Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Tariffs, Trends, & Trade Routes

With the new administration in place, there has certainly been no shortage of headlines. Many have asked what the impact is, or potentially will be, on the freight market. I think many are leery of making changes to projections or providing advice on how to pivot because what happens today can turn on a dime tomorrow when it comes to U.S. policy.

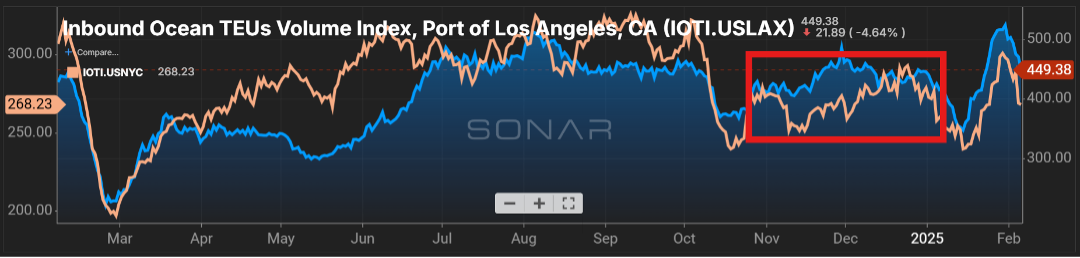

The one thing that appears certain is that many retailers pulled their inventory ahead in anticipation of tariffs being enacted. The last four months have seen a volume that outpaced the prior year. Figure 1.1 shows the container volume for Los Angeles (blue line) versus the port of New York/New Jersey. Particularly, the West Coast has seen an influx driven not just by the pull forward of volume, but the uncertainty with labor relations at the East Coast ports shifted volume west during the latter part of 2024 and early ’25.

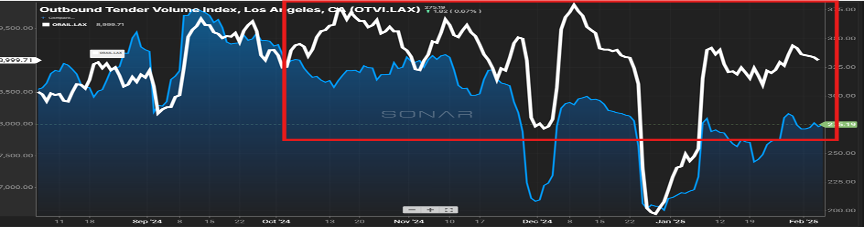

Unlike what was experienced several years ago, that increase in import volume has not translated to over-the-road moves. Figure 2.1 shows the last six months of volume handled by trucks out of the Los Angeles area versus the volume that has found its way to the rails. Unlike ’21 and ’22 when rails were a bit of the bottleneck for freight movement, they are much better positioned this time to handle the increase in volume. You can clearly see the gap in volume for rail (white line) versus truck (blue line), especially since early October.

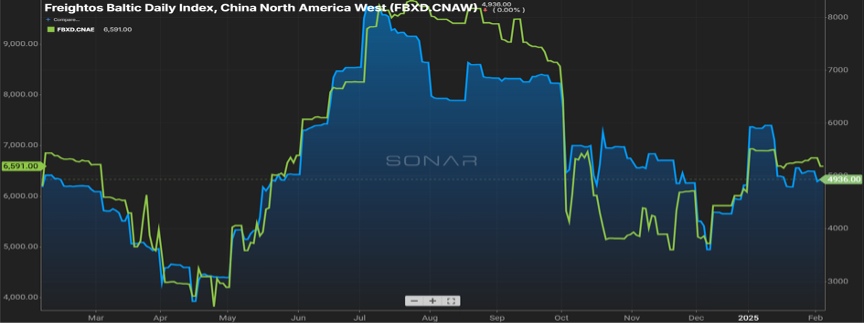

Speaking of imports, there appears to be a normalizing of the cost to procure containers for movement of goods into the U.S. Looking at Figure 3.1, the cost of a freight container from China to both the left and right side of the United States has retreated from its high during the summer months and shows a leveling out. Much of this is due to the decline seen in nefarious activity in and around the Red Sea. As calm has returned, ships are now able to utilize this corridor for transit, it has shaved transit times which in turn has opened up more ship capacity globally.

Price Hikes Ahead?

Finally, while tariffs have been the talk recently, certainly the who, what and when has been in a state of ebb and flow, one item that is not getting as much press is the scrapping of the de minimis exception. This has long been a shipping loophole for retailers that thrive on low-cost goods (think Temu or Shein). Unlike many retailers who paid millions, hundreds of millions, in duties and taxes, the companies of Shein and Temu paid a whopping $0 for all of 2024. This move now requires basically all inbound shipments to the U.S. to be subject to duties, taxes and processing fees, which has the potential to shift the landscape for companies that were able to thrive in this market.

As example, a good costing $50 once it got to the end customer was still only $50. With de minimis not in play, a $50 good could avoid fees that would almost double when you factor in the additional costs. What remains to be seen is how these increased costs are handled, but the most likely scenario is the end consumer absorbing the bulk of those costs. Typically, producing these low-cost goods in China comes with stiff competition and razor-thin margins, leaving manufacturers and shippers unable to absorb the increase.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Rising Tide of Rejection

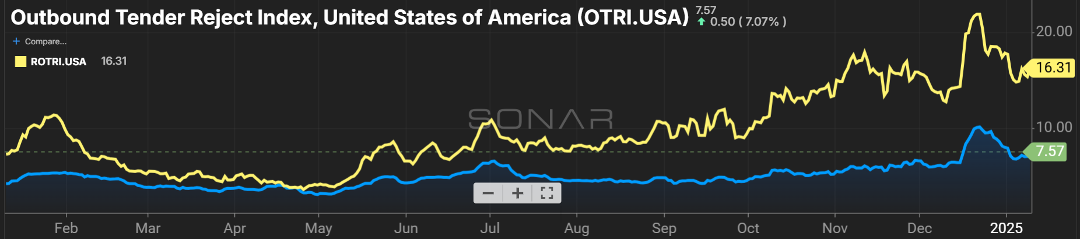

Continuing our theme of tender rejection rates being a leading indicator of freight rates, the momentum gained over the last few months continues.

While the tender rejection rate (Figure 1.1) for the overall U.S. (blue line) briefly touched the 10 percent marker, it has retreated. However, it still appears to be slowly climbing, currently sitting just below eight percent. Being 300 basis points above the mark a year ago is a big deal and shows the relationship that exists between carriers saying “no thank you” to a shipment offered to them and the continuing retreat in carrier capacity.

Further, the rejection rate on refrigerated shipments (yellow line) has continued its run of outpacing the overall U.S. rejection rate for the past eight months. Colder than normal temperatures across much of the country has contributed to the need for reefer unit trailers to keep product from freezing. Shippers, especially those that play in refrigerated commodities, need to ensure they are flush with carrier and broker capacity, and should anticipate rate increase requests from their providers.

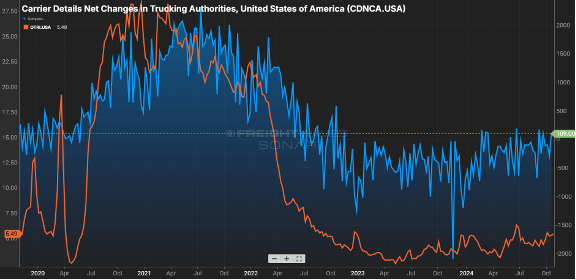

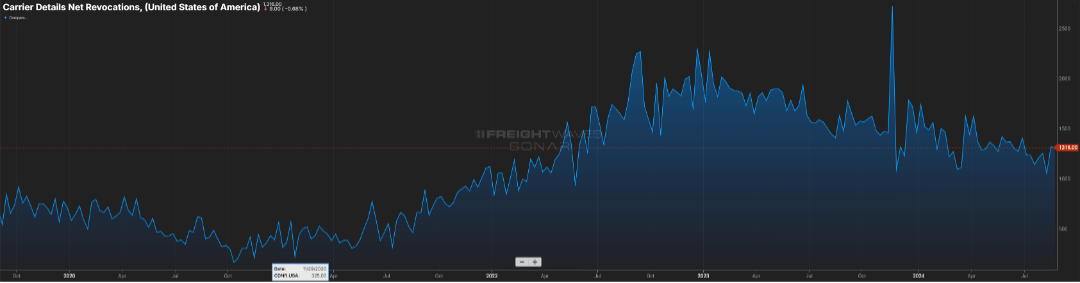

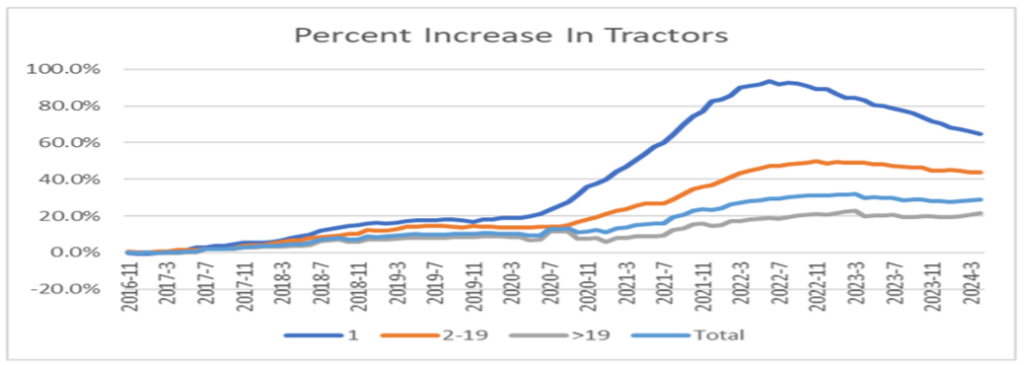

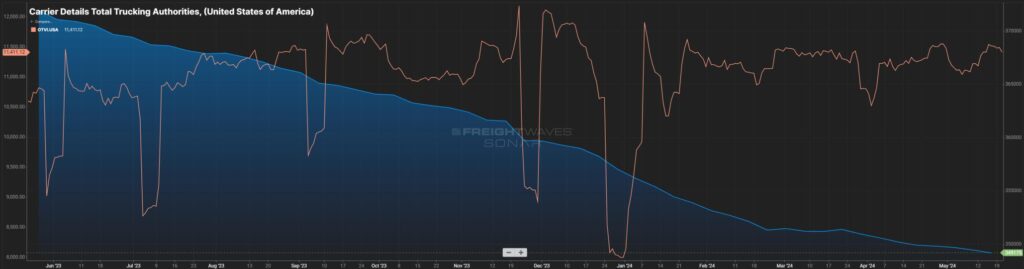

Speaking of capacity, we continue to see the slow trickle of carriers leaving the market. Looking at the past year, the trend for 2025 is we will see capacity decline at a three-to-five percent pace. Figure 2.1 shows the net change in carrier authorities, for the most part staying in the negative territory.

Looking further into the loss of capacity, the teal line shows the change in authority for micro fleets (one-to-five trucks). This is typically the owner operator community. Increases in costs to operate, as well as equipment where these carriers may be upside down on payments, has caused several to retreat from operating in the industry.

Calm Waters Ahead

Finally, a potential strike at East Coast and Gulf ports was averted for a second time. This is certainly good news as shippers continue to pull forward orders in anticipation of tariffs being imposed on import volume.

Just a few years ago, East Coast ports were seeing almost half of the U.S. import volume flow through their ports. Much of this shift was due to labor and operations issues on the West Coast. We are now seeing that reverse course.

East Coast ports are handling 41 percent of inbound ocean freight, while West Coast ports are up over the same two-year period, from 37 percent to 47 percent. With ILWU voting in favor of a contract that extends through mid-2028, and East and Gulf port workers agreeing on a six-year deal, a sense of calm should come to shippers and manufacturers that depend on our ports to receive their freight.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

CANARY IN THE CAVE

Data is everywhere, both on a macro and micro level. How this data is interpreted and reported, and the contradictions it can create, has the potential to leave one wondering just what to believe.

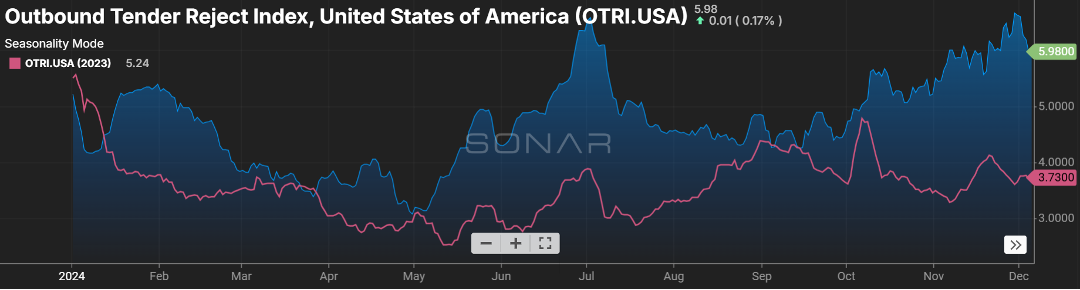

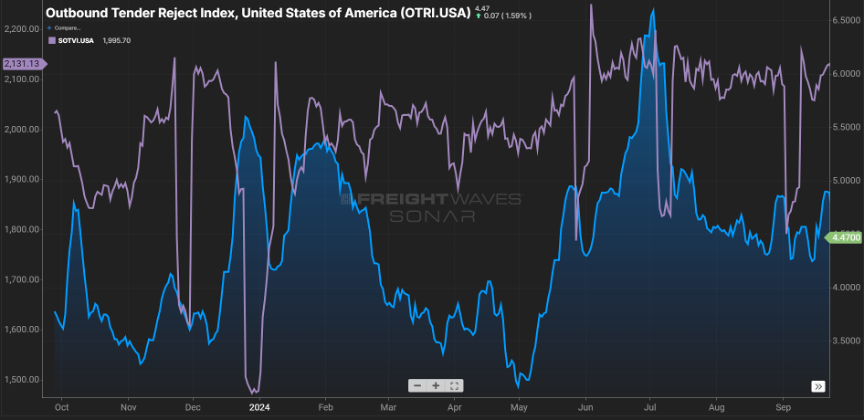

For years now, I have been, pretty much daily, watching like a hawk the ebb and flow of tender rejections (Figure 1.1). While this is focused on the contact freight market, what happens on the contract side absolutely has an impact on the spot market side. The last year plus has been pretty vanilla, with rejection rates almost negligible.

This pales in comparison to just a few years ago when carriers said “no” to shipments 30-plus percent of the time. While the current six percent rejection rate won’t set off many alarms, it is noteworthy in its trend. Heck, just six months ago, the rejection rate was hovering below three percent. Yes, there is seasonality that plays into the rejection rate, but seasonality also existed in 2023, and the rejection rate lagged during the fourth quarter of the year. While there will be some dips along the way over the next six months, I expect the upward trend to continue.

LOOMING STRIKES & DISRUPTION

Many in the industry breathed a sigh of relief when the short-lived port strikes on the East and Gulf Coasts were settled. However, while there was agreement on several issues, the automation at the ports loop remained open.

We are fast approaching the 90-day period for resolve in January, and the threat of another shutdown looms. Combined, the East and Gulf Coast ports provide service for incoming and outgoing ocean containers for more than half of the volume in the U.S.

So, what should you be prepared for if a second strike were to happen?

👉 Like it or not, we are dependent on unfinished and finished goods from overseas. Not being able to receive those goods will cause shortages on things like groceries, electronics, and clothing to name a few.

👉 The U.S. economy’s dependence on consistent flow of goods in and out of our country is to the tune of about four billion dollars per day. Even a week-long strike has the potential to severely delay the flow of goods around the ports for a month-plus.

👉 While most U.S. businesses would feel the effects, small businesses would be the most impacted as their already thin profit margins would be challenged by increased costs for goods along with a tight labor market and inflation.

👉 It’s not just consumer-ready goods. The ports play a role in the preparedness for emergency situations and defense posture.

We are already seeing the surge in import volume, up about eight percent versus a year ago as shippers look to get ahead of potential tariffs and now a labor shortage. Couple this with a downward trend in over-the-road capacity (Figure 2.1), and you have a recipe to further accelerate trucking rates.

U.S. shippers need to be reviewing their carrier and broker partners for compliance in the coming months. While many have not had the need recently, they should consider adding extra companies to their routing guides.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

What to Expect in the Short-Term

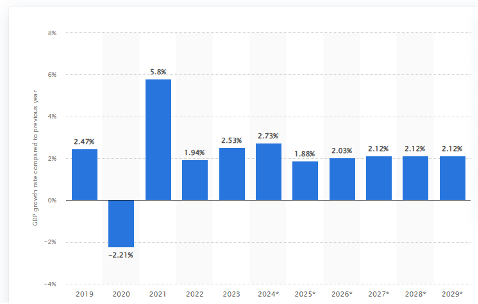

Well, so much for a recession. The U.S. is anticipating year-over-year growth of 2.8 percent in 2024 with regards to gross domestic product (GDP). That percentage of growth appears to be trending less in calendar 2025, with moderate growth forecast through the end of 2029 (Figure 1.1).

Generally, for every one percent of GDP growth, that typically translates into 1.5 percent growth in over-the-road truckload volume. Based on those projections, we expect freight volumes to climb by four to five percent in the coming year.

Conditions are also turning more favorable for a pendulum swing to the side of the carriers. Two reasons for the bullish outlook – dwindling capacity and tariffs (be it threat or real), simple supply and demand.

INCHING CLOSER TO BALANCE

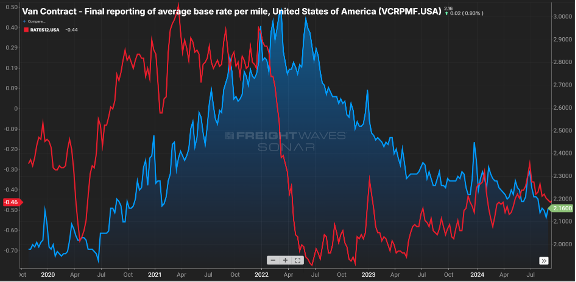

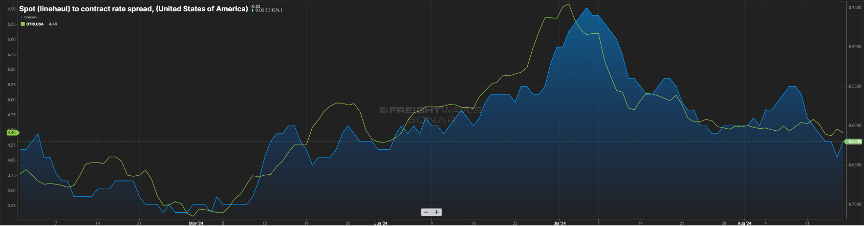

On the capacity side, the spread between contract and spot rates, which was near $0.80 per mile in the middle of 2022, has now fallen below $0.50 per mile. Keep in mind contract is almost always above spot sans latter 2020 and early 2021.

The gap has closed primarily due to contract rates receding, from the $2.30 range in early ’24 to now being $0.15 less, as illustrated by. Figure 2.. Figure 2.2 shows the net change in for-hire carriers versus the tender rejection rate. Since mid-2022, carriers have started to shun the market as higher costs to operate & lower rates made sustainability a challenge.

Where does shrinking capacity first show up? In the tender rejection rates. Carriers will say no to a guaranteed rate load either because they have no equipment in the area or there is a more favorable paying load available.

Rejection rates cresting the five percent mark may not sound significant, but keep in mind rejection rates were in the two to three percent range as we started this calendar year. Eight to 10 percent is a more balanced market, and we are close to that. Usually, rejection rates in double digits signify more pricing leverage is held by the carrier community.

The other driving factor is around demand. While there are some sectors showing slight gains, the November election could be the spark that drives a glut of freight movement.

With Republicans poised to control the White House and Congress, impending tariffs will drive a flurry of activity as shippers look to move goods prior to an imposed increase in cost, This is likely a short-term surge as “too much inventory” is a real thing, and once tariffs are imposed, consumers ultimately will feel the brunt of increased costs and could hamper purchasing. However, the next pivot point will be around movement of production to domestic U.S. or near-shore locations.

After a blah few years, things are about to get interesting.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Feels like 2022

For the majority of this year, volumes have seen their traditional seasonal patterns and have been trending above 2023 levels. Many have commented that market balance will be driven more by carrier attrition versus an event that spurs freight volumes.

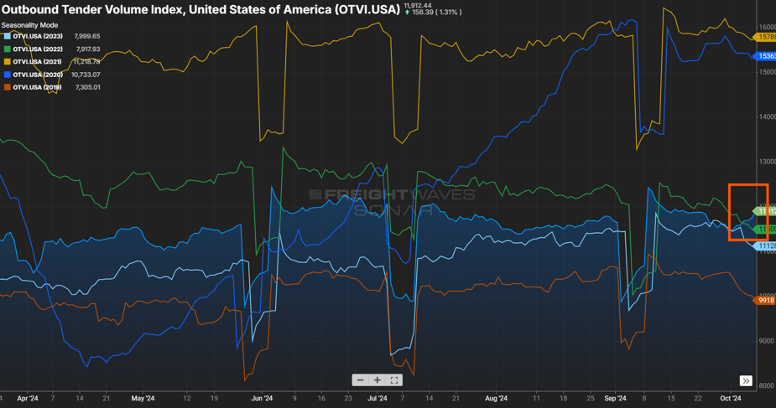

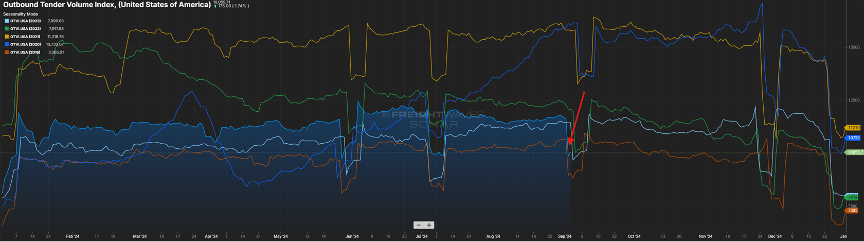

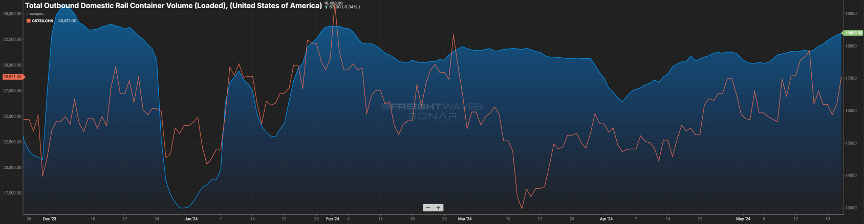

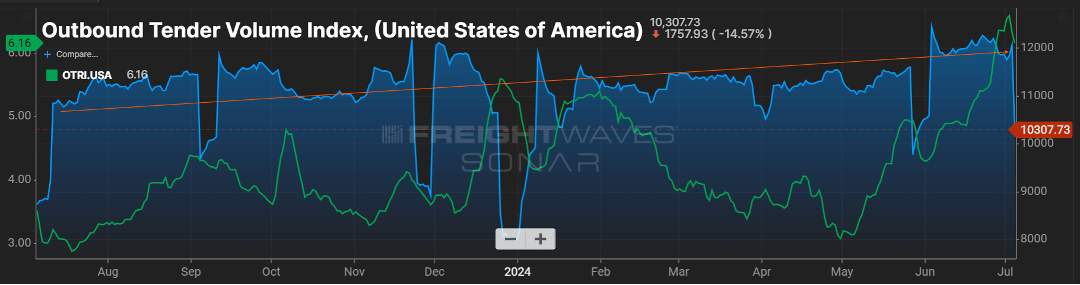

2022 was a pretty good year from an industry standpoint. Volumes were still elevated (certainly not like we saw in 2021) and capacity was inline. While it may be a blip on the radar, we have now seen the Outbound Tender Volume Index eclipse 2022 levels for the first time in two years as seen in Figure 1.1.

I think it is still too early to pin the volume uptick on the interest rate reduction or the recent hurricanes that severely impacted states in the southeast, but these events, and any potential storms that might still pop up (hurricane season isn’t quite over yet), could impact freight volumes in the coming months. Combined with consumers continuing to spend, volumes could remain consistent through the end of the year versus following their traditional end of year downward movement.

FINE….FOR NOW

While there was a sigh of relief from many with the ILA and USMX reaching a deal on wage increases for dock workers, this does not mean that everything is resolved, and potential port disruptions could occur at the 20-something docks along the East and Gulf coast.

Union-member wages were the major bargaining chip that was agreed upon last week, with dock workers receiving an immediate pay increase, with yearly pay increases to follow. When all increases have taken effect, dock workers will see a 62 percent increase in pay. One issue that was not finalized was the use of automation at select ports, which the labor union has opposition to full and semi-automation. The two sides will continue their negotiation discussions, with a timetable of three months from now to finalize a deal.

If these points can’t be resolved, it may be rinse and repeat with the threat of another strike as we get into the start of 2025.

Speaking of the recent shut down of port activity, it will take a week or so to work through the container backlog. This, along with the disruption in shipping patterns caused by the recent hurricanes, has been impacting tender rejection rates as seen in Figure 2.1.

Rejection rates crested the five percent mark recently. As port activity comes back online, expect the volume for short haul shipments (<250 miles) to remain elevated as also seen in Figure 2.1.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

YES, IT IS IMPORT-ANT

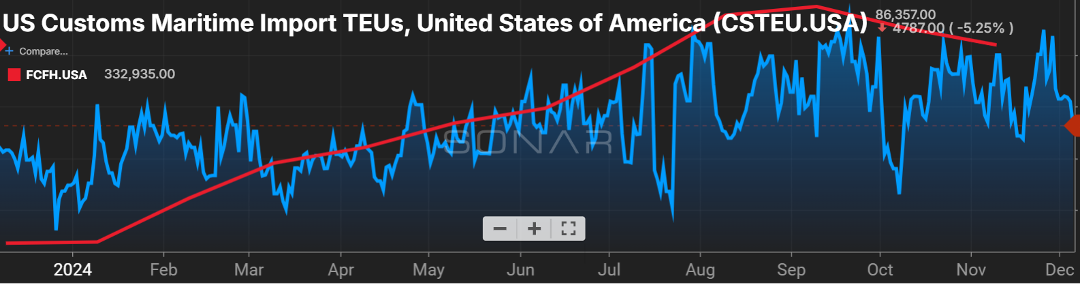

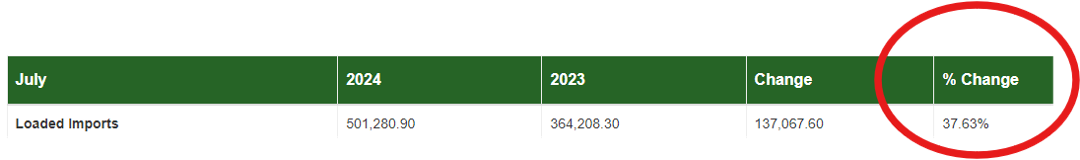

There has been much buzz in the last month around inbound container volumes to U.S. ports. There are 300+ ports of entry for goods into the country, with much of that volume handled by the top 20. Most of that buzz is around the uptick in volume.

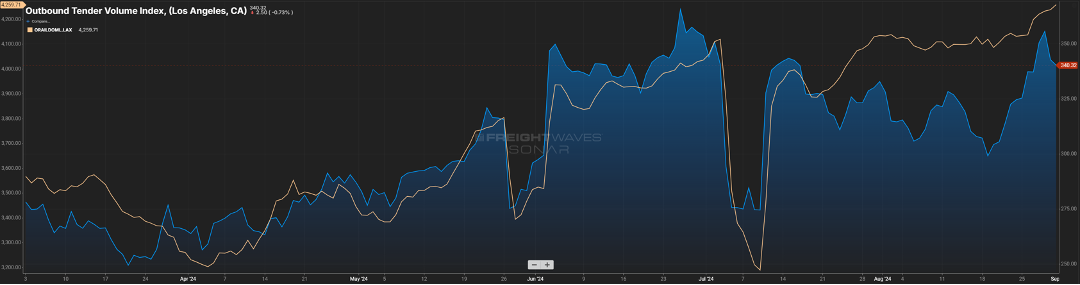

In figure 1.1, you will see for the port of Los Angeles, the largest in the country, that container volume is up almost 38 percent. That’s certainly impressive, but the neighboring port (Long Beach) was up a staggering 60 percent.

Many would anticipate this similarly impacting the outbound over-the-road volume for that market. And yes, while we see in Figure 1.2 via the blue line, there is a noticeable increase from what it was heading into the Memorial Day holiday, but it is not a direct correlation. The beige line represents the domestic rail volume from that same market, and unlike what we experienced in the “Covid years”, the rails have been a bigger mover of goods versus the bottlenecks we saw back then.

We should expect to see import volumes continue through the next few months. As goods produced overseas have become cheaper to buy, major retailers have taken advantage of these discounts with the anticipation of robust consumer spending. Remember, almost three-fourths of inbound volume is directly related to consumer purchasing. Good news for consumers as these retailers will want to liquidate this inventory quickly at lower prices.

NOT FAR FROM HEALTHY

While not in balance, the spread between contract and spot rates continues to shrink, now sitting about $0.60 per mile higher on the contract side. Keep in mind this gap was in the $0.75 to $0.90 for much of the past year. Almost in lockstep has been the tender rejection index. It has continued its slow upward movement as seen by the green line in Figure 2.1.

This can be attributed to capacity continuing to shrink slightly (Figure 2.2) and contract rates moving downward. It’s rare that spot rates will eclipse contract rates, but a spread of $0.40 to $0.50 is indicative of a healthier market, and we are not far from that right now.

I spent a few days traversing the state of Tennessee recently. At one stretch of a major interstate, there was a back-up at least five miles long. Luckily for me, it was on the eastbound side, and I was heading the opposite direction.

What struck me was the sheer number of trucks that sat idled. By my estimates, almost 80 percent of the volume was truck traffic. And while you can’t tell if a van is loaded or not, every single flatbed had freight on it. So, ladies and gentlemen, freight is still moving in this country. While it may not feel like it, volumes are trending close to 2022 levels as seen in Figure 3.1 (blue vs. green line). They say the fourth quarter is the time when carriers make hay; so here’s to an optimistic outlook for the next four months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxIf you’ve worked in the LTL industry for any bit of time, then you know that it’s always changing. Yes, sometimes that means it gets a bit more complicated. Rates adjust. Rules and processes are modified. Despite all this, there is usually one constant – the core LTL carriers we work with. Yet, in 2023, that changed; we saw the departure of the legacy LTL carrier known as Yellow Corporation.

The closing of such a large and well-established LTL carrier is very rare. The industry hadn’t felt the void of such a large company since Consolidated Freightways closed 20 years prior. So, what happened? Considering Yellow Corporation was the third largest LTL carrier, what happened to all the freight they handled?

As someone with a career in LTL, I saw this happen in real-time and have directly seen its ripple effects. I can answer some of those questions and share with you my thoughts, experiences, and observations of this impactful event in LTL history.

The Fall of Yellow Corporation

Yellow Corporation (commonly referred to as YRC) was no stranger to financial turmoil. The company was laden with debt that was worsened with the Great Recession. It almost put them into filing for bankruptcy in 2009.

A stint of other factors after that didn’t put them in a better position when COVID-19 rolled around in 2020. YRC was granted a $700 million COVID-relief loan by the U.S. government, which it used nearly half of to cover past due payments to healthcare and pensions, payments on equipment and properties, and interest accrued by its other debts. Fast forward to 2023, and that’s where their final chapter began.

A few months into 2023, YRC and the Teamsters Union engaged in back-and-forth negotiations. YRC wanted to change operational procedures and sought extra funding to help it pay off its debts. Teamsters disagreed with the proposed changes. We saw news articles and hit pieces about the conflict, week after week. It was nearly impossible for the industry to ignore it.

In July, whispers began of a possible union strike that would effectively halt YRC’s freight network. This was the writing on the wall for many shippers and third-party logistics (3PL) companies. At this point, the hull had been punctured, and water pouring in. Do you stay or do you go?

YRC and its subsidiaries were promptly disabled from countless TMS platforms. No customer wanted their freight stuck in limbo if Teamsters were to go on strike against YRC. Because of this, YRC saw a sharp decline in freight volume and tonnage. A company that was in financial disarray was now losing its primary source of revenue.

On July 30th, Yellow Corporation ceased all operations. The Teamsters had not agreed to the negotiations, and the 11th hour came and went. So, what now?

The Aftermath of YRC’s Closing

YRC’s exit affected two parties: shippers using LTL and other LTL carriers.

For shippers using LTL, they were two buckets: those who had already begun shifting their freight to other carriers in their pricing roster and those unfortunate enough to still have most or all freight with YRC. The latter had a more difficult situation to overcome as they now had to find an LTL carrier to move their freight without paying an arm and a leg.

For LTL carriers, YRC’s existing freight had to go somewhere, so they had to figure out how to absorb it. Carriers such as Estes, FedEx, and XPO and their capabilities were pushed to their limit, now drinking from a firehose of incoming freight. Volumes increased drastically, and with such a rapid rise came decreased capacity.

LTL carriers were making the difficult decision to exclude certain shippers in favor of others just to service accounts and keep their networks moving without bottlenecking. This left many smaller shippers stranded with a shorter list of available LTL carriers.

As carriers became inundated with freight, their operating ratios took a hit, and something had to be done to regain control. A season of atypical general rate increases (GRI) began. LTL carriers needed to remain profitable lest they succumb to a fate like Yellow.

3PLs and shippers alike started getting notifications from their carrier representatives about rates going up. Shipping LTL got more expensive now that the carriers had to pick and choose who they serviced with their finite capacity. The increased rate structures also priced out shippers that were used to YRC’s competitively priced tariffs or couldn’t stomach the increases.

For many shippers and 3PLs, the immediate aftermath of the Yellow Corporation bankruptcy was unlike any they had previously experienced.

Now, that’s the long and short of it, but how are things today? Surely, the disappearance of a significant LTL carrier like that would have lasting, irreversible affects.

Well, yes, but also no.

The Current Impact of YRC’s Closing

Today the LTL industry has mostly stabilized. YRC’s freight volume has dispersed, and the dust has settled. The LTL carriers have course-corrected their capacity concerns.

After the YRC bankruptcy, there were also new questions to answer, one of which was “What happens to their assets?” Those went through the bankruptcy courts, but the LTL carriers were eager to get a piece of it.

The purchased terminals and trailers meant increased footprint and capacity, which can be the difference between being the best and the biggest for LTL carriers. Several carriers bid to acquire the terminals left behind by Yellow Corporation.

Estes Express, a prominent national LTL carrier, was one of the larger victors in the bidding war. As one of Trinity’s carrier relationships, I asked Estes if they could share the impact YRC’s exit had on their company. Here’s what President and COO Webb Estes had to say:

“Estes acquired 29 terminals and a large amount of equipment as a result of Yellow’s exit from the marketplace. I can’t say enough for the dedication and resiliency of our team to work together tirelessly to quickly bring them online and add to our steady capacity growth. In addition we purchased several tractors and trailers, and we were also able to buy many smaller items – such as load bars, airbags, and freight tables – all of which help us do an even better job protecting our customer’s freight,” said Estes. “One other surprising benefit is that the additional freight we’ve taken on has allowed us to add more direct linehaul lanes, and we’re seeing better overall service in 2024 compared to last year.” Estes added, “This is a great example of how Estes continues to invest wisely in assets and capabilities that create capacity, opportunity, and resiliency for our company and those we serve. And that remains a primary reason why customers from coast-to-coast continue to rely on us for their shipping needs.”

While LTL carriers, larger shippers, and 3PLs came out in the black or relatively unscathed, others did not. Smaller shippers with all their freight lanes with YRC had no backup plans except to pay increased, non-discounted LTL rates with other carriers or risk their business operations.

How Did Trinity Logistics Fare?

At Trinity, those first few months after the bankruptcy were interesting! We saw many new shippers start a relationship with us and saw some complications in LTL carrier transit lanes that bottlenecked. Don’t worry, they were quickly resolved. Since Trinity has a broad roster of national and regional LTL carrier contracts in place, our shipper relationships were able to use our rates to course correct from the YRC closure and effectively avoid any critical disruption.

Is the last time we’ll see an industry-shaking event in the LTL space? Likely not. For now, the industry is stable, and many LTL carriers are growing and reporting profitable earnings.

In my 10+ years working in the LTL industry at a 3PL, the Yellow Corporation was always a top LTL carrier for us. Seeing them fade into the wind after decades of LTL service was surreal, and I felt sad for the many YRC employees I’ve grown to know.

Despite such an impactful event, now written in the history books, it’s a year later, and the LTL landscape is still thriving (and volatile), even with one less player at the table.

Final Thoughts

Considering the size of Yellow and the steady decline until evaporation from the industry, I actually expected more disarray from it. Sure, the first weeks after the bankruptcy had the GRIs, shipment delays, and new shipper partnerships for Trinity to handle, but after a month or two, it was relatively smooth sailing back to normal.

I think that speaks volumes to the age we live in. The amount of technology and time-saving efficiencies that LTL carriers invest in year after year. It allowed the industry to absorb the freight volume of one of the largest LTL carriers in the world and it did so in less than 60 days! It’s kind of crazy and a testament to the LTL industry and its controlled chaos.

Working with Yellow for so many years, I grew familiar with some of the names worked there. People we would see at conferences, have calls with or see on emails. People who had been in the industry much longer than I have, had extensive backgrounds, and grew their roots at Yellow.

The bankruptcy landed them in the middle of it all, but many of them went on to other LTL carriers and took their experience, adding value there. I think that’s a silver lining here. Despite the financial decision of Yellow as a company, it had people on its roster that brought purpose to LTL and now these people are creating an impact for other carriers and customers alike. For how vast it is, the LTL industry can be closeknit, so to see those former Yellow employees succeed at other LTL carriers is a bright spot in this saga.

Learn More About Trinity's LTL Services Get More Content Like This In Your InboxABOUT THE AUTHOR

Curt Kouts holds the Director of LTL position at Trinity Logistics. Kouts has been with Trinity and in the logistics industry for 14 years, having held several titles among carrier vetting, account management, and within the LTL Team itself. His main responsibilities as Director focus on elevating Trinity’s LTL customers’ experience, helping the LTL Team support in operations and billing, and aiding the company in overall LTL sales and success. Kouts finds the LTL industry incredibly challenging, presenting him and his Team a ton of problems that they have a passion for solving. He enjoys learning more about LTL whenever possible and overall, making LTL an experience that keeps all his customers, both internal and external, coming back.

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

GOOD NEWS, BUT…

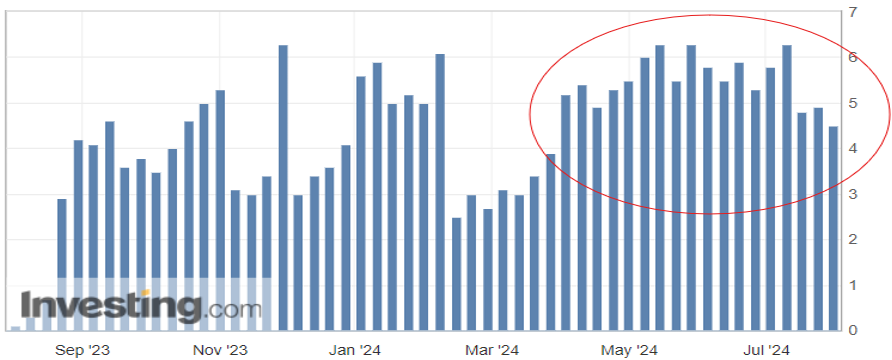

Consumer spending is the biggest driver of the U.S. economy, accounting for roughly two-thirds of the nation’s Gross Domestic Product (GDP). One measurement of that consumer spending is the Redbook index, which compares year-over-year growth for large domestic general retailers (think Walmart, Amazon, Target). The index has averaged just over 3.5 percent for the past 20 years, so the recent year-over-year (YoY) growth in the four-plus percent range speaks to the strength of consumer spending (Figure 1.1). This index alone certainly gives reason for optimism, however there is a cautionary tale with regards to consumer debt.

After years of next to zero interest rates to keep the economy on its legs, consumers have seen interest rates on the rise, with the federal funds rate at its highest level since the early 2000’s. With the increase in interest to borrow funds, combined with the increased costs of essentials (food, housing, energy), many households have turned to credit cards to fill the gap for funding of these necessities. Figure 1.2 from the New York Fed Consumer Credit Panel shows the rise in consumer delinquency particularly in those groups that utilize more than half of their available credit line.

While there appears to be relief on the horizon with the impending reduction in interest rates, it appears a portion of active consumers may be pulling back on purchases for those items that are not mission critical. This, in turn, will have an impact on restocking of inventories and trucking activity.

While it is not approaching the levels seen in 2021, the volume index is quickly approaching levels seen in 2022. This has buoyed optimism in the industry.

JUST SOME GOOD LUCK? TIME WILL TELL

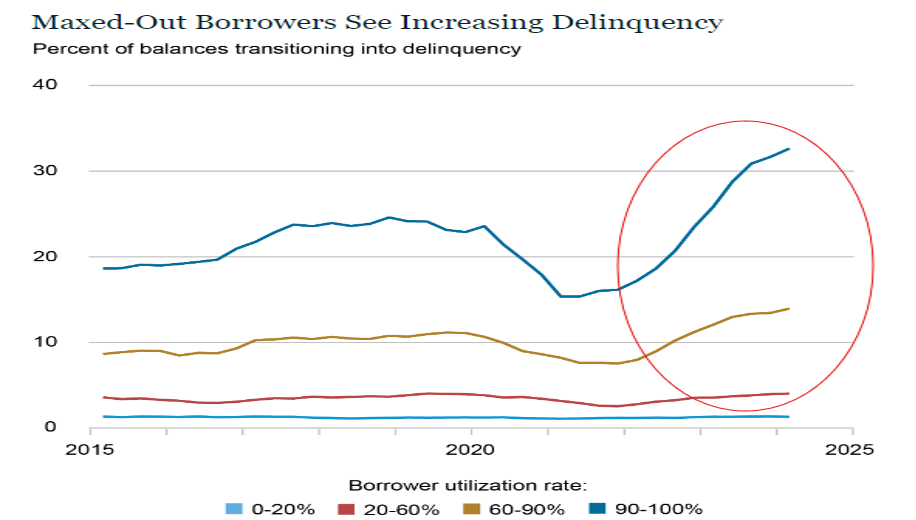

The uptick in consumer spending, restocking of inventories and the threat of labor strife in the fourth quarter of this year has been to the benefit of those involved with the rail and import business.

In Figure 2.1 below, the blue line represents loaded container rail volume in the U.S. and the past three months have seen the volume grow. Similarly, container volumes to the U.S. have been on the rise.

The orange line represents container volume from China over the past six months. While some of that traditional volume is now flowing through other countries, like Mexico, there is still a great deal of activity with U.S.-China trade. Will this continue or is it fool’s gold? That is something we will continue to keep an eye on as a pullback in consumer spending will dictate how the needle moves.

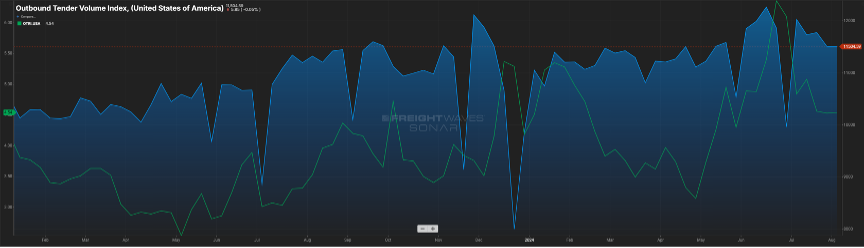

STAYING RIGHT WHERE WE ARE

Finally, looking at domestic over-the-road volume (blue line) compared with carrier rejection rates (green line). The slight upward trend continues with volumes and rejection rates (Figure 3.1). Rejection rates continue to inch towards 2022 levels, but a five-to-six rejection rate is about half of what one would see in a balanced freight market.

This has yet to manifest itself in the way of increased freight rates, as capacity still exists in the market.Shippers and carriers should anticipate little change in conditions (although hurricane season is looming) until early 2025.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

UP AND TO THE RIGHT

For the past year, the general direction of the Outbound Tender Volume Index (OTVI) has been on an upward trajectory as seen in Figure 1.1.

While it is not approaching the levels seen in 2021, the volume index is quickly approaching levels seen in 2022. This has buoyed optimism in the industry.

Another rise we’re keeping an eye on is the Outbound Tender Rejection Index, the rate at which carriers are saying “no” to freight where they have paper rates with a shipper. A six percent rejection rate may not sound important, but considering the rejection rate has stagnated in the three-to-four percent range for the past year plus, it’s another sign that the freight pendulum may be nearing more of a balanced market.

In 2021, rejection rates hovered in the 20-30 percent range. This was more a product of increased freight volumes and carriers realizing they could get higher rates in the spot market versus the contracted rates they had in place. The uptick in rejection now appears to be more of a limit of capacity in certain markets versus carriers hedging their bets on the open load board.

Drip, Drip, Drip

Speaking of that capacity, there is a reduction happening, albeit a slow drip. As shown in Figure 1.2, for the past year and a half, almost two years, the biggest reduction in capacity has been from the owner-operator segment. Most likely, the carriers in this group that have exited the market are those that rushed in when freight and rates were plentiful, and now are finding more normalized rates combined with high overhead to be unsustainable.

As shippers continue to look ahead, not having reliability among this segment of carriers could prove problematic as volumes escalate and more freight flows to the spot market, which is supported heavily by owner-operator drivers. This is a good reason for shippers to ensure they have a good mix of carrier and broker partners.

Baltimore Still Recovering

Finally, it has been just over three months since the bridge collapsed near Baltimore, MD. The waterways in the surrounding area appear to be returning to normal, and the need for traffic that populated the bridge to divert to alternate routes seems to be no worse for the wear on drivers.

Looking at volume in that market in Figure 1.3 since the end of March when the event occurred, after a slight dip when freight had to be re-routed, volumes as measured by the OTVI have increased just over 10 percent. Certainly, there is still work to be done, short- and long-term, but the Baltimore area appears to have powered through an unfortunate event.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

A LOOK AT THE PAST AND FUTURE OF THE FREIGHT MARKET

The Outbound Tender Volume Index (OTVI) measures the volume of contracted freight in the U.S. While this does not account for the spot market, ebbs and flows in contract freight have a direct impact on spot market volume and pricing. The outlier on the graph below (Figure 1.1) is the yellow line, representing calendar year 2021. This was an unprecedented year for freight volume, primarily influenced by consumer spending. While many feel the freight market is suppressed, that is not necessarily the case. 2024 will follow a more traditional freight flow pattern, with volumes up five to eight percent, year-over-year (YoY).

Measuring the freight volume is not enough to predict swings in pricing. Being able to overlay the frequency in which carriers say “no” to freight tenders via the Outbound Tender Rejection Index (OTRI) gives a good picture whether the capacity side of the market can handle those swings.

The below chart (Figure 2.1) looks at the amount of contracted freight volume (blue line) with the frequency of tender rejections (green line) overlayed. As can see, most of 2019 and the first part of 2020 saw a market where freight volumes were easily handled. This was a result of lower than anticipated freight volumes versus a glut of carriers in the market.

Then March 2020 happened. Everything went on lockdown. Volumes and rejection rates plummeted. That was quickly followed by a freight injection and for the latter part of 2020, and all of 2021, the market struggled with a lack of capacity to handle the record freight volumes.

For example, most LTL carriers were operating at 105-107 percent of capacity when they normally are in the low to mid-90s range. The freight market pendulum was in favor of the carriers. When the market gets hot, everyone wants in, which is what was happening in 2021, and 2022 – new carriers raced to get in on the action while existing carriers looked to soak up as much rolling stock as they could to capitalize on the market.

2023 saw a return to more traditional levels, but the capacity remained. As a result, rejection rates for freight tenders took a dive to below five percent, indicating carriers were eager for any freight that kept their fleets moving. This caused freight rates to take a dive (Figure 3.1) and then stabilize as of late.

But how long will shippers be able to rely on rate stability? Most likely the best determination will be the pace at which carriers exit the market.

Figure 4.1 clearly shows capacity has been coming out of the market (blue line) for the past year. Most of that capacity is small – micro-fleets and owner operators. Certainly, this is dwindling capacity, but not to the extent of a large carrier pulling out of the market. A slow drip for sure.

The orange line represents the OTVI (volume) in the market, and that has slowly climbed over the last 12 months with the normal seasonal up and downs. At some point, as the volume inches up and capacity comes down, it’s simple supply and demand. Many are pointing to the end of this year, more likely spring of 2025 when that balance starts to shift. Now is the time for shippers to learn the contingency plans that are in place with their carrier and broker providers to account for this.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox