11/18/2025 by Greg Massey

November 2025 Freight Market Update

Stay up to date on the latest information on conditions impacting the freight market, curated by Trinity Logistics through our Freightwaves Sonar subscription.

Cooling Temps & Tightening Capacity

It is getting closer to that time of the season. No, we’re not talking about turkeys and the little jolly man in the red suit; we’re talking about carriers uttering the “NO” word more often.

Typically, we see rejections elevate towards the end of the calendar year, and this year the trend is continuing.

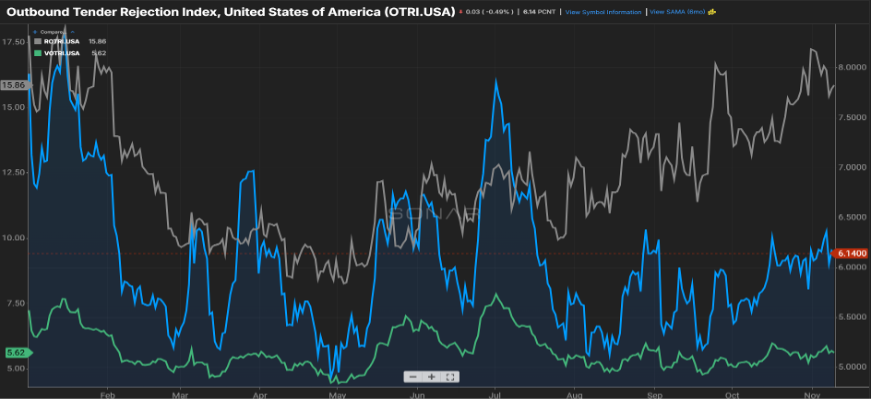

Figure 1.1 shows the steady climb up and to the right for the overall rejection rate (blue line), but what is a bigger driver of that overall rate is the rejection seen with reefer shipments (gray line). Rejections of reefer shipments currently sit just above 15 percent. Conversely, rejection rates with van shipments (green line) have held relatively steady, hovering just above five percent.

Shippers should be prepared for rejection rates on refrigerated shipments to climb even higher as end of the year demand for temperature-controlled products (we all love our shrimp trays this time of year) and colder weather necessitating protection from freezing will help to elevate volumes against a backdrop of, at best, steady capacity.

Haul Length Tell the Story

Also interesting is the length of haul for reefer versus van shipments.

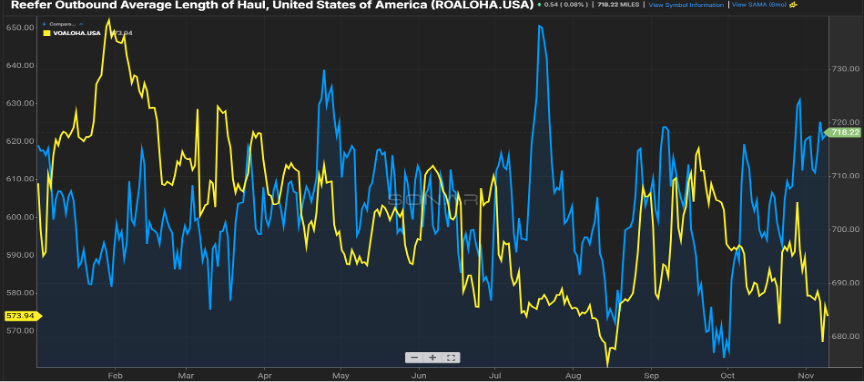

As 2.1 illustrates, refrigerated shipments have seen the miles traveled increase by almost 40 miles compared to a month ago, while van shipments continue to get shorter, some 50 miles less than where they trended in the first quarter of this year.

Typically, van trailers are used for retail and consumer goods, as well as finished goods transportation.

Well, there’s no doubt the American consumer continues to support the retail and consumer goods side. However, this benefits more of the shorter-type freight moves versus longer haul (think anything 800 miles or more) as companies like Amazon, Target, Walmart, etc. have strategically placed their distribution centers to be within one-day transit of almost the entire U.S.

We have consistently seen the manufacturing, housing, and industry struggle in 2025.

These verticals support more of that over-the-road, multi-day transit freight. It’s no surprise that shipments of this length are down 25 percent versus a year ago. Carriers typically migrate toward shipments that keep them on the road for several days versus a new shipper and/or receiver each day, making long-haul shipments an advantageous carrot to dangle especially with spot shipments.

Bid Season Buzz

Lastly, bid season is upon us.

In anticipation of rates inching higher in 2026, shippers have hit “send” on those emails requesting pricing for the next six to 12 months.

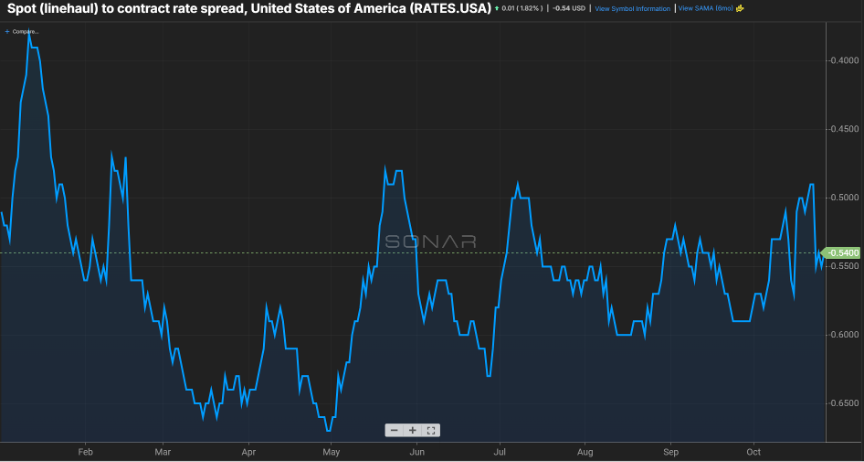

Currently, the spread of spot versus contract pricing has hovered in the $0.50”ish” per mile (Figure 3.1).

With capacity expected to further dwindle due to rising costs for operating and regulatory constraints, along with the barrier of entry into the carrier market being more challenging, a more balanced supply and demand will boost rates on the spot market.

Many, from carriers to shippers to brokers, will be carefully consulting their crystal ball over the next few months.

Stay Up To dAte

Looking for a more frequent update? Subscribe to our newsletter and receive the top five logistics articles of the week every Friday morning by selecting “Weekly News Update” when you select your preferences.

Get Weekly News Updates in Your Inbox