Most of us over the age of 25 can remember when the World Wide Web made its debut. We remember the “beep-boop” sound of dial-up and the big chunky computers that were as wide as a television set in the 1990’s. It’s been almost 30 years since the dawn of the Internet. It’s mystifying to look at the impact it still has on our everyday lives. Because of the Internet, e-commerce was born, and the need for flatbed shipping has increased.

The Beginning of ECommerce

Over time, ecommerce has taken the baton from traditional brick-and-mortar stores, leaving many big-box store retailers high and dry. Since Amazon Prime’s arrival in 2005, online shopping has exploded in the marketplace. The ease and convenience of it have forced many retailers to develop a strong online presence or risk closing their doors for good.

COVID-19 Creates Rapid Growth

Due to health concerns and social distancing practices, COVID-19 rapidly escalated the use of ecommerce. Total online spending in May 2020 was up 77 percent year-over-year (YOY), according to a report on online spending released in June by Adobe. In that report, Vivek Pandya, Adobe’s Digital Insights Manager, states that it would have typically taken 4-6 years to see the level of growth in online shopping that was seen then. Contactless online ordering helped individuals attempt to limit their exposure to the virus by shopping from home, so it’s easy to see why those reported numbers were so high.

Since the pandemic, the changes in the ways consumers shop have remained. While in-person shopping has increased compared to then, it still lacks in the amount of foot traffic that was received previously. Consumers continue to like the ease of online shopping, and with fewer in-person shoppers, companies are investing less in their brick-and-mortar locations, which has only made people less likely to want to shop in person. In fact, it’s estimated that 40,000 to 50,000 retail stores will close in the next five years, according to the UBS investment bank.

Ecommerce continues to experience growth, with 22 percent of retail sales being online in 2023, the largest U.S. ecommerce sales percentage to date, according to the U.S. Department of Commerce. As e-commerce growth carries on, it’s created a growing need for companies to expand their inventory and improve their ability to distribute their products. What used to be a problem of “too much” storage space for companies before the pandemic has quickly turned into a necessity in today’s time.

The Need for Storage Space

As online distributors continue to see growth, their need for storage space has grown as well. Prior to Covid-19, one or two warehouses could keep a medium-sized company running efficiently. Now, more space is needed to keep up with the increasing demand of companies. Having more than one distribution center can be a huge benefit to a company’s ability to stay successful these days.

This all trickles down to the construction industry. As demand grows for new or renovated warehousing, the need for building materials to meet that demand has also increased.

How ECommerce Growth Affects Flatbed Shipping

Flatbed shipping has always been a leading mode of transportation for industrial freight. Lumber, stone, racking, and other building materials travel best on an open trailer due to their odd dimensions and additional weight requirements.

Looking for an extensive guide to keep on hand for your over-dimensional shipping?

Download our FREE guide!Usually, flatbed shipping sees an increase in volume in the summer months. Construction companies take advantage of the warmer weather, which is most suitable for outdoor construction work. During this peak shipping flatbed season, it’s not unusual to see tightened capacity and higher freight rates, but any added demand for warehousing can add to that, making securing a flatbed carrier more difficult.

Strong Relationships Help

Having a relationship with a third-party logistics company (3PL can be a benefit to those who coordinate freight to be delivered to a job site. Typically, job site freight is very hands-on and has a perpetual knack for being time-sensitive. Installation crews are on-site to receive and install the material scheduled to be delivered. Even the slightest delay can cause significant ramifications to the completion of the construction project. Having a strong relationship with a 3PL can help companies mitigate risk, reduce costs, and provide peace of mind to those who are coordinating the freight.

Be Ready for Anything

It appears online shopping is here for the long-haul and whether it’s causing you to expand your warehousing or not a 3PL like Trinity Logistics can help you be prepared for any changes that may come your way. With Trinity, you’ll gain a Team of experts that can help you optimize your supply chain and arrange shipping for various of transportation modes, including flatbed, while offering end-to-end visibility of your shipments. No matter what changes the future brings, you can stay one step ahead when you choose to have Trinity Logistics by your side.

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

WILL 2024 BE A FREIGHT REBOUND YEAR?

I certainly do not expect that we will return to freight volumes like we saw in 2021, and part of 2022. Now, I will never say never, but those were most likely once in a lifetime events. However, there are many signs that point to a potential for 2024 to see a rebound in freight volumes and carrier rates.

First, let’s talk about rates for over-the-road (OTR) carriers. Many new entrants came to the carrier market in ’21 and ’22, but currently, we’re seeing the contraction of for-hire carriers.

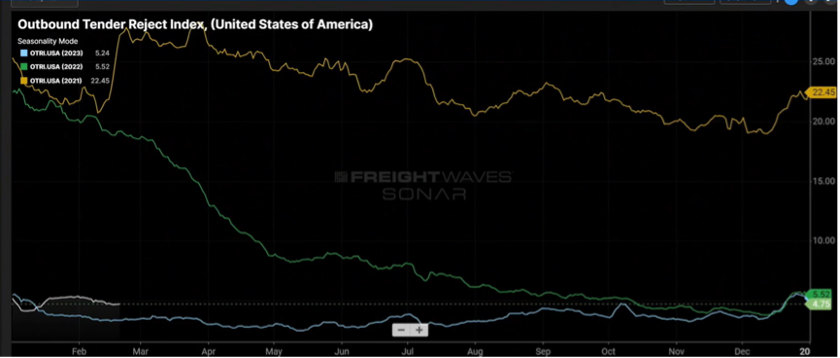

As shown in Figure 1.1, the past 14 months have seen less carriers in the market. As supply continues to dwindle, this will put upward pressure on rates. Granted, it may take another 12 months for the carrier market to find an economic balance.

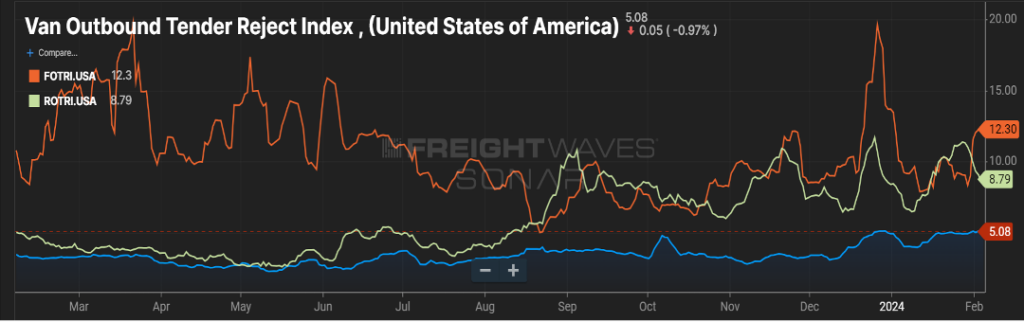

Figure 1.2 measures the rate at which carriers reject tenders (shipments) and continues to slowly climb upward. Granted, a rejection rate of five-plus percent is not earth-shattering, but in comparison to where it was in 2023, sub three percent in several months, five percent and the continuing upward movement is noticeable.

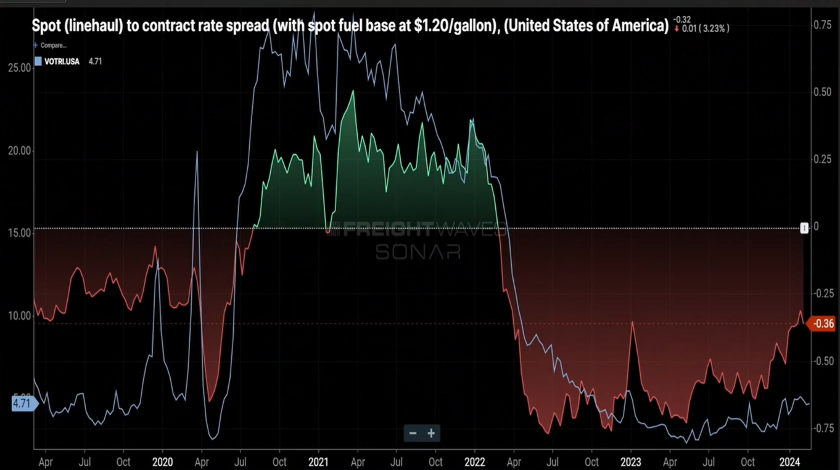

Lastly, Figure 1.3 shows that spot rates continue their slow rebound from the middle part of 2023. Contract rates throughout much of 2022 and half of 2023, were $0.60 to $0.70 cents per mile higher. Today, that gap stands at $0.36 per mile. This is a combination of spot rates inching higher, but also contract rates being less than prior years.

An Opportunistic Outlook

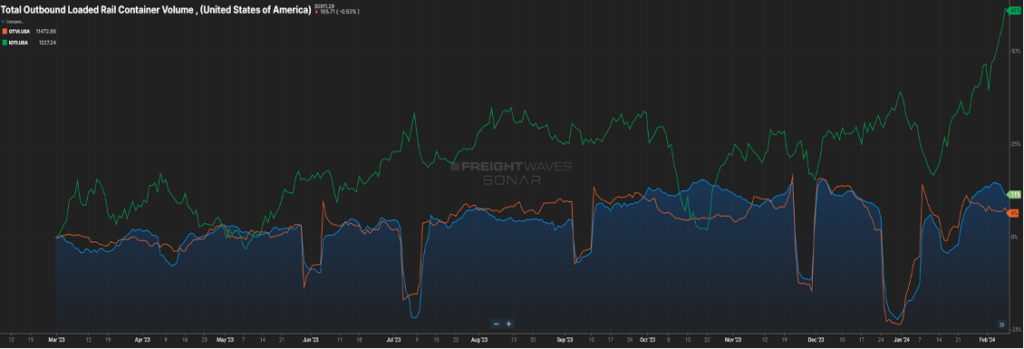

While contraction in the carrier market will influence the supply side of the economic equation, there also needs to be a demand component. The below chart (Figure 2.1) shows loaded rail car volume and over-the-road volume trending up and to the right, but the green line, representing inbound ocean containers, is really peaking.

Eventually, these containers will morph into rail and OTR volume. This is most likely a result in the drawing down of inventories, and the need for replenishment. Combine this with continuing increases in the manufacturing sector and housing market that will show better signs than 2023, it sets the stage for strong demand especially in the second half of 2024.

Will it be a bull or bear year in ’24? Well, if you would have asked that question six months ago, even maybe three months ago, my answer would have been slightly bearish or at best flat. However, seeing the recent signs on freight activity and the carriers needed to move this freight gives more reason to be optimistic as we go through the next ten months of the year.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxAfter several record setting years, 2023 saw shifts to the freight market. How did the 2023 freight market affect shipper and carrier businesses? Did other businesses have the same struggles as yours? Are they expecting to face similar difficulties in 2024? How are their partner relationships?

Trinity Logistics wanted to get answers to these questions for you, so we asked a random sample of our shipper and carrier relationships to gauge the effect 2023 had on their business and what their expectations for 2024 in our first Freight Market Survey. Here’s what we found out:

2023 SHipper & Carrier Data: Freight Market Survey Results

Past Challenges – Same, But Different

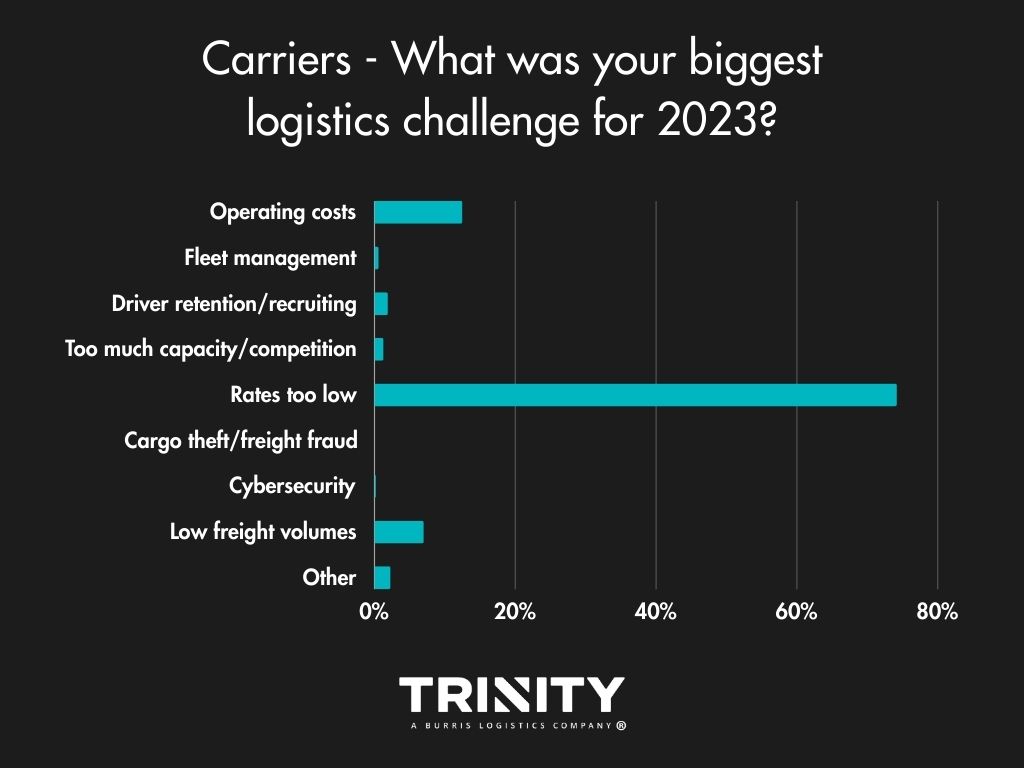

Considering the recent turndown of demand and the freight market, it’s not a big surprise that money was the biggest issue for shippers and carriers alike. Shippers answered that transportation costs were their biggest challenge in 2023, with supply chain delays/disruption and capacity not far behind. Low rates and increasing operating costs were the main challenges facing carriers.

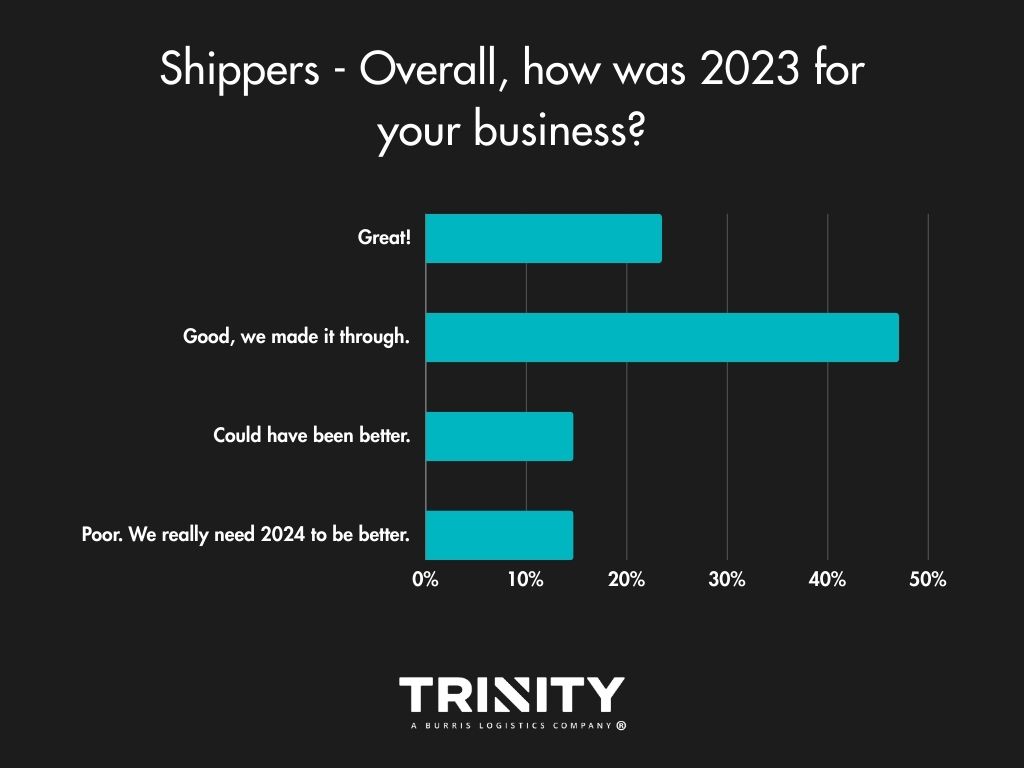

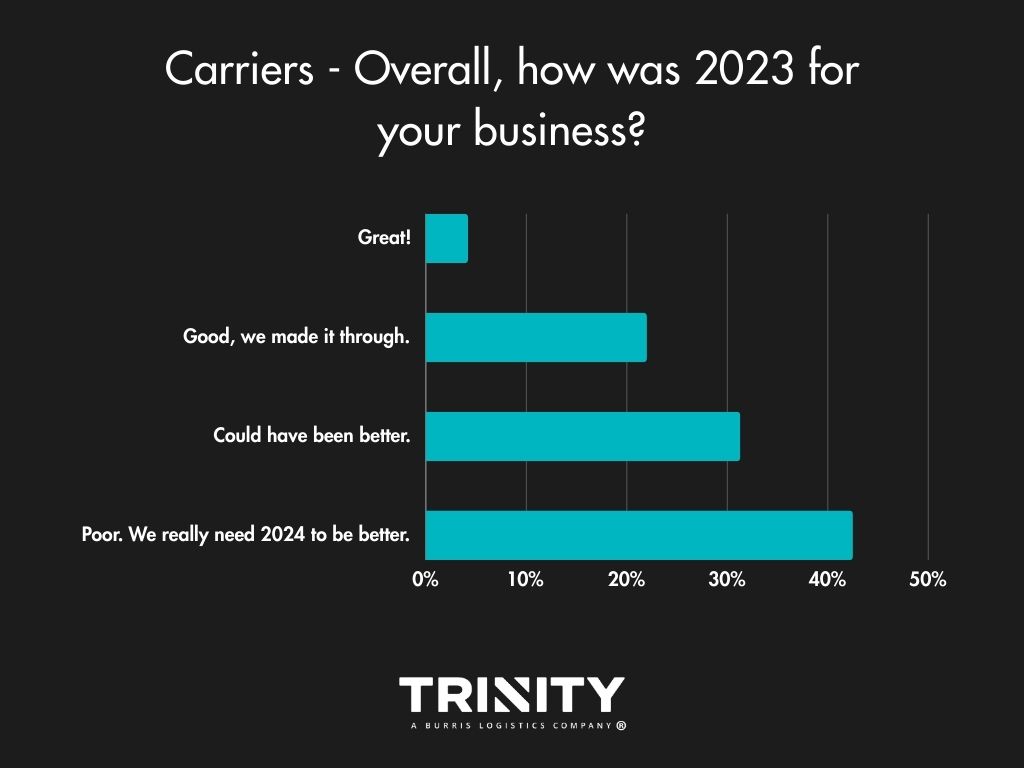

Business Impact – Could Have Been Better

Even with the change in consumer demand trending downwards throughout 2023, most shippers answered that their year was good overall. Carriers on the other hand seemed to face a rougher year in business with over half of them stating their year could have been better or was poor.

A LOOK INTO 2024

Future Challenges – Money Problems

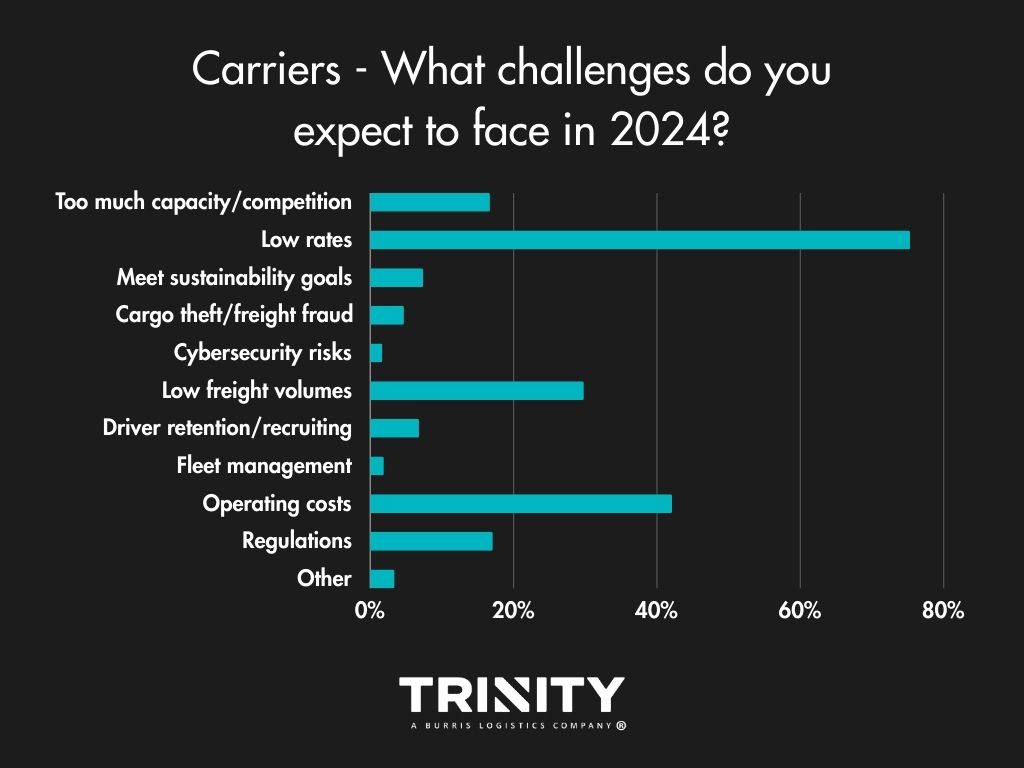

2024 isn’t looking much different in terms of challenges compared to 2023. Shippers look to have the same financial challenges as they did in 2023 with transportation costs, supply chain delays/disruption, and decreased demand being the top concerns selected. Carriers are still concerned about low rates, operating costs, and low freight volumes hurting their businesses.

Hot Trends

Even though transportation costs are shippers’ strongest concerns in their previous answers, it seems the increased amount of supply chain disruptions and delays we’ve all experienced in these recent years have hit a nerve, with the majority answering that supply chain resilience is the trend their business is most interested in. Cybersecurity also looks to be a growing interest.

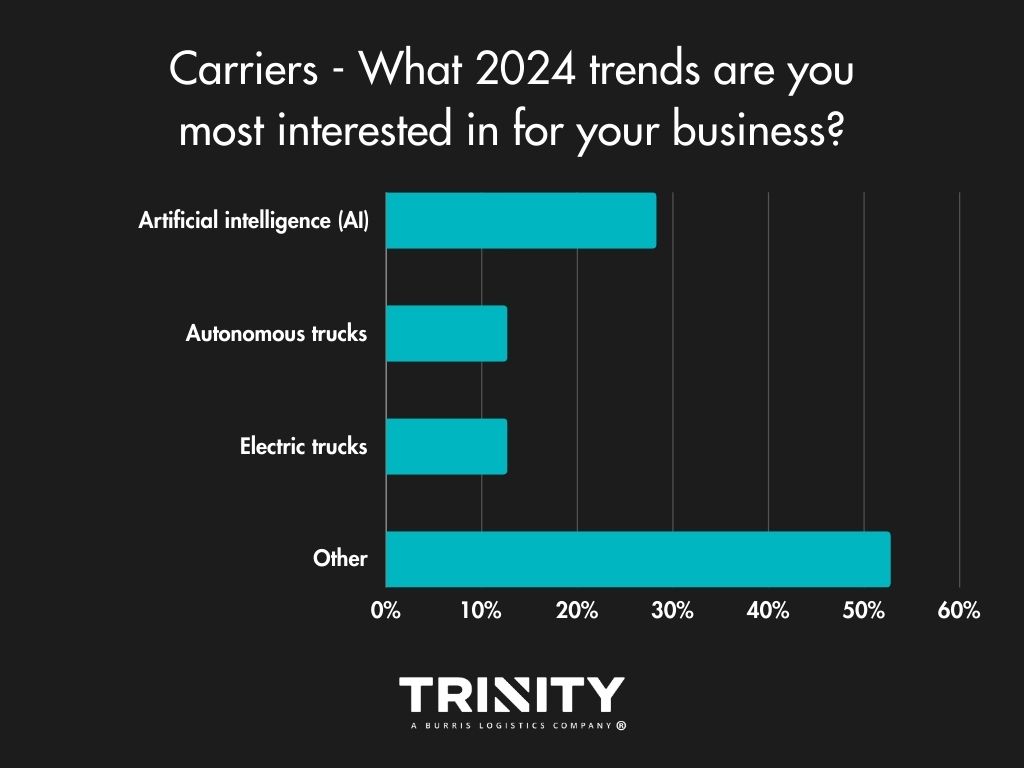

Carriers on the other hand, interestingly enough, look to the recent trend of Artificial Intelligence (AI). Also, as noted in the comment boxes of our “Other” option, increased rates and better fuel prices were trends they’d like to see in 2024.

Load Volumes & Capacity – Slightly Positive Outlook

Overall, shippers are slightly more optimistic for 2024, thinking it won’t bring any change or the change it brings will be positive. Most think load volumes will stay the same or there will be a little more in freight volumes this year. As for truck capacity, they think it will be the same as 2023 or slightly tighter.

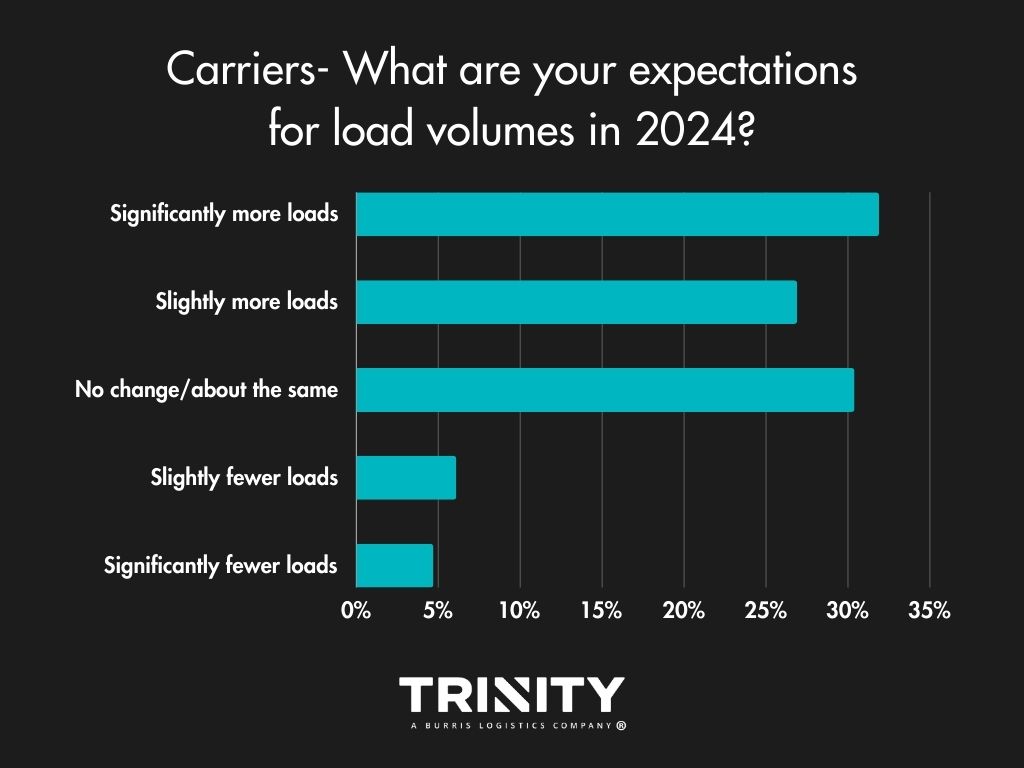

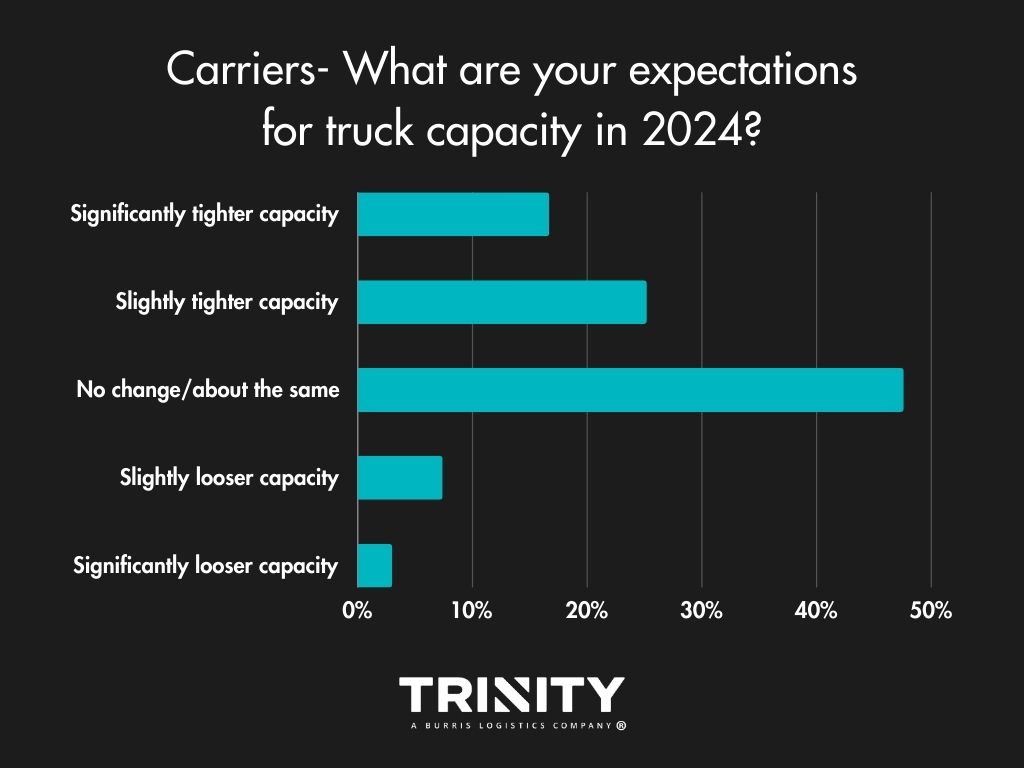

Carriers also think 2024 will bring more freight volumes and that capacity will likely stay the same or get tighten slightly versus 2023.

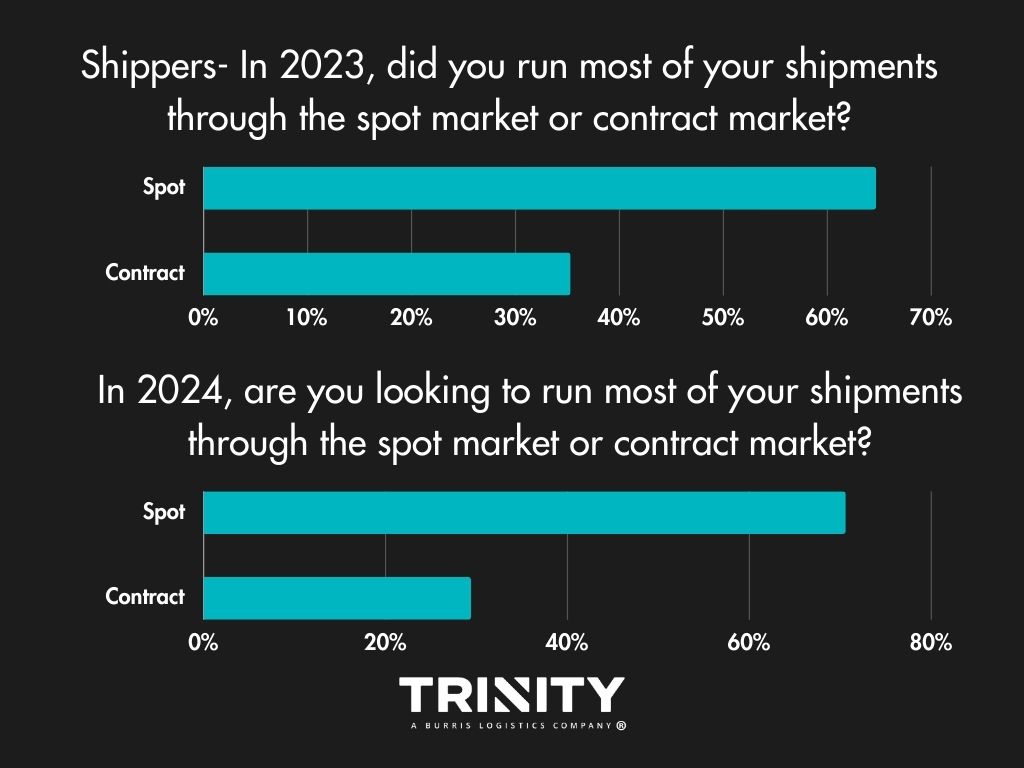

Spot or Contract?

Year-over-year, shippers aren’t looking to change much in terms of which market they turn to. Most look to continue to put most of their freight on the spot market.

For carriers, there looks to be some change anticipated. In 2023, most carriers ran spot market freight but in 2024, over half of them look to haul contracted freight.

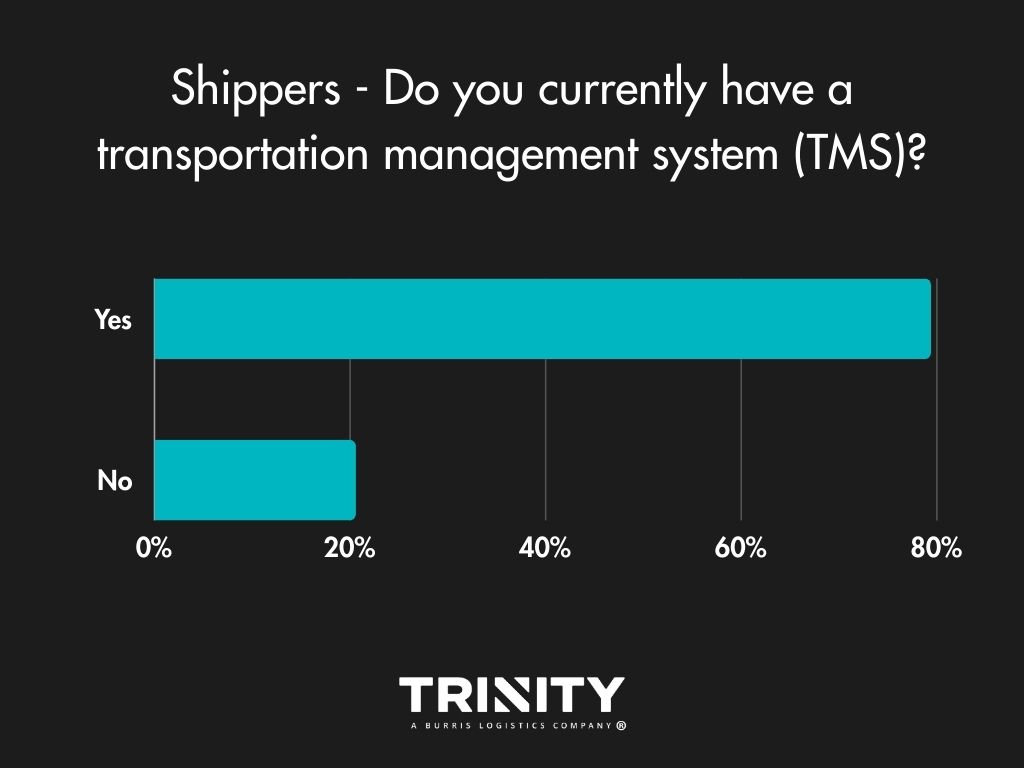

Do Shippers Have a TMS?

It’s 2024, so you’d think most shippers would have a transportation management system (TMS), and no surprise, they do. For those that don’t and answered, it seems they did not have a good experience with one in the past or don’t know enough about them.

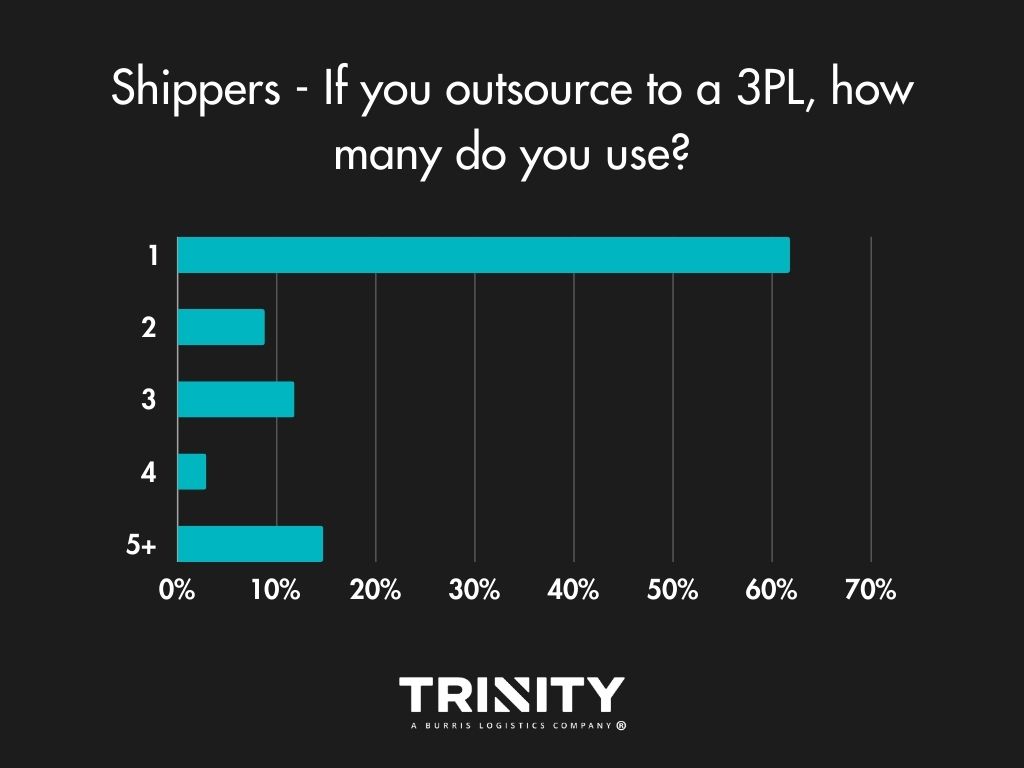

Brokers Are the Way to Go

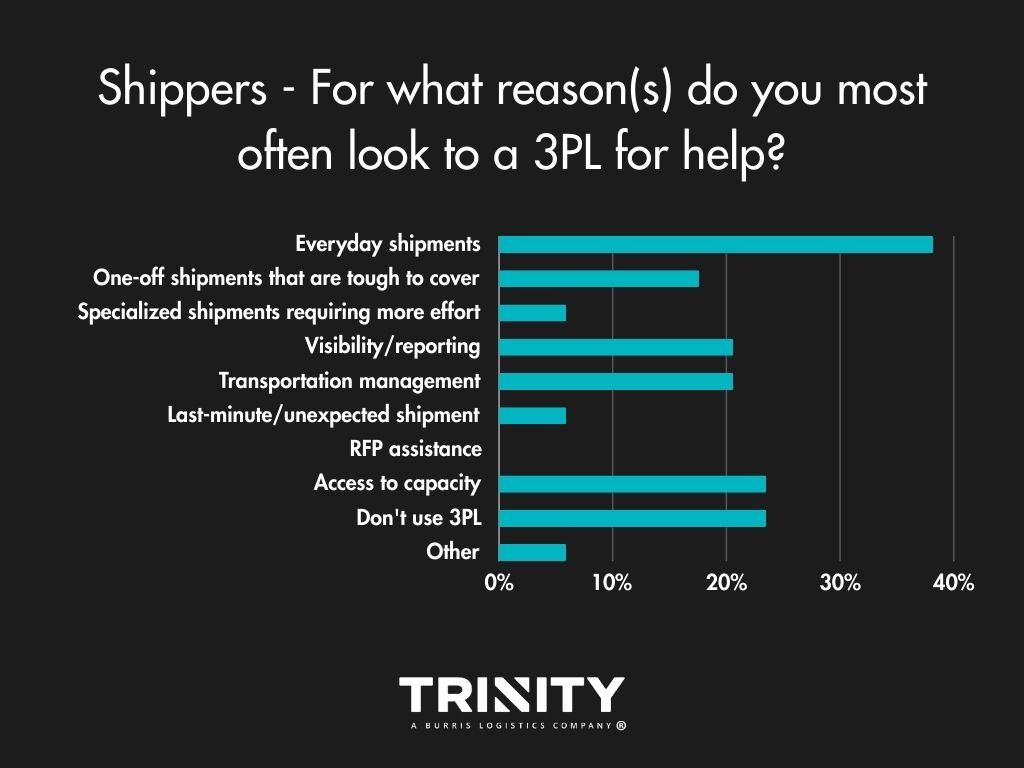

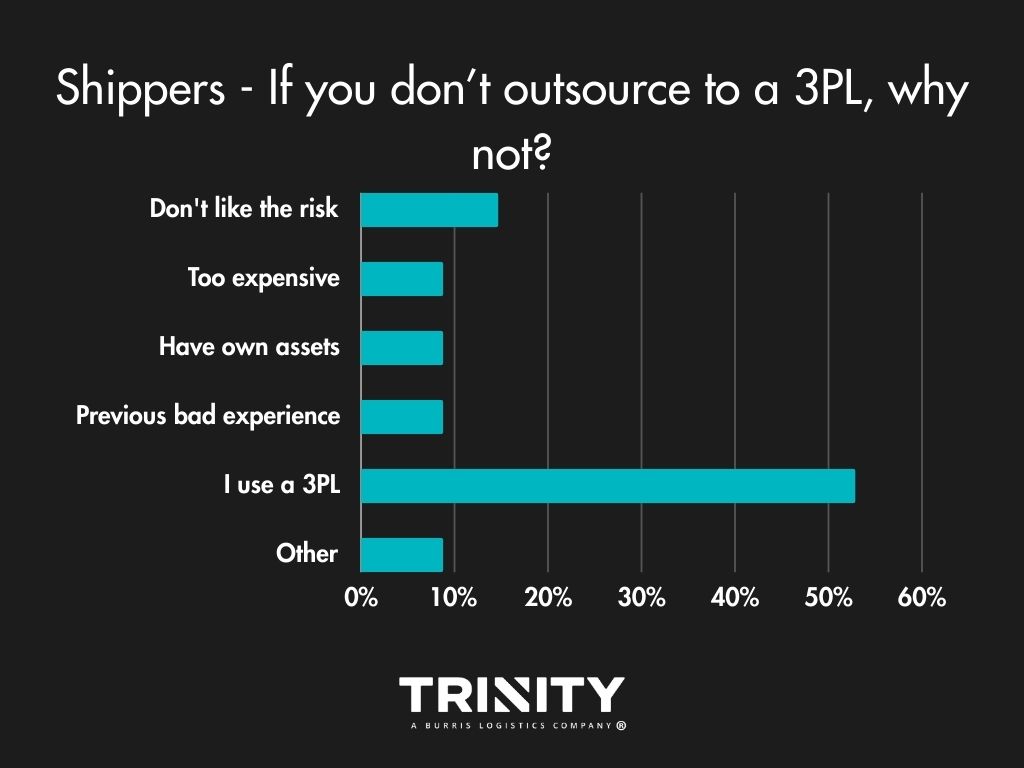

When asked how they like to move their shipments, most shippers use a mix of carriers and third-party logistics providers (3PLs) or just 3PLs. A few do use their own trucks. For those that do outsource to 3PLs, they usually just stick to one provider.

Shippers most often look to a 3PL for help with their everyday shipments, for transportation management, visibility, and access to their capacity. The main reason shippers choose not to work a 3PL for their logistics? They don’t like the risk.

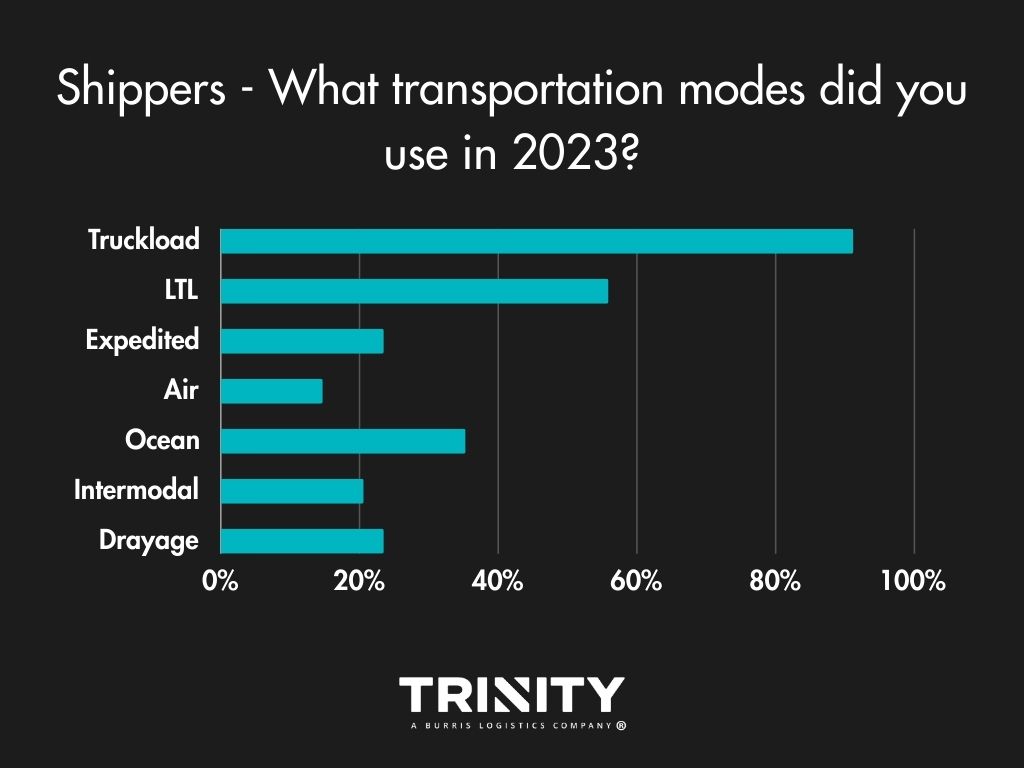

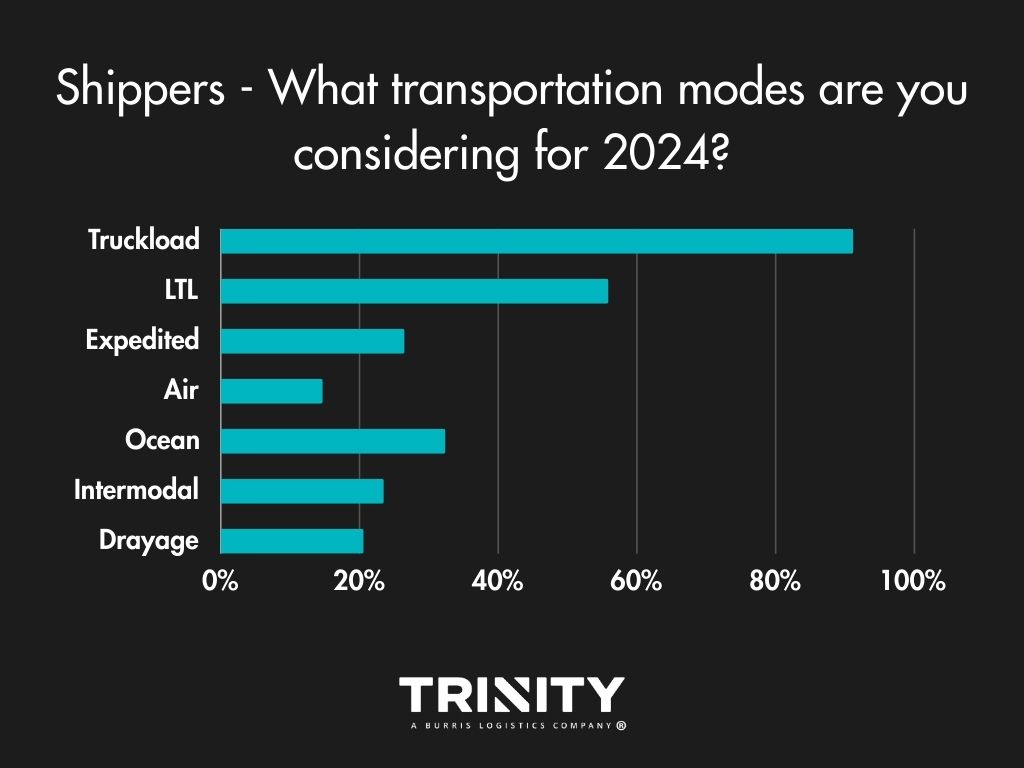

Transportation Modes – Staying Consistent

Overall, shippers aren’t looking to change what transportation modes they use for their shipments. Truckload and less-than-truckload (LTL) are the primary modes they like to use, with a little diversification sprinkled in.

Exceptional Service Stands the Test of Time

When it comes to their logistics partners, shippers find the most value in receiving exceptional service, with costs coming in as a close second.

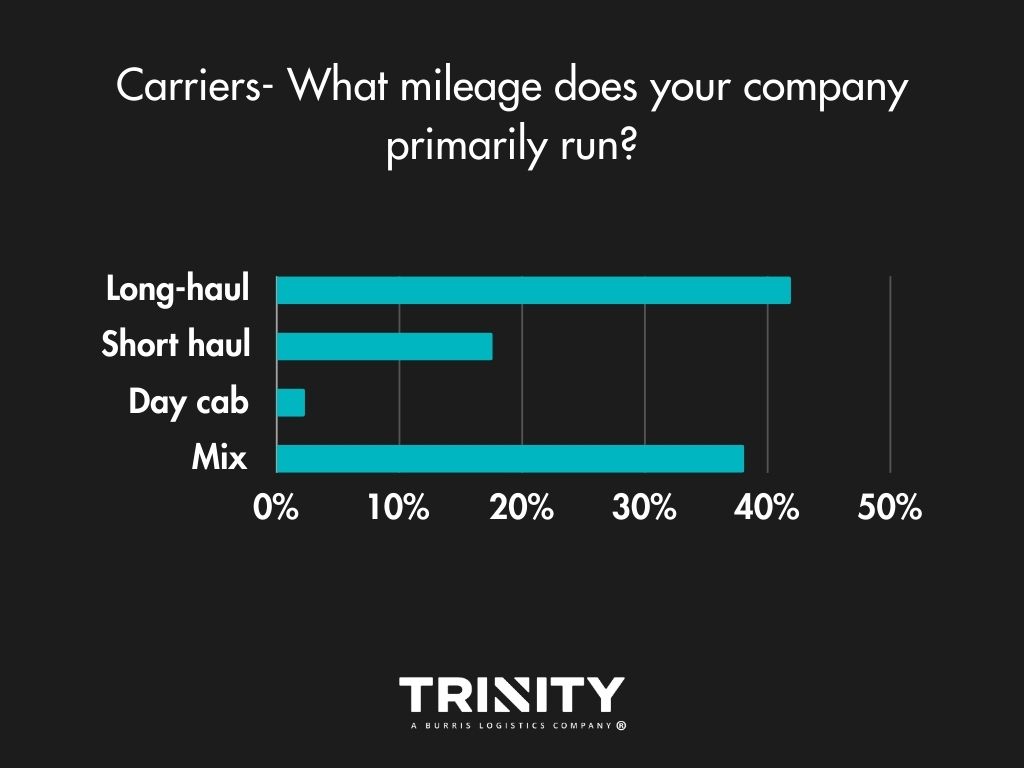

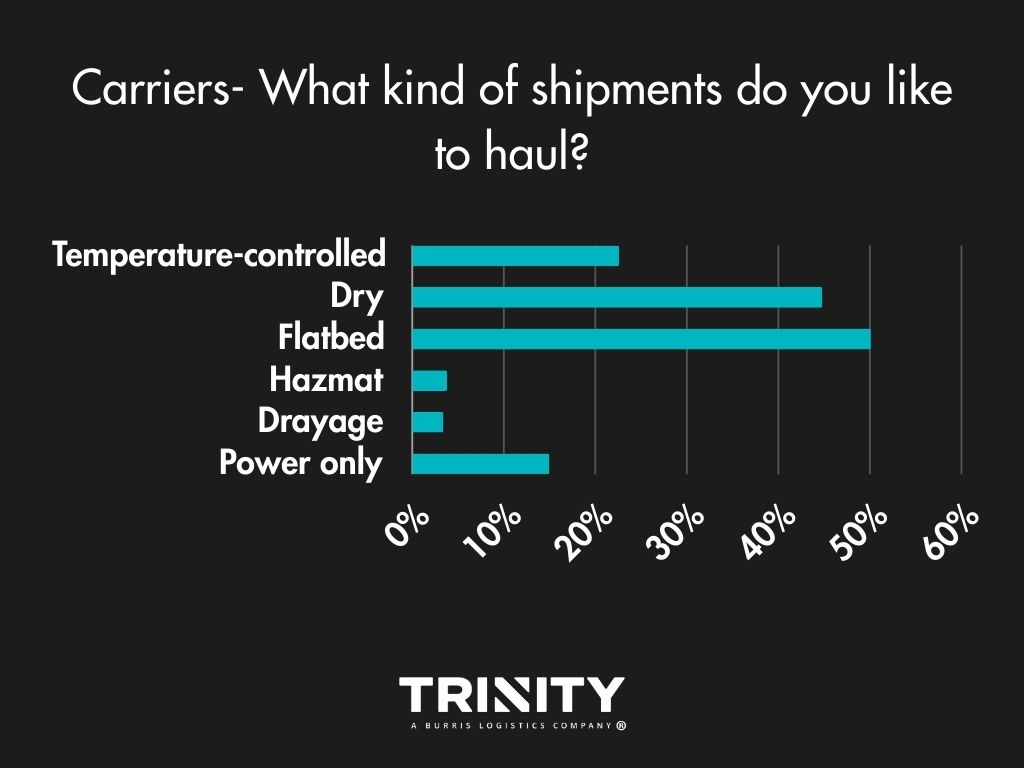

Most Wanted: Long Mileage, Flatbed Shipments

When it comes to mileage, most carrier companies tend to run long-hauls or a mix of short and long shipments. Flatbed hauls are the type of shipments most carriers like to haul with dry van coming in as a close second.

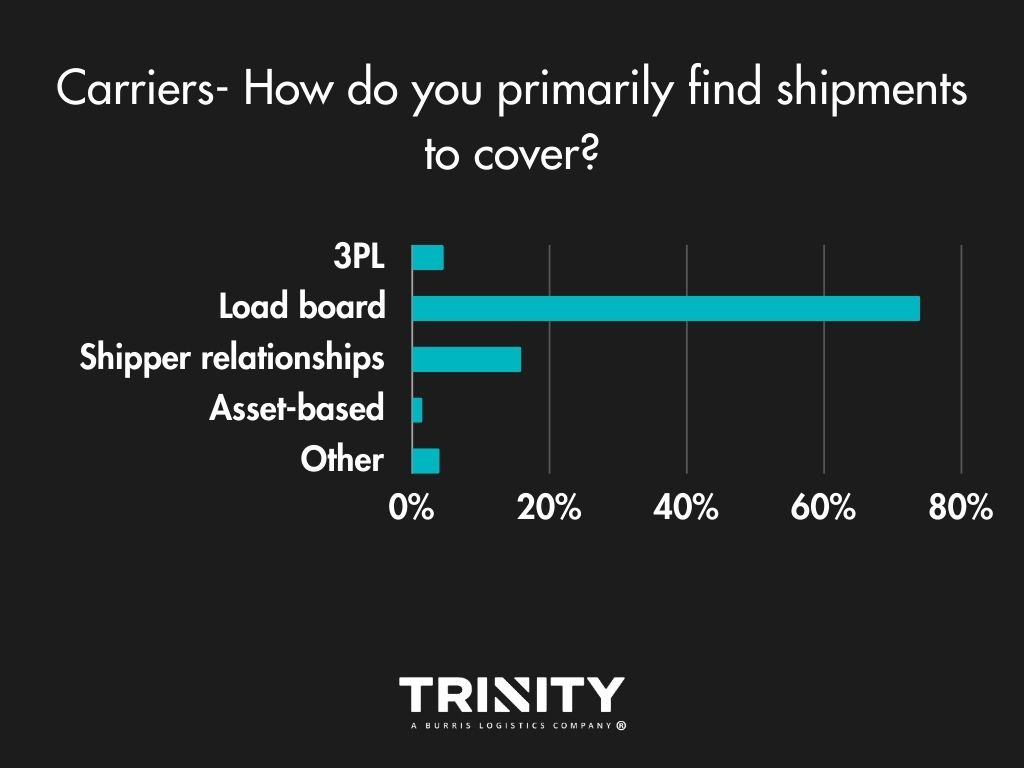

Load Boards are the Way

With 74 percent selecting this option, load boards are the norm for carriers to find available shipments. Sometimes they use their shipper relationships, and occasionally they make use of a 3PL.

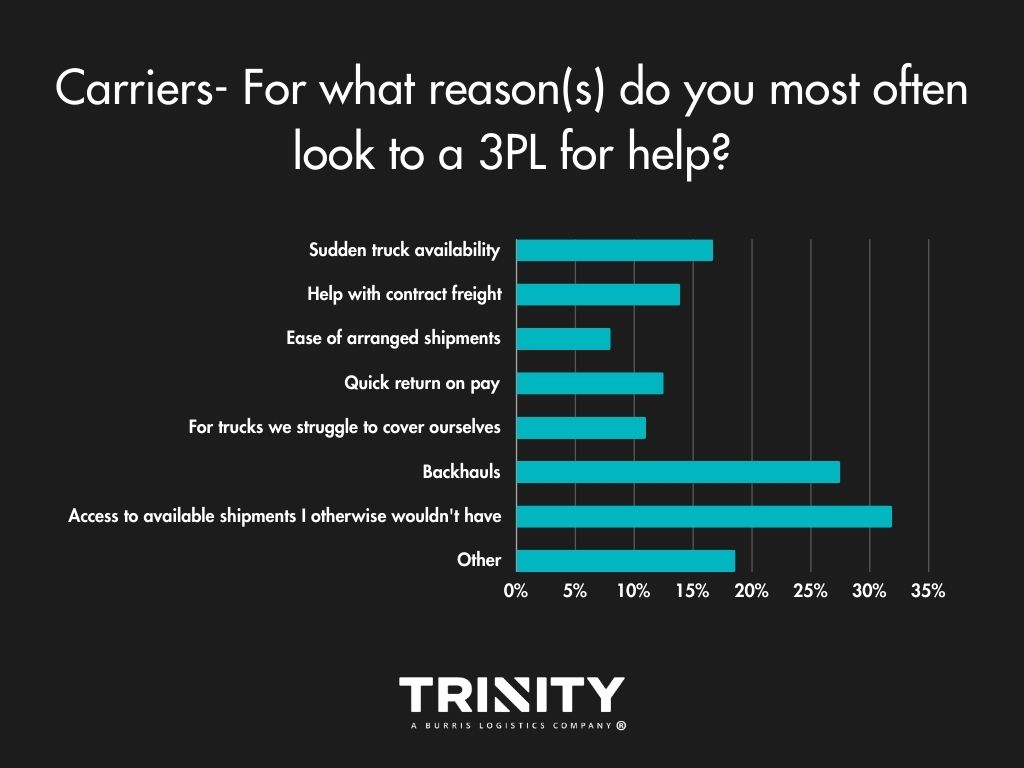

3PLs – Expanding a Carrier’s Reach

Carriers most often look to a 3PL for help with gaining access to available shipments that they wouldn’t have otherwise. Covering backhauls are another big reason carriers reach out to a 3PL.

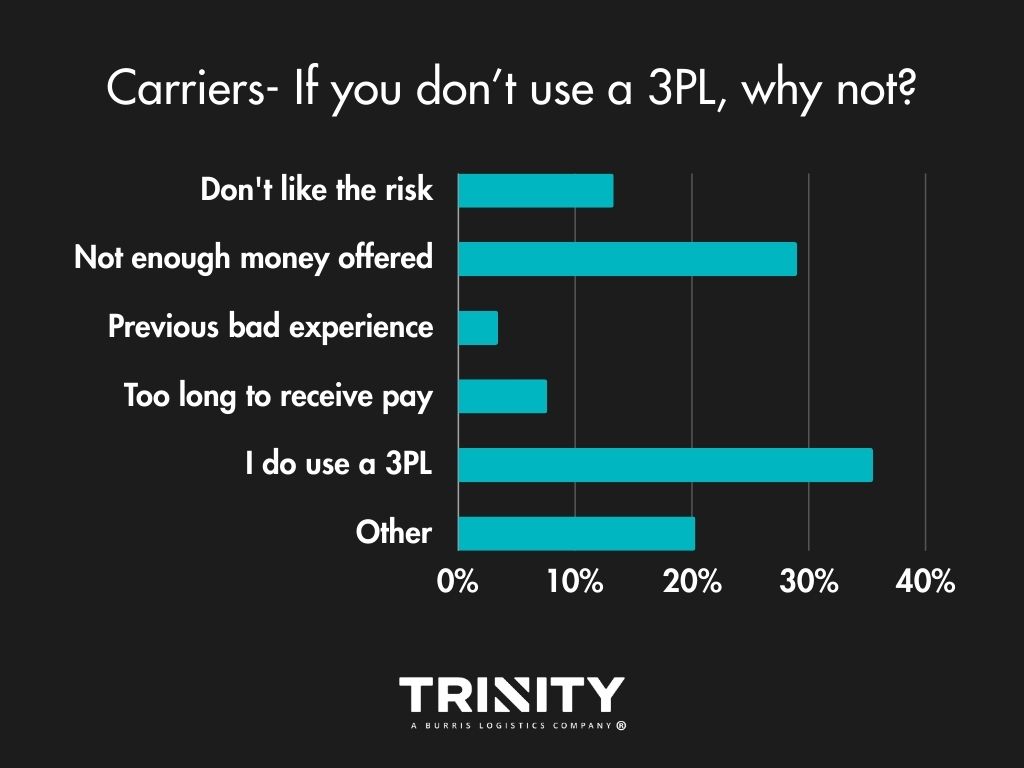

For those that choose to not work with a 3PL, it’s often because of money; rates not being high enough. Surprisingly in the comments, many are not familiar with what a 3PL or freight broker is as well.

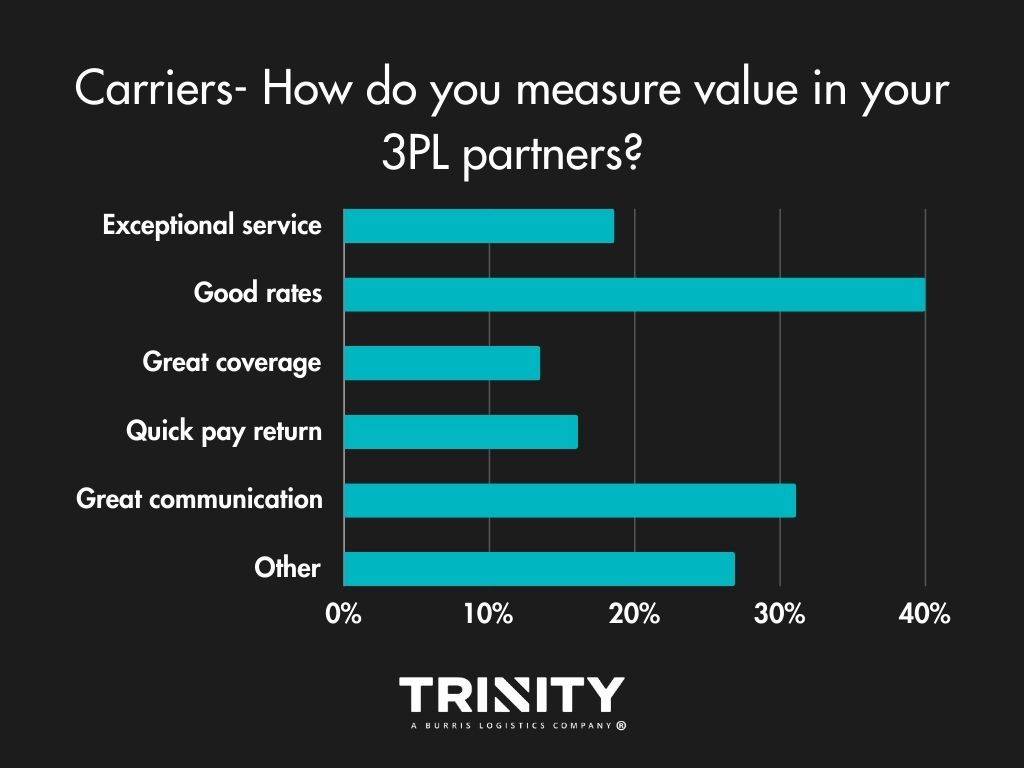

When it comes to measuring value in their 3PL partners, most carriers want good rates and great communication.

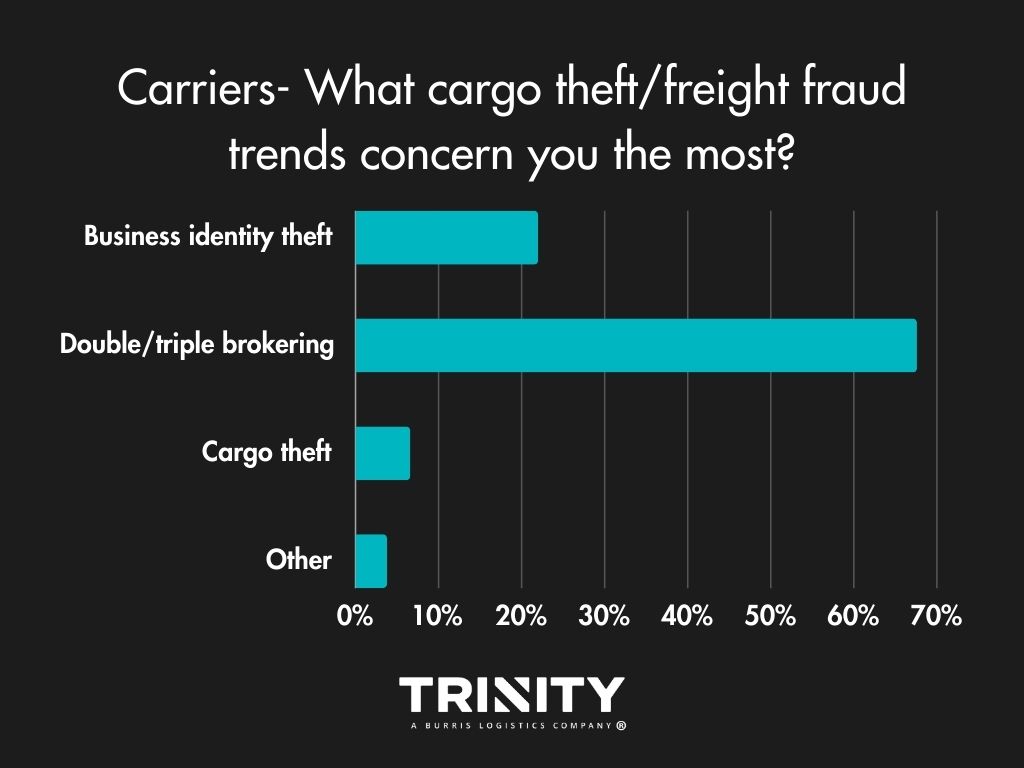

Fraud Concerns Growing

Fraud and scams have been growing in the industry, so we wanted to know what carriers think about it. Carriers are most worried about double and triple brokering affecting their businesses compared to concerns of identity theft or cargo theft.

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

COULD WE LOSE CARRIER CAPACITY….WITHOUT LOSING ACTUAL CAPACITY?

Certainly, this question could cause one to scratch his head. If we don’t have a decline in the number of operating authorities, or available trucks, then how could we lose capacity?

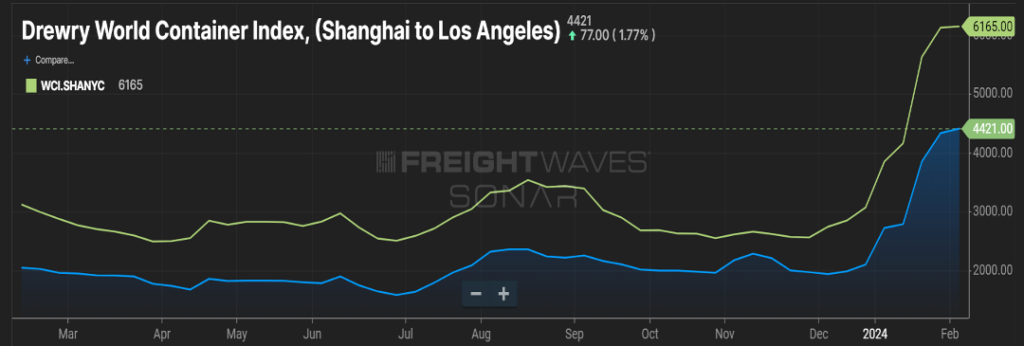

Well, technically, the answer is you would not be physically losing trucks. However, an impact could be felt from recent events with regards to container shipping that would make it feel like less trucks are available. With recent geo-political events, and events at home, shipping to the West Coast has become more feasible than it was a year, certainly two years, ago. As ocean carriers are mindful of events in the Red Sea, combined with an easing of labor tensions at the West Coast ports, freight that in prior years was diverted to the East Coast is now heading back to the left coast of our country.

As you can see in Figure 1.1, container costs from Asia to Los Angeles are over $1700 cheaper than freight bound for an East Coast port, such as New York. Figure 2.1 shows outbound freight volume for the last year in the Los Angeles market, currently seven percent higher than this time last year.

So how could this impact capacity? When freight hits the East Coast ports, it’s typically consumed close to the port or at the very least, the coast itself. This means more regional runs. When freight hits the West Coast, typically that freight is destined for locations such as Dallas, TX or Chicago, IL, so taking freight up and down the East Coast may be a one-day run. Freight out of the Los Angeles market, heading to further destinations would take a day and a half, two days.

Same freight, same one-truck move, but now it occupies that truck for twice as long. Additionally, this could necessitate a shifting of fleet resources from one coast to the other, potentially creating an over-capacity on one side of the U.S. while the other coast is more desperate for trucks.

SPRING IN 6 WEEKS?

Will that rodent in Pennsylvania be right this year, and will freight volumes accelerate quicker as a result? First of all, ‘ol Punxsutawney Phil is batting less than 50 percent for his career and the last 10 years he’s only been accurate three times.

A better canary in the cave would be how the rejection rate index ebbs and flows. As you can see in Figure 3.1, van rejection rates have been pretty stagnant for the past year. Flatbed has remained relatively high and reefer rejection rates have trended up the last five months. If Phil is a soothsayer this year, we expect flatbed rejection rates to continue rising. If produce season also starts earlier than most, reefer rejection rates will then follow.

As reminder, with increases in rejection rates, shippers typically see transportation costs increase on the spot market.

Stay tuned for next month’s update to see if an early spring is a turning of the tide for the freight market.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

LIKE TRACKING A HURRICANE

I’m sure we’ve all felt like we were in a bad storm over the past few years when it comes to the freight market, and particularly, shipping rates. As we’re now into a new year, shippers and brokers are looking at their 12-month rate forecasts and wondering how things will look come December ‘24. It’s relatively easy to project for the first few months, even the first quarter, but as you get further and further away from when you send those projections to your finance team, the level of angst goes up.

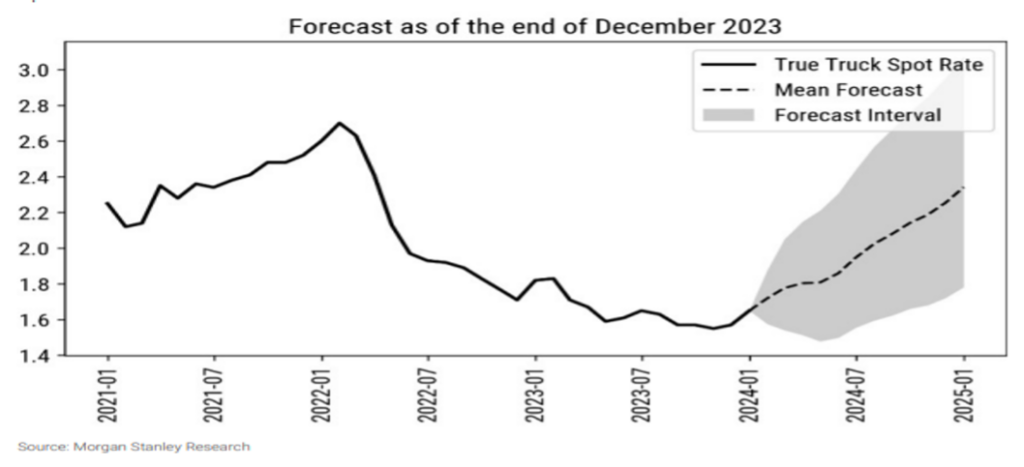

Figure 1.1 will hopefully help in assessing if your year will have a good outcome, or if there may be reason to look at your contingency plan. As we typically see in the first months of a calendar year (setting aside what we saw in 2021), rates are usually at their lowest point due to volume being restrained. Using the current rates for dry van freight, you can see the projections are for upward movement in rates as we go through the year, with rates pushing past $2.30 per mile as we close out 2024. However, as with any forecast or projection, there is always that “margin of error”.

If the projected supply and demand balance is more volatile, it’s possible to see freight rates pushing $0.50-$0.60 per mile higher. On the opposite end, if demand for freight is muted, and the carrier churn rate levels out or, dare I say, we see an increase in capacity, freight rates could be well below $2.00 per mile.

As with any major storm, it’s better to prepare and not need, than the other way around. As a shipper, boosting your carrier and broker base to give you options is always a prudent move.

CONSUMER SPENDING TO STEADY

There are some positive signs for 2024.

The dreaded word “recession” that has been thrown around for seemingly all of 2023 doesn’t seem likely. The U.S. is poised for modest GDP growth and inflation shows signs of easing throughout 2024. There is also a strong likelihood we will see rate CUTS from the Fed this year.

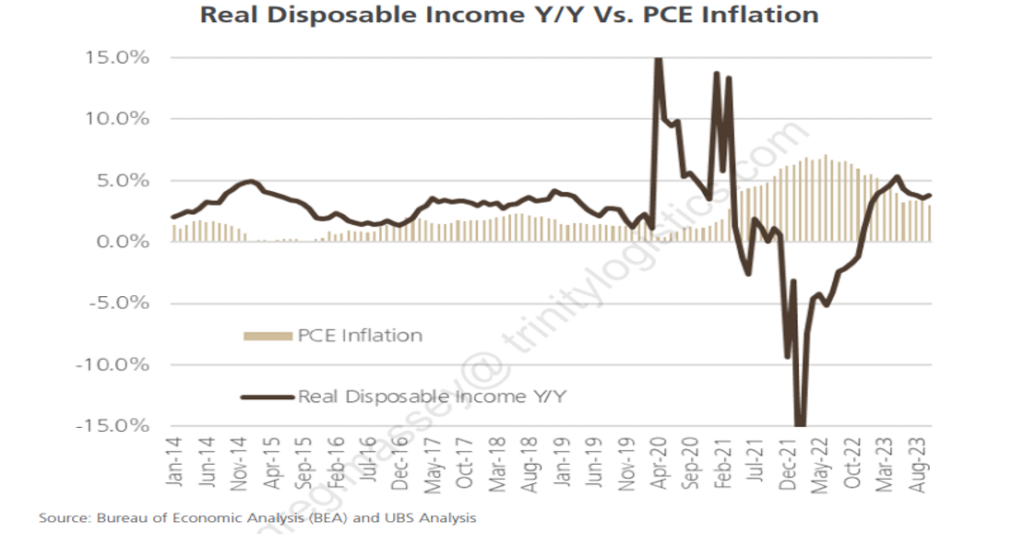

As we know, consumers are a big driver of freight activity. Look no further than the second half of 2020 and all of 2021 to see the impact consumers with disposable income can have on movement of goods. Figure 2.1 gives an indication that consumer buying will continue this year. As the ship steadies with inflation, that line will most likely head towards three percent at the end of the year, as consumers are finding dollars available to spend.

There was a lot of pent-up demand for services that gobbled up U.S. consumer dollars over the past year plus, which lends credence to consumers looking to spend their dollars on things versus services. This will certainly be a shot in the arm for the freight-challenged industry we have experienced over the last 12 months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Shippers – Don’t wait ‘Til It’s Too Late

Probably every shipper has, at certain times or maybe all the time, been inundated with requests to handle their freight over the past year. This is in stark contrast to 2021 and most of 2022 when carriers and brokers were keenly focused on existing customers and not as aggressive in pursuing new business relationships.

Currently, shippers are enjoying relatively abundant capacity and spot rates, which have fallen below $2.00 per mile. As we all know, the freight market is cyclical. Several signs point to a period of supply and demand balance, and likely a crunch with capacity. Will it happen tomorrow? No. Six months from now? Possibly. Most likely, we’ll see this scenario play out as we head toward the latter part of 2024.

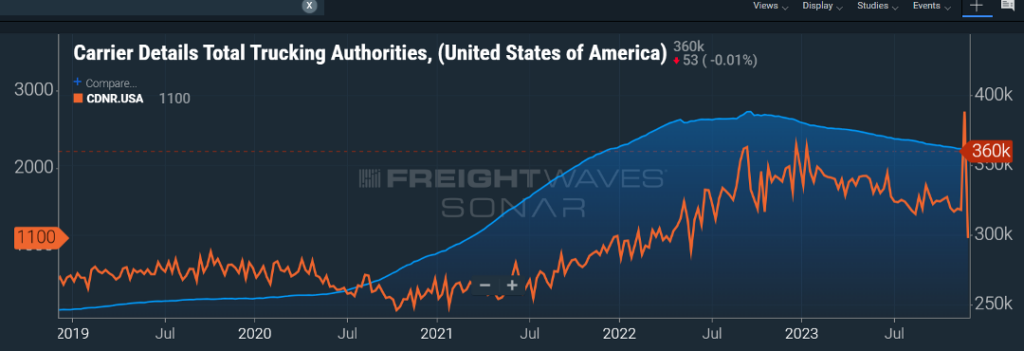

Figure 1.1 shows the total for-hire trucking authorities (blue line) and the carrier net revocations of authority (orange line) over the past five years. Clearly, carriers started flooding the market in late 2020, in response to the surge in goods moving within the supply chain. Much of that was consumer driven thanks to direct and indirect government stimulus action.

As we’ve seen freight volumes decline, carriers, mostly single person operations or small and micro fleets, have decided the juice is not worth the squeeze. This downward trend in available for-hire carriers will continue, and possibly accelerate, as we head toward more lean freight months ahead.

Shippers over the past year have right-sized their provider network. Now is the time for shippers to look at their volume forecasts and imagine having to manage that freight movement with 25-40 percent fewer providers than they currently have in their network.

If you haven’t started efforts to expand your carrier and broker partners, don’t wait until you have freight sitting on your dock and no one to move it from point A to point B. Nobody wants to be stymied like they were just a few years ago.

LTL Costs Rise

Does it feel like LTL shipments are getting more expensive, while truckload shipments are going the other direction? Why are the rates not cheaper if freight volumes are less than what we saw a few years ago?

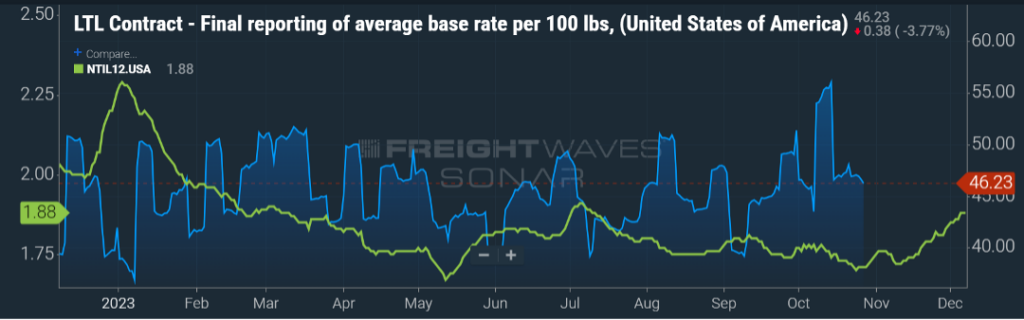

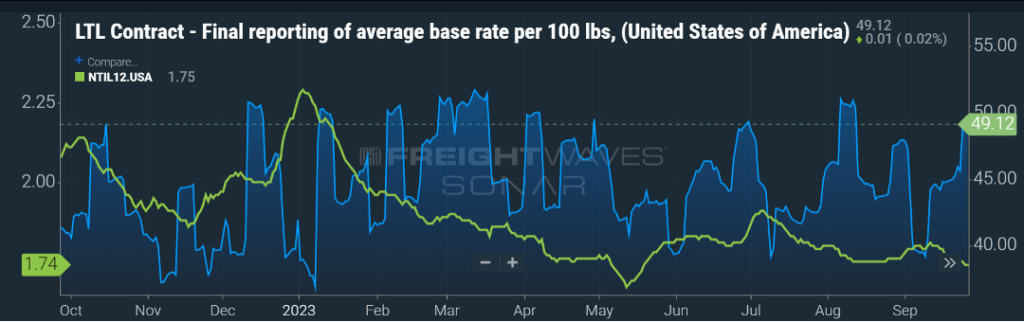

Figure 1.2 shows the spot truckload rate (green line) being almost $0.40 per mile less than the beginning of the year. LTL for the most part has seen rates (blue line) gradually head upwards as we have gone throughout the year.For a new shipper to the industry, this can be a head scratcher.

Short answer, truckload has a much more expansive network of providers, and as we highlighted above, that door being opened for new entrants into the market can happen quickly. The LTL model is more complex and a much bigger barrier of entry to the market. It would be a tremendous capital investment for a new LTL entrant to enter the market – trucks, trailers, terminals, labor, maintenance, etc. With the recent departure of one of the top 10 LTL providers (Yellow Corporation), that freight volume has been gobbled up by the remaining LTL carriers in the market but for the most part at a higher rate.

We are also approaching the time of year when LTL carriers, after assessing their financial statements and forecasting costs for the upcoming year, will start knocking on doors to discuss general rate increases (GRIs). Notice I said “increases”, not the other way. Don’t be surprised when your LTL contact lays out a proposal that elevates your LTL freight spend by four-to-six percent in the coming year.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

FLAT RATES, EXCEPT FOR LTL

Much of what we have seen this year has been around carrier rates remaining relatively flat. Apart from a few seasonal or holiday peaks, and a slight up or down influence due to fuel costs, spot rates and contract have been stagnant. As you can see in Figure 1.1, the green line has hovered between $1.70 and $1.80 for the past six months.

Less-than-truckload (LTL) rates, one would reason, would follow a similar pattern as they typically follow truckload rate movement with a few months lag. In the past few months, as indicated by the blue line in Figure 1.1, there has been an acceleration in LTL contract rates. As you probably recall, one of the larger LTL carriers, Yellow Corporation, filed for bankruptcy in August and ceased operations.

One may ask, “Well, why would rates elevate when the LTL industry was operating at less than capacity and nothing has caused an influx of new LTL freight?”

Yes, the remaining national and regional carriers were, based on available capacity on the books, able to absorb the freight Yellow was moving with no additional investment in equipment or labor. But just because the available resources are there, does not mean they are positioned in the places where service was needed.

This has necessitated LTL carriers realigning their network to move the freight that Yellow was doing prior. The more prevailing reason for rates to increase is the aggressive nature in which Yellow competed for the freight they were servicing. Typically, Yellow’s rates were far more discounted than most.

So, while the remaining LTL carriers in the network were able to position their fleets to handle the volume, they did not offer the same discounted rates that Yellow did. When you bundle all these factors together, you get rates increasing by about 10 percent in the last several months and I would not anticipate that 10 percent increase being reversed anytime soon. If anything, look for those annual general rate increases to happen as we embark on a new calendar year.

SUPPLY & DEMAND BALANCE IN 2025?

In prior monthly updates, we have highlighted the current freight environment being one of more supply than demand. Suffice to say that truckload freight volumes have been relatively unchanged over the last 12 months and carriers are saying “yes” to almost every shipment offered to them on the contract side.

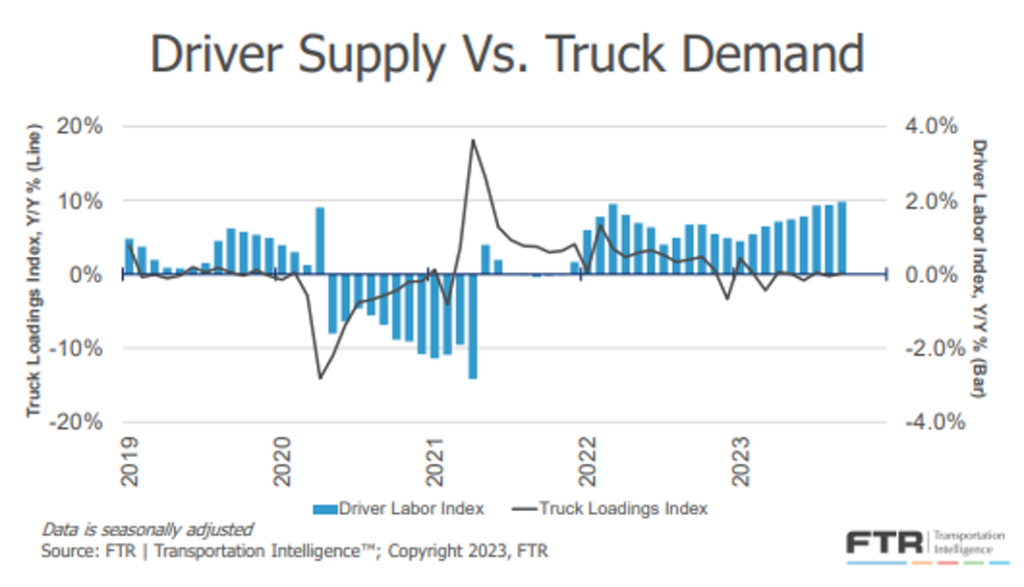

This has resulted in less freight hitting the spot market and has helped to keep rates at levels that are $0.70-$0.80 less than contract rates. When will there be better balance? A great illustration of this from FTR in Figure 1.2 tells the story.

As you can see, the driver labor index sits well above the truck loadings index and has been for the past two years. When you factor in prospects for freight volumes to accelerate, economic conditions, and the pace at which carriers are exiting the market, it will most likely be 2025 before balance returns.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your InboxMany of today’s manufacturing trends are in line with the industry’s goals to improve processes, create more efficiency, and meet consumer demand.

The manufacturing industry has seen challenges, from changes in the way people work to the rapid growth in demand, with many of these challenges accelerated by the recent covid-19 pandemic.

So, what evolutions and challenges are the manufacturing industry currently facing? Let’s dive into the latest manufacturing trends.

WHAT ARE THE LATEST TRENDS IN MANUFACTURING?

- DIFFICULTY FINDING LABOR

- DIVERSIFYING WORKFORCE

- TECHNOLOGY IS TAKING OVER

- INCREASING CYBERSECURITY

- CARBON NEUTRALITY

- BUILDING RESILIENT SUPPLY CHAINS

DIFFICULTY FINDING LABOR

Manufacturers are still struggling to find labor, with a recent Deloitte survey estimating that the manufacturing sector will be short 2.1 million skilled workers by 2030. It’s difficult for manufacturers to fill open positions, with respondents claiming it is 36 percent more difficult to recruit than in 2018.

To combat the shortage, manufacturers are looking for ways to recruit and retain skilled talent, by raising wages and reskilling current talent to meet company needs. According to the Manufacturing Institute, young employees are attracted to companies that look to train and invest in them. 70 percent of manufacturing workers under 25 said they will stick with an employer because of these opportunities to grow.

Additionally, technology is advancing and should help manufacturers combat their labor challenges. With tools like artificial intelligence (AI) and the Internet of Things (IoT) becoming more accessible, companies should be able to become more efficient and able to produce more with fewer people.

DIVERSIFYING WORKFORCE

Diversifying the workforce is one of the growing manufacturing trends because the industry has held a reputation for being a male-dominated industry. According to a study by the Manufacturing Institute, less than 30 percent of manufacturing workers are women. So, in 2021, the Building Economic Strength Through Manufacturing Act was passed. This bill seeks to double the number of women-owned and minority-owned manufacturers.

According to Glassdoor, when applying for jobs, 76 percent of applicants look for company diversity. Diversifying the workforce is a trend that goes in hand with employee recruiting. It creates opportunities for new talent and can help make operations more resilient.

TECHNOLOGY IS CHANGING THE INDUSTRY

Technology changing the industry has been and will be a manufacturing trend for some time. Technology is improving, becoming more accessible, and showing its benefits, so many manufacturers are investing in it more. Manufacturers need technology to keep up with the challenges of increased demand while facing a labor shortage.

Some technology tools companies are using include AI, automation, sensors, IoT, robotics, predictive maintenance, and remote monitoring. These tools help manufacturers with the manual and repetitive tasks that they struggle to find the labor for. In addition, companies are evaluating their operations to make the best use of technology and people.

Frontline workers will likely expand their roles to take on new responsibilities. As technology automates processes, workers will need to use more communication, collaboration, and analytical skills. Technology will also offer more flexibility and safety for frontline workers, further helping with employee recruiting and retention.

Some manufacturers are even pushing the limit and testing our “dark factories”. These are fully automated factories without any human workers on site.

Industry 4.0 is what many refer to as this trend of technology. It’s a shortened term for what is being called the fourth industrial revolution. Industry 4.0 technologies, such as the above examples, can raise productivity by 40 percent.

INCREASING CYBERSECURITY

As technology use increases and manufacturing processes get more connected and complex, a growing challenge is cybersecurity. In 2021, manufacturing was the industry that suffered the most cyberattacks, according to IBM’s X-Force Threat Intelligence Index. In fact, according to a survey by Omdia, the increasing risk of cyber attacks are one of the main challenges slowing down the implementation of more analytics, automation, and AI in manufacturing.

Because of its increased risk for cyber attacks compared to any other industry, manufacturing companies are investing more in the cybersecurity strategies and monitoring, implementing the use of multi-factor authentication, issuing employee training on cybersecurity, and building recovery plans to be prepared should any attacks take place.

CARBON NEUTRALITY

Combatting climate change is a priority on everyone’s mind and the manufacturing industry is no exception. The manufacturing industry produces almost a quarter of global greenhouse emissions. However, with the government pushing industries towards sustainability, manufacturing companies are rethinking their operations.

One manufacturing trend is carbon neutrality. Carbon neutral is when a company removes the same amount of carbon dioxide it emits into the atmosphere.

Manufacturing companies can become carbon neutral by purchasing carbon offsets. An example of this would be a company sponsoring a solar energy farm or a project for reforestation.

Did you know Trinity is ranked in the top 50 percent of all companies for sustainability by EcoVadis?BUILDING SUPPLY CHAIN RESILIENCE

Since the start of the covid-19 pandemic and the supply chain bottlenecks we continue to face, supply chain resilience remains a top manufacturing trend.

Supply chain bottlenecks like the covid-19 pandemic, high container costs and delays, severe weather, protests, and new regulations are a few of the disruptions that have shed light on manufacturers’ fragile supply chains.

Manufacturers continue to look for more resilience to keep up with consumer demand despite these challenges.

Improving communications with supply chain partners, onshoring or reshoring, and investing in supply chain technology are some of the ways manufacturers are making their supply chains more stable.

STAY AHEAD OF MANUFACTURING TRENDS

Whether you know the latest manufacturing trends are or not, having an expert on your side is one easy way to stay ahead. And that’s just what Trinity Logistics aims to be.

Yes, our primary focus is as your logistics partner, but our People-Centric culture means we’re more than that. As a business relationship, we’re invested in your company’s success. We stay knowledgeable on what’s going on in your industry to help keep you updated. And we stand at the ready to offer your business any logistics support and expertise that you need.

Don’t miss your opportunity to gain a business relationship that stays on top of your industry’s trends and is people focused. Let’s get connected.

SEE WHY YOU SHOULD WORK WITH TRINITY LOGISTICSWhether your product is coming straight from the farm, is moving between processing, or heading off to the consumer, the dairy industry needs first-rate cold chain solutions to meet their complex supply chains.

Dairy products such as milk, cheese, and butter are household staples and essential in many people’s diets. It’s no surprise that the dairy industry is considered one of the fastest-growing industries, almost doubling in value every five years. To keep up with consumer demand, the dairy industry needs exceptional cold chain solutions to keep their products cold and safe for consumption.

Why the Dairy Industry Needs Cold Chain Solutions

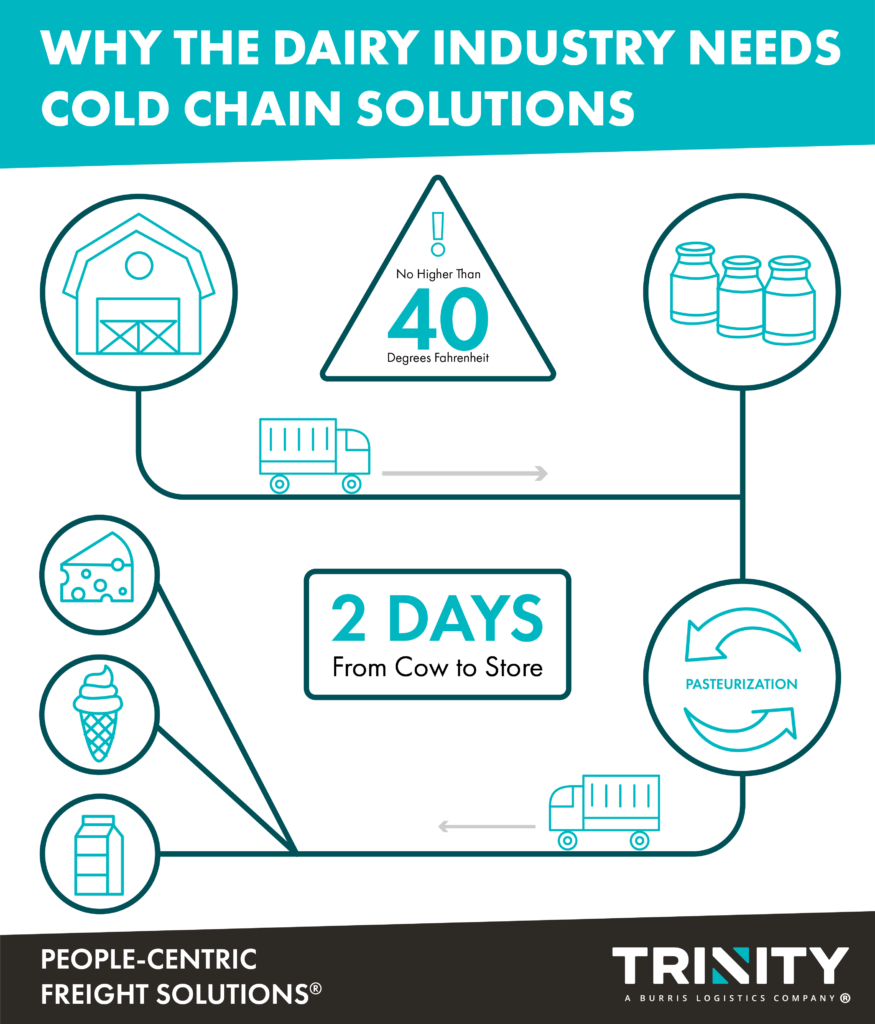

Dairy products all start with milk, and it has a short shelf life. After the cows have been milked, it immediately transports to cooling storage tanks or a chilled trailer. To ensure the milk doesn’t spoil, it must be stored at a temperature no higher than 40 degrees Fahrenheit. It’s then transported to a processing facility, pasteurized, and transported again to consumers.

Usually, this process alone, from cow to store, takes place in about two days. Now, milk is often a starting point for the many diverse dairy products available. Depending on the final product, dairy supply chains have more steps and complexities added.

Common Issues Requiring Cold Chain Solutions

- Temperature Control Needed for Most Dairy Products

- Capacity During Peak Shipping Seasons

- Managing Milk Production with Dairy Demand

- Supply Chain Disruptions

- Dairy is Highly Regulated

- Supply Chain Visibility

- Potential High Value Dairy Products

Temperature Control Needed for Most Dairy Products

Most dairy products need storage at specific temperatures to keep from spoiling. Dairy products need strict attention because of the risk posed to consumers if the cold chain is broken. If not consistently kept cold and free of humidity, bacteria in the dairy can cultivate and dairy products can become harmful.

Capacity During Peak Shipping Seasons

While some dairy products can seek out alternative transportation modes, most find shipping truckload is the most viable option. It’s usually the fastest and cheapest way to move the product because of its weight. It’s also the most viable due to freight security and nature of the product, and because it reduces the risk of claims due to temperature fluctuations or shifting. Since most dairy products need refrigerated trucks for their shipments this can make capacity an issue at times, such as produce season, when reefer capacity can be tighter. It can not only be more difficult to secure a refrigerated truck, but more expensive to do so.

Managing Milk Production with Dairy Demand

Dairy product demand can fluctuate. Yet, even when consumers want fewer dairy products, the cows don’t stop making milk. They can’t be turned on and off like machines, giving the dairy industry a unique balancing act to handle.

Additionally, when it comes to shipping milk, most of that is kept regional given the short shelf life and cost to ship, making dairy demand management even trickier.

Supply Chain Disruptions

As we’ve learned in recent years, there’s always the chance for supply chain disruption to happen. Whether that’s a truck breaking down, a roadblock, or some other instance that would cause delays. With several dairy products (like milk) having a short shelf life, any delays can risk product spoiling and going to waste. Companies in the dairy industry need to be able to act quickly if any disruption happens.

Dairy is Highly Regulated

Dairy products are associated with foodborne illnesses, so it’s no surprise that they’re highly regulated. Right from the start, milk is tested to ensure it’s of safe quality to consume and make other products from. There’s also the Food Safety Modernization Act (FSMA), which places strict requirements on sanitary transportation and the handling of dairy products.

Supply Chain Visibility

Because of so many factors mentioned above, it’s important for dairy companies to have full, real-time visibility of their supply chains. Additionally, many wholesale food distributors and grocery warehouses hold very strict requirements for appointments with very strict product quality inspections to be accepted into their inventory. Without it, dairy companies are at risk of losing products and money due to spoilage, disruptions, delays, or regulation requirements.

Potential High Value Products

Certain dairy products can be high value, like some cheeses for example. This can make the overall value of the load to be costly should there be any potential claims. It’s best for shippers to work with expert providers who have the experience and knowledge to handle any high value dairy products.

Leading Cold Chain Solutions from Trinity Logistics

Shippers in the dairy industry looking for first-rate cold chain solutions can find all they need with Trinity Logistics. We’re a leading third-party logistics (3PL) provider with over 40 years of experience serving logistics solutions to some of the top-known brands in the food and beverage sector.

Standard Operating Procedures for Temperature-Controlled Shipments

One of the reasons we excel in cold chain solutions is our standard operating procedures in place for every temperature-controlled shipment we arrange. This includes:

- Only working with carrier relationships that have downloadable reefer units

- Requiring carriers to pre-cool trailers a minimum of one to two hours before pickup

- Requiring carriers to run their reefer units on continuous

- If necessary, requiring carriers to pulp product before loading

- Requiring carriers to use one of our tracking and tracing partners for real-time shipment visibility

- Only using carriers that have refrigerated trailers that are 2015 or newer

We understand just how critical it is that your product stays at its required temperature. That’s why we work with our trusted, experienced carrier relationships to ensure your product arrives fresh.

Multi-Modal Cold Chain Solutions

No matter what transportation mode you need your product to ship, we have the logistics solutions to support your business now and in the future, including;

- Truckload

- Expedited

- International

- Cross-broder

- Air or ocean shipping

- Drayage

- Less-than-truckload

- Managed Transportation

This enables your business to seamlessly run regardless of what change or growth you experience.

In-Depth Transportation Management

Whether you need a transportation management system (TMS), to fully outsource your logistics, or your own customized managed transportation solution, we can help. We know each business is unique, which is why our system is highly configurable so we can meet your exact needs. Our Trinity experts will work as part of your business, offering in-depth reporting and data to help get you ahead of your competitors.

No Need to Worry About Disruptions

Did I mention that Trinity has been serving cold chains for over 40 years? We’ve seen it all when it comes to supply chain disruptions and delays. We know how to quickly adapt plans to keep your freight moving. While you’ll have your sole Trinity relationship to lean on for updates, we also have a 24/7 Team in case we need any additional support. You can learn to rest easy whenever your shipment is in our care.

Experts in Temp-Controlled Logistics and Dairy

Trinity Logistics has been serving cold chains for 40-plus years, in addition to our parent company, Burris Logistics, that was built on its expertise of handling temperature-controlled commodities.

There’s also Honor Foods, another Burris Logistics company you can lean on for food redistribution if needed. Honor Foods is a leading foodservice redistributor with locations throughout the Northeast, Mid-Atlantic, and Southeast regions of the U.S. They specialize in frozen, refrigerated, dairy, and dry products with over 3,000 stocked items from 300+ trusted suppliers.

Our People-Centric Service

What makes Trinity unique from other 3PLs and what our customers praise the most is our exceptional People-Centric service. We’re a company built on a culture of family and servant leadership, and that culture shines through in our service to you. It’s our care, compassion, and communication that you’ll notice and appreciate.

I’D LIKE LEARN MORE ABOUT TRINITY'S COLD CHAIN SOLUTIONSStay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Imports on the Rebound?

For the past 14 months, much of the conversation around U.S. container import volume has been gloomy.

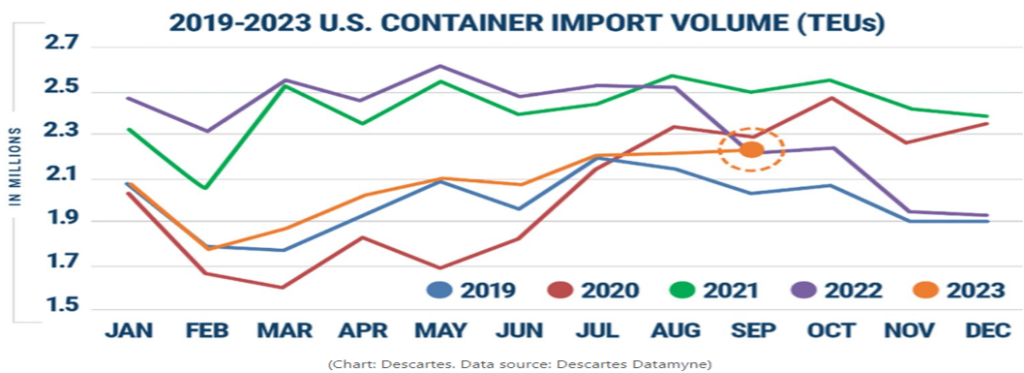

Figure 1.1 shows the steady decline in import volume that began in August of 2022, and those volumes have remained lower when you compare them year-over-year (YoY) for most of 2023.

September and October have begun to see that narrative change, with September of this year outpacing September of 2022. Comparing this year’s volume to 2021 and even 2022 is somewhat an “apples to oranges” comparison because of the frenzied consumer activity. A better comparison is how 2023 is stacking up versus pre-Covid years.

September 2019 saw approximately 2.05 million twenty-foot equivalent units (TEU’s) come through U.S. ports. September 2023 is seeing an increase of roughly seven percent in comparison. There are numerous efforts underway with U.S. retailers – like Walmart, Target and Amazon – to boost consumer sales with deals ahead of the traditional holiday buying season. This should continue to boost imports through the remainder of the year.

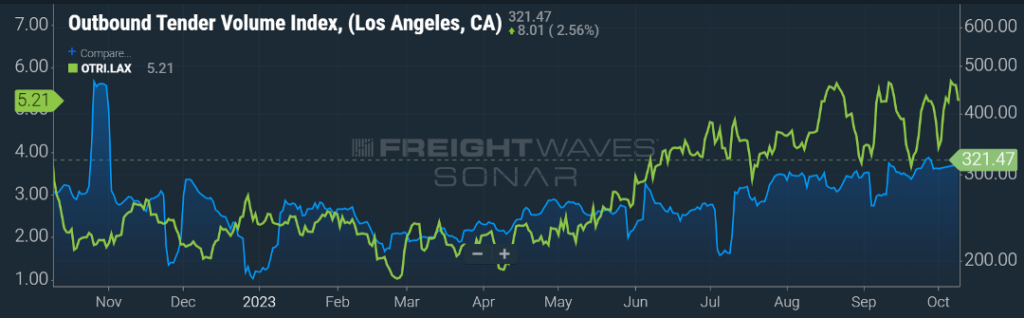

It will be important for shippers, carriers, and brokers to keep an eye on activity around U.S. ports as rates will reflect the supply and demand. An example can be seen the Los Angeles market. As seen in Figure 1.2, in the past 90 days, outbound volume from this market has increased almost 23 percent and the rate of carrier rejections has also shown an upward trend by over 50 percent.

Capacity Declining

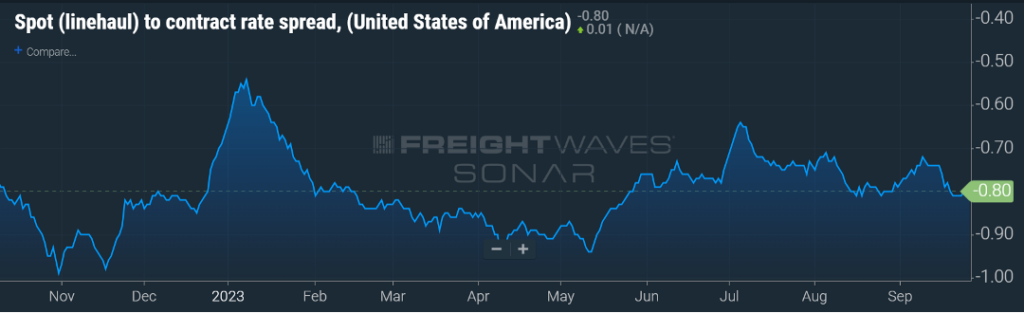

Six months ago, I would have taken a bet with anyone that the spread between contract and spot rates would not be greater than $0.50 per mile.

With capacity exiting the market and shippers making more frequent use of rate tools like mini-bids, the prevailing thought was that spot rates would remain relatively stagnant, or possibly a slight uptick, but contract rates would show a sharp decline. Good thing I was nowhere near a betting window.

The spread continues to hover around $0.80 per mile as seen in Figure 1.3, with contract rates being higher. Annual bid season is fast approaching, and it will be interesting to see if recent upward volume trends combined with an increase in carrier revocations will continue to keep contract rates where they currently reside or if the “sharpen the pencil” adage will be more prevalent.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox