B2B credit management has evolved since 2019. Here’s how to ensure your credit department succeeds.

The COVID-19 pandemic drastically changed the world, businesses, and their credit departments. It reshaped our economy. In order to meet the changing business landscape, credit managers have adapted quickly to maintain their companies’ financial stability.

Let’s briefly review the economy before the pandemic started. This will give us a clearer picture of the changes that have happened and the difficulties B2B credit managers now face. We’ll look at how your sales team can become a credit ally and close with tips on how to decision today’s B2B credit with success.

Pre-Pandemic Stability

Before COVID-19, the economy experienced comparatively stable growth. Companies were generally optimistic about their clients’ creditworthiness. The approval process for B2B credit managers was a relatively simple routine. They usually assessed customer creditworthiness based on financial statements, credit reporting, and industry benchmarks. Once a credit limit was approved, customers were generally given net payment terms.

Pandemic-Induced Shifts

The pandemic triggered a series of economic shifts that profoundly affected B2B credit practices. Government stimulus programs, supply chain disruptions, and inflation surges all contributed to a climate of uncertainty and volatility.

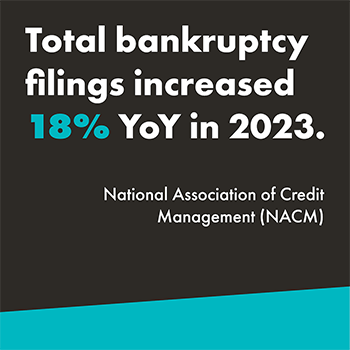

According to the National Association of Credit Management (NACM), total bankruptcy filings increased 18 percent year-over-year (YoY) in 2023.

As a result of these changes, businesses became more cautious about extending credit and credit managers had to adopt a more rigorous approach to risk assessment.

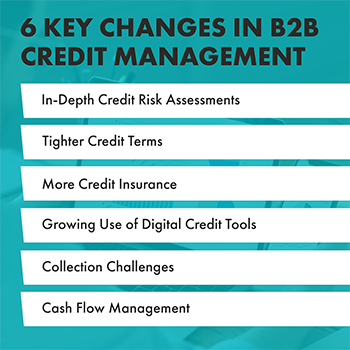

6 Key Changes in B2B Credit Management

In-Depth Credit Risk Assessments

Economic changes caused credit managers to become more reliant on data analysis to assess creditworthiness. This includes using financial modeling tools to assess a company’s ability to meet its debt obligations. Credit bureaus and alternative data sources are also leveraged to achieve a comprehensive view a customer’s financial health.

Tighter Credit Terms

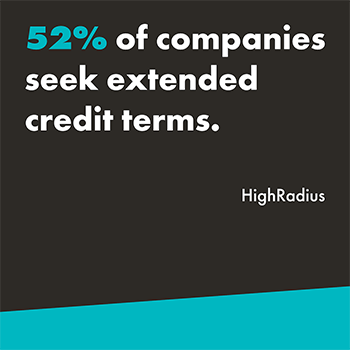

As businesses become more risk-averse, they are tightening their credit terms. This can involve shortening payment terms (e.g., from net 60 to net 30), reducing credit limits for existing customers, and issuing lower initial credit lines for new customers. According to a March 2024 report by HighRadius, 52 percent of companies seek extended terms – quite the opposite view. The same report shows that 17 percent of customers blatantly ignore credit terms while another 48 percent intentionally delay payment. This can make building strong customer relationships difficult.

Increased Use of Credit insurance

The rise in economic uncertainty has led to a surge in demand for credit insurance. Credit insurance protects businesses from monetary loss if a customer defaults on their payments. A 2023 survey by AU Group shows that since the third quarter of 2022, the number of business failures in almost every region of the world has risen. In line with that statistic, credit insurers expect growth in their sales over the next six years.

Growing Use of Digital Credit Tools

The pandemic has accelerated the adoption of digital credit tools and automation. Tasks like processing credit applications, credit checks, and collections are now being completed faster and allowing credit teams to focus on exception management.

Collection Challenges

The pandemic caused many businesses to experience cash flow disruptions. It’s made it more difficult for some companies to meet and/or maintain on time payments.

Cash Flow Management

Businesses are focusing on more effective ways to manage their working capital. This can include reworking their collection processes and closely tracking inventory levels.

Opportunity Emerges

All these changes have significantly affected credit managers and their teams. Now, they carry heavier workloads and face increased pressure to mitigate credit related risks. They also need to be able to adapt to rapid changes that may happen in today’s economy.

While these changes may have increased the burden on credit managers, they’ve also created opportunities for collaboration with sales teams. By working together, credit managers and sales teams can better service their businesses and customers.

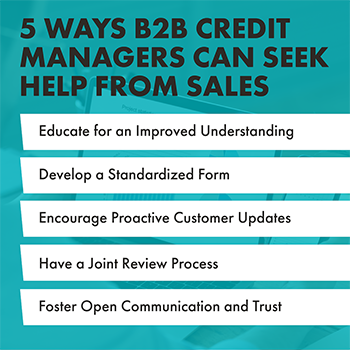

5 Ways B2B Credit Managers Can Seek Help from Sales

In today’s risky and fraud-ridden environment, the sales team support in customer onboarding and credit is vital. Credit and sales teams must collaborate to ensure a positive and seamless customer experience. Here are some tips to foster better collaboration:

Educate for an Improved Understanding

Sales teams are crucial in helping gather customer information to assess creditworthiness. Credit managers can help sales teams understand the importance of collecting this information. Sharing its use and how having it can make the approval process faster helps, too.

Develop a Standardized Form

A standardized customer information form ensures sales teams collect all the required information. This can help streamline the credit approval process.

Encourage Proactive Customer Updates

Credit teams must stay updated on customer developments. Encourage the sales team to proactively share any relevant customer updates with the credit department. Discuss what information is “relevant”, so everyone is on the same page.

Have a Joint Review Process

Joint sales and credit reviews can ensure both teams understand customer creditworthiness. They can help prevent incidents where a customer is given an okay by sales and later is deemed to be a credit risk. At the same time, joint reviews will strengthen the relationship between sales and credit while improving the customer experience.

Foster Open Communication and Trust

Open communication and trust are essential for effective collaboration between teams. Credit managers should be available to answer sales teams’ questions and provide guidance on any credit-related matters.

Is This the New Normal for B2B Credit Management?

It appears this “new normal” of post-pandemic business is here to stay, and it’s changed credit management for the foreseeable future. Because of this, we must have a more strategic and data-driven approach to B2B credit management. Those credit teams that adapt to these changes and improve collaboration with sales will be well-positioned to thrive in today’s economy. Furthermore, those who stay flexible and committed to delivering exceptional service will aid their company’s success. Will your credit team be the ones to hold revenue back or help drive it forward?

Get More Content Like This In Your InboxAbout the Author

Tracy Mitchell currently holds the position of Director of Accounts Receivable at Trinity Logistics. She has worked at Trinity for nine years, with over five years of those in credit management. She holds a Credit Business Association (CBA) designation. With a deep understanding of the industry’s dynamics, she has firsthand knowledge and provides the company with invaluable insights into the complexities of credit risk assessment, collections, and sales alignment.

If you’ve worked in the LTL industry for any bit of time, then you know that it’s always changing. Yes, sometimes that means it gets a bit more complicated. Rates adjust. Rules and processes are modified. Despite all this, there is usually one constant – the core LTL carriers we work with. Yet, in 2023, that changed; we saw the departure of the legacy LTL carrier known as Yellow Corporation.

The closing of such a large and well-established LTL carrier is very rare. The industry hadn’t felt the void of such a large company since Consolidated Freightways closed 20 years prior. So, what happened? Considering Yellow Corporation was the third largest LTL carrier, what happened to all the freight they handled?

As someone with a career in LTL, I saw this happen in real-time and have directly seen its ripple effects. I can answer some of those questions and share with you my thoughts, experiences, and observations of this impactful event in LTL history.

The Fall of Yellow Corporation

Yellow Corporation (commonly referred to as YRC) was no stranger to financial turmoil. The company was laden with debt that was worsened with the Great Recession. It almost put them into filing for bankruptcy in 2009.

A stint of other factors after that didn’t put them in a better position when COVID-19 rolled around in 2020. YRC was granted a $700 million COVID-relief loan by the U.S. government, which it used nearly half of to cover past due payments to healthcare and pensions, payments on equipment and properties, and interest accrued by its other debts. Fast forward to 2023, and that’s where their final chapter began.

A few months into 2023, YRC and the Teamsters Union engaged in back-and-forth negotiations. YRC wanted to change operational procedures and sought extra funding to help it pay off its debts. Teamsters disagreed with the proposed changes. We saw news articles and hit pieces about the conflict, week after week. It was nearly impossible for the industry to ignore it.

In July, whispers began of a possible union strike that would effectively halt YRC’s freight network. This was the writing on the wall for many shippers and third-party logistics (3PL) companies. At this point, the hull had been punctured, and water pouring in. Do you stay or do you go?

YRC and its subsidiaries were promptly disabled from countless TMS platforms. No customer wanted their freight stuck in limbo if Teamsters were to go on strike against YRC. Because of this, YRC saw a sharp decline in freight volume and tonnage. A company that was in financial disarray was now losing its primary source of revenue.

On July 30th, Yellow Corporation ceased all operations. The Teamsters had not agreed to the negotiations, and the 11th hour came and went. So, what now?

The Aftermath of YRC’s Closing

YRC’s exit affected two parties: shippers using LTL and other LTL carriers.

For shippers using LTL, they were two buckets: those who had already begun shifting their freight to other carriers in their pricing roster and those unfortunate enough to still have most or all freight with YRC. The latter had a more difficult situation to overcome as they now had to find an LTL carrier to move their freight without paying an arm and a leg.

For LTL carriers, YRC’s existing freight had to go somewhere, so they had to figure out how to absorb it. Carriers such as Estes, FedEx, and XPO and their capabilities were pushed to their limit, now drinking from a firehose of incoming freight. Volumes increased drastically, and with such a rapid rise came decreased capacity.

LTL carriers were making the difficult decision to exclude certain shippers in favor of others just to service accounts and keep their networks moving without bottlenecking. This left many smaller shippers stranded with a shorter list of available LTL carriers.

As carriers became inundated with freight, their operating ratios took a hit, and something had to be done to regain control. A season of atypical general rate increases (GRI) began. LTL carriers needed to remain profitable lest they succumb to a fate like Yellow.

3PLs and shippers alike started getting notifications from their carrier representatives about rates going up. Shipping LTL got more expensive now that the carriers had to pick and choose who they serviced with their finite capacity. The increased rate structures also priced out shippers that were used to YRC’s competitively priced tariffs or couldn’t stomach the increases.

For many shippers and 3PLs, the immediate aftermath of the Yellow Corporation bankruptcy was unlike any they had previously experienced.

Now, that’s the long and short of it, but how are things today? Surely, the disappearance of a significant LTL carrier like that would have lasting, irreversible affects.

Well, yes, but also no.

The Current Impact of YRC’s Closing

Today the LTL industry has mostly stabilized. YRC’s freight volume has dispersed, and the dust has settled. The LTL carriers have course-corrected their capacity concerns.

After the YRC bankruptcy, there were also new questions to answer, one of which was “What happens to their assets?” Those went through the bankruptcy courts, but the LTL carriers were eager to get a piece of it.

The purchased terminals and trailers meant increased footprint and capacity, which can be the difference between being the best and the biggest for LTL carriers. Several carriers bid to acquire the terminals left behind by Yellow Corporation.

Estes Express, a prominent national LTL carrier, was one of the larger victors in the bidding war. As one of Trinity’s carrier relationships, I asked Estes if they could share the impact YRC’s exit had on their company. Here’s what President and COO Webb Estes had to say:

“Estes acquired 29 terminals and a large amount of equipment as a result of Yellow’s exit from the marketplace. I can’t say enough for the dedication and resiliency of our team to work together tirelessly to quickly bring them online and add to our steady capacity growth. In addition we purchased several tractors and trailers, and we were also able to buy many smaller items – such as load bars, airbags, and freight tables – all of which help us do an even better job protecting our customer’s freight,” said Estes. “One other surprising benefit is that the additional freight we’ve taken on has allowed us to add more direct linehaul lanes, and we’re seeing better overall service in 2024 compared to last year.” Estes added, “This is a great example of how Estes continues to invest wisely in assets and capabilities that create capacity, opportunity, and resiliency for our company and those we serve. And that remains a primary reason why customers from coast-to-coast continue to rely on us for their shipping needs.”

While LTL carriers, larger shippers, and 3PLs came out in the black or relatively unscathed, others did not. Smaller shippers with all their freight lanes with YRC had no backup plans except to pay increased, non-discounted LTL rates with other carriers or risk their business operations.

How Did Trinity Logistics Fare?

At Trinity, those first few months after the bankruptcy were interesting! We saw many new shippers start a relationship with us and saw some complications in LTL carrier transit lanes that bottlenecked. Don’t worry, they were quickly resolved. Since Trinity has a broad roster of national and regional LTL carrier contracts in place, our shipper relationships were able to use our rates to course correct from the YRC closure and effectively avoid any critical disruption.

Is the last time we’ll see an industry-shaking event in the LTL space? Likely not. For now, the industry is stable, and many LTL carriers are growing and reporting profitable earnings.

In my 10+ years working in the LTL industry at a 3PL, the Yellow Corporation was always a top LTL carrier for us. Seeing them fade into the wind after decades of LTL service was surreal, and I felt sad for the many YRC employees I’ve grown to know.

Despite such an impactful event, now written in the history books, it’s a year later, and the LTL landscape is still thriving (and volatile), even with one less player at the table.

Final Thoughts

Considering the size of Yellow and the steady decline until evaporation from the industry, I actually expected more disarray from it. Sure, the first weeks after the bankruptcy had the GRIs, shipment delays, and new shipper partnerships for Trinity to handle, but after a month or two, it was relatively smooth sailing back to normal.

I think that speaks volumes to the age we live in. The amount of technology and time-saving efficiencies that LTL carriers invest in year after year. It allowed the industry to absorb the freight volume of one of the largest LTL carriers in the world and it did so in less than 60 days! It’s kind of crazy and a testament to the LTL industry and its controlled chaos.

Working with Yellow for so many years, I grew familiar with some of the names worked there. People we would see at conferences, have calls with or see on emails. People who had been in the industry much longer than I have, had extensive backgrounds, and grew their roots at Yellow.

The bankruptcy landed them in the middle of it all, but many of them went on to other LTL carriers and took their experience, adding value there. I think that’s a silver lining here. Despite the financial decision of Yellow as a company, it had people on its roster that brought purpose to LTL and now these people are creating an impact for other carriers and customers alike. For how vast it is, the LTL industry can be closeknit, so to see those former Yellow employees succeed at other LTL carriers is a bright spot in this saga.

Learn More About Trinity's LTL Services Get More Content Like This In Your InboxABOUT THE AUTHOR

Curt Kouts holds the Director of LTL position at Trinity Logistics. Kouts has been with Trinity and in the logistics industry for 14 years, having held several titles among carrier vetting, account management, and within the LTL Team itself. His main responsibilities as Director focus on elevating Trinity’s LTL customers’ experience, helping the LTL Team support in operations and billing, and aiding the company in overall LTL sales and success. Kouts finds the LTL industry incredibly challenging, presenting him and his Team a ton of problems that they have a passion for solving. He enjoys learning more about LTL whenever possible and overall, making LTL an experience that keeps all his customers, both internal and external, coming back.

The COVID-19 pandemic is currently turning the world upside down. With the changes caused by it, the logistics industry has been evolving with it. Many brokerages have been struggling to keep up with the changing freight patterns. However, this week it was announced that Trinity Logistics ranked three spots higher in the Transport Topics Top Brokerage Firms listing, from #18 to #15. Trinity has continued to grow despite any industry disruptions last year and will continue to move forward amidst this pandemic.

Technology

Trinity has invested in technology over the years to maintain the resources needed by customers, carriers, and Team Members. Due to this forward-thinking, all Team Members were prepared to transition to a remote work environment before shelter in place orders were issued by the governments. The entire company was remote within days and without skipping a beat. This focus on technology preparedness ensured that the service level never faltered. Trinity’s goal is to keep our Team Members safe while continuing to serve the needs of our customers and carriers.

It is because of the Technology Team that Trinity has also been able to continue to grow our technology services and offerings during this time. This week, Trinity launched the new Book Now option as one of a handful of brokers given early access to partner with DAT in this new venture! This feature will continue to enhance our ability to handle increased freight needs and strengthen the tools Team Members and Authorized Agents have to grow.

Financial Stability

Trinity Logistics has a long history as a financially stable company. From being able to pay Authorized Agent commissions weekly upon delivery, extending credit to all sized companies, and offering quick payment options for carriers. Trinity’s solid foundation of 40 years in business has prepared our company to continue these practices even in times of crisis. During this time, it has been reassuring for our carrier network that Trinity has been able to keep up their quick payments. Our Authorized Agents are a huge asset. The foundation that we have established allowing Trinity to continue to pay commissions to this team without change has been a great way to serve these small businesses.

Legacy

In 2019, Trinity Logistics celebrated their 40th Anniversary and in 2020, are celebrating the 30th Anniversary of the Authorized Agent Division. Now a Burris Logistics company, Trinity Logistics has a long history of thriving in both growing and challenging markets. The continued success and growth of Trinity doesn’t depend on the challenging times, but on the Guiding Values that every Team Member and Authorized Agent live every day: Integrity, Legacy, Determination, Teamwork, Continuous Improvement, Excellence, Leaders, and Fun! These values were instilled in the company 40 years ago by the founders Ed and Deanna Banning, and continue to drive the company forward today.

The one foundation and most valuable asset that continues to drive Trinity Logistics forward are the Team Members. Trinity’s Team Members and Authorized Agents live the Guiding Values every day and put the needs of others first. Developing customized solutions, delivering excellent service, and constantly striving to be their best is what will drive Trinity Logistics through any challenging time.

Are you looking to learn more about how we can support your growth as an Authorized Agent?.

AUTHOR: Jennifer Hoffman