10/16/2023 by Greg Massey

October 2023 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Imports on the Rebound?

For the past 14 months, much of the conversation around U.S. container import volume has been gloomy.

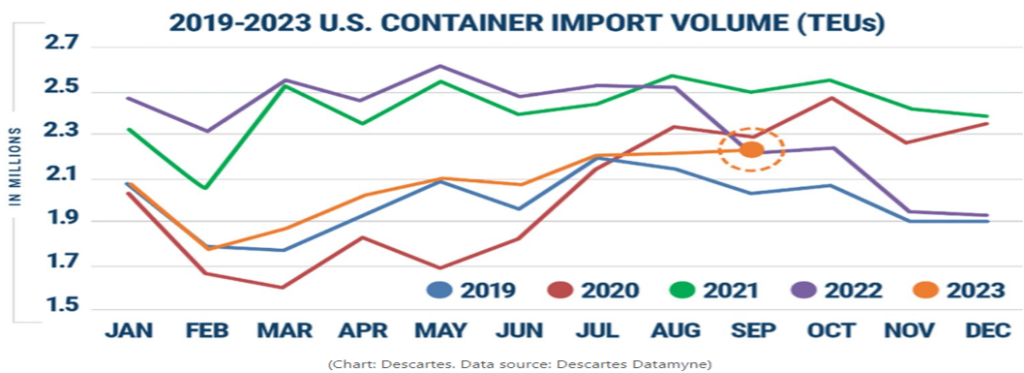

Figure 1.1 shows the steady decline in import volume that began in August of 2022, and those volumes have remained lower when you compare them year-over-year (YoY) for most of 2023.

September and October have begun to see that narrative change, with September of this year outpacing September of 2022. Comparing this year’s volume to 2021 and even 2022 is somewhat an “apples to oranges” comparison because of the frenzied consumer activity. A better comparison is how 2023 is stacking up versus pre-Covid years.

September 2019 saw approximately 2.05 million twenty-foot equivalent units (TEU’s) come through U.S. ports. September 2023 is seeing an increase of roughly seven percent in comparison. There are numerous efforts underway with U.S. retailers – like Walmart, Target and Amazon – to boost consumer sales with deals ahead of the traditional holiday buying season. This should continue to boost imports through the remainder of the year.

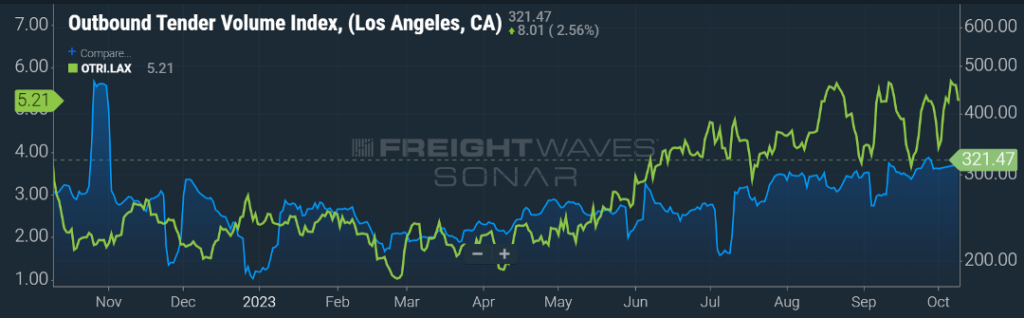

It will be important for shippers, carriers, and brokers to keep an eye on activity around U.S. ports as rates will reflect the supply and demand. An example can be seen the Los Angeles market. As seen in Figure 1.2, in the past 90 days, outbound volume from this market has increased almost 23 percent and the rate of carrier rejections has also shown an upward trend by over 50 percent.

Capacity Declining

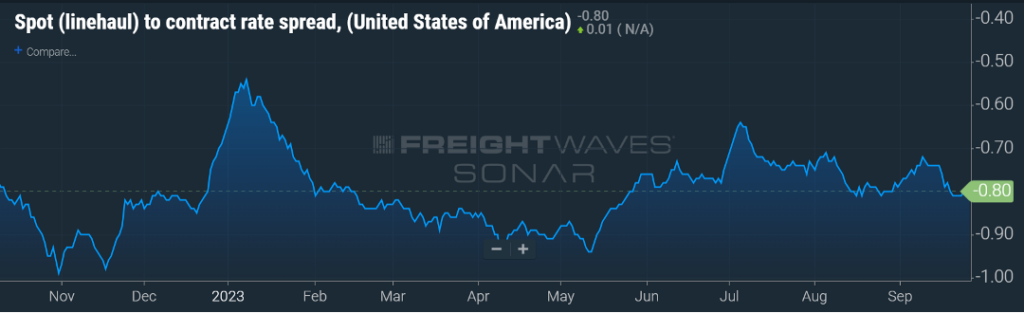

Six months ago, I would have taken a bet with anyone that the spread between contract and spot rates would not be greater than $0.50 per mile.

With capacity exiting the market and shippers making more frequent use of rate tools like mini-bids, the prevailing thought was that spot rates would remain relatively stagnant, or possibly a slight uptick, but contract rates would show a sharp decline. Good thing I was nowhere near a betting window.

The spread continues to hover around $0.80 per mile as seen in Figure 1.3, with contract rates being higher. Annual bid season is fast approaching, and it will be interesting to see if recent upward volume trends combined with an increase in carrier revocations will continue to keep contract rates where they currently reside or if the “sharpen the pencil” adage will be more prevalent.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox