02/14/2025 by Greg Massey

February 2025 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Tariffs, Trends, & Trade Routes

With the new administration in place, there has certainly been no shortage of headlines. Many have asked what the impact is, or potentially will be, on the freight market. I think many are leery of making changes to projections or providing advice on how to pivot because what happens today can turn on a dime tomorrow when it comes to U.S. policy.

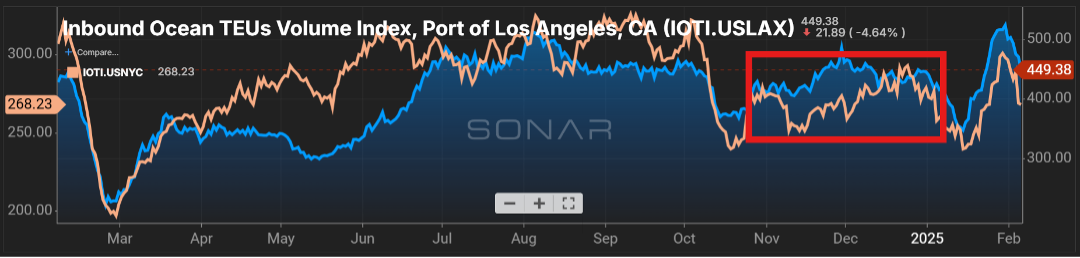

The one thing that appears certain is that many retailers pulled their inventory ahead in anticipation of tariffs being enacted. The last four months have seen a volume that outpaced the prior year. Figure 1.1 shows the container volume for Los Angeles (blue line) versus the port of New York/New Jersey. Particularly, the West Coast has seen an influx driven not just by the pull forward of volume, but the uncertainty with labor relations at the East Coast ports shifted volume west during the latter part of 2024 and early ’25.

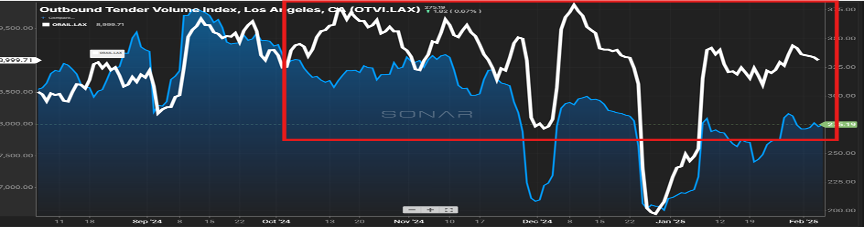

Unlike what was experienced several years ago, that increase in import volume has not translated to over-the-road moves. Figure 2.1 shows the last six months of volume handled by trucks out of the Los Angeles area versus the volume that has found its way to the rails. Unlike ’21 and ’22 when rails were a bit of the bottleneck for freight movement, they are much better positioned this time to handle the increase in volume. You can clearly see the gap in volume for rail (white line) versus truck (blue line), especially since early October.

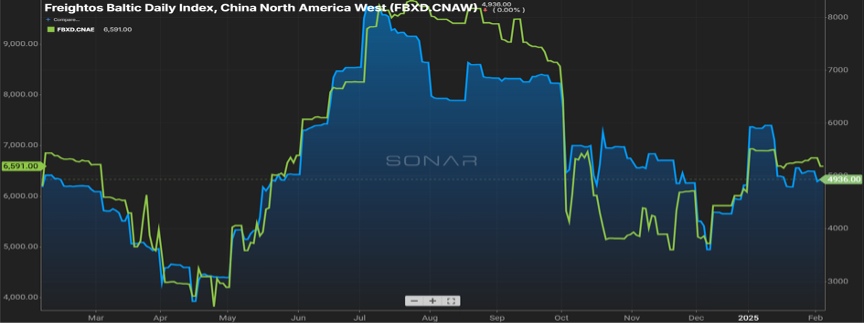

Speaking of imports, there appears to be a normalizing of the cost to procure containers for movement of goods into the U.S. Looking at Figure 3.1, the cost of a freight container from China to both the left and right side of the United States has retreated from its high during the summer months and shows a leveling out. Much of this is due to the decline seen in nefarious activity in and around the Red Sea. As calm has returned, ships are now able to utilize this corridor for transit, it has shaved transit times which in turn has opened up more ship capacity globally.

Price Hikes Ahead?

Finally, while tariffs have been the talk recently, certainly the who, what and when has been in a state of ebb and flow, one item that is not getting as much press is the scrapping of the de minimis exception. This has long been a shipping loophole for retailers that thrive on low-cost goods (think Temu or Shein). Unlike many retailers who paid millions, hundreds of millions, in duties and taxes, the companies of Shein and Temu paid a whopping $0 for all of 2024. This move now requires basically all inbound shipments to the U.S. to be subject to duties, taxes and processing fees, which has the potential to shift the landscape for companies that were able to thrive in this market.

As example, a good costing $50 once it got to the end customer was still only $50. With de minimis not in play, a $50 good could avoid fees that would almost double when you factor in the additional costs. What remains to be seen is how these increased costs are handled, but the most likely scenario is the end consumer absorbing the bulk of those costs. Typically, producing these low-cost goods in China comes with stiff competition and razor-thin margins, leaving manufacturers and shippers unable to absorb the increase.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox