Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Tariffs, Trends, & Trade Routes

With the new administration in place, there has certainly been no shortage of headlines. Many have asked what the impact is, or potentially will be, on the freight market. I think many are leery of making changes to projections or providing advice on how to pivot because what happens today can turn on a dime tomorrow when it comes to U.S. policy.

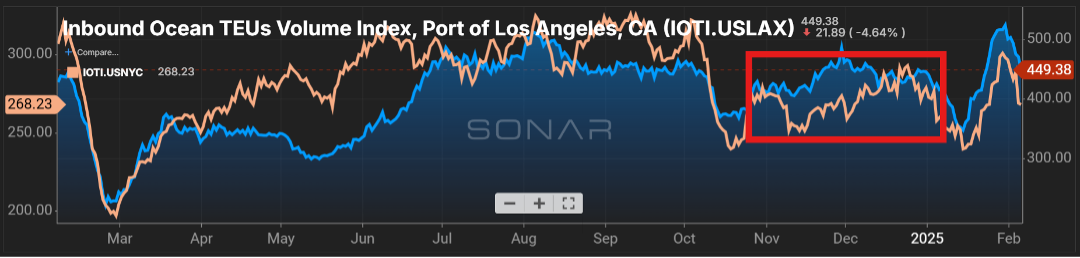

The one thing that appears certain is that many retailers pulled their inventory ahead in anticipation of tariffs being enacted. The last four months have seen a volume that outpaced the prior year. Figure 1.1 shows the container volume for Los Angeles (blue line) versus the port of New York/New Jersey. Particularly, the West Coast has seen an influx driven not just by the pull forward of volume, but the uncertainty with labor relations at the East Coast ports shifted volume west during the latter part of 2024 and early ’25.

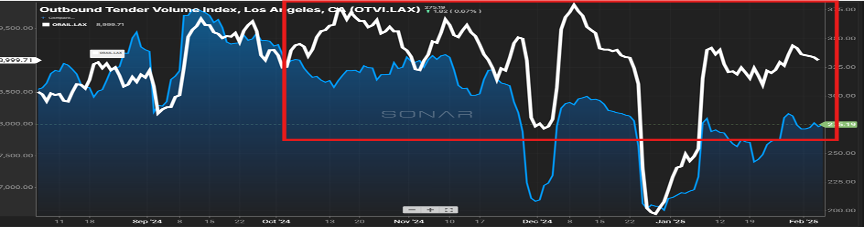

Unlike what was experienced several years ago, that increase in import volume has not translated to over-the-road moves. Figure 2.1 shows the last six months of volume handled by trucks out of the Los Angeles area versus the volume that has found its way to the rails. Unlike ’21 and ’22 when rails were a bit of the bottleneck for freight movement, they are much better positioned this time to handle the increase in volume. You can clearly see the gap in volume for rail (white line) versus truck (blue line), especially since early October.

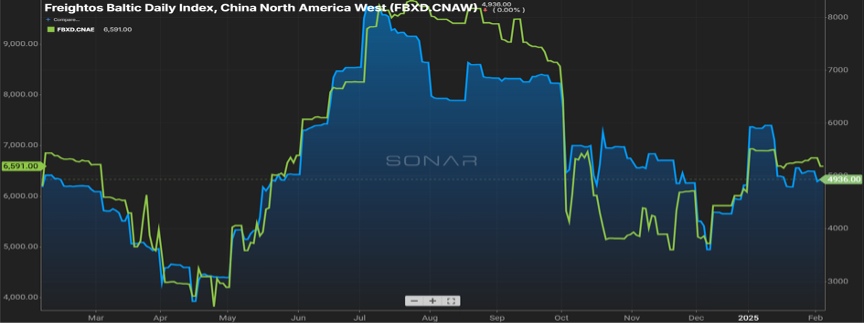

Speaking of imports, there appears to be a normalizing of the cost to procure containers for movement of goods into the U.S. Looking at Figure 3.1, the cost of a freight container from China to both the left and right side of the United States has retreated from its high during the summer months and shows a leveling out. Much of this is due to the decline seen in nefarious activity in and around the Red Sea. As calm has returned, ships are now able to utilize this corridor for transit, it has shaved transit times which in turn has opened up more ship capacity globally.

Price Hikes Ahead?

Finally, while tariffs have been the talk recently, certainly the who, what and when has been in a state of ebb and flow, one item that is not getting as much press is the scrapping of the de minimis exception. This has long been a shipping loophole for retailers that thrive on low-cost goods (think Temu or Shein). Unlike many retailers who paid millions, hundreds of millions, in duties and taxes, the companies of Shein and Temu paid a whopping $0 for all of 2024. This move now requires basically all inbound shipments to the U.S. to be subject to duties, taxes and processing fees, which has the potential to shift the landscape for companies that were able to thrive in this market.

As example, a good costing $50 once it got to the end customer was still only $50. With de minimis not in play, a $50 good could avoid fees that would almost double when you factor in the additional costs. What remains to be seen is how these increased costs are handled, but the most likely scenario is the end consumer absorbing the bulk of those costs. Typically, producing these low-cost goods in China comes with stiff competition and razor-thin margins, leaving manufacturers and shippers unable to absorb the increase.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Rising Tide of Rejection

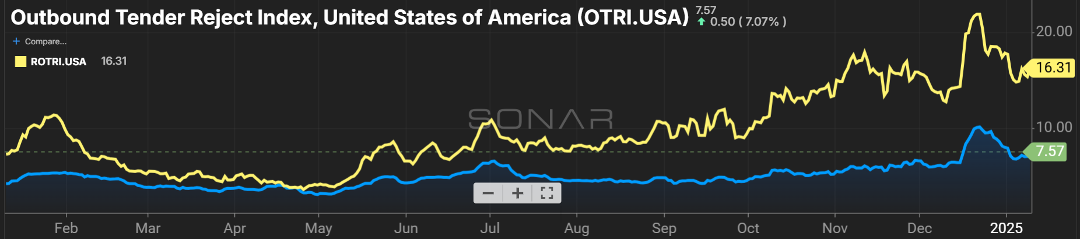

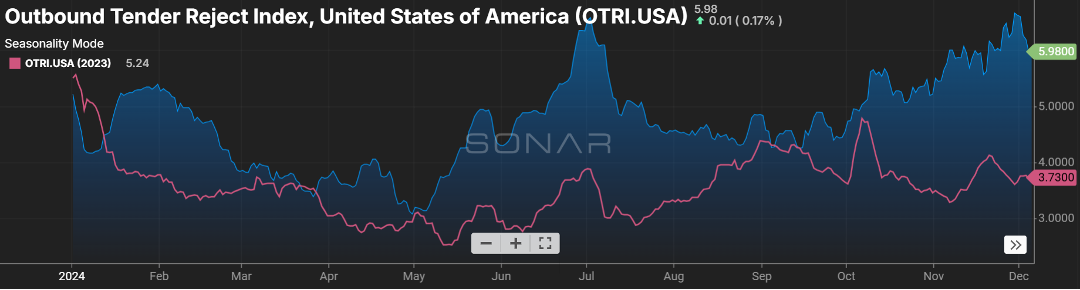

Continuing our theme of tender rejection rates being a leading indicator of freight rates, the momentum gained over the last few months continues.

While the tender rejection rate (Figure 1.1) for the overall U.S. (blue line) briefly touched the 10 percent marker, it has retreated. However, it still appears to be slowly climbing, currently sitting just below eight percent. Being 300 basis points above the mark a year ago is a big deal and shows the relationship that exists between carriers saying “no thank you” to a shipment offered to them and the continuing retreat in carrier capacity.

Further, the rejection rate on refrigerated shipments (yellow line) has continued its run of outpacing the overall U.S. rejection rate for the past eight months. Colder than normal temperatures across much of the country has contributed to the need for reefer unit trailers to keep product from freezing. Shippers, especially those that play in refrigerated commodities, need to ensure they are flush with carrier and broker capacity, and should anticipate rate increase requests from their providers.

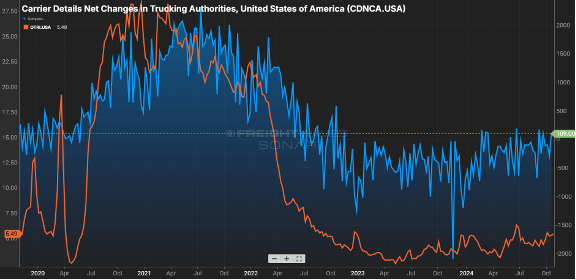

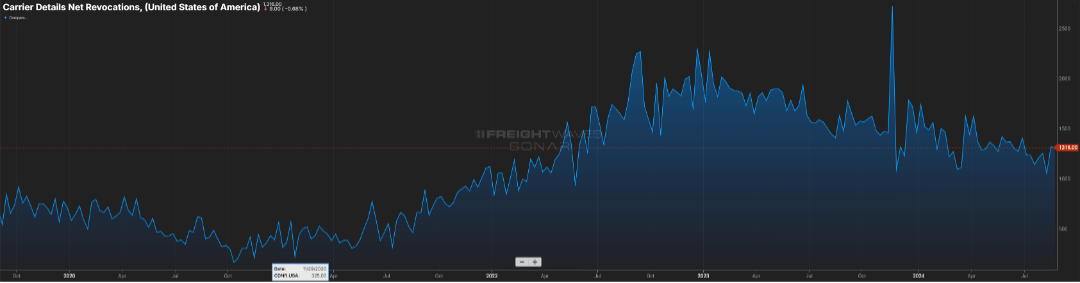

Speaking of capacity, we continue to see the slow trickle of carriers leaving the market. Looking at the past year, the trend for 2025 is we will see capacity decline at a three-to-five percent pace. Figure 2.1 shows the net change in carrier authorities, for the most part staying in the negative territory.

Looking further into the loss of capacity, the teal line shows the change in authority for micro fleets (one-to-five trucks). This is typically the owner operator community. Increases in costs to operate, as well as equipment where these carriers may be upside down on payments, has caused several to retreat from operating in the industry.

Calm Waters Ahead

Finally, a potential strike at East Coast and Gulf ports was averted for a second time. This is certainly good news as shippers continue to pull forward orders in anticipation of tariffs being imposed on import volume.

Just a few years ago, East Coast ports were seeing almost half of the U.S. import volume flow through their ports. Much of this shift was due to labor and operations issues on the West Coast. We are now seeing that reverse course.

East Coast ports are handling 41 percent of inbound ocean freight, while West Coast ports are up over the same two-year period, from 37 percent to 47 percent. With ILWU voting in favor of a contract that extends through mid-2028, and East and Gulf port workers agreeing on a six-year deal, a sense of calm should come to shippers and manufacturers that depend on our ports to receive their freight.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

CANARY IN THE CAVE

Data is everywhere, both on a macro and micro level. How this data is interpreted and reported, and the contradictions it can create, has the potential to leave one wondering just what to believe.

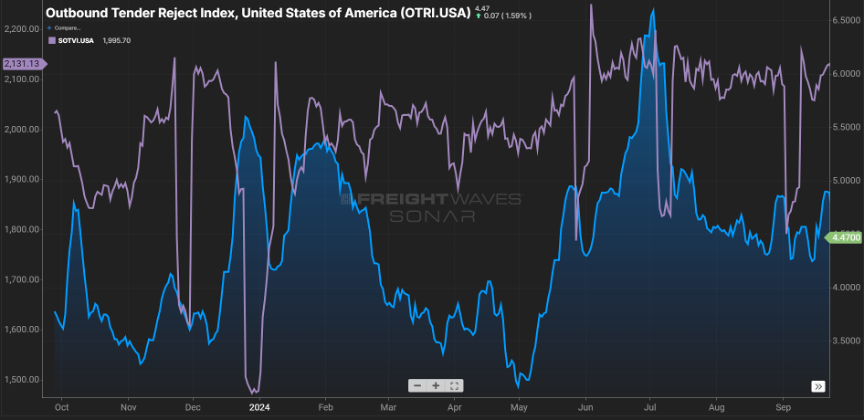

For years now, I have been, pretty much daily, watching like a hawk the ebb and flow of tender rejections (Figure 1.1). While this is focused on the contact freight market, what happens on the contract side absolutely has an impact on the spot market side. The last year plus has been pretty vanilla, with rejection rates almost negligible.

This pales in comparison to just a few years ago when carriers said “no” to shipments 30-plus percent of the time. While the current six percent rejection rate won’t set off many alarms, it is noteworthy in its trend. Heck, just six months ago, the rejection rate was hovering below three percent. Yes, there is seasonality that plays into the rejection rate, but seasonality also existed in 2023, and the rejection rate lagged during the fourth quarter of the year. While there will be some dips along the way over the next six months, I expect the upward trend to continue.

LOOMING STRIKES & DISRUPTION

Many in the industry breathed a sigh of relief when the short-lived port strikes on the East and Gulf Coasts were settled. However, while there was agreement on several issues, the automation at the ports loop remained open.

We are fast approaching the 90-day period for resolve in January, and the threat of another shutdown looms. Combined, the East and Gulf Coast ports provide service for incoming and outgoing ocean containers for more than half of the volume in the U.S.

So, what should you be prepared for if a second strike were to happen?

👉 Like it or not, we are dependent on unfinished and finished goods from overseas. Not being able to receive those goods will cause shortages on things like groceries, electronics, and clothing to name a few.

👉 The U.S. economy’s dependence on consistent flow of goods in and out of our country is to the tune of about four billion dollars per day. Even a week-long strike has the potential to severely delay the flow of goods around the ports for a month-plus.

👉 While most U.S. businesses would feel the effects, small businesses would be the most impacted as their already thin profit margins would be challenged by increased costs for goods along with a tight labor market and inflation.

👉 It’s not just consumer-ready goods. The ports play a role in the preparedness for emergency situations and defense posture.

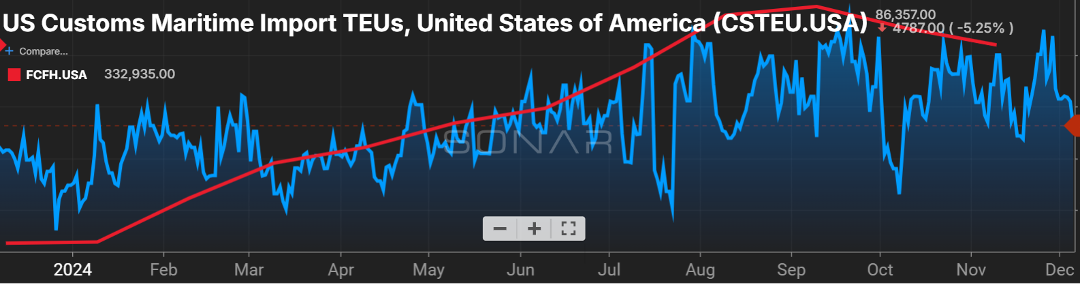

We are already seeing the surge in import volume, up about eight percent versus a year ago as shippers look to get ahead of potential tariffs and now a labor shortage. Couple this with a downward trend in over-the-road capacity (Figure 2.1), and you have a recipe to further accelerate trucking rates.

U.S. shippers need to be reviewing their carrier and broker partners for compliance in the coming months. While many have not had the need recently, they should consider adding extra companies to their routing guides.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

What to Expect in the Short-Term

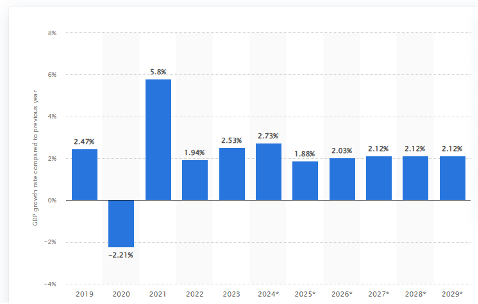

Well, so much for a recession. The U.S. is anticipating year-over-year growth of 2.8 percent in 2024 with regards to gross domestic product (GDP). That percentage of growth appears to be trending less in calendar 2025, with moderate growth forecast through the end of 2029 (Figure 1.1).

Generally, for every one percent of GDP growth, that typically translates into 1.5 percent growth in over-the-road truckload volume. Based on those projections, we expect freight volumes to climb by four to five percent in the coming year.

Conditions are also turning more favorable for a pendulum swing to the side of the carriers. Two reasons for the bullish outlook – dwindling capacity and tariffs (be it threat or real), simple supply and demand.

INCHING CLOSER TO BALANCE

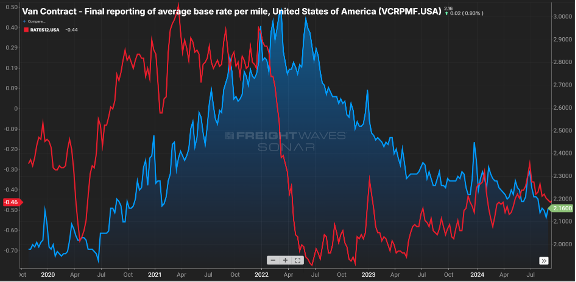

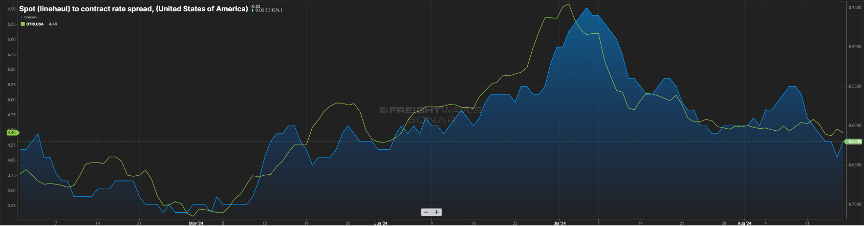

On the capacity side, the spread between contract and spot rates, which was near $0.80 per mile in the middle of 2022, has now fallen below $0.50 per mile. Keep in mind contract is almost always above spot sans latter 2020 and early 2021.

The gap has closed primarily due to contract rates receding, from the $2.30 range in early ’24 to now being $0.15 less, as illustrated by. Figure 2.. Figure 2.2 shows the net change in for-hire carriers versus the tender rejection rate. Since mid-2022, carriers have started to shun the market as higher costs to operate & lower rates made sustainability a challenge.

Where does shrinking capacity first show up? In the tender rejection rates. Carriers will say no to a guaranteed rate load either because they have no equipment in the area or there is a more favorable paying load available.

Rejection rates cresting the five percent mark may not sound significant, but keep in mind rejection rates were in the two to three percent range as we started this calendar year. Eight to 10 percent is a more balanced market, and we are close to that. Usually, rejection rates in double digits signify more pricing leverage is held by the carrier community.

The other driving factor is around demand. While there are some sectors showing slight gains, the November election could be the spark that drives a glut of freight movement.

With Republicans poised to control the White House and Congress, impending tariffs will drive a flurry of activity as shippers look to move goods prior to an imposed increase in cost, This is likely a short-term surge as “too much inventory” is a real thing, and once tariffs are imposed, consumers ultimately will feel the brunt of increased costs and could hamper purchasing. However, the next pivot point will be around movement of production to domestic U.S. or near-shore locations.

After a blah few years, things are about to get interesting.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Feels like 2022

For the majority of this year, volumes have seen their traditional seasonal patterns and have been trending above 2023 levels. Many have commented that market balance will be driven more by carrier attrition versus an event that spurs freight volumes.

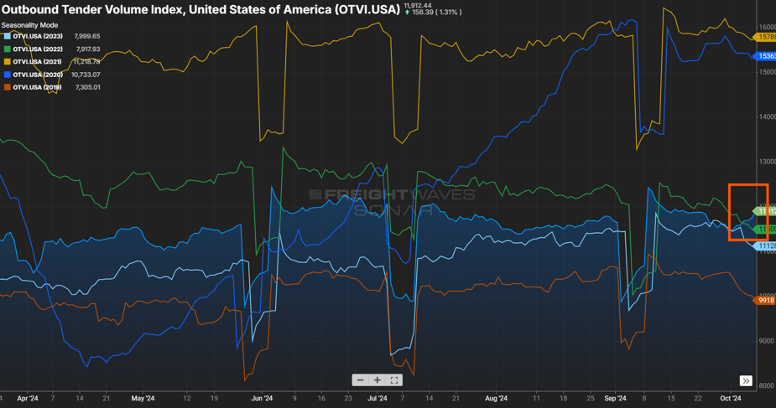

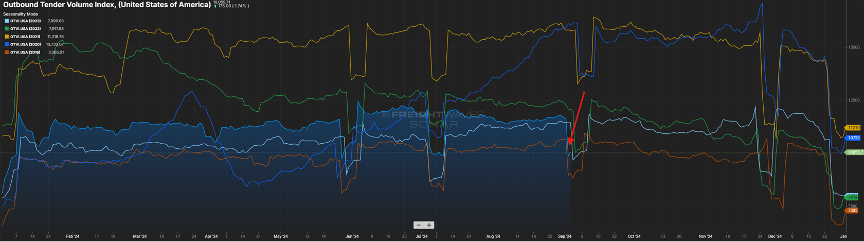

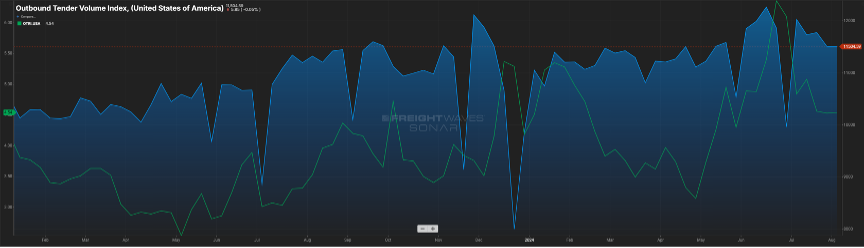

2022 was a pretty good year from an industry standpoint. Volumes were still elevated (certainly not like we saw in 2021) and capacity was inline. While it may be a blip on the radar, we have now seen the Outbound Tender Volume Index eclipse 2022 levels for the first time in two years as seen in Figure 1.1.

I think it is still too early to pin the volume uptick on the interest rate reduction or the recent hurricanes that severely impacted states in the southeast, but these events, and any potential storms that might still pop up (hurricane season isn’t quite over yet), could impact freight volumes in the coming months. Combined with consumers continuing to spend, volumes could remain consistent through the end of the year versus following their traditional end of year downward movement.

FINE….FOR NOW

While there was a sigh of relief from many with the ILA and USMX reaching a deal on wage increases for dock workers, this does not mean that everything is resolved, and potential port disruptions could occur at the 20-something docks along the East and Gulf coast.

Union-member wages were the major bargaining chip that was agreed upon last week, with dock workers receiving an immediate pay increase, with yearly pay increases to follow. When all increases have taken effect, dock workers will see a 62 percent increase in pay. One issue that was not finalized was the use of automation at select ports, which the labor union has opposition to full and semi-automation. The two sides will continue their negotiation discussions, with a timetable of three months from now to finalize a deal.

If these points can’t be resolved, it may be rinse and repeat with the threat of another strike as we get into the start of 2025.

Speaking of the recent shut down of port activity, it will take a week or so to work through the container backlog. This, along with the disruption in shipping patterns caused by the recent hurricanes, has been impacting tender rejection rates as seen in Figure 2.1.

Rejection rates crested the five percent mark recently. As port activity comes back online, expect the volume for short haul shipments (<250 miles) to remain elevated as also seen in Figure 2.1.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

YES, IT IS IMPORT-ANT

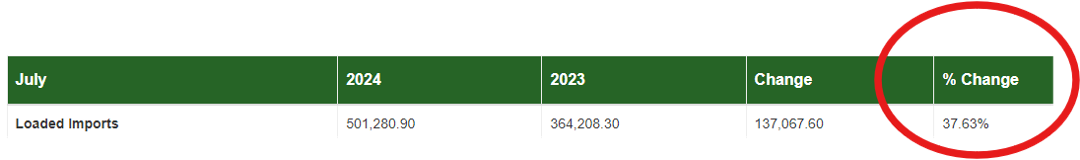

There has been much buzz in the last month around inbound container volumes to U.S. ports. There are 300+ ports of entry for goods into the country, with much of that volume handled by the top 20. Most of that buzz is around the uptick in volume.

In figure 1.1, you will see for the port of Los Angeles, the largest in the country, that container volume is up almost 38 percent. That’s certainly impressive, but the neighboring port (Long Beach) was up a staggering 60 percent.

Many would anticipate this similarly impacting the outbound over-the-road volume for that market. And yes, while we see in Figure 1.2 via the blue line, there is a noticeable increase from what it was heading into the Memorial Day holiday, but it is not a direct correlation. The beige line represents the domestic rail volume from that same market, and unlike what we experienced in the “Covid years”, the rails have been a bigger mover of goods versus the bottlenecks we saw back then.

We should expect to see import volumes continue through the next few months. As goods produced overseas have become cheaper to buy, major retailers have taken advantage of these discounts with the anticipation of robust consumer spending. Remember, almost three-fourths of inbound volume is directly related to consumer purchasing. Good news for consumers as these retailers will want to liquidate this inventory quickly at lower prices.

NOT FAR FROM HEALTHY

While not in balance, the spread between contract and spot rates continues to shrink, now sitting about $0.60 per mile higher on the contract side. Keep in mind this gap was in the $0.75 to $0.90 for much of the past year. Almost in lockstep has been the tender rejection index. It has continued its slow upward movement as seen by the green line in Figure 2.1.

This can be attributed to capacity continuing to shrink slightly (Figure 2.2) and contract rates moving downward. It’s rare that spot rates will eclipse contract rates, but a spread of $0.40 to $0.50 is indicative of a healthier market, and we are not far from that right now.

I spent a few days traversing the state of Tennessee recently. At one stretch of a major interstate, there was a back-up at least five miles long. Luckily for me, it was on the eastbound side, and I was heading the opposite direction.

What struck me was the sheer number of trucks that sat idled. By my estimates, almost 80 percent of the volume was truck traffic. And while you can’t tell if a van is loaded or not, every single flatbed had freight on it. So, ladies and gentlemen, freight is still moving in this country. While it may not feel like it, volumes are trending close to 2022 levels as seen in Figure 3.1 (blue vs. green line). They say the fourth quarter is the time when carriers make hay; so here’s to an optimistic outlook for the next four months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

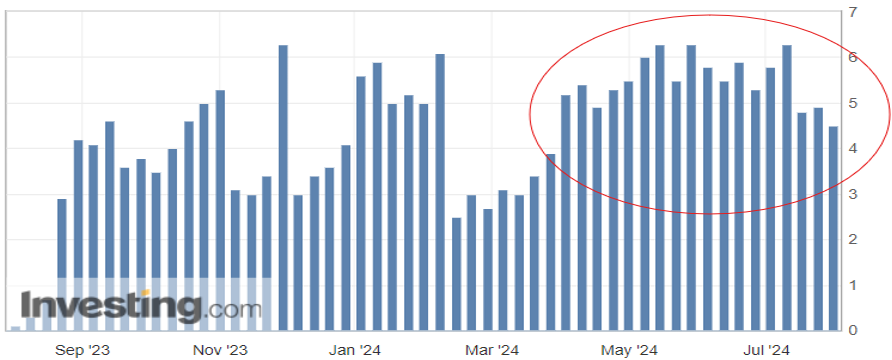

GOOD NEWS, BUT…

Consumer spending is the biggest driver of the U.S. economy, accounting for roughly two-thirds of the nation’s Gross Domestic Product (GDP). One measurement of that consumer spending is the Redbook index, which compares year-over-year growth for large domestic general retailers (think Walmart, Amazon, Target). The index has averaged just over 3.5 percent for the past 20 years, so the recent year-over-year (YoY) growth in the four-plus percent range speaks to the strength of consumer spending (Figure 1.1). This index alone certainly gives reason for optimism, however there is a cautionary tale with regards to consumer debt.

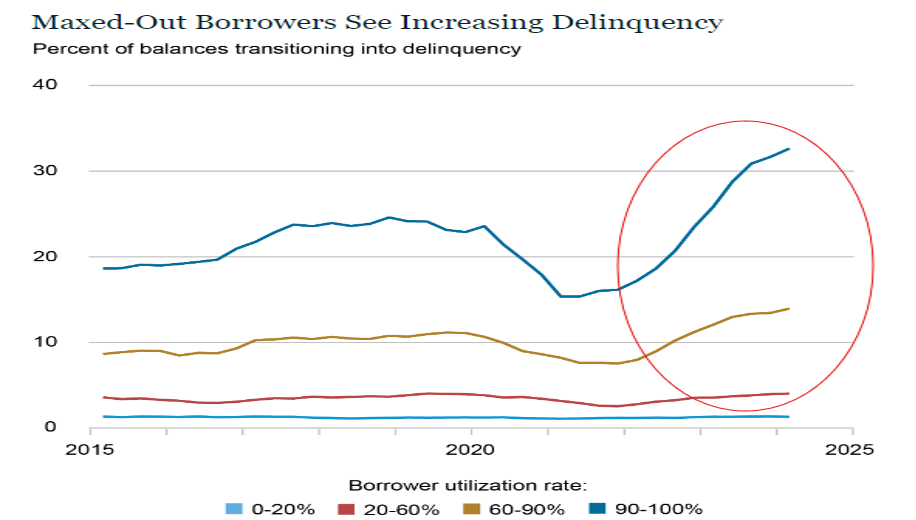

After years of next to zero interest rates to keep the economy on its legs, consumers have seen interest rates on the rise, with the federal funds rate at its highest level since the early 2000’s. With the increase in interest to borrow funds, combined with the increased costs of essentials (food, housing, energy), many households have turned to credit cards to fill the gap for funding of these necessities. Figure 1.2 from the New York Fed Consumer Credit Panel shows the rise in consumer delinquency particularly in those groups that utilize more than half of their available credit line.

While there appears to be relief on the horizon with the impending reduction in interest rates, it appears a portion of active consumers may be pulling back on purchases for those items that are not mission critical. This, in turn, will have an impact on restocking of inventories and trucking activity.

While it is not approaching the levels seen in 2021, the volume index is quickly approaching levels seen in 2022. This has buoyed optimism in the industry.

JUST SOME GOOD LUCK? TIME WILL TELL

The uptick in consumer spending, restocking of inventories and the threat of labor strife in the fourth quarter of this year has been to the benefit of those involved with the rail and import business.

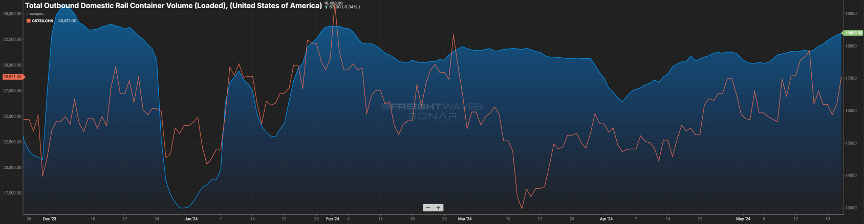

In Figure 2.1 below, the blue line represents loaded container rail volume in the U.S. and the past three months have seen the volume grow. Similarly, container volumes to the U.S. have been on the rise.

The orange line represents container volume from China over the past six months. While some of that traditional volume is now flowing through other countries, like Mexico, there is still a great deal of activity with U.S.-China trade. Will this continue or is it fool’s gold? That is something we will continue to keep an eye on as a pullback in consumer spending will dictate how the needle moves.

STAYING RIGHT WHERE WE ARE

Finally, looking at domestic over-the-road volume (blue line) compared with carrier rejection rates (green line). The slight upward trend continues with volumes and rejection rates (Figure 3.1). Rejection rates continue to inch towards 2022 levels, but a five-to-six rejection rate is about half of what one would see in a balanced freight market.

This has yet to manifest itself in the way of increased freight rates, as capacity still exists in the market.Shippers and carriers should anticipate little change in conditions (although hurricane season is looming) until early 2025.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxIt’s no surprise that one of the hottest topics in the world lately is the pain felt at the pump. Rising fuel prices have been at an all-time high, surpassing the costs since 2008, and these prices will only continue to climb. As a result, businesses are being forced to pay more to operate, causing a ripple effect for everyone.

Wait, How Did This Even Start?

You may be wondering how fuel prices even got to this all-time high. Well, they can’t be blamed on any specific event or occurrence as many different factors caused fuel prices to surge.

World Conflict

World conflict is one issue affecting fuel prices, specifically those in Western Europe. The Russia-Ukraine war has been brewing for some time now, and due to attacks, the United States among others has stopped imports, like oil, coming from Russia.

Russia is one of the world’s largest oil exporters, exporting nearly eight million barrels in one month. The drastic change in accepting oil imports from Russia has caused the price of fuel to rise because it’s not as available as it once was.

The Dreaded “C” Word

Another catalyst for the spike in fuel prices is the continual effect of Covid-19. I’m sure you’re tired of hearing it, but the world is still feeling the pains of the virus while we aim to return to life. Recently, Covid forced Chinese ports to close for a brief period and now that the ports are opening back up, supply cannot keep up with demand.

As people try to live alongside Covid-19, office workers are going back to in-person work and people are returning to travel after two years of staying put. With more people leaving their homes, it’s causing a greater demand for fuel while our supply is limited.

The Effects of These Issues

Fuel prices are affecting everyone, including consumers, and businesses, but those in the logistics industry are seeing greater challenges. That’s because the logistics sector has seen disruption after disruption. First, with the issues started by the pandemic, then the port congestion once businesses began to reopen, and so on to now with increased fuel prices. This industry has barely had a moment to catch its breath.

Logistics is at a crossroads; with the United States economy looking at a recession, and world conflicts yet to improve, it’s going to be hard for fuel prices to drop back to normal levels until everything balances out.

How Bad is it Actually?

Even though everyone has been hearing and seeing the high fuel prices, how bad are these prices? Well, in June, the U.S. national average price per gallon topped $5, which is 50 percent higher than it was this time last year. Even pre-pandemic prices were at $2.55 average for that month, showing the direct impact that covid and other issues have caused.

These prices only continue to rise when we talk about the cost of diesel fuel. This type is often more expensive than regular gas, and this is what truck drivers use to fill up their tanks. In June, diesel fuel averaged $5.50 per gallon in the U.S., which is a .50-cent increase from regular fuel. While this increase seems small, when truckers are driving over 500 miles per day, the extra cost can add up quickly.

President Joe Biden has tried to take steps to lower fuel prices in the United States. He has called on Congress to do a Federal Gas Tax Holiday, releasing the charges that the federal government has on fuel. Typically, the government charges an 18-cent tax per gallon on gasoline and a 24-cent tax per gallon on diesel, but President Biden has called for the Tax Holiday to give Americans breathing room as they battle other economic issues like inflation.

High fuel prices are not an issue solely faced by the United States. In fact, gas prices in the United States are on the lower end of the spectrum compared to other countries. For example, while the average in June for the United States was $5 per gallon, in Germany, it averaged $8.26 per liter, while one of the highest fuel prices was in Hong Kong, where gas was $10.71 per liter in June.

How Do High Fuel Prices Impact You?

So, how do the rising fuel prices affect those in the logistics industry? Well, let’s take a look.

Shippers

Increased fuel prices mean higher logistics costs because it’s now more expensive to move their products from point A to point B.

Consumers

Consumers see a direct cost increase on products due to fuel prices. Because it now costs more for shippers to move their products to their destinations, they must also raise the price of their products to continue to make a profit.

Carriers

The biggest issue carriers are seeing with the high fuel prices is the impact on their income. Their operating costs have increased due to the rising fuel and product prices. And with rates lower than they’ve been throughout the pandemic, many carriers have decided to put a pause on driving until the market return to normal. This could cause added chaos to the market. Should more carriers halt their work, there could be an imbalance in the industry, causing more backlogs and shipping delays as a result.

Trinity is Here to Help

As an experienced third-party logistics company with over 40 years in business, we’ve worked with many shippers and motor carriers through the ups and downs faced in this industry, including this one. We’ve seen it all and are here to help you through these troubling times.

Whether you’re a shipper looking for better logistics management or a motor carrier looking for dedicated freight to keep you consistently moving, you can find all the solutions you need with our People-Centric approach.

Get connected with us today so you can start having Trinity Logistics, a Burris Logistics Company, by your side, no matter the state of the market.

Learn more about Trinity Logistics Join our mailing list