04/18/2025 by Greg Massey

April 2025 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

tarifFS AND TIGHT WALLETS

A colleague of mine told me recently that anytime you give a presentation around technology, there is an obligation, almost a duty, to include “AI”. Now, it feels like anytime you talk or write about things in the freight market, you have to include the word “tariffs”. The old saying, if you don’t laugh, you’ll cry seems very appropriate.

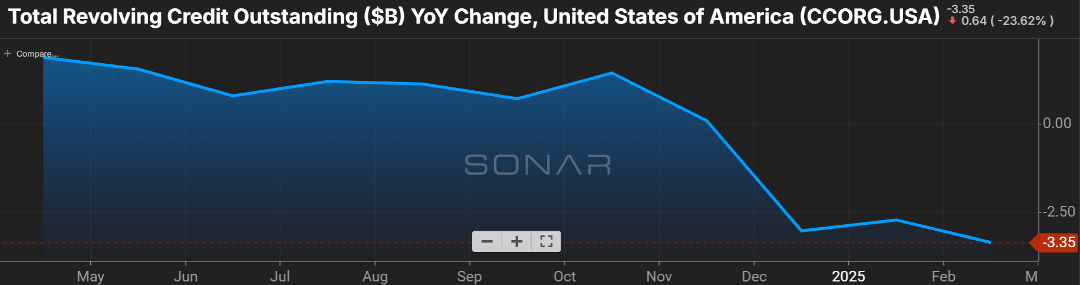

In 2024, 68 percent of personal consumer expenditures comprised our nation’s gross domestic product (GDP). This is concerning when you look at the trend over the last three months regarding consumer revolving credit.

As you can see below in Figure 1.1, year-over-year (YoY) there has been a decline. When customers feel skittish about taking on a new car loan or signing on the dotted line for a thirty-year mortgage, this has a trickle-down effect, not just on the immediate sectors, like the auto industry and housing, but those secondary and tertiary markets. If the pace of new homes being bought slows, then production of things that go into the home, like furniture, carpet, or fixtures, is also impacted negatively.

Some have pointed to the credit card revolving debt as a sign of the economy’s strength. That may have been a valid argument in January, when we saw a six percent YoY gain. But the recent report shows an annualized bump of only 0.1 percent, indicating that consumers are curtailing spending and relying on cash at hand to fund purchases versus credit cards.

Don’t be surprised if long-term debt, like auto loans, starts to show an uptick in delinquency.

Tiny Shifts, but Big Waves

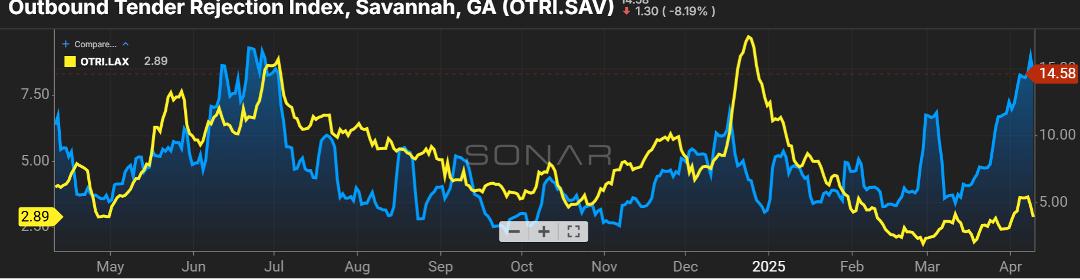

As the threat of the “T” word continues, the freight market continues to see the pull forward of goods entering the U.S. as shippers look to get ahead of an increase in production costs.

While a slight increase in port areas like Los Angeles may seem like no big deal (Figure 2.1), keep in mind over half of the import volume funnels through the LA/LB ports. Even going from a 2.5 percent rejection rate to now in the five percent range (yellow line) may not seem significant. However, when you apply that change to 413k shipments in February alone, it becomes a significant impact.

A port like Savannah (blue line) shows the impact of a fragile capacity balance, and even a slight uptick can be needle moving for rejection of freight tenders. While not to the size of the LA/LB ports, handling 265k import containers in March, a surge in volume of 30k containers compared to February 2025, an imbalance in capacity can quickly escalate rejection rates close to 15 percent as they stand currently.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox