12/16/2024 by Greg Massey

December 2024 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

CANARY IN THE CAVE

Data is everywhere, both on a macro and micro level. How this data is interpreted and reported, and the contradictions it can create, has the potential to leave one wondering just what to believe.

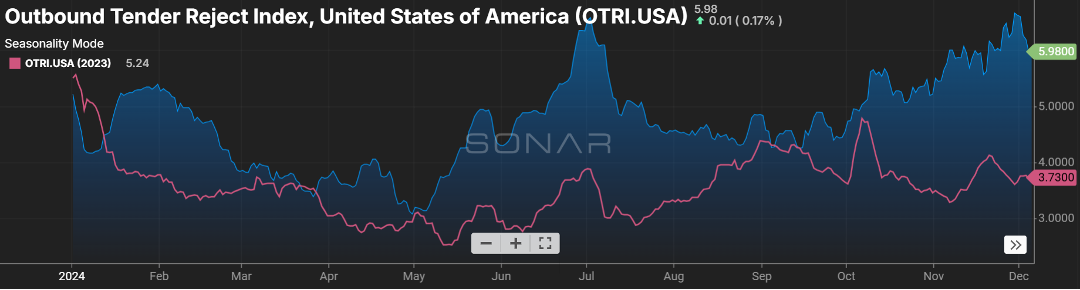

For years now, I have been, pretty much daily, watching like a hawk the ebb and flow of tender rejections (Figure 1.1). While this is focused on the contact freight market, what happens on the contract side absolutely has an impact on the spot market side. The last year plus has been pretty vanilla, with rejection rates almost negligible.

This pales in comparison to just a few years ago when carriers said “no” to shipments 30-plus percent of the time. While the current six percent rejection rate won’t set off many alarms, it is noteworthy in its trend. Heck, just six months ago, the rejection rate was hovering below three percent. Yes, there is seasonality that plays into the rejection rate, but seasonality also existed in 2023, and the rejection rate lagged during the fourth quarter of the year. While there will be some dips along the way over the next six months, I expect the upward trend to continue.

LOOMING STRIKES & DISRUPTION

Many in the industry breathed a sigh of relief when the short-lived port strikes on the East and Gulf Coasts were settled. However, while there was agreement on several issues, the automation at the ports loop remained open.

We are fast approaching the 90-day period for resolve in January, and the threat of another shutdown looms. Combined, the East and Gulf Coast ports provide service for incoming and outgoing ocean containers for more than half of the volume in the U.S.

So, what should you be prepared for if a second strike were to happen?

👉 Like it or not, we are dependent on unfinished and finished goods from overseas. Not being able to receive those goods will cause shortages on things like groceries, electronics, and clothing to name a few.

👉 The U.S. economy’s dependence on consistent flow of goods in and out of our country is to the tune of about four billion dollars per day. Even a week-long strike has the potential to severely delay the flow of goods around the ports for a month-plus.

👉 While most U.S. businesses would feel the effects, small businesses would be the most impacted as their already thin profit margins would be challenged by increased costs for goods along with a tight labor market and inflation.

👉 It’s not just consumer-ready goods. The ports play a role in the preparedness for emergency situations and defense posture.

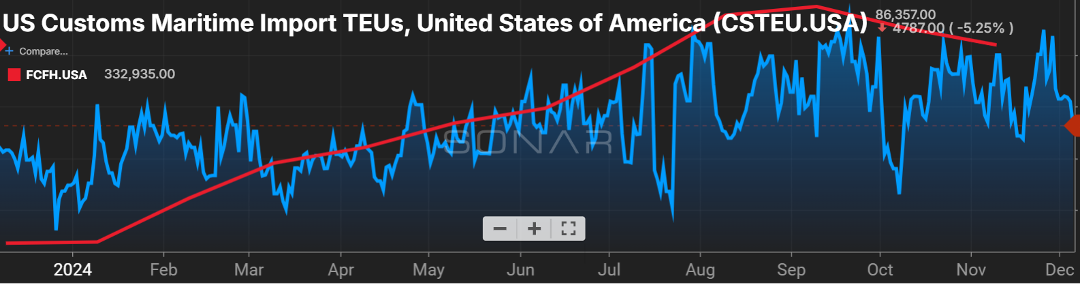

We are already seeing the surge in import volume, up about eight percent versus a year ago as shippers look to get ahead of potential tariffs and now a labor shortage. Couple this with a downward trend in over-the-road capacity (Figure 2.1), and you have a recipe to further accelerate trucking rates.

U.S. shippers need to be reviewing their carrier and broker partners for compliance in the coming months. While many have not had the need recently, they should consider adding extra companies to their routing guides.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox