01/16/2026 by Greg Massey

January 2026 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Let The 2026 Freight Games Begin

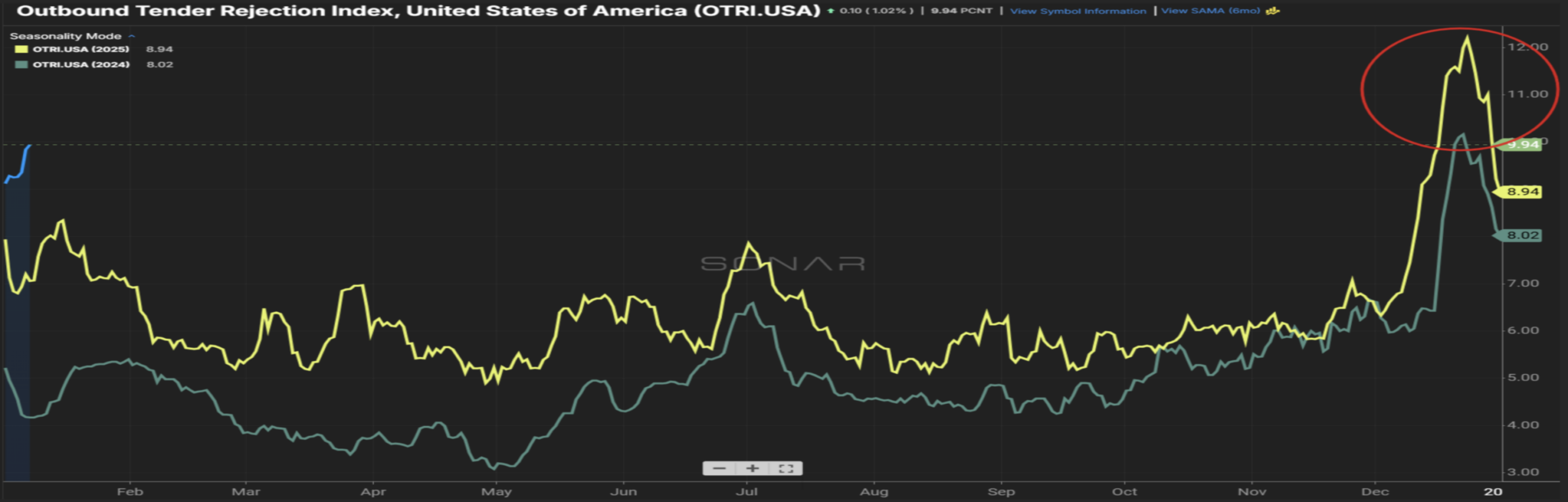

Well, there certainly has been a shift in the freight market just in the last 30 days. One of the best canaries in the cave for market health is the rejection index – the rate at which contracted carriers are saying “no thanks” to tendered freight tendered.

For a good two years, five percent was the norm, meaning shippers didn’t have to go too far down the routing guide to find a willing participant. Slowly, over the course of the last six months, that rate has been edging up.

Then in December, the ascent got more rapid, with the rejection rate touching, and eclipsing, the 10 percent mark (Figure 1.1). While the rejection rate at the end of last year was about 20 percent higher than 2024, the same could not be said about the volume side of the equation, with December 2024 being a better volume month than this past December.

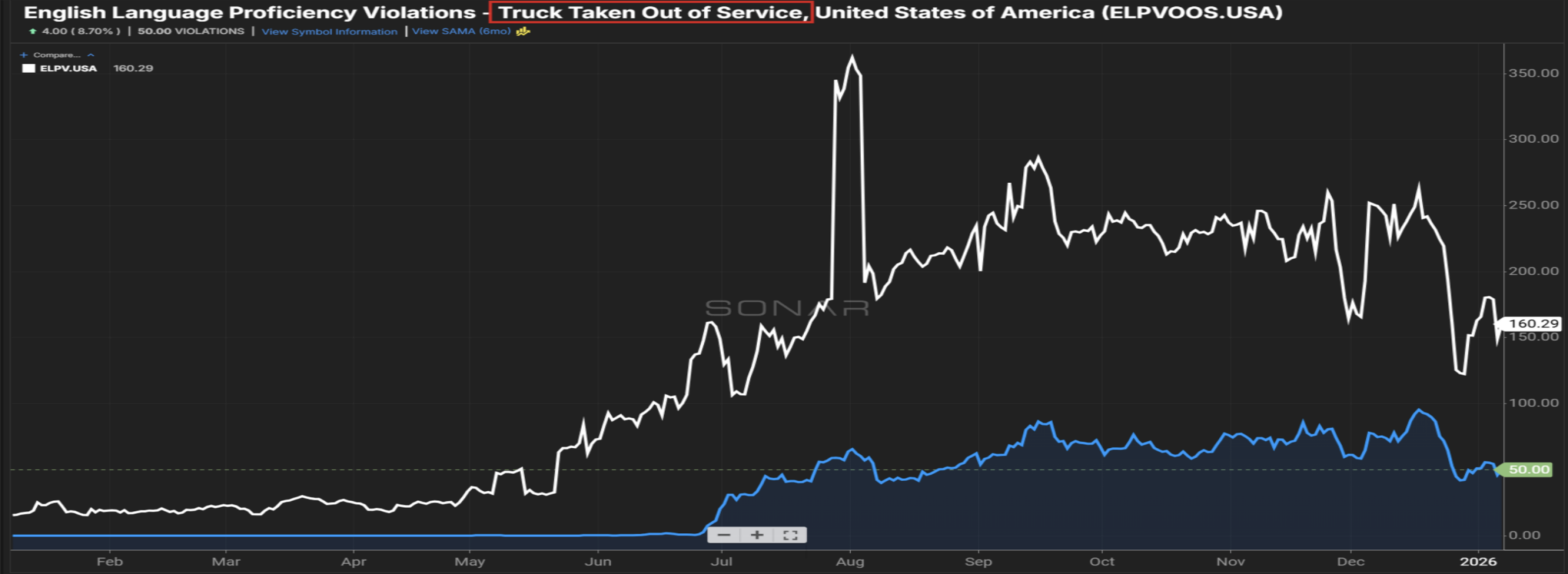

So that can really point to one thing – less capacity. Sure, some of that is the time of year, as drivers tend to extend the holidays. But one can not discount the impact – either real or perceived – of less drivers due to regulation enforcement (Figure 1.2).

January and February are typically lighter volume months, so the impact may not be as pronounced. However, when we hit March, and certainly April, if capacity continues the downward trend as we anticipate, expect rates to increase on the carrier side and compliance with routing guides to suffer.

The Tariff Coin Flip

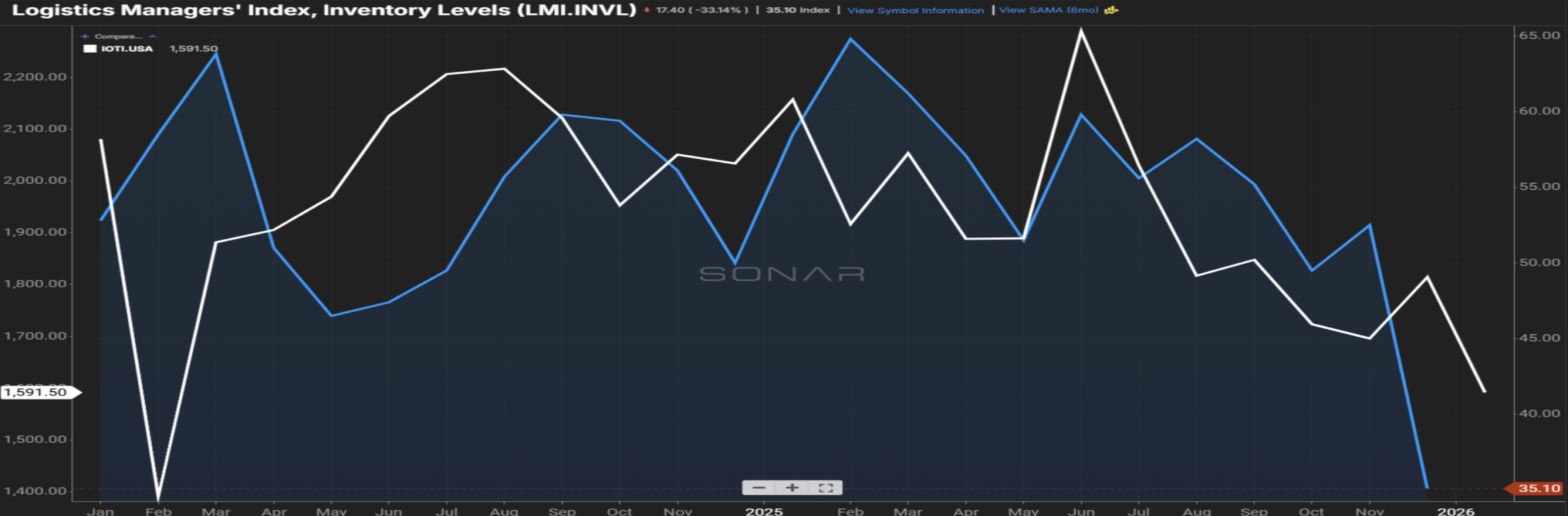

Recently, Craig Fuller, CEO at Freightwaves and Sonar, gave really good insight into the current inventory situation of retailers and the pending impact of a ruling on the IEEPA tariffs.

As you may recall, these were the tariffs put in place as an emergency measure last year. As you would expect, many importers are and have been anxiously waiting on a ruling by the Supreme Court – one way or the other – to provide clarity for their business operations.

As you can see from Figure 2.1, inventory levels have steadily declined over the past few years as excesses have bled off, and that has been followed in lock step with inbound ocean volumes. Depending on the ruling, most likely one of two things will happen.

If the tariffs are rescinded, shippers will look to capitalize on a window to bring in freight and not be subject to the higher tariffs. Now, there are ways for the administration to re-enact these tariffs, but that process could take three to six months.

If the opposite holds true, and the tariffs are affirmed, at least it gives clarity to shippers, and they will look to restock depleted inventories. Reading my crystal ball, if the tariffs are rescinded, and we have a surge in import volume – at the same time we have the capacity side decreasing – we could be in for a perfect storm with regards to freight rates.

With all the craziness that has happened recently, and is potentially on the horizon, even though freight volumes may not feel like it, now is the time for shippers to cozy up to their carrier and broker partners to ensure their products get in front of the consumers before the competition. Let the games begin!

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox