Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

SIMPLE SUPPLY AND DEMAND

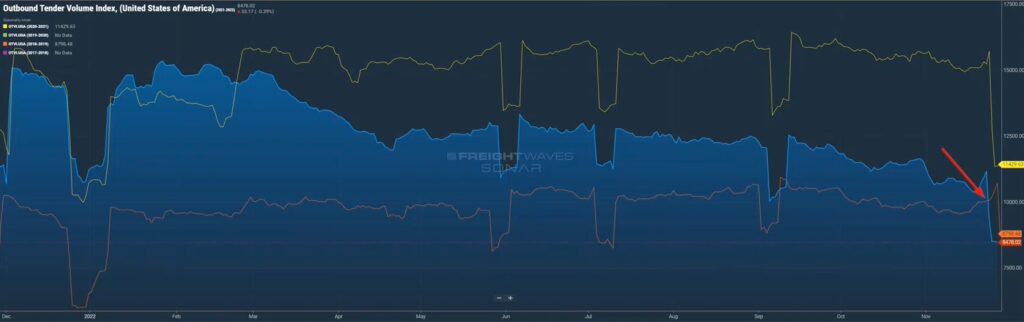

We probably all remember at some point in either our high school or college career hearing about supply and demand. A pretty simple concept that applies to goods, commodities, services, and yes, transportation. A great indicator of that is shown in Figure 1.1 which shows the growth in for-hire carriers (blue line) and the outbound tender volume index (green) since mid-2018. While this is not a 1:1 comparison, it clearly shows, especially in the past three years, how supply and demand have been the driver of transportation costs.

From roughly mid-2020 until the early part of 2022, demand was high compared to prior years, and the supply side (carriers) was trying to catch up. As a result, carriers were able to dictate rates in the market. As the supply side began to accelerate, the over-heated freight market began to normalize in late 2021/early 2022, retreating to levels seen prior to the pandemic. The rate pendulum once again swings to the shipper’s side. Some have argued based on this over-capacity situation that it could take years before there is once again equilibrium. Agree, it will take, unfortunately, attrition on the carrier side, combined with a rebound on the freight activity side to find that balance. However, taking years to do so is a bit aggressive. Most likely, mid-2024 will see supply and demand as it relates to transportation reaching a better balance.

THE GAP

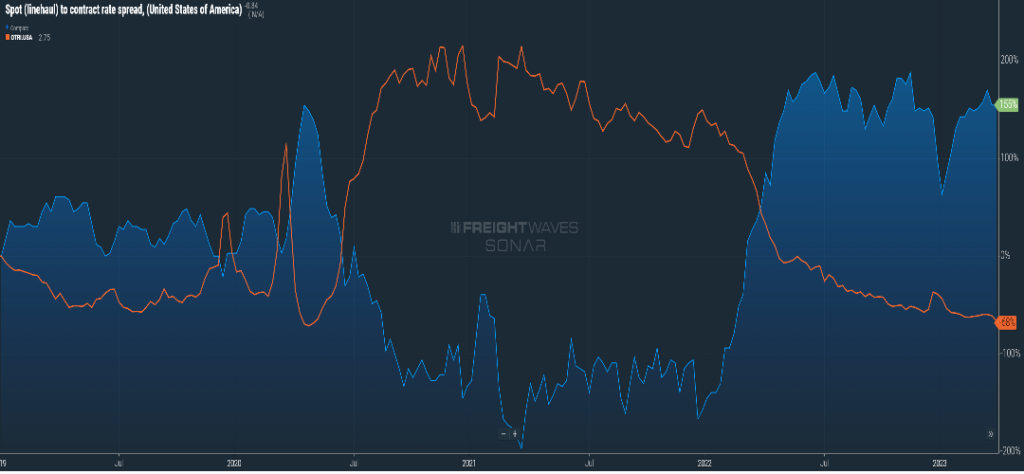

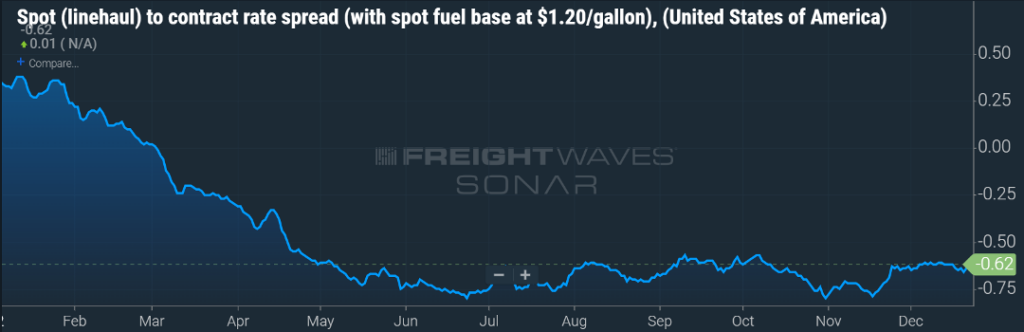

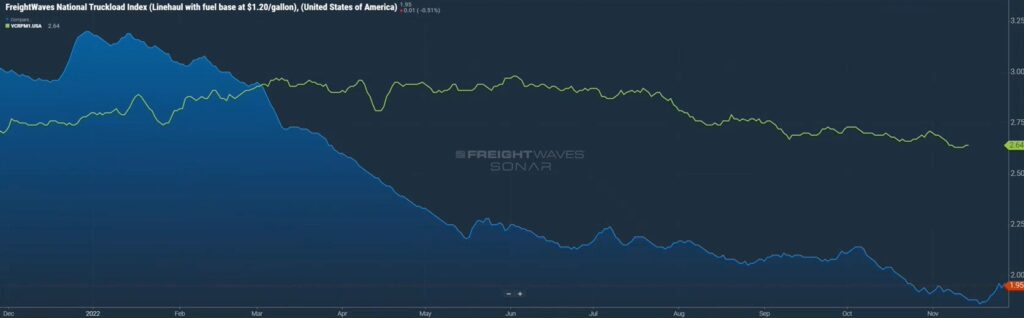

We looked at this last month, but the lag between spot and contract rates remains at historic levels. Typically, you will see a gap of maybe 10 cents or 15 cents per mile, but for the last five months, that gap has remained above the $0.50 per mile mark, currently trending at $0.86 per mile higher on the contract versus the spot side.

As you can see in Figure 1.2, that increase in the contract-to-spot gap has been in lockstep with the decreasing outbound tender rejection rate. As carriers with contract pricing are finding fewer freight opportunities versus 2021 and 2022, they are taking almost every shipment tendered their way. On average, for every 100 contracted shipments tendered to carriers, they accept 97 of those shipments. For shippers, it will be a balance between finding cost savings with spot capacity and fulfilling the requirements they have with higher-priced contracted carriers.

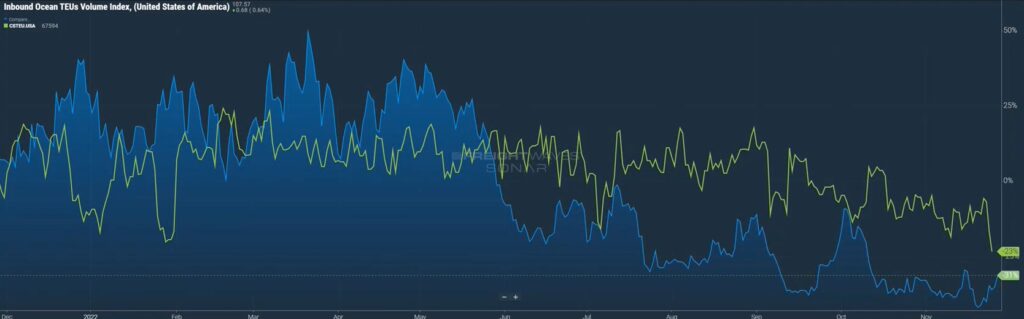

BLAH IMPORT CONDITIONS

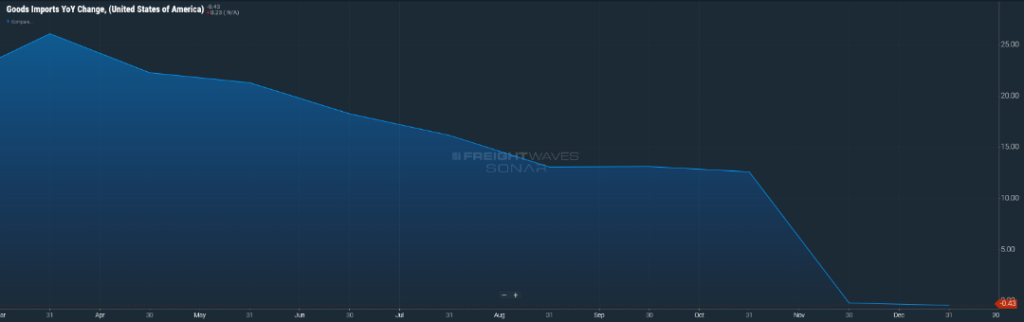

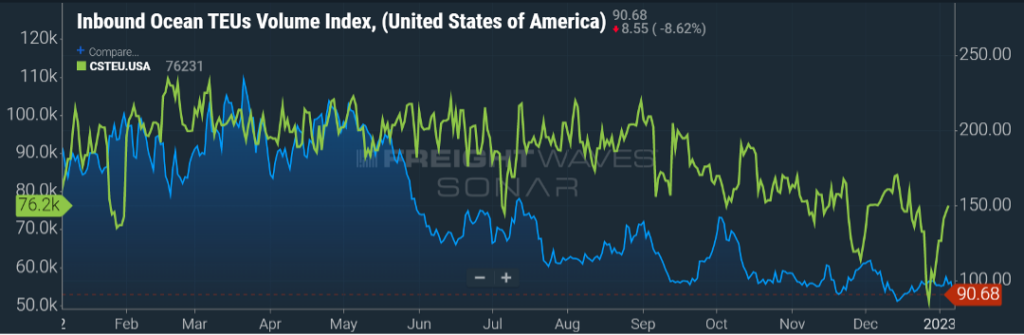

On the international side, particularly imports, we continue to see declining volumes and blank sailings. While the ports were inundated in late 2020 through the first half of 2022, that volume has stalled. Stalled to the point where the largest U.S. port of LA/LB encountered almost 100 ships at one point waiting to offload to now having “plenty of good parking spots available.”

Figure 1.3 clearly demonstrates the decline in consumer demand, along with near-shoring efforts, and the year-over-year impact. Expect, for lack of a better word, blah import conditions throughout 2023 with a rebound on the horizon for ’24 and ’25.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

WHEN WILL FREIGHT VOLUMES START TO IMPROVE?

That is the $64,000 question. Since the start of the year, freight volumes have been stable but certainly suppressed as compared to the last few years (Figure 1.1). In addition, the rate at which carriers reject shipment tenders is almost nil, with almost 97 percent of the freight tenders being nabbed by carriers with contract pricing.

We will certainly see the seasonal freight patterns in 2023, with produce and outdoor products providing a boost in the coming weeks. And the end-of-year push for back-to-school and Christmas should also lend a boost, although that end-of-year buying seems to be more spread throughout the year. Many in the industry got accustomed to an over-heated, reactionary market over the past few years. With that as the backdrop, the one word I can think of to describe how the market will feel is “blah” in 2023.

Contract rates continue to outpace the spot market. While carriers with submitted contract rates are right-sizing rates in response to the market, expenses that have been exaggerated over the past few years, such as driver pay and benefits, maintenance costs, and insurance premiums, are keeping contract rates well above spot.

As one can see in Figure 1.2, as rejection rates have declined, meaning less freight being pushed to the spot market, it has a mirror effect on the spread between contract and spot rates, currently sitting at $0.84 less per mile on the spot side. Shippers will continue to fulfill their contractual obligations with regards to tendered volume, but being able to utilize the spot market does bring cost savings to shippers.

Finally, activity at the ports continues to decline, especially on the import side. As seen in Figure 1.3, just a year ago, ports were handling 10-20 percent more inbound volume, that change today is a decrease from a year ago. Inventories have been replenished over the past year and a half, and consumer demand for goods is less. This trend is most likely to continue through the year, driving the spot container cost down and subduing activity around U.S. ports.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

SOMEWHAT HO-HUM

The current landscape for over-the-road freight looks like what it was a month ago. Freight volumes are lower year-over-year (YoY) but seem to have found a floor.

If anything, the flat lining of volume (Figure 1.1) we are seeing is eerily like what we saw in the early part of 2020. And that is not just relative to freight volumes.

Back in ’20, carriers were snatching up tenders as soon as they were offered, with rejection levels hovering in the five percent range. Right now, we are just below that five percent mark. It’s anticipated that freight flows will follow their seasonal patterns, albeit at reduced volumes compared to what we saw in 2021 and most of 2022. Spot rates continue to trend lower than contract rates, although that gap continues to shrink. It’s also anticipated that contract rates will continue to slide while spot rates should be pretty near their floor.

DECLINING PORT ACTIVITY

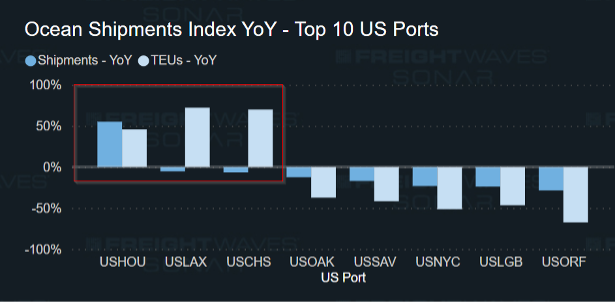

Imports will continue to weaken over the next several months. While some ports have seen slight increases in YoY volume, that increase is not indicative of an overall volume surge. It’s due to the shifting of where the freight is entering the U.S.

So, while ports like Houston (up 5.2 percent) and Baltimore (up four percent) are robust with above-average activity, major entry points like Los Angeles (down 30 percent), Oakland (down 58 percent) and Seattle (down 41 percent) are feeling the lack of volume. An opportunity should be seen with export activity (Figure 1.2). While the U.S. dollar losing value is not good for imports, it has the opposite effect on export activity.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Not Interested in Reading? Check Out Our Video Instead!

2023 Crystal Ball

It’s usually this time of year when predictions for the upcoming year start to make headlines. It’s safe to say that most folks could make some predictions based on what has transpired recently, so I wanted to highlight a few of those as we kick off the new year.

The gap between spot and contract rates will stabilize.

Now, this does not mean that they will be equal – that rarely happens. Just about a month ago, the spread was quickly approaching $1.00 per mile between contract and spot rates (with contract being higher). That gap is slowly starting to shrink (Figure 1.1). Some of that is due to spot rates seeing a holiday bump, and part of that is related to new contract rates taking hold. With many carriers taking an extended break from the road since mid-December, less capacity has pushed spot rates higher. This upward trend will be short-lived and expect rates below $2.00 per mile to become the norm as we chug through winter and into early spring. Contract rates will also trend downward, finding a floor most likely in the middle part of the year.

Few sectors will see bright spots in 2023.

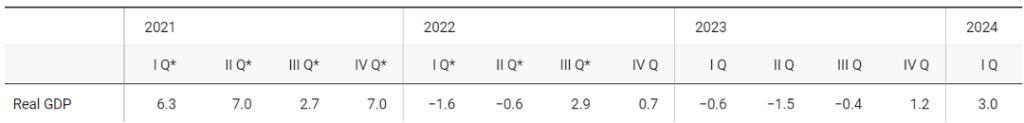

I don’t think anyone thought the economy could continue to chug along at its rapid pace seen in the latter half of 2020 and through most of 2021. Even though 2022’s growth was not as robust as the prior year, the U.S. Gross Domestic Product (GDP) should seek out a modest two percent growth rate. However, where that growth occurred sets the stage for this year.

2022 saw a return of spending on services versus goods. So, while things like healthcare are important to the overall economy, from a freight standpoint, service spending has much less impact on transportation. Expect auto sales, both new and used, to continue their strong run. As parts and inventory issues continue to be resolved, vehicles with temporary tags will be more commonplace as Americans continue to purchase cars and trucks.

On the opposite end, most notably, the housing market will have a rough 2023. With Americans seeing inflation compete for more of their take-home dollars, and the cost of borrowing increasing, many will choose to remain in their current situation. And it’s not just the building materials that will see less of a demand. With fewer new homes comes less demand for things that go in those homes – like appliances, carpets, and furniture.

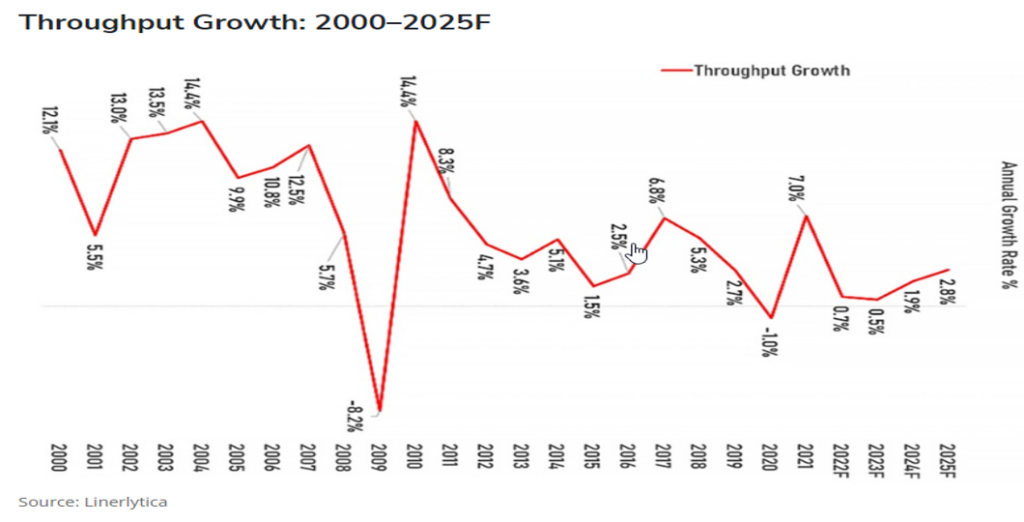

Following the building industry, manufacturing will be the next downstream effect, and banking will also see less demand for consumer and business loans. Overall, expect 2023 to see, at best, no year-over-year (YoY) growth in GDP, with 2024 being a rebound year (Figure 2.1)

Import activity will continue to slow.

As we saw in last month’s update, Figure 3.1 shows the impact of the ship backlog being resolved and container movement starting to slow. That will be a common theme this year. While 2022 saw year-over-year import activity down almost 20 percent, that downward YoY story will continue in 2023. This will have an immediate impact on intermodal activity, but also over-the-road and less-than-truckload volumes will feel the impact.

One thing to keep in mind as we see recent actual and forecasted numbers showing negative, that is against a backdrop of a very successful 2021 and modest growth year in 2022. So while 2023 will not continue that positive trend, by comparison to a recent down year like 2019, 2023 will be up from an overall volume standpoint versus just a few years ago.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

As we near the end of 2022 and the start of 2023, let’s look at three things in relation to the freight market: freight volumes, the rates, and what’s happening in the maritime segment.

SLOWING FREIGHT VOLUMES

In Figure 1.1, you can see the contracted outbound tender volume index over the past four years. The yellow line on the top represents 2021, the blue line represents 2022.

Since about the end of the first quarter of this year, we started seeing those volumes pacing around the same way as last year, but then all of the sudden they started to take a nosedive. Contract volumes are down around 15 percent below 2021 levels. What that means is we’re seeing less volume trickling to the spot market and this trend will certainly continue as we go into 2023.

FALLING RATES

Speaking of rates, in figure 2.1, you’ll see the top green line represents the average van rate for contracted freight. The blue line is vans for the spot market.

As you can see, just like with freight volumes, they were running neck and neck until about March, and then there was a discrepancy. We’re seeing this on the rates side as well. Typically, the difference between contracted and spot rates is maybe 10 or 15 cents per mile. The fact that right now it’s about 70 to 80 cents a mile, we’ve never seen it at that high of a discrepancy. We do feel that as we get into the bidding season, new contracted rates will start to kick in, so we do anticipate that the green line will trend down. I’m not sure how much the blue line, the spot line, can continue to go, as it’s currently sitting at just below $2.00/mile. We may soon reach a point where carriers are not profitable on spot rates.

FINDING MARITIME BALANCE

On the maritime side of things, in figure 3.1, the green line shows the number of actual containers that are clearing customs. They are coming off the ships, being unloaded, and clearing customs to be distributed via warehouses, intermodal, truckload, and what have you. The blue line shows the number of actual import bookings that have happened.

You may say to yourself, that doesn’t make sense. If somebody is booking freight and that number is going down, how come we are still clearing these containers? Remember, throughout much of 2021 and even 2020, there was a backlog of ships, particularly on the West Coast, waiting to get unloaded. So, while the flow of ships is not coming into the ports as greatly as it was, it just kind of shows you how big of a backlog there was, that it’s taken six months and we’re still not through this backlog of ships, both on the West and East Coast.

Overall import volume is down 20 percent year over year. Yet, East Coast and Gulf ports are up as shippers moved their freight to the East Coast when the West Coast was originally facing backlog delays.

KEY TAKEAWAYS

Low, single-digit rejection rates on contracted freight mean less is hitting the spot market, by some accounts 30 percent less than last year.

Carriers need, and we need carriers, to remain solvent. Be diligent in negotiations with carriers but understand that we are very close to the floor for when a carrier becomes unprofitable.

Less freight is coming through the ports. Short-term will trigger an over-supply situation, particularly on ports with declining YoY volumes like Los Angeles and Long Beach. Other ports like Savannah, Houston, New York, and New Jersey will see more capacity balance.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Join Our Mailing List for Frequent News UpdatesManaging transportation costs is a top challenge for shippers, while another challenge that goes in hand is sourcing consistent and reliable capacity. Here enters the contract and spot markets. Which one is best? Which has better shipping freight rates?

Some believe the spot market is the way for shippers to save money and stay on top of capacity, while others think it’s contract. Choosing to use spot rates versus contract rates can be one of the biggest decisions for a logistics manager. Understanding their differences and when is best to use them will help give your business success. So, let’s dive into each of these markets so you can better determine your business’s strategy.

WHAT ARE SPOT RATES? WHAT IS THE SPOT MARKET?

Spot freight rates are short-term transactional quotes for moving freight. These shipping freight rates are the price a transportation provider offers a shipper for a one-time quote to move their product from origin to destination. They reflect the real-time balance of supply and demand in logistics and the truckload market.

The quote is based on the value of the equipment needed at the moment of settlement. What determines the value of that equipment? Well, whether there is an excess or shortage of that exact equipment in the market and the lane at that time. Because market conditions directly affect spot rates, they are dynamic and can change day to day, even hour to hour. This is because the freight market can be more complex than simple supply and demand.

Thus, an increase in supply will lower spot rate prices if not accompanied by increased demand. And an increase in demand will raise spot rate prices unless accompanied by increased supply.

How to Track Rates in the Spot Market

You can keep track of the spot market through several industry websites and freight load boards to give you an inclination of what’s happening in the spot market. Some resources we like to follow are DAT and FREIGHTWAVES.

We even push out a monthly update to keep you in the loop of rates and other happenings in logistics. You can find our latest Freight Market Update on our YouTube channel.

It’s crucial to stay on top of the spot market should you find the need to use it. Even if you decide to use contract freight, it’s good to keep a pulse on it as contract rates are affected by the spot market. The higher spot rates are, the higher contract rates are too.

Who is the Spot Market Best for?

Many carriers, shippers, and third-party logistics (3PL) companies turn to the spot market for competitive rates. No matter how big or small, every shipper will move some of their freight on the spot market at some point. The spot market is great for when you might have a one-off shipment outside your usual shipping lanes. It’s good for shippers who don’t have enough regular volume for contracts or those who need more capacity than they contracted out. Or even those specialty shipments or non-standard load requirements.

Spot Market Pros/Cons

HOW TO GET YOUR BEST SHIPPING FREIGHT RATE ON THE SPOT MARKET

Provide Accurate, Detailed Shipment Information

Though you can get a spot quote with as little as the origin and destination zip codes, pick-up date, and equipment type, it’s best to have ALL shipment information ready. Excluding any critical information may have you unexpectedly paying for it later. The more precise information you have, the more accurate your spot rate quote will be, so you won’t have any surprise added charges.

Information you should have for your best quote:

- Origin city or zip code

- Destination city or zip code

- If your shipment requires EXACT pick-up and delivery appointments, make sure to communicate your appointments times

- Pickup date

- Equipment type (i.e., dry van, refrigerated, flatbed, RGN, etc.)

- Commodity type

- Product weight

- Any special requirements or non-standard requirements

- Examples of special/non-standard requirements are live load or unload, “no-touch” by the driver, drop trailer, hazardous materials, multi-stop, driver assist, floor-loaded, more than two hours of loading/unloading, and equipment age restrictions.

Provide Ample Lead Time

Shippers will request spot quotes anywhere from a week in advance to the day of. Most will request them one to two business days before their shipping date. The more time you can give before your shipping date, the better, as spot rates tend to increase as the pickup date approaches.

Giving yourself a few extra days to secure pricing and capacity will usually work in your favor and lead to less expensive freight rates. This is because there will be more carriers available versus trying to find one on your shipment day.

Don’t Wait Too Long to Confirm a Good Spot Rate Quote

Spot market rates are volatile and quickly change over short periods of time. Therefore, the quote you received yesterday may be different today. So, when you find a rate that works for your shipment, don’t wait to confirm it. Instead, lock it in ASAP for confirmed pricing and capacity. Once agreed on a rate, a reliable provider will rarely change it UNLESS an important piece of information about your shipment changes.

Set Appointments During Regular Business Hours

There is usually more capacity available during regular business hours. As incredibly hard-working as they are, drivers still like to be home on holidays, weekends, or nights when possible.

If your appointments need to be precise, make sure to include that information in your quote request so your quote can be accurate. But, if you can be flexible with your times, setting appointment windows instead of strict appointment times can open you up to more capacity. For example, drivers have to manage their strict Hours of Service so a flexible appointment window can help them better plan their day.

Spot Market Technology

Many providers offer digital freight platforms and give you access to free instant freight quotes. This can be a great way to stay on top of current pricing without sending a lot of emails to different providers. Good freight providers will have logistics experts on call should you have questions or need more help. But having the ability to get quotes on demand can add time back into your day.

Be Mindful of Carrier Selection

While cost is important when choosing your transportation provider, make sure you consider several other factors into consideration. You should consider their experience, efficiency, and service. While a cheap quote is great, it can sometimes result in a missed pick-up, hidden accessorial, or even a damaged product. All this could end up costing your business more.

When shopping the spot market, shop around and get quotes from a few different providers. Once you have a few quotes, evaluate the rates while considering your shipment requirements and ask yourself a few questions about your potential provider:

- Will this provider meet my service requirements?

- Are they easy to do business with?

- Can I use their tech tools to operate more efficiently?

- If something goes wrong, can I trust them to fix it?

WHAT ARE CONTRACT RATES? WHAT IS THE CONTRACT MARKET?

A contract rate is a rate quoted by a transportation provider to a shipper for a set lane and its freight characteristics over a set period of time. Contract rates can also be known as primary rates, bid rates, committed or dedicated rates. In short, they are a long-term, stable pricing agreement between shippers and transportation providers.

The contract market is highly dependent on the spot market. Typically, the three to six months of spot market activity leading up to an RFP will influence contract rates.

Contract agreements are great for both shippers and transportation providers as the shipper gains committed capacity while the transportation provider gains fixed rates and dedicated freight volume. Everybody wins.

How Contract Agreements are Set

Contracted agreements or Requests For Proposals (RFP) can be set as mini bids (monthly), quarterly, bi-annually, or annually. However, since the contract market and its rates are based on the fluctuating spot market, it’s rare to see a contracted agreement set for more than a year to stay in tune with the market.

Contract agreements are set during the bidding process, aka the RFP. The shipper will take the RFP and send it to a network of transportation providers and those providers will reply with their quotes. At the end of the bid process, the shipper will award lanes to specific providers based on their rate, service, capacity, and any other considerations.

CONTRACT RATE PROS/cons

HOW TO GET YOUR BEST SHIPPING FREIGHT RATE ON THE CONTRACT MARKET

Any shipper has the opportunity to host a bid. There’s no set minimum shipment requirement. So, no matter how large or small you are, you can take advantage of an RFP.

Just like getting quotes for the spot market, the contract market requires detailed information to get your best rates. The more information you can tell your potential providers, the more reliable rates and capacity you’ll be able to get offered. Information that should be included in your bid:

- Commodity type(s)

- Weight per load

- Cargo value

- Estimated shipping volume for each lane

- Time frame of RFP contract

- Origin and destination zip for each lane

- Shipment frequency for each lane

- Any performance requirements

- Any special load requirements/accessorials

- Fuel surcharges

- Keep in mind that fuel surcharges account for around 30 percent of a carrier’s operating expenses, and as we all know, fuel costs can fluctuate dramatically.

- It’s important to establish your own fuel surcharge matrix for each potential diesel price and communicate that with your providers before conducting a bid. This will help you get consistent and accurate rates.

What Happens When a Contract is Broken?

Sometimes, contracts will get broken. For both shippers and carriers, breaking a contract may result in fines. Most likely when a carrier breaks a contract, they will end up with a dissatisfied customer and disqualification from future bid opportunities. While shippers will face a damaged carrier relationship, less reliable capacity, and most likely, higher rates on the next bid.

Technology Needed for RFPs

While the practice of RFPs sounds great, what’s the catch? For an RFP to work effectively, shippers need to be organized in their execution and collection of information. No matter your size, every shipper needs a way to track and store their supply chain data and procurement information. It helps to have one central location to keep all your freight volumes, provider names, and awarded lanes.

Some smaller shippers will use tools like Microsoft Excel, Google Docs, or even their providers’ technology platforms to manage their RFP data.

But if you’re a larger shipper, those tools can be overkill. Instead, 90 percent of shippers use digital platforms, often transportation management systems (TMS) to manage their procurement information. A TMS can help take the complexity out of RFPs and take your process from a few hours to a few minutes. It allows you to enter your contract information quickly, select the transportation providers you want quotes from, and click send. It will also help you have one location to easily view bids and communication around your loads, keeping you from overwhelming clutter.

Regardless of which workflow you decide for your business, it’s crucial to have a well-documented record on hand to easily reference.

WHAT’S BEST FOR ME?

Usually, no shipper runs all their freight through the contract market alone. As there are positives to each market and it can be hard to predict all volume, most shippers work to have a strategic blend of both spot and contract rates. What works best for your business will depend on the current state of the freight market, your freight, and your provider relationships.

Some questions to ask yourself when determining what market will work best for you are:

- Are my freight lanes affected by peak capacity demands during the year?

- If you answered yes, the contract market, especially during those times of tight capacity, may be best for you.

- Am I willing to take on the risk of price fluctuations?

- If you answered yes, you might want to look at the spot market first.

- Does the contract price include a capacity guarantee throughout the year, without a general rate increase (GRI)?

- If you answered yes, the contract market may be best for you.

If you have determined that your volume is sporadic and not consistent, the spot market may be best for you, but it doesn’t mean that you can’t work with a carrier contractually. You can still build an approved carrier list with strong relationships even if you have to use the spot market on every shipment.

If you decide contracted freight is best for your company, keep an eye on spot market indexes and position your RFP bidding based on the freight cycle when possible. By moving your RFPs to when the market is at its lowest levels, you’ll gain your best rates.

Some shippers budget for 70 percent contracted and 30 percent spot or 50-50. No matter your balance, the freight market is always changing and so should your strategy. Keep a pulse on the market and your business needs so you can always find what’s best for your company.

NEED HELP WITH YOUR STRATEGY FOR COMPETITIVE SHIPPING FREIGHT RATES?

A shipper’s decision in balancing the use of contract versus spot rates can be difficult. Finding a good strategy for competitive shipping freight rates can be a lot of trial and error.

If you’re having challenges deciding when to use each market, Trinity Logistics can help. We have the technology and expertise you need to simplify your logistics management and offer support. Our Team Member experts are here to help you with your logistics strategy, including offering Quarterly Business Reviews and Freight Market Updates, so you can keep a pulse on industry trends and your company’s growth.

START A CONVERSATION WITH TRINITY TODAYNo one likes spending their valuable time working on manual tasks that take forever. Streamlining operations with automation is the dream for every business, yet many companies still rely on spreadsheets and manual interactions. One way to drastically reduce your manual processes is by implementing a transportation management system (TMS). Many companies use a TMS for their logistics management, like e-commerce companies, retail businesses, manufacturers, and distributors. By adopting a TMS, you’ll be able to eliminate manual processes and focus more of your team on revenue-generating tasks. Read on to learn how a TMS can help you make the most of your time by automating your manual processes.

MANUAL PROCESS: TOO MUCH TYPING

Even if you already have a TMS, you might still be doing more work than necessary if your software doesn’t have integration capabilities for order entry. You might be stuck typing each order into your enterprise resource planning system (ERP), as well as your TMS. And if you don’t have a TMS, you certainly are spending way more time doing data entry than you should.

TMS SOLUTION

If you’re currently using an ERP, you should make sure the TMS you’re working with can interface with your system, allowing order information to transfer automatically. This prevents the need for dual entry and gives you and your team more time to focus on revenue-generating tasks.

MANUAL PROCESS: QUOTE MANAGEMENT

Shopping for shipping rates can be time-consuming if you have to look through each of your carrier’s rates on a lane, and that’s if they offer contracted rates. If not, emails and phone calls to every available carrier might be necessary for even just a single lane. And even after all that, are you sure you’ve selected the best carrier for the best rate? If you work with several different shipments, it can be time-consuming to be on the phone or going through emails asking for rates from carriers in your network. Trying to manually keep track of all those quotes can take you away from more important aspects of your business.

TMS SOLUTION

Quickly compare contracted rates or submit instant spot quote requests to multiple carriers at once with a best-in-class TMS. The carrier quotes are automatically filtered into the system by the lowest cost carrier for easy comparison instead of piling up your inbox.

MANUAL PROCESS: DOCUMENT MANAGEMENT

Manually managing documents or paperwork is monotonous and outdated. Everything from manually completing the documents to organizing and filing takes a significant amount of time. Not to mention the process of searching for the documents you need later. According to a report by CMS Wire, 36 percent of an employee’s day is spent looking for documents, with information going unfound up to 44 percent of the time. Going by those statistics, you could be spending almost three hours of your day searching for lost documents.

TMS SOLUTION

Managing large volumes of loads is timely, and in business, how you spend your time is critical. Sifting through filing cabinets or folders is not an effective use of your time. By using a TMS, all of your documentation is managed, stored, and shared digitally. Not only does this keep your information more secure, but it makes organizing and accessing your documents easier. Using a TMS is the easiest way to manage all of your documents while saving you hours of time every day.

MANUAL PROCESS: FINDING AN AVAILABLE QUALIFIED CARRIER

Calling or emailing carriers to see if they can not only accept your load but have the expertise to haul it can get quite time-consuming, especially if you’ve got hundreds of loads to cover. And even more so if you’re working with many kinds of freight. Because not every shipment is the same, the same carrier probably shouldn’t handle them all. Finding carriers best suited for your shipment needs is tough. In the midst of your workday, it’s easy to forget which carriers you’ve talked to already or those you’ve missed. This can translate to a long list of uncovered loads at the end of the day.

TMS SOLUTION

Say goodbye to the dozens of phone calls and emails previously used to secure carriers on your loads. With a TMS, you can send a load tender to your preferred carrier, allowing them to accept it electronically. If they reject the tender or don’t respond promptly, the load automatically goes to the next carrier on your list based on cost, performance, or other parameters defined by your company.

MANUAL PROCESS: SHIPMENT DELAYS/TRACKING/TRACING

Without using technology, you often won’t know about a shipment delay until your unsatisfied customer calls you. If you’re tracking your shipments, you’re usually doing this manually through emails or phone calls to find out where your freight is, which can be time-consuming and frustrating. While it can be common for several different shipments to be in transit on different company trucks and located all over, tracking can be a challenge. Without a TMS, a lot of time is spent manually tracking shipments and trying to get ahead of delays.

TMS SOLUTION

Spend less time tracking your loads and more time filling your orders with a TMS. Carriers will have the ability to provide their own status updates on each of your loads either manually or automatically, allowing you to easily manage your shipments and know in real-time whether there is a delay or not. When asked what features they were looking for in the aforementioned survey, 25 percent of shippers said they needed shipment tracking.

MANUAL PROCESS: REPORTING

Reports can be a pain to produce manually since they require merging multiple spreadsheets or pulling information from different sources. This is often done in Excel, which has no way of validating if the reports are accurate. It’s also almost impossible to track carrier performance since it’s hard to see if loads were delivered on time and who shipped which load, all on one spreadsheet. Without proper reporting, how can you really know which carrier had the best performance, what your freight costs were on specific lanes, or which carrier was cheapest the past year?

TMS SOLUTION

Forget spending precious time compiling reports from multiple spreadsheets. A TMS will give you the ability to generate all your transportation reports on demand. Do note that not every TMS can generate the reporting you may need, but a best-in-class TMS can offer you advanced reporting to go into specific logistics metrics. From gauging your monthly freight spend to rating your carriers’ performance, you can easily access it if you need it. Need it on a regular basis? With Trinity’s TMS, you can schedule reports to be run daily, weekly, or monthly and even have them automatically emailed to recipients on a distribution list.

READY TO ELIMINATE MANUAL PROCESSES FROM YOUR LOGISTICS?

With the ability to eliminate multiple manual processes, it’s easy to see why a TMS allows you to focus your time and attention on more important things, like widening your profit margin.

If you’re ready to make the move to automation to improve your logistics, we’re here to help. Our combination of experienced account management and best-in-class TMS technology offers you a customized solution to help you achieve your unique supply chain goals. Whether you’re looking for Saas, a Managed TMS, a fully integrated Outsource, or something in between, we’ll work with you to design a solution that’s unique to your business. Gain control, cut costs, improve performance, and most importantly, eliminate those manual processes!

I’m ready to eliminate manual processes with a TMS.Author: Christine Morris