12/15/2025 by Greg Massey

December 2025 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Stockings Full of Slow Shifts in the Freight Market

Despite ongoing demand softness, the next six to 12 months point to a market driven not by shippers, but by significant changes on the carrier side.

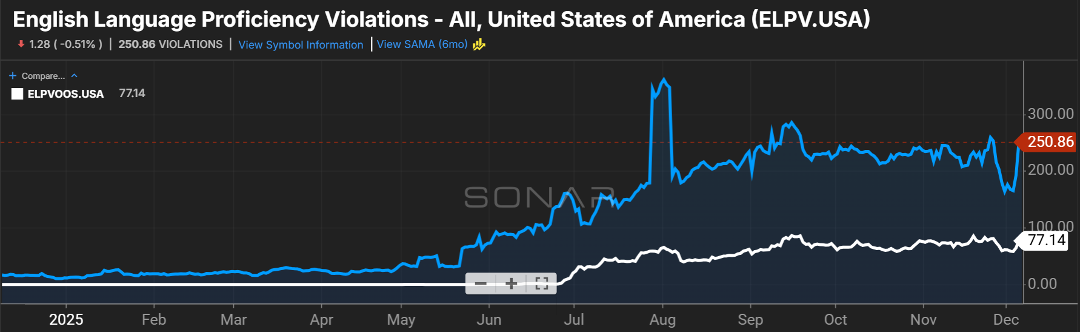

There has been much in the news around driver competency, whether it’s the English Language Proficiency (ELP), non-domiciled CDL’s, or the shutdown of sub-par driver training facilities. This has caused pockets of capacity shortages in the market, be it on a lane or market perspective.

Many have asked how much these initiatives impact capacity. It’s certainly a slow drip, but Figure 1.1 shows that indeed drivers are being placed out of service for violations in proficiency with the English language as it pertains to reading and understanding road signs.

Why the blue line (total ELP violations) does not track 100 percent with the white line (driver being taken out of service because of a violation), unfortunately I don’t have the answer.

There’s also been a crackdown on the legitimacy of providers for electronic logging devices (ELD). The shift from allowing providers to self-certify to a process that verifies the ELD works as intended, will not necessarily take drivers off the road, but it will right-size the miles driven.

By some, it is anticipated that drivers using a device that allows for manipulation of driving and down-time, will see their time behind the wheel cut in half. While most likely not as impactful as regulations targeted at the driver’s ability, it will contribute to the declining capacity.

Reefer Rejections Take Top Spot

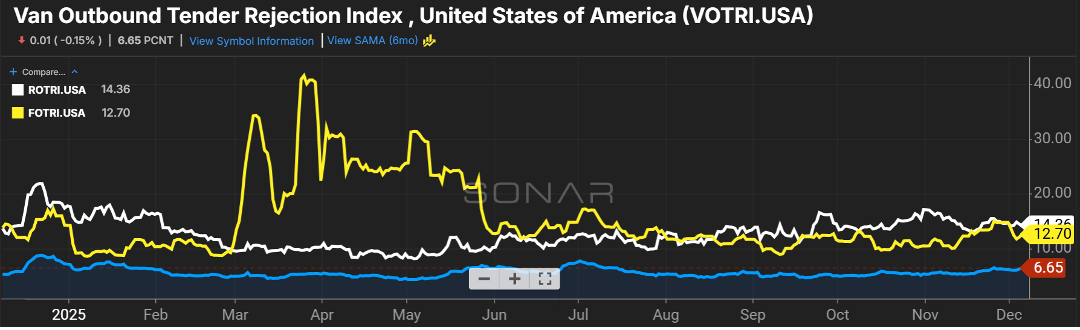

The decline in capacity will show up in the tender rejection index, the rate at which carriers say “No” to shipments tendered to them.

Rejection of refrigerated shipments (white line, Figure 2.1) continue to lead the way, just over 14 percent. Flatbed rejections come next, with a rate of just under 13 percent (yellow line). And van shipments (blue line) are being rejected, just under seven percent.

Keep in mind that while flatbed and reefer shipments are relatively high, van freight still claims the top spot for volume in the U.S.

Shippers need to be plugged into the ebb and flow of the rejection rates, as this will show itself in the spot market.

Imports Hit Snooze

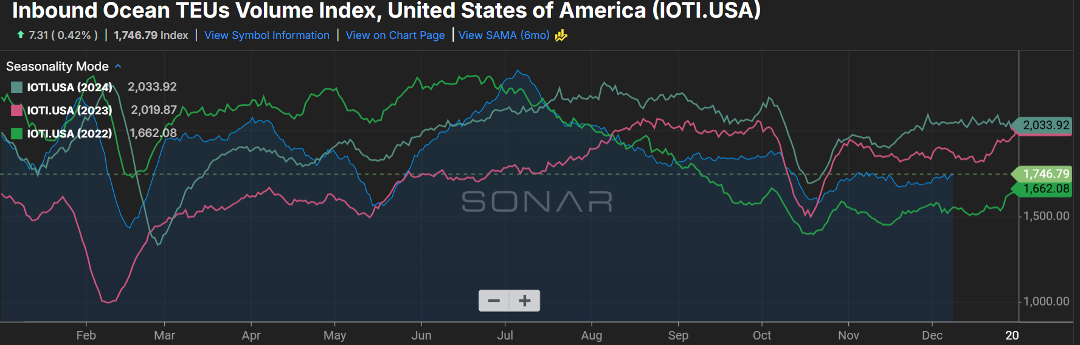

Finally, ocean imports continue to lag volumes seen over the past few years (Figure 3.1). A slight bump in the coming weeks is likely, but retailers particularly continue to burn down inventories that bulged in the middle of this year.

Most likely we will not see a surge in import activity until late February, early March.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox