Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

What to Expect in the Short-Term

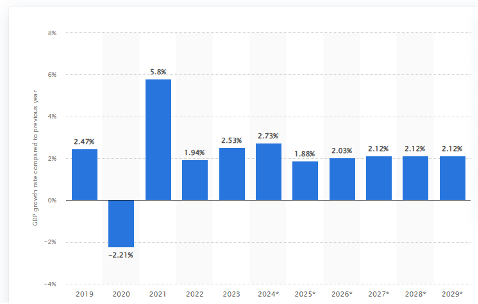

Well, so much for a recession. The U.S. is anticipating year-over-year growth of 2.8 percent in 2024 with regards to gross domestic product (GDP). That percentage of growth appears to be trending less in calendar 2025, with moderate growth forecast through the end of 2029 (Figure 1.1).

Generally, for every one percent of GDP growth, that typically translates into 1.5 percent growth in over-the-road truckload volume. Based on those projections, we expect freight volumes to climb by four to five percent in the coming year.

Conditions are also turning more favorable for a pendulum swing to the side of the carriers. Two reasons for the bullish outlook – dwindling capacity and tariffs (be it threat or real), simple supply and demand.

INCHING CLOSER TO BALANCE

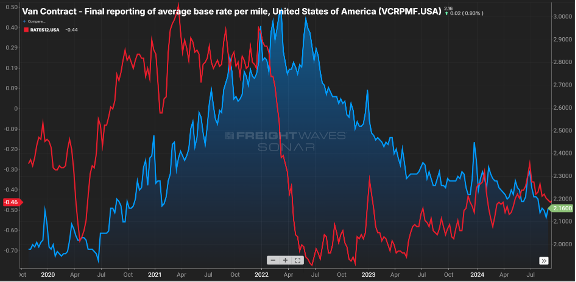

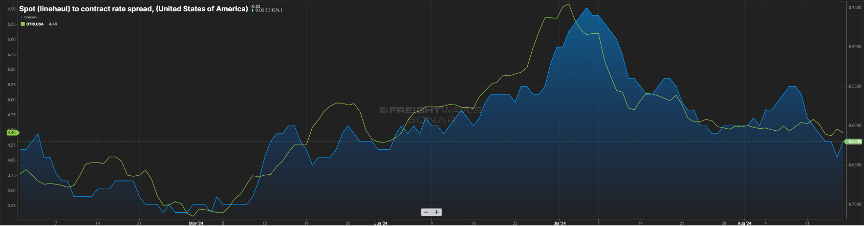

On the capacity side, the spread between contract and spot rates, which was near $0.80 per mile in the middle of 2022, has now fallen below $0.50 per mile. Keep in mind contract is almost always above spot sans latter 2020 and early 2021.

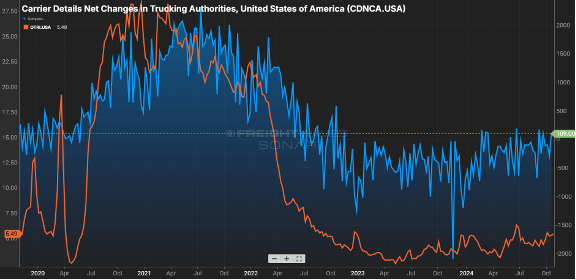

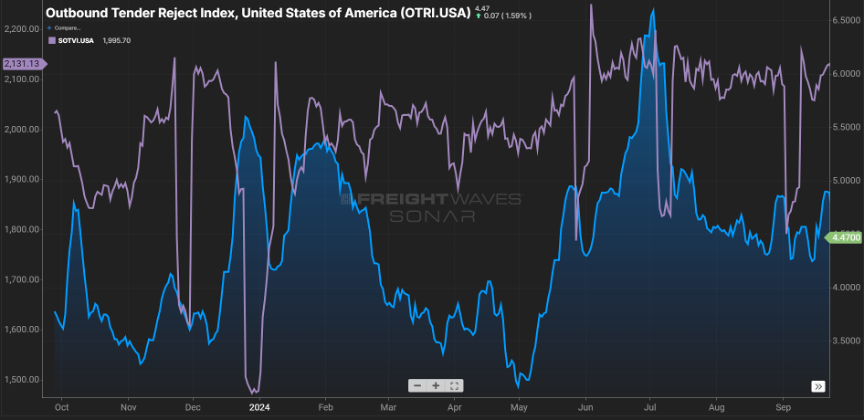

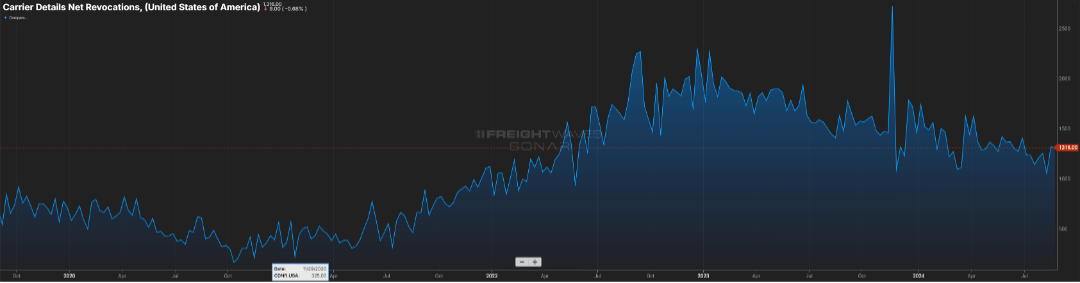

The gap has closed primarily due to contract rates receding, from the $2.30 range in early ’24 to now being $0.15 less, as illustrated by. Figure 2.. Figure 2.2 shows the net change in for-hire carriers versus the tender rejection rate. Since mid-2022, carriers have started to shun the market as higher costs to operate & lower rates made sustainability a challenge.

Where does shrinking capacity first show up? In the tender rejection rates. Carriers will say no to a guaranteed rate load either because they have no equipment in the area or there is a more favorable paying load available.

Rejection rates cresting the five percent mark may not sound significant, but keep in mind rejection rates were in the two to three percent range as we started this calendar year. Eight to 10 percent is a more balanced market, and we are close to that. Usually, rejection rates in double digits signify more pricing leverage is held by the carrier community.

The other driving factor is around demand. While there are some sectors showing slight gains, the November election could be the spark that drives a glut of freight movement.

With Republicans poised to control the White House and Congress, impending tariffs will drive a flurry of activity as shippers look to move goods prior to an imposed increase in cost, This is likely a short-term surge as “too much inventory” is a real thing, and once tariffs are imposed, consumers ultimately will feel the brunt of increased costs and could hamper purchasing. However, the next pivot point will be around movement of production to domestic U.S. or near-shore locations.

After a blah few years, things are about to get interesting.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Feels like 2022

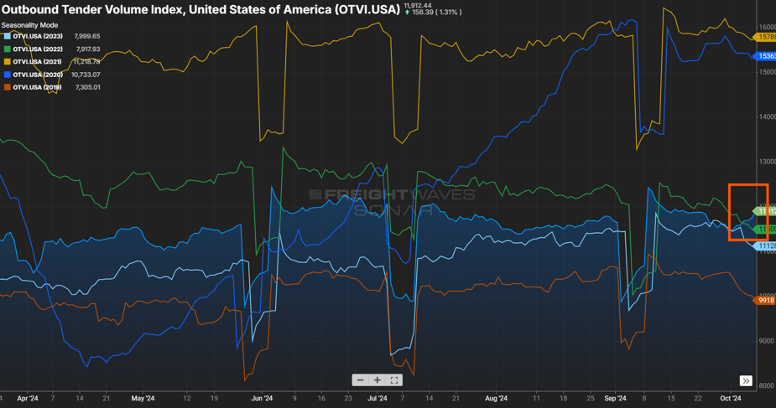

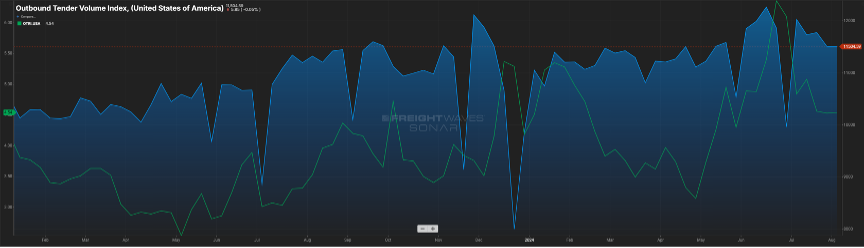

For the majority of this year, volumes have seen their traditional seasonal patterns and have been trending above 2023 levels. Many have commented that market balance will be driven more by carrier attrition versus an event that spurs freight volumes.

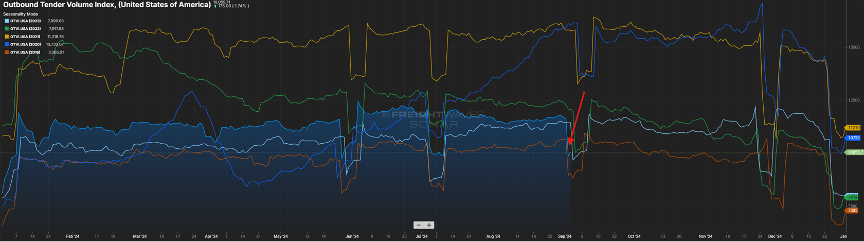

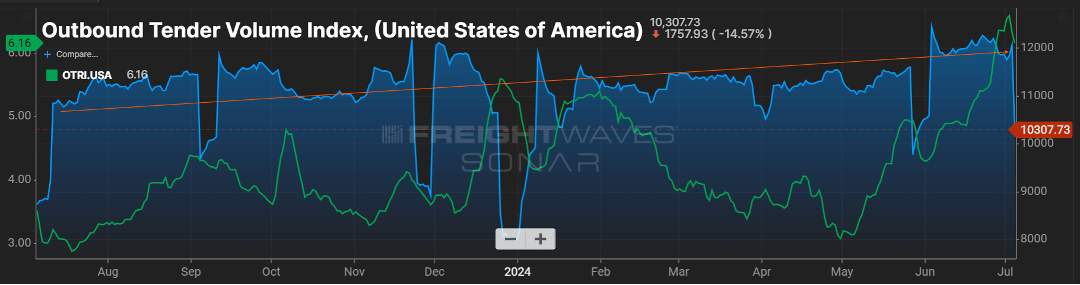

2022 was a pretty good year from an industry standpoint. Volumes were still elevated (certainly not like we saw in 2021) and capacity was inline. While it may be a blip on the radar, we have now seen the Outbound Tender Volume Index eclipse 2022 levels for the first time in two years as seen in Figure 1.1.

I think it is still too early to pin the volume uptick on the interest rate reduction or the recent hurricanes that severely impacted states in the southeast, but these events, and any potential storms that might still pop up (hurricane season isn’t quite over yet), could impact freight volumes in the coming months. Combined with consumers continuing to spend, volumes could remain consistent through the end of the year versus following their traditional end of year downward movement.

FINE….FOR NOW

While there was a sigh of relief from many with the ILA and USMX reaching a deal on wage increases for dock workers, this does not mean that everything is resolved, and potential port disruptions could occur at the 20-something docks along the East and Gulf coast.

Union-member wages were the major bargaining chip that was agreed upon last week, with dock workers receiving an immediate pay increase, with yearly pay increases to follow. When all increases have taken effect, dock workers will see a 62 percent increase in pay. One issue that was not finalized was the use of automation at select ports, which the labor union has opposition to full and semi-automation. The two sides will continue their negotiation discussions, with a timetable of three months from now to finalize a deal.

If these points can’t be resolved, it may be rinse and repeat with the threat of another strike as we get into the start of 2025.

Speaking of the recent shut down of port activity, it will take a week or so to work through the container backlog. This, along with the disruption in shipping patterns caused by the recent hurricanes, has been impacting tender rejection rates as seen in Figure 2.1.

Rejection rates crested the five percent mark recently. As port activity comes back online, expect the volume for short haul shipments (<250 miles) to remain elevated as also seen in Figure 2.1.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxThe food and beverage industry is enormous, including subindustries like grocery, restaurants, bars, catering, and more. The industry continues to evolve and adapt despite frequently changing consumer preferences and new, complex challenges. So, what’s currently affecting those in food and beverage? In this blog, we’re going to dive into some of the latest trends in the food and beverage industry.

TRENDS IN THE FOOD AND BEVERAGE INDUSTRY

LABOR SHORTAGES IN FOODSERVICE

ARTIFICIAL INTELLIGENCE & AUTOMATION

CONTINUED COLD CHAIN GROWTH

One of the well-known trends in the food and beverage industry is the continued growth of cold chains. Recently, a Grand View Research study shows that the cold chain market was estimated at USD $330,680 billion in 2023. Furthermore, it’s estimated to grow at a Compound Annual Growth Rate (CAGR) of 14.8 percent from 2024 to 2030.

Recently, there’s been an increased demand for temperature-controlled pharmaceutical logistics (think vaccines and biologics), rising demand for better food quality, including more fresh and frozen foods, and a surging need to reduce food waste. All this is anticipated to drive the market’s growth.

In light of the pandemic, the risks of COVID-19 have made consumers more interested in healthier, less processed foods that will boost their immune systems. However, less processed foods mean more food products that will need temperature control.

Additionally, the frozen food sector looks to be growing. Besides filling home freezers, frozen foods are growing in restaurants. Restaurants are also providing new menu items for the frozen grocery aisle. In an American Frozen Food Institute report, 72 percent of frozen food consumers said they combine frozen and fresh ingredients in their meals.

Comparatively, shippers are also using more cold chain services to preserve the shelf life of their products, even when temperature-controlled transportation isn’t needed.

SUSTAINABILITY

Growing climate issues are making sustainability a common trend in almost all industries. Consumers are taking notice of the sustainable practices of companies. From ethical sourcing, carbon neutrality, to eco-friendly packaging, consumers want the brands they buy from to be sustainable. Additionally, food waste is a major contributor to greenhouse gas emissions globally, contributing to cold chain issues. This makes sustainability one of the top trends in the food and beverage industry.

Consumers Care About Sustainability

One way consumers can show their support for the environment is by choosing to purchase from sustainable brands. Consumers have shown they’re willing to pay more and be loyal to brands that invest in their sustainability efforts. In a survey by YouGov, more than half of consumers said they would be willing to pay up to 10 percent more on sustainable versions of regular packaged food and drinks. In another consumer survey, 78 percent of respondents agree that sustainability is import, with 63 percent stating they have adopted greener buying habits.

Food Waste Prevention

In fact, an S&P Global Ratings report says food waste contributes to 10 percent of emissions and that $1 trillion of food is wasted each year. Similarly, according to the U.S. Environmental Protection Agency (EPA), between 73 to 152 million metric tons of food get wasted each year in the U.S. The most wasted foods are fruits and vegetables, followed by dairy and eggs, with over half of all waste occurring in households and restaurants. In addition, the food processing sector generates 34 million metric tons of food waste per year. And over the past decade, the total U.S. food waste has increased by 12 percent to 14 percent.

To put it differently, the EPA said halving food waste in the U.S. would save 3.2 trillion gallons of water, 640 million pounds of fertilizer, 262 billion kilowatt-hours of energy, and 92 million metric ton equivalents of carbon dioxide. According to the Agency, reducing the waste of meats, cereals, and fresh fruits and vegetables would have the most significant impact.

Due to this growing issue, governments and businesses have been working hard to improve sustainability efforts. In July 2021, the Zero Food Waste Act was introduced to provide grants to businesses that significantly reduce their food waste. Additionally, in November 2021, the Food Donation Improvement Act was introduced to lower food waste by making it easier for companies to donate food instead of throwing it out.

Cold chain improvements have seen growing importance even outside the food and beverage industry. One example is UPS Healthcare developing a system and opening facilities to move medicines safely. Part of their plan includes using reusable cold chain packaging. In addition, Amazon is working on insulation packaging to reduce material waste and replace 735,000 pounds of plastic film, 3.15 million pounds of cotton fiber, and 15 million pounds of non-recyclable plastic.

LABOR SHORTAGES In Foodservice

Labor shortages are common among other industries, making this another relatable trend in the food and beverage industry. As a result, hiring workers in the U.S. is becoming near impossible. According to a recent market report, labor shortages are a top concern for 23 percent of food and beverage businesses. The most difficult positions to fill look to be those in the restaurant and foodservice sectors. It’s not just the hiring of new workers, but retaining them as well.

Workers are leaving the industry due to a combination of burnout, low wages, and a desire for better work-life balance. Because of this, restaurants and foodservice companies have had to reduce their hours or limit their menu, while consumers have felt it in longer wait times and less personalized service. With good customer experiences being paramount to a company’s success, resolving this issue is critical.

For this reason, advanced technology can help remove some redundant tasks and help supplement amidst labor shortages. For example, those in the bar sector are being introduced to self-pour technology, which uses RFID tracking and allows customers to pour their own beverages. .

CONSUMERS ARE MORE COMPLEX

Over the years, consumers and their choices in food and beverage and their preferred shopping habits, have become more complex. Because of this, there is a greater assortment of products than ever, with more items requiring temperature control as consumers move away from processed foods and look for fresher, healthier items. Consequently, the supply chain for grocery continues to evolve as the message from consumers is clear. They want what they want, when they want it, where they want it, and expect businesses to respond to their demands.

Continued Decline of In-Person Shopping

In speaking to consumer shopping preferences, it looks like online grocery shopping, food delivery, and food subscription boxes are here to stay. Many consumers prefer the option to receive food and beverage products at their door. For instance, in recent a study by Drive Research, the use of grocery delivery services in 2024 have risen 56 percent compared to 2022. Additionally, the use of grocery curbside or pickup in 2024 have risen 100 percent compared to 2022, further showing the decline of in-person shopping for food and beverage items.

Cost of Food and Beverage Products a Large Concern

Additionally, inflation and rising costs for everyday items, including food and beverages, have consumers rethinking how much and what brands they buy. For example, a recent study showed 54 percent of respondents stating they’ve reduced how much, and unfortunately, 20 percent said they were skipping meals to save money on food. Data from another survey found that 43 percent of consumers are cooking dishes with less meat to save on grocery costs. Others are choosing to purchase cheaper cuts of meat.

Private label brands continue to see growth as shoppers look to save money whenever possible. In fact, according to Numerator, private label brands hold almost a quarter of sales in the grocery sector. The Private Label Manufacturers Association shows that private label sales saw 2.5 percent growth compared to a decline of 0.8 percent by national brands in 2024.

Taste and Experience is a Must

Consumers want to feel good about what they eat. They want nutritious options that alight with their dietary preferences or health goals. In a survey but the International Food Information Council, 54 percent of consumers consider the healthfulness of food in their purchasing decision. Yet, even with the health benefits, they still want their products to taste good, as Datassential shared 35 percent of them purchase items that sound both delicious and healthy.

Consumers are interested in trends like unprocessed foods, natural ingredients, anti-inflammatory, and hydration. Alcohol-free and non-alcoholic beverages are also a rapidly growing trend, with 2 in 5 consumers abstaining from drinking alcohol.

Consumers generally want a positive experience with food and beverage products. While it’s fuel for the body, it can also serve as a source of community, entertainment, and more. In one study, 53 percent of consumers see experiences as essential to their personal lives, especially among the younger generations since the pandemic. They’re interested in trying to tastes and spices, products that bring a sense of nostalgia, or food and beverages that tie in with a story, as shown by the recent increase in pop-up restaurants and bars.

supply chain Challenges

Since the pandemic, supply chains have been seen more of the limelight. As shown by rising costs faced by consumers, food and beverage supply chains have been challenged by shortages of raw materials, disruptions like strikes or a bridge collapse, and a growing demand by consumers for transparency and speed.

Consumers are also becoming more interested in knowing where the products they buy come from. According to a study by IBM, nearly 70 percent of consumers want to see a brand’s sourcing practices. They want to know how the products they buy were manufactured. They’re looking for companies who show concern to how their manufacturing affects the planet’s life span and how their product is raised or grown. Consumers want to feel like the products they choose to buy will make a difference.

According to a Mckinsey report, food and beverage supply chains see supply chain disruption roughly once every three years. A 2023 risk report shows that supply chain executives are concerned about disruptions from climate change, environmental factors, and geopolitical conflicts. Another risk report shows that 73 percent of companies experienced higher supply chain losses within that past two years. Because of this, building supply chain resiliency is a huge trend for food and beverage companies.

ARTIFICIAL INTELLIGENCE & AUTOMATION

Artificial intelligence (AI) is a buzzword across all industries, but how could it affect food and beverage? One way is through providing clearer insights into shopper preferences, helping companies better market to them to grow brand loyalty. It can help with supply chain optimization, helping businesses better understand consumer demand and optimize production planning and management, reduce overstocking, and minimize waste. Some companies, like Campbell Soup Co., are using AI to help with product development, tracking data and discovering what its customers want next.

According to WifiTalents, 62 percent of food and beverage executives believe AI will have a significant impact on their industry within the next five years. With the uses for AI in the food and beverage industry being so extensive, it will be interesting to see how companies make use of it.

There’s also a lot to be talked about in AI and automation for the customer experience. Companies are looking into AI-driven customer service opportunities and ways to streamline customer interactions. You see a lot of this in the restaurant industry with the use of table side tablets, interactive menus, and mobile ordering and payment. AI is used in mobile apps to personalize menus and promotions based on customer preferences.

Growing Cold Storage Demand

The demand for refrigerated warehouses is continuing to soar to new heights. A report from Skyquest forecasts the U.S. cold storage market to increase with a compound annual growth rate of 13.5 percent through 2031, expecting to reach a value of $118.8 billion.

Temperature-controlled storage is critical to many sectors, from grocery to pharmaceutical companies. The growing demand for cold storage facilities comes the adoption of automation and technology, the popularity of ecommerce and demand for faster delivery, as well as online grocery platforms. There’s also a thriving demand for convenience foods – those that are usually chilled but ready to eat with little to no preparation.

STAY AHEAD OF TRENDS IN THE FOOD & BEVERAGE INDUSTRY

No matter the trends in the food and beverage industry, having a logistics resource, consultant, or expert is one way to stay ahead. Whatever phrase you want to use but ultimately, have support on your side for any complex situation. This is where a third-party logistics company (3PL), such as Trinity Logistics, can come in. We can help you find creative solutions to your logistics challenges.

Now, you’re likely wondering, “why work with Trinity Logistics?” For one, we’ve been serving cold chains for over 45 years! Whether you have a complex challenge or just need help with one shipment, we have the experience and quality carrier relationships to meet your needs.

You can also count on us to stay knowledgeable on what’s going on in your industry so you can stay updated too. We know that even in times of supply chain disruption, your industry doesn’t stop, so neither do we.

And lastly, what makes Trinity unique from other 3PLs and what our customers praise the most is our exceptional People-Centric service. We’re a company built on a culture of family and servant leadership, and that culture shines through in our service to you. It’s our care, compassion, and communication that you’ll notice and appreciate.

If you’re ready to have Trinity Logistics on your side for logistics support and expertise, no matter the industry trends, then let’s get connected.

DISCOVER HOW WORKING WITH TRINITY CAN BENEFIT YOUR COMPANY STAY UP-TO-DATE VIA OUR EMAILStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

YES, IT IS IMPORT-ANT

There has been much buzz in the last month around inbound container volumes to U.S. ports. There are 300+ ports of entry for goods into the country, with much of that volume handled by the top 20. Most of that buzz is around the uptick in volume.

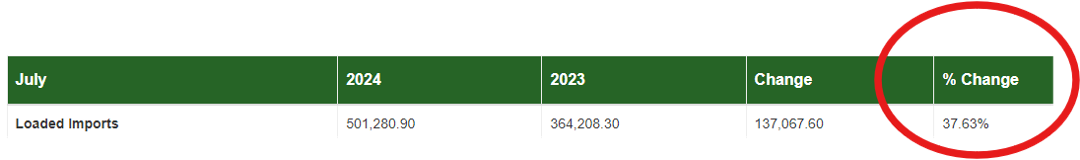

In figure 1.1, you will see for the port of Los Angeles, the largest in the country, that container volume is up almost 38 percent. That’s certainly impressive, but the neighboring port (Long Beach) was up a staggering 60 percent.

Many would anticipate this similarly impacting the outbound over-the-road volume for that market. And yes, while we see in Figure 1.2 via the blue line, there is a noticeable increase from what it was heading into the Memorial Day holiday, but it is not a direct correlation. The beige line represents the domestic rail volume from that same market, and unlike what we experienced in the “Covid years”, the rails have been a bigger mover of goods versus the bottlenecks we saw back then.

We should expect to see import volumes continue through the next few months. As goods produced overseas have become cheaper to buy, major retailers have taken advantage of these discounts with the anticipation of robust consumer spending. Remember, almost three-fourths of inbound volume is directly related to consumer purchasing. Good news for consumers as these retailers will want to liquidate this inventory quickly at lower prices.

NOT FAR FROM HEALTHY

While not in balance, the spread between contract and spot rates continues to shrink, now sitting about $0.60 per mile higher on the contract side. Keep in mind this gap was in the $0.75 to $0.90 for much of the past year. Almost in lockstep has been the tender rejection index. It has continued its slow upward movement as seen by the green line in Figure 2.1.

This can be attributed to capacity continuing to shrink slightly (Figure 2.2) and contract rates moving downward. It’s rare that spot rates will eclipse contract rates, but a spread of $0.40 to $0.50 is indicative of a healthier market, and we are not far from that right now.

I spent a few days traversing the state of Tennessee recently. At one stretch of a major interstate, there was a back-up at least five miles long. Luckily for me, it was on the eastbound side, and I was heading the opposite direction.

What struck me was the sheer number of trucks that sat idled. By my estimates, almost 80 percent of the volume was truck traffic. And while you can’t tell if a van is loaded or not, every single flatbed had freight on it. So, ladies and gentlemen, freight is still moving in this country. While it may not feel like it, volumes are trending close to 2022 levels as seen in Figure 3.1 (blue vs. green line). They say the fourth quarter is the time when carriers make hay; so here’s to an optimistic outlook for the next four months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxWhile many of us are soaking up the last of summer’s sun and fun, food manufacturing supply chains are readying for the upcoming holiday food rush.

Have you ever noticed a lot of our favorite memories are surrounded by food? When we go to celebrate something like a birthday, anniversary, or special achievement, it usually involves food. It’s no surprise then that over the holiday season, nearly 165 million consumers across the U.S. purchase food and beverages to celebrate, according to a study from Cornell. As the holidays soon approach, food consumption surges, with the average American indulging up to an extra 440 calories per serving!

The increased demand and tight holiday deadlines can present challenges for many food and beverage companies with their logistics. This is in addition to already facing a competitive peak shipping season! However, by understanding the dynamics of this unique period of time, shippers can ensure success is ahead of them. First, let’s dive into some fascinating facts and insights about food during the holiday season. Then, we’ll follow that with some essential tips so your company can be prepared for the holiday food rush!

Holiday Food Supply Timeline & Stats

The Holiday Food Surge Begins with Fall

The holiday food rush first begins with the arrival of fall flavors. Pumpkin spice, now seen as the quintessential flavor of fall, has seen a 47 percent increase in sales, as reported by The Guardian, within the past five years. In 2023 alone, Datassential reported 144 new limited-time offers that featured pumpkin on major restaurant menus. From the infamous Pumpkin Spice Lattes (PSLs) to pumpkin soups and ravioli, this flavor dominates the season. But we can’t forget another fall favorite – apple. Food and beverage items with caramel apple were one of the highest-indexing flavors last fall.

Halloween Signals Significant Holiday Food Consumption Increase

Halloween is a major milestone in the holiday food timeline, with 65 percent of consumers participating in the festivities. In fact, of all 172 million that celebrate the spooky season, 95 percent of them purchase candy. Even more staggering is that a quarter of all the candy sold annually comes from Halloween sales. It’s not all about the sweets, though! Pizza is the most popular dinner staple on All Hallow’s Eve, according to Grubhub. There’s also the annual tradition of carving a pumpkin, with Statista reporting roughly 154 million Americans partaking in the activity in 2023.

Dia de Los Muertos Celebrations Begin to Trend

Datassential reports that 10 percent of consumers in the U.S. report celebrating Dia de Los Muertos, or Day of the Dead. This holiday is gaining popularity, which means so are the celebratory foods associated with it! Pan de Muerto is one traditional sweet bread that’s essential to the celebration.

Thanksgiving Continues to Drive Food Supply Chain Demand

Thanksgiving remains the most popular fall holiday, with 83 percent of Americans celebrating the tradition. A whopping 46 million turkeys are consumed each year, according to the U.S. Department of Agriculture. Other top holiday staples include cranberry sauce, stuffing, green bean casserole, mashed potatoes, macaroni and cheese, sweet potatoes, and pumpkin and apple pies. That’s a lot of food to prepare for a meal, so 23 percent of consumers will buy a full, ready-made meal from a restaurant. Another 22 percent will supplement with some food from restaurants for part of their feasts.

Sweets, Candy & Chocolate Build Holiday Food Demand at Christmas & New Year’s

Leading up to Christmas, many enjoy hot cocoa, cookies, and other treats. 1.76 billion candy canes, a holiday staple, are made annually for this joyous time of the year. 70 percent of Americans make Christmas desserts, with frosted sugar cookies being the top ones consumed annually. Don’t forget the eggnog! 122 million pounds of it is poured and drunk each year.

When it comes to Christmas dinner, pork dishes are the most popular globally, but turkey still trumps all for the U.S. Other winter feast staples include roasted or mashed potatoes, roasted carrots, gravy, stuffing, shrimp, and lots of Christmas pudding, cookies, and pies. Sweet tooths rejoice as 83 percent of consumers fill stockings with treats like candy and chocolate.

Christmas and New Year’s are among the busiest holidays for restaurants. Both holidays also see a spike in alcohol consumption, with New Year’s Eve being the second most alcohol-associated holiday behind Mardi Gras. Champagne is the fan favorite for those ringing in the New Year.

Logistics & SHipping Tips for Holiday Food Shipping

The holiday season often brings those in logistics the gift of increased demand and decreased capacity. Like most Americans, truck drivers aim to be home for the holidays, trimming the number of available carriers down. Freight of all kinds can increase during the period, further cutting the number of trucks available. Shippers with more specialized requirements, like temperature control, can find even less capacity. Shippers also have tighter deadlines to meet at this time to make the most of the seasonal business.

Overall, the holiday season can be a time of heightened stress and disruption. Given these unique challenges, it’s crucial for food and beverage shippers to prepare thoroughly to appease customers.

Five Tips for the Best Holiday Food Shipping Logistics Outcomes

Tip 1: Keep Inventory Stocked

Running out of stock during the holiday season is a surefire way to lose customers. Track your inventory levels closely and replenish supplies early to ensure you’re well-stocked. By keeping orders moving consistently, you’ll be able to meet consumer demand and avoid causing any disappointment.

Tip 2: Have Backup Shipping Plans Ready

The chances of any disruptions or delays happening during this season are increased. Having backup shipping plans already prepared is essential to keep your goods moving.

Build relationships with multiple carriers and suppliers, or even a third-party logistics provider (3PL). This way, you’ll have known contacts ready in case you need any help.

Look at alternate modes of transportation and be prepared to quickly shift plans should something happen. Exploring multimodal options can be a great way to diversify risk, add capacity, and protect your freight budget. Having this flexibility available and ready can help you stay on track and your supply chain running smoothly.

Tip 3: Real-Time Visibility is Needed for Success

In today’s supply chains, having access to the visibility you need is crucial. You should either work with a provider that offers it or invest in your own technology, like a Transportation Management System (TMS).

A TMS can be very helpful during the holiday season. It can help you with routing decisions by matching your freight with the best carriers, lanes, and rates. In addition, it will allow you to optimize the in-house processes of your transportation network – which can be helpful during busy and slow seasons. By selecting the best carriers and optimizing your routes, you’ll not only increase your service but reduce your risk.

Using a TMS also gives you data-driven insights to better manage disruptions, reduce downtime, and budget your logistics spend. Data analytics can help you recognize which carriers are most likely to have the capacity, saving you time arranging your shipments.

Tip 4: Communication and Collaboration

Effective communication is key to a successful holiday season. Regularly communicate with all stakeholders, including suppliers, carriers, and customers. Collaborating with your partners during the seasonal planning phase can provide valuable insights and help you identify potential issues before they arise.

Tip 5: Partner with a 3PL

Working with a 3PL can be a game-changer during the holiday season. A 3PL offers access to a larger network of carriers, advanced technology, and expertise in managing complex logistics challenges. With their support, you can ensure your supply chain remains resilient, even in the face of unexpected disruptions.

Treat Yourself with Easier Logistics This Holiday Season

Navigating the holiday food rush can be overwhelming, and that’s why Trinity Logistics is here to be your guide. Like Santa, we’ve been around a while, with 45 years of experience handling logistics during holiday seasons.

Right away, you’ll gain access to our large network of vetted, quality carrier relationships to cover your shipments. But that’s just the start! There are many more benefits to working with Trinity, including:

- Multiple modes of transportation to find the best bang for your buck, support your business growth, or just have a backup plan ready

- Best-in-class technology and customized Managed Transportation solutions available, giving you the exact visibility and data you want

- 24/7/365 support, so no matter what day or time it is, you’ll have the help you need

One benefit that tends to shine above all else? Our exceptional People-Centric service. It’s the trait that makes Trinity different from other 3PLs and keeps our customers returning time and time again. It’s truly our care, compassion, and communication that you’ll notice and appreciate.

Everyone wants to enjoy the holiday season. Why not let Trinity focus on the logistics for your business, so you can go back to doing what you enjoy – helping consumers savor holiday treats and create memorable moments with your product.

Try out Trinity Logistics for Your Next Shipment Learn How Trinity Supports Food & Beverage Shippers Sample More of the Trinity Culture & Service – Join Our Mailing ListAre you a Freight Agent that stumbled across this article?

Freight Agents, Indulge in an Exceptional 3PL PartnerDon’t let your company get caught off guard by CVSA Brake Safety Week, August 25th to August 31st, 2024!

Shippers and carriers, mark your calendars! Brake Safety Week is soon approaching. This annual event aims to improve commercial vehicle safety and make our roadways safer, however it does impact those in logistics! Shippers and carriers alike can see disruption to their businesses. To keep your operations moving forward, it’s helpful to understand what Brake Safety Week entails and its effect on the overall freight market.

What is the CVSA? What is Brake Safety Week?

The Commercial Vehicle Safety Alliance (CVSA) is a non-profit organization dedicated to improving commercial motor vehicle safety through collaboration between law enforcement, industry stakeholders, and the public sector. In partnership with the Federal Motor Carrier Safety Administration (FMCSA), the CVSA launched its Operation Airbrake program in 1998. The goal of this initiative is to improve commercial vehicle brake safety and highway crashes due to faulty brake systems.

This initiative includes two annual events, Brake Safety Week and an unannounced one-day inspection event, that can happen at any time. During both events, commercial vehicle inspectors conduct brake safety inspections on large trucks and buses. The inspections take place across North America, so the U.S., Canada, and Mexico.

Brake safety is an important focus because brake-related concerns or issues are the largest percentage of out-of-service violations during roadside inspections. In fact, brake safety violations were the top vehicle violation at 25.2 percent of all out-of-service violations during last year’s International Roadcheck Event.

Each year has a primary focus surrounding brake safety, with this year’s being the condition of brake lining and pads. During roadside inspections, any commercial vehicles found to have brake-related out-of-service violations will be removed from the roadways until they can be corrected.

Brake Safety Week Inspection Procedure

These are the items the CVSA inspector will look over during your inspection:

- Driver’s license

- Registration

- Low air warning device

- Pushrod travel

- Brake linings/drums

- Air loss rate

- Tractor protection system

A typical inspection during Brake Safety Week will follow these steps:

- Check air brake mechanical components

- Check steering axle brake mechanical components

- Build the air pressure to 90-100 PSI

- Check brake adjustment

- Check the tractor protection system

- Check the air brake ABS system

- Test low air pressure warning device

- Test air loss rate

- Finalize paperwork and provide results to the driver

Why Should I Be Concerned About Brake Safety Week?

It’s important to be aware of when Brake Safety Week takes place because of the impact it has on shipping freight. Even though it’s just one week out of the year, no one likes to be unprepared for potential disruption or delays to their business.

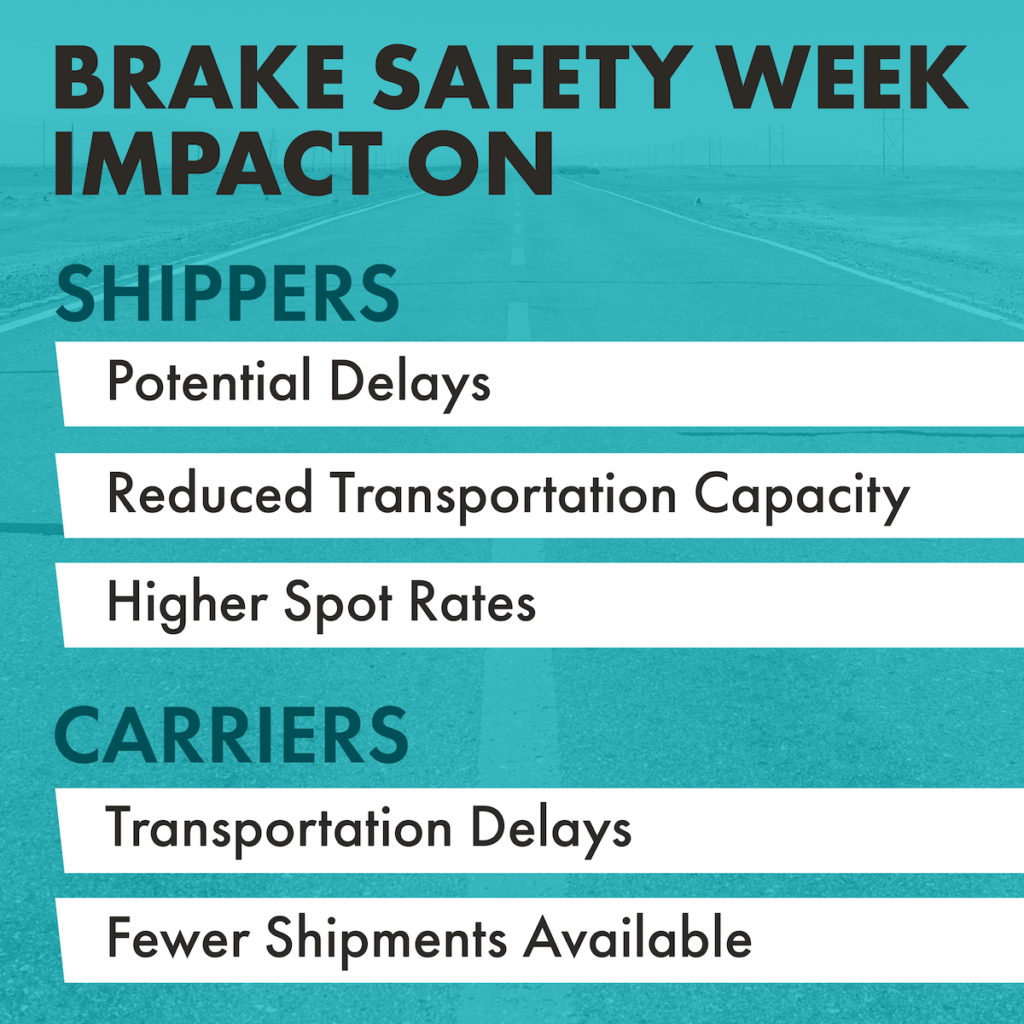

Brake Safety Week Impact on Shippers

Shippers may face potential delays, see reduced transportation capacity, and likely higher spot rates.

Potential Delays

There can be potential delays due to the brake safety inspections.

Reduced Transportation Capacity

The increased inspection effort sometimes leads carriers to strategically choose to close their business temporarily for the week to avoid any risk of fines or penalties. You might find it more difficult to secure reliable carriers for any last-minute shipments.

Higher Spot Rates

With the potential for fewer trucks available and delays, spot rates can be heightened during this time.

Brake Safety Week Impact on Carriers

Carriers are similarly affected, so there is the potential for delays and less freight volume.

Transportation Delays

Just like shippers, carriers should expect to see potential delays in the movement of traffic due to the increased inspections. This could disrupt your operations.

Fewer Shipments Available

Shippers may choose to plan around this week, reroute certain shipments, or even look into alternative modes. Less freight may be available during this week.

How to Prepare for Brake Safety Week:

Shippers

Ensure Documentation Accuracy

Double-check all shipment documentation. Ensure it is accurate and complete to avoid delays during any unexpected inspections.

Communicate Sensitive Shipment Needs

If you have any special requirements or time sensitivities, communicate this well in advance. This helps your logistics provider plan effectively. Any last-minute communication risks delays.

Find Alternatives

Consider alternative transportation modes or routes if you expect any delays.

Keep Customers Aware

Be proactive and communicate potential delays during this week to your customers to manage expectations.

Share Any Concerns

Discuss any concerns you might have with your logistics provider. They can offer valuable insights and help develop strategies to reduce disruptions.

Pricing Awareness

Be aware of possible higher spot rates during Brake Safety Week. When possible, plan shipments before or after this period to secure better pricing.

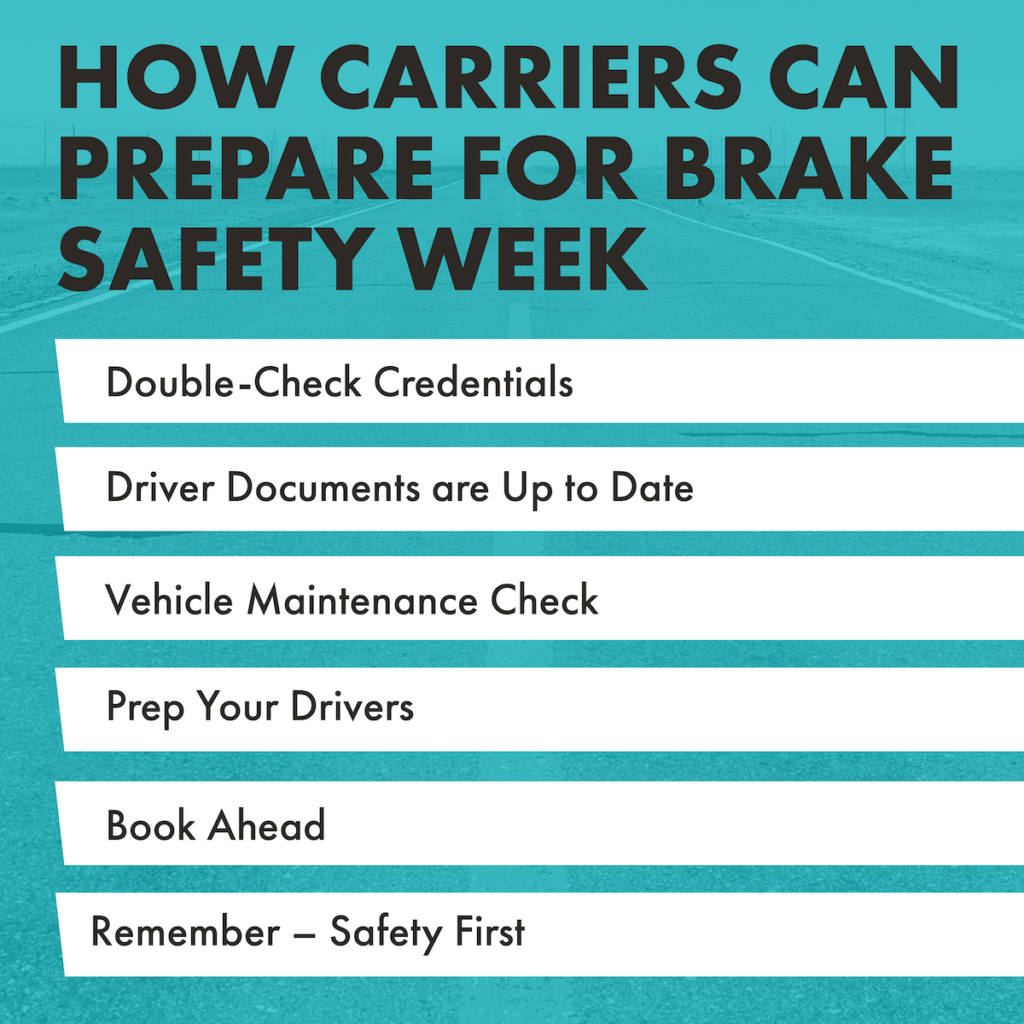

Carriers

Double-Check Credentials

Ensure all required credentials, like operating authority, hazmat endorsements, TWIC cards, and any other relevant permits, are current and accessible.

Driver Documents are Up to Date

Have drivers verify that all paperwork is up to date and accessible in case of inspection.

Vehicle Maintenance Check

Double-check that all vehicles have undergone any necessary preventive maintenance and are in top operating condition to avoid delays due to roadside repairs.

Prep Your Drivers

Make sure drivers are aware of this week and the potential for stops or delays. Train drivers on what to expect and the inspection procedure. Share this CVSA inspection checklist or tips sheet to help them improve their own brake maintenance checks. Make sure they know the channels to communicate any disruptions to their journey.

Book Ahead

Shippers may choose to reroute shipments, choose alternative modes, or plan around this week. Consider booking shipments well in advance for this week.

Remember – Safety First

The importance of this week is not disruptions but brake safety. This is a great time to remind drivers of their role in proper vehicle checks and maintenance.

Let’s Work Together to Keep Our Roads Safe

We believe road safety is paramount. While Brake Safety Week might cause some temporary disruptions, it serves a vital purpose in keeping the importance of brake safety and its needed maintenance front of mind.

By staying informed and taking proactive steps, you can likely see minimal effects of Brake Safety Week.

For additional opportunities to stay ahead of disruption to your business during Brake Safety Week, consider working with Trinity Logistics. We have over 45 years of experience helping thousands of shipper and carrier companies conquer more complicated shipping situations, like CVSA inspection weeks. We’re confident in our ability to make this week (and all others) a painless one for your business.

Severe weather events are the new normal. Can the logistics industry handle more supply chain disruption?

It’s a hot, sunny day, and you’ve found the perfect spot on the beach to sit back, relax, and enjoy the cool breeze of the ocean waves. As you’ve sat down and unpacked your snacks, a thunderstorm rolls in, causing the lifeguards to hop off their chairs, stating the beach is closing. Plans = ruined.

We’ve all been there – when poor weather makes an inconvenient appearance. But severe weather is more than just rain on your wedding day. It’s more extreme, like high winds, flooding from heavy rain, wildfires, or droughts. Severe weather events are becoming more intense and commonplace, causing supply chains to struggle. Logistics professionals often face challenges like disrupted deliveries, product shortages, and skyrocketing costs.

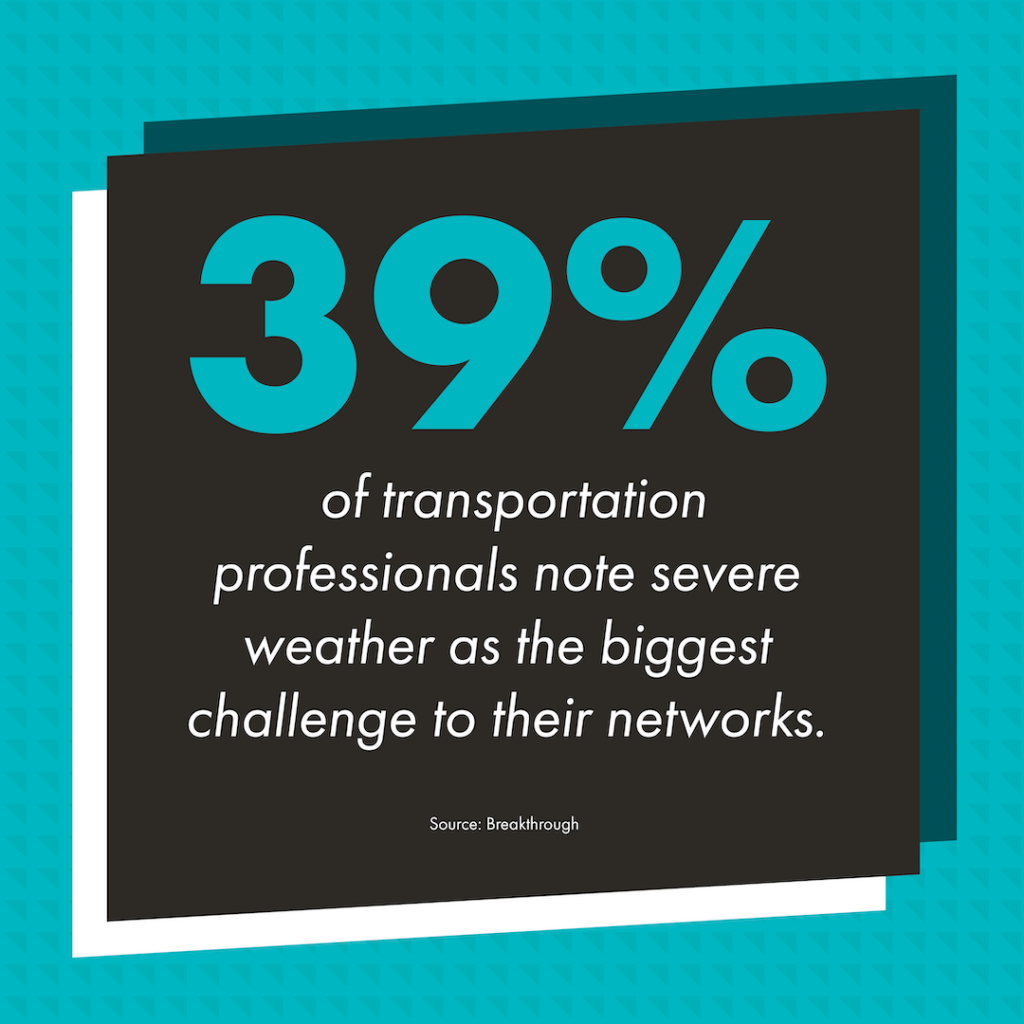

From intense hurricanes to wildfires, the growing effects of climate change on supply chains are becoming impossible to ignore. In a report by Breakthrough, 39 percent of transportation professionals note severe weather as the biggest challenge to their networks, having primary concerns surrounding climate change and sustainability. With severe weather and its effect of supply chain disruption being a challenge for companies for the foreseeable future, they must take proactive measures to maintain resiliency. Is your supply chain prepared?

CASES OF SUPPLY CHAIN DISRUPTION FROM RECENT SEVERE WEATHER

Climate change has led to an increase in severe weather events. If you’re uncertain as to how much of an increase we’ve seen, let me share an eye-opening fact with you. The U.S. National Climate Assessment estimates that in the 1980’s, a billion-dollar extreme weather event would take place once every four months. Now, they occur once every three weeks! That’s not a lot of downtime in between events for affected supply chains to regroup.

Supply chain disruption from severe weather like the ones mentioned below is no longer a distant worry but a constant concern.

Droughts

In recent years, droughts have been impacting vital waterways. The Panama Canal, a critical path for global shipments, has experienced its worst drought since records began in 1950. Due to low water levels, restrictions were imposed, limiting heights and the number of daily vessels. Similarly, the Mississippi River has faced periods of drought and low water levels, making it difficult to transport goods.

Elevated heat and droughts affect not only waterways for transportation but also the production of goods. For example, coffee, cocoa beans, and olives have all recently faced drought conditions, resulting in a lower output of their respective products.

Wildfires

Often fueled by extreme heat and droughts, wildfires are now an expected annual danger to many parts of the world, like the Western U.S. and parts of Canada. Fire seasons start earlier and last longer while growing in intensity and size. Though the wildfires themselves are one problem, the spread of the smoke coming off them greatly expands their impact. The smoke reduces not only our air quality but also visibility, such as with the wildfires in Canada in 2023, which created widespread smoky conditions and delayed several shipments in populated locations such as Chicago and New York.

Hurricanes

Hurricane Season continues to bring more hurricanes and stronger storms each year. In fact, the National Oceanic and Atmospheric Association (NOAA) forecasts that the 2024 season will see 17 – 25 named storms, with four to seven being a Category 3 or greater. On average, there are 14 named storms with three being a Category 3 storm or greater.

Hurricane Ian was one severe weather event to cause supply chain disruption in the Southeast in 2022. Ian was a Category 4 storm when it made landfall in Florida and resulted in a 75 percent drop in shipments during its course. More than $416 million of citrus crops, a major good grown in the area, were destroyed by Ian.

Another Category 4, Hurricane Harvey, struck Texas in 2017. More than 50 inches of rain fell, breaking previous U.S. records and causing massive flooding, which closed roadways and many facilities. Several ports along the Gulf Coast were closed for nearly a week.

Even a Category 1 hurricane can impact supply chains. In July 2024, Hurricane Beryl hit South Texas, causing major flooding, power outages, and port closures.

Deep Freezes

Several locations have seen unusual deep freezes in recent years. In 2021, Texas saw a widespread freeze that their electric grid was unplanned for, causing a blackout for over two weeks. Many manufacturing businesses had to shut down, and railroads did, too. This caused significant supply chain disruption for transportation between Texas and the Pacific Northwest.

In 2022, New York experienced Winter Storm Elliott, which lasted roughly a week. Heavy snowfall and extreme cold temperatures caused power outages, resulting in a 40 percent decrease in shipment volume.

These are just a few examples of the impact severe weather has had on supply chains in recent years. Scientists believe that supply chain disruption from severe weather events will only intensify in the coming years as extreme temperatures and sea levels continue to rise.

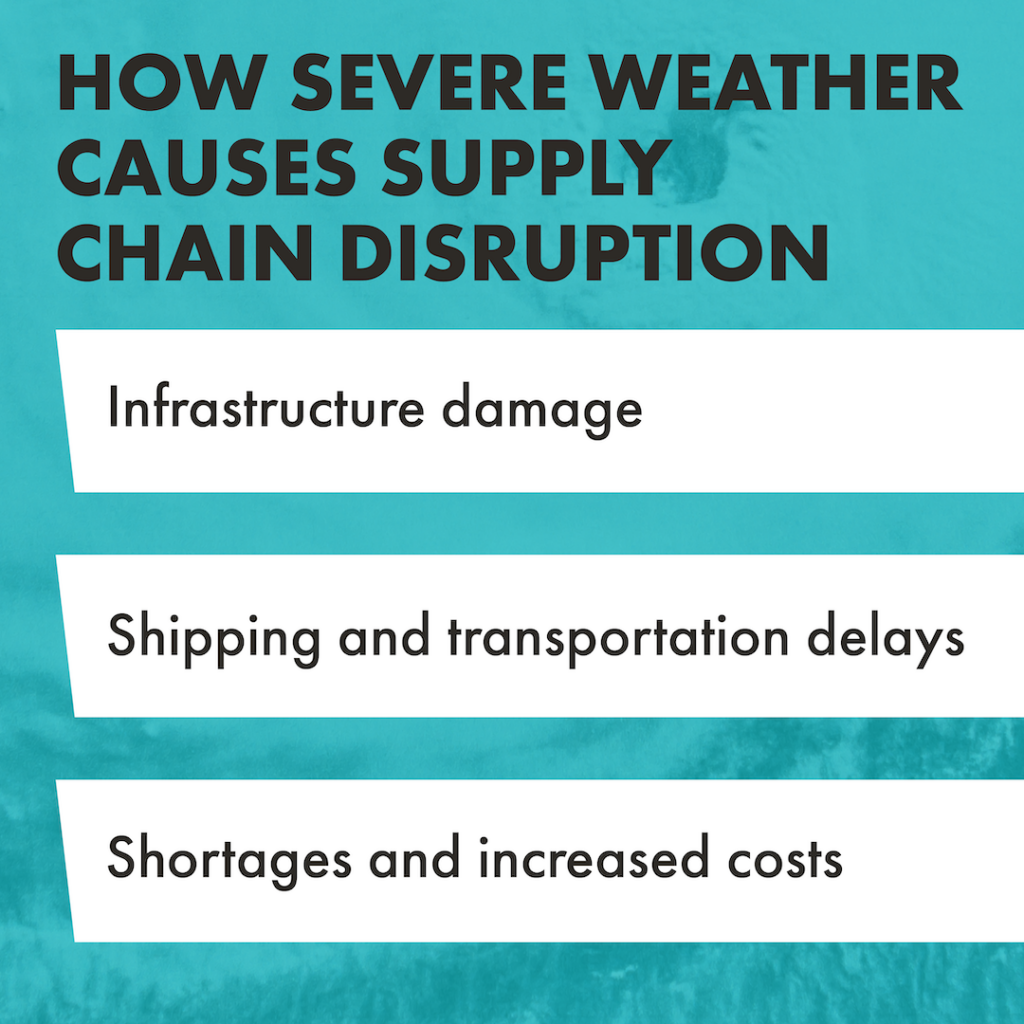

HOW SEVERE WEATHER CAUSES SUPPLY CHAIN DISRUPTION

Severe weather events can wreak havoc on supply chains in many ways!

Infrastructure Damage

Roads, bridges, or ports can become damaged and make routes unavailable.

Shipping and Transportation Delays

The effects of severe weather, such as flooding or wind gusts, can slow or stop transit, causing delays and increased shipping times.

Shortages and Increased Costs

Damages and delays from severe weather can impact production, reducing inventory and capacity. Increased demand then increases the cost of materials, products, or shipping.

HOW SUPPLY CHAINS CAN STAY PROACTIVE

While you can’t control the weather, you can control whether your supply chain is prepared. Now is the time to be proactive and plan so your supply chain survives and thrives when severe weather strikes.

Assess Your Risk

Map out your entire supply chain to find gaps and vulnerabilities. Identify which companies and suppliers are involved and what severe weather events might impact them. If capable, look at previous data on supply chain disruption to learn from it. Are there certain sites that experience frequent disruption? How could you have been better prepared?

Have a Contingency Plan

Now that your supply chain is mapped and risks identified, it’s time to build plans for when disruption hits. Confirm that your supply chain partners have their own plan in place. Determine backup suppliers and partners for when current ones are affected. Find and select alternative transportation methods and routes. Once established, regularly assess this plan to ensure it will operate effectively.

Invest in Extra Insurance

This may seem like simple advice but invest in insurance to protect your business from losses. For example, flood or hurricane insurance will help you restore any damaged assets from a severe storm. Business interruption coverage can offer added protection, covering any lost sales during a disruption from severe weather.

Invest in Technology

There is a lot of technology available to help you be prepared for severe weather. Technology with Artificial Intelligence (AI) and predictive analytics can be useful to help you forecast and respond quickly when issues unfold. Leveraging AI and machine learning can help you reach a level of automation in which decisions can be made from data in a matter of seconds.

Create End-to-End Visibility

One of the most common weaknesses in supply chains is a lack of visibility. With the increase in severe weather and supply chain disruption, visibility is needed now more than ever. Having real-time access to tracking, carriers, suppliers, and inventory can help you identify any issues before disruption takes place.

A transportation management system (TMS) can provide the visibility you need. It provides critical data about your shipments and orders in real-time, giving you an advantage should a problem arise. This can help you make quick decisions to reroute shipments, avoid affected areas, and keep your customers informed.

See how a TMS could help you.Establish Open Communication

Establishing open communication among your supply chain partners now will benefit you when severe weather happens. Be transparent. Share details about when you receive orders, where they go, and when they are due.

Let partners know your backup plans and ensure they are prepared for any severe weather events. When there is a chance of supply chain disruption, send communications right away. The earlier you can make partners aware of the possibility, the more time they have to adjust their plans.

Collaborate with Resilient Partners

Are your supply chain partners prepared for potential disruption? Identify those who are ready to weather the storms and those who are vulnerable. Supply chain disruption isn’t going away, so you’ll want to raise your concerns and highlight your need for resiliency. If the risk is too great for your supply chain, you may consider looking into alternative partners to replace them.

WEATHER ANY STORM WITH TRINITY LOGISTICS

Working with a reliable logistics provider like Trinity Logistics is a great way to build supply chain resiliency and overcome severe weather threats.

Trinity Logistics has been supporting thousands of supply chains through all sorts of supply chain disruption for over 45 years. Severe weather events don’t scare us away, as we thrive on quickly solving issues like those that storms can bring. We also have a dedicated After-Hours Team to support your business at any time. Even if severe weather halts your shipping overnight, on a holiday, or weekend, we’re here to help.

Our nationwide network of trusted carrier relationships will ensure your shipments arrive safely at their delivery locations. You can also count on our multiple transportation options to allow you to keep your goods moving through rain, hail, or snow. Lastly, our customizable Managed Transportation solutions can give you the real-time visibility you need to stay updated and make any changes in a matter of minutes.

Don’t let supply chain disruption fog up your company’s goals. Try Trinity Logistics and see how our People-Centric service can light the way to success.

GET A FREE QUOTE ON YOUR NEXT SHIPMENT SUBSCRIBE & STAY IN THE KNOW LEARN MORE ABOUT TRINITY'S SOLUTIONSStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

GOOD NEWS, BUT…

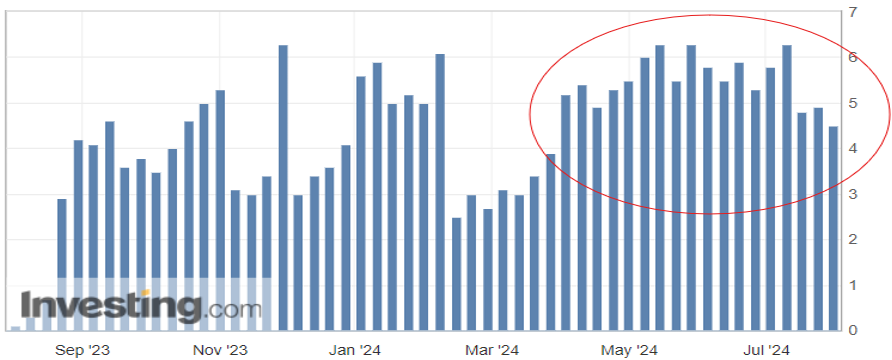

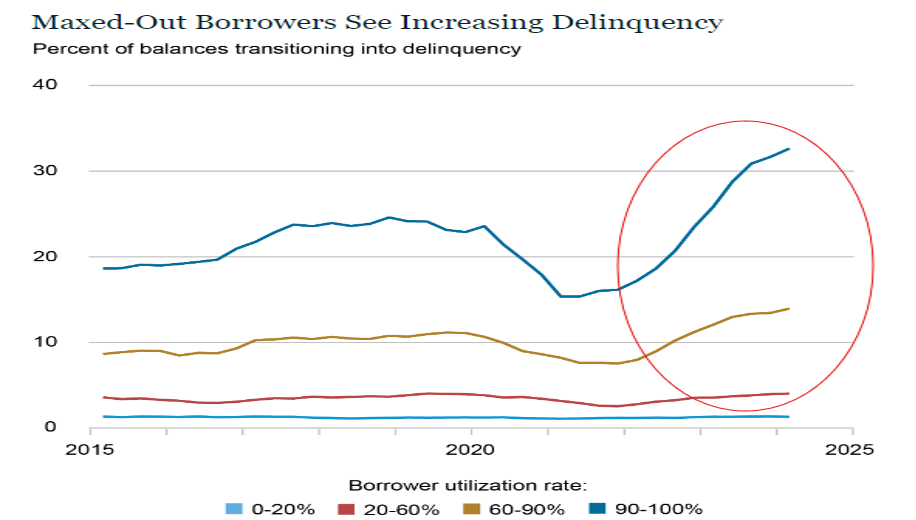

Consumer spending is the biggest driver of the U.S. economy, accounting for roughly two-thirds of the nation’s Gross Domestic Product (GDP). One measurement of that consumer spending is the Redbook index, which compares year-over-year growth for large domestic general retailers (think Walmart, Amazon, Target). The index has averaged just over 3.5 percent for the past 20 years, so the recent year-over-year (YoY) growth in the four-plus percent range speaks to the strength of consumer spending (Figure 1.1). This index alone certainly gives reason for optimism, however there is a cautionary tale with regards to consumer debt.

After years of next to zero interest rates to keep the economy on its legs, consumers have seen interest rates on the rise, with the federal funds rate at its highest level since the early 2000’s. With the increase in interest to borrow funds, combined with the increased costs of essentials (food, housing, energy), many households have turned to credit cards to fill the gap for funding of these necessities. Figure 1.2 from the New York Fed Consumer Credit Panel shows the rise in consumer delinquency particularly in those groups that utilize more than half of their available credit line.

While there appears to be relief on the horizon with the impending reduction in interest rates, it appears a portion of active consumers may be pulling back on purchases for those items that are not mission critical. This, in turn, will have an impact on restocking of inventories and trucking activity.

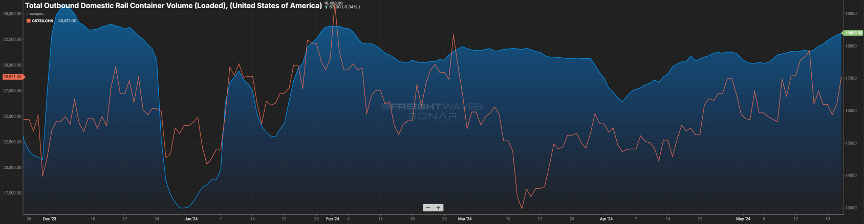

While it is not approaching the levels seen in 2021, the volume index is quickly approaching levels seen in 2022. This has buoyed optimism in the industry.

JUST SOME GOOD LUCK? TIME WILL TELL

The uptick in consumer spending, restocking of inventories and the threat of labor strife in the fourth quarter of this year has been to the benefit of those involved with the rail and import business.

In Figure 2.1 below, the blue line represents loaded container rail volume in the U.S. and the past three months have seen the volume grow. Similarly, container volumes to the U.S. have been on the rise.

The orange line represents container volume from China over the past six months. While some of that traditional volume is now flowing through other countries, like Mexico, there is still a great deal of activity with U.S.-China trade. Will this continue or is it fool’s gold? That is something we will continue to keep an eye on as a pullback in consumer spending will dictate how the needle moves.

STAYING RIGHT WHERE WE ARE

Finally, looking at domestic over-the-road volume (blue line) compared with carrier rejection rates (green line). The slight upward trend continues with volumes and rejection rates (Figure 3.1). Rejection rates continue to inch towards 2022 levels, but a five-to-six rejection rate is about half of what one would see in a balanced freight market.

This has yet to manifest itself in the way of increased freight rates, as capacity still exists in the market.Shippers and carriers should anticipate little change in conditions (although hurricane season is looming) until early 2025.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

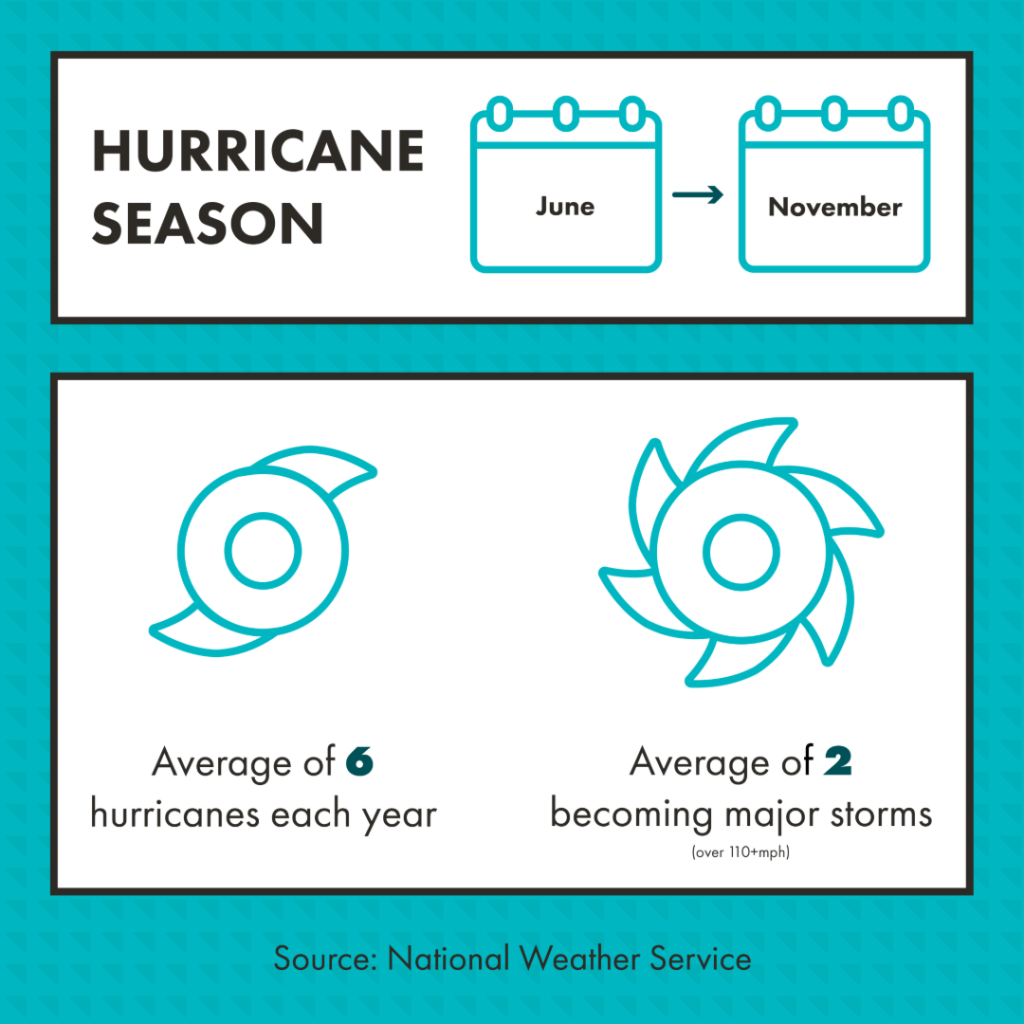

Get Weekly News Updates in Your InboxJune 1st through the end of November is considered Hurricane Season for the Atlantic and Gulf Coast, with heightened chances of storms occurring from early August to October. According to the National Weather Service, there’s an average of six hurricanes each year, with two typically becoming major storms hosting winds of 110-plus mph.

Even on its best days, the logistics industry is considered complicated. Throw a hurricane in the mix, and you can have straight-up chaos. Hurricane Season means supply chains should prepare for the worst in weather, like heavy rain, dangerous gusts of wind, limited visibility, and flooding. Shipping setbacks such as impassable roadways, stranded trucks and drivers, loss of cargo, and extended deliveries are just some of what can be experienced. Here’s what your organization needs to know to prepare during peak Hurricane Season so your company can avoid delays and a loss in revenue.

Supply Chain Tips for Peak Hurricane Season

Stay Informed

A hurricane’s path and level of impact can change very quickly. It’s crucial you stay informed of potential storms that could impact your supply chain during Hurricane Season.

Set up alerts to be notified of newly formed storms and hurricanes. When a potential storm is in your path find a trusted weather news source and check it often for updates. Don’t just follow the updates before the storm, but also during and after. You may also adopt and use advanced weather tracking systems to get up-to-date information to make informed, real-time decisions.

Maintain Communication

Natural disasters, like hurricanes, can have a huge impact on your company’s supply chain. An easy way to stay ahead is to be transparent and communicate openly throughout. Transparency builds trust and helps manage expectations during a crisis.

If a potential hurricane threatens your business, acknowledge it immediately. Then, start communicating with your customers and partners about the potential effects. Regular updates on potential disruptions and recovery efforts can go a long way in maintaining strong business relationships.

Have an Emergency Plan Ready

You should have a company-wide plan that outlines its actions during a hurricane. Your emergency plan should include important details like;

- an evacuation route for buildings affected

- a crisis communication plan

- assigned employee emergency roles and responsibilities

- instructions on how to protect inventory and equipment

- where emergency supplies are located and how best to use them

- how capable facilities will support when others are affected

When planning, make safety your company’s top priority during a hurricane. Once established, your plan should be reviewed often and updated as needed to ensure it remains effective. Additionally, running practice drills can help everyone know their roles and responsibilities.

Consider Alternatives

Consider what alternative workspaces and methods of transport you could use in the event of a hurricane. Are there temporary warehouse solutions where inventory could be stored? Could intermodal replace a truckload shipment that’s in the path of the storm? Are there alternative routes? How can facilities outside of the storm’s path support those affected? These alternative options should be included in your emergency plan.

While you may not have all the answers when planning, the more you include, the quicker you can make strategic decisions when needed. Having room for flexibility and adaptability is key to minimizing disruptions.

Have Visibility in Your Supply Chain

Visibility is needed now more than ever for supply chains. Having visibility not only helps you on good days but especially during hurricane season.

A transportation management system (TMS) can provide the necessary visibility during a hurricane. It provides critical data about your shipments and orders in real-time, giving you an advantage should a problem arise. This can help you make quick decisions to reroute shipments, avoid affected areas, and keep your customers informed.

See how a TMS could help youThink About Recovery

According to the Federal Emergency Management Agency (FEMA), almost 40 percent of businesses that have to shut down for 24 hours due to a natural disaster never open again.

Ensure your business won’t be in that 40 percent if it happens. Have a plan ready to roll for the aftermath of a hurricane. Prepare for the worst and then plan how to recover from it quickly. This will help prevent any potentially steep revenue loss.

Recovery Team, assemble! It’s time to identify the key employees and providers to get your business back to normal operations. An initial assessment will need to take place and your team’s sole responsibility should be to restore and resume processes. Having those alternative solutions and backup suppliers or providers will be handy here.

Weather the Storm with a Reliable Logistics Partner

Sometimes, you just need extra help. A relationship with a reliable logistics provider, like Trinity Logistics, can help your supply chain overcome the threats of Hurricane Season.

Hurricanes can roll in a cloudy overcast of unknowns, but Trinity shines a light toward safety and security. We have over 45 years of experience helping thousands of supply chains through ups and downs. We thrive on problem-solving and handling issues like the ones hurricanes can bring. We also have a dedicated After-Hours Team to support and quickly resolve any potential challenges – no matter the time of night, holidays, or weekend.

Our nationwide network of trusted carrier relationships ensures your shipments arrive safely at their delivery locations. Additionally, multiple transportation options offer the flexibility to keep your goods moving. Lastly, we’ll help you find real-time visibility with our customizable Managed Transportation solutions. Our dedicated Team (comprised of six Regional offices across the nation) is ready to help you maintain continuity and resilience in your supply chain.

Partner with Trinity logistics so your supply chain can stay afloat, no matter the weather. (Our exceptional service might just blow you away, though!)

GET A FREE QUOTE ON YOUR NEXT SHIPMENT SUBSCRIBE & STAY IN THE KNOW LEARN MORE ABOUT TRINITY LOGISTICS

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

UP AND TO THE RIGHT

For the past year, the general direction of the Outbound Tender Volume Index (OTVI) has been on an upward trajectory as seen in Figure 1.1.

While it is not approaching the levels seen in 2021, the volume index is quickly approaching levels seen in 2022. This has buoyed optimism in the industry.

Another rise we’re keeping an eye on is the Outbound Tender Rejection Index, the rate at which carriers are saying “no” to freight where they have paper rates with a shipper. A six percent rejection rate may not sound important, but considering the rejection rate has stagnated in the three-to-four percent range for the past year plus, it’s another sign that the freight pendulum may be nearing more of a balanced market.

In 2021, rejection rates hovered in the 20-30 percent range. This was more a product of increased freight volumes and carriers realizing they could get higher rates in the spot market versus the contracted rates they had in place. The uptick in rejection now appears to be more of a limit of capacity in certain markets versus carriers hedging their bets on the open load board.

Drip, Drip, Drip

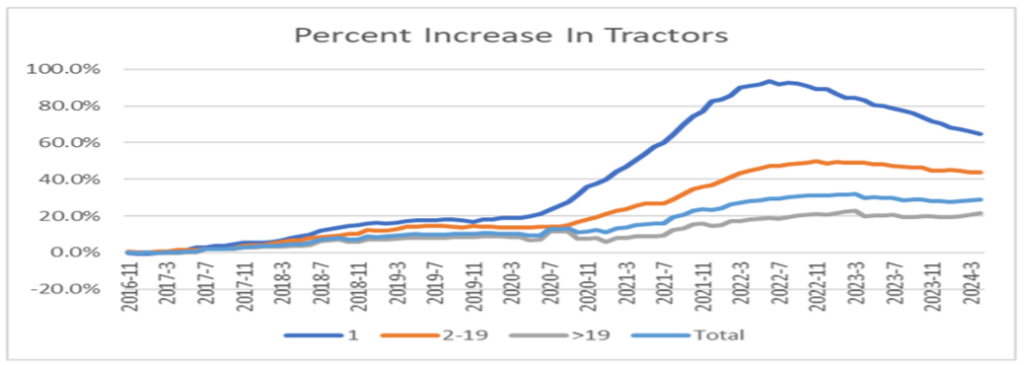

Speaking of that capacity, there is a reduction happening, albeit a slow drip. As shown in Figure 1.2, for the past year and a half, almost two years, the biggest reduction in capacity has been from the owner-operator segment. Most likely, the carriers in this group that have exited the market are those that rushed in when freight and rates were plentiful, and now are finding more normalized rates combined with high overhead to be unsustainable.

As shippers continue to look ahead, not having reliability among this segment of carriers could prove problematic as volumes escalate and more freight flows to the spot market, which is supported heavily by owner-operator drivers. This is a good reason for shippers to ensure they have a good mix of carrier and broker partners.

Baltimore Still Recovering

Finally, it has been just over three months since the bridge collapsed near Baltimore, MD. The waterways in the surrounding area appear to be returning to normal, and the need for traffic that populated the bridge to divert to alternate routes seems to be no worse for the wear on drivers.

Looking at volume in that market in Figure 1.3 since the end of March when the event occurred, after a slight dip when freight had to be re-routed, volumes as measured by the OTVI have increased just over 10 percent. Certainly, there is still work to be done, short- and long-term, but the Baltimore area appears to have powered through an unfortunate event.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox