipment arrives for unloading, the receiver should always first take a sample to confirm the right product was delivered and in good condition.

Hazardous Labeling

Regulations mandate that any trailer transporting hazardous materials must be labeled. This helps anyone recognize the kind of content the trailer is carrying so they know what precautions are required.

WHO IS RESPONSIBLE FOR WHAT?

It’s important to know your and other parties’ responsibilities to ensure a safely transported bulk liquid shipment.

Shipper Responsibilities

- Have knowledge of the properties of the liquid product you’re shipping

- Communication that information with the provider, along with any needed equipment or certifications

- Know which regulations apply

- Give the driver any placards, seals, or other items required

- Give the drive all paperwork for the shipment

- Provide personnel to load the tanker

Receiver Responsibilities

- Before unloading, verify that you’re receiving the correct commodity and in good condition

- Make sure there’s enough room for the delivered product

- Provide a clean and safe environment for unloading

- Assign someone to check unloading

Carrier Responsibilities

- Provide a clean tanker

- Have appropriate insurance

- Provide a driver who is well-trained and has all necessary licenses, certifications, or permits

- Provide any safety equipment required by the shipper to ensure safe loading

- Provide proper driver safety equipment, such as personal protection equipment (PPE), if the shipment is hazardous

BULK TRANSPORTATION: LIQUID FREIGHT REGULATIONS

Depending on what kind of liquid freight you’re transporting in bulk, regulations can vary. For instance, if you’re shipping liquid intended for human consumption, you’ll need to abide by any regulations set by the U.S. Food and Drug Administration (FDA), like the Food and Safety Modernization Act (FSMA).

If you’re shipping hazardous liquid freight, you’ll need to abide by any hazmat regulations.

Regardless of the kind of liquid freight you’re transporting, you’ll need to make sure the provider you work with has a tanker endorsement.

At the time this article is being published, it’s been 22 months, just shy of 2 years, with Covid-19. As time has passed and treatments and vaccines have become available, most (though not all) of life has returned to normal. A “new normal” as many now call it. In-person gatherings and events have returned, remote and flexible workstyles have become the new norm, kids are back in school, and online shopping and inflation have rapidly risen. So, what are we wishing wasn’t part of this “new normal”? Supply chain disruption.

The Start of Supply Chain Disruption

As COVID-19 began to spread, governments responded with lockdowns. Nonessential businesses closed, and panicked consumers bought out paper products, soap, and disinfectants. With many businesses closed or down to a skeleton crew, this meant longer transportation times. To make do, alternative routes and modes were sought out, but even those became backlogged too. Shipping networks started to become strained. With people staying home and governments offering financial help, online shopping quickly increased.

Amidst the waves of Covid-19 came more supply chain disruption. There was the Texas freeze that caused many manufacturing plants to shut down. Then there was the Suez Canal blockage which caused severe delays in imports from several days of being blocked. There were the wildfires that raged across the west coast, adding further supply chain disruption. As a result, companies have faced material shortages, increased freight costs, labor shortages, tight capacity, and more.

Current Conditions

In the standard supply chain, raw materials get sent to factories to manufacture goods. Then shipped to warehouses for storage, then to retailers or consumers. Currently, companies face warehouse shortages, labor shortages, tight capacity, exponentially high freight rates, and import delays. It’s gotten so bad for so long that supply chain disruption continues to be a headline in the news. Even people not in or knowledgeable about logistics are talking about it.

The hot topic in the news as of late is the overwhelming demand surging at U.S. ports. Demand for goods has grown so rapidly since the start of the pandemic that it’s equal to adding about 50 million new Americans to the economy, as reported by Insider. Lately, we’ve seen record highs in ships waiting to dock, containers waiting to unload, a lack of storage space to put goods, and empty containers sitting in truck lots and streets, with no place to go.

What to Expect in 2022

Experts continue to say that we will keep seeing supply chain disruption and delays through 2022, if not to 2023. This is because we’ll still have our current supply chain bottlenecks to work through, labor, material, and warehousing shortages to figure out, and Covid-19 remains an issue.

But perhaps we will begin to see some easing of supply chain disruption this coming year. For one, the recently passed infrastructure bill will hopefully begin to affect and strengthen supply chains through its funding into roads, bridges, and ports. More and better infrastructure will help keep certain supply chain disruptions at bay, such as offering more warehousing space and keeping bridges and roads safe and free from closing. Nonetheless, this is longer-term and farther out.

Ideally, what would give the supply chain some short-term relief would be if consumers slowed down a bit with their online shopping. It’s still expected that consumer spending will at one point switch back to travel and entertainment at some port, but no one is quite sure when that may happen.

Tips for Shippers

The past (almost) two years have shown us that supply chains aren’t as resilient as we thought they were. Considering we’re still in the thick of supply chain disruption, it makes sense to improve your supply chain and logistics. Here are some tips you may find useful in keeping your business moving forward until we get back to normal.

Consider Shortening Your Chain

Global supply chains are seeing the worst disruption in their logistics. If anything’s come to light since Covid-19 began, it’s that businesses might want to look into shortening their supply chains. One way to do this is by moving your manufacturing back to the U.S., also known as onshoring.

Identify Any Vulnerabilities

By understanding where any risks lie, you’ll be able to better protect yourself from supply chain disruption. You’ll need to take some time to map out your entire supply chain, down to your distribution facilities and transportation hubs. Though this may be time-consuming and expensive, it can help prevent you from facing a surprise disruption that brings your business to a stop and can be much more costly.

Diversify Your Supply Chain

Once you’ve identified where risk is in your supply chain, you can take that information to address it. This can be done by diversifying your resources. Instead of heavy dependence on one high-risk source, you can add more sources in locations that are not vulnerable to the same risk, so if one gets disrupted, you don’t have to be shut down completely.

Begin Holding Safety Stock (if possible)

This may not be possible for all shippers, and now may not be the best time to start this considering all the current bottlenecks supply chains are facing. But, when possible, this is something that could save you from supply chain disruption down the road.

Keep Up With Timely Communication

Communication is always needed to run your best business, but even more so during this pandemic. Make sure you are communicating properly and timely with your carriers and transportation providers on any new sanitation procedures, requirements, changes in operating hours, or upcoming closures.

Also, Keep Transparency

Be transparent with your audiences. They appreciate it more than you think.

Stay Informed

COVID-19 and many other supply chain disruptions came quickly, and the future remains uncertain. Be sure to stay updated on current developments that may end up slowing down your business.

Find Support in a Transportation Partner

Third-party logistics companies, such as Trinity Logistics, can help you find creative ways to your logistics challenges. We’re experienced in complicated situations and stay knowledgeable on what is going on in the industry. We were quickly able to pivot when the pandemic first hit, so we could keep your business moving forward. We know that even in times of disruption, the shipping industry does not stop, so neither do we.

If you’re ready to gain support in your logistics with Trinity Logistics, no matter the condition of the industry, let’s get connected.

Author: Christine Morris