06/14/2023 by Greg Massey

June 2023 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Why are Contract Rates Elevated in Comparison to Spot Rates?

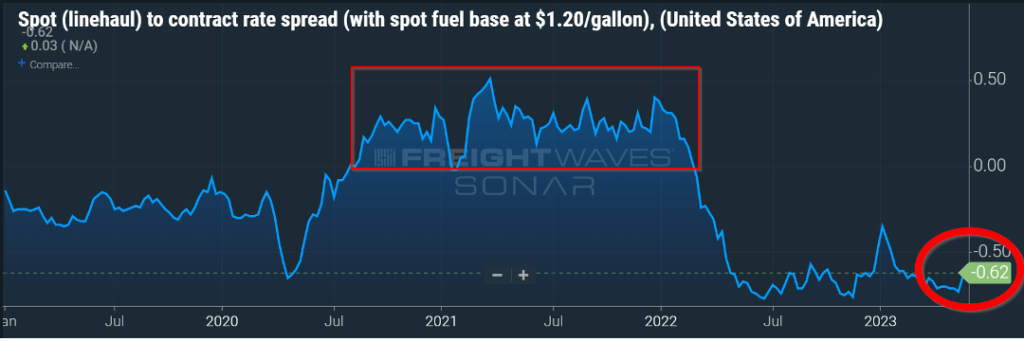

If freight volumes are, by some accounts, 30 percent less than what we experienced in the over-heated freight market of ’21 and most of ’22; and rejection rates are almost nil, why is the gap between contract and spot rates so wide, currently at $0.62 per mile as seen in Figure 1.1?

Typically, the gap between spot and contract in a “normal” freight market hovers around $0.15 per mile. During 2021 and most of 2022, spot rates were higher than contract rates for an extended period. For the majority of 2023, spot rates have fallen short of their contract rate counterparts.

As rates were high, especially on the spot side the last few years, capacity, particularly single-truck or small fleet operations, flooded the market. When challenging consumer conditions presented themselves towards the end of 2022, that meant less freight was traveling on America’s roads. So, you had a situation where less freight was in the contract space, which meant contract carriers were less likely to say “no” to freight tenders. This meant less freight flowed downstream to the spot market. When it did hit the spot market, there was a glut of carriers just waiting to bid for it, oftentimes doing so at break-even or very skinny profit margins just to keep the wheels turning.

We have seen in recent days the gap narrow. Part of that is due to continued pressure on contracted rates and another part of that is due to recent holiday and safety events that have stymied spot capacity. The gap will continue to narrow, mainly due to contract rates continuing to recede as spot rates, while maybe not at their floor, have very little room to move downward before they put carriers in a negative profit situation.

HO, HUM

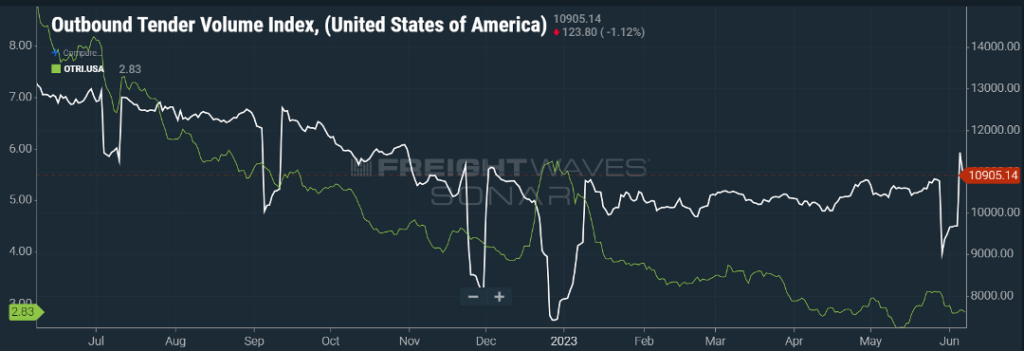

On the topic of volumes and rejection rates, not much has changed since we last visited our trusty SONAR charts (Figure 2.1).

There was a brief blip in volume around the Memorial Day holiday, but that was short-lived, and volumes are returning to the levels we have become accustomed to over the past several months. Additionally, rejection of freight briefly pushed past the three percent mark but has since fallen back into the mid-two percent range.

Produce season will certainly give a boost to volumes, and drive rejections a tad higher. As well, depending on the situation with labor disputes at the west coast ports, that could potentially cause a brief halt to movement out of the west coast ports. When the labor disputes are resolved, it will give a burst to freight coming out of the ports of Los Angeles and Long Beach especially. But for now, things are a bit ho-hum.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive Weekly News Updates every Friday by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox