Don’t let your company get caught off guard by CVSA Operation Safe Driver Week, July 7th to July 13th, 2024!

Shippers and carriers, mark your calendars! Operation Safe Driver Week is approaching. While this annual event is designed to make our roadways safer, it’s also a crucial week for those in logistics. This pivotal time can impact operational efficiency for shippers and carriers alike. To be prepared, it’s important for all those involved in shipping freight to understand what Operation Safe Driver Week entails and its effect on the freight market.

- What is the CVSA?

- What is Operation Safe Driver Week?

- Impact on Shippers

- Impact on Carriers

- How Shippers Can Prepare

- How Carriers Can Prepare

- Let’s Work Together

What is the CVSA? What is Operation Safe Driver Week?

The Commercial Vehicle Safety Alliance (CVSA) is a non-profit organization dedicated to improving commercial motor vehicle safety through collaboration between law enforcement, industry stakeholders, and the public sector. In partnership with the Federal Motor Carrier Safety Administration (FMCSA), the CVSA launched the Operation Safe Driver initiative in 2007. The goal of this initiative is to reduce the number of deaths and injuries from crashes involving large trucks, buses, and cars.

This initiative includes an annual event, Operation Safe Driver Week. It aims to improve driver behavior through education and increased enforcement efforts, focusing on unsafe driving behaviors. It takes place across North America, so the U.S., Canada, and Mexico. Unlike the CVSA’s other two initiatives (International Road Check and Brake Safety Week), which solely focus on commercial drivers, this event affects all drivers on the road.

Each year has a primary focus with this year’s being reckless, careless, or dangerous driving. This includes actions like:

- Speeding

- Texting while driving

- Drunk or drugged driving

- Following too closely

- Driving too aggressively

- Improper lane changes

- Failure to obey traffic control devices

- Failing to use a seat belt

Those drivers identified are pulled over by law enforcement and issued warnings or citations.

According to the National Highway Traffic Safety Association (NHTSA), drivers’ actions are the reason behind 94 percent of all traffic crashes. Research from the University of Missouri-Columbia has shown that interactions with law enforcement, not just education, are what brings change. During last year’s event, law enforcement interacted with 66,421 drivers! Drivers were informed and educated on how they can improve their driving behavior and do their part in reducing crashes.

Why Should I Be Concerned About Operation Safe Driver Week?

It’s important to be aware of when Operation Safe Driver Week takes place because of the impact it has on shipping freight. Even though it’s just one week out of the year, no one likes to be unprepared for potential disruption or delays to their business.

Operation Safe Driver Week Impact on Shippers

Shippers may face potential delays, see reduced transportation capacity, and likely higher spot rates.

Potential Delays

Increased enforcement activity can lead to potential delays due to any road stop inspections or pullovers.

Reduced Transportation Capacity

The increased enforcement effort sometimes leads carriers to strategically choose to close their business temporarily for the week to avoid any risk of fines or penalties. You might find it more difficult to secure reliable carriers for any last-minute shipments.

Higher Spot Rates

With the potential for fewer trucks available and delays, spot rates can be heightened during this time.

Operation Safe Driver Week Impact on Carriers

Carriers are similarly affected, and there is the potential for delays, less freight volume, and higher scrutiny from law enforcement.

Transportation Delays

Just like shippers, carriers should expect to see potential delays in the movement of traffic due to the increased enforcement. This could disrupt your operations.

Fewer Shipments Available

Shippers may choose to plan around this week, reroute certain shipments, or even look into alternative modes. Less freight may be available during this week.

Increased Law Enforcement

Expect to see increased law enforcement, so more eyes will be looking for unsafe driver behavior, and drivers may receive fines.

How to Prepare for Operation Safe Driver Week:

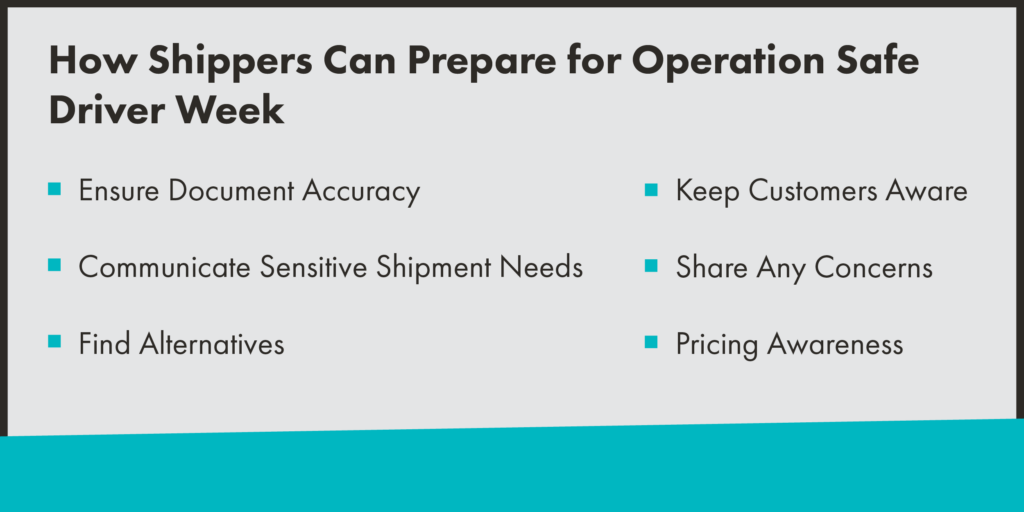

Shippers

Ensure Documentation Accuracy

Double-check all shipment documentation. Ensure it is accurate and complete to avoid delays during any unexpected inspections.

Communicate Sensitive Shipment Needs

If you have any special requirements or time sensitivities, communicate this well in advance. This helps your logistics provider plan effectively. Any last-minute communication risks delays.

Find Alternatives

Consider alternative transportation modes or routes if you expect any delays.

Keep Customers Aware

Be proactive and communicate potential delays during this week to your customers to manage expectations.

Share Any Concerns

Discuss any concerns you might have with your logistics provider. They can offer valuable insights and help develop strategies to reduce disruptions.

Pricing Awareness

Be aware of possible higher spot rates during Operation Safe Driver Week. When possible, plan shipments before or after this period to secure better pricing.

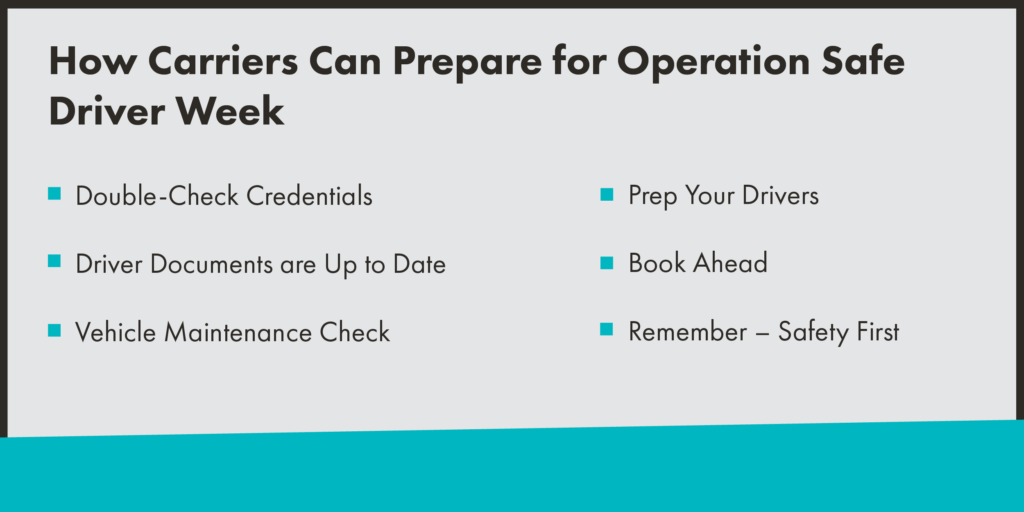

Carriers

Double-Check Credentials

Ensure all company credentials, like operating authority, hazmat endorsements, TWIC cards, and any other relevant permits, are current and accessible.

Driver Documents are Up to Date

Have drivers verify that all paperwork is up to date and accessible in case of inspection.

Vehicle Maintenance Check

Double-check that all vehicles have undergone any necessary preventive maintenance and are in top operating condition to avoid delays due to roadside repairs.

Prep Your Drivers

Make sure drivers are aware of this week and the potential for stops or delays. Train drivers on proper procedures for interacting with law enforcement. Make sure they know the channels to communicate any disruptions to their journey.

Book Ahead

Shippers may choose to reroute shipments, choose alternative modes, or plan around this week. Consider booking shipments well in advance for this week.

Remember – Safety First

The importance of this week is not disruptions but road safety. This is a great time to talk with drivers about safe driving behavior. You could also help educate the public on proper driving behavior when interacting with trucks. Remember, this week benefits everyone who shares the road.

Let’s Work Together to Keep Our Roads Safe

We believe road safety is paramount. While Operation Safe Driver Week might cause some temporary disruptions, it serves a vital purpose in promoting safe driving behaviors.

By staying informed and taking proactive steps, you can likely see minimal effects of Operation Safe Driver Week.

For additional opportunities to stay ahead of disruption to your business during Operation Safe Driver Week, consider working with Trinity Logistics. We have over 45 years of experience helping thousands of shipper and carrier companies conquer more complicated shipping situations, like CVSA inspection weeks. We’re confident in our ability to make this week (and all others) a painless one for your business.

After several record setting years, 2023 saw shifts to the freight market. How did the 2023 freight market affect shipper and carrier businesses? Did other businesses have the same struggles as yours? Are they expecting to face similar difficulties in 2024? How are their partner relationships?

Trinity Logistics wanted to get answers to these questions for you, so we asked a random sample of our shipper and carrier relationships to gauge the effect 2023 had on their business and what their expectations for 2024 in our first Freight Market Survey. Here’s what we found out:

2023 SHipper & Carrier Data: Freight Market Survey Results

Past Challenges – Same, But Different

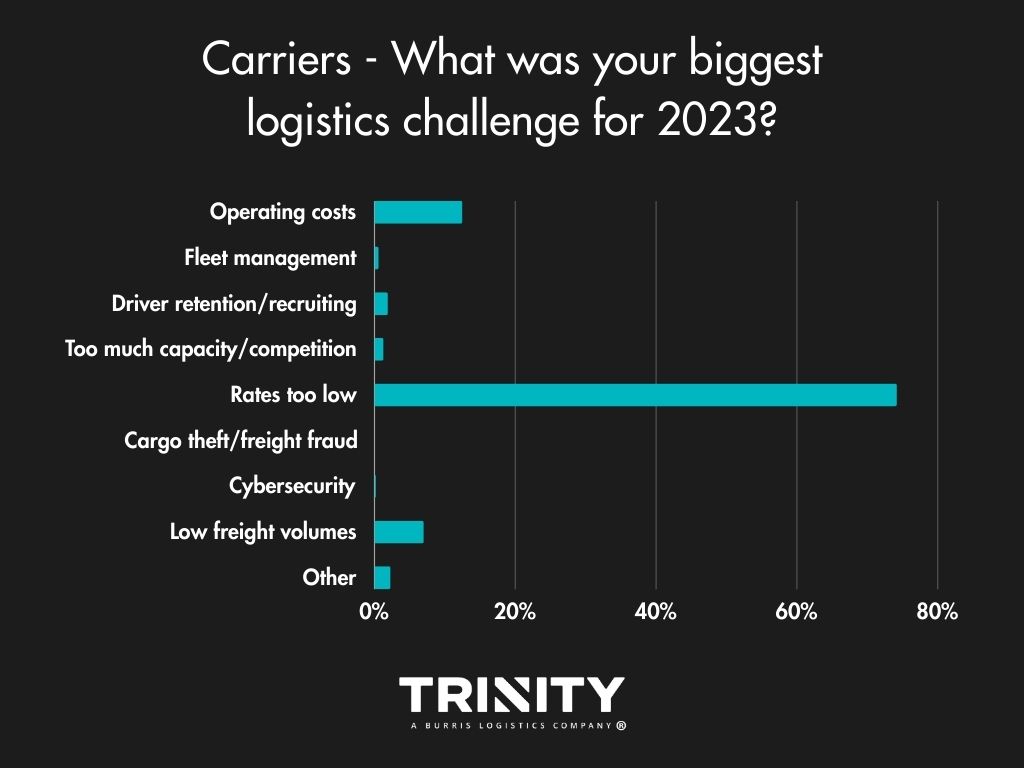

Considering the recent turndown of demand and the freight market, it’s not a big surprise that money was the biggest issue for shippers and carriers alike. Shippers answered that transportation costs were their biggest challenge in 2023, with supply chain delays/disruption and capacity not far behind. Low rates and increasing operating costs were the main challenges facing carriers.

Business Impact – Could Have Been Better

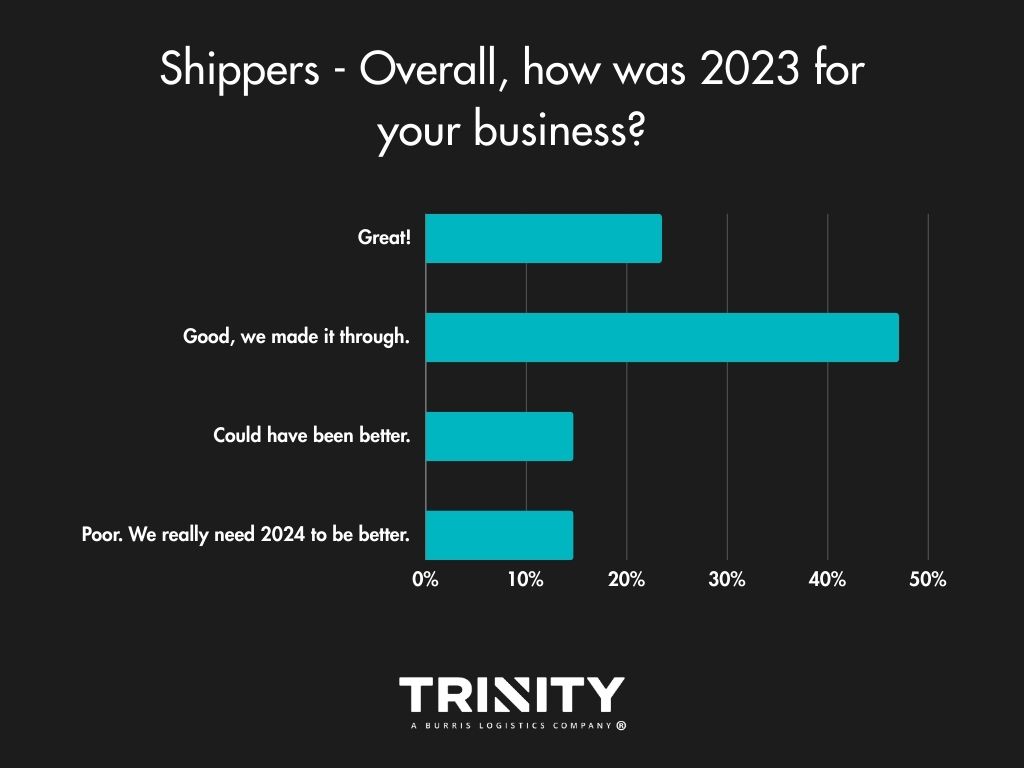

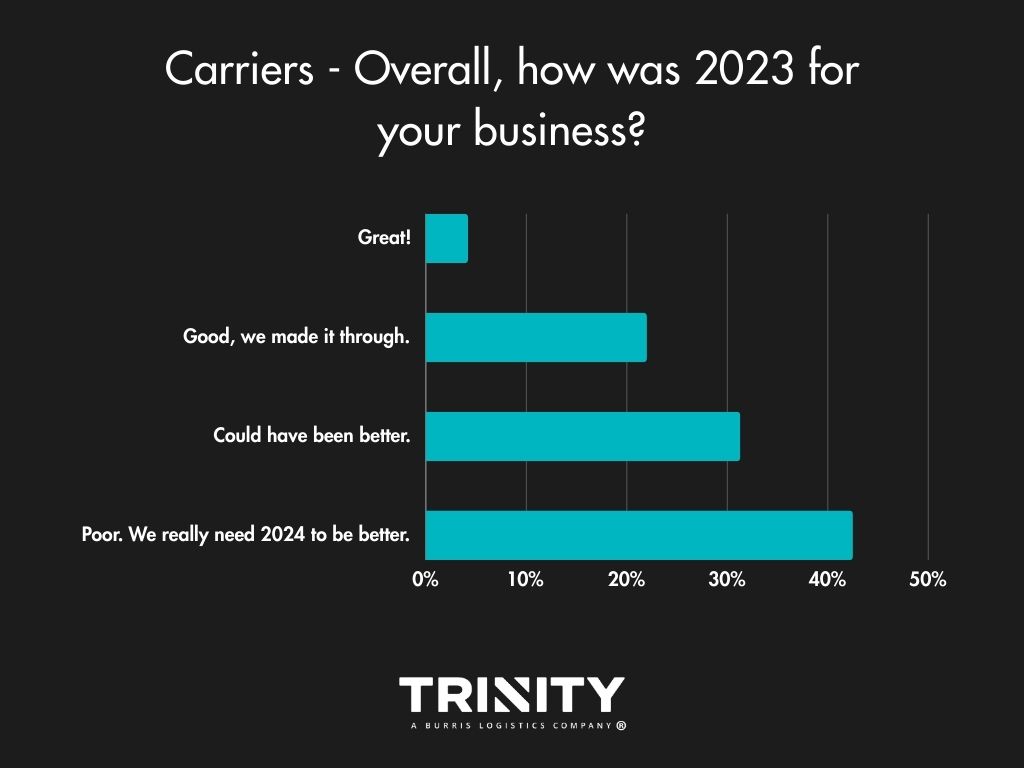

Even with the change in consumer demand trending downwards throughout 2023, most shippers answered that their year was good overall. Carriers on the other hand seemed to face a rougher year in business with over half of them stating their year could have been better or was poor.

A LOOK INTO 2024

Future Challenges – Money Problems

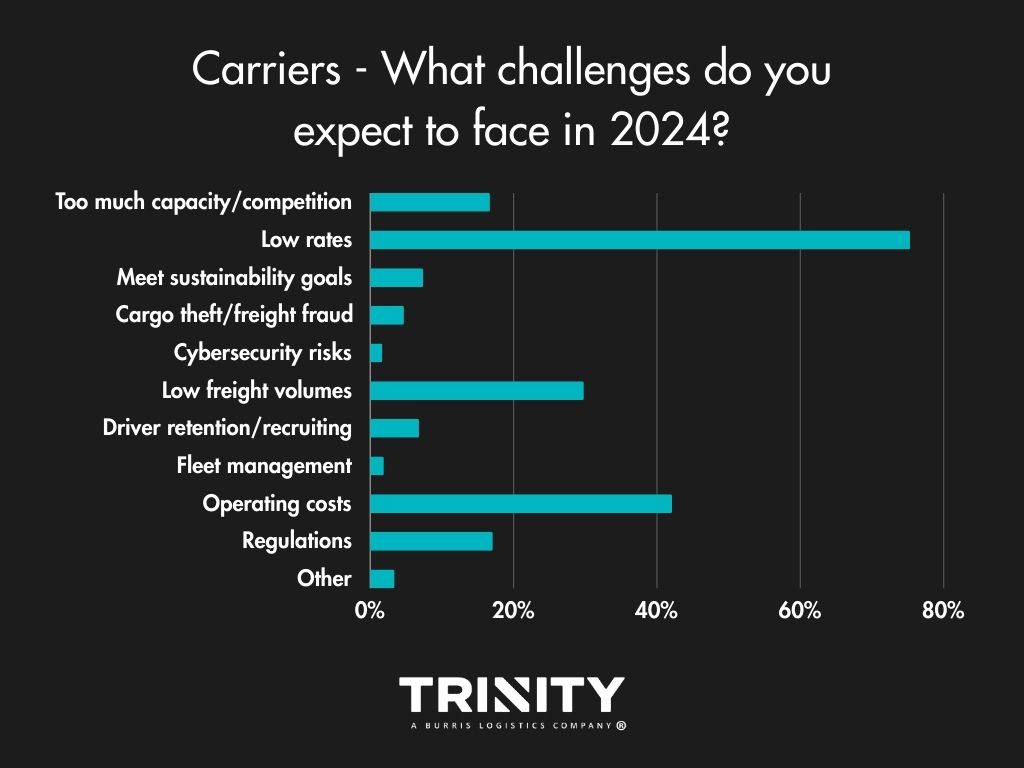

2024 isn’t looking much different in terms of challenges compared to 2023. Shippers look to have the same financial challenges as they did in 2023 with transportation costs, supply chain delays/disruption, and decreased demand being the top concerns selected. Carriers are still concerned about low rates, operating costs, and low freight volumes hurting their businesses.

Hot Trends

Even though transportation costs are shippers’ strongest concerns in their previous answers, it seems the increased amount of supply chain disruptions and delays we’ve all experienced in these recent years have hit a nerve, with the majority answering that supply chain resilience is the trend their business is most interested in. Cybersecurity also looks to be a growing interest.

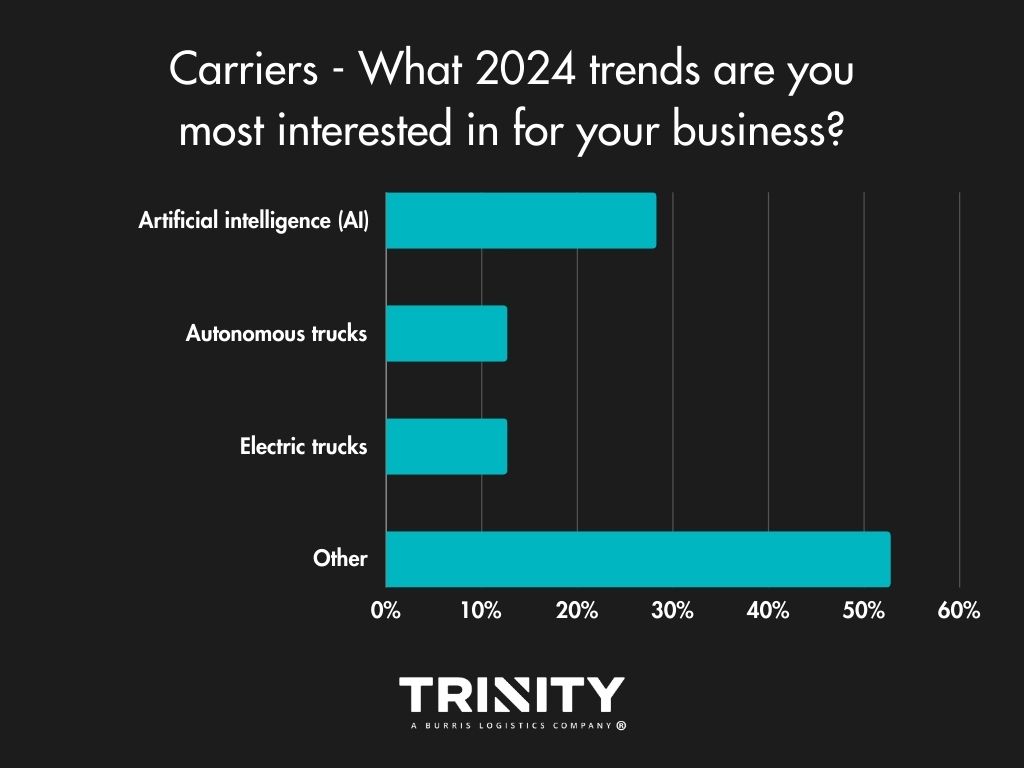

Carriers on the other hand, interestingly enough, look to the recent trend of Artificial Intelligence (AI). Also, as noted in the comment boxes of our “Other” option, increased rates and better fuel prices were trends they’d like to see in 2024.

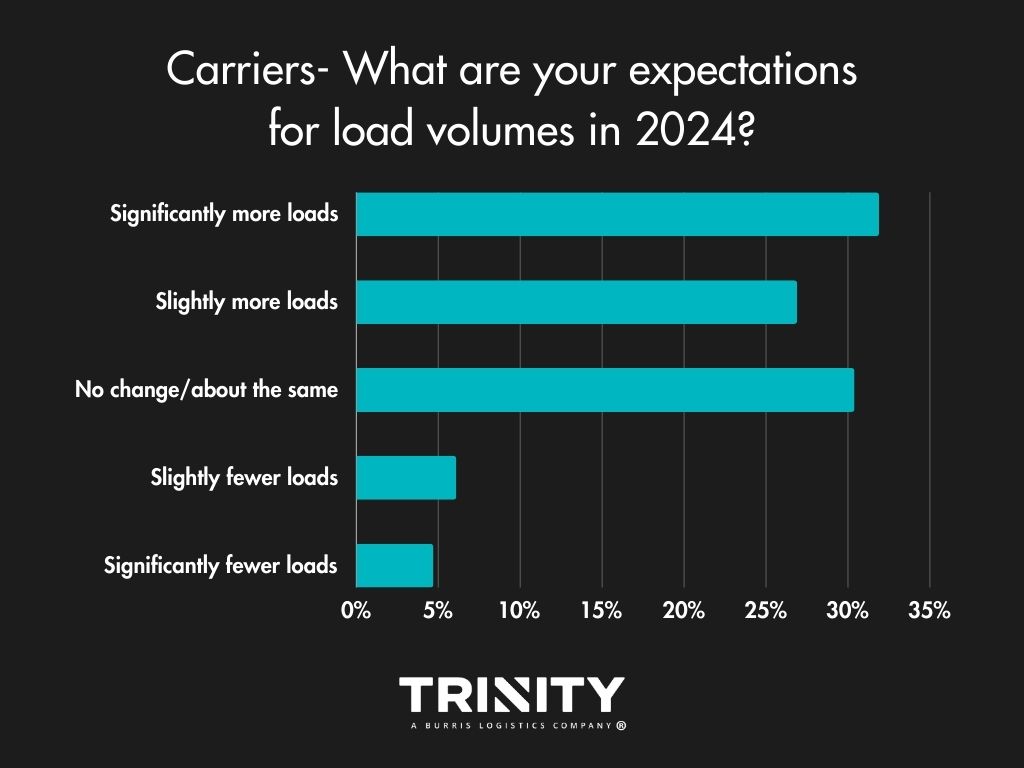

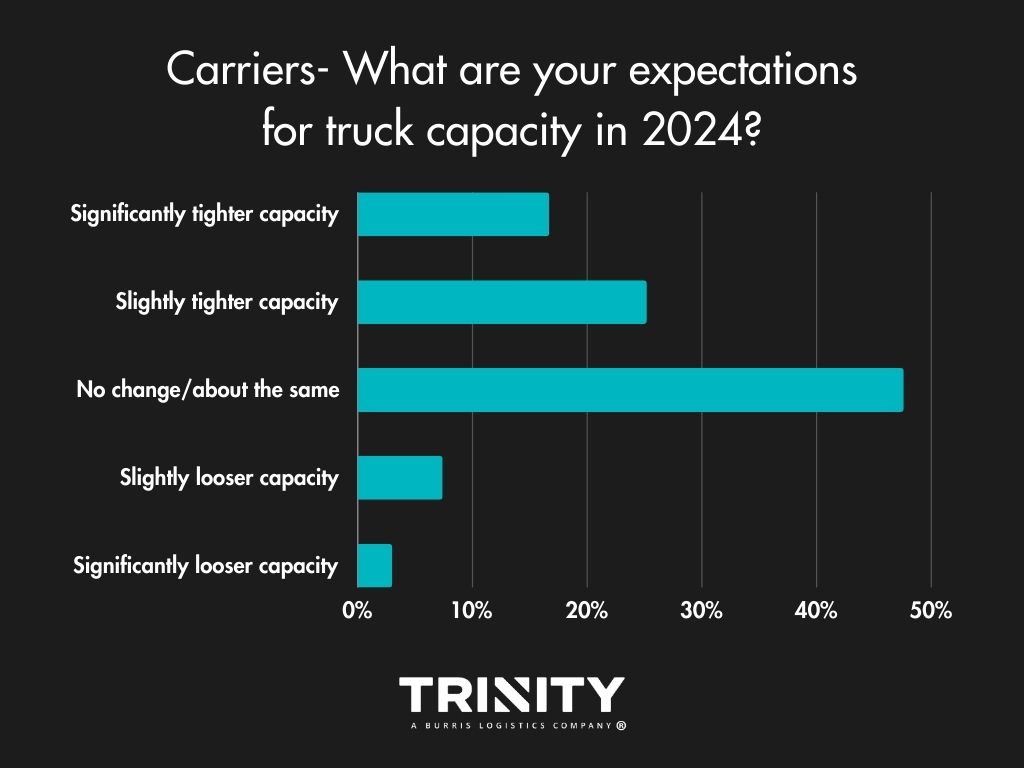

Load Volumes & Capacity – Slightly Positive Outlook

Overall, shippers are slightly more optimistic for 2024, thinking it won’t bring any change or the change it brings will be positive. Most think load volumes will stay the same or there will be a little more in freight volumes this year. As for truck capacity, they think it will be the same as 2023 or slightly tighter.

Carriers also think 2024 will bring more freight volumes and that capacity will likely stay the same or get tighten slightly versus 2023.

Spot or Contract?

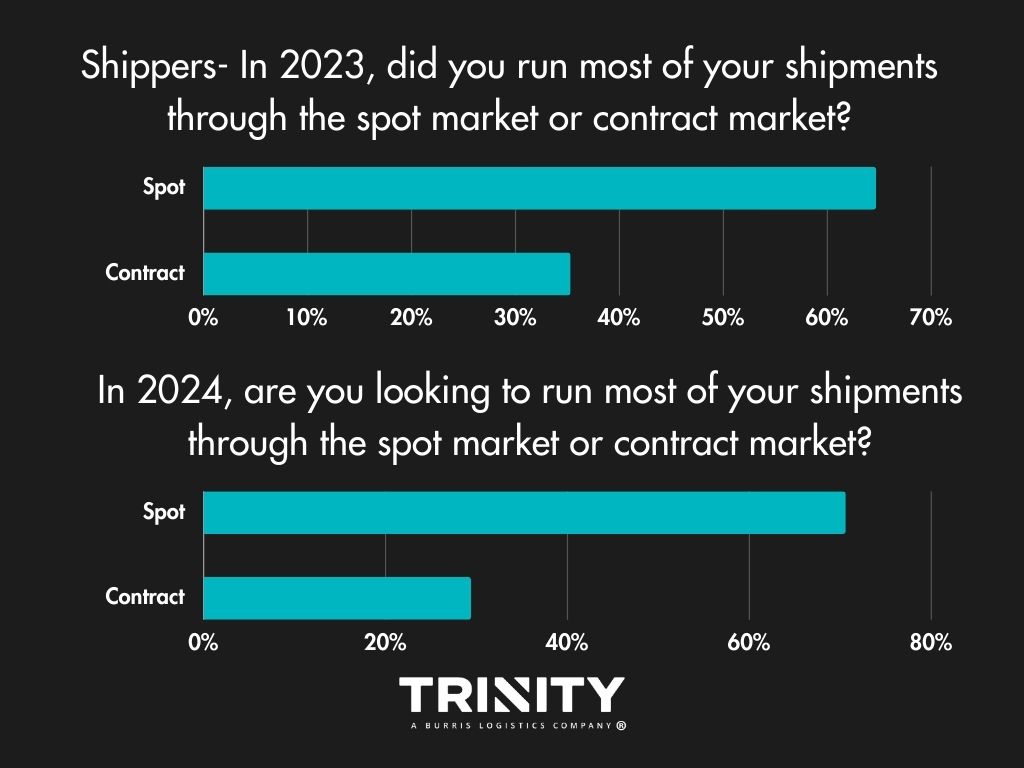

Year-over-year, shippers aren’t looking to change much in terms of which market they turn to. Most look to continue to put most of their freight on the spot market.

For carriers, there looks to be some change anticipated. In 2023, most carriers ran spot market freight but in 2024, over half of them look to haul contracted freight.

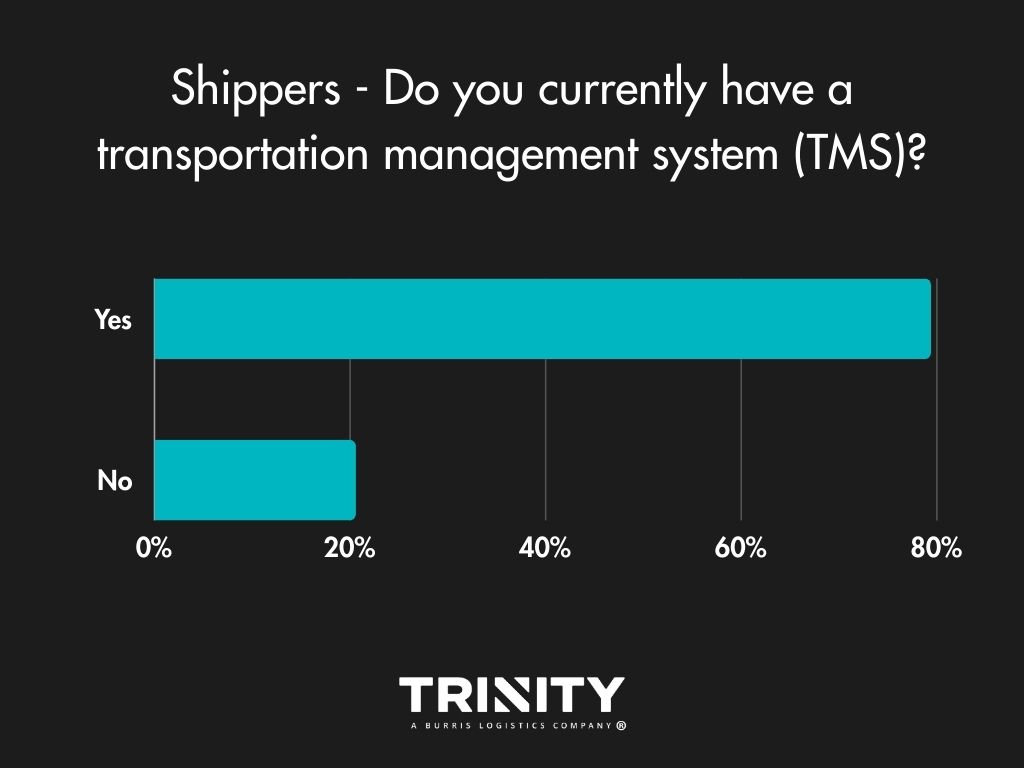

Do Shippers Have a TMS?

It’s 2024, so you’d think most shippers would have a transportation management system (TMS), and no surprise, they do. For those that don’t and answered, it seems they did not have a good experience with one in the past or don’t know enough about them.

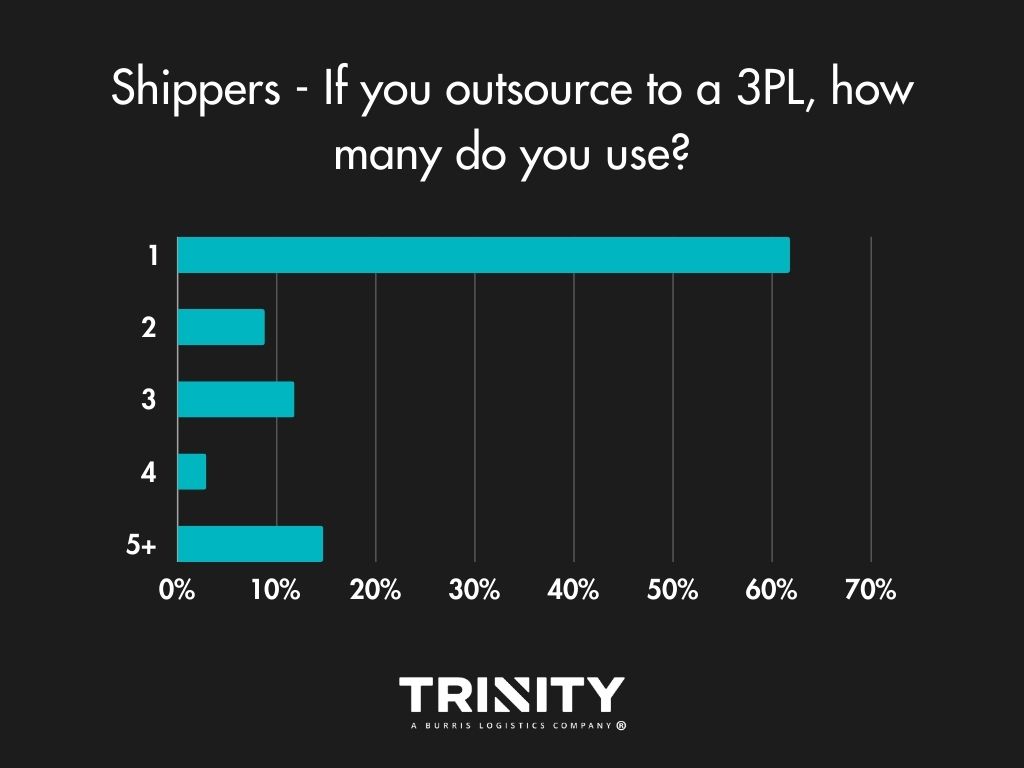

Brokers Are the Way to Go

When asked how they like to move their shipments, most shippers use a mix of carriers and third-party logistics providers (3PLs) or just 3PLs. A few do use their own trucks. For those that do outsource to 3PLs, they usually just stick to one provider.

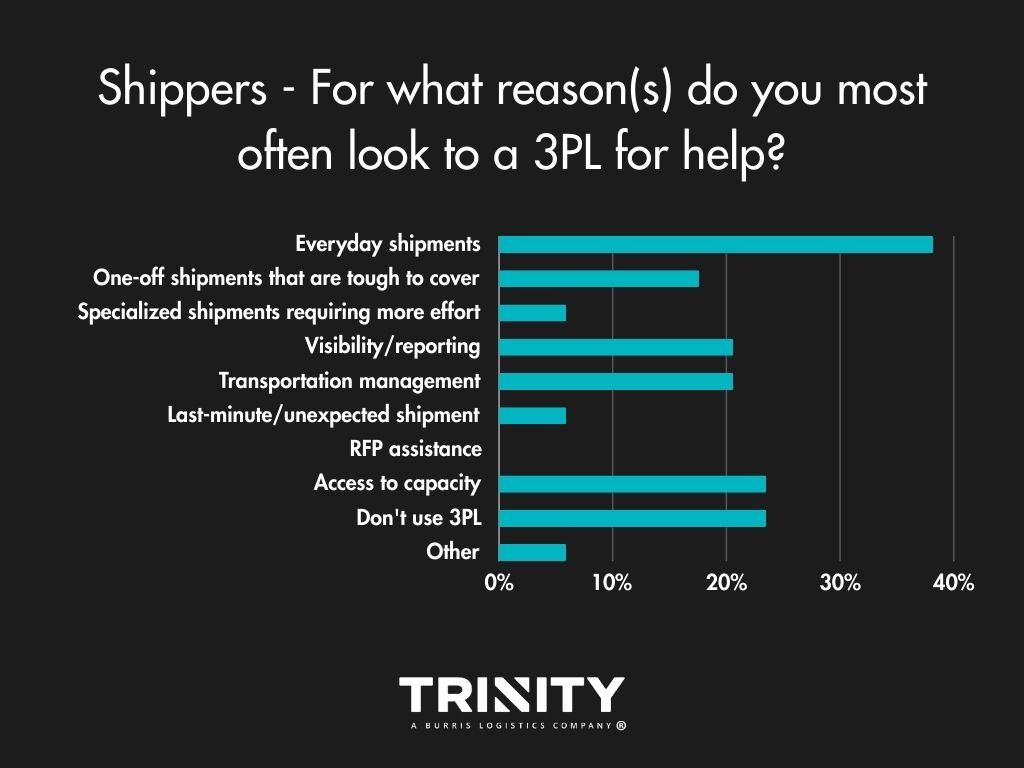

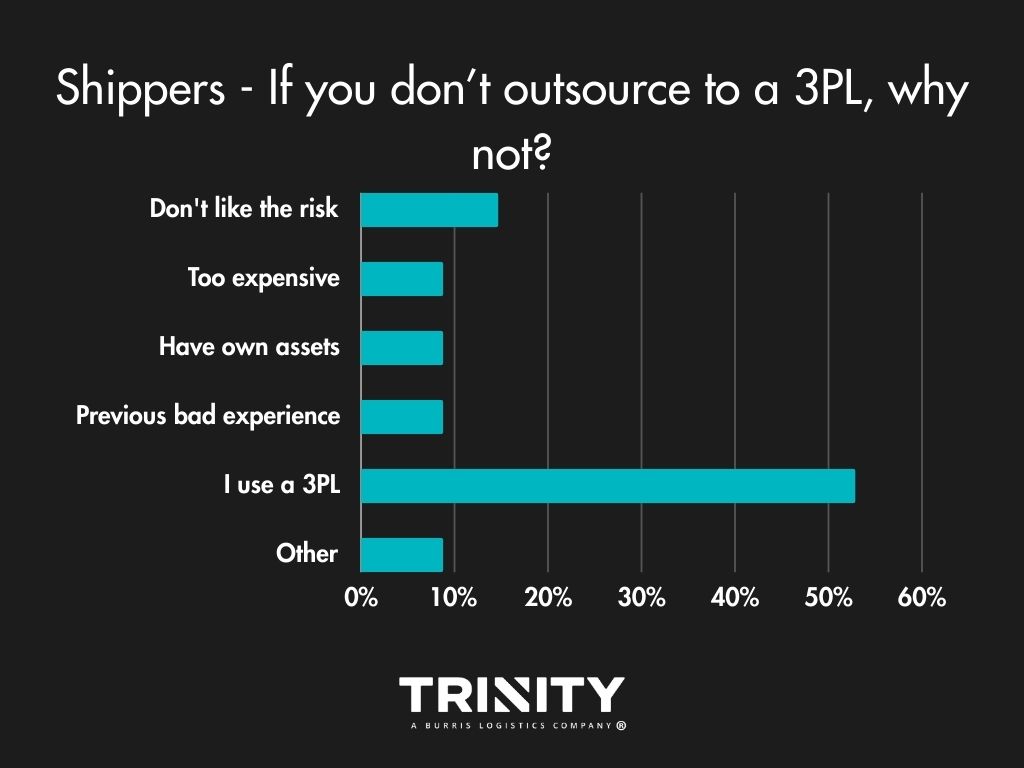

Shippers most often look to a 3PL for help with their everyday shipments, for transportation management, visibility, and access to their capacity. The main reason shippers choose not to work a 3PL for their logistics? They don’t like the risk.

Transportation Modes – Staying Consistent

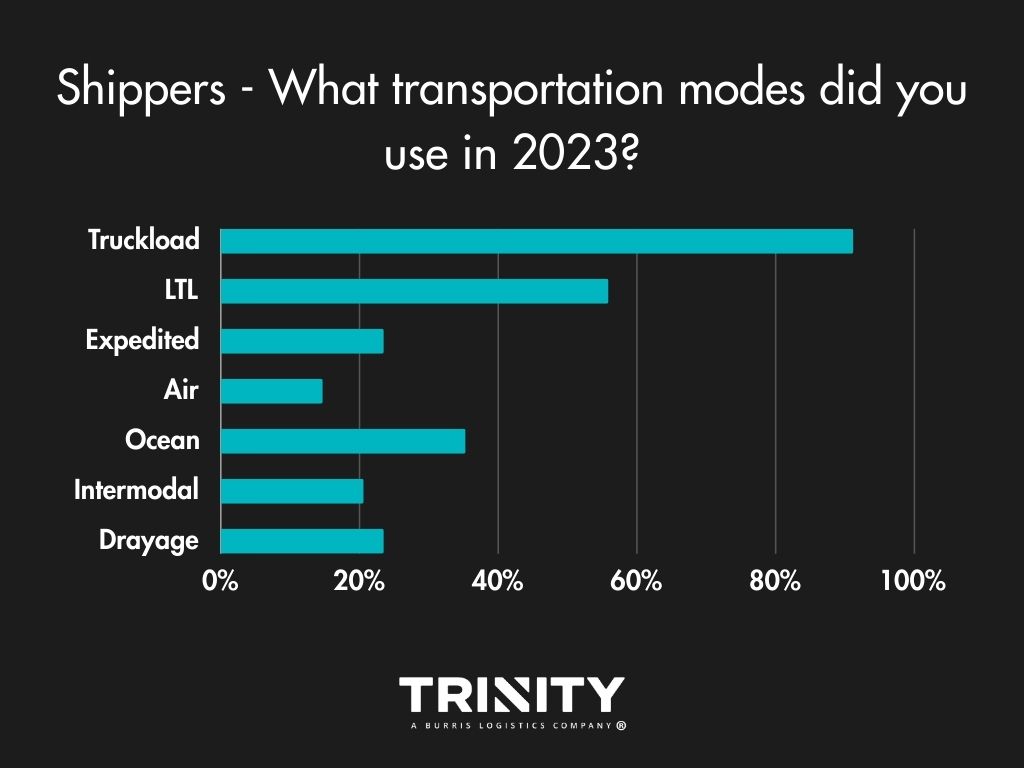

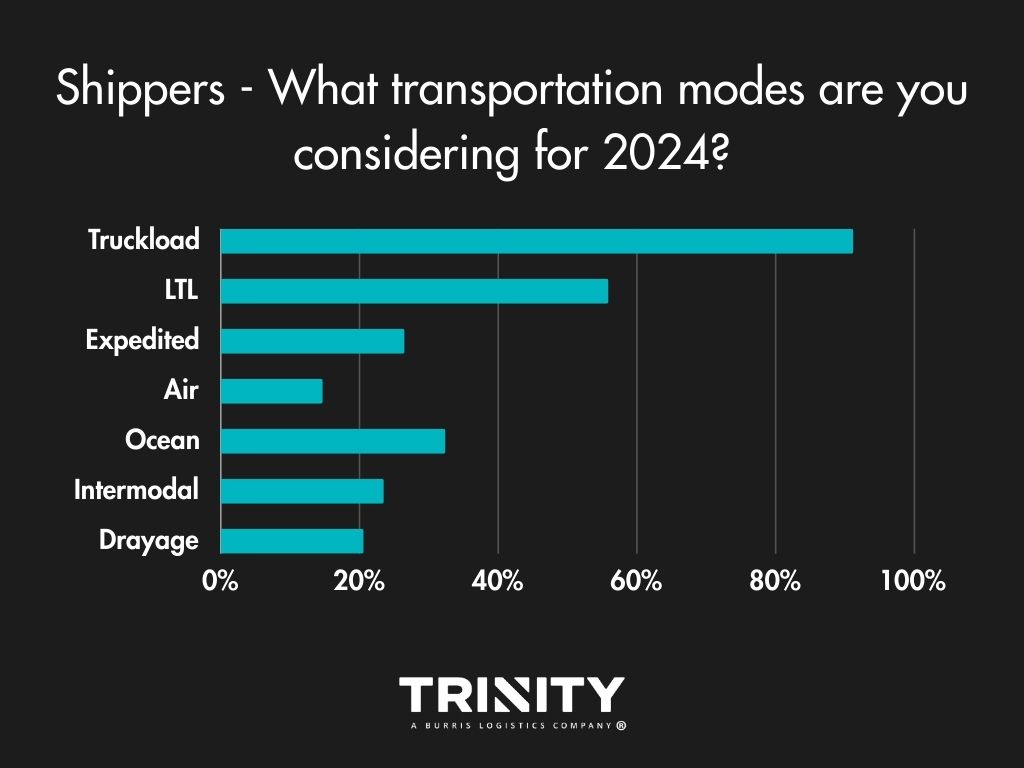

Overall, shippers aren’t looking to change what transportation modes they use for their shipments. Truckload and less-than-truckload (LTL) are the primary modes they like to use, with a little diversification sprinkled in.

Exceptional Service Stands the Test of Time

When it comes to their logistics partners, shippers find the most value in receiving exceptional service, with costs coming in as a close second.

Most Wanted: Long Mileage, Flatbed Shipments

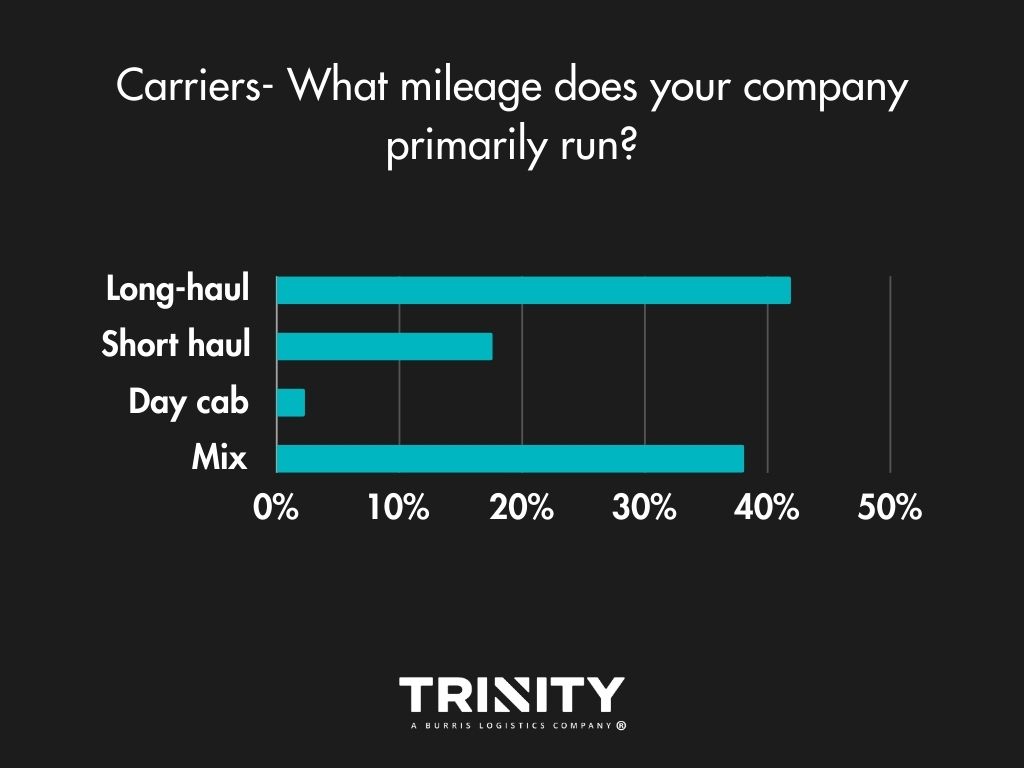

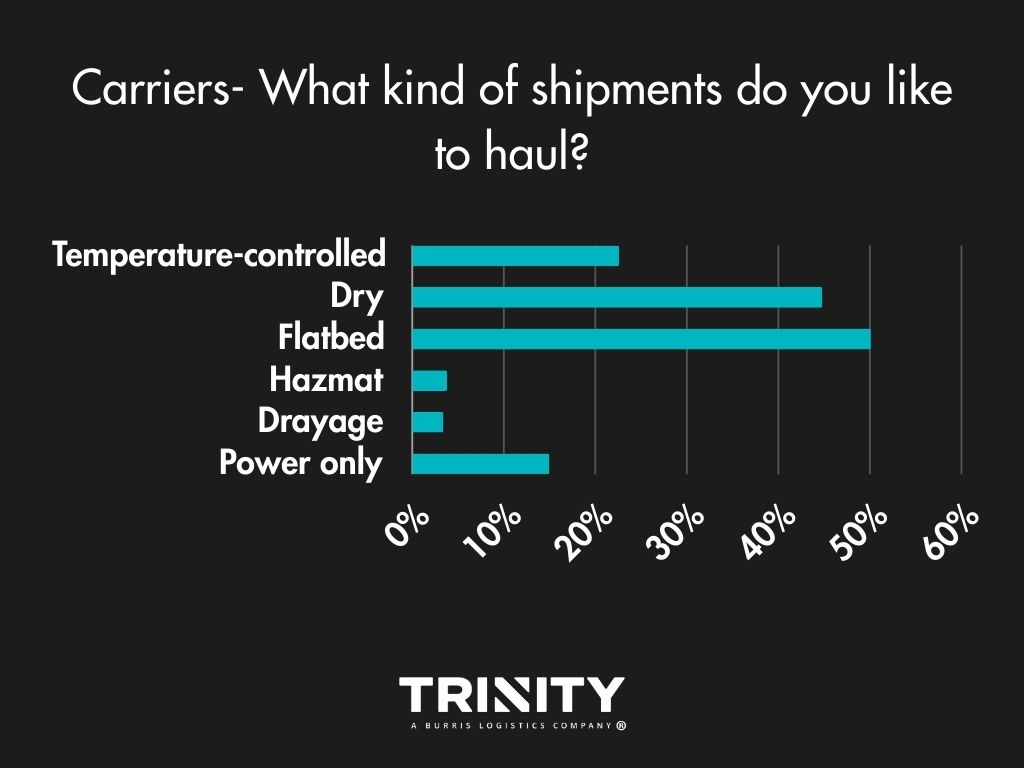

When it comes to mileage, most carrier companies tend to run long-hauls or a mix of short and long shipments. Flatbed hauls are the type of shipments most carriers like to haul with dry van coming in as a close second.

Load Boards are the Way

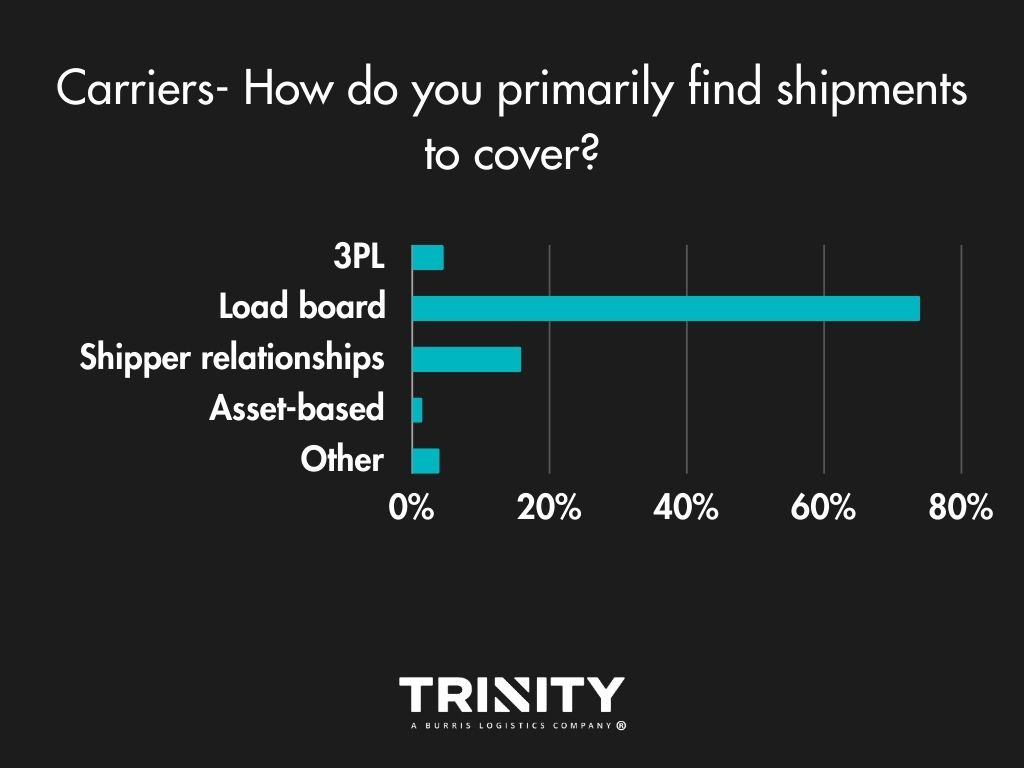

With 74 percent selecting this option, load boards are the norm for carriers to find available shipments. Sometimes they use their shipper relationships, and occasionally they make use of a 3PL.

3PLs – Expanding a Carrier’s Reach

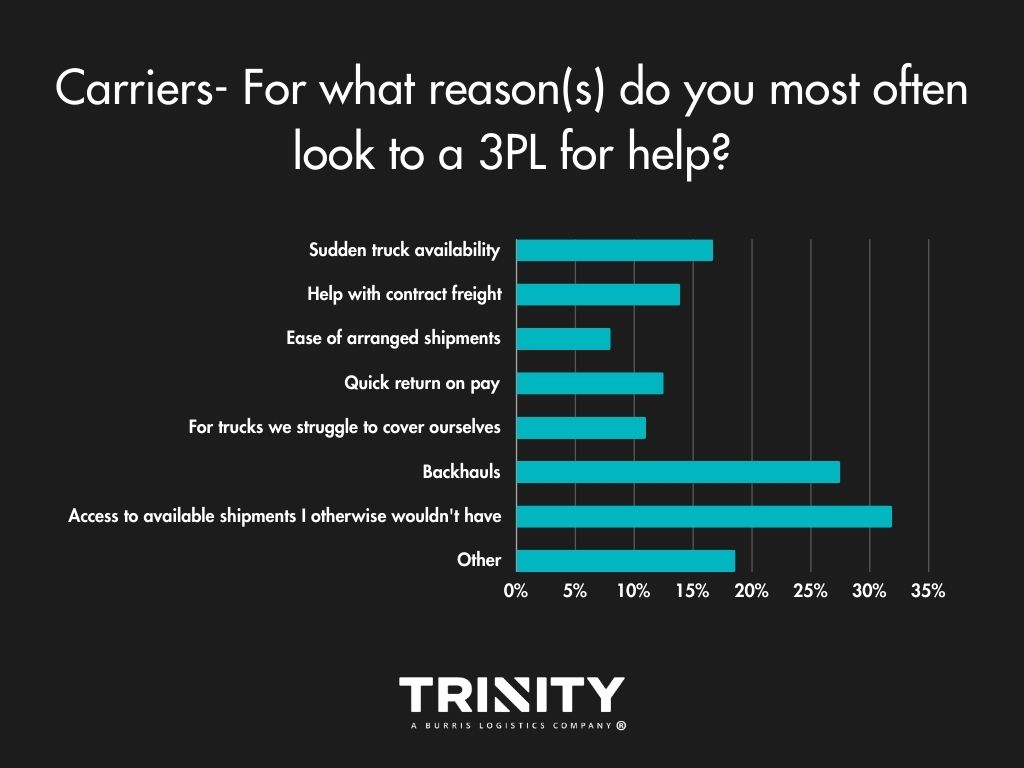

Carriers most often look to a 3PL for help with gaining access to available shipments that they wouldn’t have otherwise. Covering backhauls are another big reason carriers reach out to a 3PL.

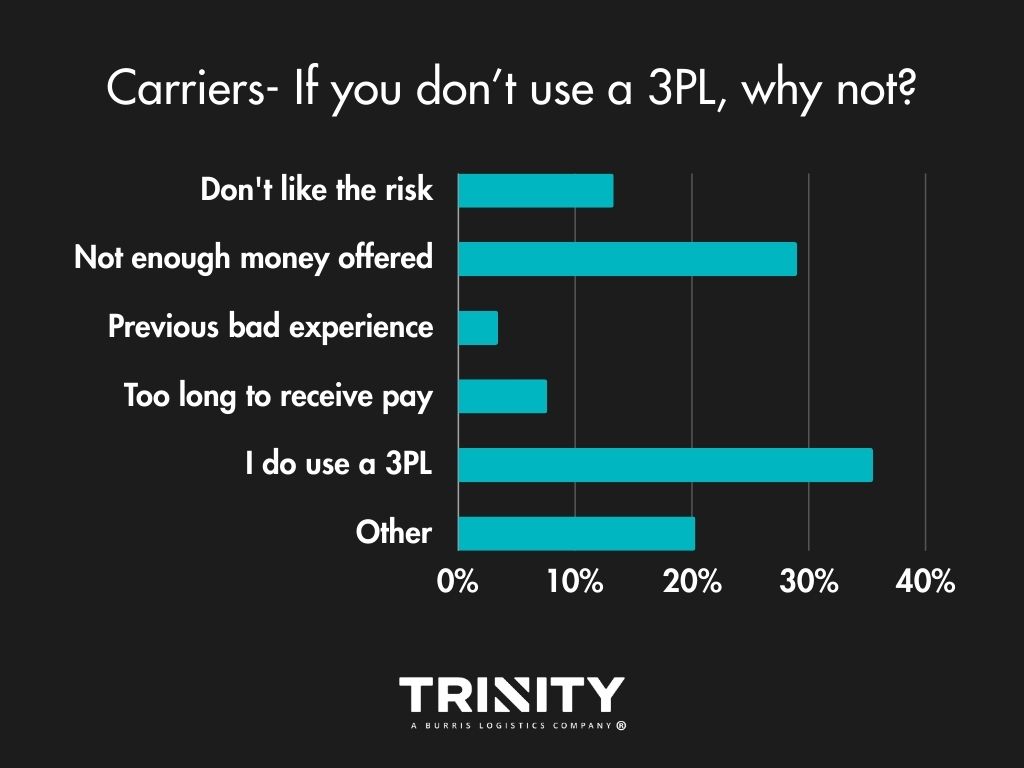

For those that choose to not work with a 3PL, it’s often because of money; rates not being high enough. Surprisingly in the comments, many are not familiar with what a 3PL or freight broker is as well.

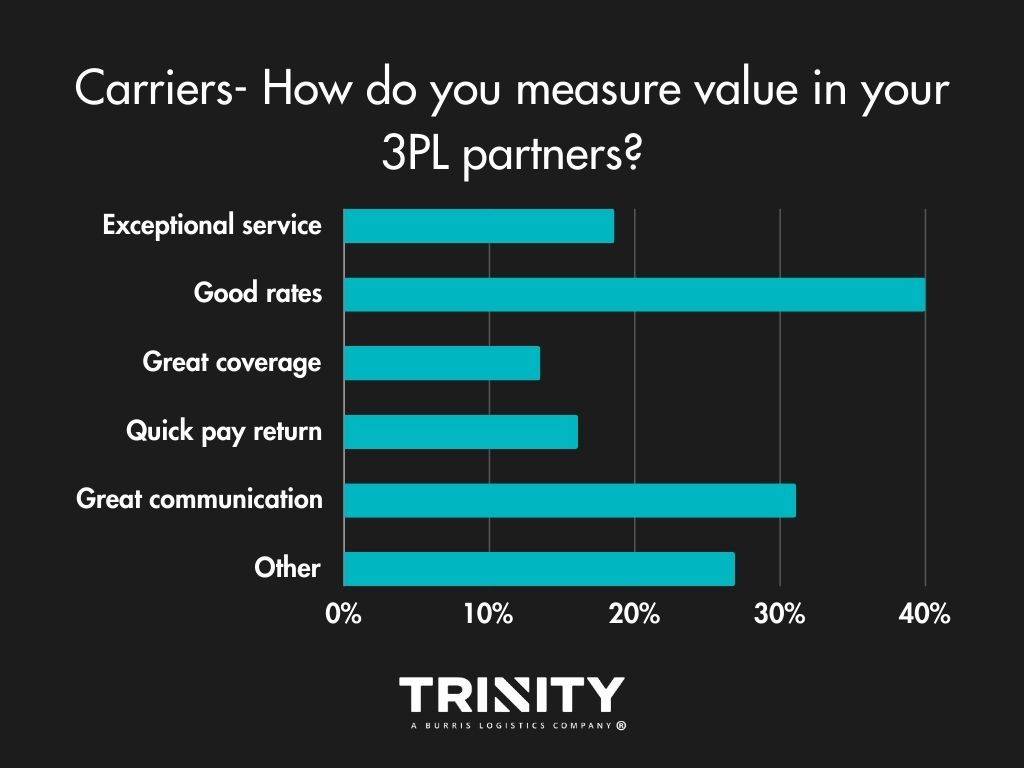

When it comes to measuring value in their 3PL partners, most carriers want good rates and great communication.

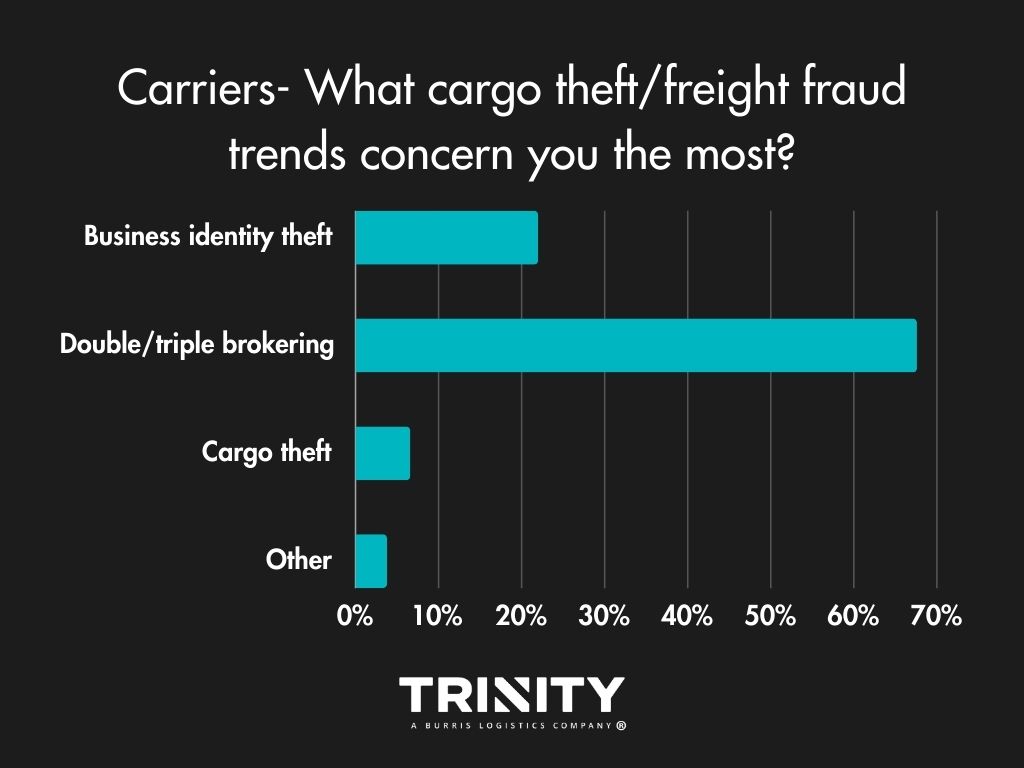

Fraud Concerns Growing

Fraud and scams have been growing in the industry, so we wanted to know what carriers think about it. Carriers are most worried about double and triple brokering affecting their businesses compared to concerns of identity theft or cargo theft.

We have learned that anything can happen in the last three-plus years when it comes to transportation. Currently, we are seeing interest rates above seven percent, and the future freight market is not clear. Being uncertain about what the future brings can make people afraid of it, but being engulfed in that fear is bad for everyone.

As a Freight Agent, what should you be doing in this uncertain freight market? What do you need to offer the best support to your shipper and carrier relationships?

When the freight market is uncertain, when things are not clear, people look for certainty, for comfort that everything will come together alright. Like a warm blanket on a cold night.

For this article, I want to talk to you about how to bring that sense of comfort and confidence in your service for shipper relationships, your carrier relationships, and even for yourself.

1: Have Access to Data and Know It

The first part of this tip should be simple. The second part takes a little more work.

When we’re unsure, it just means we don’t know enough. As a Freight Agent, this is where you can come in as a valuable resource for your shipper and carrier relationships. This is where they need you most.

You should be getting your freight market information from a reputable source. Ideally, your third-party logistics provider (3PL) should be providing this for you, but if not, some good resources to check out are FreightWaves, Transport Topics, or Supply Chain Dive.

Once you’ve found your source, a great tip is to make your own printable data slides or documents that you can have on hand to share as needed. Always keep these on you, either easily accessible via your phone or computer or printed and in a folder that you carry with you. Take these to every meeting or consultation you have. These can help you visually show your expertise and confidence, as being shown something always goes further in building credibility than just being told, especially in something as complex as logistics.

That’s only the beginning. You also need to know this information inside and out. You need to be able to explain the facts in the clearest and most effective way, so make sure you thoroughly study and understand the freight market information you are looking to share. Always be ready to answer any questions your relationships may have so you can share your confidence and build their trust.

2: Contact Your Prospective and Current Relationships

Do it. Do it now, as Arnold Schwarzenegger says. Contact your current relationships and your leads.

No matter what you do, this should be a constant in your business. Look at any successful Freight Agent, and they will tell you that keeping in contact with your relationships is a very important part of the process (if not the lifeblood), no matter how much you have going on. Plan in time to do this.

For example, we have a very successful Freight Agent in our network who makes an amazing living and has a lot of very predictable freight shipping every day. This person stays so focused on consistently contacting their relationships because they know you’re only as good as the last load that was delivered.

Your relationships will know that now is a good time to do business with you if they see you reaching out to them and trying to teach them about current freight market conditions versus pulling away and not being that trusted resource to them.

3: Build Up Your Confidence

Time to give yourself, your skills, and your work an honest look. What do you do well, and what do you need to work on?

The areas you should pay attention to and do well in as a Freight Agent should be generating new business, cold calling, maintaining your customer and carrier relationships, and keeping updated on the freight market. If you’re lacking in any of these, of course you won’t be as confident, so it’s time to get to work on improving your skills or knowledge. Seek out resources to help you. Our Freight Agent blog articles are a great starting point!

4: Take Responsibility

A great coach is more likely to be successful in carrying out the team’s plans when they hold themselves responsible for their players, especially when those players are holding them accountable for their game plan.

Set some business goals and tell your family and friends about them. Tell everyone about your big goals. Not only does this help you keep yourself accountable, but those you told will likely check in from time to time, helping you keep your goals front of mind and continuously check in on them.

If you end up reaching them, celebrate! Setting goals, working towards them, and eventually meeting them are great ways to build more confidence in yourself and see business success.

5: Partner with a Great 3PL

A great 3PL will help you stay confident regardless of freight market conditions. While the freight market may present challenges at times, the key to thriving lies in forging the right partnership. When you partner with a reliable and experienced 3PL like Trinity Logistics, you’re taking a significant step toward confidence and success.

Here’s briefly how Trinity can help you stay at the forefront of the industry and your business as a Freight Agent.

Continuous Education

We understand the importance of staying updated with the latest industry trends and knowledge. That’s why we provide a wealth of resources and training opportunities to keep our Freight Agent network well-informed and ahead of the curve.

Goal Setting and Achievement

Setting and achieving your business goals is easier when you have dedicated support. Our Agent Support Team works closely with Freight Agents to help them establish realistic goals and create a roadmap to success. We’re committed to seeing your business grow and prosper.

Team Support

At Trinity Logistics, we’re more than just your business partner. Our dedicated Team Members are here to support you, from compliance to technology to sales. Our Team is your Team, ready to provide you with the assistance and guidance you need.

If you’re looking to boost your confidence and lead your Freight Agent business to new heights, consider becoming a part of Trinity’s Freight Agent network. Together, we can navigate the challenges and seize opportunities that the freight market throws at us.

To learn more about the benefits of joining our Freight Agent network, call 800-846-1908 or email [email protected].

How do we get supply chains back on track after years of constant disruption and setbacks? The supply chain backlogs came largely from the shock at the start of the pandemic, but even before then, there have been many supply chain vulnerabilities.

Supply Chain Resiliency: Alleviating Backlogs and Strengthening Long-Term Security

Recently, Congress met to discuss our national and global supply chains, current supply chain issues that we need to focus on now, and how to build supply chain resiliency for the long term. Congress invited individuals and organizations to come to testify, to present their views for inclusion on the topic. U.S. Senator for Delaware, Tom Carper, asked Doug Potvin, Chief Financial Officer (CFO) of Trinity Logistics to testify.

With 16 years of service at Trinity and over 30 years of industry experience, Doug sees first-hand the problems plaguing supply chains. Doug’s testimony gave the Members of this panel valuable insight into the continued problems in supply chains and how members of the Transportation Intermediary Association (TIA), like Trinity Logistics, continue to serve the nation amidst these difficult times.

Doug’s Testimony Before Congress

“ I want to introduce myself as the CFO, Chief Fun Officer at Trinity Logistics because we like to have fun when we’re working hard. Thank you for the opportunity to speak with you today regarding how policymakers and business leaders are addressing the existing backlogs in the supply chain in the short term and building more resilient supply chains in the long term. My name is Doug Potvin. I’m the CFO of Trinity, a third-party logistics company (3PL) headquartered in Seaford. I’m privileged, honored, and humbled here today representing Trinity, our association, Transportation Intermediary Association, and the entire third-party logistics industry that we serve.

We serve as an intermediary in solving the logistical needs of our shipper customers by sourcing capacity from motor carriers and vendor partners. We are proud to report today that this past year we’ve generated over 1 billion dollars in revenue, arranged over half a million shipments, and offered 350 individuals full and part-time jobs. We truly are a proud Delaware company.

From Charles Dickens, the novel, The Tale of Two Cities; It was the best of times, it was the worst of times. Season of light is the season of darkness, a spring of hope is a winter of despair. Over the last two years, the same could be said of the international supply chain and from our perspective, closer to home, the domestic transportation industry.

In March of 2020 as both domestic and international countries shut our businesses including the shutting of the port cities and operations in China and the fact most consumers were at home facing an uncertain future, freight volumes plummeted. Motor carrier capacity increased dramatically due to the steep drop in goods moving and the transportation market saw prices for motor carriers fall. In fact, Trinity Logistics was mentioned on a Facebook post that we were earning an average gross margin of 60 percent, which was simply wrong.

In addition, a small number of motor carriers came to Washington D.C. and demanded rate transparency. Interesting after the businesses, ports, and countries opened up freight volumes began to skyrocket, available motor carrier capacity tightened up, and rates paid to motor carriers increased due to reflecting the change in market conditions. Demand for rate transparency went silent.

The pricing in our industry is driven by market conditions, supply and demand. Large scale, no entity on either side of the equation has enough market share to drive rates. In addition, each shipment has its own variable considerations to take into account including everything from available to capacity in various regional markets, lead time for products, dwell time at shippers and consignees, commodities needing move, and type of equipment needed. All this happens in real-time to ensure goods get to market, keeping our economy moving forward.

Now more than ever, the role of third-party logistics professionals has become more valuable. Companies like Trinity and the other 28,000 licensed property brokers are working overtime to ensure that essential goods continue to be delivered in an efficient manner to meet our customer and consumer needs. Our industry along with motor carriers are the main component as the why during the crisis and disruption, the supply chain bent but never broke.

Trinity Logistics applauds the U.S. Senate and House of Representatives’ Bipartisan passage of the Infrastructure Investment and Job Act, a historic investment into transportation and infrastructure. We’re very pleased to see how quickly the Federal Motor Carrier Safety Administration (FMSCA) established the Safe Driver Apprenticeship Pilot Program. Trinity hopes this three-year pilot program will be successful and made permanent so individuals ages 18 to 20 will explore interstate transport careers. Trinity also believes that as the spending on the Investment Act ramps up in the near future it will provide enough support to the economy to keep the motor carriers employed as we are starting to see freight volumes pull back over the last 30 to 60 days.

Trinity would also like to thank Chairman Carper, John Cornyn, Senator Menendez, and Senator Tim Scott for the support in offering legislation and getting the Senate to act unanimously in passing the Custom Trade Partnership Against Terrorism Act (CTPAT).

Currently, the vaccine mandate for truck drivers coming to the country to deliver freight from Canada and Mexico continues, these professional drivers spend most of their professional time alone in the truck cab, presenting a zero percent risk of spreading Covid-19. This should be lifted immediately to open up capacity and shorten the amount of time it takes to move goods across borders.

Another issue that greatly impacts not only the efficient movement of goods, but highway safety, is the lack of a federal motor carrier safety selection standard. Currently, because of broken safety rating systems from the FMCSA, almost 90 percent of trucking companies are considered unrated. There are no requirements in place before selecting a trucking company, that drastically impacts the overall safety of our nation’s highways. The latest report from the national highway traffic safety administration noted that the number of accidents involving commercial motor vehicles increased 13 percent in 2021. The status quo is not working, and highway safety needs to be improved. Trinity Logistics and our trade association, TIA, fully support legislation to create a motor carrier safety selection and mend the safety rating process.

The U.S. trucking spot market conditions have reflected towards weaker and more normal conditions, though we still will see what the future holds and how that trend continues. Hopefully as a result of this meeting and coordinated actions taken by the United States, our trading partners, manufacturers, supply chain vendors, our nations become resilient when facing similar conditions and uncertainty.”

Trinity Logistics would like to thank Chairman Tom Carper and the TIA for inviting Doug to testify before the Committee. He is a very valuable leader in the industry and Trinity Logistics appreciates all he does for our company, our industry, and our nation.

If you would like to watch the full hearing:

Stay in the know. Join our mailing list.Managing transportation costs is a top challenge for shippers, while another challenge that goes in hand is sourcing consistent and reliable capacity. Here enters the contract and spot markets. Which one is best? Which has better shipping freight rates?

Some believe the spot market is the way for shippers to save money and stay on top of capacity, while others think it’s contract. Choosing to use spot rates versus contract rates can be one of the biggest decisions for a logistics manager. Understanding their differences and when is best to use them will help give your business success. So, let’s dive into each of these markets so you can better determine your business’s strategy.

WHAT ARE SPOT RATES? WHAT IS THE SPOT MARKET?

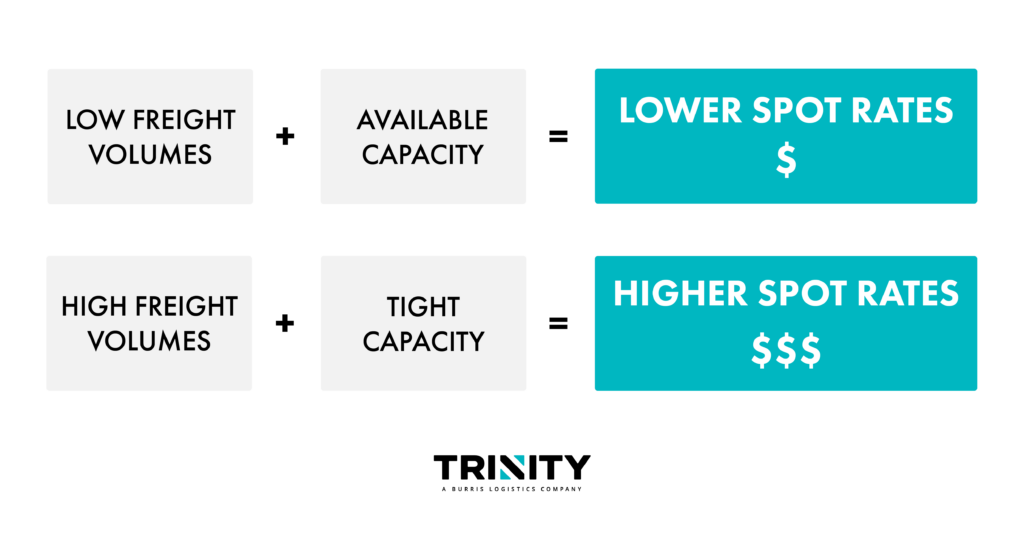

Spot freight rates are short-term transactional quotes for moving freight. These shipping freight rates are the price a transportation provider offers a shipper for a one-time quote to move their product from origin to destination. They reflect the real-time balance of supply and demand in logistics and the truckload market.

The quote is based on the value of the equipment needed at the moment of settlement. What determines the value of that equipment? Well, whether there is an excess or shortage of that exact equipment in the market and the lane at that time. Because market conditions directly affect spot rates, they are dynamic and can change day to day, even hour to hour. This is because the freight market can be more complex than simple supply and demand.

Thus, an increase in supply will lower spot rate prices if not accompanied by increased demand. And an increase in demand will raise spot rate prices unless accompanied by increased supply.

How to Track Rates in the Spot Market

You can keep track of the spot market through several industry websites and freight load boards to give you an inclination of what’s happening in the spot market. Some resources we like to follow are DAT and FREIGHTWAVES.

We even push out a monthly update to keep you in the loop of rates and other happenings in logistics. You can find our latest Freight Market Update on our YouTube channel.

It’s crucial to stay on top of the spot market should you find the need to use it. Even if you decide to use contract freight, it’s good to keep a pulse on it as contract rates are affected by the spot market. The higher spot rates are, the higher contract rates are too.

Who is the Spot Market Best for?

Many carriers, shippers, and third-party logistics (3PL) companies turn to the spot market for competitive rates. No matter how big or small, every shipper will move some of their freight on the spot market at some point. The spot market is great for when you might have a one-off shipment outside your usual shipping lanes. It’s good for shippers who don’t have enough regular volume for contracts or those who need more capacity than they contracted out. Or even those specialty shipments or non-standard load requirements.

Spot Market Pros/Cons

HOW TO GET YOUR BEST SHIPPING FREIGHT RATE ON THE SPOT MARKET

Provide Accurate, Detailed Shipment Information

Though you can get a spot quote with as little as the origin and destination zip codes, pick-up date, and equipment type, it’s best to have ALL shipment information ready. Excluding any critical information may have you unexpectedly paying for it later. The more precise information you have, the more accurate your spot rate quote will be, so you won’t have any surprise added charges.

Information you should have for your best quote:

- Origin city or zip code

- Destination city or zip code

- If your shipment requires EXACT pick-up and delivery appointments, make sure to communicate your appointments times

- Pickup date

- Equipment type (i.e., dry van, refrigerated, flatbed, RGN, etc.)

- Commodity type

- Product weight

- Any special requirements or non-standard requirements

- Examples of special/non-standard requirements are live load or unload, “no-touch” by the driver, drop trailer, hazardous materials, multi-stop, driver assist, floor-loaded, more than two hours of loading/unloading, and equipment age restrictions.

Provide Ample Lead Time

Shippers will request spot quotes anywhere from a week in advance to the day of. Most will request them one to two business days before their shipping date. The more time you can give before your shipping date, the better, as spot rates tend to increase as the pickup date approaches.

Giving yourself a few extra days to secure pricing and capacity will usually work in your favor and lead to less expensive freight rates. This is because there will be more carriers available versus trying to find one on your shipment day.

Don’t Wait Too Long to Confirm a Good Spot Rate Quote

Spot market rates are volatile and quickly change over short periods of time. Therefore, the quote you received yesterday may be different today. So, when you find a rate that works for your shipment, don’t wait to confirm it. Instead, lock it in ASAP for confirmed pricing and capacity. Once agreed on a rate, a reliable provider will rarely change it UNLESS an important piece of information about your shipment changes.

Set Appointments During Regular Business Hours

There is usually more capacity available during regular business hours. As incredibly hard-working as they are, drivers still like to be home on holidays, weekends, or nights when possible.

If your appointments need to be precise, make sure to include that information in your quote request so your quote can be accurate. But, if you can be flexible with your times, setting appointment windows instead of strict appointment times can open you up to more capacity. For example, drivers have to manage their strict Hours of Service so a flexible appointment window can help them better plan their day.

Spot Market Technology

Many providers offer digital freight platforms and give you access to free instant freight quotes. This can be a great way to stay on top of current pricing without sending a lot of emails to different providers. Good freight providers will have logistics experts on call should you have questions or need more help. But having the ability to get quotes on demand can add time back into your day.

Be Mindful of Carrier Selection

While cost is important when choosing your transportation provider, make sure you consider several other factors into consideration. You should consider their experience, efficiency, and service. While a cheap quote is great, it can sometimes result in a missed pick-up, hidden accessorial, or even a damaged product. All this could end up costing your business more.

When shopping the spot market, shop around and get quotes from a few different providers. Once you have a few quotes, evaluate the rates while considering your shipment requirements and ask yourself a few questions about your potential provider:

- Will this provider meet my service requirements?

- Are they easy to do business with?

- Can I use their tech tools to operate more efficiently?

- If something goes wrong, can I trust them to fix it?

WHAT ARE CONTRACT RATES? WHAT IS THE CONTRACT MARKET?

A contract rate is a rate quoted by a transportation provider to a shipper for a set lane and its freight characteristics over a set period of time. Contract rates can also be known as primary rates, bid rates, committed or dedicated rates. In short, they are a long-term, stable pricing agreement between shippers and transportation providers.

The contract market is highly dependent on the spot market. Typically, the three to six months of spot market activity leading up to an RFP will influence contract rates.

Contract agreements are great for both shippers and transportation providers as the shipper gains committed capacity while the transportation provider gains fixed rates and dedicated freight volume. Everybody wins.

How Contract Agreements are Set

Contracted agreements or Requests For Proposals (RFP) can be set as mini bids (monthly), quarterly, bi-annually, or annually. However, since the contract market and its rates are based on the fluctuating spot market, it’s rare to see a contracted agreement set for more than a year to stay in tune with the market.

Contract agreements are set during the bidding process, aka the RFP. The shipper will take the RFP and send it to a network of transportation providers and those providers will reply with their quotes. At the end of the bid process, the shipper will award lanes to specific providers based on their rate, service, capacity, and any other considerations.

CONTRACT RATE PROS/cons

HOW TO GET YOUR BEST SHIPPING FREIGHT RATE ON THE CONTRACT MARKET

Any shipper has the opportunity to host a bid. There’s no set minimum shipment requirement. So, no matter how large or small you are, you can take advantage of an RFP.

Just like getting quotes for the spot market, the contract market requires detailed information to get your best rates. The more information you can tell your potential providers, the more reliable rates and capacity you’ll be able to get offered. Information that should be included in your bid:

- Commodity type(s)

- Weight per load

- Cargo value

- Estimated shipping volume for each lane

- Time frame of RFP contract

- Origin and destination zip for each lane

- Shipment frequency for each lane

- Any performance requirements

- Any special load requirements/accessorials

- Fuel surcharges

- Keep in mind that fuel surcharges account for around 30 percent of a carrier’s operating expenses, and as we all know, fuel costs can fluctuate dramatically.

- It’s important to establish your own fuel surcharge matrix for each potential diesel price and communicate that with your providers before conducting a bid. This will help you get consistent and accurate rates.

What Happens When a Contract is Broken?

Sometimes, contracts will get broken. For both shippers and carriers, breaking a contract may result in fines. Most likely when a carrier breaks a contract, they will end up with a dissatisfied customer and disqualification from future bid opportunities. While shippers will face a damaged carrier relationship, less reliable capacity, and most likely, higher rates on the next bid.

Technology Needed for RFPs

While the practice of RFPs sounds great, what’s the catch? For an RFP to work effectively, shippers need to be organized in their execution and collection of information. No matter your size, every shipper needs a way to track and store their supply chain data and procurement information. It helps to have one central location to keep all your freight volumes, provider names, and awarded lanes.

Some smaller shippers will use tools like Microsoft Excel, Google Docs, or even their providers’ technology platforms to manage their RFP data.

But if you’re a larger shipper, those tools can be overkill. Instead, 90 percent of shippers use digital platforms, often transportation management systems (TMS) to manage their procurement information. A TMS can help take the complexity out of RFPs and take your process from a few hours to a few minutes. It allows you to enter your contract information quickly, select the transportation providers you want quotes from, and click send. It will also help you have one location to easily view bids and communication around your loads, keeping you from overwhelming clutter.

Regardless of which workflow you decide for your business, it’s crucial to have a well-documented record on hand to easily reference.

WHAT’S BEST FOR ME?

Usually, no shipper runs all their freight through the contract market alone. As there are positives to each market and it can be hard to predict all volume, most shippers work to have a strategic blend of both spot and contract rates. What works best for your business will depend on the current state of the freight market, your freight, and your provider relationships.

Some questions to ask yourself when determining what market will work best for you are:

- Are my freight lanes affected by peak capacity demands during the year?

- If you answered yes, the contract market, especially during those times of tight capacity, may be best for you.

- Am I willing to take on the risk of price fluctuations?

- If you answered yes, you might want to look at the spot market first.

- Does the contract price include a capacity guarantee throughout the year, without a general rate increase (GRI)?

- If you answered yes, the contract market may be best for you.

If you have determined that your volume is sporadic and not consistent, the spot market may be best for you, but it doesn’t mean that you can’t work with a carrier contractually. You can still build an approved carrier list with strong relationships even if you have to use the spot market on every shipment.

If you decide contracted freight is best for your company, keep an eye on spot market indexes and position your RFP bidding based on the freight cycle when possible. By moving your RFPs to when the market is at its lowest levels, you’ll gain your best rates.

Some shippers budget for 70 percent contracted and 30 percent spot or 50-50. No matter your balance, the freight market is always changing and so should your strategy. Keep a pulse on the market and your business needs so you can always find what’s best for your company.

NEED HELP WITH YOUR STRATEGY FOR COMPETITIVE SHIPPING FREIGHT RATES?

A shipper’s decision in balancing the use of contract versus spot rates can be difficult. Finding a good strategy for competitive shipping freight rates can be a lot of trial and error.

If you’re having challenges deciding when to use each market, Trinity Logistics can help. We have the technology and expertise you need to simplify your logistics management and offer support. Our Team Member experts are here to help you with your logistics strategy, including offering Quarterly Business Reviews and Freight Market Updates, so you can keep a pulse on industry trends and your company’s growth.

START A CONVERSATION WITH TRINITY TODAYWhat is a freight agent versus a freight broker? Is one better than the other? How do they work together?

These are commonly asked questions of us. Being a freight broker who works with freight agents, we have experience with both. In this blog, we’ll walk you through what a freight broker is, what a freight agent is, how they compare, and how they work together.

WHAT IS A FREIGHT AGENT?

A freight agent’s primary role is to help arrange the movement of freight between their customers and carriers. A freight agent can be one person or group of people that work as an independent contractor under a freight broker’s operating license.

Unlike a freight broker, a freight agent doesn’t have their own operating authority and legally can’t arrange the movement of freight on their own. Therefore, the only way for them to do business is by working with a freight broker. Because of this, freight agents assume very little liability, as that lies on the freight broker.

Sometimes a freight agent may be called a sales agent since they often sell services for the freight broker they work with.

Freight agents earn money on a commission percentage that’s agreed upon between them and the freight broker.

While they often have their own culture, they represent the reputation of the freight broker they work with. So, freight agents want to make sure the culture of the freight broker they choose to work with is similar or aligned.

Freight agents are responsible for building their own customer base and book of business. Freight brokers will often have a clearance process in place to check that the customer is not already working with one of them or another freight agent with the company.

WHAT IS A FREIGHT BROKER?

Freight brokers are companies that arrange the movement of transportation between customers and carriers.

It is a requirement for freight brokers to have a property broker license from the Federal Motor Carrier Safety Administration (FMCSA) and a surety bond for the minimum value of $75,000. They also need to carry the proper insurance. Freight brokers need to maintain a level of compliance yearly as guided by the FMCSA. The FMCSA requires that freight brokers keep all records on file for at least three years.

Freight brokers have the responsibilities of overseeing the invoicing of their shippers, paying their freight agents, working with freight factoring companies, and making sure their carriers receive payment for any loads moved. Freight brokers are also required to keep their records for three years and to hold insurance.

SIMILARITIES BETWEEN A FREIGHT AGENT VERSUS A FREIGHT BROKER

Freight agents and brokers can both be considered freight service providers. Both provide a high level of freight capacity and service, with many considering them to be problem solvers and logistics consultants for their client base. Both freight brokers and agents work to match available freight shipments from their customers with their carriers to optimize service and price. Both also negotiate with their customers and carriers on pricing to earn a profit.

DIFFERENCES BETWEEN FREIGHT AGENT VERSUS A FREIGHT BROKER

Freight agents have less liability in comparison to a freight broker. Freight agents need freight brokers to operate, whereas freight brokers can operate without freight agents.

A freight broker will have a more consistent brand look and feel across its office(s) versus freight agents that operate under the broker.

In comparison to size, freight agents are often smaller businesses, not always, but most often. While freight brokers are usually a much larger entity.

When it comes to daily tasks, freight agents only take care of finding their own customers and carriers and arranging their own freight. Whereas freight brokers do that and everything else, like invoicing, compliance, claims, credit checks, and more.

Freight brokers can offer other services like transportation management and technology. Freight agents have the opportunity to do that too, but those resources are only available based on the freight broker they work with.

WHY WOULD ONE PREFER TO BE A FREIGHT AGENT VERSUS A FREIGHT BROKER?

There are many reasons one might choose to work as a freight agent vs. a freight broker. For one, there is a much lower cost to being a freight agent because of the entire back-office support provided by a freight broker. This includes those tasks like invoicing, payables, receivables or collections, and curating marketing materials. It also consists of the larger costs like technology, such as a transportation management system to operate, cargo and liability insurance, the required surety bond, and contract management.

Additionally, a freight agent’s potential customer base may not like working with a small broker but would work with a freight agent knowing they are protected at a higher level by the freight broker they work under.

A freight broker also provides the freight agent with long-standing motor carrier relationships and contracts that are available to offer shipper solutions for them from day one.

Working as a freight agent would essentially simplify the business for them. Working as a freight agent allows them to focus on what they do best, cultivating customer relationships. In contrast, the freight broker handles many items a freight agent would otherwise have to operate, pay, and worry about if they were a stand-alone entity.

WHY THEY WORK GREAT TOGETHER

By working with a freight broker, freight agents get to focus on what they do best – building a strong customer base and servicing them with robust logistics solutions. In addition, small freight agents can quickly grow with the support and reputation of a well-known freight broker.

By working with freight agents, freight brokers can grow a nationwide or worldwide presence without building or obtaining office space. Additionally, freight brokers can see a growth in revenue by working with freight agents who work well at building new customer relationships.

TRINITY’S FREIGHT AGENT PROGRAM

Some people simply prefer tasks a freight agent has to complete versus a freight broker. They enjoy what they do and don’t want to worry about the rest of it. If that’s you, Trinity has a great agent program for those who like working more independently.

At Trinity, we have 30 years of experience aiding the success of our agents, with many seeing a 25 to 45 percent increase in their business over a two-year period from their initial start date with us. In addition, we offer many extras for our freight agent network, such as:

Continued Education Opportunities

We have an in-house Education Team available. Every month, they host virtual classes offered to increase sales skills, learn more about our logistics solutions, or help with technology. They also provide many virtual classes through our Learning Management System that you can take on your own time.

Technology

We offer many best-in-class applications and an entire Team of in-house software engineers, constantly striving to provide you and your customers with the best logistics technology available.

Agent Support Team

We also have a Team solely dedicated to assisting and encouraging our agent network. These Team Members work with you to help you set and reach your own goals, offer suggestions, and help you every step of the way. You’ll never fall behind or feel unsure with Team Trinity rallying behind you.

Consider joining our Agent Network today, so you can gain more time to focus on your customers, generate more revenue, and we’ll focus on everything else.

Join Trinity's Freight Agent NetworkAuthor: Christine Morris