09/18/2023 by Greg Massey

September 2023 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Freight Volumes Stagnant

As the U.S. continues to pull the levers to throttle the over-heated economy we experienced over the past few years, freight volumes, which are largely driven by consumer activity, have seen the impact of less buying from John and Jane Doe. It’s expected that muted consumer activity will continue through the first half of the calendar year 2024. We still expect to see a seasonal increase in spending at the end of the year for holiday shopping, but with consumers being more dependent on credit for purchases, and the rate of savings on the decline, expenditures are expected to be less than in prior years.

Combined with declines seen on the industrial production and manufacturing side, the hope for a rebound in freight volumes will not take place in 2023. The prevailing thought at this point is a return to a more balanced supply and demand regarding freight transportation will be driven by carrier attrition.

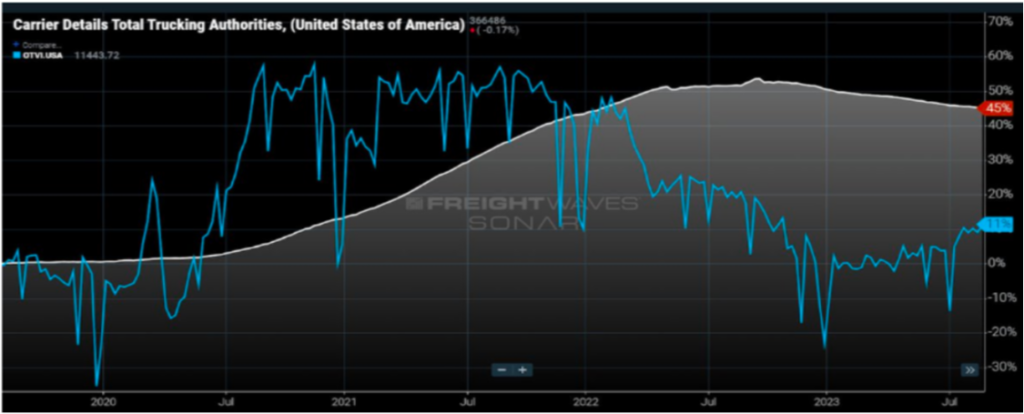

Nobody likes to see businesses fail, but we continue to see a market where oversupply has created trucking rates, particularly on the spot side, that are borderline if not less than what it costs a carrier to operate. Since the middle of 2022 and continuing this year, that decline in carriers for hire has continued as seen in Figure 1.1. Most of the attrition is carriers with five trucks or less, but as we’ve seen recently with Yellow Corporation closing its doors, no carrier is immune.

Capacity Declining

To further illustrate the impact of freight volumes on capacity, Figure 1.2 shows how capacity responds, almost in lockstep, with increases and decreases in freight volumes.

As freight volumes were accelerating in the latter part of 2020 and through early 2022, trucking companies popped up at a rapid pace to meet the demands of shippers. Carrier compliance, to a small extent, took a backseat as shippers were eager to make new friends with those who could get their product off the docks and to the end user in a race to satisfy consumer demand.

As freight volumes started to decline, as seen by the blue line in Figure 1.2, the need for capacity waned and began the downward trend (as shown by the white line) regarding carriers in the market.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox